UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

| x |

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended May 31, 2015

OR

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

to

Commission File No. 001-10635

NIKE, Inc.

(Full title of the plan)

401(k)

Savings and Profit Sharing Plan for Employees of NIKE, Inc.

(Name of issuer of the securities held pursuant to the plan)

One Bowerman Drive

Beaverton, Oregon 97005

(Address of the plan and address of issuer’s

principal executive offices)

401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc.

Financial Statements and Supplemental Schedules

May 31, 2015 and 2014

401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc.

Index

Reports of Independent Registered Public Accounting Firms

To the Participants and Administrator of

401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc.

We have audited the

accompanying statement of net assets available for benefits of the 401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc. (the “Plan”) as of May 31, 2015 and the related statement of changes in net assets available for

benefits for the year ended May 31, 2015. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we

plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial

reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of

the Plan’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes

assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets of the Plan at May 31, 2015 and

the changes in net assets for the year ended May 31, 2015, in conformity with accounting principles generally accepted in the United States of America.

The supplemental information in the accompanying schedule of assets (held at end of year) as of May 31, 2015, schedule of assets (acquired and disposed of within year) for the year ended May 31,

2015, and schedule of reportable transactions for the year ended May 31, 2015, have been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the

responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing

procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content,

is presented in conformity with Department of Labor’s Rules and Regulations for Reporting under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in

relation to the financial statements as a whole.

/s/ Plante & Moran, PLLC

Chicago, Illinois

November 18, 2015

To the Participants and Administrator of

401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc.:

In our opinion, the

accompanying statement of net assets available for benefits and the related statement of changes in net assets available for benefits present fairly, in all material respects, the net assets available for benefits of the 401(k) Savings and Profit

Sharing Plan for Employees of NIKE, Inc. (the “Plan”) at May 31, 2014, and the changes in net assets available for benefits for the year ended May 31, 2014, in conformity with accounting principles generally accepted in the

United States of America. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these statements in

accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material

misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the

overall financial statement presentation. We believe that our audit provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers

LLP

Portland, Oregon

November 21, 2014

401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc.

Statements of Net Assets Available for Benefits

May 31, 2015 and 2014

|

|

|

|

|

|

|

|

|

| |

|

2015 |

|

|

2014 |

|

| Assets |

|

|

|

|

|

|

|

|

| Investments, at fair value |

|

|

|

|

|

|

|

|

| Collective trust funds |

|

$ |

2,227,044,493 |

|

|

$ |

1,975,060,167 |

|

| NIKE, Inc. Class B common stock |

|

|

797,649,342 |

|

|

|

646,689,659 |

|

| Registered investment companies |

|

|

125,305,033 |

|

|

|

106,374,959 |

|

| Corporate and foreign bonds |

|

|

— |

|

|

|

35,723,314 |

|

| Interest bearing cash |

|

|

10,022 |

|

|

|

1,705,571 |

|

| Preferred stocks |

|

|

— |

|

|

|

569,520 |

|

| Common and foreign stocks |

|

|

— |

|

|

|

2,382 |

|

|

|

|

|

|

|

|

|

|

| Total investments |

|

|

3,150,008,890 |

|

|

|

2,766,125,572 |

|

|

|

|

|

|

|

|

|

|

| Receivables |

|

|

|

|

|

|

|

|

| Employer contributions |

|

|

60,132,041 |

|

|

|

50,576,135 |

|

| Notes receivable from participants |

|

|

32,808,584 |

|

|

|

29,612,682 |

|

| Participant contributions |

|

|

3,985,837 |

|

|

|

3,428,578 |

|

| Accrued interest and dividends |

|

|

2,198,309 |

|

|

|

2,662,164 |

|

| Due from broker for securities sold |

|

|

391,092 |

|

|

|

1,138,118 |

|

|

|

|

|

|

|

|

|

|

| Total receivables |

|

|

99,515,863 |

|

|

|

87,417,677 |

|

|

|

|

|

|

|

|

|

|

| Cash |

|

|

— |

|

|

|

366,761 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

3,249,524,753 |

|

|

|

2,853,910,010 |

|

|

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

| Due to broker for securities purchased |

|

|

— |

|

|

|

1,097,583 |

|

| Accrued expenses |

|

|

210,036 |

|

|

|

153,393 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

210,036 |

|

|

|

1,250,976 |

|

|

|

|

|

|

|

|

|

|

| Net assets available for benefits at fair value |

|

|

3,249,314,717 |

|

|

|

2,852,659,034 |

|

| Adjustment from fair value to contract value for interest in collective trust relating to fully benefit-responsive investment

contracts |

|

|

(1,852,621 |

) |

|

|

(1,415,088 |

) |

|

|

|

|

|

|

|

|

|

| Net assets available for benefits |

|

$ |

3,247,462,096 |

|

|

$ |

2,851,243,946 |

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

3

401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc.

Statement of Changes in Net Assets Available for Benefits

Year Ended May 31, 2015

|

|

|

|

|

| Additions |

|

|

|

|

| Investment income |

|

|

|

|

| Net appreciation in fair value of investments |

|

$ |

312,278,329 |

|

| Interest and dividends |

|

|

11,743,598 |

|

|

|

|

|

|

| Total investment income |

|

|

324,021,927 |

|

| Less: Investment expenses |

|

|

(255,693 |

) |

|

|

|

|

|

| Net investment income |

|

|

323,766,234 |

|

|

|

|

|

|

| Interest income on notes receivable from participants |

|

|

1,269,941 |

|

|

|

|

|

|

| Contributions |

|

|

|

|

| Employer, net of forfeitures |

|

|

118,542,785 |

|

| Participant |

|

|

99,847,300 |

|

| Rollover |

|

|

11,995,732 |

|

|

|

|

|

|

| Total contributions |

|

|

230,385,817 |

|

|

|

|

|

|

| Total additions |

|

|

555,421,992 |

|

|

|

|

|

|

| Deductions |

|

|

|

|

| Benefits paid to participants |

|

|

(157,448,980 |

) |

| Administrative expenses |

|

|

(1,754,862 |

) |

|

|

|

|

|

| Total deductions |

|

|

(159,203,842 |

) |

|

|

|

|

|

| Net increase |

|

|

396,218,150 |

|

| Net assets available for benefits |

|

|

|

|

| Beginning of year |

|

|

2,851,243,946 |

|

|

|

|

|

|

| End of year |

|

$ |

3,247,462,096 |

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

4

401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc.

