United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 20-F

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

for the fiscal year ended December 31, 2014

Commission file number 025566

ASML HOLDING N.V.

(Exact Name of Registrant as Specified in Its Charter)

THE NETHERLANDS

(Jurisdiction of Incorporation or Organization)

DE RUN 6501

5504 DR VELDHOVEN

THE NETHERLANDS

(Address of Principal Executive Offices)

Craig DeYoung

Telephone: +1 480 696 2762

E-mail: craig.deyoung@asml.com

2650 W Geronimo Place

Chandler, AZ 85224, USA

(Name, Telephone, E-mail, and / or Facsimile number

and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each class |

|

Name of each exchange on which registered |

|

|

|

|

Ordinary Shares |

|

The NASDAQ Stock Market LLC |

|

|

|

|

(nominal value EUR 0.09 per share) |

|

|

|

|

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of

Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of

Class)

Indicate the number of outstanding shares of each of the issuer’s classes of

capital or common stock as of the close of the period covered by the annual report.

432,935,288 Ordinary Shares

(nominal value EUR 0.09 per share)

Indicate by check mark if the

registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes (x) No ( )

If this report is an annual or transition report, indicate by check mark if the registrant

is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ( ) No (x)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant

was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes (x) No ( )

Indicate by check mark whether the registrant has submitted electronically

and posted on its corporate web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule

405 of Regulation

S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required

to submit and post such files).

Yes (x) No ( )

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer (x) Accelerated filer ( ) Non-accelerated filer ( )

Indicate by check mark which basis of accounting the registrant has used to prepare

the financial statements included in this filing:

U.S. GAAP (x) International Financial Reporting Standards as issued by the

International Accounting Standards Board ( ) Other ( )

If “Other” has been checked in response to the previous question, indicate by checkmark

which financial statement item the registrant has elected to follow.

Item 17

( ) Item 18 ( )

If this is an annual report, indicate by check mark whether the registrant is a

shell company (as defined in Rule 12b-2 of the Exchange Act)

Yes ( ) No (x)

Name and address of person authorized to receive notices and

communications

from the Securities and Exchange Commission:

James A. McDonald

Skadden, Arps, Slate, Meagher & Flom (UK) LLP

40 Bank Street,

Canary Wharf London E14 5DS England

Form 20-F

Contents

Part I

Special Note Regarding Forward-Looking Statements

In addition to historical information, this Annual Report

contains statements relating to our future business and/or results. These statements include certain projections and business trends that are “forward-looking” within the meaning of the Private Securities Litigation Reform Act of 1995. You

can generally identify these statements by the use of words like “may”, “will”, “could”, “should”, “project”, “believe”, “anticipate”, “expect”, “plan”,

“estimate”, “forecast”, “potential”, “intend”, “continue” and variations of these words or comparable words. They appear in a number of places throughout this Annual Report and include statements

with respect to our outlook, expected customer demand in specified market segments, expected sales levels and trends, systems backlog, IC unit demand, expected financial results, including expected gross margin and expenses, expected shipments of

tools, productivity of our tools and systems performance, including EUV system performance (such as endurance), the development of EUV technology and the number of EUV systems expected to be shipped and recognized in revenue and timing of shipments,

dividend policy and intention to repurchase shares, purchase commitments and statements about our CCIP.

These forward-looking statements are not

historical facts, but rather are based on current expectations, estimates, assumptions and projections about the business and our future financial results and readers should not place undue reliance on them. Forward-looking statements do not

guarantee future performance, and actual results may differ materially from projected results as a result of certain risks, and uncertainties. These risks and uncertainties include, without limitation, those described under Item 3.D. “Risk

Factors”. These forward-looking statements are made only as of the date of this Annual Report. We do not undertake to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Item 1 Identity of Directors, Senior Management and Advisors

Not applicable.

Item 2 Offer

Statistics and Expected Timetable

Not applicable.

Item

3 Key Information

A. Selected Financial Data

The following selected consolidated financial data should be read in conjunction with Item 5 “Operating and Financial Review and Prospects” and Item 18 “Financial Statements”.

On May 30, 2013, we acquired 100 percent of the issued share capital of Cymer. Financial information presented in our Annual Report includes Cymer

from May 30, 2013 onwards.

A summary of all abbreviations, technical terms and definitions (of capitalized terms) used in this Annual Report is

set forth on pages D-1 through D-4.

|

|

|

|

|

| ASML ANNUAL REPORT 2014 |

|

1 |

|

|

Five-Year Financial Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Year ended December 31

(in thousands, except per share data) |

|

|

2014

EUR |

|

|

|

2013

EUR |

|

|

|

2012

EUR |

|

|

|

2011

EUR |

1

|

|

|

2010

EUR |

|

| |

|

|

|

|

|

|

|

| Consolidated Statements of Operations data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

|

5,856,277 |

|

|

|

5,245,326 |

|

|

|

4,731,555 |

|

|

|

5,651,035 |

|

|

|

4,507,938 |

|

| Cost of sales |

|

|

(3,259,903) |

|

|

|

(3,068,064) |

|

|

|

(2,726,298) |

|

|

|

(3,201,645) |

|

|

|

(2,552,768) |

|

| |

|

|

|

|

|

|

|

| Gross profit |

|

|

2,596,374 |

|

|

|

2,177,262 |

|

|

|

2,005,257 |

|

|

|

2,449,390 |

|

|

|

1,955,170 |

|

| Other income |

|

|

81,006 |

|

|

|

64,456 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Research and development costs |

|

|

(1,074,035) |

|

|

|

(882,029) |

|

|

|

(589,182) |

|

|

|

(590,270) |

|

|

|

(523,426) |

|

| Selling, general and administrative costs |

|

|

(321,110) |

|

|

|

(311,741) |

|

|

|

(259,301) |

|

|

|

(217,904) |

|

|

|

(181,045) |

|

| |

|

|

|

|

|

|

|

| Income from operations |

|

|

1,282,235 |

|

|

|

1,047,948 |

|

|

|

1,156,774 |

|

|

|

1,641,216 |

|

|

|

1,250,699 |

|

| Interest and other, net |

|

|

(8,600) |

|

|

|

(24,471) |

|

|

|

(6,196) |

|

|

|

7,419 |

|

|

|

(8,176) |

|

| |

|

|

|

|

|

|

|

| Income before income taxes |

|

|

1,273,635 |

|

|

|

1,023,477 |

|

|

|

1,150,578 |

|

|

|

1,648,635 |

|

|

|

1,242,523 |

|

| Provision for income taxes |

|

|

(76,995) |

|

|

|

(7,987) |

|

|

|

(4,262) |

|

|

|

(181,675) |

|

|

|

(220,703) |

|

| |

|

|

|

|

|

|

|

| Net income |

|

|

1,196,640 |

|

|

|

1,015,490 |

|

|

|

1,146,316 |

|

|

|

1,466,960 |

|

|

|

1,021,820 |

|

|

|

|

|

|

|

| Earnings per share data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic net income per ordinary share |

|

|

2.74 |

|

|

|

2.36 |

|

|

|

2.70 |

|

|

|

3.45 |

|

|

|

2.35 |

|

| Diluted net income per ordinary

share2 |

|

|

2.72 |

|

|

|

2.34 |

|

|

|

2.68 |

|

|

|

3.42 |

|

|

|

2.33 |

|

|

|

|

|

|

|

| Number of ordinary shares used

in computing per share amounts (in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

