UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

|

|

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended

December 31, 2016

OR

|

|

|

|

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from

__________

to

__________

Commission file number 001-31343 (Associated Banc-Corp)

|

|

|

|

|

|

A.

|

Full title of the plan and the address of the plan, if different from that of the issuer named below:

|

ASSOCIATED BANC-CORP 401(k) & EMPLOYEE STOCK OWNERSHIP PLAN

|

|

|

|

|

|

B.

|

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

|

ASSOCIATED BANC-CORP

433 Main Street

Green Bay, Wisconsin 54301

ASSOCIATED BANC-CORP

401(k) & EMPLOYEE STOCK OWNERSHIP PLAN

Financial Statements and Schedule

December 31, 2016

and

2015

(With Report of Independent Registered Public Accounting Firm Thereon)

ASSOCIATED BANC-CORP

401(k) & EMPLOYEE STOCK OWNERSHIP PLAN

Table of Contents

|

|

|

|

|

|

|

Page

|

|

Report of Independent Registered Public Accounting Firm

|

|

|

Statements of Net Assets Available for Benefits, December 31, 2016 and 2015

|

|

|

Statements of Changes in Net Assets Available for Benefits, Years Ended December 31, 2016 and 2015

|

|

|

Notes to Financial Statements

|

|

|

Schedule H, line 4i - Schedule of Assets (Held at End of Year), December 31, 2016

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Plan Administrator

Associated Banc-Corp 401(k) &

Employee Stock Ownership Plan

We have audited the accompanying statements of net assets available for benefits of the Associated Banc-Corp 401(k) & Employee Stock Ownership Plan (the Plan) as of

December 31, 2016

and

2015

, and the related statements of changes in net assets available for benefits for the years then ended. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as of

December 31, 2016

and

2015

, and the changes in net assets available for benefits for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

The supplementary information in the accompanying schedule of assets (held at end of year) as of

December 31, 2016

has been subjected to the audit procedures performed in conjunction with the audit of the Associated Banc-Corp 401(k) & Employee Stock Ownership Plan‘s financial statements. The supplementary information is presented for the purpose of additional analysis and is not a required part of the financial statements but includes supplementary information required by the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. The supplementary information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplementary information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplementary information. In forming our opinion on the supplementary information in the accompanying schedule, we evaluated whether the supplementary information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplementary information in the accompanying schedule is fairly stated in all material respects in relation to the financial statements as a whole.

/s/ Schenck SC

Certified Public Accountants

Green Bay, Wisconsin

June 21, 2017

ASSOCIATED BANC-CORP

401(k) & EMPLOYEE STOCK OWNERSHIP PLAN

Statements of Net Assets Available for Benefits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

|

2016

|

|

2015

|

|

Assets:

|

|

|

|

|

|

Investments, at fair value:

|

|

|

|

|

|

Collective trust funds

|

|

$

|

195,468,993

|

|

|

$

|

174,896,257

|

|

|

Associated Banc-Corp Common Stock Fund

|

|

46,471,549

|

|

|

41,181,221

|

|

|

Mutual funds

|

|

253,185,699

|

|

|

221,478,985

|

|

|

Cash surrender value of life insurance

|

|

63,081

|

|

|

74,088

|

|

|

Total investments

|

|

495,189,322

|

|

|

437,630,551

|

|

|

Receivables:

|

|

|

|

|

|

Due from broker for securities sold

|

|

16,664

|

|

|

48,253

|

|

|

Notes receivable from participants

|

|

5,493,019

|

|

|

4,875,116

|

|

|

Employer contribution receivable

|

|

13,882,065

|

|

|

11,121,203

|

|

|

Ahmann-Martin 401(k) Plan receivable

|

|

—

|

|

|

13,273,749

|

|

|

Liberty Insurance Agency, Inc. Profit Sharing Plan Receivable

|

|

57,131

|

|

|

—

|

|

|

Total receivables

|

|

19,448,879

|

|

|

29,318,321

|

|

|

Cash

|

|

903,559

|

|

|

684,876

|

|

|

Total assets

|

|

515,541,760

|

|

|

467,633,748

|

|

|

Liabilities:

|

|

|

|

|

|

Administrative expenses payable

|

|

189,676

|

|

|

146,217

|

|

|

Due to broker for securities purchased

|

|

574,966

|

|

|

450,094

|

|

|

Excess contributions payable

|

|

53,137

|

|

|

189,480

|

|

|

Total liabilities

|

|

817,779

|

|

|

785,791

|

|

|

Net assets available for plan benefits

|

|

$

|

514,723,981

|

|

|

$

|

466,847,957

|

|

See accompanying notes to financial statements.

