SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

ANNUAL REPORT

PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Mark One):

[X] Annual Report Pursuant To Section 15(d) Of The Securities Exchange Act Of 1934 for the fiscal year ended December 31, 2014

or

[ ] Transition Report Pursuant To Section 15(d) Of The Securities Exchange Act Of 1934 for the transition period from __________ to _____________

Commission file number 000-20557

| |

A. | Full title of the plan and the address of the plan, if different from that of the issuer named below: The Andersons, Inc. Retirement Savings Investment Plan. |

| |

B. | Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: The Andersons, Inc., 480 West Dussel Drive, Maumee, Ohio 43537. |

|

| |

Contents |

| |

| |

| |

Financial Statements: | |

| |

| |

| |

| |

| |

Supplemental Schedule: | |

| |

| |

| |

Report of Independent Registered Public Accounting Firm

To the Retirement Benefits Committee

The Andersons, Inc. Retirement Savings Investment Plan

We have audited the accompanying statements of net assets available for benefits of The Andersons, Inc. Retirement Savings Investment Plan (the Plan) as of December 31, 2014 and 2013, and the related statement of changes in net assets available for benefits for the year ended December 31, 2014. These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2014 and 2013, and the changes in net assets available for benefits for the year ended December 31, 2014, in conformity with accounting principles generally accepted in the United States of America.

The supplemental information in the accompanying schedule of assets (held at end of year) as of December 31, 2014 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is presented for the purpose of additional analysis and is not a required part of the financial statements but includes supplemental information required by the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. The supplemental information is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedule, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated in all material respects in relation to the financial statements as a whole.

/s/ McGladrey LLP

Columbus, Ohio

June 26, 2015

The Andersons, Inc. Retirement Savings Investment Plan

Statements of Net Assets Available for Benefits

|

| | | | | | | |

| December 31, |

| 2014 | | 2013 |

Assets Participant-directed investments: | | | |

Mutual funds: | | | |

Fidelity Spartan 500 Index Fund | $ | 40,805,196 |

| | $ | 35,647,559 |

|

Fidelity U.S. Bond Index Fund | 20,754,618 |

| | 17,780,464 |

|

Fidelity Money Market Trust, Retirement Government Money Market Portfolio | 9,567,268 |

| | 12,569,608 |

|

Fidelity Low-Priced Stock Fund | 16,176,417 |

| | 16,439,501 |

|

Fidelity Contrafund | 23,924,444 |

| | 23,382,686 |

|

Harbor International Institutional Fund | 2,352,655 |

| | 2,281,367 |

|

Janus Enterprise Fund | 11,872,682 |

| | 9,528,904 |

|

Fidelity Freedom Funds | 49,490,847 |

| | 43,725,803 |

|

Dodge and Cox Stock Fund | 14,136,823 |

| | 12,354,842 |

|

First Eagle Overseas Fund | 8,504,924 |

| | 7,791,074 |

|

Fidelity Small Cap Stock Fund | — |

| | 3,020,467 |

|

Litman Gregory Masters Fund | 7,454,090 |

| | 8,869,888 |

|

Invesco Developing Markets Fund | 883,523 |

| | 667,787 |

|

American Beacon Small Cap Value Fund | 4,484,227 |

| | 4,574,461 |

|

Vanguard Short-Term Investment Fund | 4,246,511 |

| | 4,496,238 |

|

RBC Small Cap Core Fund | 3,390,020 |

| | 578,182 |

|

Common stock of The Andersons, Inc. | 20,114,911 |

| | 21,038,760 |

|

Self-directed brokerage accounts | 439,729 |

| | — |

|

Receivables: | | | |

Notes from participants | 4,002,904 |

| | 3,756,341 |

|

Employer supplemental contribution | 3,793,299 |

| | 2,985,353 |

|

Net Assets Available for Benefits | $ | 246,395,088 |

| | $ | 231,489,285 |

|

See Notes to Financial Statements.

