UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-35666

Summit Midstream Partners, LP

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 45-5200503 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | |

1790 Hughes Landing Blvd, Suite 500 The Woodlands, TX | | 77380 |

(Address of principal executive offices) | | (Zip Code) |

| | |

Registrant’s telephone number, including area code: (832) 413-4770 |

| | |

Securities registered pursuant to Section 12(b) of the Act: |

| | |

Title of each class | | Name of exchange on which registered |

Common Units | | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

x Yes o No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Act.

o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

x Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer x | | Accelerated filer o |

Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o Yes x No

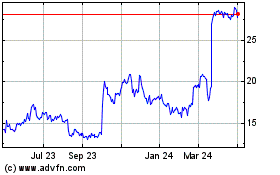

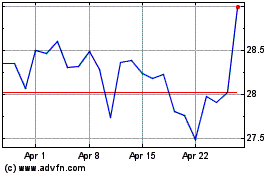

The aggregate market value of the common units held by non-affiliates of the registrant as of June 30, 2014, was $1,260,163,276.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

| | |

Class | | As of January 31, 2015 |

Common Units | | 34,426,513 units |

Subordinated Units | | 24,409,850 units |

General Partner Units | | 1,200,651 units |

TABLE OF CONTENTS

|

| | |

| | |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| | |

| | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

| | |

| | |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

| | |

| | |

Item 15. | | |

FORWARD-LOOKING STATEMENTS

Investors are cautioned that certain statements contained in this report as well as in periodic press releases and certain oral statements made by our officials during our presentations are “forward-looking” statements. Forward-looking statements include, without limitation, any statement that may project, indicate or imply future results, events, performance or achievements, and may contain the words “expect,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “will be,” “will continue,” “will likely result,” and similar expressions, or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” In addition, any statement concerning future financial performance (including future revenues, earnings or growth rates), ongoing business strategies or prospects, and possible actions taken by us or our subsidiaries, are also forward-looking statements. These forward-looking statements involve external risks and uncertainties, including, but not limited to, those described under the section entitled “Risk Factors” included herein.

Forward-looking statements are based on current expectations and projections about future events and are inherently subject to a variety of risks and uncertainties, many of which are beyond the control of our management team. All forward-looking statements in this report and subsequent written and oral forward-looking statements attributable to us, or to persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements in this paragraph. These risks and uncertainties include, among others:

| |

• | fluctuations in natural gas, natural gas liquids ("NGLs") and crude oil prices; |

| |

• | the extent and success of drilling efforts, as well as the extent and quality of natural gas and crude oil volumes produced within proximity of our assets; |

| |

• | failure or delays by our customers in achieving expected production in their natural gas and crude oil projects; |

| |

• | competitive conditions in our industry and their impact on our ability to connect hydrocarbon supplies to our gathering and processing assets or systems; |

| |

• | actions or inactions taken or non-performance by third parties, including suppliers, contractors, operators, processors, transporters and customers, including the inability or failure of our shipper customers to meet their financial obligations under our gathering agreements; |

| |

• | our ability to acquire any assets owned by Summit Midstream Partners, LLC ("Summit Investments"), which is subject to a number of factors, including Summit Investments deciding, in its sole discretion, to offer us the right to acquire such assets, the ability to reach agreement on acceptable terms, the approval of the conflicts committee of our general partner's board of directors (if appropriate), prevailing conditions and outlook in the natural gas, NGL and crude oil industries and markets, and our ability to obtain financing on acceptable terms from the credit and/or capital markets or other sources; |

| |

• | our ability to consummate acquisitions, successfully integrate the acquired businesses, realize any cost savings and other synergies from any acquisition; |

| |

• | the ability to attract and retain key management personnel; |

| |

• | commercial bank and capital market conditions and the potential impact of changes or disruptions in the credit and/or capital markets; |

| |

• | changes in the availability and cost of capital, and the results of our financing efforts, including availability of funds in the credit and/or capital markets; |

| |

• | restrictions placed on us by the agreements governing our debt instruments; |

| |

• | the availability, terms and cost of downstream transportation and processing services; |

| |

• | natural disasters, accidents, weather-related delays, casualty losses and other matters beyond our control; |

| |

• | operational risks and hazards inherent in the gathering, treating and processing of natural gas; |

| |

• | weather conditions and seasonal trends; |

| |

• | timely receipt of necessary government approvals and permits, our ability to control the costs of construction, including costs of materials, labor and rights-of-way and other factors that may impact our ability to complete projects within budget and on schedule; |

| |

• | the effects of existing and future laws and governmental regulations, including environmental and climate change requirements; |

| |

• | the effects of litigation; |

| |

• | changes in general economic conditions; and |

| |

• | certain factors discussed elsewhere in this report. |

Developments in any of these areas could cause actual results to differ materially from those anticipated or projected or cause a significant reduction in the market price of our common units and senior notes.

The foregoing list of risks and uncertainties may not contain all of the risks and uncertainties that could affect us. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this document may not in fact occur. Accordingly, undue reliance should not be placed on these statements. We undertake no obligation to publicly update or revise any forward-looking statements as a result of new information, future events or otherwise, except as otherwise required by law.

Glossary of Terms

adjusted EBITDA: EBITDA plus adjustments related to MVC shortfall payments, impairments and other noncash expenses or losses, less other noncash income or gains

AMI: area of mutual interest; AMIs require that any production from natural gas wells drilled by our customers within the AMI be shipped on or processed by our gathering systems

associated natural gas: a form of natural gas which is found with deposits of petroleum, either dissolved in the oil or as a free "gas cap" above the oil in the reservoir

Bcf: one billion cubic feet

condensate: a natural gas liquid with a low vapor pressure, mainly composed of propane, butane, pentane and heavier hydrocarbon fractions

conventional resource basin: a basin where natural gas production is developed from a well drilled into a geologic formation in which the reservoir and fluid characteristics permit the crude oil and natural gas to readily flow to the wellbore; also referred to as a conventional resource play

delivery point: the point where hydrocarbons are delivered into a gathering system, processing or fractionation facility or downstream transportation pipeline

distributable cash flow: adjusted EBITDA plus cash interest received, less cash interest paid, senior notes interest, cash taxes paid and maintenance capital expenditures

dry gas: a gas primarily composed of methane where heavy hydrocarbons and water either do not exist or have been removed through processing

EBITDA: net income or loss, plus interest expense, income tax expense, and depreciation and amortization, less interest income and income tax benefit

end users: the ultimate users and consumers of transported energy products

Mcf: one thousand cubic feet

MMBtu: one million British Thermal Units

MMcf: one million cubic feet

MMcf/d: one million cubic feet per day

MQD: minimum quarterly distribution; our partnership agreement has established a minimum quarterly distribution of $0.40 per unit per quarter, or $1.60 per unit per year

MVC: minimum volume commitment; an MVC contractually obligates a customer to ship on our systems and/or use our processing services for a minimum quantity of natural gas

