TIDMANCR

RNS Number : 6546F

Animalcare Group PLC

24 February 2015

Animalcare Group plc

("Animalcare" or the "Group")

Half Yearly Report

Animalcare Group plc (AIM: ANCR), a leading supplier of

veterinary medicines, announces interim results for the six months

ended 31(st) December 2014 and confirms a solid first half to all

three areas of the business. Animalcare is made up of three product

groups: Licensed Veterinary Medicines, Companion Animal

Identification and Animal Welfare products.

Financial Highlights

6 months to 6 months to

31(st) Dec 31(st) Dec

2014 2013 % change

------------------------------- ----------- ----------- --------

Revenue GBP6.93m GBP6.46m +7.2%

------------------------------- ----------- ----------- --------

Underlying* EBITDA GBP1.93m GBP1.58m +22.2%

------------------------------- ----------- ----------- --------

Underlying* operating profit GBP1.79m GBP1.44m +24.7%

------------------------------- ----------- ----------- --------

Profit before tax GBP1.76m GBP1.38m +27.6%

------------------------------- ----------- ----------- --------

Basic underlying* earnings per

share 6.8p 5.5p +23.6%

------------------------------- ----------- ----------- --------

Interim dividend 1.8p 1.5p +20.0%

------------------------------- ----------- ----------- --------

Cash and cash equivalents GBP5.04m GBP3.64m +38.5%

------------------------------- ----------- ----------- --------

* Underlying measures are before the effect of exceptional and

other items. These are analysed in note 3.

Operational Highlights

-- Strong revenue growth from our Licensed Veterinary Medicines

group, up 10.6% to GBP4.40m (2013: GBP3.98m) in part due to a

non-recurring benefit from sales of Buprecare as a result of

competitor supply issues.

-- Companion Animal Identification group continued to perform

well, delivering revenue growth of 5.0% to GBP1.26m (2013:

GBP1.20m). Sales of both microchips and database services increased

in the period.

-- Continued focus on investment in our product development

pipeline, with expenditure weighted to the second half. Further

recruitment planned to expand the business development team and

support growth plans.

-- Cash generation in the period was stronger than expected,

with Group cash balances up GBP1.23m to GBP5.04m (2013:

GBP3.64m).

-- Interim dividend increased by 20% to 1.8 pence per share (2013: 1.5p per share).

James Lambert, Chairman of Animalcare Group plc, said: "I am

delighted to report a solid start to our financial year in all

three areas of the business. The Group remains on target to perform

in line with management expectations for the full year to 30(th)

June 2015. The Board is committed to its strategy to invest in

enhanced generic medicines that will deliver growth and protectable

revenue to the medium to long-term. I am extremely pleased to be

able to increase the interim dividend to 1.8 pence per share, given

the solid trading performance and strong financial position of the

Group."

Animalcare Group plc Tel: 01904 487 687

Iain Menneer, Chief Executive Officer

Chris Brewster, Chief Financial

Officer

Panmure Gordon (Nominated Adviser and Tel: 020 7886 2500

Broker)

Freddy Crossley/Peter Steel

Walbrook PR Ltd Tel: 020 7933 8780 or animalcare@walbrookpr.com

Paul McManus Mob: 07980 541 893

Lianne Cawthorne Mob: 07584 391 303

Chairman's Statement

I am delighted to report a solid first half in all three areas

of the business leading to an overall increase in sales of 7.2% to

GBP6.9m. The strategy to focus on both the Licensed Veterinary

Medicines and the Companion Animal Identification products and

services has delivered this result. This has flowed through to

basic underlying earnings per share of 6.8p (2013: 5.5p), a year on

year increase of over 19%.

The 10.6% growth in Licensed Veterinary Medicines revenue was

driven by organic growth and a one-off benefit from sales of

Buprecare, as a result of supply issues experienced by one of

competitors. This more than offset reduced sales of some of our

lower margin pharmaceuticals.

Sales in our Companion Animal Identification group generated

growth of 5.0% with a small increase in gross profit. The

commercial and political opportunities and threats that the

compulsory chipping of dogs in 2016 will bring to Animalcare are

much clearer now and I believe there should be modest benefits to

us.

Sales from our Animal Welfare Products group fell by 1.2% with a

small increase in gross margin, leaving the profitability broadly

flat year on year.

Operating cash flow growth was created by a general reduction in

stock, increased profits and a below originally planned investment

in new products.

As I stated in our 2014 Annual Report, we have gathered a strong

team and are increasing the level of investment in our Licensed

Veterinary Medicines new product development pipeline, which will

provide added benefits to both the veterinary practitioner and the

animals in their care. Progress is being made on projects in the

development pipeline with several new opportunities identified in

the period. An uplift in investment is expected in the second half

and in subsequent years.

I am very pleased to welcome Mr George Gunn on to the Board of

Animalcare. George joined the Board in February 2015 having stepped

down recently as Head of the Animal Health Division and from the

Executive Committee of Novartis AG on completion of the sale of

that division on 1(st) January 2015. He has extensive experience in

Animal Health Pharmaceuticals over a career that has spanned 30

years within the industry.

George will complement the skills of the existing Board members

and bring additional commercial and product development experience

to the team to help deliver our strategy.

Given the strong trading in the first half and the structural

improvements to the business, the Board remains confident about the

prospects and outcome for the full year and beyond.

