Antipodean Currencies Fall Amid Risk Aversion

May 23 2016 - 10:15PM

RTTF2

Antipodean currencies such as the Australian and the New Zealand

dollars weakened against their major counterparts in the Asian

session on Tuesday, as Asian shares fell, following the lackluster

cues overnight from Wall Street and rising expectations that the

U.S. Federal Reserve will lift interest rates as early as June. In

addition, lower commodity prices weighed on resources stocks.

Crude oil for July delivery are currently down $0.19 to $47.89 a

barrel. Crude oil fell as the dollar strengthened on talks of a

rate hike by the Federal Reserve.

The aussie has also been weighed by comments from the RBA

Governor Glenn Stevens, who hinted at further easing in the

upcoming months.

While speaking at the Trans-Tasman Business Circle boardroom

briefing in Sydney, the RBA Stevens defended the central bank's 2-3

percent inflation target.

Monday, the Australian dollar fell 0.06 percent against the U.S.

dollar, 0.72 percent against the yen and 0.12 percent against the

euro.

Meanwhile, the NZ dollar showed mixed trading against its major

rivals. While the kiwi rose against the euro and the U.S. dollar,

it fell against the yen.

In the Asian trading, the Australian dollar fell to nearly a

3-week low of 78.59 against the yen and nearly a 2-week low of

1.5599 against the euro, from yesterday's closing quotes of 78.89

and 1.5528, respectively. If the aussie extends its downtrend, it

is likely to find support around 77.00 against the yen and 1.56

against the euro.

Against the U.S. and the Canadian dollars, the aussie dropped to

a 5-day low of 0.7183 and a 4-day low of 0.9460 from yesterday's

closing quotes of 0.7222 and 0.9491, respectively. The aussie may

test support near 0.70 against the greenback and 0.92 against the

loonie.

The aussie edged down to 1.0692 against the NZ dollar, from an

early 6-day high of 1.0734. On the downside, 1.05 is seen as the

next support level for the aussie.

The NZ dollar fell to an 8-day low of 73.45 against the yen,

from yesterday's closing value of 73.85. The kiwi is likely to find

support around the 72.00 area.

Against the euro and the U.S. dollar, the kiwi dropped to a

6-day low of 1.6685 and a 5-day low of 0.6714 from yesterday's

closing quotes of 1.6583 and 0.6761, respectively. If the kiwi

extends its downtrend, it is likely to find support around 1.69

against the euro and 0.66 against the greenback.

Looking ahead, Swiss trade data for April and Germany's final

GDP data for the first quarter are due to be released in the

pre-European session at 2:00 am ET.

U.K. public sector finance data for April and German ZEW

economic sentiment index for May are slated for release later in

the day.

At 5:00 am ET, Bank of England's Governor Mark Carney is likely

to appear before UK parliament's Treasury Committee to discuss May

Inflation Report in London.

In the New York session, U.S. new home sales data for April and

U.S. Richmond Fed manufacturing index for May are set to be

published.

At 9:00 am ET, the euro area finance ministers are scheduled to

meet in Brussels.

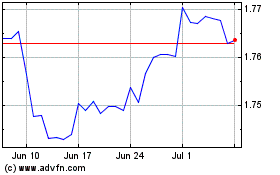

Euro vs NZD (FX:EURNZD)

Forex Chart

From Mar 2024 to Apr 2024

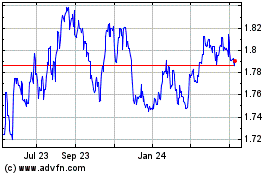

Euro vs NZD (FX:EURNZD)

Forex Chart

From Apr 2023 to Apr 2024