NGLs: natural gas liquids; the combination of ethane, propane, normal butane, iso-butane and natural gasolines that when removed from natural gas become liquid under various levels of higher pressure and lower temperature

play: a proven geological formation that contains commercial amounts of hydrocarbons

receipt point: the point where hydrocarbons are received by or into a gathering system or transportation pipeline

residue gas: the natural gas remaining after being processed or treated

segment adjusted EBITDA: calculated as adjusted EBITDA excluding the impact of the corporate expenses that we allocate to our reportable segments

shortfall payment: the payment received from a counterparty when its volume throughput does not meet its MVC for the applicable period

tailgate: refers to the point at which processed residue natural gas and NGLs leave a processing facility for end-use markets

Tcf: one trillion cubic feet

throughput volume: the volume of natural gas transported or passing through a pipeline, plant or other facility during a particular period; also referred to as volume throughput

unconventional resource basin: a basin where natural gas production is developed from unconventional sources that require hydraulic fracturing as part of the completion process, for instance, natural gas produced from shale formations and coalbeds; also referred to as an unconventional resource play

wellhead: the equipment at the surface of a well used to control the well's pressure; also, the point at which the hydrocarbons and water exit the ground

Industry Overview

General

The midstream segment of the natural gas industry is the link between the exploration and production of natural gas from the wellhead and the delivery of the natural gas and its other components to end-use markets. Companies within this industry create value at various stages along the natural gas value chain by gathering natural gas from producers at the wellhead, separating the hydrocarbons into dry gas and NGLs and then routing the separated dry gas and NGLs streams for delivery to end-markets or to the next intermediate stage of the value chain. The following diagram illustrates the assets commonly found along the natural gas value chain:

Midstream Services

The range of services provided by midstream natural gas service companies are generally divided into the following six categories:

Gathering. At the initial stages of the midstream value chain, a network of typically small diameter pipelines known as gathering systems directly connect to wellheads, pad sites or other receipt points in the production area. These gathering systems transport natural gas from the wellhead to downstream pipelines or a central location for treating

and processing. Gathering systems are typically designed to be highly flexible to allow gathering of natural gas at different pressures and scalable to allow for additional production and well connections.

Compression. Gathering systems are operated at design pressures that enable the maximum amount of production to be gathered from connected wells. Through a mechanical process known as compression, volumes of natural gas at a given pressure are compressed to a sufficiently higher pressure, thereby allowing those volumes to be delivered to treating, dehydration, processing and fractionation facilities and ultimately the market via a higher pressure downstream pipeline. Since wells produce at progressively lower field pressures as they age, it becomes necessary to add additional compression over time to maintain throughput across the gathering system.

Treating and Dehydration. Treating and dehydration involves the removal of impurities such as water, carbon dioxide, nitrogen and hydrogen sulfide, which may be present when natural gas is produced at the wellhead. These impurities must be removed for the natural gas to meet the specifications for transportation on long-haul intrastate and interstate pipelines. Moreover, end users will not purchase natural gas with high levels of impurities.

Processing. The principal components of natural gas are methane and ethane. Most natural gas also contains varying amounts of other NGLs. Even after treating and dehydration, some natural gas is not suitable for long-haul intrastate and interstate pipeline transportation or commercial use because it contains NGLs and condensate. This natural gas, referred to as liquids-rich natural gas, must also be processed to remove these heavier hydrocarbon components. NGLs not only interfere with pipeline transportation, but are also valuable commodities once removed from the natural gas stream. The removal and separation of NGLs usually takes place in a processing plant and fractionation facility using industrial processes that exploit differences in the weights, boiling points, vapor pressures and other physical characteristics of NGL components.

Fractionation. Fractionation is the process by which NGLs are separated into individual liquid products for sale to petrochemical and industrial end users. The NGL components that can be separated in fractionation generally include: ethane, propane, normal butane, iso-butane and natural gasoline. This mixture of raw NGLs is often referred to as y-grade or raw natural gas liquid mix.

Transportation and Storage. After treating and dehydration, processing and fractionation, the natural gas and NGL components are either stored or transported and marketed to end-use markets. Each pipeline system typically has storage capacity located both throughout the pipeline network and at major market centers to help temper seasonal demand and daily supply-demand shifts.

Contractual Arrangements

Midstream natural gas services, other than transportation and storage, are usually provided under contractual arrangements that vary in the amount of commodity price risk they carry. Three typical types of contracts are described below.

Fee-Based. Under fee-based arrangements, the service provider typically receives a fee for each unit of natural gas gathered and/or compressed at the wellhead and an additional fee per unit of natural gas treated or processed at its facility. As a result, the service provider bears no direct commodity price risk exposure.

Percent-of-Proceeds. Under percent-of-proceeds arrangements, the service provider typically remits to the producers either a percentage of the proceeds from the sale of residue gas and/or NGLs or a percentage of the actual residue gas and/or NGLs at the tailgate. These types of arrangements expose the gatherer/processor to commodity price risk, as the revenues from the contracts directly correlate with the fluctuating price of natural gas condensate and NGLs.

Keep-Whole. Under these arrangements, the service provider keeps 100% of the NGLs produced, and the processed natural gas, or value of the natural gas, is returned to the producer. Since some of the natural gas is used and removed during processing, the processor compensates the producer for the amount of natural gas used and removed in processing by supplying additional natural gas or by paying an agreed-upon value for the natural gas utilized. These arrangements have the highest commodity price exposure for the processor because the costs are dependent on the price of natural gas and the revenues are based on the price of NGLs.

PART I

Item 1. Business.

Summit Midstream Partners, LP ("SMLP") is a Delaware limited partnership that completed its initial public offering ("IPO") on October 3, 2012 to become a publicly traded entity. Summit Investments is a Delaware limited liability company and the predecessor for accounting purposes (the "Predecessor") of SMLP. References to the "Company," "we," or "our," when used for dates or periods ended on or after the IPO, refer collectively to SMLP and its subsidiaries. References to the "Company," "we," or "our," when used for dates or periods ended prior to the IPO, refer collectively to Summit Investments and its subsidiaries. For additional information, see Note 1 to the audited consolidated financial statements.

Item 1. Business is divided into the following sections:

| |

• | Regulation of the Natural Gas and Crude Oil Industries |

Overview

SMLP is a growth-oriented limited partnership focused on developing, owning and operating midstream energy infrastructure assets that are strategically located in the core producing areas of unconventional resource basins, primarily shale formations, in North America. We provide natural gas gathering, treating and processing services pursuant to primarily long-term and fee-based natural gas gathering and processing agreements with our customers and counterparties. We generally refer to all of the services provided as gathering services.

We currently operate in four unconventional resource basins:

| |

• | the Appalachian Basin, which includes the Marcellus Shale formation in northern West Virginia; |

| |

• | the Williston Basin, which includes the Bakken and Three Forks shale formations in northwestern North Dakota; |

| |

• | the Fort Worth Basin, which includes the Barnett Shale formation in north-central Texas; and |

| |

• | the Piceance Basin, which includes the Mesaverde formation and the Mancos and Niobrara shale formations in western Colorado and eastern Utah. |

Our systems and the basins they serve are as follows:

| |

• | the Mountaineer Midstream system, which serves the Appalachian Basin; |

| |

• | the Bison Midstream system, which serves the Williston Basin; |

| |

• | the DFW Midstream system, which serves the Fort Worth Basin; and |

| |

• | the Grand River system, which serves the Piceance Basin. |

We have a diverse group of customers and counterparties comprising affiliates and/or subsidiaries of some of the largest crude oil and natural gas producers in North America. Our anchor customers and the systems they serve are as follows:

| |

• | Antero Resources Corp. ("Antero"), which is the anchor for the Mountaineer Midstream system ("Mountaineer Midstream"); |

| |

• | EOG Resources, Inc. ("EOG") and Oasis Petroleum, Inc. ("Oasis"), which are the anchors for the Bison Midstream system ("Bison Midstream"); |

| |

• | Chesapeake Energy Corporation ("Chesapeake"), which is the anchor for the DFW Midstream system ("DFW Midstream"); and |

| |

• | Encana Corporation ("Encana") and WPX Energy, Inc. ("WPX"), which are the anchors for the Grand River system ("Grand River"). |

A significant percentage of our revenue is attributable to these anchor customers. (For additional information on customer concentrations, see Note 11 to the audited consolidated financial statements.)