The Andersons, Inc. Retirement Savings Investment Plan

Statement of Changes in Net Assets Available for Benefits

|

| | | |

| Year Ended December 31, 2014 |

Additions | |

Contributions: | |

Participants | $ | 8,924,977 |

|

Employer | 10,997,384 |

|

Rollovers | 797,959 |

|

Total contributions | 20,720,320 |

|

| |

Investment income: | |

Interest and dividends | 10,990,405 |

|

Net appreciation in fair value of investments | 1,134,590 |

|

Total investment income | 12,124,995 |

|

Interest income on notes receivable from participants | 167,858 |

|

Total additions | 33,013,173 |

|

| |

Deductions | |

Benefit payments made to active and terminated participants | 18,021,752 |

|

Administrative fees | 85,618 |

|

Total deductions | 18,107,370 |

|

| |

Net Increase | 14,905,803 |

|

| |

Net Assets Available for Benefits - Beginning of year | 231,489,285 |

|

| |

Net Assets Available for Benefits - End of year | $ | 246,395,088 |

|

See Notes to Financial Statements.

The Andersons, Inc. Retirement Savings Investment Plan

Notes to Financial Statements

December 31, 2014 and 2013

Note 1 – Summary of Significant Accounting Policies

The accounting records of The Andersons, Inc. Retirement Savings Investment Plan (the “Plan”) are maintained on the accrual basis by The Andersons, Inc. (the “Plan Sponsor”, "Plan Administrator" or “Employer”). Plan assets are maintained by Fidelity Management Trust Company (the “Trustee”) and monitored by the Retirement Benefits Committee established by the Plan Sponsor.

The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of net assets available for benefits and changes therein. Actual results could differ from those estimates.

Benefits are recorded when paid.

Investments are stated at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair values of the Plan’s investments in mutual funds are based on net asset values on the last business day of the plan year. The fair value of the Plan’s investments in The Andersons, Inc. common stock is based on NASDAQ closing market price on the last business day of the plan year.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on an accrual basis. Dividends are recorded on the ex-dividend date. Net appreciation (depreciation) includes the Plan’s gains and losses on investments bought and sold as well as held during the year.

Investment securities are exposed to various risks, such as interest rate, market, and credit risk. It is at least reasonably possible that changes in the values of investment securities will occur in the near term and such changes could materially affect participants’ account balances and the amounts reported in the statements of net assets available for benefits.

Participant contributions are recognized when the participant contributions are withheld from the employee’s earnings. Employer matching and employer transition contributions are recognized each pay period. Employer supplemental contributions are recognized when declared.

The Plan Administrator has evaluated subsequent events through the date and time the financial statements were issued.

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Delinquent participant loans are reclassified as distributions based upon the terms of the Plan document.

Note 2 - Description of the Plan

The following description of the Plan is provided for general information. Participants should refer to the Plan document for a more complete description of the Plan’s provisions.

The Andersons, Inc. Retirement Savings Investment Plan

The Plan is a defined contribution plan that covers substantially all employees of The Andersons, Inc. and its wholly owned subsidiary, The Andersons Mower Center, Inc. (the “Company”). The Plan provides for retirement, disability, and death benefits for participants who meet certain eligibility requirements, including attaining age 21. Full-time employees are eligible to begin deferring money into the Plan as soon as administratively practicable following their date of hire. Part-time employees are eligible to begin deferring money into the Plan upon meeting the 1,000 hours and 12-month service requirement. Employer matching contributions begin once the employee enters the Plan.

Participants are automatically enrolled in the Plan with an effective pre-tax deferral of 3 percent of compensation unless the participant affirmatively elects out of the automatic deferral feature or elects a different deferral rate. Employee contributions may be made by salary reduction up to 75 percent of annual compensation (in 1.0 percent increments) subject to the maximum annual contribution allowed by law. The Plan provides for a required minimum employer matching contribution of 100 percent of the first 3 percent of a participant’s deferred compensation plus 50 percent of the next 2 percent of a participant’s deferred compensation, subject to limitations in the Internal Revenue Code ("IRC"). The Plan was amended in 2013 to include an automatic deferral. As of February 25, 2013 new participants enrolled in the Plan will incur an automatic increase in their withholding amount of 1 percent per year, up to 6 percent withheld. The Plan was also amended on December 20, 2013 to provide participants the option to choose Roth deferrals and again on January 2, 2014 to provide participants the option to allocate their earnings into a self-directed brokerage account.

The Plan may accept rollover contributions from certain IRAs or from other qualified defined benefit or contribution plans of The Andersons, Inc. or participants’ former employers. In addition, the Plan Sponsor may make supplemental contributions to the Plan at its discretion.

