Antipodean currencies such as the Australian and the New Zealand

dollars strengthened against their major counterparts in the Asian

session on Thursday, after data showed that China's exports

rebounded at a faster than expected pace, while growth in imports

slowed in March.

Data from the General Administration of Customs showed that the

China's exports, in dollar terms, grew 16.4 percent year-on-year in

March, reversing February's 1.3 percent decline. Shipments were

expected to rise 3.4 percent.

At the same time, imports advanced 20.3 percent after expanding

38.1 percent in February. Economists had forecast a 15.5 percent

increase.

As a result, the trade surplus totaled $23.9 billion in March,

smaller the expected surplus of $12.5 billion.

Exports grew 22.3 percent and imports climbed 26.3 percent in

yuan terms in March. In the first quarter, exports increased 14.8

percent and imports surged 31.1 percent.

Ahead of the data, the Australian dollar rose against its major

rivals after data showed that the number of employment in

Australian rose more-then-expected in March.

Data from the Australian Bureau of Statistics showed that the

Australian economy added 60,900 jobs in March to 12,059,600,

shattering expectations for a gain of 20,000 following the loss of

6,400 jobs in the previous month.

Full-time employment increased 74,500 to 8,238,600 and part-time

employment decreased 13,600 to 3,821,000.

The unemployment rate in Australia was steady at a seasonally

adjusted 5.9 percent in March. That was in line with estimates and

unchanged from the February reading.

Also, the NZ dollar rose against its most major rivals earlier,

after data showed that manufacturing sector in New Zealand picked

up steam in March.

Data from Business NZ showed that the manufacturing sector in

New Zealand picked up steam in March, with a Performance of

Manufacturing Index score of 57.8. That's up sharply from 55.7 in

February. The March reading also marks a 14-month high for the

index.

In other economic news, data from Statistics New Zealand showed

that food prices in New Zealand dipped 0.3 percent on month in

March. That follows the 0.2 percent increase in February.

Wednesday, the Australian dollar showed mixed trading against

its major rivals. While the aussie rose against the U.S. dollar, it

fell against the yen. Against the euro, the aussie held steady.

The NZ dollar fell 0.15 percent against the U.S. dollar, 0.41

percent against the yen and 0.24 percent against the euro.

In the Asian trading, the Australian dollar rose to a 2-day high

of 82.56 against the yen, from yesterday's closing value of 81.97.

The aussie may test resistance near the 85.00 region.

Against the euro and the U.S. dollar, the aussie advanced to

8-day highs of 1.4068 and 0.7585 from yesterday's closing quotes of

1.4170 and 0.7521, respectively. If the aussie extends its uptrend,

it is likely to find resistance around 1.39 against the euro and

0.76 against the greenback.

Against the New Zealand and the Canadian dollars, the aussie

climbed to a 1-week high of 1.0838 and a 3-day high of 1.0035 from

yesterday's closing quotes of 1.0795 and 0.9958, respectively. On

the upside, 1.10 against the kiwi and 1.01 against the loonie are

seen as the next resistance levels for the aussie.

The NZ dollar rose to a 9-day high of 0.7003 against the U.S.

dollar and a 2-day high of 1.5224 against the euro, from

yesterday's closing quotes of 0.6968 and 1.5305, respectively. If

the kiwi extends its uptrend, it is likely to find resistance

around 0.71 against the greenback and 1.51 against the euro.

Against the yen, the kiwi advanced to 76.23 from yesterday's

closing value of 75.91. The kiwi may test resistance near the 78.00

region.

Looking ahead, Swiss PPI for March and Bank of England's credit

conditions survey data are due to be released later in the day.

In the New York session, Canada new housing price index and

manufacturing sales data, for February, U.S. PPI for March, U.S.

weekly jobless claims for the week ended April 8, U.S. University

of Michigan's preliminary consumer sentiment index for April and

U.S. Baker Hughes rig count data are slated for release.

At 10:00 am ET, Bank of Canada Governor Stephen Poloz is

expected to testify along with Senior Deputy Governor Carolyn

Wilkins before the Standing Senate Committee on Banking, Trade and

Commerce, in Ottawa.

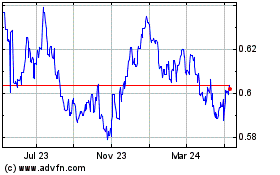

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Apr 2024

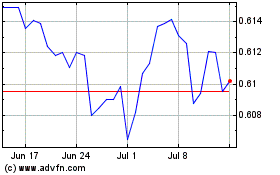

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2023 to Apr 2024