Notes to Financial Statements

May 31, 2015 and 2014

| 1. |

Description of the Plan |

The following description of the 401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc. (the “Plan”) provides only

general information. Participants should refer to the Plan document for a more complete description of the Plan’s provisions.

General

The Plan was established to provide for the retirement income

requirements of and sharing in NIKE, Inc. (the “Company”) profits by eligible employees of the Company and a retirement savings program for the employees of the Company not covered by a collective bargaining agreement. The Plan is subject

to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”), as amended. Administration of the Plan is performed by the Administrative Subcommittee of the Retirement Committee. The Plan is amended from time to time

in order to comply with changes in applicable laws and to make changes in Plan administration.

The Northern Trust Company

(“Northern Trust” or the “Trustee”) is the trustee and Aon Hewitt Associates (“Aon Hewitt” or the “Record keeper”) is the record keeper of the Plan’s net assets. Self-directed brokerage account assets are

held in the custody of Charles Schwab & Co. Inc. (“Charles Schwab” or the “Custodian”) and are maintained by the Trustee. The Plan’s investment decisions are overseen by the Investment Subcommittee of the Retirement

Committee. Members of the Retirement Committee are appointed by the Board of Directors of the Company.

Eligibility

All employees, except those employees who are (1) covered by a collective bargaining agreement, (2) living

outside the United States and not covered by the Company expatriate program, (3) working at the Company’s Memphis Apparel Distribution Center, whose employment is established pursuant to the Company’s Seasonal On Call Casual Employee

Reserve (“SOCCER”) program, (4) not common-law employees, such as leased employees and individuals designated by NIKE as independent contractors, or (5) residing in Puerto Rico and working at the Puerto Rico facility, become

eligible to receive profit sharing contributions on the first day of the Plan fiscal year coinciding with or immediately preceding completion of one year of employment with at least 1,000 hours of service. Employees are eligible to participate in

the 401(k) portion of the Plan on the first day of employment.

Contributions

Participants may contribute up to 50% of their pre-tax annual compensation to the Plan, subject to annual individual deferral limitations

under the Internal Revenue Code (“IRC”). Participants who have attained age 50 before the end of the Plan year are eligible to make catch-up contributions, as defined by the IRC. Participants may also contribute amounts representing

distributions from other qualified defined contribution plans as well as after-tax contributions from their current compensation. Additionally, the Company will match participant pre-tax contributions at a rate of 100% of the first 5% of the

participant’s eligible pay that is contributed to their account.

5

401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc.

Notes to Financial Statements

May 31, 2015 and 2014

Prior to May 13, 2011, the Company match contributions related to the Plan’s 401(k) feature were

invested in the NIKE stock fund which is comprised of NIKE, Inc. Class B common stock and a small residual cash balance. As of June 1, 2001, these match contributions became subject to participant self-direction after the initial investment in

the company stock fund was made to the Plan. Participants could redeem their shares in the company stock fund and reinvest the cash into other managed funds. As of May 13, 2011, the Company match followed participants’ fund selections and

the NIKE stock fund became one of the investment choices. No more than 10% of a participant’s deferral and corresponding match can go into the NIKE stock fund and a participant can only transfer a portion of his or her existing account balance

to purchase the NIKE stock fund if the percentage of their account balance invested in the NIKE stock fund is less than or equal to 20%. Transfers out of the NIKE stock fund are permitted at any time.

Under the Plan’s profit sharing features, the Company may make discretionary annual contributions as designated by the

Company’s Board of Directors. However, this amount cannot be greater than the amount allowable as a tax deduction under the IRC. The annual contributions will be funded no later than the date the Company’s federal income tax return is

filed.

Profit sharing contributions are invested in various fixed income and equity funds similar to those

offered under the Plan’s 401(k) features. Investments held by the Plan on behalf of participants related to profit sharing contributions are nonparticipant-directed. In a nonparticipant-directed program, the Investment Subcommittee, under the

guidance of investment managers, directs the specific investments held by the Plan. See Note 7 for applicable disclosures. Investments held by the Plan on behalf of participants related to 401(k) contributions are participant-directed. In a

participant-directed program, the individual participant selects the investments for his or her individual account.

Participant Accounts

Separate individual 401(k) and profit sharing accounts are maintained for each participant. Each participant’s 401(k) account is credited with the participant’s contributions and rollovers, the

Company’s matching contributions, Plan expenses and an allocation of the Plan’s investment income or losses based upon the participant’s election of investment options. Participants direct the investment of their contributions into

various investment options offered by the Plan.

An eligible profit sharing participant is entitled to an annual allocation of

the employer profit sharing contribution and former participant profit sharing forfeitures after restoration of previously forfeited accounts. Employer profit sharing contributions and former participant forfeitures are allocated in the proportion

of the participant’s annual compensation to compensation of all participants subject to the IRC Section 415 defined maximum limitations. Participants do not direct the investment of profit sharing contributions.

Profit sharing investment income or losses and Plan expenses are allocated daily based on a ratio of each participant’s profit

sharing account balance to the total profit sharing account balances.

The total benefit to which a participant is entitled is

the benefit that can be provided from the participant’s vested 401(k) and profit sharing accounts.

Vesting

Participants in the 401(k) portion of the Plan are immediately vested in their elective, rollover, and Company matching

contributions, plus actual earnings thereon. The Company contributions into the profit sharing portion of the Plan vest at 25% per year after completing two years of service, and vesting increases 25% for each additional year of service until

fully vested after five years. Participants in the profit sharing portion of the Plan become fully vested in the Company’s contributions in the event of total and permanent disability, death, attainment of 65 years of age, or termination of the

Plan.

6

401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc.

Notes to Financial Statements

May 31, 2015 and 2014

Forfeitures

Upon a participant’s termination, the unvested portion of the participant’s profit sharing account is forfeited. Profit sharing forfeitures may be used to reduce future employer contributions or

be allocated back to active participants at the Company’s discretion. During the year ended May 31, 2015, profit sharing forfeitures of $1,662,421 were used to reduce employer contributions. At May 31, 2015 and 2014, accumulated

profit sharing forfeitures totaled $1,814,247 and $1,590,615 respectively.

