TIDMAIE

RNS Number : 6353U

Anite PLC

30 July 2015

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION (IN WHOLE OR IN

PART), DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION

For immediate release 30 July 2015

Recommended Cash Acquisition

of

ANITE PLC ("Anite")

by

KEYSIGHT TECHNOLOGIES NETHERLANDS B.V. ("Keysight B.V.")

(a wholly owned indirect subsidiary of Keysight Technologies,

Inc. ("Keysight"))

to be effected by means of a

Scheme of Arrangement

under Part 26 of the Companies Act 2006

Results of Court Meeting and General Meeting

The board of Anite is pleased to announce that, at the Court

Meeting and General Meeting convened earlier today in connection

with the recommended cash acquisition of the entire issued and to

be issued share capital of Anite by Keysight B.V. by way of a

scheme of arrangement under Part 26 of the Companies Act 2006 (the

"Scheme"), all resolutions proposed were duly passed.

The Scheme was approved by the Scheme Shareholders at the Court

Meeting and the special resolution to implement the Scheme (the

"Special Resolution") was passed by the Anite Shareholders at the

General Meeting.

The detailed voting results in relation to the Court Meeting and

the General Meeting are summarised below.

Court Meeting

The Court Meeting, convened in accordance with the order of the

Court, sought approval from Scheme Shareholders for the Scheme.

At the Court Meeting, a majority in number of Scheme

Shareholders who voted (either in person or by proxy), representing

99.55 per cent. by value of those Scheme Shareholders who voted,

voted in favour of the resolution to approve the Scheme. The

resolution proposed at the Court Meeting was approved by the

requisite majority on a poll vote. Details of the votes cast were

as follows:

FOR AGAINST

---------------------- -------------------- ---------------

Number % Number %

---------------------- ------------ ------ -------- -----

Scheme Shares Voted 208,945,253 99.55 951,771 0.45

---------------------- ------------ ------ -------- -----

Scheme Shareholders

who voted 617 93.06 46 6.94

---------------------- ------------ ------ -------- -----

Scheme Shares voted

as a percentage of

the total number of

Scheme Shares 69.44 0.32

---------------------- ------------ ------ -------- -----

Anite General Meeting

At the Anite General Meeting, the Special Resolution was passed

by the requisite majority on a poll vote. The full text of the

Special Resolution is contained in the Notice of General Meeting

set out in the Scheme Document, which was posted to Anite

Shareholders on 06 July 2015 and which is available on Anite's

website at http://www.anite.com/investor-relations. The voting

results for the Special Resolution were as follows:

FOR AGAINST WITHHELD*

-------------- -------------------- --------------- ----------

Number % Number % Number

-------------- ------------ ------ -------- ----- ----------

Anite Shares

voted 208,009,179 99.56 916,646 0.44 1,416,399

-------------- ------------ ------ -------- ----- ----------

* Votes withheld do not count in the total of votes cast.

Next Steps

Completion of the Acquisition remains subject to the

satisfaction or ,if capable of waiver, waiver of the other

Conditions and certain further terms of the Scheme and the

Acquisition set out in Appendix I of the Scheme Document, including

sanction of the Scheme by the Court at the Court Sanction Hearing

and the delivery of the Court Order to the Registrar of Companies.

Subject to sanction of the Scheme by the Court and the satisfaction

or waiver of the other conditions, the Scheme is expected to become

effective in mid-August 2015.

Other

Capitalised terms in this announcement (unless otherwise

defined) have the same meanings as set out in the Scheme

Document.

The expected timetable for the implementation of the Scheme is

set out in the appendix to this announcement.

Enquiries

Anite plc Tel: +44 (0) 12 5277

5200

Christopher Humphrey, Chief Executive

Richard Amos, Group Finance Director

Evercore Partners International LLP (lead Tel: +44 (0) 20 7653

financial adviser to Anite) 6000

Edward Banks

Tiarnán O'Rourke

Jefferies International Limited (financial Tel: +44 (0) 20 7029

adviser and corporate broker to Anite) 8000

Simon Hardy

Canaccord Genuity Limited (financial adviser Tel: +44 (0) 20 7523

and corporate broker to Anite) 8000

Simon Bridges

MHP Communications (PR adviser to Anite) Tel: +44 (0) 20 3128

8100

Reg Hoare

Further Information

Evercore Partners International LLP ("Evercore"), which is

authorised and regulated in the United Kingdom by the Financial

Conduct Authority, is acting as lead financial adviser exclusively

for Anite and no one else in connection with the Acquisition and

will not regard any other person as its client in relation to the

matters referred to in this announcement and will not be

responsible to anyone other than Anite for providing the

protections afforded to clients of Evercore, nor for providing

advice in relation to the matters referred to in this announcement.