Our results are driven primarily by the volumes of natural gas that we gather, treat and process across our systems. As of December 31, 2014, our gathering systems had more than 2,300 miles of pipeline and over 250,000 horsepower of compression. During 2014, we gathered an average of 1,418 MMcf/d of natural gas.

We generate a substantial majority of our revenue under long-term, primarily fee-based natural gas gathering agreements. The fee-based nature of these agreements enhances the stability of our cash flows by limiting our direct commodity price exposure. During the year ended December 31, 2014, we generated approximately 94% of our revenue, net of pass-through items, from fee-based gathering services. In addition, substantially all of our gas gathering and processing agreements include areas of mutual interest ("AMIs"). Our AMIs cover more than 1.4 million acres in the aggregate.

Certain of our gas gathering and processing agreements include minimum volume commitments or minimum revenue commitments (collectively referred to as "MVCs"). To the extent the customer does not meet its MVC, it must make payments to cover the shortfall of natural gas not shipped or processed, either on a monthly, quarterly or annual basis. We have designed our MVC provisions to ensure that we will generate a certain amount of revenue from each customer over the life of the respective gas gathering or processing agreement, whether by collecting gathering or processing fees on actual throughput or from cash payments to cover any MVC shortfall. As of December 31, 2014, we had remaining MVCs totaling 3.8 Tcf. Our MVCs have a weighted-average remaining life of 9.7 years (assuming minimum throughput volume for the remainder of the term) and average approximately 1,248 MMcf/d through 2018.

We believe that we are positioned for growth through the increased utilization and further development of our existing midstream assets. In addition, we intend to grow our business through the execution of new, and the expansion of existing, strategic partnerships with large producers to provide midstream services for their upstream exploration and production projects. We also intend to continue expanding our operations and diversifying our geographic footprint through asset acquisitions from Summit Investments and third parties, although Summit Investments has no obligation to offer any assets to us and we have no obligation to acquire the assets that they offer to us, if any.

Organization and Results of Operations

SMLP was formed in May 2012 in anticipation of our IPO. Since the IPO, we have issued additional common units and general partner interests in connection with two drop down transactions, one third-party acquisition and certain unit-based compensation awards. As of December 31, 2014, Summit Investments, through a wholly owned subsidiary, held 5,293,571 SMLP common units, 24,409,850 SMLP subordinated units and 1,200,651 general partner units representing a 2% general partner interest in SMLP, along with all of the incentive distribution rights ("IDRs") issued by SMLP. For additional information, see Notes 1, 8 and 15 to the audited consolidated financial statements.

Summit Investments was formed in 2009 by members of our management team and our Sponsor, Energy Capital Partners. Due to its ownership interest in Summit Investments and its representation on Summit Investments' board of managers, Energy Capital Partners controls our general partner and its activities, and as a result, SMLP.

We currently conduct our natural gas gathering, treating and processing operations in the midstream sector through our four natural gas gathering systems, each of which represents one of our four reportable segments. Our reportable segments reflect the way in which we internally report the financial information used to make decisions and allocate resources in connection with our operations. The primary assets of each of our reportable segments consist of natural gas gathering systems and related property, plant and equipment.

Our financial results are primarily driven by the volumes of natural gas that we gather, treat and process across our systems and our management of expenses. We use a variety of financial and operational metrics to analyze our performance, including among others, throughput volume, revenues, operation and maintenance expense, EBITDA, adjusted EBITDA and distributable cash flow. For additional information on our results of operations, reportable segment disclosures, EBITDA, adjusted EBITDA and distributable cash flow, see Item 6. Selected Financial Data, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations ("MD&A"), and the audited consolidated financial statements and notes thereto included in this report.

Our Sponsor

Energy Capital Partners, together with its affiliated funds, is a private equity firm with over $13.0 billion in capital commitments that is focused on investing in North America's energy infrastructure. Energy Capital Partners has significant energy and financial expertise to complement its investment in us, including investments in the power generation, midstream oil and gas, electric transmission, energy equipment and services, environmental infrastructure and other energy related sectors.

Summit Investments, which indirectly owns our general partner, has an inventory of midstream assets and joint venture interests comprising more than $2.3 billion of previous acquisitions and current and future development projects. In addition to its midstream assets located in the Denver-Julesburg ("DJ") Basin in Colorado, the Utica Shale in Ohio, and the Williston Basin in North Dakota, Summit Investments also participates in a joint venture which is developing a liquids-rich natural gas gathering system, a dry natural gas gathering system and a condensate stabilization facility in the southeastern core of the Utica Shale. Each of these assets provide us with opportunities for customer and service offering diversification into crude oil and/or produced water gathering, dry gas gathering and liquids-rich natural gas gathering and processing. Furthermore, we believe these assets present an opportunity to further diversify our operations geographically. While these assets have not been contributed to SMLP and Summit Investments or its affiliates is not obligated to sell these assets to us, we believe they represent a future opportunity for execution of our business strategy.

Business Strategies

Our principal business strategy is to increase the amount of cash distributions we make to our unitholders over time. Our plan for continuing to execute this strategy includes the following key components:

| |

• | Pursuing accretive acquisition opportunities from Summit Investments. We intend to pursue opportunities to expand our asset base by acquiring midstream assets and joint venture interests that are owned, operated and under development by Summit Investments. In addition to its significant ownership interest in us, Summit Investments owns and operates, and seeks to acquire and develop, crude oil, natural gas and water-related midstream assets in service and under construction in geographic areas in which we currently operate as well as in geographic areas outside of our current areas of operations. For example, in December 2014, Summit Investments announced an agreement to develop and operate a new 500 MMcf/d natural gas gathering system in the Utica Shale ("Summit Utica"). Summit Utica will gather, compress and deliver natural gas produced by XTO Energy Inc. into Regency Energy Partners LP's 2.1 Bcf/d high-pressure Utica Ohio River Trunkline Project, which is currently under construction, and other downstream delivery points. While Summit Investments has indicated that it intends to offer us the opportunity to acquire its interests in its various midstream assets, it is not under any contractual obligation to do so and we are unable to predict whether or when such opportunities may arise. In its role as a midstream development vehicle for our Sponsor, we believe that Summit Investments’ development efforts mitigate potential development and cash flow timing risks associated with large-scale greenfield development projects that would otherwise be borne by us. |