Notes Receivable From Participants

Participants may borrow a portion of their elective and rollover contributions by applying to the Plan’s record

keeper. Participants may borrow from their accounts amounts equal to the lesser of 50% of their vested account balance or $50,000 reduced by the balance of any outstanding loans. The term of the loan repayments ranges up to five years for general

purpose loans and up to ten years for the purchase of a primary residence. The loans are secured by the balance in the participant’s account and bear interest at the prime rate plus one percentage point. Principal and interest are paid ratably

through bi-weekly payroll deductions.

Benefit Payments

On termination of service due to death, disability, hardship, resignation, discharge and retirement, a participant is eligible to receive

payments in the amount equal to the value of the participant’s vested interest in his or her account.

Vested benefits

are distributed to participants in a lump-sum payment upon termination or are transferred to another qualified account. Participants with vested benefits greater than $1,000 can elect to receive a distribution or leave their balance in the Plan

until reaching the age of 65. Participants may apply to the Plan’s recordkeeper to withdraw their voluntary 401(k) contributions in the event the participant is over age 59-1/2, or the participant has a financial hardship as stipulated in the

Plan provisions. No withdrawals may be made from the unvested portion of the Company’s profit sharing contributions or earnings thereon.

Plan Termination

Although it has not expressed any intent to do so, the

Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event of Plan termination, the accounts of all participants would become fully vested. The net

assets of the Plan would be distributed among the participants and beneficiaries of the Plan in proportion to their interests after proper allocation of any Plan expenses incurred upon termination.

| 2. |

Significant Accounting Policies |

Basis of Accounting

The accompanying financial statements have been

prepared on the accrual basis of accounting.

Investment Valuation and Income Recognition

The Company’s Retirement Committee determines the Plan’s valuation policies utilizing information provided by the Trustee and

collective trust funds.

Investments held by the Plan are stated at fair value, except for the Morley Stable Value Fund, a

collective trust fund that is stated at fair value with an adjustment to contract value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants

at the measurement date. See Note 4 for further discussion of fair value measurements.

7

401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc.

Notes to Financial Statements

May 31, 2015 and 2014

Investments are purchased and sold at the fair value of the underlying investments and receive the interest and

dividend earnings of the underlying investments. Purchases and sales of securities are recorded on a trade date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. The Plan presents, in the

Statement of Changes in Net Assets Available for Benefits, the net appreciation or depreciation in the fair value of its investments, which consists of the realized gains or losses and the unrealized appreciation or depreciation on those

investments.

Notes Receivable From Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Interest income is

recorded on the accrual basis. Related fees are recorded as administrative expenses and are expensed when they are incurred. No allowance for credit losses has been recorded as of May 31, 2015 or 2014. If a participant ceases to make loan

repayments and the plan administrator deems the participant loan to be in default, the participant loan balance is reduced and a benefit payment is recorded.

Benefits Payable

Benefits are recorded when paid. Accordingly, benefits

payable to persons that have elected to withdraw from the Plan but not yet paid have not been accrued. At May 31, 2015 and 2014, there were $1,359,155 and $908,293, respectively, payable to participants.

Expenses

Expenses of administering the Plan and those which are directly related to investment transactions are paid out of the assets of the Plan.

Certain administrative expenses are paid for by the Company.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America

requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of additions to and

deductions from net assets available for benefits during the reporting period. Actual results could differ from those estimates.

Risks and Uncertainties

The Plan offers investments in securities that are

exposed to various risks, such as interest rate, market and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities, and thus the

net asset value (NAV) of the funds, will occur in the near term and that such changes could materially affect participants’ account balances and the amount reported in the Statements of Net Assets Available for Benefits and the Statement of

Changes in Net Assets Available for Benefits. Market values of investments may decline for a number of reasons, including changes in prevailing market and interest rates, increases in defaults and credit rating downgrades. The fair values assigned

to the investments by the Plan are based upon available information believed to be reliable, which may be affected by conditions in the financial markets. The Plan may not be able to sell its investments when it desires to do so or to realize what

it perceives to be its fair value in the event of a sale.

8

401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc.

Notes to Financial Statements

May 31, 2015 and 2014

The

following presents investments that represent 5% or more of the Plan’s net assets at May 31, 2015:

|

|

|

|

|

|

|

| Participant-directed |

|

|

|

|

| NIKE, Inc. Class B Common Stock |

|

$ |

797,649,342 |

|

| Collective trust funds |

|

|

|

|

| NT Collective S&P 500 Equity Index Fund |

|

|

629,845,122 |

|

| NT Collective Russell 2000 Equity Index Fund |

|

|

298,028,090 |

|

| NT Collective All Country World Ex-US Index Fund |

|

|

276,159,178 |

|

| NT Collective Aggregate Bond Index Fund * |

|

|

238,176,036 |

|

| Morley Stable Value Fund, at contract value |

|

|

182,066,145 |

|

|

|

| Nonparticipant-directed |

|

|

|

|

| Collective trust funds |

|

|

|

|

| NT Collective Russell 3000 Equity Index Fund |

|

|

242,279,977 |

|

| NT Collective All Country World Ex-US Investable Market Index Fund |

|

|

166,064,569 |

|

| * |

The Plan has additional non participant-directed investments in this fund which do not exceed 5% or more of the Plan’s net assets. |

The following presents investments that represent 5% or more of the Plan’s net assets at May 31, 2014:

|

|

|

|

|

|

|

| Participant-directed |

|

|

|

|

| NIKE, Inc. Class B Common Stock |

|

$ |

646,689,659 |

|

| Collective trust funds |

|

|

|

|

| NT Global Investments Collective Daily S&P 500 Equity Index Fund |

|

|

536,436,807 |

|

| NT Global Investments Collective Daily Russell 2000 Equity Index Fund * |

|

|

260,503,936 |

|

| NT Collective ACWI ex-US Fund (Lending) |

|

|

259,587,395 |

|

| NT Global Investments Collective Daily Aggregate Bond Index Fund * |

|

|

200,024,349 |

|

| Morley Stable Value Fund, at contract value |

|

|

164,147,602 |

|

|

|

| Nonparticipant-directed |

|

|

|

|

| Collective trust funds |

|

|

|

|

| Northern Trust Global Investments Collective Daily S&P 500 Equity Index Fund |

|

|

163,352,118 |

|

| * |

The Plan has additional non participant-directed investments in this fund which do not exceed 5% or more of the Plan’s net assets. |

9

401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc.

