During the year, as part of a move to strengthen minority

shareholder protection in companies with a controlling shareholder,

such as ours, new Listing Rules came into force that require such

companies to enter into relationship agreements with their

controlling shareholders. The Company has therefore entered into a

new relationship agreement, which includes the mandatory provisions

required by the new Listing Rules that require transactions between

the controlling shareholders and the company to be on arm's length

terms and the controlling shareholder will not take any action that

will prevent the Company from complying with its obligations under

the Listing Rules. The Company and our controlling shareholders

believe that this new agreement further clarifies the relationship

and provides comfort to all shareholders on how the Company

conducts its business. I hope you agree.

Also, as part of the new Listing Rules, all of our independent

Non-Executive Directors are now subject to a dual vote by

shareholders when they stand for re-election today. This means that

each resolution to elect or re-elect an independent Non-Executive

Director must be approved by both a majority vote of all

shareholders and a majority vote of the Company's independent

shareholders.

In September last year I stepped back from the position of

Executive Chairman to become Non-Executive Chairman. At the same

time Diego Hernandez took on the role of Group CEO, having

previously been responsible for the mining division. These changes

reflect the development of the Group and my role is now less

focused on the day-to-day operations and more concerned with the

strategic development of the Group and leading the Board.

Also, I would like to take this opportunity to thank Nelson

Pizarro for the valuable contribution that he made to the Group

during his time as a non-executive director and I wish him well in

his important new position as CEO of Codelco.

Looking ahead - Our three-pillar strategy for growth remains

unchanged. We focus first on optimising our existing operations,

where investment generates good returns quickly. Secondly, we look

for sustainable, organic growth in the areas around our operations.

And thirdly we seek growth beyond our core businesses both in Chile

and abroad.

Chile continues to offer good opportunities for growth. Our

largest current development is our Antucoya project in the north of

Chile where commissioning is underway with ramp-up to full capacity

expected to be completed by the end of this year with the first

year of full production in 2016. Beyond Antucoya, we have a number

of brownfield projects underway. The first of these to come

on-stream is the expansion of the Centinela concentrator. Work

continues to optimise the concentrator and we expect to reach

throughput of 105,000 tonnes per day in late 2015, up from the

86,000 tonnes per day we achieved in 2014.

The next brownfield project in our project pipeline is Encuentro

Oxides which will enable Centinela's SX-EW plant to continue to

produce at full capacity of 100,000 tonnes of cathode per year,

helping to offset a decline in production that we would otherwise

see as a result of falling grades. The feasibility study was

completed in November of last year and full-scale construction

started early this year. Through a number of optimisations of the

project, including mine fleet, pre-stripping and truck shop

optimisations, we have been able to reduce the pre-feasibility

study capital expenditure estimate for the project by more than

$150 million to a feasibility study estimate of $636 million.

Also at Centinela, we have completed the feasibility study on

the construction of a molybdenum plant which would come into

production at the end of 2016 producing some 2,400 tonnes of moly a

year for the first five years, before it increases once the second

concentrator at Centinela is completed to over 6,000 tonnes per

year.

Our last project at Centinela is the construction of a second

concentrator whose pre-feasibility study, as I mentioned earlier,

will be brought to the Board for approval in the coming months.

Work on the Environmental Impact Assessment ("EIA") is well

advanced and is expected to be submitted for approval by the end of

this year with production starting in 2019. The Second Concentrator

is designed to produce approximately 140,000 tonnes of copper per

year, 150,000 ounces of gold and 6,500 tonnes of moly, and capital

expenditure is estimated at $2.7 billion. This will be Phase 1 of

the development and we expect that Phase 2 would start some five

years later increasing throughput by over 60% and metal production

by a further 60,000 tonnes of copper, 20,000 ounces of gold and

3,000 tonnes of moly.

The last of our current brownfield projects is at Los Pelambres.

The feasibility study examining the options for an incremental

expansion to increase daily throughput at Los Pelambres to 205,000

tonnes continued during 2014. An environmental baseline study which

is required as part of the project development has been started and

we expect to submit the EIA in mid-2016. This EIA has been delayed

by the need for additional work following our commitment only to

use sea water for any expansion at Los Pelambres and we hope that

the EIA will be approved by the regulatory authorities in

2017/2018.