437,142 |

|

|

|

429,770 |

|

|

|

424,096 |

|

|

|

425,618 |

|

|

|

435,146 |

|

| Diluted2 |

|

|

439,693 |

|

|

|

433,446 |

|

|

|

426,986 |

|

|

|

429,053 |

|

|

|

438,974 |

|

| 1 |

As of January 1, 2011, we adopted ASU 2009-13 “Sales Arrangements with Multiple Deliverables” which converted into ASC 605-25 “Revenue Recognition –

Multiple-Element Arrangements”. The ASU was adopted prospectively and had an insignificant impact on timing and allocation of revenues. |

| 2 |

The calculation of diluted net income per ordinary share assumes the exercise of options issued under our stock option plans and the issuance of shares under our share plans for

periods in which exercises or issuances would have a dilutive effect. The calculation of diluted net income per ordinary share does not assume exercise of such options or issuance of shares when such exercises or issuance would be anti-dilutive.

|

|

|

|

|

|

| ASML ANNUAL REPORT 2014 |

|

2 |

|

|

Five-Year Financial Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As of December 31 |

|

|

2014 |

|

|

|

2013 |

|

|

|

2012 |

|

|

|

2011 |

1 |

|

|

2010 |

|

|

|

| (in thousands, unless otherwise indicated) |

|

EUR |

|

|

EUR |

|

|

EUR |

|

|

EUR |

|

|

EUR |

|

|

|

| |

| Consolidated Balance Sheets data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

2,419,487 |

|

|

|

2,330,694 |

|

|

|

1,767,596 |

|

|

|

2,731,782 |

|

|

|

1,949,834 |

|

|

|

| Short-term investments |

|

|

334,864 |

|

|

|

679,884 |

|

|

|

930,005 |

|

|

|

- |

|

|

|

- |

|

|

|

| Working capital2 |

|

|

4,257,335 |

|

|

|

4,156,917 |

|

|

|

3,745,559 |

|

|

|

3,473,767 |

|

|

|

2,787,220 |

|

|

|

| Total assets |

|

|

12,203,945 |

|

|

|

11,513,730 |

|

|

|

7,410,478 |

|

|

|

7,260,815 |

|

|

|

6,180,358 |

|

|

|

| Long-term debt (including the current portion of long-term debt) |

|

|

1,154,137 |

|

|

|

1,074,570 |

|

|

|

759,490 |

|

|

|

736,368 |

|

|

|

710,060 |

|

|

|

| Total shareholders’ equity |

|

|

7,512,590 |

|

|

|

6,922,427 |

|

|

|

4,066,893 |

|

|

|

3,444,154 |

|

|

|

2,773,908 |

|

|

|

| Share capital |

|

|

39,426 |

|

|

|

40,092 |

|

|

|

37,470 |

|

|

|

38,354 |

|

|

|

39,293 |

|

|

|

|

|

|

|

|

|

|

| Consolidated Statements of Cash Flows data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

254,644 |

|

|

|

228,775 |

|

|

|

186,620 |

|

|

|

165,185 |

|

|

|

151,444 |

|

|

|

| Impairment |

|

|

10,528 |

|

|

|

13,057 |

|

|

|

3,234 |

|

|

|

12,272 |

|

|

|

8,563 |

|

|

|

| Net cash provided by operating activities |

|

|

1,025,206 |

|

|

|

1,054,173 |

|

|

|

703,478 |

|

|

|

2,070,440 |

|

|

|

940,048 |

|

|

|

| Purchase of property, plant and equipment 3 |

|

|

(358,280) |

|

|

|

(210,804) |

|

|

|

(171,878) |

|

|

|

(300,898) |

|

|

|

(128,728) |

|

|

|

| Purchase of available for sale securities |

|

|

(504,756) |

|

|

|

(904,856) |

|

|

|

(1,379,997) |

|

|

|

- |

|

|

|

- |

|

|

|

| Maturity of available for sale securities |

|

|

849,776 |

|

|

|

1,195,031 |

|

|

|

449,992 |

|

|

|

- |

|

|

|

- |

|

|

|

| Acquisition of subsidiary (net of cash acquired) |

|

|

- |

|

|

|

(443,712) |

4 |

|

|

(10,292) |

|

|

|

- |

|

|

|

- |

|

|

|

| Net cash provided by (used in) investing activities |

|

|

(16,212) |

|

|

|

(368,341) |

|

|

|

(1,119,833) |

|

|

|

(300,898) |

|

|

|

(124,903) |

|

|

|

| Net proceeds from issuance of shares |

|

|

39,679 |

|

|

|

31,822 |

|

|

|

3,907,666 |

5 |

|

|

34,084 |

|

|

|

31,000 |

|

|

|

| Capital repayment |

|

|

- |

|

|

|

- |

|

|

|

(3,728,324) |

6 |

|

|

- |

|

|

|

- |

|

|

|

| Dividend paid |

|

|

(267,962) |

|

|

|

(216,085) |

|

|

|

(188,892) |

|

|

|

(172,645) |

|

|

|

(86,960) |

|

|

|

| Deposits from customers |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(150,000) |

|

|

|

150,000 |

|

|

|

| Purchase of shares |

|

|

(700,000) |

|

|

|

(300,000) |

|

|

|

(535,373) |

|

|

|

(700,452) |

|

|

|

- |

|

|

|

| Net proceeds from issuance of notes |

|

|

- |

|

|

|

740,445 |

7 |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

| Repurchase of notes |

|

|

- |

|

|

|

(368,303) |

8 |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

| Net cash provided by (used in) financing activities |

|

|

(928,439) |

|

|

|

(113,111) |

|

|

|

(545,583) |

|

|

|

(991,561) |

|

|

|

92,702 |

|

|

|

| Net increase (decrease) in cash and cash equivalents |

|

|

88,793 |

|

|

|

563,098 |

|

|

|

(964,186) |

|

|

|

781,948 |

|

|

|

912,760 |

|

|

|

|

|

|

|

|

|

|

| Ratios and other data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit as a percentage of net sales |