Notes to Financial Statements

May 31, 2015 and 2014

During the year ended May 31, 2015,

all of the Plan’s investments (including gains and losses on investments bought and sold, as well as held during the year) appreciated in value as follows:

|

|

|

|

|

| NIKE, Inc. Class B common stock |

|

$ |

201,161,169 |

|

| Collective trust funds |

|

|

124,233,844 |

|

| Registered investment companies * |

|

|

(14,743,465 |

) |

| Corporate and foreign bonds |

|

|

(1,107,969 |

) |

| Preferred and common stocks |

|

|

2,734,750 |

|

|

|

|

|

|

|

|

$ |

312,278,329 |

|

|

|

|

|

|

| * |

Included in this total are gains related to the self-directed brokerage accounts of $2,104,341. |

| 4. |

Fair Value Measurement |

In determining fair value, the Plan uses a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair

value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurement) and the lowest priority to unobservable inputs (Level 3 measurement). The three levels of the

fair value hierarchy are described below:

| |

Level l |

Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Plan has the ability to access.

|

| |

Level 2 |

Inputs to the valuation methodology include: |

| |

• |

|

Quoted price for similar assets or liabilities in active markets; |

| |

• |

|

Quoted price for identical or similar assets or liabilities in inactive markets; |

| |

• |

|

Inputs, other than quoted prices, that are observable for the asset or liability; |

| |

• |

|

Inputs that are derived principally from, or corroborated by, observable market data by correlation or other means. |

If the asset or liability has a specified (contractual) term, the Level 2 input must be observable for substantially the full term of the

asset or liability.

| |

Level 3 |

Inputs to the valuation methodology are unobservable and significant to the fair value measurement. |

The asset’s or liability’s fair value measurement level within the fair value hierarchy is based on the most conservative level

of input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs.

The valuation methods described below may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its

valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in different fair value measurement at the

reporting date.

Following is a description of the valuation methodologies used for assets measured at fair value. There have

been no changes in the methodologies used at May 31, 2015 and 2014.

Common, Preferred and Foreign Stocks:

Investments in preferred, common and foreign stocks listed on a national securities exchange and over-the-counter securities are valued at the last reported sale price on the valuation date or, if no sales are reported for that day, the last

published sale price.

10

401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc.

Notes to Financial Statements

May 31, 2015 and 2014

Fixed Income Securities: Corporate and foreign bonds and US Treasuries are valued based on market values

quoted by dealers who are market makers in these securities, by independent pricing services, or by a methodology approved by Northern Trust. Valuation techniques incorporate available market information and proprietary valuation models, which

consider characteristics such as benchmark yield curve, coupon rates, credit spreads, estimated default rates and other features.

Registered Investment Companies: Registered investment companies (or mutual funds) are valued at the daily closing price as reported by the fund. Mutual funds held by the Plan are open-end mutual

funds that are registered with the Securities and Exchange Commission. These funds are required to publish their daily NAV and to transact at that price. The mutual funds held by the Plan are deemed to be actively traded.

Collective trust funds: Collective trust funds represent investments held in pooled funds. The Plan’s interests in the

collective trust funds are valued based on the NAV provided by Northern Trust. The accuracy of the NAV is verified using the audited financial statements of the collective trust funds. The NAV, as provided by the trustee, is used as a practical

expedient to estimate fair value. The NAV is based on the fair value of the underlying investments held by the fund less its liabilities. This practical expedient is not used when it is determined to be probable that the fund will sell the

investment for an amount different than the reported NAV. Participant transactions (purchases and sales) may occur daily. Were the Plan to initiate a full redemption of the collective trust, the investment advisor reserves the right to temporarily

delay withdrawal from the trust in order to ensure that securities liquidations will be carried out in an orderly business manner.

Stable Value Fund: The Plan invests in the Union Bond & Trust Company Morley Stable Value Fund (“Morley Stable Value Fund”), a collective trust fund, which holds fully

benefit-responsive investment contracts. This fund can be redeemed daily by participants subject to limitations on noncompeting options. The Morley Stable Value Fund’s trustee reserves the right to delay plan sponsor-initiated redemptions for

up to 365 days. The fund primarily holds guaranteed investment contracts and synthetic investment contracts. The fair value of the guaranteed investment contracts is based on current yields of similar instruments with comparable durations taking

into account the contract terms including interest reset intervals and the credit rating of the issuer. The fair value of fixed-income securities included in the synthetic investment contracts is determined by quoted market prices and/or using

market data for similar instruments in establishing prices, discounted cash flow models, and other pricing models. These models are primarily industry-standard models that consider various assumptions, including time value and yield curve as well as

other relevant economic measures. The fair value of a wrapper contract provided by a security-backed contract issuer is based on the replacement wrapper fee and the contracted wrapper fee. There are no unfunded commitments to the fund. The

Investment Subcommittee reviews the reasonableness of management’s use of the annual Morley Stable Value Fund audited financial statement fair value, adjusted to the Plan’s year-end, to determine the fair value of this fund.

Interest-bearing Cash: These investments are valued at fair value based on quoted market prices.

The Plan’s policy is to recognize transfers between levels of the fair value hierarchy as of the actual date of the event of change

in circumstances that caused the transfer. There were no significant transfers between levels of the fair value hierarchy during the year ending May 31, 2015.

The Plan also holds other assets and liabilities not measured at fair value on a recurring basis, including employer and employee contributions receivable, cash, accrued income, accrued liabilities and

unsettled trades. The fair value of these assets and liabilities approximates the carrying amounts in the accompanying financial statements due to the short maturity of the instruments.

11

401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc.

Notes to Financial Statements

May 31, 2015 and 2014

The following tables set forth by level, within the fair value hierarchy, the Plan’s assets at fair value

as of May 31, 2015 and 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Assets at Fair Value at May 31, 2015 |

|

| |

|

Level l |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

| Collective trust funds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity index funds |

|

$ |

— |

|

|

$ |

1,612,376,936 |

|

|

$ |

— |

|

|

$ |

1,612,376,936 |

|

| Other fixed income funds |

|

|

|

|

|

|

391,226,258 |

|

|

|

|

|

|

|

391,226,258 |

|

| Real estate funds |

|

|

|

|

|

|

32,661,095 |

|

|

|

|

|

|

|

32,661,095 |

|

| Stable value funds |

|

|

|

|

|

|

|

|

|

|

183,918,766 |

|

|

|

183,918,766 |

|

| Other short term investment funds |

|

|

|

|

|

|

6,861,438 |

|

|

|

|

|

|

|

6,861,438 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total collective trust funds |

|

|

— |

|

|

|

2,043,125,727 |

|

|

|

183,918,766 |

|

|

|

2,227,044,493 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common and foreign stocks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consumer discretionary |