ASSOCIATED BANC-CORP

401(k) & EMPLOYEE STOCK OWNERSHIP PLAN

Statements of Changes in Net Assets Available for Benefits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Years Ended December 31,

|

|

|

|

2016

|

|

2015

|

|

Additions:

|

|

|

|

|

|

Additions to net assets attributed to:

|

|

|

|

|

|

Investment income:

|

|

|

|

|

|

Net appreciation (depreciation) of investments

|

|

$

|

44,092,403

|

|

|

$

|

(5,373,772

|

)

|

|

Interest and dividends

|

|

4,334,301

|

|

|

4,336,233

|

|

|

Total investment income (loss)

|

|

48,426,704

|

|

|

(1,037,539

|

)

|

|

Interest income on notes receivable from participants

|

|

285,696

|

|

|

260,828

|

|

|

Contributions:

|

|

|

|

|

|

Participant

|

|

23,184,741

|

|

|

21,139,433

|

|

|

Employer

|

|

13,894,980

|

|

|

11,171,469

|

|

|

Rollover

|

|

3,703,522

|

|

|

4,616,681

|

|

|

Total contributions

|

|

40,783,243

|

|

|

36,927,583

|

|

|

Total additions

|

|

89,495,643

|

|

|

36,150,872

|

|

|

Deductions:

|

|

|

|

|

|

Deductions from net assets attributed to:

|

|

|

|

|

|

Benefits paid to participants

|

|

42,347,951

|

|

|

45,548,702

|

|

|

Insurance premiums

|

|

4,893

|

|

|

4,893

|

|

|

Administrative expenses

|

|

803,198

|

|

|

702,462

|

|

|

Total deductions

|

|

43,156,042

|

|

|

46,256,057

|

|

|

Net increase (decrease) in net assets available for plan benefits before transfers

|

|

46,339,601

|

|

|

(10,105,185

|

)

|

|

Transfers from Ahmann-Martin 401(k) Plan

|

|

674,492

|

|

|

13,317,164

|

|

|

Transfers from Liberty Insurance Agency, Inc. Profit Sharing Plan

|

|

861,931

|

|

|

—

|

|

|

Net increase in net assets available for plan benefits after transfers

|

|

47,876,024

|

|

|

3,211,979

|

|

|

Net assets available for plan benefits:

|

|

|

|

|

|

Beginning of year

|

|

466,847,957

|

|

|

463,635,978

|

|

|

End of year

|

|

$

|

514,723,981

|

|

|

$

|

466,847,957

|

|

See accompanying notes to financial statements.

ASSOCIATED BANC-CORP

401(k) & EMPLOYEE STOCK OWNERSHIP PLAN

Notes to Financial Statements

December 31, 2016 and 2015

|

|

|

|

(1)

|

Description of the Plan

|

The following brief description of the Associated Banc-Corp 401(k) & Employee Stock Ownership Plan (the “Plan”) is provided for general information. The Plan contains 401(k) provisions. Participants should refer to the summary plan description for a more complete description of the Plan’s provisions.

Background

Associated Banc-Corp (the “Corporation”) has established the Associated Banc-Corp 401(k) & Employee Stock Ownership Plan, a defined contribution plan. The 401(k) provisions of the Plan provide for employee contributions complying with the provisions of Internal Revenue Code (the "Code") Section 401(k) as well as discretionary employer matching contributions. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (ERISA).

In May 2016, the Corporation completed an acquisition of Liberty Insurance Agency, Inc. In connection with the merger, the Liberty Insurance Agency, Inc. Profit Sharing Plan was merged into the Plan in September 2016. Additionally, in February 2015, the Corporation completed an acquisition of Ahmann & Martin Co. In connection with the merger, the Ahmann-Martin 401(k) Plan was merged into the Plan on December 31, 2015. A delayed payment option was elected for one fund within the Ahmann-Martin Plan to avoid a 5% surrender charge. The transfer of this fund into the Associated Banc-Corp 401(k) plan was completed in September 2016.

Participants

Employees of the Corporation and its subsidiaries that have adopted the Plan are eligible to participate in the employer contribution provisions of the Plan on January 1 of the year in which

1,000

hours of service are completed. Employees are eligible to participate in the employee 401(k) contribution portion of the Plan if they are reasonably expected to complete

1,000

hours of service annually. Otherwise, employees are eligible to participate in the Plan immediately after completing

1,000

hours of service in a Plan year.