|

|

44.3 |

|

|

|

41.5 |

|

|

|

42.4 |

|

|

|

43.3 |

|

|

|

43.4 |

|

|

|

| Income from operations as a percentage of net sales |

|

|

21.9 |

|

|

|

20.0 |

|

|

|

24.4 |

|

|

|

29.0 |

|

|

|

27.7 |

|

|

|

| Net income as a percentage of net sales |

|

|

20.4 |

|

|

|

19.4 |

|

|

|

24.2 |

|

|

|

26.0 |

|

|

|

22.7 |

|

|

|

| Shareholders’ equity as a percentage of total assets |

|

|

61.6 |

|

|

|

60.1 |

|

|

|

54.9 |

|

|

|

47.4 |

|

|

|

44.9 |

|

|

|

| Income taxes as a percentage of income before income taxes |

|

|

6.0 |

|

|

|

0.8 |

|

|

|

0.4 |

|

|

|

11.0 |

|

|

|

17.8 |

|

|

|

| Sales of systems (in units) |

|

|

136 |

|

|

|

157 |

|

|

|

170 |

|

|

|

222 |

|

|

|

197 |

|

|

|

| ASP of system sales (in millions) |

|

|

31.2 |

|

|

|

25.4 |

|

|

|

22.4 |

|

|

|

22.0 |

|

|

|

19.8 |

|

|

|

| Value of systems backlog (in millions) |

|

|

2,772.4 |

9 |

|

|

1,953.3 |

|

|

|

1,214.1 |

|

|

|

1,732.5 |

10 |

|

|

3,855.7 |

|

|

|

| Systems backlog (in units) |

|

|

82 |

9 |

|

|

56 |

|

|

|

46 |

|

|

|

71 |

10 |

|

|

157 |

|

|

|

| ASP of systems backlog (in millions) |

|

|

33.8 |

9 |

|

|

34.9 |

|

|

|

26.4 |

|

|

|

24.4 |

10 |

|

|

24.6 |

|

|

|

| Value of booked systems (in millions) |

|

|

4,902.2 |

9 |

|

|

4,644.0 |

|

|

|

3,312.3 |

|

|

|

2,909.3 |

10 |

|

|

6,212.7 |

|

|

|

| Net bookings (in units) |

|

|

157 |

9 |

|

|

166 |

|

|

|

144 |

|

|

|

134 |

10 |

|

|

285 |

|

|

|

| ASP of booked systems (in millions) |

|

|

31.2 |

9 |

|

|

28.0 |

|

|

|

23.0 |

|

|

|

21.7 |

10 |

|

|

21.8 |

|

|

|

| Number of payroll employees (in FTEs) |

|

|

11,318 |

|

|

|

10,360 |

|

|

|

8,497 |

|

|

|

7,955 |

|

|

|

7,184 |

|

|

|

| Number of temporary employees (in FTEs) |

|

|

2,754 |

|

|

|

2,865 |

|

|

|

2,139 |

|

|

|

1,935 |

|

|

|

2,061 |

|

|

|

| Increase (decrease) net sales in percentage |

|

|

11.6 |

|

|

|

10.9 |

|

|

|

(16.3) |

|

|

|

25.4 |

|

|

|

182.4 |

|

|

|

| Number of ordinary shares issued and outstanding (in thousands) |

|

|

432,935 |

|

|

|

440,852 |

|

|

|

407,165 |

|

|

|

413,669 |

|

|

|

436,593 |

|

|

|

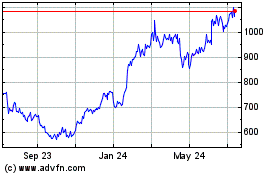

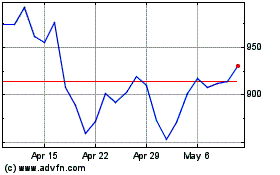

| Closing ASML share price in EUR on Euronext Amsterdam |

|

|

89.50 |

|

|

|

68.04 |

|

|

|

48.00 |

|

|

|

32.48 |

|

|

|

28.90 |

|

|

|

| Volatility 260 days as percentage of our shares listed on Euronext |

|

|

27.49 |

|

|

|

23.98 |

|

|

|

28.64 |

|

|

|

32.46 |

|

|

|

30.25 |

|

|

|

| Amsterdam11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Closing ASML share price in USD on NASDAQ |

|

|

107.83 |

|

|

|

93.70 |

|

|

|

64.39 |

|

|

|

41.79 |

|

|

|

38.34 |

|

|

|

| Volatility 260 days as percentage of our shares listed on NASDAQ12 |

|

|

26.01 |

|

|

|

24.01 |

|

|

|

30.05 |

|

|

|

41.83 |

|

|

|

35.25 |

|

|

|

| Dividend per ordinary share in EUR |

|

|

0.70 |

13 |

|

|

0.61 |

|

|

|

0.53 |

|

|

|

0.46 |

|

|

|

0.40 |

|

|

|

| Dividend per ordinary share in USD |

|

|

0.79 |

13,14 |

|

|

0.84 |

15 |

|

|

0.69 |

15 |

|

|

0.61 |

15 |

|

|

0.58 |

15 |

|

|

| 1 |

As of January 1, 2011, we adopted ASU 2009-13 “Sales Arrangements with Multiple Deliverables” which converted into ASC 605-25 “Revenue Recognition –

Multiple-Element Arrangements”. The ASU was adopted prospectively and had an insignificant impact on timing and allocation of revenues. |

| 2 |

Working capital is calculated as the difference between total current assets and total current liabilities. |

| 3 |

An amount of EUR 95.5 million (2013: EUR 115.9 million, 2012: EUR 204.8 million, 2011: EUR 300.5 million, 2010: EUR 214.1 million) of the additions in

property, plant and equipment relates to non-cash transfers from inventory, other movements include EUR 1.5 million increase (2013: EUR 12.5 million decrease, 2012: EUR 9.6 million decrease, 2011: EUR 17.7 million decrease and

2010: EUR nil million), mainly relating to investments not yet paid and inceptions of finance lease arrangements. Since the transfers between inventory and property, plant and equipment are non-cash events, these are not reflected in the

Consolidated Statements of Cash Flows data. For further details see Note 12 to the Financial Statements. |

| 4 |

In addition to the cash paid in relation to the acquisition of Cymer, we issued 36,464,576 shares for an amount of EUR 2,346.7 million (non-cash event) as part of the

consideration paid. |

| 5 |

Net proceeds from issuance of shares includes an amount of EUR 3,853.9 million related to the share issuances in connection to the CCIP. See Note 28 to the Financial

Statements. |

| 6 |

The difference of EUR 125.6 million between the capital repayment of EUR 3,728.3 million and the net proceeds from issuance of shares of EUR 3,853.9 million

relates to the capital repayment on ASML’s treasury shares which was part of the synthetic share buyback in November 2012. |

| 7 |

Net proceeds from issuance of notes relate to the total cash proceeds of EUR 740.4 million (net of incurred transaction costs) from the issuance of our EUR 750 million