|

|

797,649,342 |

|

|

|

|

|

|

|

|

|

|

|

797,649,342 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Registered investment companies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity funds |

|

|

43,864,297 |

|

|

|

|

|

|

|

|

|

|

|

43,864,297 |

|

| Bond funds |

|

|

41,678,260 |

|

|

|

|

|

|

|

|

|

|

|

41,678,260 |

|

| Commodity funds |

|

|

34,440,805 |

|

|

|

|

|

|

|

|

|

|

|

34,440,805 |

|

| Short term funds |

|

|

4,634,475 |

|

|

|

|

|

|

|

|

|

|

|

4,634,475 |

|

| Real estate funds |

|

|

687,196 |

|

|

|

|

|

|

|

|

|

|

|

687,196 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total registered investment companies * |

|

|

125,305,033 |

|

|

|

— |

|

|

|

— |

|

|

|

125,305,033 |

|

| Interest bearing cash |

|

|

10,022 |

|

|

|

|

|

|

|

|

|

|

|

10,022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets at fair value |

|

$ |

922,964,397 |

|

|

$ |

2,043,125,727 |

|

|

$ |

183,918,766 |

|

|

$ |

3,150,008,890 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * |

Included within the total registered investment companies’ of $125,305,033 is $59,620,186 of self-directed brokerage accounts. |

12

401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc.

Notes to Financial Statements

May 31, 2015 and 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Assets at Fair Value at May 31, 2014 |

|

| |

|

Level l |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

| Collective trust funds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity index funds |

|

$ |

— |

|

|

$ |

1,425,640,560 |

|

|

$ |

— |

|

|

$ |

1,425,640,560 |

|

| Other fixed income funds |

|

|

|

|

|

|

341,181,833 |

|

|

|

|

|

|

|

341,181,833 |

|

| Real estate funds |

|

|

|

|

|

|

40,145,084 |

|

|

|

|

|

|

|

40,145,084 |

|

| Stable value funds |

|

|

|

|

|

|

|

|

|

|

164,147,602 |

|

|

|

164,147,602 |

|

| Other short term investment funds |

|

|

|

|

|

|

3,945,088 |

|

|

|

|

|

|

|

3,945,088 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total collective trust funds |

|

|

— |

|

|

|

1,810,912,565 |

|

|

|

164,147,602 |

|

|

|

1,975,060,167 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common and foreign stocks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consumer discretionary |

|

|

646,689,659 |

|

|

|

|

|

|

|

|

|

|

|

646,689,659 |

|

| Information technology |

|

|

2,382 |

|

|

|

|

|

|

|

|

|

|

|

2,382 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total common and foreign stocks |

|

|

646,692,041 |

|

|

|

— |

|

|

|

— |

|

|

|

646,692,041 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred stocks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consumer goods |

|

|

569,520 |

|

|

|

|

|

|

|

|

|

|

|

569,520 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total preferred stocks |

|

|

569,520 |

|

|

|

— |

|

|

|

— |

|

|

|

569,520 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Registered investment companies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commodity funds |

|

|

49,396,932 |

|

|

|

|

|

|

|

|

|

|

|

49,396,932 |

|

| Equity funds |

|

|

42,141,078 |

|

|

|

|

|

|

|

|

|

|

|

42,141,078 |

|

| Bond funds |

|

|

10,203,914 |

|

|

|

|

|

|

|

|

|

|

|

10,203,914 |

|

| Short term funds |

|

|

4,020,058 |

|

|

|

|

|

|

|

|

|

|

|

4,020,058 |

|

| Real estate funds |

|

|

612,977 |

|

|

|

|

|

|

|

|

|

|

|

612,977 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total registered investment companies |

|

|

106,374,959 |

|

|

|

— |

|

|

|

— |

|

|

|

106,374,959 |

|

| Corporate and foreign bonds |

|

|

|

|

|

|

35,723,314 |

|

|

|

|

|

|

|

35,723,314 |

|

| Interest bearing cash |

|

|

1,705,571 |

|

|

|

|

|

|

|

|

|

|

|

1,705,571 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets at fair value |

|

$ |

755,342,091 |

|

|

$ |

1,846,635,879 |

|

|

$ |

164,147,602 |

|

|

$ |

2,766,125,572 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * |

Included within the total registered investment companies’ of $106,374,959 is $57,114,557 of self-directed brokerage accounts. |

Level 3 Gains and Losses

The following table sets forth a summary of changes in the fair value of the Plan’s Level 3 assets for the year ended May 31, 2015:

|

|

|

|

|

| |

|

Morley Stable

Value Fund |

|

| Balance at beginning of year |

|

$ |

164,147,602 |

|

|

|

| Purchases |

|

|

79,600,707 |

|

| Sales |

|

|

(61,969,930 |

) |

| Realized gains, net |

|

|

996,031 |

|

| Unrealized gains, net |

|

|

1,144,356 |

|

|

|

|

|

|

| Balance at end of year |

|

$ |

183,918,766 |

|

|

|

|

|

|

13

401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc.

Notes to Financial Statements

May 31, 2015 and 2014

Fair Value of Investments in Entities that Use NAV

The following table summarizes those investments measured at fair value using NAV as a practical expedient as of May 31, 2015 and

2014, respectively.