In conjunction with the 401(k) provisions of the Plan, participants can elect to contribute an amount between 1% of their compensation and the limitations (

$18,000

for both

2016

and

2015

) of Section 402(g) of the Code in increments of 1% to the Plan by means of regular payroll deductions. Participants may contribute pre-tax 401(k) contributions, Roth 401(k) contributions or a combination of both. New plan participants are automatically enrolled to contribute 3% of their annual compensation on a pre-tax basis. Participants can change this percentage at any time. Participants who have attained age

50

are eligible to make catch-up contributions in accordance with, and subject to the limitations (

$6,000

for both

2016

and

2015

) of, Section 414(v) of the Code. Participants are also allowed to contribute amounts qualifying as rollover contributions under Section 402(c)(4) of the Code.

The Plan provides for a discretionary Corporation matching contribution. For

2016

, the discretionary match was equal to

100%

of the first 5% deferred for plan participants who met the service requirements. For

2015

the discretionary match was equal to

100%

of the first 3% deferred plus

50%

of the next 3% deferred for plan participants who met the service requirements.

Vesting

Participants are

100%

vested in both employee and Corporation matching contributions to the Plan.

Investment of Plan Assets

At

December 31, 2016

, participants can direct their accounts to be invested in the Associated Banc-Corp Common Stock Fund, eight collective trust funds and twelve mutual funds offered by the Plan as investment options. Plan assets are held in trust with Associated Trust Company, N.A. (the "Trustee") a subsidiary of Associated Bank, N.A., which is a subsidiary of the Corporation.

ASSOCIATED BANC-CORP

401(k) & EMPLOYEE STOCK OWNERSHIP PLAN

Notes to Financial Statements

December 31, 2016 and 2015

The following is a brief description of each fund:

Associated Banc-Corp Common Stock Fund

– The fund is designed to share in the performance of Associated Banc-Corp. The share price and return will vary according to factors affecting the Associated Banc-Corp common stock.

Associated Trust Company, N.A. Equity Income Fund

– The fund is designed to pursue growth of capital while providing above average dividend yield. The fund invests in common stocks believed to be undervalued.

Associated Trust Company, N.A. Balanced Lifestage Fund

– The fund is designed to put equal emphasis on the pursuit of capital growth through investments in stocks, along with the stability and income generation provided by fixed income securities. Approximately one-half of the portfolio will consist of investment grade bonds with the remaining half consisting of a diversified mix of stocks, with an emphasis on large capitalization stocks, but will also include mid-cap, small-cap, and foreign stocks.

Associated Trust Company, N.A. Growth Balanced Lifestage Fund

– The fund is designed to seek both long-term growth of capital and a modest amount of income and stability through a mixture of stocks and bonds. The equity portion of the portfolio will consist of a diversified mix of stocks with an emphasis on large company stocks, but will also include mid-cap, small-cap, and foreign stocks. The remainder of the portfolio will consist of short to intermediate-term, investment grade bonds.

Associated Trust Company, N.A. Growth Lifestage Fund

– The fund is designed to achieve growth of capital through investment in a broadly diversified portfolio of common stocks. The objective is long-term growth and current income is incidental to the primary focus. The portfolio will consist of a diversified mix of stocks with an emphasis on large company stocks, but will also include mid-cap, small-cap, and foreign stocks.

Associated Trust Company, N.A. Core Bond Fund

– The fund is designed to earn a competitive total return through diversified investments in U.S. Treasury Notes, U.S. government agencies, investment grade corporate bonds, and mortgage-backed securities.

Associated Trust Company, N.A. Short Term Bond Fund

– The fund is designed to earn a competitive total return through diversified investments in U.S. Treasury Notes, U.S. government agencies, investment grade corporate bonds, and mortgage-backed securities.

Associated Trust Company, N.A. Conservative Balanced Lifestage Fund

– The fund is designed to emphasize stability of principal and income through investments in fixed income securities with a smaller emphasis on capital growth through investment in stocks. The portfolio will primarily consist of investment grade bonds with the equity portion consisting primarily of large capitalization stocks, but will also include mid-cap, small-cap, and foreign stocks.

Associated Money Market Fund

– This investment alternative is designed to provide safety of principal. This fund will be invested in short-term Treasury Bills and repurchase agreements.

Dodge & Cox Stock Fund

– The fund is designed to pursue long-term growth of principal and income. The Fund intends to remain fully invested in equities with at least 80% of assets in common stocks, including depositary receipts evidencing ownership of common stocks.

EuroPacific Growth Fund

– The fund is designed to pursue long-term growth of capital. The fund invests in at least 80% of assets in equity securities of issuers from Europe and the Pacific Basin.