The Plan includes an employer transition contribution that is intended to reduce the impact of the Company’s defined benefit pension plan freeze, which was effective July 1, 2010 for all of its non-retail line of business employees. Therefore, the employee must be a defined benefit plan participant under age 65 as of June 30, 2010 to be eligible for the transition contribution. The transition contribution is a per-pay contribution based on age and years of service in the defined benefit plan and it represents a minimum Plan contribution regardless of performance.

A performance contribution is an annual employer supplemental contribution. All non-retail employees who are eligible to participate in the Plan, accumulate 1,000 hours during the year, and are active at the Plan’s year-end will be eligible to receive a performance contribution. The Company determines how much to contribute to each participant based on the Company’s performance, with the measure of performance being pre-tax income. The performance contribution will range from 0% to 5% of eligible compensation depending on the actual level of Company performance (a minimum of 20% of budgeted income must be achieved before a minimum performance contribution of 1% will be made).

If a participant is eligible to receive an employer transition contribution, the participant will receive the greater of the transition contribution or the performance contribution. That means if the discretionary employer supplemental performance contribution is greater than the transition contribution received during the year, the participant will receive the difference after the end of the Plan’s year when the employer supplemental performance contribution is paid. Employer supplemental performance contributions, in excess of employer transition contributions, were $3,793,299 for the year ended December 31, 2014.

The Andersons, Inc. Retirement Savings Investment Plan

Forfeited balances of terminated accounts are used to reduce future employer contributions. The balance of forfeited nonvested accounts was not material at December 31, 2014 and 2013.

Each participant directs Fidelity Management Trust Company to invest any or all of his or her account among various investment options, including an option to invest in the common stock of The Andersons, Inc. Participants may transfer account balances among the different funds on a daily basis.

Each participant’s account is credited with their contributions, the employer matching contributions, the employer transition contributions, and the employer supplemental contributions and an allocation of investment earnings. Allocations are based on the participant’s selected allocation percentages. Investment income is allocated to participant accounts by investment fund balance on a daily basis. This allocation is based upon the ratio of each participant’s weighted average fund balance to the total of all participants’ fund balances. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account. No assets of any participant account may be used for the benefit of any other account or participant.

Although it has not expressed any intent to do so, the Plan Sponsor has the right under the Plan to terminate the Plan and the trust at any time. In the event of termination of the Plan, participants become fully vested in their individual accounts.

A participant is entitled to a benefit representing his or her salary reduction contributions, the vested amount of employer contributions, and allocated income thereon (including realized and unrealized gains and losses). Upon termination of employment due to retirement, permanent disability, or death, a participant or his or her beneficiary is entitled to receive distribution of the vested account balance in a lump sum or in monthly installments.

Participants are immediately 100 percent vested in the participant, employer matching, and rollover contributions and any income or loss thereon. The transition and performance contributions ratably vest over a five-year period. The Plan was amended as of March 19, 2013 to include employees of an acquired entity or business into the Plan and recognize each individual's service for vesting purposes if such service would have been treated as service if it had been rendered at the Company.

Withdrawals of employer and employee salary reduction contributions and related income thereon during the participant’s employment are prohibited unless the participant has attained age 59 ½ or the participant can show immediate and extreme financial hardship as determined by the Retirement Benefits Committee.

Additional information about the Plan Agreement and limitations on contributions is available from the human resources department of the Plan Sponsor or from designated individuals at the Company.

Participants may borrow up to 50 percent of their vested account balances. The minimum loan amount is $1,000 and the maximum is $50,000. Each participant may only have one loan outstanding and each loan bears interest at a fixed rate equal to the prime rate at the end of the quarter previous to initiation of the loan plus one percent. Loans must provide for at least quarterly repayments utilizing a level amortization schedule. Loan terms will not exceed five years unless the loan qualifies as a home loan in which the term will be established by the Plan Administrator at the time of the loan.

The Plan Sponsor pays substantially all costs of administering the Plan, including trustee fees. The Plan pays investment fees.