| |

• | Maintaining our focus on fee-based revenue with minimal direct commodity price exposure. As we expand our business, we intend to maintain our focus on providing midstream energy services under fee-based arrangements. Our midstream services are provided under primarily long-term and fee-based contracts with original terms up to 25 years. Currently, all of the contracts associated with assets owned and being developed by Summit Investments are fee based. We believe that our focus on fee-based revenues with minimal direct commodity exposure is essential to maintaining stable cash flows. |

| |

• | Capitalizing on organic growth opportunities to maximize throughput on our existing systems. We intend to continue to leverage our management team's expertise in constructing, developing and optimizing our midstream assets to grow our business through organic development projects. We believe that our broad and geographically diverse operating footprint provides us with a competitive advantage to pursue organic development projects that are designed to extend our geographic reach, diversify our customer base, expand our midstream service offerings, increase the number of our hydrocarbon receipt points and maximize volume throughput. |

| |

• | Diversifying our asset base by expanding our midstream service offerings and exploring acquisition and development opportunities in various geographic areas. Our natural gas gathering operations in the Marcellus, Bakken, Three Forks and Barnett shale plays and the Piceance Basin currently represent our core business. However, in the future, we intend to diversify our service offerings into crude oil and |

produced water gathering. We also intend to diversify our operations into other geographic regions, through both greenfield development projects and acquisitions from affiliated and non-affiliated parties.

| |

• | Partnering with producers to provide midstream services for their development projects in high-growth, unconventional resource plays. We seek to promote commercial relationships with established and well-capitalized producers that are willing to serve as anchor customers and commit to long-term MVCs and AMIs. We will continue to pursue partnership opportunities with established producers to develop new midstream energy infrastructure in unconventional resource basins that we believe will complement our existing assets and/or enhance our overall business by facilitating our entry into new basins. These opportunities generally consist of a strategic acreage position in an unconventional resource play that is well-positioned for accelerated production but has limited existing midstream energy infrastructure to support such growth. |

Competitive Strengths

We believe that we will be able to execute the components of our principal business strategy successfully because of the following competitive strengths:

| |

• | Strategically located assets in core areas of prolific unconventional resource basins supported by partnerships with large producers. We believe our assets are strategically positioned within the core areas of four established unconventional resource basins. The geologic formations in the basins served by our assets have either relatively low drilling and completion costs, highly economic production profiles, or a combination of both which incent producers to develop more actively than in more marginal areas. |

| |

• | Fee-based revenues underpinned by long-term contracts with AMIs and MVCs. A substantial majority of our revenue for the year ended December 31, 2014 was generated under long-term and fee-based gas gathering and processing agreements. We believe that long-term, fee-based gas gathering and processing agreements enhance the stability of our cash flows by limiting our direct commodity price exposure. |

| |

• | Capital structure and financial flexibility. At December 31, 2014, we had $808.0 million of total indebtedness and the unused portion of our $700.0 million amended and restated senior secured revolving credit facility (the "revolving credit facility") totaled $492.0 million. Under the terms of our revolving credit facility, our total leverage ratio (total net indebtedness to consolidated trailing 12-month EBITDA, as defined in the credit agreement) was approximately 3.9 to 1.0 at December 31, 2014, which compares with a total leverage ratio upper limit of not more than 5.0 to 1.0, or not more than 5.5 to 1.0 for up to 270 days following certain acquisitions (as defined in the credit agreement). |

| |

• | Experienced management team with a proven record of asset acquisition, construction, development, operations and integration expertise. Our senior leadership team has an average of 20 years of energy experience and a proven track record of identifying, consummating and integrating significant acquisitions in addition to partnering with major producers to construct and develop midstream energy infrastructure. |

| |

• | Relationship with a large and committed financial sponsor. Our Sponsor, Energy Capital Partners, is an experienced energy investor with a proven track record of making substantial, long-term investments in high-quality energy assets. We believe that the relationship with our Sponsor is a competitive advantage as it brings not only significant financial and management experience, but also numerous relationships throughout the energy industry that we believe will continue to benefit us as we seek to grow our business. |

Our Midstream Assets

Our midstream assets currently consist of four natural gas gathering systems:

| |

• | Mountaineer Midstream in northern West Virginia; |

| |

• | Bison Midstream in northwestern North Dakota; |

| |

• | DFW Midstream in north-central Texas; and |

| |

• | Grand River in western Colorado and eastern Utah. |

We compete with other midstream companies, producers and intrastate and interstate pipelines. Competition for natural gas volumes is primarily based on reputation, commercial terms, service levels, access to end-use markets,

location and available capacity. We may also face competition to gather production drilled outside of our AMIs and attract producer volumes to our gathering systems. Additionally, we could face incremental competition to the extent we make acquisitions.

We earn revenue by providing natural gas gathering, treating and processing services pursuant to primarily long-term and fee-based natural gas gathering and processing agreements with some of the largest and most active producers in North America. The fee-based nature of these agreements enhances the stability of our cash flows by limiting our direct commodity price exposure.

The significant features of our gas gathering and processing agreements and the gathering systems to which they relate are discussed in more detail below. For additional information on a consolidated basis and by reportable segment, see the "Results of Operations" section in MD&A.

Areas of Mutual Interest

A substantial majority of our gathering and processing agreements contain AMIs. The AMIs generally have original terms up to 25 years and require that any production by our customers within the AMIs will be shipped on our gathering systems. Our customers do not have leased production acreage that currently cover our entire AMIs but, to the extent that our customers lease additional acreage in the future within our AMIs, natural gas produced by our customers from that leased acreage is required to be gathered and/or processed by our systems.

Under certain of our gas gathering agreements, we have agreed to construct pipeline laterals to connect our gathering systems to pad sites located within the AMI. However, we may choose not to participate in a discretionary opportunity presented by a customer because we believe that the project would not meet our economic return expectations. Under this scenario, the customer may, in certain circumstances, construct the additional infrastructure and sell it to us at a price equal to their cost plus an applicable margin, or, in some cases, we may release the relevant acreage dedication from the AMI.

Minimum Volume Commitments

Many of our gas gathering and processing agreements contain MVCs pursuant to which our customers agree to ship or process a minimum volume of natural gas on our gathering systems, or, in some cases, to pay a minimum monetary amount, over certain periods during the term of the MVC. The original terms of our MVCs range from two to 15 years and had a weighted-average remaining life of 9.7 years as of December 31, 2014. In addition, certain of our customers have an aggregate MVC, which is a total amount of natural gas that the customer has agreed to ship or process on our systems (or an equivalent monetary amount) over the MVC term. In these cases, once a customer achieves its aggregate MVC, any remaining future MVCs will terminate and the customer will then simply pay the applicable gathering or processing rate multiplied by the actual throughput volumes shipped or processed.

In addition to AMIs, MVCs are beneficial in connection with the development and ongoing operation of a gathering system because they provide a contracted portfolio at start up and limit our direct commodity price exposure during the life of the gathering system.

For additional information on our MVCs, see the "Critical Accounting Estimates" section in MD&A and Notes 2 and 6 to the audited consolidated financial statements.