May 31, 2015

|

|

|

|

|

|

|

|

|

|

|

| Fund |

|

Fair Value |

|

|

Unfunded

Commitments |

|

Redemption

Frequency |

|

Redemption

Notice Period |

|

|

|

|

|

| NTGI Collective Short Term Government Fund |

|

$ |

26,084,035 |

|

|

N/A |

|

Daily |

|

Same Day |

| NT Collective Government STIF |

|

|

6,861,438 |

|

|

N/A |

|

Daily |

|

Same Day |

| NT Collective Russell 3000 Equity Index Fund |

|

|

242,279,977 |

|

|

N/A |

|

Daily |

|

Same Day |

| NT Collective Aggregate Bond Index Fund |

|

|

309,639,404 |

|

|

N/A |

|

Daily |

|

Same Day |

| NT Collective Russell 2000 Equity Index Fund |

|

|

298,028,090 |

|

|

N/A |

|

Daily |

|

Same Day |

| NT Collective S&P 500 Equity Index Fund |

|

|

629,845,122 |

|

|

N/A |

|

Daily |

|

Same Day |

| NT Collective World Government Bond Index Fund |

|

|

55,502,819 |

|

|

N/A |

|

Daily |

|

1 Day |

| NT Collective All Country World Ex-US Index Fund |

|

|

276,159,178 |

|

|

N/A |

|

Daily |

|

1 Day |

| NT Collective All Country World Ex-US Investable Market Index Fund |

|

|

166,064,569 |

|

|

N/A |

|

Daily |

|

1 Day |

| NT Collective Global Real Estate Index Fund |

|

|

32,661,095 |

|

|

N/A |

|

Daily |

|

1 Day |

| Morley Stable Value Fund |

|

|

183,918,766 |

|

|

N/A |

|

Daily |

|

Same Day |

| May 31, 2014

|

|

|

|

|

|

|

|

|

|

|

| Fund |

|

Fair Value |

|

|

Unfunded

Commitments |

|

Redemption

Frequency |

|

Redemption

Notice Period |

|

|

|

|

|

| NT Collective Government Short Term Investment Fund |

|

$ |

3,987,743 |

|

|

N/A |

|

Daily |

|

Same Day |

| NT Collective ACWI ex-US Fund (Non-Lending) |

|

|

78,812,676 |

|

|

N/A |

|

Daily |

|

1 Day |

| NT Collective Daily Aggregate Bond Index Fund |

|

|

292,327,018 |

|

|

N/A |

|

Daily |

|

Same Day |

| NT Collective Daily Russell 2000 Equity Index Fund |

|

|

299,223,989 |

|

|

N/A |

|

Daily |

|

Same Day |

| NT Collective S&P 400 Index Fund |

|

|

41,264,879 |

|

|

N/A |

|

Daily |

|

Same Day |

| NT Collective Daily S&P 500 Equity Index Fund |

|

|

699,788,925 |

|

|

N/A |

|

Daily |

|

Same Day |

| NT Collective World Government Bond Index Fund |

|

|

48,812,161 |

|

|

N/A |

|

Daily |

|

1 Day |

| NT Collective ACWI ex-US Fund (Lending) |

|

|

259,587,395 |

|

|

N/A |

|

Daily |

|

1 Day |

| NT Collective Developed International Small Cap Index Fund |

|

|

46,962,695 |

|

|

N/A |

|

Daily |

|

1 Day |

| NT Collective Global Real Estate Index Fund |

|

|

40,145,084 |

|

|

N/A |

|

Daily |

|

1 Day |

| Morley Stable Value Fund |

|

|

164,147,602 |

|

|

N/A |

|

Daily |

|

Same Day |

| 5. |

Party-in-Interest Transactions |

The Plan’s investments represent funds invested in, or maintained by, Northern Trust and Charles Schwab. Northern Trust is the trustee of the Plan assets and Charles Schwab is the custodian of

selected assets and, therefore, these investments represent exempt party-in-interest transactions.

14

401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc.

Notes to Financial Statements

May 31, 2015 and 2014

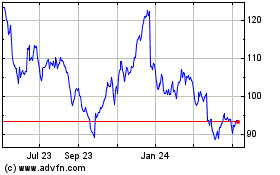

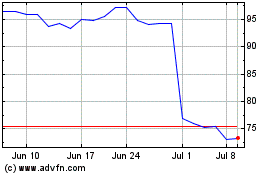

Certain Plan investments are shares of Company common stock. For the year ended May 31, 2015 and 2014, the

Plan purchased 257,506 and 135,834 shares of NIKE, Inc. Class B common stock, respectively, at a cost of $10,893,677 and $9,499,193, respectively. For the same years ended, the Plan sold 820,427 and 511,649 shares of NIKE, Inc. Class B common stock,

respectively, with proceeds of $49,541,486 and $36,502,288, respectively. At May 31, 2015 and 2014, the Plan held $797,649,342 (7,845,474 shares) and $646,689,659 (8,408,395 shares), respectively, of NIKE, Inc. Class B common stock.

The

Internal Revenue Service (“IRS”) has determined and informed the Plan by letter dated December 16, 2013 that the Plan is designed in accordance with applicable sections of the Internal Revenue Code (IRC). Although the Plan has been

amended since receiving the determination letter, the Plan administrator believes that the Plan is designed and is currently being operated in compliance with the applicable requirements of the IRC.

| 7. |

Nonparticipant-directed Investments |

Information about the net assets at May 31 and the significant components of the changes in net assets for the year ended May 31 relating to the nonparticipant-directed investments is as

follows:

|

|

|

|

|

|

|

|

|

| |

|

2015 |

|

|

2014 |

|

| Net assets |

|

|

|

|

|

|

|

|

| Collective trust funds |

|

$ |

600,282,895 |

|

|

$ |

553,862,586 |

|

| Employer receivable |

|

|

57,931,594 |

|

|

|

48,690,673 |

|

| Registered investment companies |

|

|

65,684,847 |

|

|

|

49,260,401 |

|

| Corporate and foreign bonds |

|

|

— |

|

|

|

35,723,314 |

|

| Accrued interest and dividends |

|

|

35 |

|

|

|

637,919 |

|

| Cash |

|

|

— |

|

|

|

13,488 |

|

| Interest bearing cash |

|

|

— |

|

|

|

1,695,548 |

|

| Common and foreign stocks |

|

|

— |

|

|

|

2,382 |

|

| Preferred stocks |

|

|

— |

|

|

|

569,520 |

|

| Due from broker for securities sold |

|

|

— |

|

|

|

882,545 |

|

| Due to broker for securities purchased |

|

|

— |

|

|

|

(1,097,583 |

) |

| Accrued expenses |

|

|

(44,878 |

) |

|

|

(70,123 |

) |

|

|

|

|

|

|

|

|

|

| Total net assets |

|

$ |

723,854,493 |

|

|

$ |

690,170,670 |

|

|

|

|

|

|

|

|

|

|

15

401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc.

