UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 11-K

ý ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the year ended December 31, 2014

Or

o TRANSITION REPORT PURSUANT TO SECTION 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from __________________ to __________________

Commission file number 1-32525

| |

A. | Full title of the plan and the address of the plan, if different from that of the issuer named below: |

AMERIPRISE FINANCIAL 401(k) PLAN

| |

B. | Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: |

AMERIPRISE FINANCIAL, INC.

55 Ameriprise Financial Center

Minneapolis, MN 55474

Ameriprise Financial 401(k) Plan

Financial Statements and Supplemental Schedule

December 31, 2014 and 2013

with Report of Independent Registered Public Accounting Firm

Ameriprise Financial 401(k) Plan

Form 11-K

INDEX

|

| | |

Report of Independent Registered Public Accounting Firm | 1 |

|

| |

Financial Statements | |

Statements of Net Assets Available for Benefits as of December 31, 2014 and 2013 | 2 |

|

Statements of Changes in Net Assets Available for Benefits for the years ended

December 31, 2014 and 2013 | 3 |

|

Notes to Financial Statements | 4 |

|

| |

Supplemental Schedule | |

Schedule H, Line 4i — Schedule of Assets (Held at End of Year) | 16 |

|

Signature | 24 |

|

Exhibit Index | 25 |

|

Report of Independent Registered Public Accounting Firm

To the Administrator of the Ameriprise Financial 401(k) Plan:

In our opinion, the accompanying statements of net assets available for benefits and the related statement of changes in net assets available for benefits present fairly, in all material respects, the net assets available for benefits of the Ameriprise Financial 401(k) Plan (the “Plan”) at December 31, 2014 and 2013, and the changes in net assets available for benefits for the years then ended in conformity with accounting principles generally accepted in the United States of America. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

The supplemental schedule of assets (held at end of year) as of December 31, 2014 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the schedule of assets (held at end of year) is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ PricewaterhouseCoopers LLP

Minneapolis, Minnesota

June 24, 2015

Ameriprise Financial 401(k) Plan

Statements of Net Assets Available for Benefits

|

| | | | | | | |

| December 31, |

| 2014 | | 2013 |

| | | |

Assets | |

| | |

|

Cash | $ | 502,017 |

| | $ | 189,331 |

|

Investments at fair value: | |

| | |

|

Mutual funds | 40,876,042 |

| | 79,502,766 |

|

Collective investment funds | 887,871,928 |

| | 767,966,195 |

|

Ameriprise Financial Stock Fund | 210,310,608 |

| | 189,519,702 |

|

Personal Choice Retirement Account | 274,738,783 |

| | 248,551,484 |

|

Income Fund | 125,572,928 |

| | 131,525,981 |

|

Total investments at fair value | 1,539,370,289 |

| | 1,417,066,128 |

|

Receivables: | |

| | |

|

Accrued income | 27,386 |

| | 43,190 |

|

Due from broker | 1,001,477 |

| | 1,830,131 |

|

Employer contributions | 845,960 |

| | 921,701 |

|

Participant loans | 32,031,701 |

| | 30,954,826 |

|

Total assets | 1,573,778,830 |

| | 1,451,005,307 |

|

| | | |

Liabilities | |

| | |

|

Due to broker | 5,422,854 |

| | 14,132,988 |

|

Accrued expenses | 237,634 |

| | 228,699 |

|

Total liabilities | 5,660,488 |

| | 14,361,687 |

|

Net assets available for benefits, before adjustment to contract value | 1,568,118,342 |

| | 1,436,643,620 |

|

Adjust fully benefit-responsive investment contracts to contract value | (1,219,397 | ) | | (739,149 | ) |

Net assets available for benefits at end of year | $ | 1,566,898,945 |

| | $ | 1,435,904,471 |

|

See Notes to Financial Statements. |

Ameriprise Financial 401(k) Plan

Statements of Changes in Net Assets Available for Benefits

|

| | | | | | | |

| Years Ended December 31, |

| 2014 | | 2013 |

Contributions: | | | |

|

Employer, net of forfeitures | $ | 43,376,537 |

| | $ | 41,404,904 |

|

Participant | 81,565,786 |

| | 76,635,537 |

|

Participant rollovers | 7,231,303 |

| | 5,802,792 |

|

Total contributions | 132,173,626 |

| | 123,843,233 |

|

Investment income: | | | |

Interest | 1,659,792 |

| | 1,845,099 |

|

Dividends | 7,907,298 |

| | 9,001,692 |

|

Net realized/unrealized appreciation: | | | |

Mutual funds | 42,356 |

| | 59,280,711 |

|

Collective investment funds | 68,953,758 |

| | 119,531,475 |

|

Ameriprise Financial Stock Fund | 27,752,377 |

| | 90,168,963 |

|

Personal Choice Retirement Account | 5,961,529 |

| | 35,136,335 |

|

Total net realized/unrealized appreciation | 102,710,020 |

| | 304,117,484 |

|

Total investment income | 112,277,110 |

| | 314,964,275 |

|

Other income | 378,981 |

| | 3,472,077 |

|

Interest on participant loans | 1,033,505 |

| | 998,011 |

|

Total additions | 245,863,222 |

| | 443,277,596 |

|

Administrative expenses | (1,087,744 | ) | | (1,562,744 | ) |

Withdrawal payments | (113,781,004 | ) | | (142,637,867 | ) |

Net increase in net assets available for benefits | 130,994,474 |

| | 299,076,985 |

|

Net assets available for benefits at beginning of year | 1,435,904,471 |

| | 1,136,827,486 |

|

Net assets available for benefits at end of year | $ | 1,566,898,945 |

| | $ | 1,435,904,471 |

|

See Notes to Financial Statements. |

Ameriprise Financial 401(k) Plan

Notes to Financial Statements

December 31, 2014

1. Description of the Plan

General

The Ameriprise Financial 401(k) Plan (the “Plan”), which became effective October 1, 2005, is a defined contribution plan. Under the terms of the Plan, regular full-time and part-time employees of Ameriprise Financial, Inc. and its participating subsidiaries (the “Company”) can make contributions to the Plan and are eligible to receive Company contributions in the pay period in which they complete 60 days of service.

The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). The following is not a comprehensive description of the Plan, and therefore, does not include all situations and limitations covered by the Plan. Participants should refer to the Plan document for more complete information.

Administration of Plan Assets

Wells Fargo Bank, N.A is the Plan’s recordkeeper and the trustee of all plan assets, with the exception of the Schwab Personal Choice Retirement Account (“PCRA”) for which Charles Schwab Trust Company is the trustee. The Plan is administered by the Ameriprise Financial Employee Benefits Administration Committee (“EBAC”). The Ameriprise Financial 401(k) Investment Committee (“KIC”) selects and monitors the investment options offered to participants under the Plan and oversees matters related to Plan investments (excluding the Ameriprise Financial Stock Fund and investments selected by participants under the PCRA). Members of the EBAC and KIC are appointed by appointing fiduciaries as specified in the Plan.

Contributions

Elective Contributions

Each pay period, eligible participants may make pretax and/or Roth 401(k) contributions (up to 80% of eligible compensation), and after-tax contributions (up to 10% of eligible compensation) or a combination of any of the three, not to exceed 80% of their eligible compensation to the Plan through payroll deductions. The Internal Revenue Code of 1986, as amended (the “Code”), imposes a limitation on participants’ pretax and Roth 401(k) contributions to plans, which are qualified under Code Section 401(k), and other specified tax favored plans. This limit per the Code was $17,500 for employees under age 50 and $23,000 for employees age 50 and older for both 2014 and 2013. The Plan complied with nondiscrimination requirements under the Code for both 2014 and 2013.

Fixed Match Contributions

The Company matches 100% of the first 5% of eligible compensation an employee contributes on a pretax and/or Roth 401(k) basis for each pay period. At the end of each year, the Company completes a fixed match true-up to ensure the fixed match contribution provided by the Company is equal to the lesser of the 5% of eligible compensation or the participants’ annual deferral rate average.

Limit on Contributions

For purposes of the Plan, eligible compensation is a participant’s regular cash compensation up to $260,000 and $255,000 for 2014 and 2013, respectively, before tax deductions and certain other withholdings. Eligible compensation for all employees includes performance related cash bonuses, overtime, commissions and certain other amounts in addition to regular earnings.

Rollover Contributions

A rollover is a transfer to the Plan of a qualified distribution in accordance with the provisions of the Plan. Rollovers into the Plan are not eligible for Company match contributions.

Vesting

Participants are immediately vested in their pretax, Roth 401(k), after-tax, and rollover contributions and income and appreciation on such contributions. Company contributions are vested on a five-year graded schedule of 20% per year of service with the Company or if the participant attains age 65 as an active employee, or becomes disabled or deceased

Ameriprise Financial 401(k) Plan

Notes to Financial Statements (continued)

December 31, 2014

while employed. Company contributions not vested at the time of termination of employment are forfeited and can be used to pay plan expenses or future Company contributions. Forfeitures for the plan years ended December 31, 2014 and 2013 were $2,349,269 and $2,689,358, respectively.