Neither Evercore nor any of its subsidiaries, branches or

affiliates owes or accepts any duty, liability or responsibility

whatsoever (whether direct or indirect, whether in contract, in

tort, under statute or otherwise) to any person who is not a client

of Evercore in connection with this announcement, any statement

contained herein or otherwise.

Jefferies International Limited ("Jefferies"), which is

authorised and regulated in the United Kingdom by the Financial

Conduct Authority, is acting exclusively for Anite as financial

adviser and corporate broker and no-one else in connection with the

Acquisition and Jefferies will not regard any other person as its

client(s) of Jefferies in relation to the Acquisition and will not

be responsible to anyone other than Anite for providing the

protections afforded to its clients or for providing advice in

relation to the Acquisition, the contents of this announcement or

any transaction, arrangement or other matter referred to in this

announcement.

Canaccord Genuity Limited ("Canaccord"), which is authorised and

regulated in the United Kingdom by the Financial Conduct Authority,

is acting exclusively for Anite as financial adviser and corporate

broker and no-one else in connection with the Acquisition and will

not regard any other person as its client in relation to the

Acquisition and will not be responsible to anyone other than Anite

for providing the protections afforded to its clients or for

providing advice in relation to the Acquisition, the contents of

this announcement or any transaction, arrangement or other matter

referred to in this announcement.

This announcement is for information purposes only and is not

intended to and does not constitute or form part of an offer to

sell or otherwise dispose of or invitation to purchase or otherwise

acquire any securities or the solicitation of any vote or approval

in any jurisdiction, nor shall there be any sale, issue or transfer

of the securities referred to in this announcement in any

jurisdiction in contravention of applicable law. The Acquisition

will be made solely by means of the Scheme Document, which contains

the full terms and conditions of the Acquisition, including details

of how to vote in respect of the Acquisition. Any vote in respect

of the Scheme or other response in relation to the Acquisition

should be made only on the basis of the information contained in

the Scheme Document.

Overseas Shareholders

This announcement has been prepared for the purpose of complying

with the laws of the United Kingdom and the Code and the

information disclosed may not be the same as that which would have

been disclosed if this announcement had been prepared in accordance

with the laws of jurisdictions outside the United Kingdom. The

release, publication or distribution of this announcement in

certain jurisdictions may be restricted by law. Persons who are not

resident in the United Kingdom or who are subject to other

jurisdictions should inform themselves of, and observe, any

applicable requirements. Further details in relation to Overseas

Shareholders are contained in the Scheme Document.

The Acquisition relates to the shares of a United Kingdom

company and is being effected by means of a scheme of arrangement

under the laws of the United Kingdom. Neither the proxy

solicitation rules nor (unless implemented by means of an Offer)

the tender offer rules under the US Securities Exchange Act of

1934, as amended, apply to the Acquisition. Moreover, the

Acquisition is subject to the disclosure requirements and practices

applicable in the United Kingdom and under the Code to schemes of

arrangement, which differ from the disclosure requirements of the

US proxy solicitation rules and tender offer rules. If Keysight

B.V. exercises its right to implement the Acquisition of the Anite

Shares by way of an Offer and determines to extend the Offer into

the United States, the Offer will be made in compliance with

applicable United Kingdom and US securities laws and regulations.

Financial information relating to Anite included in this

announcement and the Scheme Document has been or will have been

prepared in accordance with accounting standards applicable in the

United Kingdom that may not be comparable to financial information

of US companies or companies whose financial statements are

prepared in accordance with generally accepted

accounting principles in the United States.

Unless otherwise determined by Keysight B.V. or required by the

Code, and permitted by applicable law and regulation, the

Acquisition will not be made available, directly or indirectly, in,

into or from a Restricted Jurisdiction where to do so would violate

the laws in that jurisdiction and no person may vote in favour of

the Scheme by any such use, means, instrumentality or form within a

Restricted Jurisdiction or any other jurisdiction if to do so would

constitute a violation of the laws of that jurisdiction.

Accordingly, copies of this announcement and all documents relating

to the Acquisition are not being, and must not be, directly or

indirectly, mailed or otherwise forwarded, distributed or sent in,

into or from a Restricted Jurisdiction where to do so would violate

the laws in that jurisdiction, and persons receiving this

announcement and all documents relating to the Acquisition

(including custodians, nominees and trustees) must not mail or

otherwise distribute or send them in, into or from such

jurisdictions where to do so would violate the laws in that

jurisdiction.

The availability of the Acquisition to Anite Shareholders who

are not resident in the United Kingdom may be affected by the laws

of the relevant jurisdictions in which they are resident. Persons

who are not resident in the United Kingdom should inform themselves

of, and observe, any applicable requirements.