Goldman Sachs Growth Opportunities Institutional Fund

– The fund is designed to achieve long-term growth of capital. The fund invests in at least 90% of assets in equity securities with a primary focus on mid-cap companies.

Growth Fund of America

– The fund is designed to achieve growth of capital. The fund invests primarily in common stocks and seeks to invest in companies that appear to offer superior opportunities for growth of capital. It may invest a portion of its assets in securities of issuers domiciled outside the United States.

Perkins Small Cap Value Fund

– The fund is designed to achieve capital appreciation. The fund invests at least 80% of assets in equity securities of small companies whose market capitalization, at the time of initial purchase, is less than the 12-month average of the maximum market capitalization for companies included in the Russell 2000

®

index.

Ridgeworth Mid-Cap Value Equity Fund

– The fund is designed to provide capital appreciation; current income is a secondary objective. The fund invests at least 80% of its assets in U.S. equity securities of mid-cap companies. The subadvisor considers mid-cap companies to be companies with market capitalization similar to those of companies in the Russell Midcap® Index.

ASSOCIATED BANC-CORP

401(k) & EMPLOYEE STOCK OWNERSHIP PLAN

Notes to Financial Statements

December 31, 2016 and 2015

American New World Fund

– The fund is designed to achieve long-term capital appreciation. The fund invests primarily in common stocks of companies with significant exposure to countries with developing economies and/or markets.

Templeton Institutional Foreign Equity Fund

– The fund is designed to achieve long-term capital growth. The fund normally invests at least 80% of net assets in foreign (non-U.S.) equity securities. It also invests in depositary receipts and emerging market countries.

Vanguard Balanced Index Admiral Fund

– The fund is designed to achieve income and long-term growth of income and capital. With 60% of its assets, the fund tracks the CRSP U.S. Total Market Index. With 40% of its assets, the fund tracks the Barclays U.S. Aggregate Float Adjusted Index.

Vanguard Institutional Index Fund

– The fund is designed to replicate the aggregate price and yield performance of the S&P 500 Index. The fund invests all, or substantially all, of its assets in the stocks that make up the S&P 500 in approximately the same proportion as they are represented in the Index.

Wasatch Small Cap Growth Fund

– The fund is designed to achieve long-term capital growth, with income as a secondary consideration. The fund invests primarily in small growth companies. It invests at least 80% of net assets in equity securities of small companies with market capitalization of less than $2.5 billion. The fund may invest up to 20% of assets in securities issued by foreign companies in developing or emerging markets.

Templeton Global Bond Advisor Fund

– The fund is designed to achieve current income with capital appreciation and growth of income. The fund normally invests at least 80% of net assets in bonds issued by governments and government agencies located around the world. It also may invest up to 25% of total assets in bonds that are rated below investment grade.

Participants can elect to invest in one of the aforementioned funds or in 1% increments in two or more funds. Participants can change the allocation of the Plan accounts on a daily basis.

Notes Receivable From Participants

A participant may request a loan for any reason. Loans are limited to the lesser of (1)

$50,000

, reduced by the excess of the highest outstanding balance of loans from the Plan during the one-year period ending on the day before the date on which such loan was made over the outstanding balance of loans from the Plan on the date on which such loan was made or (2)

50%

of the vested benefit of the participant’s account balance. Participant loans will not be granted for less than

$1,000

.

A commercially reasonable fixed rate of interest will be assessed on the loan with the current rate set at the prime rate plus

2%

offered by Associated Bank, N.A. Interest rates range from

4.00%

to

9.00%

. The loan will provide bi-weekly payments under a level amortization schedule of not greater than 5 years unless the loan is used to acquire a principal residence in which case, the maximum term of the loan would be 15 years. The plan may also hold grandfathered or inherited loans from merged plans with maturity dates extended beyond the 15 years allowed by the Plan document.

Participant Accounts

The Plan is a defined contribution plan under which a separate individual account is established for each participant. Plan investments are valued daily. Due to daily valuation, contributions are allocated to participant accounts upon receipt, and income and changes in asset values are immediately allocated to the participants’ accounts. Under a daily valued plan, participants can verify account balances daily utilizing the VRU (Voice Response Unit) or Internet access.

Distributions

Distributions are made in the form of lump-sum payments, payments over a period in monthly, quarterly, semi-annual or annual installments and other payment forms allowed by the Plan document. Distributions must begin no later than 60 days after the close of the Plan year in which the later of the participant’s attainment of age 65 or the termination date occurs, unless the participant elects to delay commencement of the distribution until April 1 following the attainment of age 70 1/2. Participants may withdraw amounts for any reason upon reaching age 59 1/2. Earnings are credited to a participant’s account through the date of distribution.