The Andersons, Inc. Retirement Savings Investment Plan

Note 3 - Fair Value Measurements

Generally accepted accounting principles provide a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. In general, fair values determined by Level 1 inputs use quoted prices in active markets for identical assets or liabilities that the Plan has the ability to access. Fair values determined by Level 2 inputs use other inputs that are observable, either directly or indirectly. These Level 2 inputs include quoted prices for similar assets and liabilities in active markets, and other inputs such as interest rates and yield curves that are observable at commonly quoted intervals. Level 3 inputs are unobservable inputs, including inputs that are available in situations where there is little, if any, market activity for the related asset or liability. In instances where inputs used to measure fair value fall into different levels of the fair value hierarchy, fair value measurements in their entirety are categorized based on the lowest level input that is significant to the valuation. The Plan’s assessment of the significance of particular inputs to these fair value measurements requires judgment and considers factors specific to each asset or liability.

Disclosures concerning assets measured at fair value are presented below. The Plan has no liabilities measured at fair value.

The following table sets forth by level, within the fair value hierarchy, the Plan's assets at fair value as of December 31, 2014:

|

| | | | | | | | | | | | | | | |

| Quotes Prices in Active Markets for Identical Assets (Level 1) | |

Significant Other Observable Inputs (Level 2) | |

Significant Unobservable Inputs (Level 3) | |

Total |

Mutual Funds: | | | | | | | |

Large-Cap Funds | $ | 78,866,463 |

| | $ | — |

| | $ | — |

| | $ | 78,866,463 |

|

Mid-Cap Funds | 28,049,099 |

| | — |

| | — |

| | 28,049,099 |

|

Small-Cap Funds | 7,874,247 |

| | — |

| | — |

| | 7,874,247 |

|

Blended Funds | 49,490,847 |

| | — |

| | — |

| | 49,490,847 |

|

International Funds | 19,195,192 |

| | — |

| | — |

| | 19,195,192 |

|

Bond Funds | 25,001,129 |

| | — |

| | — |

| | 25,001,129 |

|

Money-Market Fund | 9,567,268 |

| | — |

| | — |

| | 9,567,268 |

|

Common Stock of The Andersons, Inc. | 20,114,911 |

| | — |

| | — |

| | 20,114,911 |

|

Self-directed brokerage accounts | 439,729 |

| | — |

| | — |

| | 439,729 |

|

| $ | 238,598,885 |

| | $ | — |

| | $ | — |

| | $ | 238,598,885 |

|

The Andersons, Inc. Retirement Savings Investment Plan

The following table sets forth by level, within the fair value hierarchy, the Plan's assets at fair value as of December 31, 2013:

|

| | | | | | | | | | | | | | | |

| Quotes Prices in Active Markets for Identical Assets (Level 1) | |

Significant Other Observable Inputs (Level 2) | |

Significant Unobservable Inputs (Level 3) | |

Total |

Mutual Funds: | | | | | | | |

Large -Cap Funds | $ | 71,385,087 |

| | $ | — |

| | $ | — |

| | $ | 71,385,087 |

|

Mid-Cap Funds | 25,968,405 |

| | — |

| | — |

| | 25,968,405 |

|

Small-Cap Funds | 8,173,110 |

| | — |

| | — |

| | 8,173,110 |

|

Blended Funds | 43,725,803 |

| | — |

| | — |

| | 43,725,803 |

|

International Funds | 19,610,116 |

| | — |

| | — |

| | 19,610,116 |

|

Bond Funds | 22,276,702 |

| | — |

| | — |

| | 22,276,702 |

|

Money-Market Fund | 12,569,608 |

| | — |

| | — |

| | 12,569,608 |

|

Common Stock of The Andersons, Inc. | 21,038,760 |

| | — |

| | — |

| | 21,038,760 |

|

| $ | 224,747,591 |

| | $ | — |

| | $ | — |

| | $ | 224,747,591 |

|

The methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date. There were no transfers between fair value levels for the year ended December 31, 2014.

Note 4 – Investments

The following table presents investments that represent 5% or more of the Plan's net assets: |

| | | | | | | |

| December 31, |

| 2014 | | 2013 |

Fidelity Spartan 500 Index Fund | $ | 40,805,196 |

| | $ | 35,647,559 |

|

Fidelity Spartan U.S. Bond Index Fund | 20,754,618 |

| | 17,780,464 |

|

Fidelity Money Market Trust, Retirement Government Money Market Portfolio | * | | 12,569,608 |