Dealing disclosure requirements

Under Rule 8.3(a) of the Takeover Code, any person who is

interested in 1 per cent or more of any class of relevant

securities of an offeree company or of any securities exchange

offeror (being any offeror other than an offeror in respect of

which it has been announced that its offer is, or is likely to be,

solely in cash) must make an Opening Position Disclosure following

the commencement of the offer period and, if later, following the

announcement in which any securities exchange offeror is first

identified.

An Opening Position Disclosure must contain details of the

person's interests and short positions in, and rights to subscribe

for, any relevant securities of each of (i) the offeree company and

(ii) any securities exchange offeror(s). An Opening Position

Disclosure by a person to whom Rule 8.3(a) applies must be made by

no later than 3.30 p.m. (London time) on the 10th business day

following the commencement of the offer period and, if appropriate,

by no later than 3.30 p.m. (London time) on the 10th business day

following the announcement in which any securities exchange offeror

is first identified. Relevant persons who deal in the relevant

securities of the offeree company or of a securities exchange

offeror prior to the deadline for making an Opening Position

Disclosure must instead make a Dealing Disclosure.

Under Rule 8.3(b) of the Takeover Code, any person who is, or

becomes, interested in 1 per cent or more of any class of relevant

securities of the offeree company or of any securities exchange

offeror must make a Dealing Disclosure if the person deals in any

relevant securities of the offeree company or of any securities

exchange offeror. A Dealing Disclosure must contain details of the

dealing concerned and of the person's interests and short positions

in, and rights to subscribe for, any relevant securities of each of

(i) the offeree company and (ii) any securities exchange offeror,

save to the extent that these details have previously been

disclosed under Rule 8. A Dealing Disclosure by a person to whom

Rule 8.3(b) applies must be made by no later than 3.30 p.m. (London

time) on the business day following the date of the relevant

dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. If you are in any doubt as to whether you are required

to make an Opening Position Disclosure or a Dealing Disclosure, you

should contact the Panel's Market Surveillance Unit on +44 (0)20

7638 0129.

Information Relating to Anite Shareholders

Please be aware that addresses, electronic addresses and certain

information provided by Anite Shareholders, persons with

information rights and other relevant persons for the receipt of

communications from Anite may be provided to Keysight during the

offer period as requested under Section 4 of Appendix 4 of the

Takeover Code to comply with Rule 2.6(c).

Publication on website

In accordance with Rule 24.1 of the Takeover Code, a copy of

this announcement will be available on Keysight's website

(http://about.keysight.com/docs/investor_info.shtml) and Anite's

website (http://www.anite.com/investor-relations) by no later than

12.00 noon on the Business Day following publication of this

announcement.

APPENDIX

EXPECTED TIMETABLE OF PRINCIPLE EVENTS

All times shown in this announcement are London times unless

otherwise stated.

Event Time and/or date

The following dates are indicative only and are subject to

change1

Court Sanction Hearing Date 10 August 2015 ("D")2

Last day of dealings in the Anite D

Shares

Dealings in the Anite Shares suspended 5.00 p.m. on D

Scheme Record Date 6.00 p.m. on D

Effective Date of the Scheme D+5

Delisting of the Anite Shares 7.30 a.m. on D+6

Latest date for despatch of cheques within 14 days of the Effective

or for settlement through CREST Date

Long Stop Date 02 January 20163

Notes:

1 These dates are indicative only and will depend, among other

things, on the date upon which (i) the Conditions are satisfied or,

if capable of being waived, waived; (ii) the Court sanctions the

Scheme; and (iii) the Court Order is delivered to the Registrar of

Companies for registration (which will be dependent on, amongst

other things, the period of time taken by HMRC to stamp the Court

Order). Anite will give notice of all of these dates when known by

issuing an announcement through a Regulatory Information

Service.

2 Any references to a day before or after "D" are references to a Business Day.

3 This is the latest date by which the Scheme may become

effective unless Keysight B.V. determines that such date shall be a

later date (which the Panel and, if required, the Court may

permit).

The dates given are based on Anite's current expectations and

may be subject to change. All Scheme Shareholders have the right to

attend the Court Sanction Hearing to sanction the Scheme.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ROMSDSFISFISEIW

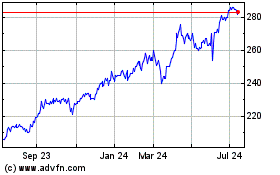

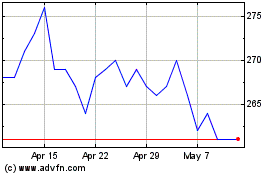

Ashoka India Equity Inve... (LSE:AIE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ashoka India Equity Inve... (LSE:AIE)

Historical Stock Chart

From Apr 2023 to Apr 2024