Tax Status

As long as the Plan remains qualified and remains tax exempt, amounts invested in the Plan through participant and Company contributions and rollovers, as well as the income and appreciation on such amounts, are not subject to federal income tax until distributed to the participant. See Note 8 for additional information on the Plan's tax status.

Distributions and Withdrawals

If employment ends, participants are eligible to receive a distribution of their vested account balance. Participants (or their beneficiaries) may elect to receive their accounts as a single lump-sum distribution in cash, whole shares of common stock, mutual fund shares held under the PCRA, or a combination of cash and shares. Termed participants can defer payments until age 70½.

Participants may be eligible to request an in-service withdrawal of all or a portion of their vested account balance subject to limitations under the terms of the Plan and certain tax penalties imposed by the Code. Participants may elect to receive their withdrawal in cash, whole shares of common stock, mutual fund shares held under the PCRA, or a combination of cash and shares.

Loan Program

Participants may borrow from their fund accounts a minimum of $500 and up to a maximum of the lesser of $50,000 or 50% of their vested account balance. The administrative loan origination fee of $75 per loan is paid by the participant and is deducted from the proceeds of the loan. Loan terms range up to 59 months or up to 359 months if the loan is used towards the purchase of a primary residence. The loans are secured by the balance in the participant’s account and bear a fixed interest rate of the prime rate as reported in the Wall Street Journal on the first business day of the month before the date the loan is originated. Principal and interest payments are deducted automatically from the participant’s pay each period. If the participant’s service with the Company ends for any reason, the entire principal and interest of any outstanding loan is due and payable within 45 days. A loan is considered in default if payments are not received by the Plan within 90 days following the date payment is due under the note. Loans not repaid within that time frame are reported as taxable distributions.

Plan Termination

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event of Plan termination, participants will become 100% vested in their accounts.

2. Significant Accounting Policies and Future Adoption of New Accounting Standards

Basis of Accounting

The accompanying financial statements have been prepared on the accrual basis of accounting.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

Plan Fees and Expenses

Administrative expenses, which may include recordkeeping, participant servicing, legal fees, trustee fees, and investment consulting fees, among other expenses, are paid by Plan participants and recorded as incurred, unless paid by the Company. Administrative expenses also include expenses related to the PCRA and loan origination fees. The

Ameriprise Financial 401(k) Plan

Notes to Financial Statements (continued)

December 31, 2014

Company currently pays a portion of the administrative expenses, including fees of the auditors, legal fees and certain investment managers.

Prior to the fourth quarter of 2014, eligible administrative expenses were paid with revenue sharing payments received from certain of the Plan's investment options, which were deposited into a dedicated expense account in the Plan.

Beginning in the fourth quarter of 2014, a flat fee of $21 per quarter is charged to participant accounts with a balance of $5,000 or more (including loan balances). It is deducted proportionately from the participant's investment options on a quarterly basis. The fee will be deposited in the dedicated expense account and may be used to pay eligible administrative expenses of the Plan. The flat fee replaced the revenue sharing payments. In anticipation of these changes, several investment options were changed in 2013 to share classes that do not pay revenue sharing. The only remaining revenue sharing is on certain PCRA investments, with such revenue sharing amounts deposited into the dedicated expense account that may be used to pay eligible administrative expenses.

Fees paid to investment managers are paid from the fees associated with the investment options offered by the Plan, unless paid by the Company. In addition, expenses related to the investment of the Plan funds, for example, brokerage commissions, stock transfer or other taxes and charges incurred for the purchase or sale of the funds’ investments, as opposed to administrative expenses, are generally paid by the Plan participants out of the applicable investment. Fees paid out of an investment reduce the return of that investment.

Other Income

Other income includes revenue sharing payments which are recorded when earned. During an internal audit of the Plan, a fee discrepancy was discovered and a special allocation of positive adjustments was made to the Plan to resolve the discrepancy. The adjustment amount was calculated based on investment fund balances in affected funds from September 2010 to March 2013. Other income for the Plan years ended December 31, 2014 and 2013 includes this special allocation.

Valuation of Investments and Income Recognition

Investments are reported at fair value. See Note 5 for information on the Plan’s accounting policies related to valuation of investments. Defined contribution plans are required to report fully benefit-responsive investment contracts at contract value and also report fair value; therefore, a reconciliation of fair value to contract value is presented on the Statements of Net Assets Available for Benefits.

Purchases and sales of securities are reflected on a trade-date basis. The cost of securities sold is determined using the average cost method. Dividend income is recorded on the ex-dividend date. Interest income is recorded as earned. As required by the Plan, all dividend and interest income is reinvested into the same investment funds in which the dividends and interest arose. Net appreciation (depreciation) includes the Plan’s gains and losses on investments bought and sold as well as the change in fair value of assets.

Participant Loans

Participant loans are measured at their unpaid principal balance plus any accrued but unpaid interest, which is a reasonable estimate of fair value due to restrictions on the transfers of these loans. Interest income on participant loans is recorded when it is earned.

Withdrawal Payments

Withdrawal payments are recorded when paid.

Ameriprise Financial 401(k) Plan

Notes to Financial Statements (continued)

December 31, 2014

3. Recent Accounting Pronouncements

Future Adoption of New Accounting Standards

Fair Value Measurement - Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent)

In May 2015, the Financial Accounting Standards Board (“FASB”) updated the accounting standards related to fair value measurement. The update applies to investments that are measured at net asset value (“NAV”). The standard eliminates the requirement to categorize within the fair value hierarchy all investments for which fair value is measured using the net asset value per share as a practical expedient. In addition, the update limits disclosures to investments for which the entity elected to measure the fair value using the practical expedient rather than all eligible investments. The standard is effective for interim and annual periods beginning after December 15, 2015. The standard should be applied retrospectively to all periods presented and early adoption is permitted. There will be no impact of the standard to the Plan’s Statements of Net Assets Available for Benefits and Statements of Changes in Net Assets Available for Benefits.

4. Investments

Investment Elections

A participant may currently elect to invest contributions in any combination of investment funds in increments of 1% and change investment elections for future contributions or transfer existing account balances on any business day the New York Stock Exchange is open. Investment funds may impose redemption restrictions.

Investment Options

Effective September 13, 2013, as a result of changes in the fee structure for the Plan, several investment options were changed to share classes that do not pay revenue sharing. See Note 2 for additional information on the changes in the fee structure, which were effective in the fourth quarter of 2014.

A summary of investment options at December 31, 2014 is set forth below:

Mutual Funds

Alger Small Cap Growth Fund (Class Z) is managed by Alger Group.

Collective Investment Funds

Columbia Trust Large Cap Index Fund A, Columbia Trust Balanced Fund (Class I), Columbia Trust Contrarian Core Fund I, and Columbia Trust Intermediate Bond Fund A are collective funds, managed by Ameriprise Trust Company and sub-advised by Columbia Management Investment Advisers, LLC, wholly-owned subsidiaries of Ameriprise Financial, Inc. The investment strategy for the Columbia Trust Large Cap Index Fund A is to approximate, as closely as possible, the rate of return of the S&P 500 Index, an unmanaged index. The investment strategy for the Columbia Trust Balanced Fund (Class I) is to provide a balance of growth of capital and current income by investing in a portfolio that is primarily balanced between common stocks and fixed income securities. The investment strategy for the Columbia Trust Contrarian Core Fund I is to provide long-term growth of capital. Under normal market conditions, the fund invests at least 80% of its net assets in equity securities of companies listed on U.S. exchanges with market capitalizations greater than $5 billion at the time of purchase. The universe of stocks from which the portfolio managers select investments is that of the fund’s benchmark, the S&P 500 Index. The fund may hold both growth and value stocks. The investment strategy for the Columbia Trust Intermediate Bond Fund A is to provide a high level of current income, conserving the value of the investment for the longest period of time. The fund invests primarily in corporate bonds, at least 50% in the higher-rated, lower-risk bond categories, or their equivalent, and in government bonds.

Wellington Trust Mid Cap Growth Portfolio Fund and Wellington Trust Large Cap Growth Portfolio Fund (Series 1) are managed by Wellington Management Company LLP. The investment strategy for the Wellington Trust Mid Cap Growth Portfolio Fund and Wellington Trust Large Cap Growth Portfolio Fund, respectively, is to provide long-term total return in excess of the Russell Midcap Growth Index and Russell 1000 Growth Index, respectively, and provide shareholders with long-term growth of capital.

Ameriprise Financial 401(k) Plan

Notes to Financial Statements (continued)

December 31, 2014

Waddell & Reed International Core Equity CIT Fund (Class 2) is managed by Waddell & Reed Investment Management Company. The investment strategy for the Waddell & Reed International Core Equity CIT Fund is to invest the portfolio via a disciplined approach that seeks investment opportunities around the world, preferring cash generating, well-managed and reasonably valued companies that are exposed to themes which should yield above average growth.