Notes to Financial Statements

May 31, 2015 and 2014

|

|

|

|

|

| |

|

Year Ended |

|

| |

|

May 31, 2015 |

|

| Changes in net assets |

|

|

|

|

| Net appreciation in fair value of investments |

|

$ |

7,004,985 |

|

| Employer contributions |

|

|

57,931,594 |

|

| Interest and dividends |

|

|

3,076,125 |

|

| Administrative and investment expenses |

|

|

(611,912 |

) |

| Benefits paid to participants |

|

|

(33,716,969 |

) |

|

|

|

|

|

|

|

$ |

33,683,823 |

|

|

|

|

|

|

| 8. |

Reconciliation of Financial Statements to Form 5500 |

The following is a reconciliation of net assets available for benefits per the financial statements to the Form 5500 at May 31, 2015 and 2014:

|

|

|

|

|

|

|

|

|

| |

|

2015 |

|

|

2014 |

|

| Net assets available for benefits per the financial statements |

|

$ |

3,247,462,096 |

|

|

$ |

2,851,243,946 |

|

| Benefits payable |

|

|

(1,359,155 |

) |

|

|

(908,293 |

) |

| Deemed distributions |

|

|

|

|

|

|

(626,773 |

) |

| Adjustment from fair value to contract value for interest in collective trust relating to fully benefit-responsive investment

contracts |

|

|

1,852,621 |

|

|

|

1,415,088 |

|

|

|

|

|

|

|

|

|

|

| Net assets available for benefits per Form 5500 |

|

$ |

3,247,955,562 |

|

|

$ |

2,851,123,968 |

|

|

|

|

|

|

|

|

|

|

The following is a reconciliation of the net increase in net assets available for benefits per the

financial statements to the Form 5500 at May 31, 2015:

|

|

|

|

|

| Net increase in net assets per the financial statements |

|

$ |

396,218,150 |

|

| Benefits payable at May 31, 2015 |

|

|

(1,359,155 |

) |

| Benefits payable at May 31, 2014 |

|

|

908,293 |

|

| Deemed distributions at May 31, 2014 |

|

|

626,773 |

|

| Adjustment from fair value to contract value for interest in collective trust at May 31, 2015 |

|

|

1,852,621 |

|

| Adjustment from fair value to contract value for interest in collective trust at May 31, 2014 |

|

|

(1,415,088 |

) |

|

|

|

|

|

| Net increase in net assets per Form 5500 |

|

$ |

396,831,594 |

|

|

|

|

|

|

16

Supplemental Schedules

401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc.

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

May 31, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

|

(b) |

|

(c) |

|

(d) |

|

|

(e) |

|

| |

|

Identity of Issue, Borrower, |

|

|

|

|

|

|

Current |

|

| |

|

Lessor or Similar Party |

|

Description of Investments |

|

Cost (1) |

|

|

Value |

|

|

|

Participant directed |

|

|

|

|

|

|

|

|

|

|

|

|

Self-directed Brokerage Accounts |

|

Registered investment company |

|

|

|

|

|

$ |

59,620,186 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NIKE, Inc., Class B Common Stock |

|

Common stock |

|

|

|

|

|

|

797,649,342 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * |

|

NT Collective Aggregate Bond Index Fund |

|

Collective trust fund |

|

|

|

|

|

|

238,176,036 |

|

| * |

|

NT Collective All Country World Ex-US Index Fund |

|

Collective trust fund |

|

|

|

|

|

|

276,159,178 |

|

| * |

|

NT Collective Government STIF |

|

Collective trust fund |

|

|

|

|

|

|

634,406 |

|

| * |

|

NT Collective Russell 2000 Equity Index Fund |

|

Collective trust fund |

|

|

|

|

|

|

298,028,090 |

|

| * |

|

NT Collective S&P 500 Equity Index Fund |

|

Collective trust fund |

|

|

|

|

|

|

629,845,122 |

|

|

|

Morley Stable Value Fund |

|

Collective trust fund |

|

|

|

|

|

|

183,918,766 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,626,761,598 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest bearing cash |

|

|

|

|

|

|

10,022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total participant directed investments |

|

|

|

|

|

|

2,484,041,148 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonparticipant-directed |

|

|

|

|

|

|

|

|

|

|

|

|

Powershares Exchange-Traded Fund Intl |

|

Registered investment company |

|

|

26,920,459 |

|

|

|

24,669,984 |

|

|

|

PIMCO Commodities Plus Strategy Fund |

|

Registered investment company |

|

|

41,117,008 |

|

|

|

34,389,175 |

|

|

|

Vanguard Whitehall Emerging Markets Govt Bond Index Fund |

|

Registered investment company |

|

|

6,689,117 |

|

|

|

6,625,688 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total registered investment company |

|

|

74,726,584 |

|

|

|

65,684,847 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * |

|

NT Collective Aggregate Bond Index Fund |

|

Collective trust fund |

|

|

55,569,865 |

|

|

|

71,463,368 |

|

| * |

|

NT Collective Global Real Estate Index Fund |

|

Collective trust fund |

|

|

19,269,849 |

|

|

|

32,661,095 |

|

| * |

|

NT Collective Government STIF |

|

Collective trust fund |

|

|

6,227,032 |

|

|

|

6,227,032 |

|

| * |

|

NT Collective All Country World Ex-US Investable Market Index Fund |

|

Collective trust fund |

|

|

150,156,886 |

|

|

|

166,064,569 |

|

| * |

|

NT Collective Russell 3000 Equity Index Fund |

|

Collective trust fund |

|

|

212,963,241 |

|

|

|

242,279,977 |

|

| * |

|

NTGI Collective Short Term Government Fund |

|

Collective trust fund |

|

|

25,995,141 |

|

|

|

26,084,035 |

|

| * |

|

NT Collective World Government Bond Index Fund |

|

Collective trust fund |

|

|

57,972,699 |

|

|

|

55,502,819 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total collective trust funds |

|

|

528,154,713 |

|

|

|

600,282,895 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total nonparticipant-directed investments |

|

$ |

602,881,297 |

|

|

$ |

665,967,742 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total investments |

|

|

|

|

|

$ |

3,150,008,890 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * |

|

Notes Receivable from Participants |

|

Interest Rate: 4.25% - 9.25% |

|

|

|

|

|

$ |

32,808,584 |

|

| (1) |

Cost information is not required for participant directed assets. |

18

401(k) Savings and Profit Sharing Plan for Employees of NIKE, Inc.