Mountaineer Midstream

In June 2013, we acquired certain high-pressure natural gas gathering pipelines and compression assets located in the liquids-rich window of the Marcellus Shale Play from an affiliate of MarkWest Energy Partners, L.P. (“MarkWest”). We refer to these assets as the Mountaineer Midstream system. The Mountaineer Midstream system, which operates in the Appalachian Basin, benefits from its location in Doddridge and Harrison counties in West Virginia where it gathers natural gas under a long-term, fee-based contract with Antero. The Mountaineer Midstream system consists of newly constructed, high-pressure natural gas gathering pipelines ranging from 8 inches to 20 inches in diameter and two compressor stations. This rich-gas gathering and compression system serves as a critical inlet to MarkWest's Sherwood Processing Complex, a primary destination for liquids-rich natural gas in northern West Virginia. The Mountaineer Midstream system currently provides our midstream services for the Marcellus Shale reportable segment.

During the third quarter of 2014, throughput capacity was increased to 1,050 MMcf/d to support Antero's current and future anticipated drilling activities. We expect volumes to continue to grow on this system during 2015 as new Antero wells are connected by other third parties upstream of our system.

The following table provides information regarding our Mountaineer Midstream system as of December 31, 2014. |

| | | | | | |

Gathering system | | Approximate length (Miles) | | Compression (Horsepower) | | Throughput capacity (MMcf/d) |

Mountaineer Midstream (1) | | 49 | | 21,330 | | 1,050 |

(1) Contract terms related to AMIs and MVCs are excluded for confidentiality purposes.

In November 2013, we amended our original fee-based natural gas gathering agreement with Antero whereby we agreed to construct approximately nine miles of high-pressure, 20-inch pipeline on the Mountaineer Midstream system (the "Zinnia Loop"). The Zinnia Loop project is underpinned by a new, 12-year, minimum revenue commitment from Antero, which extends the original term of the contract through 2026. With this expansion, we believe the Mountaineer Midstream system will enhance its strategic position as a primary source of natural gas deliveries to the Sherwood Processing Complex.

Bison Midstream

In June 2013, we acquired certain associated natural gas gathering pipeline, dehydration and compression assets in the Williston Basin in northwestern North Dakota from a subsidiary of Summit Investments. We refer to these assets as the Bison Midstream system. The Bison Midstream system gathers, compresses and treats associated natural gas that exists in the crude oil stream produced from the Bakken and Three Forks shale formations. These formations are primarily targeted for crude oil production and producer drilling decisions and activity are based largely on the prevailing price of crude oil. As such, natural gas volume throughput is also impacted by the prevailing price of crude oil. Our gas gathering agreements for the Bison Midstream system are long-term, primarily fee-based, contracts ranging from five years to 15 years and provide diversity of commodity price exposure for us relative to our other natural gas midstream operations. The Bison Midstream system currently provides our midstream services for the Williston Basin reportable segment.

The Bison Midstream system, which is located in Mountrail and Burke counties, consists of low- and high-pressure pipeline and six compressor stations and includes gathering lines ranging from 3 inches to 10 inches in diameter. Natural gas gathered on the Bison Midstream system is delivered to Aux Sable Midstream LLC's ("Aux Sable") Palermo Conditioning Plant in Palermo, North Dakota and then delivered to its 2.1 Bcf/d natural gas processing plant in Channahon, Illinois.

Total throughput capacity on the system is in the process of being expanded from 26 MMcf/d to 32 MMcf/d with the installation of new compression which is expected to be completed by the end of the first quarter of 2015. Volume throughput on the Bison Midstream system is underpinned by MVCs from its anchor customers, EOG and Oasis.

The following table provides information regarding our Bison Midstream system as of December 31, 2014.

|

| | | | | | | | | | | | | | |

Gathering system | | Approximate length (Miles) | | Compression (Horsepower) | | Throughput capacity (MMcf/d) | | Approximate AMIs (Acres) | | Average daily MVCs through 2018 (MMcf/d) | | Remaining MVCs (Bcf) | | Weighted-average remaining contract life (Years) (1) |

Bison Midstream | | 391 | | 9,770 | | 26 | | 676,500 | | 12 | | 20 | | 5.6 |

(1) Weighted average based on total remaining MVC (total remaining MVCs multiplied by average rate).

In addition to its fee-based gas gathering agreement with EOG and percent-of-proceeds gas gathering agreement with Oasis, the Bison Midstream system is also supported by other fee-based gas gathering agreements. As of December 31, 2014, these gas gathering agreements had AMIs extending through 2027. We continue to develop the Bison Midstream system to extend our gathering reach, increase capacity, increase our receipt points and maximize throughput. Since its acquisition, we have increased capacity and improved system reliability by adding pipeline, continuing to connect additional pad sites located within our AMIs, and installing additional compression.

DFW Midstream

In September 2009, we acquired approximately 17 miles of pipeline and 2,500 horsepower of electric-drive compression in north-central Texas from Energy Future Holdings Corp. ("Energy Future Holdings") and Chesapeake. We refer to these assets as the DFW Midstream system. Since the initial acquisition, we have expanded this system by adding pipeline and continuing to connect additional pad sites located within our AMIs. In addition, we have expanded throughput capacity by installing additional electric-drive compression for which we

retain a small fixed percentage of the natural gas that we receive to offset the costs we incur to operate our electric-drive compressors. The DFW Midstream system is primarily located in southeastern Tarrant County, the largest natural gas producing county in Texas. We consider this area to be the core of the core of the Barnett Shale because of the quality of the geology and the high production profile of the wells drilled to date. The DFW Midstream system includes gathering lines ranging from 4 inches to 30 inches in diameter and is located along existing electric transmission corridors and under both private and public property. It currently has six primary interconnections with third-party, intrastate pipelines. These interconnections enable us to connect our customers, directly or indirectly, with the major natural gas market hubs of Waha, Carthage, and Katy in Texas, and Perryville and Henry Hub in Louisiana. The DFW Midstream system currently provides our midstream services for the Barnett Shale reportable segment.

The DFW Midstream system benefits from its location in southeastern Tarrant County, Texas, which is commonly referred to as the core of the Barnett Shale. Based on peak month average daily production rates sourced from the Railroad Commission of Texas as of December 2014, this area contains the most prolific wells in the Barnett Shale. For example, the two largest and five of the ten largest wells drilled in the Barnett Shale (based on peak month average daily rates) are connected to the DFW Midstream system.

We designed the DFW Midstream system to benefit from incremental volumes arising from high-density, infill drilling on existing pad sites that are already connected to the gathering system and as such would not require significant additional capital expenditures. Development of the DFW Midstream system has enabled our customers to efficiently produce natural gas by utilizing horizontal drilling techniques from pad sites already connected in our AMIs. Given the urban nature of southeastern Tarrant County, we expect that the majority of future natural gas drilling in this area will occur from existing pad sites. We believe that the AMIs underpinning our system are substantially undeveloped compared with other areas in the Barnett Shale due to the historical lack of gathering infrastructure.

The following table provides information regarding our DFW Midstream system as of December 31, 2014. |

| | | | | | | | | | | | | | |

Gathering system | | Approximate length (Miles) | | Compression (Horsepower) | | Throughput capacity (MMcf/d) | | Approximate AMIs (Acres) | | Average daily MVCs through 2018 (MMcf/d) | | Remaining MVCs (Bcf) | | Weighted-average remaining contract life (Years) (1) |

DFW Midstream | | 128 | | 66,100 | | 480 | | 108,300 | | 131 | | 191 | | 4.9 |

(1) Weighted average based on total remaining MVC (total remaining MVCs multiplied by average rate).