The Voya Target Solution Trust Funds (previously named ING Target Solution Trust Funds) are managed by Voya Investment Management (previously named ING Investment Management). The investment strategy of the Voya Target Solution Trust Funds is to outperform its primary benchmark, the S&P Target Date Index, as well as the internally developed strategic allocation benchmark which is comprised of the weighted average of each of the Fund’s strategic asset allocations.

Victory Small Cap Value Collective Fund (85) is managed by Victory Capital Management. Victory’s Small Cap Value strategy employs a bottom-up, classic value investment process to build a diversified portfolio of small cap companies which Victory Capital Management believes to be undervalued and offering above-average total return potential.

The EB US Mid Cap Opportunistic Value Equity CIT II is managed by Boston Company Asset Management, LLC. The investment strategy seeks to outperform the Russell Midcap Index over a long-term investment horizon and invests primarily in common stocks and other equity securities generally traded in a major United States exchange. The US Mid Cap Opportunistic Value invests primarily in mid cap U.S. value companies.

The Robeco Large Cap Value Equity Collective Investment Trust (Class D) is managed by Robeco Investment Management. The investment strategy is to outperform its benchmark Index, the Russell 1000 Value Index over a market cycle. The fund invests primarily in stocks with low valuation, strong fundamentals and improving business momentum.

Ameriprise Financial Stock Fund

The Ameriprise Financial Stock Fund is an Employee Stock Ownership Plan (“ESOP”) that invests primarily in the Company’s common stock, purchased in either the open market or directly from the Company, and in cash or short-term cash equivalents.

Schwab Personal Choice Retirement Account

The PCRA, the Plan’s self-directed brokerage option, gives participants the freedom to choose from thousands of mutual fund products (including Columbia Funds). It also provides the ability to invest in exchange-traded funds and closed-ended mutual funds. Ameriprise Financial, Inc. was formerly a wholly owned subsidiary of American Express Company (“American Express”). On September 30, 2005, Ameriprise Financial, Inc. spun-off from American Express. As a result, American Express common stock was an investment option as specified by the plan. Employees had the option to transfer the value of the American Express common stock to another investment in the plan or transfer it to the self-directed brokerage option. American Express Company common stock may be held in the PCRA on a hold or sell basis only and, with the exception of reinvestment of dividends, new purchases are not allowed.

Income Fund

The Income Fund is a stable value separately managed account which invests primarily in various book value wrap contracts with varying maturities, sizes and yields, offered by insurance companies, banks or financial institutions, which are backed by fixed income securities issued by the U.S. government and its agencies. See Note 4 for a more comprehensive discussion of book value wrap contracts. Ameriprise Trust Company is the investment manager for the Income Fund. The Income Fund also invests in the Columbia Trust Government Money Market Fund (which invests primarily in short-term debt instruments issued by the U.S. government and its agencies), the Columbia Trust 2017 Declining Duration Bond Fund (which invests primarily in U.S. Treasury, agency and mortgage backed securities), the Met Life Insurance Stable Value Government Separate Account (which invests primarily in U.S. Treasury, agency and mortgage backed securities), and the Columbia Trust Stable Government Fund (which invests primarily in book value wrap contracts with varying maturities, sizes and yields, which are backed by a diversified pool of U.S. Treasury, agency and mortgage backed securities). The investment objective of the Income Fund is to preserve principal and income, while maximizing current income. There is no assurance that the Income Fund will meet its objective.

Ameriprise Financial 401(k) Plan

Notes to Financial Statements (continued)

December 31, 2014

At December 31, 2014 and 2013, investments with a fair value representing 5% or more of the Plan’s net assets available for benefits were as follows:

|

| | | | | | | | | | | |

Description | | Number of Shares | | Cost | | Fair Value |

2014 | | |

| | |

| | |

|

Collective Investment Funds | | |

| | |

| | |

|

Columbia Trust Contrarian Core Fund 1 | | 10,603,432 |

| | $ | 108,088,915 |

| | $ | 132,224,803 |

|

Columbia Trust Large Cap Index Fund A | | 1,362,830 |

| | $ | 62,016,109 |

| | $ | 93,858,088 |

|

Waddell & Reed International Core Equity CIT Fund | | 6,069,895 |

| | $ | 65,832,090 |

| | $ | 79,272,834 |

|

Ameriprise Financial Stock Fund | | |

| | |

| | |

|

Ameriprise Financial, Inc. Common Shares | | 1,571,811 |

| | $ | 62,061,544 |

| | $ | 207,872,005 |

|

|

| | | | | | | | | | | |

Description | | Number of Shares | | Cost | | Fair Value |

2013 | | |

| | |

| | |

|

Collective Investment Funds | | |

| | |

| | |

|

Columbia Trust Contrarian Core Fund 1 | | 10,783,481 |

| | $ | 107,978,954 |

| | $ | 118,726,129 |

|

Columbia Trust Large Cap Index Fund A | | 1,311,886 |

| | $ | 52,982,177 |

| | $ | 79,526,525 |

|

Waddell & Reed International Core Equity CIT Fund | | 5,637,422 |

| | $ | 57,525,306 |

| | $ | 72,835,498 |

|

Ameriprise Financial Stock Fund | | |

| | |

| | |

|

Ameriprise Financial, Inc. Common Shares | | 1,624,397 |

| | $ | 62,527,884 |

| | $ | 186,886,875 |

|

4. Book Value Wrap Contracts

Book value wrap contracts are fully benefit-responsive and comprised of both an investment and a contractual component. The investment component consists of units of collective investment funds with fixed income strategies and a pooled portfolio of actively managed fixed income securities, referred to as the Covered Assets, which may be owned by the Income Fund or in some cases the third party that underwrites the performance of the Covered Assets for the benefit of the Income Fund. The securities owned by the third party are held in a Separate Account and are not subject to the liabilities of the general account of the third party. The Covered Assets include U.S. Treasury, agency and mortgage backed securities. The Income Fund enters into book value wrap contracts (the contractual component) with third parties, generally insurance companies, banks or financial institutions, to underwrite the performance of the Covered Assets from the risk of adverse interest rate movements. Under these contracts, the third party is obligated to provide sufficient funds to cover participant benefit withdrawals and certain types of investment transfers regardless of the market value of the Covered Assets. While the contracts are designed to protect the Income Fund against interest rate risk, the Income Fund is still exposed to risk if issuers of Covered Assets default on payment of interest or principal or upon the occurrence of certain events, described below, involving the Income Fund, its plan sponsor or its investment manager.

Fully benefit-responsive book value wrap contracts held by a separately managed account created for a defined contribution plan are required to be reported at fair value. However, contract value is the relevant measurement attribute for that portion of the net assets available for benefits of a defined contribution plan attributable to fully benefit-responsive book value wrap contracts because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan. Contract value represents the face amount of the contract plus accrued interest at the contract rate. Therefore, the Statements of Net Assets Available for Benefits presents the fair value of the Covered Assets and the fair value of the book value wrap contracts as well as the adjustment of the book value wrap contracts from fair value to contract value. The Statement of Changes in Net Assets Available for Benefits is prepared on a contract value basis.

Ameriprise Financial 401(k) Plan

Notes to Financial Statements (continued)

December 31, 2014

Certain events may limit the ability of the Income Fund to transact at contract value with the book value wrap contract issuers for participant benefit payments or investment transfers. Possible events include a transfer from the Income Fund in violation of the equity wash required by the book value wrap contracts. An equity wash restriction prohibits money from being moved directly from the Income Fund to the PCRA, without first being invested in another investment fund for 90 days. After the 90 days, the assets may be transferred from the other investment fund to the PCRA. Other possible events include participant-directed withdrawals that occur due to a plan sponsor-initiated event, such as the implementation of an early retirement program or facility closing, of which the book value wrap contract issuer has not been made aware or a request by the trustee to terminate a contract at market value. While these events are not probable, it is possible that they could occur.

Certain events may allow the book value wrap contract issuer to terminate a book value wrap contract and settle at the market value of the Covered Assets, as opposed to contract value. These events may include the termination of the Plan or the Trust holding the Income Fund assets, the replacement of the trustee of the Income Fund without the consent of the book value wrap contract issuer, a change in the investment guidelines, administration or policies of the Income Fund that may cause a material adverse effect on the book value wrap contract issuer, a breach of the contract terms by a counterparty, a legal or regulatory event such as a ruling by a regulatory agency governing the Income Fund, its investment manager or the book value wrap contract issuer that may cause material adverse effect to a party under the book value wrap contract, or the failure of the Trust to be tax-exempt under the Internal Revenue Code.

The crediting rate of a book value wrap contract is the rate at which the Income Fund will recognize income on Covered Assets. The rate is tied to the performance and duration of the Covered Assets and is generally reset quarterly. The weighted average crediting rates on the book value wrap contracts were 1.42% and 1.63% at December 31, 2014 and 2013, respectively. The average yield on the book value wrap contracts was 2.15% for 2014 compared to (0.16)% for 2013.

5. Fair Value Measurements

U.S. GAAP defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date; that is, an exit price. The exit price assumes the asset or liability is not exchanged subject to a forced liquidation or distressed sale.