Distributions are made in cash or, if a participant has investments in Corporation common shares, the participant may elect to receive the distribution of that particular investment in the form of Corporation common shares plus cash for any fractional share.

ASSOCIATED BANC-CORP

401(k) & EMPLOYEE STOCK OWNERSHIP PLAN

Notes to Financial Statements

December 31, 2016 and 2015

Amounts payable to participants for contributions in excess of amounts allowed by the Internal Revenue Service are recorded as a liability with a corresponding reduction to contributions.

Termination of Plan

While the Corporation has not expressed any intent to terminate the Plan, it is free to do so at any time subject to the provisions of ERISA.

|

|

|

|

(2)

|

Summary of Significant Accounting Policies

|

The following is a summary of significant accounting policies consistently followed by the Plan in the preparation of the financial statements:

Basis of Presentation

The financial statements of the Plan have been prepared on the accrual basis of accounting.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires the Plan Administrator to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Changes in the economic environment, financial markets, and any other parameters used in determining these estimates and assumptions could cause actual results to differ.

Risks and Uncertainties

The Plan, at the direction of the participant, invests in various investment securities. The Plan’s investments are exposed to various risks, such as interest rate, market and credit risks. Due to the level of risk associated with certain investments and the level of uncertainty related to changes in the values of investments, it is at least reasonably possible that changes in risks in the near term could materially affect participant account balances and the amounts reported in the financial statements of the Plan.

a)

Interest Rate

Interest rate risk refers to the impact of interest rate changes on the Plan’s financial position. Interest rate changes directly impact the fair value of U.S. government obligations and have an indirect impact on the other investments held by the Plan.

b)

Market

Market risk is the risk that the fair value of an investment will fluctuate as a result of changes in market price.

c)

Credit

Credit risk is associated with the potential failure of a counterparty to fulfill its obligations based on the contractual terms of the agreements. The amount of credit risk will increase or decrease during the lives of the investments as interest rates or foreign exchange rates or credit spreads fluctuate.

Investments and Income Recognition

Investment securities are recorded at fair value. Fair value of mutual funds is based on quoted market prices. The investments in units of the collective trust funds and Common Stock Fund are carried at the net asset value (NAV), which is the value at which units in the funds can be withdrawn and approximates fair value as a practical expedient. See Note 6, Fair Value Measurements, for discussion of fair value measurements.

Fair value of cash surrender value of life insurance are provided by the underlying insurance providers at year-end and also upon individual policy surrender. As such, these holdings are valued at the year-end cash surrender values, which approximates fair value. Upon death of the participant, death benefits are paid directly to the beneficiary from the insurance provider and not by the Plan. Any cash surrender value upon termination of a life insurance policy is paid directly to the terminated participant or to the Plan for active participants.

ASSOCIATED BANC-CORP

401(k) & EMPLOYEE STOCK OWNERSHIP PLAN

Notes to Financial Statements

December 31, 2016 and 2015

Plan assets are held by the Trustee. Net appreciation (depreciation) of investments includes realized gains and losses on investments purchased and sold and changes in appreciation (depreciation) for the period. Purchases and sales of securities are recorded on a trade-date basis. Realized gains and losses on the sale of investments are determined through the use of moving average basis. The Plan records interest income on the accrual basis and dividends on the ex-dividend date.

Notes Receivable from Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. No allowance for credit losses has been recorded as of

December 31, 2016

or

2015

. Delinquent participant loans are reclassified as distributions based upon the terms of the Plan document.

Payment of Benefits

Benefits are recorded when paid.

Operating Expenses

Loan and distribution recordkeeping fees are paid by the respective participant. All other expenses of maintaining the Plan are paid by the Plan.

New Accounting Pronouncements

In May 2015, the Financial Accounting Standards Board (FASB) issued an amendment to eliminate the requirement to categorize investments measured using the NAV practical expedient in the fair value hierarchy table. Entities are required to disclose the fair value of investments measured using the NAV practical expedient so that financial statement users can reconcile amounts reported in the fair value hierarchy table to amounts reported on the balance sheet. The new guidance is applied retrospectively and is effective for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. The Plan adopted the accounting standard during the first quarter of 2016, as required, with no material impact on results of operations, financial position, or liquidity. See Note 6, Fair Value Measurements, for more information.