3.375 percent senior notes due 2023. |

| 8 |

Repurchase of notes relates to the net cash outflows of EUR 368.3 million for the partial repurchase of our EUR 600 million 5.75 percent senior notes due 2017 including

the partial unwinding of the related interest rate swaps. |

|

|

|

|

|

| ASML ANNUAL REPORT 2014 |

|

3 |

|

|

| 9 |

Our systems backlog and net bookings include sales orders for which written authorizations have been accepted and shipment and/or revenue recognition is expected within 12

months. As of 2014 we also include EUV in our backlog starting with our NXE:3350B systems. As a result, two NXE:3350B systems are now included in our systems backlog and net bookings. Before 2014, our systems backlog and net bookings include only

sales orders for which written authorizations have been accepted and system shipment and revenue recognition dates within the following 12 months have been assigned. This change has no impact on the comparative figures. |

| 10 |

From January 1, 2011, we value our net bookings and systems backlog at system sales value including factory options. Prior to January 1, 2011, we valued net bookings

and systems backlog at full order value (i.e. including factory options, field options and services). The comparative figures for prior periods have not been adjusted because the impact on the comparative figures is insignificant (approximately EUR

20.0 million negative impact on backlog value as of December 31, 2010). |

| 11 |

Volatility represents the variability in our share price on Euronext Amsterdam as measured over the 260 business days of each year presented (source: Bloomberg Finance LP).

|

| 12 |

Volatility represents the variability in our share price on NASDAQ as measured over the 260 business days of each year presented (source: Bloomberg Finance LP).

|

| 13 |

Subject to approval of the AGM to be held on April 22, 2015. |

| 14 |

The exchange rate used to express the proposed dividend per ordinary share in USD is the exchange rate of USD/EUR 1.13 as of January 30, 2015. |

| 15 |

The dividends per ordinary share in USD for the years 2010, 2011, 2012 and 2013 have been adjusted compared to the respective Annual Reports to reflect the actual exchange rates

at time of dividend payment. |

|

|

|

|

|

| ASML ANNUAL REPORT 2014 |

|

4 |

|

|

Exchange Rate Information

We publish our Financial Statements in euro. A portion of our assets, liabilities, net sales and costs is, and historically has been, denominated in currencies other than the euro. For a discussion of the impact of

exchange rate fluctuations on our financial condition and results of operations, see Item 5.A. “Operating Results – Foreign Exchange Management”.

The following are the Noon Buying Rates certified by the Federal Reserve Bank for customs purposes, expressed in U.S. dollars per euro.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Calendar year |

|

2015

(through January 31, 2015) |

|

|

2014 |

|

|

2013 |

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

| |

|

|

|

|

|

|

|

|

|

| Period End |

|

|

|

|

1.13 |

|

|

|

1.21 |

|

|

|

1.38 |

|

|

|

1.32 |

|

|

|

1.30 |

|

|

|

1.33 |

|

| Period Average 1 |

|

|

|

|

1.16 |

|

|

|

1.33 |

|

|

|

1.33 |

|

|

|

1.29 |

|

|

|

1.40 |

|

|

|

1.33 |

|

| Period High |

|

|

|

|

1.20 |

|

|

|

1.39 |

|

|

|

1.38 |

|

|

|

1.35 |

|

|

|

1.49 |

|

|

|

1.45 |

|

| Period Low |

|

|

|

|

1.13 |

|

|

|

1.21 |

|

|

|

1.28 |

|

|

|

1.21 |

|

|

|

1.29 |

|

|

|

1.20 |

|

| 1 |

The average of the Noon Buying Rates on the last business day of each month during the period presented. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Months of |

|

January

2015 |

|

|

December

2014 |

|

|

November

2014 |

|

|

October

2014 |

|

|

September

2014 |

|

|

August

2014 |

|

| |

|

|

|

|

|

|

|

|

|

| Period High |

|

|

|

|

1.20 |

|

|

|

1.25 |

|

|

|

1.26 |

|

|

|

1.28 |

|

|

|

1.31 |

|

|

|

1.34 |

|

| Period Low |

|

|

|

|

1.13 |

|

|

|

1.21 |

|

|

|

1.24 |

|

|

|

1.25 |

|

|

|

1.26 |

|

|

|

1.32 |

|

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

In conducting our business, we face many risks that may interfere with our business objectives. Some of these risks relate to our operational processes, while

others relate to our business environment. It is important to understand the nature of these risks and the impact they may have on our business, financial condition and results of operations. Some of the more relevant risks are described below.

These risks are not the only ones that we face. Some risks may not yet be known to us and certain risks that we do not currently believe to be material could become material in the future.

Risks Related to the Semiconductor Industry

The Semiconductor Industry Is Highly Cyclical and We May Be

Adversely Affected by Any Downturn

As a supplier to the global semiconductor industry, we are subject to the industry’s business cycles, of

which the timing, duration and volatility are difficult to predict. The semiconductor industry has historically been cyclical. Sales of our lithography systems depend in large part upon the level of capital expenditures by semiconductor

manufacturers. These capital expenditures depend upon a range of competitive and market factors, including:

| • |

|

The current and anticipated market demand for semiconductors and for products utilizing semiconductors; |

| • |

|

Semiconductor production costs and manufacturing capacity utilization for semiconductors; |

| • |

|

Semiconductor equipment industry capacity; |

| • |

|

Changes in semiconductor inventory levels; |

| • |

|

General economic conditions; and |

Reductions or delays in

capital equipment purchases by our customers could have a material adverse effect on our business, financial condition and results of operations.

|

|

|

|

|

| ASML ANNUAL REPORT 2014 |

|

5 |

|

|

In an industry downturn, our ability to maintain profitability will depend substantially on whether we are able to

lower our costs and break-even level, which is the level of sales that we must reach in a year to achieve positive net income. If sales decrease significantly as a result of an industry downturn and we are unable to adjust our costs over the same

period, our net income may decline significantly or we may suffer losses. As we need to keep certain levels of inventory on hand to meet anticipated product and service demand, we may also incur increased costs related to inventory obsolescence in

an industry downturn, and such inventory obsolescence costs may be higher with our newer technology systems such as EUV. In addition, industry downturns generally result in overcapacity, resulting in downward pressure on sales prices and impairment

of machinery and equipment, which in the past has had, and in the future could have, a material adverse effect on our business, financial condition and results of operations.

The financial crises that affected the international banking system and global financial markets in 2008-2009 have been in many respects unprecedented and international financial markets and the global economy have

remained volatile. Instability of the financial markets and the global economy in general can have a number of effects on our business, including (i) declining business and consumer confidence resulting in reduced, or delayed purchase of our

products or shorter-term capital expenditures for our products; insolvency of key suppliers resulting in product delays, (ii) an inability of customers to obtain credit to finance purchases of our products, delayed payments from our customers

and/or customer insolvencies and (iii) other adverse effects that we cannot currently anticipate. If global economic and market conditions deteriorate, we are likely to experience material adverse impacts on our business, financial condition

and results of operations.