Valuation Hierarchy

The Plan categorizes its fair value measurements according to a three-level hierarchy. The hierarchy prioritizes the inputs used by the Plan’s valuation techniques. A level is assigned to each fair value measurement based on the lowest level input that is significant to the fair value measurement in its entirety. The three levels of the fair value hierarchy are defined as follows:

| |

Level 1 | Unadjusted quoted prices for identical assets or liabilities in active markets that are accessible at the measurement date. |

| |

Level 2 | Prices or valuations based on observable inputs other than quoted prices in active markets for identical assets and liabilities. |

| |

Level 3 | Prices or valuations that require inputs that are both significant to the fair value measurement and unobservable. |

Ameriprise Financial 401(k) Plan

Notes to Financial Statements (continued)

December 31, 2014

The following tables present the balances of assets measured at fair value on a recurring basis:

|

| | | | | | | | | | | | | | | |

| December 31, 2014 |

| Level 1 | | Level 2 | | Level 3 | | Total |

Investments | |

| | |

| | |

| | |

|

Mutual funds: | |

| | |

| | |

| | |

|

U.S. equity securities | $ | 40,876,042 |

| | $ | — |

| | $ | — |

| | $ | 40,876,042 |

|

Total mutual funds | 40,876,042 |

| | — |

| | — |

| | 40,876,042 |

|

Collective investment funds: | |

| | |

| | |

| | |

|

U.S. equity securities | — |

| | 481,784,031 |

| | — |

| | 481,784,031 |

|

U.S. fixed income securities | — |

| | 48,754,617 |

| | — |

| | 48,754,617 |

|

Non-U.S. equity securities | — |

| | 79,272,834 |

| | — |

| | 79,272,834 |

|

Balanced | — |

| | 278,060,446 |

| | — |

| | 278,060,446 |

|

Total collective investment funds | — |

| | 887,871,928 |

| | — |

| | 887,871,928 |

|

Ameriprise Financial Stock Fund | |

| | |

| | |

| | |

|

Money market fund | 2,438,603 |

| | — |

| | — |

| | 2,438,603 |

|

Common stock | 207,872,005 |

| | — |

| | — |

| | 207,872,005 |

|

Total Ameriprise Financial Stock Fund | 210,310,608 |

| | — |

| | — |

| | 210,310,608 |

|

Personal Choice Retirement Account: | |

| | |

| | |

| | |

|

Money market fund | 22,304,297 |

| | — |

| | — |

| | 22,304,297 |

|

Common stock | 23,072,310 |

| | — |

| | — |

| | 23,072,310 |

|

Mutual funds: | |

| | |

| | |

| | |

|

U.S. equity securities | 101,406,510 |

| | — |

| | — |

| | 101,406,510 |

|

U.S. fixed income securities | 29,159,498 |

| | — |

| | — |

| | 29,159,498 |

|

Balanced | 25,705,778 |

| | — |

| | — |

| | 25,705,778 |

|

Non-U.S. securities(1) | 35,107,185 |

| | — |

| | — |

| | 35,107,185 |

|

Exchange-traded funds(1) | 37,983,205 |

| | — |

| | — |

| | 37,983,205 |

|

Total Personal Choice Retirement Account | 274,738,783 |

| | — |

| | — |

| | 274,738,783 |

|

Income Fund: | |

| | |

| | |

| | |

|

U.S. government and agency securities | 17,862,217 |

| | 55,564,405 |

| | — |

| | 73,426,622 |

|

Collective investment funds: | |

| | |

| | |

| | |

|

U.S. fixed income securities | — |

| | 35,803,400 |

| | — |

| | 35,803,400 |

|

Pooled separate accounts | — |

| | 16,316,263 |

| | — |

| | 16,316,263 |

|

Wrapper contracts | — |

| | — |

| | 26,643 |

| | 26,643 |

|

Total Income Fund | 17,862,217 |

| | 107,684,068 |

| | 26,643 |

| | 125,572,928 |

|

Total investments at fair value | $ | 543,787,650 |

| | $ | 995,555,996 |

| | $ | 26,643 |

| | $ | 1,539,370,289 |

|

(1) Includes both equity and fixed income securities. |

Ameriprise Financial 401(k) Plan

Notes to Financial Statements (continued)

December 31, 2014

|

| | | | | | | | | | | | | | | |

| December 31, 2013 |

| Level 1 | | Level 2 | | Level 3 | | Total |

Investments | |

| | |

| | |

| | |

|

Mutual funds: | |

| | |

| | |

| | |

|

U.S. equity securities | $ | 79,502,766 |

| | $ | — |

| | $ | — |

| | $ | 79,502,766 |

|

Total mutual funds | 79,502,766 |

| | — |

| | — |

| | 79,502,766 |

|

Collective investment funds: | |

| | |

| | |

| | |

|

U.S. equity securities | — |

| | 399,944,415 |

| | — |

| | 399,944,415 |

|

U.S. fixed income securities | — |

| | 46,223,163 |

| | | | 46,223,163 |

|

Non-U.S. equity securities | — |

| | 72,835,498 |

| | — |

| | 72,835,498 |

|

Balanced | — |

| | 248,963,119 |

| | |

| | 248,963,119 |

|

Total collective investment funds | — |

| | 767,966,195 |

| | — |

| | 767,966,195 |

|

Ameriprise Financial Stock Fund | |

| | |

| | |

| | |

|

Money market fund | 2,632,827 |

| | — |

| | — |

| | 2,632,827 |

|

Common stock | 186,886,875 |

| | — |

| | — |

| | 186,886,875 |

|

Total Ameriprise Financial Stock Fund | 189,519,702 |

| | — |

| | — |

| | 189,519,702 |

|

Personal Choice Retirement Account: | |

| | |

| | |

| | |

|

Money market fund | 23,487,551 |

| | — |

| | — |

| | 23,487,551 |

|

Common stock | 23,327,003 |

| | — |

| | — |

| | 23,327,003 |

|

Mutual funds: | |

| | |

| | |

| | |

|

U.S. equity securities | 100,281,829 |

| | — |

| | — |

| | 100,281,829 |

|

U.S. fixed income securities | 26,303,908 |

| | — |

| | — |

| | 26,303,908 |

|

Balanced | 15,276,953 |

| | — |

| | — |

| | 15,276,953 |

|

Non-U.S. securities(1) | 34,078,050 |

| | — |

| | — |

| | 34,078,050 |

|

Exchange-traded funds(1) | 25,796,190 |

| | — |

| | — |

| | 25,796,190 |

|

Total Personal Choice Retirement Account | 248,551,484 |

| | — |

| | — |

| | 248,551,484 |

|

Income Fund: | |

| | |

| | |

| | |

|

U.S. government and agency securities | 16,783,122 |

| | 66,336,027 |

| | — |

| | 83,119,149 |

|

Collective investment funds: | |

| | |

| | |

| | |

|

U.S. fixed income securities | — |

| | 32,243,183 |

| | — |

| | 32,243,183 |

|

Pooled separate accounts | — |

| | 16,139,073 |

| | — |

| | 16,139,073 |

|

Wrapper contracts | — |

| | — |

| | 24,576 |

| | 24,576 |

|

Total Income Fund | 16,783,122 |

| | 114,718,283 |

| | 24,576 |

| | 131,525,981 |

|

Total investments at fair value | $ | 534,357,074 |

| | $ | 882,684,478 |

| | $ | 24,576 |

| | $ | 1,417,066,128 |

|

(1) Includes both equity and fixed income securities. |

Ameriprise Financial 401(k) Plan

Notes to Financial Statements (continued)

December 31, 2014

The following table provides a summary of changes in Level 3 assets measured at fair value on a recurring basis:

|

| | | | | | | | |

| Wrapper Contracts | |

| 2014 | | 2013 | |

Balance, January 1 | $ | 24,576 |

| | $ | 31,176 |

| |

Total gains (losses) included in: | |

| | |

| |

Net realized/unrealized appreciation | 2,067 |

| | (6,600 | ) | |

Balance, December 31 | $ | 26,643 |

| | $ | 24,576 |

| |

Change in unrealized gains (losses) included in investment income relating to assets held at December 31, 2014 and 2013 | $ | 2,067 |

| (1) | $ | (6,600 | ) | (1) |

(1) Included in net realized/unrealized appreciation in the Statements of Changes in Net Assets Available for Benefits. |

The Company recognizes transfers between levels of the fair value hierarchy as of the beginning of the plan year in which each transfer occurred. There were no transfers of assets between levels for the plan years ended December 31, 2014 and 2013.

Determination of Fair Value

The Plan uses valuation techniques consistent with the market and income approaches to measure the fair value of its assets. The Plan’s market approach uses prices and other relevant information generated by market transactions involving identical or comparable assets. The Plan’s income approach uses valuation techniques to convert future projected cash flows to a single discounted present value amount.

When applying either approach, the Plan maximizes the use of observable inputs and minimizes the use of unobservable inputs.