In July 2015, the FASB issued a three part amendment on plan accounting. Part II of this amendment, which is applicable to the Plan, eliminates the requirements that plans disclose (1) individual investments that represent 5% or more of the net assets available for benefits and (2) the net appreciation or depreciation for investments by general type. The new guidance is applied retrospectively and is effective for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. The Plan adopted the accounting standard during the first quarter of 2016, as required, with no material impact on results of operations, financial position, or liquidity.

|

|

|

|

(3)

|

Transactions with Related Parties

|

The Associated Banc-Corp Common Stock Fund at

December 31, 2016

and

2015

included

1,858,878

shares and

2,165,871

shares, respectively, of common stock of the Corporation with fair values of

$45,914,089

and

$40,610,167

, respectively. Dividend income from Corporation stock totaled

$944,949

and

$933,567

in

2016

and

2015

, respectively. Also included in the Associated Banc-Corp Common Stock Fund at

December 31, 2016

and

2015

were units of Goldman Sachs Financial Square Prime Obligations Fund with fair values of

$557,460

and

$571,054

, respectively. The Goldman Sachs Financial Square Prime Obligations Fund is an unrelated party.

Associated Trust Company, N.A. performs asset management and participant recordkeeping for the Plan. These expenses totaled $

803,198

in

2016

and

$702,462

in

2015

and were paid by the Plan. Additionally, Associated Trust Company, N.A. performs loan recordkeeping services for the Plan. Fees for these services are paid directly by participants and totaled

$68,725

in

2016

and

$59,855

in

2015

.

The Plan invests in various Associated Trust Company, N.A. collective trust funds and a Money Market Fund. As of

December 31, 2016

and

2015

,

$195,468,993

and

$174,896,257

, respectively, were invested in Associated Trust Company, N.A. collective trust funds.

ASSOCIATED BANC-CORP

401(k) & EMPLOYEE STOCK OWNERSHIP PLAN

Notes to Financial Statements

December 31, 2016 and 2015

|

|

|

|

(4)

|

Reconciliation to Form 5500

|

The following is a reconciliation of net assets available for plan benefits per the financial statements to Form 5500:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

2015

|

|

|

Net assets available for plan benefits per the financial statements

|

$

|

514,723,981

|

|

$

|

466,847,957

|

|

|

|

Amounts allocated to excess contributions payable

|

53,137

|

|

189,480

|

|

|

|

Net assets available for the plan benefits per the Form 5500

|

$

|

514,777,118

|

|

$

|

467,037,437

|

|

The following is a reconciliation of the net increase (decrease) in net assets available for plan benefits before transfers per the financial statements to Form 5500:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

2015

|

|

|

Net increase (decrease) in net assets available for plan benefits

|

$

|

46,339,601

|

|

$

|

(10,105,185

|

)

|

|

|

Amounts allocated to excess contributions payable

|

53,137

|

|

189,480

|

|

|

|

Reversal of previous year excess contributions payable

|

(189,480

|

)

|

—

|

|

|

|

Net Income (loss) per Form 5500

|

$

|

46,203,258

|

|

$

|

(9,915,705

|

)

|

The Plan Administrator received a favorable tax determination letter, dated August 26, 2014, from the Internal Revenue Service indicating that the Plan qualifies under the provisions of Section 401(a) of the Code. Although the Plan has been amended since receiving the determination letter, the Plan Administrator and the Plan’s tax counsel believe that the Plan is designed, and is currently being operated, in compliance with the applicable requirements of the IRC and, therefore, believe that the Plan is qualified, and the related trust is tax-exempt. Therefore, a provision for income taxes has not been included in the Plan’s financial statements.

|

|

|

|

(6)

|

Fair Value Measurements

|

Fair value represents the estimated price at which an orderly transaction to sell an asset or to transfer a liability would take place between market participants at the measurement date under current market conditions (i.e., an exit price concept). Assets and liabilities are categorized into three levels based on the markets in which the assets and liabilities are traded and the reliability of the assumptions used to determine fair value. In instances where the determination of the fair value measurement is based on inputs from different levels of the fair value hierarchy, the level in the fair value hierarchy in which the entire fair value measurement falls is based on the lowest level input that is significant to the fair value measurement in its entirety. The Plan’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the asset or liability. Below is a brief description of each fair value level.

Level 1 inputs

– utilize quoted prices (unadjusted) in active markets for identical assets or liabilities that the Plan has the ability to access.

Level 2 inputs

– inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. Level 2 inputs may include quoted prices for similar assets and liabilities in active markets, as well as inputs that are observable for the asset or liability (other than quoted prices), such as interest rates, foreign exchange rates, and yield curves that are observable at commonly quoted intervals.