Conversely, in anticipation of periods of increasing demand for semiconductor manufacturing equipment, we must maintain

sufficient manufacturing capacity and inventory and we must attract, hire, integrate and retain a sufficient number of qualified employees to meet customer demand. Our ability to predict the timing and magnitude of industry fluctuations is limited

and our products require significant lead-time to successfully complete. Accordingly, we may not be able to effectively increase our production capacity to respond to an increase in customer demand in an industry upturn resulting in lost sales,

damage to customer relationships and we may lose market share.

Our Business Will Suffer If We or the Industry Do Not Respond Rapidly to Commercial

and Technological Changes in the Semiconductor Industry

The semiconductor manufacturing industry is subject to:

| • |

|

Rapid change towards more complex technologies; |

| • |

|

Frequent new product introductions and enhancements; |

| • |

|

Evolving industry standards; |

| • |

|

Changes in customer requirements; and |

| • |

|

Shorter product life cycles. |

Our products

could become obsolete sooner than anticipated because of a faster than anticipated change in one or more of the technologies related to our products or in market demand for products based on a particular technology. Our success in developing new

products and in enhancing our existing products depends on a variety of factors, including the successful management of our R&D programs and the timely completion of product development and design relative to competitors. If we do not develop

and introduce new and enhanced systems at competitive prices and on a timely basis, our customers will not integrate our systems into the planning and design of new production facilities and upgrades of existing facilities, which would have a

material adverse effect on our business, financial condition and results of operations.

In particular, we are investing considerable financial and

other resources to develop and introduce new products and product enhancements, such as Dry, Immersion, EUV and Holistic Lithography. If we or our suppliers are unable to successfully develop and introduce these products and technologies, or if our

customers do not fully adopt the new technologies, products or product enhancements due to a preference for more established or alternative new technologies and products, due to the failure to meet their development roadmaps which require our new

technology or for any other reason, we may not recoup all of our investments in these technologies or products, which could have a material adverse effect on our business, financial condition and results of operations.

|

|

|

|

|

| ASML ANNUAL REPORT 2014 |

|

6 |

|

|

The success of EUV, which we believe is critical for keeping pace with Moore’s Law, which postulates that the

number of transistors on a chip doubles approximately every 18 to 24 months at equivalent costs, remains dependent on continuing technical advances by us and our suppliers, particularly with respect to technology related to the light source, source

power, system availability, and scanner performance, without which EUV tools cannot achieve the productivity and yield required to economically justify the higher price of these tools. A delay in the developments of these tools or a delay in such

tools meeting production requirements could discourage or result in much slower adoption of this EUV technology and could delay purchases of these tools. In addition, the introduction of alternative technologies or processes by our competitors that

compete with EUV could discourage or result in much slower adoption of EUV technology. If the technologies that we pursue to assist our customers in producing smaller and more efficient chips are not as effective as those developed by our

competitors, or if our customers adopt new technological architectures that are less focused on lithography, this may adversely affect our business, financial condition and results of operations.

We Face Intense Competition

The semiconductor equipment

industry is highly competitive. The principal elements of competition in our market are:

| • |

|

The technical performance characteristics of a lithography system; |

| • |

|

The value of ownership of that system based on its purchase price, maintenance costs, productivity, and customer service and support costs;

|

| • |

|

The exchange rate of the euro, particularly against the Japanese yen- strengthening of the euro against the yen could result in a loss of market share;

|

| • |

|

The relative strength and breadth of our portfolio of patents and other intellectual property rights; and |

| • |

|

Our customers’ desire to obtain lithography equipment from more than one supplier. |

Our competitiveness increasingly depends upon our ability to develop new and enhanced semiconductor equipment that is competitively priced and introduced on a

timely basis, as well as our ability to protect and defend our intellectual property rights. See Item 4.B. “Business Overview—Intellectual Property”, and Note 19 to the Financial Statements.

We compete primarily with Nikon and Canon. Both Nikon and Canon have substantial financial resources and broad patent portfolios. Each continues to introduce new

products with improved price and performance characteristics that compete directly with our products, which may cause a decline in our sales or a loss of market acceptance for our lithography systems. In addition, adverse market conditions, industry

overcapacity or a decrease in the value of the Japanese yen in relation to the euro or the U.S. dollar, could further intensify price-based competition in those regions that account for the majority of our sales, resulting in lower prices and

margins which could have a material adverse effect on our business, financial condition and results of operations.

In addition to competitors in

lithography, we may face competition with respect to alternative technologies for the non-critical layers or for all layers. If we fail to keep pace with Moore’s Law or in the event the delivery of new technology is delayed, our customers may

opt for other solutions in IC manufacturing as a substitute for purchasing our products.

In the future the IC industry may not find it economically or

technically feasible to maintain the pace of Moore’s Law through the use of lithography systems, which could result in our customers choosing solutions other than lithography for IC manufacturing. In addition, if the pace of Moore’s Law is

not maintained, this could also result in the IC industry utilizing fewer leading technology systems, which could result in lower sales and margins.

Risks Related to ASML

The Number of Systems We Can

Produce Is Limited by Our Dependence on a Limited Number of Suppliers of Key Components

We rely on outside vendors for components and subassemblies

used in our systems including the design thereof, each of which is obtained from a single supplier or a limited number of suppliers. Our reliance on a limited group of suppliers involves several risks, including a potential inability to obtain an

adequate supply of required components, reduced control over pricing and the risk of untimely delivery of these components and subassemblies.

|

|

|

|

|

| ASML ANNUAL REPORT 2014 |

|

7 |

|

|

The number of lithography systems we are able to produce may be limited by the production

capacity of Zeiss. Zeiss is our single supplier of lenses, mirrors, collectors and other critical optical components (which we refer to as optics). If Zeiss were unable to maintain and increase production levels or if we are unable to maintain our

business relationship with Zeiss in the future we could be unable to fulfill orders, which could damage relationships with current and prospective customers and have a material adverse effect on our business, financial condition and results of

operations. If Zeiss were to terminate its relationship with us or if Zeiss were unable to maintain production of optics over a prolonged period, we would effectively cease to be able to conduct our business. See Item 4.B. “Business

Overview—Manufacturing, Logistics and Suppliers”. In addition to Zeiss’ current position as a supplier of optics, a number of other critical components such as drive lasers included in our CO2 lasers used in our EUV systems are available from only a limited number of suppliers.

Designing and manufacturing some of these components and subassemblies that we use in our manufacturing processes is an extremely complex process and could result in delays by our suppliers. A prolonged inability

to obtain adequate deliveries of components or subassemblies, or any other circumstance that requires us to seek alternative sources of supply, could significantly hinder our ability to deliver our products in a timely manner, which could damage

relationships with current and prospective customers and have a material adverse effect on our business, financial condition and results of operations.

