Antofagasta Again Lowers Forecast for Copper Output-Update

October 28 2015 - 8:30AM

Dow Jones News

(Adds detail, comment)

By Alex MacDonald

LONDON--Chilean copper producer Antofagasta PLC (ANTO.LN) has

again lowered its target for copper output this year, but kept its

goal for cash costs unchanged after reporting stable production in

the third quarter compared with the previous three months.

The FTSE-100 miner suffered a series of unexpected setbacks this

year ranging from protests at its flagship Los Pelambres mine to

unusually heavy rainfall that resulted in lower copper output from

its mines in the country's northern Atacama dessert. This, coupled

with the delayed ramp up of its Antucoya project due to equipment

issues, led the company to cut its original copper output guidance

of 710,000 metric tons twice before.

On Wednesday, the company lowered the guidance again to 635,000

tons from 665,000 tons most recently due to a minor pit-wall slide

at its Centinela cathode operations and delayed ramp-up at

Centinela concentrates operations.

This follows 157,000 metric tons of copper output in the third

quarter, on par with the second, as higher output from its Los

Pelambres mine and the commissioning of its Antucoya project more

than offset lower output from its Michilla and Centinela mines.

The $1.9 billion Antucoya mine in north Chile has produced 2,200

tons of copper cathode since starting production in September but

isn't forecast to reach commercial production until the first half

of 2016, according to the company.

Meanwhile gold output fell 17% on quarter to 45,700 troy ounces

while molybdenum production remained flat on quarter at 2,600 tons

in the third quarter.

Antofagasta's shares fell 3.3% to 526.5 pence a share as of 1133

GMT, while the FTSE 350 Mining index was down 1.1%.

The company's third quarter copper, gold and molybdebnum output

missed BMO Capital Markets' forecast by 11%, 30% and 28%

respectively.

On a positive note, the miner kept its full-year net cash cost

at $1.47 a pound. It had a net cash cost of $1.42 a pound in the

third quarter, down 11% from the second quarter largely due to

higher production at its flagship Los Pelambres mine, lower input

prices, particularly energy, and the impact of the weaker Chilean

peso against the dollar during the quarter.

The copper target cut "reflects what has been quite a difficult

year operationally for the company; however, BMO Research continues

to view Antofagasta as a well-run company with high-quality

assets," the bank said in a note.

Write to Alex MacDonald at alex.macdonald@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 28, 2015 08:15 ET (12:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

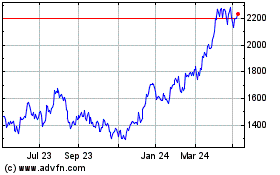

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

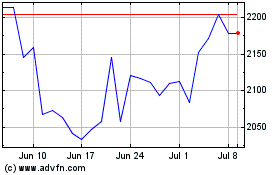

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Apr 2023 to Apr 2024