The following is a description of the valuation techniques used to measure fair value and the general classification of these instruments pursuant to the fair value hierarchy.

Investments

Mutual Funds

The fair value of mutual funds is determined by the net asset value (“NAV”) which represents the exit price. Mutual funds are classified as Level 1 as they are traded in active markets and quoted prices are available.

Collective Investment Funds

The fair value of collective investment funds is determined by the NAV which represents the exit price. Collective investment funds are classified as Level 2 as they are traded in principal-to-principal markets with little publicly released pricing information. Collective investment funds allow for daily redemptions but may require advance notice in certain circumstances. There were no unfunded commitments for the Collective Investment Funds.

Ameriprise Financial Stock Fund

The fair value of the assets of the Ameriprise Financial Stock Fund is determined using quoted prices in active markets for Ameriprise Financial, Inc. common shares and is classified as Level 1. Actively traded money market funds are measured at their NAV and classified as Level 1.

Personal Choice Retirement Account

Actively traded money market funds are measured at their NAV and classified as Level 1. The fair value of common stock and exchange-traded funds are determined using quoted prices in active markets and are classified as Level 1. The fair value of mutual funds is determined by the NAV which represents the exit price. Mutual funds are classified as Level 1 as they are traded in active markets and quoted prices are available.

Ameriprise Financial 401(k) Plan

Notes to Financial Statements (continued)

December 31, 2014

Income Fund

The fair value of fixed income securities is obtained from third party pricing services, non-binding broker quotes, or other model-based valuation techniques such as the present value of future cash flows. Fixed income securities classified as Level 1 include U.S. Treasuries and those classified as Level 2 include agency mortgage backed securities, commercial mortgage backed securities, and U.S. government and agency securities. The fair value of pooled separate accounts is determined by the NAV which represents the exit price. Collective investment funds are classified as Level 2 as they are traded in principal-to-principal markets with little publicly released pricing information. The fair value of wrapper agreements is based on the present value of the difference between the current market wrapper fee rate and the current fee rate attributable to each wrapper contract. Wrapper agreements are classified as Level 3 as there are significant unobservable inputs.

6. Transaction with Parties-in-Interest

The Plan allows for transactions with certain parties who may perform services or have fiduciary responsibilities to the Plan. Parties-in-interest include the Company and the trustees of the plan assets (Wells Fargo Bank, N.A. and Charles Schwab Trust Company). Transactions involving funds managed by the Company and trustees of plan assets are considered Party-in-interest transactions. These transactions, based on customary and reasonable rates, are not, however, considered prohibited transactions under Section 408(b) of ERISA and the regulations promulgated thereunder.

The Columbia Funds are managed by Columbia Management Investment Advisers, LLC. The Columbia Trust Collective Funds are maintained by Ameriprise Trust Company and distributed by Columbia Management Investment Distributors, Inc., member FINRA. Ameriprise Trust Company, a Minnesota-chartered trust company, serves as trustee and offers investment management and related services to these collective funds. These companies are wholly-owned subsidiaries of Ameriprise Financial, Inc.

The total fair value of Ameriprise Financial, Inc.'s common stock was $207,872,005 and $186,886,875 at December 31, 2014 and 2013, respectively. The total fair value of the investment options managed by subsidiaries of Ameriprise Financial, Inc. was $354,070,277 and $404,312,538 at December 31, 2014 and 2013, respectively. As investment manager, these subsidiaries earn annual management fees ranging from 0.11% to 0.41% of the amounts invested in the Collective Investment Funds. Fees incurred for investment management services for the Income Fund, excluding fees associated with wrap contracts which are paid by the Plan, are paid directly by the Company. Fees paid by the Plan for investment management services are included as a reduction of the return earned on each collective investment fund. Participant loans also qualify as party-in interest transactions and are secured by the vested balances in participant accounts.

See Note 2 for more information on Plan fees and expenses.

7. Risks and Uncertainties

The Plan invests in various investment securities, which are exposed to various risks such as interest rate, market and credit risks. Due to the level of risk associated with certain investments, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the Statements of Net Assets Available for Benefits.

8. Income Tax Status

The Plan received a favorable determination letter from the Internal Revenue Service dated May 30, 2014 indicating that the Plan is qualified under the Code and the Trust established under the Plan is tax exempt and the Plan satisfies the requirement of Code Section 4975(e)(7) as an ESOP. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualification. The Company believes the Plan is operated in compliance with the applicable requirements of the Code, and therefore the Plan is intended to be qualified, the Trust tax exempt and the Plan satisfies the requirements of Code Section 4975(e)(7). There are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits

Ameriprise Financial 401(k) Plan

Notes to Financial Statements (continued)

December 31, 2014

by tax jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan believes it is no longer subject to income tax examinations for years prior to 2010.

9. Litigation

In October 2011, a putative class action lawsuit entitled Roger Krueger, et al. vs. Ameriprise Financial, et al. was filed in the United States District Court for the District of Minnesota against the Company, certain of its present or former employees and directors, as well as certain fiduciary committees on behalf of participants and beneficiaries of the Ameriprise Financial 401(k) Plan. The alleged class period is from October 1, 2005 to the present. The action alleges that Ameriprise breached fiduciary duties under ERISA, by selecting and retaining primarily proprietary mutual funds with allegedly poor performance histories, higher expenses relative to other investment options and improper fees paid to the Company or its subsidiaries. The action also alleges that the Company breached fiduciary duties under ERISA because it paid unreasonable record-keeping fees, used its affiliate, Ameriprise Trust Company, as the Plan trustee and record-keeper and improperly reaped profits from the sale of the record-keeping business to Wachovia Bank, N.A. On March 26, 2015, the parties submitted to the Court for approval a settlement in the amount of $27.5 million that would result in full and final dismissal of all remaining claims. On April 6, 2015, the Court preliminarily approved the settlement, and set a final approval hearing for July 13, 2015. The Plan was not a named defendant in this action. The settlement amount, if approved by the Court, net of certain plaintiffs’ counsel’s legal fees and certain administrative fees, will be paid to members of the class, which includes certain current and former participants, as provided in the Class Action Settlement Agreement.

10. Reconciliation of Financial Statements to Form 5500

The following is a reconciliation of amounts reported in the financial statements to amounts reported on Form 5500.

|

| | | | | | | |

| December 31, |

| 2014 | | 2013 |

Net assets available for benefits per the financial statements | $ | 1,566,898,945 |

| | $ | 1,435,904,471 |

|

Deemed distributions of participant loans | (407,411 | ) | | (404,958 | ) |

Difference between contract value and fair value of fully benefit-responsive investment contracts | 1,219,397 |

| | 739,149 |

|

Net assets available for benefits per Form 5500 | $ | 1,567,710,931 |

| | $ | 1,436,238,662 |

|

|

| | | | | | | |

| December 31, |

| 2014 | | 2013 |

Net increase in net assets available for benefits per the financial statements | $ | 130,994,474 |

| | $ | 299,076,985 |

|

Change in deemed distributions of participant loans | (2,453 | ) | | 9,648 |

|

Change in difference between contract value and fair value of fully benefit-responsive investment contracts | 480,248 |

| | (2,108,943 | ) |

Net income per Form 5500 | $ | 131,472,269 |

| | $ | 296,977,690 |

|

11. Subsequent Events

The Company evaluated events or transactions that occurred after the statement of net assets available for benefits date for potential recognition or disclosure through the date the financial statements were issued.

The annual fixed match true-up contribution for the 2014 plan year which is recorded as a receivable at December 31, 2014, was posted to participant accounts on January 31, 2015.

On June 16, 2015, all investments in Alger Small Cap Growth Z automatically transferred to Wells Fargo Advantage Small Company Growth R6.

Ameriprise Financial 401(k) Plan

SUPPLEMENTAL SCHEDULE

Ameriprise Financial 401(k) Plan

Schedule H, Line 4i — Schedule of Assets (Held at End of Year)

December 31, 2014

Name of Plan Sponsor: Ameriprise Financial, Inc.