In September 2009, we entered into a long-term, fee-based gas gathering agreement with Chesapeake as our anchor customer that included a 20-year area of mutual interest covering approximately 95,000 acres and a 10-year MVC totaling approximately 450 Bcf. In addition to Chesapeake, the DFW Midstream system is underpinned by other long-term, fee-based gas gathering agreements.

We continue to develop the DFW Midstream system to extend our gathering reach, diversify our customer base, increase our receipt points and maximize throughput. For example, in February 2014, we commissioned a 150 gallon per minute natural gas treating facility that allows us to provide treating services that would otherwise be provided to our customers by third parties. Additionally, in September 2014, we acquired certain natural gas gathering assets which increased throughput capacity on the DFW Midstream system by approximately 30 MMcf/d. We believe our strategic location in the Barnett Shale provides us with a competitive advantage to add incremental throughput with limited additional investment capital due to the anticipated future, high-density, infill drilling from our customers on connected pad sites and nearby pad sites that have yet to be connected given the urban landscape and the efforts of our producer customers to minimize their surface footprint. Furthermore, we believe the production profile of wells drilled within our AMIs and flowing on the DFW Midstream system will continue to attract drilling activity over the long term as producers become more selective in their drilling locations and focus on the core areas of certain basins to maximize their returns.

Grand River

In October 2011, Grand River acquired certain natural gas gathering pipeline, dehydration and compression assets in the Piceance Basin in western Colorado from Encana Oil & Gas (USA) Inc., a subsidiary of Encana. These assets gather natural gas from the Mesaverde formation and the Mancos and Niobrara shale formations located within the Piceance Basin in western Colorado. They are primarily located in Garfield County, the largest natural gas

producing county in Colorado. We refer to the assets that we acquired in October 2011 as the Legacy Grand River system.

In March 2014, we acquired 100% of the interests in Red Rock Gathering Company, LLC ("Red Rock Gathering") from a subsidiary of Summit Investments. Summit Investments acquired the natural gas gathering pipeline, dehydration, compression and processing assets in the Piceance Basin that comprise the Red Rock Gathering system from a subsidiary of Energy Transfer Partners, L.P. in September 2012. These assets gather and process natural gas from the Mesaverde formation and the emerging Mancos and Niobrara shale formations located within the Piceance Basin in western Colorado and eastern Utah. They are primarily located in Rio Blanco and Mesa counties in Colorado and Uintah and Grand counties in Utah. We refer to the assets that we acquired in March 2014 as the Red Rock Gathering, and collectively with the Legacy Grand River system, as the Grand River system. The Grand River system currently provides our midstream services for the Piceance Basin reportable segment.

Natural gas gathered and/or processed on the Grand River system is compressed, dehydrated, processed and/or discharged to downstream pipelines serving (i) Enterprise's Meeker Natural Gas Processing Plant, a 1.8 Bcf/d processing facility located in Meeker, Colorado, (ii) Williams Partners L.P.'s Northwest Pipeline system, and (iii) Kinder Morgan, Inc.'s TransColorado Pipeline system. Processed NGLs from the Grand River system are injected into Enterprise's Mid-America Pipeline system.

The Grand River system is primarily a low-pressure gathering system that was originally designed to gather natural gas produced from directional wells targeting the liquids-rich Mesaverde formation. The Mesaverde is a shallow, tight sands geologic formation that producers have targeted with directional drilling for several decades. We also gather natural gas from our customers' wells targeting the emerging Mancos and Niobrara shale formations, which underlie the Mesaverde formation, via a new medium-pressure gathering system. Based on our customers' current drilling activities, we anticipate that the majority of our near-term throughput on the Grand River system will continue to originate from the Mesaverde formation. We expect to continue to pursue additional volumes on the low-pressure system to more fully utilize the existing throughput capacity. In addition, we believe that the Grand River system is optimally located for expansion to gather production from the emerging Mancos and Niobrara shale formations.

The following table provides information regarding our Grand River system as of December 31, 2014. |

| | | | | | | | | | | | | | | |

Gathering system | | Approximate length (Miles) | | Compression (Horsepower) | | Throughput capacity (MMcf/d) | | Approximate AMIs (Acres) | | Average daily MVCs through 2018 (MMcf/d) | | Remaining MVCs (Bcf) | | Weighted-average remaining contract life (Years) (1) |

Grand River | | 1,780 | | 154,150 | | 1,153 | | 670,960 | | 726 |

| | 2,143 | | 10.4 |

(1) Weighted average based on total remaining MVC (total remaining MVCs multiplied by average rate).

In October 2011, we entered into a long-term, fee-based gas gathering agreement with Encana as our anchor customer that included a 25-year AMI covering approximately 187,000 acres and a 15-year MVC totaling approximately 1,558 Bcf. In conjunction with Summit Investments' acquisition of Red Rock Gathering, we assumed fee-based agreements with Black Hills Exploration and Production, Inc. ("Black Hills") and a subsidiary of WPX. Both agreements include long-term acreage dedications and collectively provide more than 375 Bcf of MVCs. Certain of the Grand River system's other gas gathering and processing agreements include MVCs with original terms ranging from from two to 15 years and areas of mutual interest with original terms up to 25 years.

In connection with the Black Hills agreement, we constructed a 20 MMcf/d cryogenic processing plant and related gas gathering infrastructure in the DeBeque, Colorado area to support Black Hills' development of its liquids-rich Mancos and Niobrara acreage. In connection with the WPX agreement, we agreed to expand our gathering and compression services by constructing gas gathering infrastructure to gather new WPX production in the Rifle, Colorado area. The processing plant in DeBeque was commissioned in March 2014 and the WPX project is in process and development is expected to continue over the next few years. We intend to expand the Grand River system by connecting additional pad sites within our areas of mutual interest, adding new customers, and acquiring nearby gathering systems. In addition to Encana, WPX and Black Hills, the Grand River system is underpinned by other long-term, fee-based gas gathering and compression agreements.

For additional information relating to our business and gathering systems as well as the recent decline in natural gas and crude oil prices and our commodity price exposure, see the "Trends and Outlook—Natural gas, NGL and crude oil supply and demand dynamics" and "Results of Operations" sections in MD&A.

Regulation of the Natural Gas and Crude Oil Industries

General. Sales by producers of natural gas, crude oil, condensate, and NGLs are currently made at market prices. However, gathering and transportation services are subject to various types of regulation, which may affect certain aspects of our business and the market for our services. The Federal Energy Regulatory Commission ("FERC") regulates the transportation of natural gas in interstate commerce and the interstate transportation of crude oil, petroleum products and NGLs. FERC regulation includes reviewing and accepting or approving rates and other terms and conditions for such transportation services. FERC is also authorized to prevent and sanction market manipulation in natural gas markets while the Federal Trade Commission is authorized to prevent and sanction market manipulation in petroleum markets. State and municipal regulations may apply to the production and gathering of natural gas, the construction and operation of natural gas and crude oil facilities, and the rates and practices of gathering systems and intrastate pipelines.