In addition, as we develop new technologies, such as EUV, this requires our suppliers to participate in the development process so that the components they supply

will meet the requirements of our development roadmap, and this may require significant R&D spending on the part of our suppliers. If our suppliers are unable to maintain their development roadmap in line with ours, this may delay the

development and introduction of new products. In addition, our suppliers may not have or may not be willing to spend sufficient financial resources to make the necessary R&D expenditures to enable them (and therefore us) to continue development

roadmaps. In this case, we may be required to co-invest with our suppliers to continue the R&D required to continue development roadmaps.

A High

Percentage of Net Sales is Derived From a Few Customers

Historically, we have sold a substantial number of lithography systems to a limited number

of customers. We expect customer concentration to increase because of continuing consolidation in the semiconductor manufacturing industry. Consequently, while the identity of our largest customers may vary from year to year, sales may remain

concentrated among relatively few customers in any particular year. In 2014, recognized sales to our largest customer accounted for EUR 1,532.1 million, or 26.2 percent of net sales, compared with EUR 2,058.6 million, or 39.2 percent of

net sales, in 2013. The loss of any significant customer or any significant reduction in orders by a significant customer may have a material adverse effect on our business, financial condition and results of operations.

Additionally, as a result of our limited number of customers, credit risk on our receivables is concentrated. Our three largest customers (based on net sales)

accounted for EUR 643.2 million, or 49.3 percent of accounts receivable and finance receivables on December 31, 2014, compared with EUR 861.4 million, or 73.3 percent on December 31, 2013. As a result, business failure or

insolvency of one of our main customers may have a material adverse effect on our business, financial condition and results of operations.

We Derive

Most of Our Revenues From the Sale of a Relatively Small Number of Products

We derive most of our revenues from the sale of a relatively small

number of lithography equipment systems (136 units in 2014 and 157 units in 2013), with an ASP per system in 2014 of EUR 31.2 million (EUR 35.6 million for new systems and EUR 5.8 million for used systems) and an ASP per system in

2013 of EUR 25.4 million (EUR 27.4 million for new systems and EUR 6.9 million for used systems). As a result, the timing of recognition of revenue for a particular reporting period from a small number of system sales may have a

material adverse effect on our business, financial condition and results of operations in that period. Specifically, the failure to receive anticipated orders, or delays in shipments near the end of a particular reporting period, due, for example,

to:

| • |

|

A downturn in the highly cyclical semiconductor industry; |

| • |

|

Volatility in the Logic and Memory end-markets as a result of oversupply and undersupply; |

| • |

|

Cancellation or order push-back by customers; |

| • |

|

Unexpected manufacturing difficulties; or |

| • |

|

Delays in deliveries by suppliers |

may cause

net sales in a particular reporting period to fall significantly below net sales in previous periods or below our expected net sales, and may have a material adverse effect on our results of operations for that period. In particular, our published

quarterly earnings may vary significantly from quarter to quarter and may vary in the future and reduce our visibility on future sales for the reasons discussed above.

|

|

|

|

|

| ASML ANNUAL REPORT 2014 |

|

8 |

|

|

The Time Window for New Product Introduction is Shorter and is Accompanied by Potential Design and Production

Delays and by Significant Costs

The development and initial production, installation and enhancement of the systems we produce is often accompanied

by design and production delays and related costs of a nature typically associated with the introduction and transition to full-scale manufacturing of complex capital equipment. While we expect and plan for a corresponding learning-curve effect in

our product development cycle, we cannot predict with precision the time and expense required to overcome these initial problems and to ensure full performance to specifications. Moreover, we anticipate that this learning-curve effect will continue

to present increasingly difficult challenges with each new generation of our products as a result of increasing technological complexity. In particular, the development of an EUV volume production system is dependent on, and subject to the

successful implementation of, among other things, technology related to the light source, source power, system availability, scanner performance and other technologies specific to EUV. There is a risk that we may not be able to introduce or bring to

full-scale production new products as quickly as we anticipate in our product introduction plans, which could have a material adverse effect on our business, financial condition and results of operations.

For the market to accept technology enhancements, our customers, in many cases, must upgrade their existing technology capabilities. Such upgrades from established

technology may not be available to our customers to enable volume production using our new technology enhancements. This could result in our customers not purchasing, or pushing back or canceling orders for our technology enhancements, which could

negatively impact our business, financial condition and results of operations.

We are also dependent on our suppliers to maintain their development

roadmaps to enable us to introduce new technologies on a timely basis, and if they are unable to keep pace whether due to technological factors, lack of financial resources or otherwise, this could prevent us from meeting our development roadmaps.

Additionally, in connection with our EUV production, we have made advanced payments to suppliers that we may not recoup if we do not reach expected EUV

sales levels in the future. We may make similar advance payments (or other investments in our suppliers) to suppliers in connection with EUV or other technologies we develop, and we may not recoup those advanced payments or other investments (e.g.

if expected sales are not met). See Note 9 to our Financial Statements.

As Lithography Technologies Become More Complex, the Success of Our R&D

Programs Becomes More Uncertain and More Expensive

Our lithography systems have become increasingly complex, and accordingly, the costs to develop

new products and technologies have increased, and we expect such costs to continue to increase. This increase in costs requires us to continue obtaining sufficient funding for our R&D programs. For example, we obtained partial funding for our

EUV R&D program through the CCIP. We may however, be unable to obtain this type of funding from customers in the future, in which case we may be unable to fund R&D investments necessary to maintain our technological leadership. The

increasing complexity of new technologies, which leads to increasing cost of R&D programs for new technologies, also increases the risk that a new product or technology may not be successful

Furthermore, as the innovation cycle becomes more complex, developing new technology, including EUV technology, requires increased R&D investments by our

suppliers in order to meet the technology demands of us and our customers. Our suppliers may not have, or may not be willing to invest, the resources necessary to continue the development of the new technologies to the extent such investments are

necessary, which may result in our contributing funds to such R&D programs or limiting the R&D investments that we can undertake.

Failure to

Adequately Protect the Intellectual Property Rights Upon Which We Depend Could Harm Our Business

We rely on intellectual property rights such as

patents, copyrights and trade secrets to protect our proprietary technology. However, we face the risk that such measures could prove to be inadequate because:

| • |

|

Intellectual property laws may not sufficiently support our proprietary rights or may change in the future in a manner adverse to us;

|

| • |

|

Patent rights may not be granted or interpreted as we expect; |

| • |

|

Patents will expire which may result in key technology becoming widely available that may hurt our competitive position; |

| • |

|

The steps we take to prevent misappropriation or infringement of our proprietary rights may not be successful; and |

| • |

|

Third parties may be able to develop or obtain patents for similar competing technology. |

In addition, litigation may be necessary to enforce our intellectual property rights, to determine the validity and scope of the proprietary rights of others, or

to defend against claims of infringement. Any such litigation may result in substantial costs and diversion of management resources, and, if decided unfavorably to us, could have a material adverse effect on our business, financial condition and

results of operations.

|

|

|

|

|

| ASML ANNUAL REPORT 2014 |

|

9 |

|

|

A Disruption in Our Information Technology Systems, Including Those Related to Cybersecurity, Could Adversely

Affect Our Business Operations

We rely on the accuracy, capacity and security of our information technology systems. Despite the measures that we

have implemented, including those related to cybersecurity, our systems could be breached or damaged by computer viruses and systems attacks, natural or man-made incidents, disasters or unauthorized physical or electronic access.