Employer Identification Number: 13-3180631

Three-Digit Plan Number: 001

|

| | | | | | |

(a) | (b) Identity of Issue, Borrower, Lessor, or Similar Party | (c) Shares/Units or Face Amount | | (d) Cost** | | (e) Current Value |

|

| | | | | | | | | |

| Mutual Funds — | |

| | | | |

|

| Alger Small Cap Growth Fund (Class Z) | 4,960,685 |

| | | | $ | 40,876,042 |

|

| Total Mutual Funds | |

| | | | 40,876,042 |

|

| | | | | | |

| Collective Investment Funds — | |

| | | | |

|

* | Columbia Trust Balanced Fund (Class I) | 3,664,926 |

| | | | 43,429,370 |

|

* | Columbia Trust Contrarion Core Fund I | 10,603,432 |

| | | | 132,224,803 |

|

* | Columbia Trust Intermediate Bond Fund A | 4,543,767 |

| | | | 48,754,617 |

|

* | Columbia Trust Large Cap Index Fund A | 1,362,830 |

| | | | 93,858,088 |

|

| EB US Mid Cap Opportunistic Value Fund II | 3,426,927 |

| | | | 37,353,504 |

|

| Robeco Large Cap Value Equity CIT D | 3,574,615 |

| | | | 58,123,237 |

|

| Voya Target Solution Trust (Class 4) | 590,716 |

| | | | 7,192,146 |

|

| Voya Target Solution Trust 2015 (Class 4) | 951,454 |

| | | | 11,940,573 |

|

| Voya Target Solution Trust 2020 (Class 4) | 2,040,363 |

| | | | 26,792,300 |

|

| Voya Target Solution Trust 2025 (Class 4) | 2,982,838 |

| | | | 40,437,137 |

|

| Voya Target Solution Trust 2030 (Class 4) | 2,816,748 |

| | | | 39,392,674 |

|

| Voya Target Solution Trust 2035 (Class 4) | 2,809,407 |

| | | | 40,018,977 |

|

| Voya Target Solution Trust 2040 (Class 4) | 2,120,061 |

| | | | 30,971,151 |

|

| Voya Target Solution Trust 2045 (Class 4) | 1,543,397 |

| | | | 22,802,040 |

|

| Voya Target Solution Trust 2050 (Class 4) | 651,138 |

| | | | 9,615,890 |

|

| Voya Target Solution Trust 2055 (Class 4) | 369,918 |

| | | | 5,468,188 |

|

| Victory Small Cap Value Collective Fund (85) | 3,575,604 |

| | | | 42,813,211 |

|

| Waddell & Reed International Core Equity CIT Fund (Class 2) | 6,069,895 |

| | | | 79,272,834 |

|

| Wellington Trust Large Cap Growth Portfolio Fund (Series 1) | 1,996,354 |

| | | | 49,210,137 |

|

| Wellington Trust Mid Cap Growth Portfolio Fund | 3,555,842 |

| | | | 68,201,051 |

|

| Total Collective Investment Funds | |

| | | | 887,871,928 |

|

| | | | | | |

| Ameriprise Financial Stock Fund — | |

| | | | |

|

* | Wells Fargo Heritage Money Market Fund | 2,438,603 |

| | | | 2,438,603 |

|

* | Ameriprise Financial, Inc. Common Shares | 1,571,811 |

| | | | 207,872,005 |

|

| Total Ameriprise Financial Stock Fund | | | | | 210,310,608 |

|

| | | | | | |

*** | Personal Choice Retirement Account | |

| | | | 274,738,783 |

|

| |

* | Indicates Party-in-interest |

| |

** | Cost information not required for participant-directed investments |

| |

*** | The PCRA includes Party-in-interest investment options 17 |

Ameriprise Financial 401(k) Plan

Schedule H, Line 4i — Schedule of Assets (Held at End of Year) (continued)

December 31, 2014

|

| | | | | | |

(a) | (b) Identity of Issue, Borrower, Lessor, or Similar Party | (c) Shares/Units or Face Amount | | (d) Cost** | | (e) Current Value |

| Income Fund — |

|

| | | | | | | | |

* | Columbia Trust Gov Money Market Fund | 17,796,296 |

| | | | 17,796,296 |

|

| MetLife Insurance Stable Value Government Separate Account | 160,293 |

| | | | 16,316,263 |

|

* | Columbia Trust 2017 Declining Duration Bond Fund | 1,580,778 |

| | | | 15,997,470 |

|

* | Columbia Trust Stable Government Fund | 74,010 |

| | | | 2,009,634 |

|

| U.S. Government and agency securities: | | | | | |

| FEDERAL FARM CR BKS 5/25/16 | 645,000 |

| | | | 645,935 |

|

| FEDERAL FARM CR BKS 7/15/16 | 405,000 |

| | | | 405,522 |

|

| FEDERAL FARM CR BKS 6/22/15 | 1,000,000 |

| | | | 1,000,456 |

|

| FEDERAL FARM CR BKS 12/6/16 | 320,000 |

| | | | 320,653 |

|

| FHLB 6/8/18 | 2,500,000 |

| | | | 2,481,743 |

|

| FNMA 1/20/16 | 395,000 |

| | | | 396,092 |

|

| FNMA 1.625% 10/26/15 | 2,989,000 |

| | | | 3,023,015 |

|

| FNMA 1.625% 11/27/18 | 1,805,000 |

| | | | 1,813,691 |

|

| FNMA BENCH 1.000% 9/27/2017 | 835,000 |

| | | | 833,318 |

|

| PRIVATE EXPT FDG CORP 1.375% 2/15/17 | 615,000 |

| | | | 620,700 |

|

| U.S. TREAS NTS 0.750% 2/28/18 | 3,455,000 |

| | | | 3,407,494 |

|

| U.S. TREAS NTS 0.875% 1/31/17 | 270,000 |

| | | | 270,781 |

|

| U.S. TREAS NTS 1.375% 9/30/18 | 5,240,000 |

| | | | 5,235,085 |

|

| U.S. TREAS NTS 2.625% 11/15/20 | 4,885,000 |

| | | | 5,099,100 |

|

| U.S. TREAS NTS 4.125% 5/15/15 | 1,585,000 |

| | | | 1,608,404 |

|

| U.S. TIPS 0.125% 4/15/18 | 2,190,000 |

| | | | 2,241,353 |

|

| FGOLD 15YR 3.50% 8/1/25 | 316,073 |

| | | | 334,144 |

|

| FGOLD 15YR 3.00% 1/1/27 | 416,939 |

| | | | 433,860 |

|

| FGOLD 15YR 3.00% 2/1/27 | 141,615 |

| | | | 147,361 |

|

| FGOLD 15YR 3.00% 8/1/21 | 13,603 |

| | | | 14,176 |

|

| FGOLD 15YR 3.00% 9/1/26 | 316,891 |

| | | | 329,714 |

|

| FGOLD 15YR 3.00% 10/1/26 | 14,188 |

| | | | 14,762 |

|

| FGOLD 15YR 3.00% 10/1/26 | 38,910 |

| | | | 40,487 |

|

| FGOLD 15YR 3.00% 11/1/25 | 11,547 |

| | | | 12,000 |

|

| FGOLD 15YR 3.00% 11/1/26 | 224,114 |

| | | | 233,197 |

|

| FGOLD 15YR 3.00% 12/1/26 | 590,320 |

| | | | 614,293 |

|

| FGOLD 15YR 3.50% 1/1/21 | 18,953 |

| | | | 20,036 |

|

| FGOLD 15YR 3.50% 6/1/26 | 306,048 |

| | | | 323,545 |

|

| FGOLD 15YR 3.50% 7/1/26 | 212,998 |

| | | | 225,175 |

|

| FGOLD 15YR 3.50% 7/1/26 | 625,753 |

| | | | 661,707 |

|

| FGOLD 15YR 3.50% 8/1/26 | 248,585 |

| | | | 262,880 |

|

| |

* | Indicates Party-in-interest |

| |

** | Cost information not required for participant-directed investments |

| |

*** | The PCRA includes Party-in-interest investment options 18 |

Ameriprise Financial 401(k) Plan

Schedule H, Line 4i — Schedule of Assets (Held at End of Year) (continued)

December 31, 2013

|

| | | | | | |

(a) | (b) Identity of Issue, Borrower, Lessor, or Similar Party | (c) Shares/Units or Face Amount | | (d) Cost** | | (e) Current Value |