Schedule H, Line 4i – Schedule of Assets (Acquired and Disposed of Within Year)

Year Ended May 31, 2015

|

|

|

|

|

|

|

|

|

|

|

| (a) |

|

(b) |

|

(c) |

|

|

(d) |

|

| Identity of Issue, Borrower, |

|

Description of |

|

Cost of |

|

|

Proceeds of |

|

| Lessor or Similar Party |

|

Investments |

|

Acquisitions |

|

|

Dispositions |

|

| AIRCASTLE LTD |

|

Corporate Bond |

|

|

305,250 |

|

|

|

379,687 |

|

| ALCOA INC |

|

Corporate Bond |

|

|

175,000 |

|

|

|

177,437 |

|

| ALERE INC |

|

Corporate Bond |

|

|

78,750 |

|

|

|

79,125 |

|

| ALLIANCE DATA SYS |

|

Corporate Bond |

|

|

400,000 |

|

|

|

394,684 |

|

| ANIXTER INC |

|

Corporate Bond |

|

|

175,250 |

|

|

|

175,385 |

|

| ARDAGH PACKAGING |

|

Foreign Bond |

|

|

306,720 |

|

|

|

299,032 |

|

| BONANZA CREEK |

|

Corporate Bond |

|

|

186,512 |

|

|

|

354,091 |

|

| CARE UK HEALTH FRN GTD |

|

Foreign Bond |

|

|

257,550 |

|

|

|

221,966 |

|

| CARRIZO OIL & GAS |

|

Corporate Bond |

|

|

261,250 |

|

|

|

257,294 |

|

| CCO HLDGS LLC / CCO HLDGS CAP CORP |

|

Corporate Bond |

|

|

176,312 |

|

|

|

482,844 |

|

| CLEAR CHANNEL |

|

Corporate Bond |

|

|

339,000 |

|

|

|

645,108 |

|

| DAVITA HEALTHCARE |

|

Corporate Bond |

|

|

425,000 |

|

|

|

421,281 |

|

| EQUINIX INC |

|

Corporate Bond |

|

|

258,125 |

|

|

|

386,187 |

|

| FGI OPER CO LLC |

|

Corporate Bond |

|

|

49,500 |

|

|

|

211,331 |

|

| FORESIGHT ENERGY |

|

Corporate Bond |

|

|

106,375 |

|

|

|

470,314 |

|

| GENCORP INC |

|

Corporate Bond |

|

|

191,625 |

|

|

|

367,206 |

|

| HUGHES SATELLITE |

|

Corporate Bond |

|

|

195,125 |

|

|

|

481,115 |

|

| INFINITY ACQSTN |

|

Corporate Bond |

|

|

200,000 |

|

|

|

183,853 |

|

| INTELSAT JACKSON HLDGS S A |

|

Corporate Bond |

|

|

96,625 |

|

|

|

395,883 |

|

| INTELSAT JACKSON HLDGS S A |

|

Corporate Bond |

|

|

104,750 |

|

|

|

107,424 |

|

| JAGUAR HLDG CO I SR PIK 144A |

|

Corporate Bond |

|

|

203,000 |

|

|

|

204,340 |

|

| KINETIC CONCEPTS INC / KCI USA INC |

|

Corporate Bond |

|

|

197,312 |

|

|

|

190,276 |

|

| MONITCHEM HOLDCO 2 S.A. 144A |

|

Foreign Bond |

|

|

306,349 |

|

|

|

310,479 |

|

| NAT RES |

|

Corporate Bond |

|

|

183,312 |

|

|

|

347,153 |

|

| NATL FINL PARTNERS |

|

Corporate Bond |

|

|

302,156 |

|

|

|

280,276 |

|

| OXFORD FIN LLC |

|

Corporate Bond |

|

|

106,000 |

|

|

|

308,453 |

|

| PVTPL 1011778 B C UNLIMITED LIABILITY |

|

Corporate Bond |

|

|

297,750 |

|

|

|

299,820 |

|

| PVTPL 144A AMSURG CORP SR NT |

|

Corporate Bond |

|

|

298,875 |

|

|

|

306,355 |

|

| PVTPL ACI WORLDWIDE INC SR NT 144A |

|

Corporate Bond |

|

|

52,625 |

|

|

|

180,421 |

|

| PVTPL AECOM SR NT 144A |

|

Corporate Bond |

|

|

401,687 |

|

|

|

409,672 |

|

| PVTPL ANTERO RESOURCES CORP |

|

Corporate Bond |

|

|

150,750 |

|

|

|

145,384 |

|

| PVTPL CANTOR COML REAL ESTATE CO L P / CC R E FIN CORP SR NT |

|

Corporate Bond |

|

|

80,812 |

|

|

|

266,037 |

|

| PVTPL CHS / CMNTY HEALTH SYS INC SR NT |

|

Corporate Bond |

|

|

312,750 |

|

|

|

320,743 |

|

| PVTPL CONSOL ENERGY INC SR NT |

|

Corporate Bond |

|

|

127,125 |

|

|

|

270,658 |

|

| PVTPL DRAWBRIDGE SPL OPPORTUNITIES FD LP/ DRA SR NT |

|

Corporate Bond |

|

|

174,562 |

|

|

|

174,204 |

|

| PVTPL FMG RES AUGUST 2006 PTY LTD SR NT |

|

Corporate Bond |

|

|

103,500 |

|

|

|

104,375 |

|

| PVTPL HUDBAY MINERALS INC SR NT 144A |

|

Corporate Bond |

|

|

187,250 |

|

|

|

182,816 |

|

| PVTPL LEVEL 3 ESCROW II INC SR NT 144A |

|

Corporate Bond |

|

|

598,250 |

|

|

|

601,918 |

|

| PVTPL NAI ENTERTAINMENT HLDING |

|

Corporate Bond |

|

|

207,000 |

|

|

|

203,249 |

|

| PVTPL NORTHERN BLIZZARD RES INC |

|

Corporate Bond |

|

|

105,000 |

|

|

|

249,655 |

|

| PVTPL PETCO ANIMAL SUPPLIES INC SR NT |

|

Corporate Bond |

|

|

161,062 |

|

|

|

155,141 |

|

| PVTPL RSP PERMIAN INC SR NT |

|

Corporate Bond |

|

|

225,000 |

|

|

|

223,869 |

|

| PVTPL SBA COMMUNICATIONS CORP SR NT |

|

Corporate Bond |

|

|

297,534 |

|

|

|

289,807 |

|

| PVTPL STEEL DYNAMICS INC SR NT 144A |

|

Corporate Bond |

|

|

300,000 |

|

|

|

307,125 |

|

| PVTPL VPII ESCR CORP SR NT |

|

Corporate Bond |

|

|

157,500 |

|

|

|

156,849 |

|

| PVTPL WIND ACQUISITION FIN S A SR SECD NT |

|

Corporate Bond |

|

|

325,000 |

|

|

|

313,683 |

|

| PVTPL1 NIELSEN FIN LLC 144A |

|

Corporate Bond |

|

|

277,344 |

|

|

|

276,176 |

|