|

Fidelity Low-Priced Stock Fund | 16,176,417 |

| | 16,439,501 |

|

Fidelity Contrafund | 23,924,444 |

| | 23,382,686 |

|

Dodge and Cox Stock Fund | 14,136,823 |

| | 12,354,842 |

|

Common stock of The Andersons, Inc. | 20,114,911 |

| | 21,038,760 |

|

The Andersons, Inc. Retirement Savings Investment Plan

The Plan’s investments at December 31, 2014 and 2013 are held by the Trustee. The Plan’s investments (including investments bought, sold, and held during the year) appreciated (depreciated) in fair value during the year ended December 31, 2014 as follows:

|

| | | |

Net appreciation (depreciation) in fair value: | |

Mutual funds | $ | 3,363,467 |

|

The Andersons, Inc. common stock | (2,194,119 | ) |

Self-directed brokerage accounts | $ | (34,758 | ) |

Total | $ | 1,134,590 |

|

The form 5500 includes notes receivable from participants as investments.

Note 5 - Transactions with Parties-in-interest

Certain investments held by the Plan are invested in securities managed by Fidelity Investments Institutional Operations Company, Inc., an affiliate of the Trustee, as well as shares of the Company’s common stock. Fees paid by the Plan for administrative services provided by Fidelity Investments Institutional Operations Company, Inc. amounted to $85,618 for the year ended December 31, 2014. Certain employees of the Company provide administrative services for the Plan and are not reimbursed for their services from the Plan. Certain other administrative and legal expenses are paid by the Company on behalf of the Plan.

Note 6 - Income Tax Status

On February 16, 2012, the Plan Administrator received a favorable determination letter from the Internal Revenue Service relating to its tax exempt status under Section 401(a) of the IRC. The determination letter is applicable for the amendments executed on January 21, 2010 and September 29, 2008. The Plan is required to operate in conformity with the IRC and ERISA to maintain its tax-exempt status. The Plan Administrator is not aware of any course of action or events that have occurred that might adversely affect the Plan’s qualified status. The Plan has been amended since the determination letter was issued. Management believes that the amendments do not change the Plan's status for meeting the requirements for Section 401(a) of the IRC and that the trust is still exempt from taxation.

The Financial Accounting Standards Board issued guidance on accounting for uncertainty in income taxes. Management evaluated the Plan’s tax positions and concluded that the Plan had maintained its tax exempt status and had taken no uncertain tax positions that require adjustment to the financial statements. Therefore, no provision or liability for income taxes has been included in the financial statements. With few exceptions, the Plan is no longer subject to income tax examinations by the U.S. federal, state, or local tax authorities for years before 2011.

The Andersons, Inc. Retirement Savings Investment Plan

Schedule of Assets (Held at End of Year)

Form 5500, Schedule H, Item 4i

EIN 34-1562374, Plan No. 003

December 31, 2014

|

| | | | | | | | | | |

Identity of Issue, Borrower, Lessor, or Similar Party | | Description of Investment | | Shares Held or Rate of Interest | | Cost | | Fair Value |

Participant-directed investments: | | | | | | | | |

** Fidelity Investments | | Fidelity Spartan 500 Index Fund - Mutual fund | | 560,049 Shares | | * | | $ | 40,805,196 |

|

** Fidelity Investments | | Fidelity Spartan U.S. Bond Index Fund - Mutual fund | | 1,767,855 Shares | | * | | 20,754,618 |

|

** Fidelity Investments | | Fidelity Money Market Trust, Retirement Government Money Market Portfolio - Mutual fund | | 9,567,268 Shares | | * | | 9,567,268 |

|

** Fidelity Investments | | Fidelity Low-priced Stock Fund - Mutual fund | | 322,239 Shares | | * | | 16,176,417 |

|

** Fidelity Investments | | Fidelity Contrafund - Mutual fund | | 244,376 Shares | | * | | 23,924,444 |

|

Harbor | | Harbor International Instl Fund - Mutual fund | | 36,318 Shares | | * | | 2,352,655 |

|

Janus | | Janus Enterprise Fund - Mutual fund | | 137,718 Shares | | * | | 11,872,682 |