| Income Fund (continued) — |

|

| | | | | | | | |

| FGOLD 15YR 3.50% 9/1/26 | 13,929 |

| | | | 14,726 |

|

| FGOLD 15YR 3.50% 10/1/25 | 325,792 |

| | | | 344,418 |

|

| FGOLD 15YR 3.50% 11/1/25 | 316,260 |

| | | | 334,341 |

|

| FGOLD 15YR 3.50% 12/1/25 | 639,583 |

| | | | 676,173 |

|

| FGOLD 15YR 3.50% 12/1/25 | 24,907 |

| | | | 26,331 |

|

| FGOLD 15YR 5.00% 6/1/18 | 14,490 |

| | | | 15,222 |

|

| FGOLD 15YR 5.00% 11/1/17 | 13,104 |

| | | | 13,765 |

|

| FGOLD 15YR 5.50% 2/1/19 | 26,859 |

| | | | 28,565 |

|

| FGOLD 15YR 5.50% 10/1/18 | 7,566 |

| | | | 8,002 |

|

| FGOLD 15YR GIANT 3.00% 9/1/27 | 79,093 |

| | | | 82,299 |

|

| FGOLD 15YR GIANT 3.00% 11/1/26 | 688,107 |

| | | | 716,030 |

|

| FGOLD 15YR GIANT 3.00% 12/1/26 | 283,411 |

| | | | 294,907 |

|

| FGOLD 15YR GIANT 3.50% 1/1/27 | 497,503 |

| | | | 525,947 |

|

| FGOLD 15YR GIANT 3.50% 9/1/26 | 155,271 |

| | | | 164,161 |

|

| FGOLD 15YR GIANT 3.50% 10/1/26 | 492,817 |

| | | | 520,993 |

|

| FGOLD 15YR GIANT 3.50% 12/1/25 | 9,615 |

| | | | 10,165 |

|

| FGOLD 15YR GIANT 4.00% 5/1/25 | 258,916 |

| | | | 276,298 |

|

| FGOLD 15YR GIANT 4.00% 6/1/26 | 790,805 |

| | | | 843,897 |

|

| FGOLD 15YR GIANT 4.00% 7/1/26 | 300,980 |

| | | | 322,089 |

|

| FGOLD 15YR GIANT 4.00% 12/1/26 | 154,615 |

| | | | 164,615 |

|

| FGOLD 30YR 7.00% 4/1/32 31287SHN0 | 16,572 |

| | | | 19,042 |

|

| FGOLD 30YR 7.00% 4/1/32 31287SKF3 | 3,147 |

| | | | 3,260 |

|

| FHLMC 5/1 HYBRID ARM 2.239% 1/1/37 | 85,370 |

| | | | 90,800 |

|

| FHLMC 5/1 HYBRID ARM 2.259% 12/1/36 | 80,663 |

| | | | 86,573 |

|

| FHLMC 5/1 HYBRID ARM 2.423% 9/1/37 | 50,039 |

| | | | 54,465 |

|

| FSPC_T-13 6.085% 9/25/29 | 510 |

| | | | 511 |

|

| FGOLD 15YR TBA (REG B) 3.00% 1/20/30 | 2,062,790 |

| | | | 2,140,999 |

|

| FGOLD 15YR TBA (REG B) 3.50% 1/20/30 | 1,460,000 |

| | | | 1,541,213 |

|

| FNMA 15YR 3.50% 1/1/26 | 17,197 |

| | | | 18,191 |

|

| FNMA 15YR 3.50% 1/1/26 | 174,656 |

| | | | 184,780 |

|

| FNMA 15YR 3.50% 2/1/26 | 317,720 |

| | | | 336,137 |

|

| FNMA 15YR 3.50% 10/1/25 | 350,000 |

| | | | 370,219 |

|

| FNMA 15YR 3.50% 10/1/25 | 638,722 |

| | | | 675,598 |

|

| FNMA 15YR 3.50% 10/1/25 | 136,976 |

| | | | 144,899 |

|

| FNMA 15YR 3.50% 12/1/25 | 72,630 |

| | | | 76,826 |

|

| FNMA 15YR 4.00% 5/1/25 | 185,168 |

| | | | 197,828 |

|

| |

* | Indicates Party-in-interest |

| |

** | Cost information not required for participant-directed investments |

| |

*** | The PCRA includes Party-in-interest investment options 19 |

Ameriprise Financial 401(k) Plan

Schedule H, Line 4i — Schedule of Assets (Held at End of Year) (continued)

December 31, 2013

|

| | | | | | |

(a) | (b) Identity of Issue, Borrower, Lessor, or Similar Party | (c) Shares/Units or Face Amount | | (d) Cost** | | (e) Current Value |

| Income Fund (continued) — |

|

| | | | | | | | |

| FNMA 15YR 4.00% 6/1/25 | 333,771 |

| | | | 356,674 |

|

| FNMA 15YR 4.00% 8/1/18 | 179,956 |

| | | | 190,700 |

|

| FNMA 15YR 4.00% 9/1/24 | 186,919 |

| | | | 198,692 |

|

| FNMA 15YR 4.50% 2/1/25 | 356,049 |

| | | | 384,825 |

|

| FNMA 15YR 4.50% 3/1/23 | 11,502 |

| | | | 12,204 |

|

| FNMA 15YR 4.50% 5/1/24 | 11,506 |

| | | | 12,374 |

|

| FNMA 15YR 4.50% 10/1/24 | 205,458 |

| | | | 222,043 |

|

| FNMA 15YR 5.00% 1/1/19 | 42,411 |

| | | | 44,756 |

|

| FNMA 15YR 5.00% 2/1/24 | 154,894 |

| | | | 167,263 |

|

| FNMA 15YR 5.00% 5/1/23 | 125,057 |

| | | | 131,894 |

|

| FNMA 15YR 5.00% 5/1/23 | 104,635 |

| | | | 112,901 |

|

| FNMA 15YR 5.00% 6/1/23 | 83,284 |

| | | | 89,454 |

|

| FNMA 15YR 5.00% 8/1/20 | 174,356 |

| | | | 187,331 |

|

| FNMA 15YR 5.00% 11/1/18 | 14,205 |

| | | | 15,021 |

|

| FNMA 15YR 5.00% 11/1/23 | 70,903 |

| | | | 76,472 |

|

| FNMA 15YR 5.00% 12/1/18 | 64,073 |

| | | | 68,615 |

|

| FNMA 15YR 5.50% 2/1/18 | 9,029 |

| | | | 9,539 |

|

| FNMA 15YR 5.50% 3/1/18 | 20,622 |

| | | | 21,776 |

|

| FNMA 15YR 5.50% 7/1/18 | 20,318 |

| | | | 21,469 |

|

| FNMA 15YR 5.50% 7/1/18 | 9,139 |

| | | | 9,657 |

|

| FNMA 15YR 6.00% 2/1/20 | 9,804 |

| | | | 10,219 |

|

| FNMA 30YR 6.00% 11/1/28 | 28,780 |

| | | | 32,428 |

|

| FNMA 30YR 6.50% 4/1/32 | 47,741 |

| | | | 54,369 |

|

| FNMA 30YR 6.50% 4/1/32 | 16,372 |

| | | | 18,695 |

|

| FNMA 30YR 7.00% 7/1/28 | 6,216 |

| | | | 6,300 |

|

| FNMA 10/1 HYBRID ARM 1.758% 8/1/34 | 13,008 |

| | | | 12,864 |

|

| FNMA 10/1 HYBRID ARM 1.788% 3/1/34 | 39,543 |

| | | | 38,615 |

|

| FNMA 10/1 HYBRID ARM 1.790% 12/1/32 | 44,736 |

| | | | 47,627 |

|

| FNMA 10/1 HYBRID ARM 1.790% 11/1/32 | 7,290 |

| | | | 7,496 |

|

| FNMA 10/1 HYBRID ARM 1.885% 10/1/34 | 14,172 |

| | | | 14,891 |

|

| FNMA 10/1 HYBRID ARM 2.222% 12/1/33 | 4,180 |

| | | | 4,424 |

|

| FNMA 10/1 HYBRID ARM 4.478% 5/1/35 | 78,591 |

| | | | 82,087 |

|

| FNMA 10/1 HYBRID ARM 5.147% 9/1/35 | 87,298 |

| | | | 87,187 |

|

| FNMA 10/1 HYBRID ARM 6.050% 12/1/35 | 22,941 |

| | | | 24,060 |

|

| FNMA 15YR 3.500% 1/1/26 | 17,713 |

| | | | 18,739 |

|

| FNMA 15YR 3.500% 1/1/26 | 286,056 |

| | | | 302,635 |

|

| |

* | Indicates Party-in-interest |

| |

** | Cost information not required for participant-directed investments |

| |

*** | The PCRA includes Party-in-interest investment options 20 |

Ameriprise Financial 401(k) Plan

Schedule H, Line 4i — Schedule of Assets (Held at End of Year) (continued)

December 31, 2013

|

| | | | | | |

(a) | (b) Identity of Issue, Borrower, Lessor, or Similar Party | (c) Shares/Units or Face Amount | | (d) Cost** | | (e) Current Value |