From time to time we experience cybersecurity attacks on our information technology systems, which are becoming more sophisticated and include malicious software,

attempts to gain unauthorized access to data, and other electronic security breaches that could lead to disruptions in critical systems, unauthorized release of confidential or otherwise protected information (including confidential information

relating to our customers and suppliers), and corruption of data. Any system failure, accident or security breach could result in business disruption, theft of our intellectual property, trade secrets (including our proprietary technology), customer

or supplier information and unauthorized access to personnel information.

Moreover, there can be no assurance that such measures we have implemented

will be sufficient to prevent a system failure, accident or security breach from occurring. To the extent that our business is interrupted or data or proprietary technology is lost, destroyed or inappropriately used or disclosed, such disruptions

could adversely affect our competitive position, relationships with customers and suppliers or our business, financial condition and results of operations. In addition, we may be required to incur significant costs to protect against or repair the

damage caused by these disruptions or security breaches in the future.

Defending Against Intellectual Property Claims Brought by Others Could Harm

Our Business

In the course of our business, we are subject to claims by third parties alleging that our products or processes infringe upon their

intellectual property rights. If successful, such claims could limit or prohibit us from developing our technology and manufacturing our products, which could have a material adverse effect on our business, financial condition and results of

operations.

In addition, our customers may be subject to claims of infringement from third parties, alleging that our products used by such customers

in the manufacture of semiconductor products and/or the processes relating to the use of our products infringe one or more patents issued to such third parties. If such claims were successful, we could be required to indemnify customers for some or

all of any losses incurred or damages assessed against them as a result of such infringement, which could have a material adverse effect on our business, financial condition and results of operations.

We also may incur substantial licensing or settlement costs, which although potentially strengthening or expanding our intellectual property rights or limiting our

exposure to intellectual property claims of third parties, may have a material adverse effect on our business, financial condition and results of operations.

From late 2001 through 2004, ASML was a party to a series of civil litigations and administrative proceedings in which Nikon alleged ASML’s infringement of Nikon patents relating to lithography. ASML in turn

filed claims against Nikon. Pursuant to agreements executed on December 10, 2004, ASML and Nikon agreed to settle all pending worldwide patent litigation between the companies. The settlement included an exchange of releases, a patent

cross-license agreement related to lithography equipment used to manufacture semiconductor devices, and payments to Nikon by ASML.

Under the terms of

the Nikon Cross-License Agreement, beginning on January 1, 2015, the parties may bring suit for infringement of certain patents subject to the agreement, including any infringement that occurred from January 1, 2010 through

December 31, 2014 (the “Cross-License Transition Period”). Damages resulting from claims for patent infringement occurring during the Cross-License Transition Period are limited to three percent of the net sales price of applicable

licensed products or optical components.

Accordingly, from January 1, 2015, both Nikon and we are no longer prohibited under the agreement from

bringing claims against each other on the basis of infringement of certain patents subject to the Nikon Cross-License Agreement.

If Nikon files suit

against us alleging patent infringement, we may incur substantial legal fees and expenses, and we may not prevail. Similarly, if we file suit against Nikon alleging patent infringement, we may incur substantial legal fees and expenses, and we may

not prevail. Patent litigation is complex and may extend for a protracted period of time, giving rise to the potential for both substantial costs and diverting the attention of key management and technical personnel. Potential adverse outcomes from

patent litigation may include, without limitation, payment of significant monetary damages, injunctive relief prohibiting the sale of products, and/or settlement involving significant costs to be paid by us, any of which may have a material adverse

effect on our business, financial condition and/or results of operations. We are unable to predict at this time whether any such patent suit will in fact materialize, or, if so, what its outcome might be.

|

|

|

|

|

| ASML ANNUAL REPORT 2014 |

|

10 |

|

|

We Are Subject to Risks in Our International Operations

The majority of our sales are made to customers outside Europe. There are a number of risks inherent in doing business in some of those regions:

| • |

|

Potentially adverse tax consequences; |

| • |

|

Unfavorable political or economic environments; |

| • |

|

Unexpected legal or regulatory changes; |

| • |

|

An inability to effectively protect intellectual property; and |

| • |

|

Adverse effects of foreign currency fluctuations. |

If we are unable to manage successfully the risks inherent in our international activities, our business, financial condition and results of operations could be materially and adversely affected.

In particular, 19.2 percent of our 2014 net sales and 42.4 percent of our 2013 net sales were derived from customers in Taiwan. Taiwan has a unique international

political status. The People’s Republic of China asserts sovereignty over Taiwan and does not recognize the legitimacy of the Taiwanese government. Changes in relations between Taiwan and the People’s Republic of China, Taiwanese

government policies and other factors affecting Taiwan’s political, economic or social environment could have a material adverse effect on our business, financial condition and results of operations. In addition, certain of our manufacturing

facilities as well as customers are located in South Korea. There are tensions between the Republic of South Korea and the Democratic People’s Republic of Korea since the division of the Korean Peninsula following World War II. The worsening of

relations between those two countries or the outbreak of war on the Korean Peninsula could have a material adverse effect on our business, financial condition or results of operations.

In addition, the installation and servicing of our products requires us to travel to our customers’ premises. Natural disasters could affect our ability to do so. For example, the Japanese earthquake in 2011

resulted in the disruption of our installation and servicing of systems for our customers in Japan. Natural disasters in areas where our customers are located could prevent or disrupt the installation or servicing of our systems. In addition, we

have customers located in Israel. If the geopolitical environment prevents travel to Israel, it could result in the disruption of our installation and servicing of systems for our customers.

Lastly, if there is a pandemic outbreak located near any of our customers, it could result in the disruption of our installation and servicing of systems for our customers near the outbreak. Therefore, if there is

a natural disaster, geopolitical conflict or pandemic that prevents our ability to travel to our customers’ premises, our business, financial condition and results of operations may be materially adversely effected.

We Are Dependent on the Continued Operation of a Limited Number of Manufacturing Facilities

All of our manufacturing activities, including subassembly, final assembly and system testing, take place in cleanroom facilities in Veldhoven, the Netherlands, in Wilton, Connecticut and in San Diego, California,

both in the United States, in Pyeongtaek, South-Korea and in Linkou, Taiwan. These facilities may be subject to disruption for a variety of reasons, including work stoppages, fire, energy shortages, flooding or other natural disasters. We cannot

ensure that alternative production capacity would be available if a major disruption were to occur or that, if such capacity was available, it could be obtained on favorable terms. Such a disruption could have a material adverse effect on our

business, financial condition and results of operations. In addition, some of our key suppliers, including Zeiss, have a limited number of manufacturing facilities, the disruption of which may significantly and adversely affect our production

capacity.