Regulation of Oil and Natural Gas Exploration, Production and Sales. Sales of crude oil and NGLs are not currently regulated and are transacted at market prices. In 1989, the U.S. Congress enacted the Natural Gas Wellhead Decontrol Act, which removed all remaining price and non-price controls affecting wellhead sales of natural gas. FERC, which has the authority under the Natural Gas Act to regulate the prices and other terms and conditions of the sale of natural gas for resale in interstate commerce, has issued blanket authorizations for all gas resellers subject to its regulation, except interstate pipelines, to resell natural gas at market prices. Either Congress or FERC (with respect to the resale of gas in interstate commerce), however, could re-impose price controls in the future.

Exploration and production operations are subject to various types of federal, state and local regulation, including, but not limited to, permitting, well location, methods of drilling, well operations, and conservation of resources. While these regulations do not directly apply to our business, they may affect our customers' ability to produce natural gas.

Regulation of the Gathering and Transportation of Natural Gas. We believe that our gas pipeline facilities qualify as gathering facilities that are exempt from the jurisdiction of FERC under the Natural Gas Act and the Natural Gas Policy Act of 1978 (the "NGPA"), although we are subject to FERC's anti-market manipulation regulations. The distinction between federally unregulated gathering facilities and FERC-regulated transmission pipelines has been the subject of extensive litigation and changes in the policies and interpretations of laws and regulations. In addition, the status of any individual gathering system may be determined by FERC on a case-by-case basis, although FERC has made no determinations as to the status of our facilities. Consequently, the classification and regulation of gathering systems (including some of our pipelines) could change based on future determinations by FERC or the courts.

Intrastate pipelines, which may include some pipelines that perform gathering functions, may be subject to safety regulation by the U.S. Department of Transportation although typically state regulatory authorities (operating under a federal certification) perform this function. State regulatory authorities also have jurisdiction over the rates and practices of intrastate pipelines and gathering systems, including requirements for ratable takes or non-discriminatory access to pipeline services. The basis for state regulation and the degree of regulatory oversight of gathering systems and intrastate pipelines varies from state to state. In Texas, we are regulated as a gas utility and have filed tariffs with the Railroad Commission of Texas to establish rates and terms of service for our DFW Midstream system assets. We have not been required to file a tariff in Colorado for our Grand River system assets, nor have we been required to file a tariff in West Virginia or North Dakota for our operations in those states, although regulatory authorities in North Dakota have recently issued new rules requiring the submission of shape files to identify the location of underground gathering pipelines. The states in which we operate have adopted complaint-based regulation that allows natural gas producers and shippers to file complaints with state regulators in an effort to resolve access issues and rate grievances, among other matters. State authorities in Texas, Colorado, North Dakota, and West Virginia generally have not initiated investigations of the rates or practices of gathering systems or intrastate pipelines in the absence of a complaint. State regulation of intrastate pipelines continues to evolve and may become more stringent in the future.

Natural gas production, gathering and transportation, including the construction of new gathering facilities and expansion of existing gathering facilities may also be subject to local regulation, such as approval and permit requirements.

Anti-Market Manipulation Rules. We are subject to the anti-market manipulation provisions in the Natural Gas Act and the NGPA, as amended by the Energy Policy Act of 2005, which authorize FERC to impose fines of up to $1,000,000 per day per violation of the Natural Gas Act, the NGPA, or their implementing regulations. In addition, the Federal Trade Commission holds statutory authority under the Energy Independence and Security Act of 2007

to prevent market manipulation in petroleum markets, including the authority to request that a court impose fines of up to $1,000,000 per violation. These agencies have promulgated broad rules and regulations prohibiting fraud and manipulation in oil and gas markets. The Commodity Futures Trading Commission (the "CFTC") is directed under the Commodity Exchange Act to prevent price manipulations in the commodity and futures markets, including the energy futures markets. Pursuant to statutory authority, the CFTC has adopted anti-market manipulation regulations that prohibit fraud and price manipulation in the commodity and futures markets. The CFTC also has statutory authority to seek civil penalties of up to the greater of $1,000,000 per day per violation or triple the monetary gain to the violator for violations of the anti-market manipulation sections of the Commodity Exchange Act. We are also subject to various reporting requirements that are designed to facilitate transparency and prevent market manipulation.

Safety and Maintenance. We are subject to regulation by the U.S. Department of Transportation under the Natural Gas Pipeline Safety Act of 1968, as amended (the “NGPSA”) which establishes federal safety standards for the design, construction, operation and maintenance of natural gas pipeline facilities. In the Pipeline Safety Act of 1992, Congress expanded the U.S. Department of Transportation's regulatory authority to include regulated gathering lines that had previously been exempt from federal jurisdiction. The Pipeline Safety Improvement Act of 2002 and the Pipeline Inspection, Protection, Enforcement and Safety Act of 2006 established mandatory inspections for certain U.S. oil and natural gas transmission pipelines in high consequence areas. The Pipeline Safety, Regulatory Certainty, and Job Creation Act of 2011 reauthorizes funding for federal pipeline safety programs through 2015, increases penalties for safety violations, establishes additional safety requirements for newly constructed pipelines, and requires studies of certain safety issues that could result in the adoption of new regulatory requirements for existing pipelines.

The U.S. Department of Transportation has delegated the implementation of safety requirements to the Pipeline and Hazardous Materials Safety Administration (the "PHMSA"), which has adopted and enforces safety standards and procedures applicable to a limited number of our pipelines. In addition, many states, including the states in which we operate, have adopted regulations that are identical to or more restrictive than existing U.S. Department of Transportation regulations for intrastate pipelines. Among the regulations applicable to us, the PHMSA requires pipeline operators to develop integrity management programs for certain pipelines located in high consequence areas, which include high-population areas such as the Dallas-Fort Worth greater metropolitan area where our DFW gathering system is located. While the majority of our pipelines meet the U.S. Department of Transportation definition of gathering lines and are thus exempt from the integrity management requirements of the PHMSA, we also operate a limited number of pipelines that are subject to the integrity management requirements. Those regulations require operators, including us, to:

| |

• | perform ongoing assessments of pipeline integrity; |

| |

• | identify and characterize applicable threats to pipeline segments that could impact a high consequence area; |

| |

• | maintain processes for data collection, integration and analysis; |

| |

• | repair and remediate pipelines as necessary; |

| |

• | adopt and maintain procedures, standards and training programs for control room operations; and |

| |

• | implement preventive and mitigating actions. |

The PHMSA has published notices and advanced notices of proposed rulemaking to solicit comments on the need for changes to its safety regulations, including whether to revise the integrity management requirements. The PHMSA has also solicited comments on changes to the definition of gathering pipelines, which could subject many currently exempted pipelines to the PHMSA regulations. The PHMSA also published an advisory bulletin providing guidance on verification of records related to pipeline maximum allowable operating pressure. Pipelines that do not meet the PHMSA's record verification standards may be required to perform additional testing or reduce their operating pressures.

Gathering systems like ours are also subject to a number of federal and state laws and regulations, including the Federal Occupational Safety and Health Act and comparable state statutes, the purposes of which are to protect the health and safety of workers, both generally and within the pipeline industry. In addition, the OSHA hazard communication standard, Environmental Protection Agency ("EPA") community right-to-know regulations under Title III of the federal Superfund Amendment and Reauthorization Act and comparable state statutes require that information be maintained concerning hazardous materials used or produced in our operations and that such information be provided to employees, state and local government authorities and the public.