|

** Fidelity Investments | | Fidelity Freedom Income Fund - Mutual fund | | 133,892 Shares | | * | | 1,585,281 |

|

** Fidelity Investments | | Fidelity Freedom 2005 Fund - Mutual fund | | 92,533 Shares | | * | | 1,200,149 |

|

** Fidelity Investments | | Fidelity Freedom 2010 Fund - Mutual fund | | 296,569 Shares | | * | | 3,914,715 |

|

** Fidelity Investments | | Fidelity Freedom 2015 Fund - Mutual fund | | 298,514 Shares | | * | | 4,059,791 |

|

** Fidelity Investments | | Fidelity Freedom 2020 Fund - Mutual fund | | 746,200 Shares | | * | | 10,625,884 |

|

** Fidelity Investments | | Fidelity Freedom 2025 Fund - Mutual fund | | 382,575 Shares | | * | | 5,685,059 |

|

** Fidelity Investments | | Fidelity Freedom 2030 Fund - Mutual fund | | 439,336 Shares | | * | | 6,664,729 |

|

** Fidelity Investments | | Fidelity Freedom 2035 Fund - Mutual fund | | 297,050 Shares | | * | | 4,636,946 |

|

** Fidelity Investments | | Fidelity Freedom 2040 Fund - Mutual fund | | 238,562 Shares | | * | | 3,733,500 |

|

** Fidelity Investments | | Fidelity Freedom 2045 Fund - Mutual fund | | 202,483 Shares | | * | | 3,251,875 |

|

** Fidelity Investments | | Fidelity Freedom 2050 Fund - Mutual fund | | 190,451 Shares | | * | | 3,079,597 |

|

** Fidelity Investments | | Fidelity Freedom 2055 Fund - Mutual fund | | 88,514 Shares | | * | | 1,053,321 |

|

Dodge and Cox | | Dodge and Cox Stock Fund - Mutual fund | | 78,130 Shares | | * | | 14,136,823 |

|

First Eagle | | First Eagle Overseas Fund - Mutual fund | | 390,672 Share | | * | | 8,504,924 |

|

Invesco | | Invesco Developing Markets Fund - Mutual fund | | 29,073 Shares | | * | | 883,523 |

|

Masters | | Litman Gregory Masters Fund - Mutual Fund | | 429,383 Shares | | * | | 7,454,090 |

|

American Beacon | | American Beacon Small Cap Value Fund - Mutual fund | | 178,868 Shares | | * | | 4,484,227 |

|

Vanguard | | Vanguard Short-Term Investment Fund - Mutual fund | | 398,359 Shares | | * | | 4,246,511 |

|

RBC | | RBC Small Cap Core I - Mutual Fund | | 102,140 Shares | | * | | 3,390,020 |

|

** The Andersons, Inc. | | The Andersons, Inc. common stock | | 378,497 Shares | | * | | 20,114,911 |

|

** Brokeragelink | | Self-directed brokerage accounts | |

| | * | | 439,729 |

|

** Participants | | Participant loans | | 4.25% to 9.50% | | | | 4,002,904 |

|

| | Total | | | | | | $ | 242,601,789 |

|

* Cost information is not required under ERISA for participant directed investments

** Represents party-in-interest

SIGNATURES

Pursuant to the requirements of the Securities Exchange act of 1934, the Plan Administrator has duly caused this Annual Report to be signed on its behalf by the undersigned hereunto duly authorized.

The Andersons, Inc. Retirement Savings Investment Plan

(Name of Plan)

|

| |

| The Andersons, Inc. |

| (Registrant) |

| |

Date: June 26, 2015 | By /s/ Michael J. Anderson |

| Michael J. Anderson |

| Chairman and Chief Executive Officer |

| |

Date: June 26, 2015 | By /s/ John Granato |

| John Granato |

| Chief Financial Officer |

| |

| |

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in Registration Statement (No. 333-53137) on Form S-8 of The Andersons, Inc. of our report dated June 26, 2015, relating to our audit of the financial statements and supplemental schedule of The Andersons, Inc. Retirement Savings Investment Plan, which appears in this Annual Report on Form 11-K of The Andersons, Inc. Retirement Savings Investment Plan for the year ended December 31, 2014.

/s/ McGladrey LLP

Columbus, Ohio

June 26, 2015

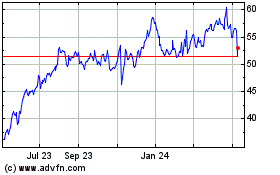

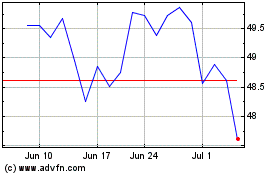

Andersons (NASDAQ:ANDE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Andersons (NASDAQ:ANDE)

Historical Stock Chart

From Apr 2023 to Apr 2024