From kitchen stoves to paper clips, U.S. antitrust enforcers are

putting the brakes on a series of corporate deals that have tested

the government's willingness to let longtime rivals combine two big

businesses.

On Monday, the Federal Trade Commission filed a lawsuit to block

Staples Inc.'s roughly $6 billion takeover of Office Depot Inc., a

deal that would create an office supplier with nearly $40 billion

in annual sales.

The lawsuit alleged the combination would mean higher prices for

companies that buy office supplies in bulk. Staples and Office

Depot said they would contest the suit, but shares of both

companies tumbled.

The FTC's unanimous decision came the same day that General

Electric Co. abandoned a $3.3 billion agreement to sell its

appliances business to Electrolux AB of Sweden. GE walked away from

the deal, which it struck 15 months ago, in the middle of a

courtroom fight with the U.S. Department of Justice.

Once again, government lawyers argued the combination would

reduce competition and raise prices. Shares of Electrolux, whose

CEO had testified the deal was "absolutely critical" to its

business, lost 15% of their value, while GE shares slipped less

than 1%.

Both transactions would have left bigger companies atop

industries that have been consolidating for years. Adding Office

Depot, which merged with OfficeMax in 2013, would leave Staples

with 70% of the market for pens, pads and office essentials that

large businesses buy directly, according to the FTC. Combining GE

and Electrolux would have created a merged firm that sold two of

every three cooking ranges in the U.S., government lawyers

said.

"Each horizontal merger raises concentration. And when market

concentration goes up, the likelihood that the next merger will be

challenged goes up as well," said University of Iowa law professor

Herbert Hovenkamp. "The government has been on a decent roll in

merger cases the last couple of years. These are both good examples

of that."

Cheap debt and a slow-growth economy has helped fuel a record

year for mergers and acquisitions—with $4.35 trillion in global

volume and $2.12 trillion in U.S. deals, according to Dealogic. But

it has also been a banner year for transactions that have fallen at

the hands of antitrust police appointed by President Barack

Obama.

Antitrust objections by the Justice Department earlier this year

helped derail Comcast Corp.'s $45 billion bid for Time Warner Cable

Inc. The FTC won a court fight in June that blocked the $3.5

billion combination of food-distribution rivals Sysco Corp. and US

Foods Inc. Last week, two leading tuna producers—the owners of

Bumble Bee and Chicken of the Sea brands— called off a $1.5 billion

merger in light of U.S. concerns.

The agencies this year have sought to stop deals in an array of

other markets, including movie advertising networks, hospitals and

the semiconductor industry. So far this year, Dealogic says

companies have abandoned 77 deals worth $263 billion, though that

tally includes many deals withdrawn for nonregulatory reasons.

All four current FTC commissioners, three Democrats and a

Republican, voted in favor of the Staples lawsuit. Market expansion

or new entry by other office-supply vendors wouldn't be timely,

likely or sufficient to counter the anticompetitive effects of the

merger, the FTC said. Shares of Office Depot fell 16% Monday, while

Staples lost 14%.

The companies said the decision was "based on a flawed analysis

and misunderstanding of the intense competitive landscape." The

lawsuit marks the second time the FTC has intervened to prevent the

two companies from combining. The commission in 1997 won a ruling

from a federal judge that blocked a Staples-Office Depot

merger.

Both companies argued the industry has evolved over the past two

decades, including through growing competition from the Internet

and big-box retailers. The FTC acknowledged this evolution when it

allowed Office Depot to merge with OfficeMax.

"The FTC now contradicts its prior ruling, even though

competition has materially intensified in the two years since the

commission declared this market highly competitive," the companies

wrote in a letter to clients. "This contradiction is not only

unfair; it flies in the face of marketplace realities."

The FTC said business-to-business market is distinct from the

more competitive retail markets for office supplies sold to

consumers.

The companies had sought to ease FTC concerns by offering to

shed hundreds of millions of dollars in corporate contracts. FTC

staffers weren't enthusiastic about the divestiture offer, and the

companies in recent days had offered larger concessions, according

to people familiar with the matter.

Both Staples and Electrolux asked the government to take a

broader view of markets and give credit to newer, smaller

competitors.

The GE transaction was in jeopardy since the summer, when the

Justice Department filed a lawsuit to block it.

"This deal was bad for the millions of consumers who buy cooking

appliances every year. Electrolux and General Electric could not

overcome that reality at trial," Justice Department lawyer David

Gelfand said Monday.

The companies pointed to the Bush Justice Department's decision

in 2006 to allow Whirlpool Corp. to acquire rival Maytag Corp.

Top executives from Electrolux and GE had testified during the

trial, which began in early November. Though the court handling the

case had yet to render a verdict, GE used its right to terminate

the sale after 15 months of talks, which was its first opportunity

to walk away from the transaction and collect a breakup fee.

GE said Monday it is entitled to a $175 million breakup fee.

Electrolux, though, said it was reviewing the terms of the fee.

"The appliances business is performing well and GE will continue

to run the business while it pursues a sale," GE said. The deal's

failure is a setback to the company's effort to focus on high-tech

industrial industries but GE has been confident it could find

another buyer if the Electrolux deal fell through, according to

people familiar with the company's thinking.

Electrolux had hoped to create an appliances seller capable of

competing with the behemoth of Whirlpool and rising Asian

competitors. "We are disappointed but we are certainly not

defeated," Electrolux CEO Keith McLoughlin said during a conference

call.

The merged Electrolux-GE business would have had about

one-quarter of the U.S. market last year, compared with roughly 30%

for Whirlpool, and 12% and 13%, respectively, for South Korean

rivals LG Corp. and Samsung Electronics Co., according to data from

TraQline.

Jens Hansegard contributed to this article.

Write to Brent Kendall at brent.kendall@wsj.com, Drew FitzGerald

at andrew.fitzgerald@wsj.com and Ted Mann at ted.mann@wsj.com

(END) Dow Jones Newswires

December 07, 2015 20:55 ET (01:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

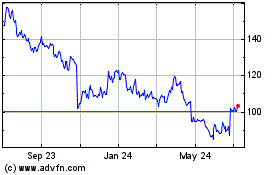

Whirlpool (NYSE:WHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

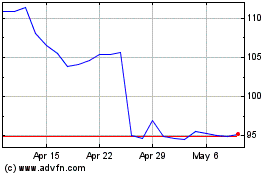

Whirlpool (NYSE:WHR)

Historical Stock Chart

From Apr 2023 to Apr 2024