Beyond our key brownfield projects, we have a number of

greenfield projects. Our largest longer-term growth projects are a

potential further expansion of Los Pelambres and the development of

Twin Metals.

The pre-feasibility study on Twin Metals, our copper, nickel and

platinum group metals ("PGMs") project based in Minnesota, in the

United States was completed in August last year. In November 2014

the Group entered into an agreement to acquire all of the issued

and outstanding shares of our project partner Duluth Metals

Limited, bringing Antofagasta's ownership in the project to 100%.

The acquisition was completed in early 2015 and we are now

evaluating further optimisations of the prefeasibility study that

was completed in 2014 while also advancing the permitting process.

The project has significant reserves of copper and nickel with a

long mine life, and is a world-class deposit in terms of size and I

expect it to be an important part of the Group in the future.

Finally, we look for growth further afield where considerable

and more diverse opportunities exist, but where we do not have the

benefit of any organic synergies. We have an active early-stage

exploration programme beyond our existing core locations at

Centinela and Los Pelambres with a number of exploration earn-ins

and strategic alliances with junior mining companies around the

world. These are all early stage at the moment, but we hope that

one or more may one day become operating mines.

Each year we strive to improve our environmental and social

performance. Last year we became a member of the International

Council on Mining and Metals (the ICMM) and this required us to

first satisfy their entry requirements for sustainable behaviour

and transparency. We are now working with the ICMM in promoting the

highest principles and standards for sustainable mining and by

fulfilling these standards ourselves.

Today, you will have noticed, we have provided you with a copy

of our latest Sustainability Report. It has only just been issued

and I hope you enjoy reading it and seeing what we have achieved

during the year. This includes the progress in the various

renewable power projects we have invested in, with the El Arrayán

wind farm coming on-line in June 2014 and our commitment to take

power from two new solar projects. I am proud to say that by

mid-2016, 50% of Los Pelambres' power will come from renewable

sources and by the end of 2018 this should increase to 80%

including the Alto Maipo run-of-river power generator - a major

achievement for a mine of its size.

Looking to the years ahead our strategy remains unchanged. We

invest throughout the cycle in projects that generate good returns.

Our core assets form the foundation of our strategy, providing the

cash flow and ability to develop organically and externally. The

success of our operations is the focus of the day-to-day activities

of the Group and it is upon this that we build for the future.

Sustainability and the health and safety of our employees remain

central to our success.

In 2015 we expect to produce 695,000 tonnes of copper at a net

cash cost of $1.40/lb and while we continue to work on reducing

costs during this period of consolidation.

This year will be an important year for Antofagasta as we

complete our current projects, prepare for our next phase of growth

and face the challenges that the current macroeconomic environment

brings.

Whilst the sector faces challenges in the short term, we

continue to invest through the cycle. We have a portfolio of

quality, long-life assets; we are focussed on developing and

expanding our two world-class mining districts and advancing our

portfolio of projects. With our low costs and strong balance sheet

we are well-placed to weather the current market conditions and to

take advantage of the upturn when it occurs.

I would like to take this opportunity to thank all of the

employees and contractors that work across the Group whose

contribution has helped to make Antofagasta what it is today and

also to thank the communities in which we operate for their support

and engagement.

Investors - London Public Relations Advisors - London

Andrew Lindsay alindsay@antofagasta.co.uk Carole Cable antofagasta@brunswickgroup.com

Paresh Bhanderi pbhanderi@antofagasta.co.uk Robin Wrench antofagasta@brunswickgroup.com

Telephone +44 20 7808 0988 Telephone +44 20 7404 5959

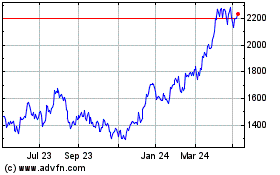

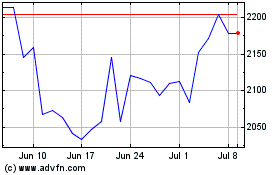

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Apr 2023 to Apr 2024