| Income Fund (continued) — |

|

| | | | | | | | |

| FNMA 15YR 3.500% 1/1/27 | 306,346 |

| | | | 324,003 |

|

| FNMA 15YR 3.500% 1/1/27 | 555,500 |

| | | | 587,320 |

|

| FNMA 15YR 3.500% 2/1/26 | 167,751 |

| | | | 177,447 |

|

| FNMA 15YR 3.500% 2/1/26 | 543,032 |

| | | | 574,532 |

|

| FNMA 15YR 3.500% 6/1/27 | 272,826 |

| | | | 288,528 |

|

| FNMA 15YR 3.500% 8/1/26 | 15,638 |

| | | | 16,541 |

|

| FNMA 15YR 3.500% 8/1/26 | 147,043 |

| | | | 155,494 |

|

| FNMA 15YR 3.500% 8/1/27 | 138,440 |

| | | | 146,508 |

|

| FNMA 15YR 3.500% 9/1/29 | 7,225,001 |

| | | | 7,638,852 |

|

| FNMA 15YR 3.500% 10/1/26 | 405,341 |

| | | | 428,559 |

|

| FNMA 15YR 3.500% 10/1/26 | 298,342 |

| | | | 315,709 |

|

| FNMA 15YR 3.500% 10/1/26 | 421,624 |

| | | | 446,000 |

|

| FNMA 15YR 3.500% 10/1/26 | 360,488 |

| | | | 382,286 |

|

| FNMA 15YR 4.000% 1/1/29 | 264,483 |

| | | | 280,665 |

|

| FNMA 15YR 4.000% 1/1/29 | 264,483 |

| | | | 280,665 |

|

| FNMA 15YR 4.000% 1/1/29 | 264,483 |

| | | | 280,665 |

|

| FNMA 15YR 4.000% 1/1/29 | 264,483 |

| | | | 280,665 |

|

| FNMA 15YR 4.000% 11/1/26 | 206,956 |

| | | | 221,833 |

|

| FNMA 15YR 4.500% 5/1/24 | 100,658 |

| | | | 108,762 |

|

| FNMA 5/1 HYBRID ARM 2.386% 3/1/40 | 207,922 |

| | | | 222,370 |

|

| FNMA 5/1 HYBRID ARM 2.445% 12/1/35 | 78,601 |

| | | | 84,381 |

|

| FNMA 7/1 HYBRID ARM 2.055% 1/1/36 | 4,733 |

| | | | 4,992 |

|

| FNMA 7/1 HYBRID ARM 2.198% 1/1/34 | 35,406 |

| | | | 37,702 |

|

| FNMA 7/1 HYBRID ARM 2.475% 3/1/36 | 23,471 |

| | | | 24,712 |

|

| FNMA_03-W11 3.291% 6/25/33 | 585 |

| | | | 614 |

|

| FNMA_04-60 5.500% 4/25/34 | 53,005 |

| | | | 56,569 |

|

| GNMA_10-141 1.864% 8/16/31 | 35,802 |

| | | | 35,863 |

|

| FHLMC_3676 4.00% 7/15/24 | 82,530 |

| | | | 84,364 |

|

| FHLMC_3812 2.75% 9/15/18 | 197,421 |

| | | | 202,205 |

|

| FNMA_09-37 4.000% 3/25/24 | 138,284 |

| | | | 143,496 |

|

| FNMA_10-87 4.000% 2/25/24 | 49,085 |

| | | | 49,949 |

|

| FNMA_11-15 5.500% 3/25/26 | 212,719 |

| | | | 228,811 |

|

| FNMA_11-16 3.500% 3/25/26 | 49,729 |

| | | | 51,465 |

|

| FNMA_11-55 3.000% 7/25/25 | 361,597 |

| | | | 377,532 |

|

| FNMA_12-31 1.750% 10/25/22 | 800,753 |

| | | | 806,423 |

|

| GNMA_10-16 3.214% 1/16/40 | 21,234 |

| | | | 21,358 |

|

| |

* | Indicates Party-in-interest |

| |

** | Cost information not required for participant-directed investments |

| |

*** | The PCRA includes Party-in-interest investment options 21 |

Ameriprise Financial 401(k) Plan

Schedule H, Line 4i — Schedule of Assets (Held at End of Year) (continued)

December 31, 2013

|

| | | | | | |

(a) | (b) Identity of Issue, Borrower, Lessor, or Similar Party | (c) Shares/Units or Face Amount | | (d) Cost** | | (e) Current Value |

| Income Fund (continued) — |

|

| | | | | | | | |

| GNMA_10-49 2.870% 3/16/51 | 25,676 |

| | | | 25,647 |

|

| GNMA_11-109 2.450% 7/16/32 | 36,071 |

| | | | 36,177 |

|

| GNMA_11-143 3.940% 3/16/33 | 219,106 |

| | | | 223,776 |

|

| GNMA_11-58 2.191% 10/16/33 | 69,624 |

| | | | 69,862 |

|

| GNMA_12-111 2.211% 4/16/47 | 162,266 |

| | | | 163,084 |

|

| GNMA_12-142 1.105% 5/16/37 | 346,614 |

| | | | 341,618 |

|

| GNMA_12-55 1.750% 8/16/33 | 334,997 |

| | | | 337,624 |

|

| GNMA_12-86 1.558% 4/16/40 | 322,384 |

| | | | 318,111 |

|

| GNMA_13-105 1.705% 2/16/37 | 514,888 |

| | | | 511,480 |

|

| GNMA_13-12 1.410% 10/16/42 | 348,376 |

| | | | 343,833 |

|

| GNMA_13-126 1.540% 4/16/38 | 278,665 |

| | | | 275,449 |

|

| GNMA_13-138 2.150% 8/16/35 | 306,936 |

| | | | 307,377 |

|

| GNMA_13-140 1.650% 2/16/38 | 821,408 |

| | | | 806,799 |

|

| GNMA_13-146 2.000% 8/16/40 | 527,488 |

| | | | 528,861 |

|

| GNMA_13-17 1.558% 10/16/43 | 287,518 |

| | | | 283,100 |

|

| GNMA_13-2 1.600% 12/16/42 | 426,708 |

| | | | 422,892 |

|

| GNMA_13-30 1.500% 5/16/42 | 484,427 |

| | | | 472,290 |

|

| GNMA_13-32 1.900% 1/16/42 | 444,521 |

| | | | 440,850 |

|

| GNMA_13-33 1.061% 7/16/38 | 450,409 |

| | | | 434,410 |

|

| GNMA_13-35 1.618% 2/16/40 | 408,886 |

| | | | 399,940 |

|

| GNMA_13-40 1.511% 10/16/41 | 304,498 |

| | | | 299,998 |

|

| GNMA_13-45 1.450% 10/16/40 | 331,323 |

| | | | 324,161 |

|

| GNMA_13-52 1.150% 6/16/38 | 372,500 |

| | | | 365,651 |

|

| GNMA_13-57 1.350% 6/16/37 | 408,345 |

| | | | 401,366 |

|

| GNMA_13-73 1.350% 1/16/39 | 305,320 |

| | | | 299,852 |

|

| GNMA_13-78 1.624% 7/16/39 | 172,269 |

| | | | 169,197 |

|

| GNMA_13-179 1.800% 7/16/37 | 236,522 |

| | | | 235,038 |

|

| GNMA_13-194 2.250% 5/16/38 | 241,202 |

| | | | 241,700 |

|

| GNMA_14-103 1.742% 6/16/53 | 539,356 |

| | | | 532,555 |

|

| GNMA_14-109 2.325% 1/16/46 | 168,584 |

| | | | 169,614 |

|

| GNMA_14-47 2.250% 8/16/40 | 398,602 |

| | | | 401,210 |

|

| PRIVATE EXPT FDG CORP 5.45% 9/15/17 | 345,000 |

| | | | 384,000 |

|

| |

* | Indicates Party-in-interest |

| |

** | Cost information not required for participant-directed investments |

| |

*** | The PCRA includes Party-in-interest investment options 22 |

Ameriprise Financial 401(k) Plan

Schedule H, Line 4i — Schedule of Assets (Held at End of Year) (continued)

December 31, 2013

|

| | | | | | |

(a) | (b) Identity of Issue, Borrower, Lessor, or Similar Party | (c) Shares/Units or Face Amount | | (d) Cost** | | (e) Current Value |

| Income Fund (continued) — |

|

| | | | | | | | |

| Wrappers: | | | | | |

| Bank of America Wrapper | | | | | 5,951 |

|

| RBC Wrapper | | | | | 10,108 |

|

| Pacific Life Wrapper | | | | | 5,177 |

|

| Transamerica I Wrapper | | | | | 3,638 |

|

| Transamerica II Wrapper | | | | | 1,769 |

|

| Total Income Fund | | | | | 125,572,928 |

|

| | | | | | |

* | Loans to Participants | | | | | |

| Various Loans, 3.25% — 9.5% due through 2044 | | | | | 32,031,701 |

|

| Less: Deemed distributions | | | | | (407,411 | ) |

| Net participant loans | | | | | 31,624,290 |

|

| | | | | | |

|

| Assets Held at End of Year per Form 5500 | | | | | $ | 1,570,994,579 |

|

| |

* | Indicates Party-in-interest |

| |

** | Cost information not required for participant-directed investments |

| |

*** | The PCRA includes Party-in-interest investment options 23 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Employee Benefits Administration Committee has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | | AMERIPRISE FINANCIAL, INC. |

| | | (Registrant) |

| | | |

| | | |

Date: | June 24, 2015 | By | /s/ Michelle Rudlong |

| | | Michelle Rudlong |

| | | Delegate |

| | | Employee Benefits Administration Committee |

| | | |

EXHIBIT INDEX

Exhibit Description

| |

23.1 | Consent of PricewaterhouseCoopers LLP, Independent Registered Public Accounting Firm. |

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We hereby consent to the incorporation by reference in the Registration Statements on Forms S‑8 (No. 333-128790 and No. 333-156074) of Ameriprise Financial, Inc. of our report dated June 24, 2015 relating to the financial statements and supplemental schedule of the Ameriprise Financial 401(k) Plan, which appears in this Form 11-K.

/s/ PricewaterhouseCoopers LLP

Minneapolis, Minnesota

June 24, 2015

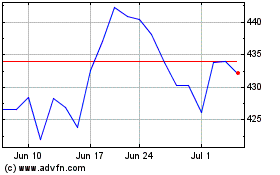

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Apr 2023 to Apr 2024