Level 3 inputs

– unobservable inputs for the asset or liability, which are typically based on the Plan’s own assumptions, as there is little, if any, related market activity.

Various inputs are used in determining the fair value of the Plan’s investments as of the reporting period end. The designated input levels are not necessarily an indication of the risk or liquidity associated with this investment.

The following is a description of the valuation methodologies used for Plan assets measured at fair value. There have been no changes in the valuation methodologies used at

December 31, 2016

and

2015

, respectively, and there have been no transfers between fair value levels.

ASSOCIATED BANC-CORP

401(k) & EMPLOYEE STOCK OWNERSHIP PLAN

Notes to Financial Statements

December 31, 2016 and 2015

Collective trust funds and Common Stock Fund:

Valued at the NAV of units of the fund. The NAV, as provided by the Trustee, is used as a practical expedient to estimate fair value. The NAV is based on the fair value of the underlying investments held by the fund less its liabilities. This practical expedient is not used when it is determined to be probable that the fund will sell the investment for an amount different than the reported NAV. Participant transactions (purchases and sales) may occur daily. Were the Plan to initiate a full redemption of the fund, the investment advisor reserves the right to temporarily delay withdrawal from the trust in order to ensure that securities liquidations will be carried out in an orderly business manner.

Mutual funds:

Valued at the daily closing price as reported by the fund. Mutual funds held by the Plan are open-ended mutual funds that are registered with the Securities and Exchange Commission. These funds are required to publish their daily NAV and to transact at that price. The mutual funds held by the Plan are deemed to be actively traded.

The preceding methods may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, although the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

The following table sets forth by level, within the fair value hierarchy, the Plan's fair value measurements at

December 31, 2016

and

2015

, respectively:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments at December 31, 2016:

|

|

Fair Value

|

Level 1

|

Level 2

|

Level 3

|

|

Collective trust funds

(1)

|

|

$

|

195,468,993

|

|

|

|

|

|

Associated Banc-Corp Common Stock Fund

(1)

|

|

46,471,549

|

|

|

|

|

|

Mutual funds

|

|

253,185,699

|

|

$

|

253,185,699

|

|

|

|

|

Cash surrender value of life insurance

|

|

63,081

|

|

|

|

$

|

63,081

|

|

|

Total

|

|

$

|

495,189,322

|

|

$

|

253,185,699

|

|

$

|

—

|

|

$

|

63,081

|

|

|

|

|

|

|

|

|

|

Investments at December 31, 2015:

|

|

Fair Value

|

Level 1

|

Level 2

|

Level 3

|

|

Collective trust funds

(1)

|

|

$

|

174,896,257

|

|

|

|

|

|

Associated Banc-Corp Common Stock Fund

(1)

|

|

41,181,221

|

|

|

|

|

|

Mutual funds

|

|

221,478,985

|

|

$

|

221,478,985

|

|

|

|

|

Cash surrender value of life insurance

|

|

74,088

|

|

|

|

$

|

74,088

|

|

|

Total

|

|

$

|

437,630,551

|

|

$

|

221,478,985

|

|

$

|

—

|

|

$

|

74,088

|

|

|

|

|

|

(1)

|

Certain investments that are measured at fair value using the NAV per share (or its equivalent) practical expedient have not been classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statement of Net Assets Available for Benefits. See Note 2 for additional information on this new accounting pronouncement.

|

For the funds reported using the NAV, there are no restrictions on redemptions, nor are there any required commitments to invest in the funds. Investment decisions are fully directed by the participant.

ASSOCIATED BANC-CORP

401(k) & EMPLOYEE STOCK OWNERSHIP PLAN

Notes to Financial Statements

December 31, 2016 and 2015

The table below sets forth a summary of changes in the fair value of the Plan’s Level 3 investments for the years ended

December 31, 2016

and

2015

, respectively:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2016

|

|

2015

|

|

|

|

Cash surrender value of life insurance

|

|

Cash surrender value of life insurance

|

|

Beginning balance

|

|

$

|

74,088

|

|

|

$

|

73,848

|

|

|

Unrealized gains

|

|

1,923

|

|

|

240

|

|

|

Purchases, sales, issuances and settlements, net

|

|

(12,930

|

)

|

|

—

|

|

|

Ending balance

|

|

$

|

63,081

|

|

|

$

|

74,088

|

|

|

The amount of total gains or (losses) for the period attributable to the change in unrealized gains or losses relating to assets still held at the reporting date.

|

|

$

|

1,923

|

|

|

$

|

240

|

|

The Plan Administrator has evaluated the effects on the Plan financial statements of subsequent events that have occurred subsequent to

December 31, 2016

through

June 21, 2017

, the date these financial statements were issued. During this period, there have been no material events that would require recognition in the financial statements or disclosures to the financial statements.

