Annual Statement of Changes in Beneficial Ownership (5)

February 13 2015 - 4:25PM

Edgar (US Regulatory)

LIMITED POWER OF ATTORNEY FOR

SECTION 16 REPORTING OBLIGATIONS

Know all by these presents, that the undersigned hereby makes,

constitutes and appoints Gil C. Tily and Jerry C. Allison (either of whom may

act individually) as the undersigned's true and lawful attorney-in-fact, with

full power and authority as hereinafter described on behalf of and in the name,

place and stead of the undersigned to:

(1) prepare, execute, acknowledge, deliver and file Forms 3, 4, and 5

(including any amendments thereto) with respect to the securities of Amkor

Technology, Inc., a Delaware corporation (the "Company"), with the United States

Securities and Exchange Commission, any national securities exchanges and the

Company, as considered necessary or advisable under Section 16(a) of the

Securities Exchange Act of 1934 and the rules and regulations promulgated

thereunder, as amended from time to time (the "Exchange Act");

(2) seek or obtain, as the undersigned's representative and on the

undersigned's behalf, information on transactions in the Company's securities

from any third party, including brokers, employee benefit plan administrators

and trustees, and the undersigned hereby authorizes any such person to release

any such information to the undersigned and approves and ratifies any such

release of information; and

(3) perform any and all other acts which in the discretion of such

attorney-in-fact are necessary or desirable for and on behalf of the undersigned

in connection with the foregoing.

The undersigned acknowledges that:

(1) this Power of Attorney authorizes, but does not require, such

attorney-in-fact to act in their discretion on information provided to such

attorney-in-fact without independent verification of such information;

(2) any documents prepared and/or executed by such attorney-in-fact on

behalf of the undersigned pursuant to this Power of Attorney will be in such

form and will contain such information and disclosure as such attorney-in-fact,

in his or her discretion, deems necessary or desirable;

(3) neither the Company nor such attorney-in-fact assumes (i) any liability

for the undersigned's responsibility to comply with the requirements of the

Exchange Act, (ii) any liability of the undersigned for any failure to comply

with such requirements, or (iii) any obligation or liability of the undersigned

for profit disgorgement under Section 16(b) of the Exchange Act; and

(4) this Power of Attorney does not relieve the undersigned from

responsibility for compliance with the undersigned's obligations under the

Exchange Act, including without limitation the reporting requirements under

Section 16 of the Exchange Act.

The undersigned hereby gives and grants the foregoing

attorney-in-fact full power and authority to do and perform all and every act

and thing whatsoever requisite, necessary or appropriate to be done in and about

the foregoing matters as fully to all intents and purposes as the undersigned

might or could do if present, hereby ratifying all that such attorney-in-fact

of, for and on behalf of the undersigned, shall lawfully do or cause to be done

by virtue of this Limited Power of Attorney.

This Power of Attorney shall remain in full force and effect until

revoked by the undersigned in a signed writing delivered to such

attorney-in-fact.

IN WITNESS WHEREOF, the undersigned has caused this Power of Attorney to

be executed as of this 7th day of November, 2007.

(Signed Copy on File)

James J. Kim

(Signed Copy on File)

John T. Kim

Exhibit 99.1

A Schedule 13D was filed by James J. Kim and those members of the reporting

group who then constituted the group on November 28, 2005, as amended by

Amendment No. 1 filed with the Securities and Exchange Commission (the

"Commission") on April 4, 2008, Amendment No. 2 filed with the Commission on

March 19, 2009, Amendment No. 3 filed with the Commission on April 16, 2009,

Amendment No. 4 filed with the Commission on February 5, 2010, Amendment No. 5

filed with the Commission on March 28, 2011, Amendment No. 6 filed with the

Commission on November 17, 2011, Amendment No. 7 filed with the Commission on

March 29, 2013, Amendment No. 8 filed with the Commission on March 28, 2014, as

further amended from time to time (the "Schedule 13D"). Those individuals and

entities listed in the Schedule 13D, including the filer of a Form 3 filed on or

about the date hereof may be deemed to be members of a group (the "Group") who

each exercise voting or investment power with respect to shares of Amkor

Technology, Inc.'s (the "Issuer") Common Stock in concert with other members of

the Group. The Group may be deemed to beneficially own more than 10% of the

outstanding voting securities of the Issuer. The reporting person states that

the filing of this Form 5 Report shall not be deemed an admission that the

reporting person is the beneficial owner of the reported securities owned by the

other members of the Group, for the purpose of Section 16 of the Securities

Exchange Act of 1934, as amended, or for any other purpose.

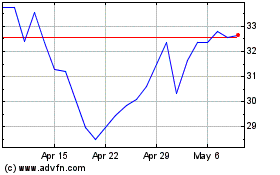

Amkor Technology (NASDAQ:AMKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

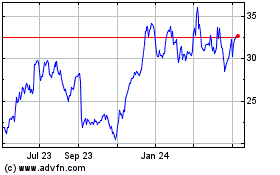

Amkor Technology (NASDAQ:AMKR)

Historical Stock Chart

From Apr 2023 to Apr 2024