Because of Labor Laws and Practices, Any Workforce Reductions That We May Seek to Implement in Order to Reduce Costs Company-Wide May Be

Delayed or Suspended

The semiconductor market is highly cyclical and as a consequence we may need to implement workforce reductions in case of a

downturn, in order to adapt to such market changes. In accordance with labor laws and practices applicable in the jurisdictions in which we operate, a reduction of any significance may be subject to formal procedures that can delay or may result in

the modification of our planned workforce reductions. For example, ASML Netherlands B.V., our operating subsidiary in the Netherlands, has a Works Council, as required by Dutch law. If the Works Council renders contrary advice in connection with a

proposed workforce reduction in the Netherlands, but we nonetheless determine to proceed, we must temporarily suspend any action while the Works Council determines whether to appeal to the Enterprise Chamber of the Amsterdam Court of Appeal. This

appeal process can cause a delay of several months and may require us to address any procedural inadequacies identified by the Court in the way we reached our decision. Such delays could impair our ability to reduce costs company-wide to levels

comparable to those of our competitors. Also see Item 6.D “Employees”.

Fluctuations in Foreign Exchange Rates Could Harm Our Results

of Operations

We are exposed to currency risks. We are particularly exposed to fluctuations in the exchange rates between the U.S. dollar, Japanese

yen and the euro, as we incur manufacturing costs for our systems predominantly in euros while portions of our net sales and cost of sales are denominated in U.S. dollars.

|

|

|

|

|

| ASML ANNUAL REPORT 2014 |

|

11 |

|

|

In addition, a portion of our assets and liabilities and operating results are denominated in U.S. dollars,

particularly following our acquisition of Cymer in 2013, and a small portion of our assets, liabilities and operating results are denominated in currencies other than the euro and the U.S. dollar. Our Financial Statements are expressed in euros.

Accordingly, our results of operations and assets and liabilities are exposed to fluctuations in exchange rates between the euro and such other currencies, and changes in currency exchange rates can result in losses in our Financial Statements. In

general, our customers generally run their businesses in U.S. dollars and therefore a weakening of the U.S. dollar against the euro might impact the ability or desire of our customers to purchase our products.

Furthermore, a strengthening of the euro particularly against the Japanese yen could further intensify price-based competition in those regions that account for

the majority of our sales, resulting in lower prices and margins and a material adverse effect on our business, financial condition and results of operations.

See Item 5.A. “Operating Results – Foreign Exchange Management”.

We May Be Unable to Make

Desirable Acquisitions or to Integrate Successfully Any Businesses We Acquire

Our future success may depend in part on the acquisition of businesses

or technologies intended to complement, enhance or expand our current business or products or that might otherwise offer us growth opportunities. Our ability to complete such transactions may be hindered by a number of factors, including potential

difficulties in obtaining government approvals.

Any acquisition that we do make would pose risks related to the integration of the new business or

technology with our business. We cannot be certain that we will be able to achieve the benefits we expect from a particular acquisition or investment. Acquisitions may also strain our managerial and operational resources, as the challenge of

managing new operations may divert our management from day-to-day operations of our existing business. Our business, financial condition and results of operations may be materially and adversely affected if we fail to coordinate our resources

effectively to manage both our existing operations and any businesses we acquire.

In May 2013, we acquired all of the outstanding shares of Cymer, a

light source supplier with the goal of making EUV technology more efficient, preventing additional delays in the introduction of EUV technology, and simplifying the supply chain of EUV modules. If we fail to integrate Cymer successfully, this may

result in a delay in the development of EUV. Even if we are able to successfully integrate Cymer, there is no assurance that our acquisition of Cymer will result in successful or timely development of our EUV technology.

In addition, in connection with acquisitions, anti-trust regulators may impose conditions on us, including requirements to divest assets or other conditions that

could make it difficult for us to integrate the businesses that we acquire. For example, in connection with the Cymer acquisition we have agreed to maintain Cymer Light Sources as a stand-alone business.

Our Business and Future Success Depend on Our Ability to Attract and Retain a Sufficient Number of Adequately Educated and Skilled Employees

Our business and future success significantly depends upon our employees, including a large number of highly qualified professionals, as well as our ability to

attract and retain employees. Competition for such personnel is intense, and we may not be able to continue to attract and retain such personnel. Our R&D programs require a significant number of qualified employees. If we are unable to attract

sufficient numbers of qualified employees, this could affect our ability to conduct our research and development programs on a timely basis, which could adversely affect our business, financial condition and results of operations.

In addition, if we lose a key employee to retirement, illness or otherwise, particularly a number of our highly qualified professionals and/or senior management,

we may not be able to timely find a suitable replacement. Moreover, as a result of the uniqueness and complexity of our technology, qualified engineers capable of working on our systems are scarce and generally not available (e.g. from other

industries or companies). As a result, we must educate and train our employees to work on our systems. Therefore, a loss of a number of key professionals and/or senior management can be disruptive, costly and time consuming.

Furthermore, the increasing complexity of our products results in a longer learning-curve for new and existing employees and suppliers leading to an inability to

decrease cycle times and may result in the incurrence of significant additional costs.

Our suppliers face similar risks in attracting qualified

employees, including attracting employees in connection with R&D programs that will support our R&D programs and technology developments. To the extent that our suppliers are unable to attract qualified employees, this could adversely affect

our business, financial condition and results of operations.

|

|

|

|

|

| ASML ANNUAL REPORT 2014 |

|

12 |

|

|

Hazardous Substances Are Used in the Production and Operation of Our Systems and Failure to Comply with Applicable

Regulations or Failure to Implement Appropriate Practices for Customer and Employee Environment, Health and Safety could Subject us to Significant Liabilities

Hazardous substances are used in the production and operation of our lithography systems, which subjects us to a variety of governmental regulations relating to environmental protection and employee and product

health and safety, including the transport, use, storage, discharge, handling, emission, generation, and disposal of toxic or other hazardous substances. In addition, operating our machines (which use lasers and other potentially hazardous tools) is

dangerous and can result in injury. The failure to comply with current or future regulations could result in substantial fines being imposed on us or other adverse consequences. Additionally, our products have become increasingly complex. The

increasing complexity requires us to invest in continued risk assessments and development of appropriate preventative and protective measures for health and safety for both our employees (in connection with the production and installation of our

systems) and our customers’ employees (in connection with the operation of our systems). There can be no assurance that the health and safety practices we develop will be adequate to mitigate all health and safety risks. Failing to comply with

applicable regulations or the failure of our implemented practices for customer and employee health and safety could subject us to significant liabilities, which could have a material adverse effect on our business, financial condition and results

of operations.

Risks Related to Our Ordinary Shares

We May Not Declare Cash Dividends at All or in Any Particular Amounts in Any Given Year

We aim to pay an