ASSOCIATED BANC-CORP

401(k) & EMPLOYEE STOCK OWNERSHIP PLAN

Schedule H, line 4i - Schedule of Assets (Held at End of Year)

|

|

|

|

|

|

|

|

|

December 31, 2016

|

|

(b) Identity of issue, borrower, lessor, or similar party

|

(e) Current Value

|

|

Collective Trust Funds:

|

|

|

* Associated Trust Company, N.A. Equity Income Fund

|

$

|

8,946,812

|

|

|

* Associated Trust Company, N.A. Balanced Lifestage Fund

|

41,094,523

|

|

|

* Associated Trust Company, N.A. Growth Balanced Lifestage Fund

|

27,504,712

|

|

|

* Associated Trust Company, N.A. Growth Lifestage Fund

|

44,725,008

|

|

|

* Associated Trust Company, N.A. Core Bond Fund

|

23,196,535

|

|

|

* Associated Trust Company, N.A. Short Term Bond Fund

|

8,670,988

|

|

|

* Associated Trust Company, N.A. Conservative Balanced Lifestage Fund

|

4,866,561

|

|

|

* Associated Money Market Fund

|

36,463,854

|

|

|

Total collective trust funds

|

195,468,993

|

|

|

|

|

|

* Associated Banc-Corp Common Stock Fund

|

46,471,549

|

|

|

|

|

|

Mutual Funds:

|

|

|

Dodge & Cox Stock Fund

|

37,668,606

|

|

|

Europacific Growth Fund

|

17,704,760

|

|

|

Goldman Sachs Growth Opportunities Institutional Fund

|

21,358,920

|

|

|

Growth Fund of America

|

33,322,621

|

|

|

Perkins Small Cap Value Fund

|

20,866,439

|

|

|

Ridgeworth Mid-Cap Value Equity Fund

|

15,491,708

|

|

|

American New World Fund

|

6,446,342

|

|

|

Templeton Institutional Foreign Equity Fund

|

8,064,314

|

|

|

Vanguard Balance Index Admiral Fund

|

28,370,888

|

|

|

Vanguard Institutional Index Fund

|

43,855,138

|

|

|

Wasatch Small Cap Growth Fund

|

15,429,311

|

|

|

Templeton Global Bond Advisor Fund

|

4,606,652

|

|

|

Total mutual funds

|

253,185,699

|

|

|

|

|

|

Cash Surrender Value of Life Insurance:

|

|

|

Penn Mutual Life Insurance Co.

|

10,360

|

|

|

The Guardian Insurance and Annuity Co.

|

40,226

|

|

|

General American Life Ins. Co.

|

12,494

|

|

|

Total cash surrender value of life insurance

|

63,081

|

|

|

Total Investments per Statement of Net Assets

|

495,189,322

|

|

|

* Notes receivable from participants (631 participant loans with interest rates ranging from 4.00% to 9.00% and maturity dates ranging from 1/13/2017 to 11/14/2031)

|

5,493,019

|

|

|

Total Investments per 5500

|

$

|

500,682,341

|

|

|

* Denotes a party-in-interest

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Associated Banc-Corp Retirement Program Committee has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSOCIATED BANC-CORP

|

|

|

|

401(k) & EMPLOYEE STOCK

|

|

|

|

OWNERSHIP PLAN

|

|

|

|

|

Date June 21, 2017

|

|

/s/ Judith M. Docter

|

|

|

|

Judith M. Docter, Executive Vice President and Chief Human Resources Officer

|

|

|

|

|

|

|

|

|

Date June 21, 2017

|

|

/s/ Tammy C. Stadler

|

|

|

|

Tammy C. Stadler, Executive Vice President, Principal Accounting Officer, and Corporate Controller

|

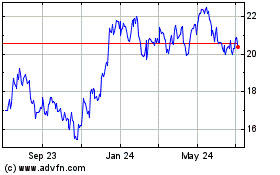

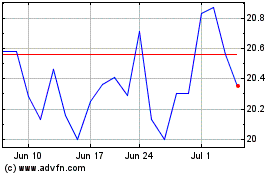

Associated Banc (NYSE:ASB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Associated Banc (NYSE:ASB)

Historical Stock Chart

From Apr 2023 to Apr 2024