Environmental Matters

General. Our operation of pipelines and other assets for the gathering, compressing and dehydration of natural gas and other products is subject to stringent and complex federal, state and local laws and regulations relating to the protection of the environment. As an owner or operator of these assets, we must comply with these laws and regulations at the federal, state and local levels. These laws and regulations can restrict or impact our business activities in many ways, such as:

| |

• | requiring the installation of pollution-control equipment or otherwise restricting the way we operate; |

| |

• | limiting or prohibiting construction activities in sensitive areas, such as wetlands, coastal regions or areas inhabited by endangered or threatened species; |

| |

• | delaying system modification or upgrades during permit reviews; |

| |

• | requiring investigatory and remedial actions to mitigate pollution conditions caused by our operations or attributable to former operations; and |

| |

• | enjoining the operations of facilities deemed to be in non-compliance with permits or permit requirements issued pursuant to or imposed by such environmental laws and regulations. |

Failure to comply with these laws and regulations may trigger administrative, civil and criminal enforcement measures, including the assessment of monetary penalties. Certain environmental statutes impose strict joint and several liability for costs required to clean up and restore sites where substances, hydrocarbons or wastes have been disposed or otherwise released. Moreover, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the release of hazardous substances, hydrocarbons or other waste products into the environment.

The trend in environmental regulation is to place more stringent requirements, resulting in more restrictions and limitations, on activities that may affect the environment. Thus, there can be no assurance as to the amount or timing of future expenditures for environmental compliance or remediation and actual future expenditures may be different from the amounts we currently anticipate. We try to anticipate future regulatory requirements that might be imposed and plan accordingly to remain in compliance with changing environmental laws and regulations and to minimize the costs of such compliance. We also actively participate in industry groups that help formulate recommendations for addressing existing and future regulations.

The following is a discussion of the material environmental laws and regulations that relate to our business.

Hazardous Substances and Waste. Our operations are subject to environmental laws and regulations relating to the management and release of solid and hazardous wastes and other substances, including hydrocarbons. These laws generally regulate the generation, storage, treatment, transportation and disposal of solid and hazardous waste and may impose strict joint and several liability for the investigation and remediation of affected areas where hazardous substances may have been released or disposed. Furthermore, the Toxic Substances Control Act, and analogous state laws, impose requirements on the use, storage and disposal of various chemicals and chemical substances at our facilities. The Comprehensive Environmental Response, Compensation, and Liability Act ("CERCLA") and comparable state laws impose liability, without regard to fault or the legality of the original conduct, on certain classes of persons that contributed to the release of a hazardous substance into the environment. We may handle hazardous substances within the meaning of CERCLA, or similar state statutes, in the course of our ordinary operations and, as a result, may be jointly and severally liable under CERCLA for all or part of the costs required to clean up sites at which these hazardous substances have been released into the environment.

We also generate industrial wastes that are subject to the requirements of the Resource Conservation and Recovery Act and comparable state statutes. While the Resource Conservation and Recovery Act regulates both solid and hazardous wastes, it imposes strict requirements on the generation, storage, treatment, transportation and disposal of hazardous wastes. Although we generate minimal hazardous waste, it is possible that non-hazardous wastes, which could include wastes currently generated during our operations, will in the future be designated as hazardous wastes and, therefore, be subject to more rigorous and costly disposal requirements. Moreover, from time to time, the EPA and state regulatory agencies have considered the adoption of stricter disposal standards for non-hazardous wastes, including natural gas wastes.

We currently own or lease properties where hydrocarbons are being or have been handled for many years. Although we believe that the previous operators utilized operating and disposal practices that were standard in the industry at the time, hydrocarbons or other wastes may have been disposed of or released on or under the

properties owned or leased by us or on or under the other locations where these hydrocarbons and wastes have been transported for treatment or disposal. These properties and the wastes disposed thereon may be subject to CERCLA, the Resource Conservation and Recovery Act and analogous state laws. Under these laws, we could be required to remove or remediate previously disposed wastes (including wastes disposed of or released by prior owners or operators), to clean up contaminated property (including contaminated groundwater) or to perform remedial operations to prevent future contamination. We are not currently aware of any facts, events or conditions relating to such requirements that could materially impact our operations or financial condition.

Air Emissions. Our operations are subject to the federal Clean Air Act and comparable state and local laws and regulations. These laws and regulations regulate emissions of air pollutants from various industrial sources, including our compressor stations, and also impose various monitoring and reporting requirements. Such laws and regulations may require that we obtain pre-approval for the construction or modification of certain projects or facilities expected to produce or significantly increase air emissions, obtain and strictly comply with air permits containing various emissions and operational limitations and utilize specific emission control technologies to limit emissions. Our failure to comply with these requirements could subject us to monetary penalties, injunctions, conditions or restrictions on operations and criminal enforcement actions. Furthermore, we may be required to incur certain capital expenditures in the future to obtain and maintain operating permits and approvals for air pollutant emitting sources.

In April 2012, the EPA finalized rules that establish new air emission reporting, monitoring, and control requirements for oil and natural gas production and natural gas processing operations. Specifically, the EPA's rule package included New Source Performance Standards ("NSPS") to address emissions of sulfur dioxide and volatile organic compounds ("VOCs") from a number of sources that were previously not regulated in the oil and gas industry. Additionally, the EPA revised several existing regulations to address hazardous air pollutants frequently associated with oil and natural gas production and processing activities. The rules establish specific new requirements regarding emissions from compressors, pneumatic controllers, dehydrators, storage tanks and other production equipment. In addition, the rules establish new leak detection requirements for natural gas processing plants at 500 ppm. These rules required a number of modifications to our operations, including the installation of new equipment to control emissions from VOC emitting tanks at initial startup. To date, compliance with such rules has not resulted in significant costs, but we will continue to evaluate their impact and associated costs.

On December 17, 2014, the EPA proposed to lower the existing national ambient air quality standard (“NAAQS”) for ozone. A lowered ozone NAAQS could result in a significant expansion of ozone nonattainment areas across the United States, including areas in which we operate, which could subject us to increased regulatory burdens in the form of more stringent emission controls, emission offset requirements, and increased permitting delays and costs.

In addition, in February 2014, the Colorado Department of Public Health and Environment’s Air Quality Control Commission finalized regulations imposing stringent new requirements relating to air emissions from oil and gas facilities in Colorado. These new Colorado rules include storage tank control, monitoring, recordkeeping and reporting requirements as well as leak detection and repair requirements for both well production facilities and compressor stations and associated equipment. The new requirements went into effect January 2015.

Water Discharges. The Clean Water Act, and analogous state laws impose restrictions and strict controls regarding the discharge of pollutants into regulated waters, which impacts our ability to conduct construction activities in waters and wetlands. Certain state regulations and the general permits issued under the Federal National Pollutant Discharge Elimination System program prohibit the discharge of pollutants and chemicals. In addition, the Clean Water Act and analogous state laws require individual permits or coverage under general permits for discharges of storm water runoff from certain types of facilities. These permits require us to control storm water runoff from some of our facilities. Some states also maintain groundwater protection programs that require permits for discharges or operations that may impact groundwater conditions. Federal and state regulatory agencies can impose administrative, civil and criminal penalties for non-compliance with discharge permits or other requirements of the Clean Water Act and analogous state laws and regulations.