James Lambert

Chairman

Business Review

Introduction

The Group delivered another solid trading performance during the

six month period ended 31(st) December 2014, building on the firm

foundations established during the previous financial year. This

performance resulted in a 7.2% increase in revenues to GBP6.93m

(2013: GBP6.46m) and a 24.7% increase in underlying operating

profit, our measure of trading performance before exceptional

items, to GBP1.79m (2013: GBP1.44m).

Our robust balance sheet and cash position continues to reflect

the highly cash generative nature of our operations, supported in

the first half by planned activity to reduce our inventory

levels.

Strategically, we continue to focus on delivering growth from

our current core business and our product development pipeline to

accelerate our organic expansion from 2016 onwards.

Our sustained trading performance and balance sheet strength

prompted the Board's to increase the dividend by 20% to 1.8 pence

per share (2013: 1.5 pence per share).

Operating results

6 months to 6 months to

Revenue 31(st) Dec 31(st) Dec

GBP'000 2014 2013 % change

-------------------------------- ----------- ----------- --------

Licensed Veterinary Medicines 4,396 3,975 10.6%

-------------------------------- ----------- ----------- --------

Companion Animal Identification 1,261 1,201 5.0%

-------------------------------- ----------- ----------- --------

Animal Welfare Products 1,271 1,286 (1.2%)

-------------------------------- ----------- ----------- --------

TOTAL 6,928 6,462 7.2%

-------------------------------- ----------- ----------- --------

The Licensed Veterinary Medicines group, representing around 60%

of overall business revenues, continues to be our main growth

driver, with sales up 10.6% versus prior period to GBP4.40m, 8.7%

of which is like-for-like. This increase includes a circa GBP0.2m

non-recurring first half benefit from sales of Buprecare as a

result of supply issues with a competitor product. The remaining

growth has come from products launched during FY14 which have

performed well in the first half.

Our Companion Animal Identification group has continued to

perform well, delivering an overall increase in sales of 5.0% to

GBP1.26m. With increasing competition in the pet insurance market,

much of this growth was driven by microchip revenues following

further sales and marketing focus.

Revenues from our Animal Welfare Products group fell modestly to

GBP1.27m however, as observed in the previous financial year,

overall gross profitability has been broadly maintained as a result

of improved sales mix, including growth in the infusion accessories

range.

Gross profit increased by 10.0% to GBP4.0m (2013: GBP3.6m). Our

gross margins increased to 57.1% (2013: 55.6%) primarily reflecting

the non-recurring benefit of higher than expected sales of

Buprecare as noted above, however, underlying gross margins have

also modestly improved due to favourable sales mix.

Underlying* operating profit increased by 24.7% to GBP1.79m

(2013: GBP1.44m) largely as a result of improved gross profits

whilst maintaining control of overall overheads, excluding research

and development costs, at similar levels to H1 FY13. During the

period, we completed the restructuring of our UK sales team,

including the introduction of a telesales function. We expect to

continue to invest in our staff base in a planned and measured way

to support our growth strategy.

Cash flow

Cash flows generated by operations were GBP2.55m (2013:

GBP0.95m). During the period, as planned, the Group has focused on

reducing its inventory levels from the peak seen in FY14. Whilst

the GBP0.48m stock decrease was higher than expected, partly due to

strong December sales, we continue to focus on optimising our

inventory mix whilst ensuring our customers' requirements are

met.

Net income taxes paid at GBP0.29m include a GBP0.10m cash

benefit in relation to FY13 research and development tax

credits.

Capital expenditure in the period principally relates to

investment in our product development pipeline. Whilst

significantly higher than prior period, this was lower than

originally planned. This is an important activity for the Group and

is progressing well and has benefitted from the additions made to

the Technical and Business Development teams during FY14. We expect

overall FY15 expenditure to be weighted to the second half.

Group cash balances at 31(st) December 2014 were GBP5.04m

(30(th) June 2014: GBP3.81m, 31(st) December 2013: GBP3.64m).

Earnings per share ("EPS")

Basic underlying* EPS increased by 23.6% to 6.8 pence (2013: 5.5

pence). The statutory basic EPS increased by 26.9% to 6.6 pence

(2013: 5.2 pence) reflecting the lower cost of exceptional items in

the period.

Dividend

Given the solid trading performance and strong financial

position of the Group, the Board is pleased to announce, a 20%

increase in the interim dividend to 1.8 pence per share (2013: 1.5

pence per share), which follows the 4.0% increase in the final

dividend for FY14. The interim dividend will be paid on 7(th) May

2015 to shareholders on the register on 10(th) April 2015.

The Board will continue to monitor the Group's cash position to

ensure an appropriate balance between investment for growth and

return for shareholders.

New Product Development

As previously stated, we have a strategy to grow the business

through investment in the Licensed Veterinary Medicines group.

Though it inevitably takes time for this progress to be visible

externally, the activity in our product development pipeline has

increased significantly in the last 18 months.

As can be seen in the table below the projects in our pipeline

are moving forward through the stages.

Please see this link for a copy of the table:

http://www.rns-pdf.londonstockexchange.com/rns/6546F_-2015-2-23.pdf

In addition, the number of potential projects short-listed from

our structured product identification process has increased

significantly in H1 FY15. These projects will be assessed for their

technical and commercial feasibility before Board assessment and

the start of investment.

More novel technologies are being reviewed as part of our

enhanced generic strategy and we believe that George Gunn's

appointment to the Board as a director will undoubtedly enhance the

quality and number of opportunities available to Animalcare.

Summary and outlook

Changes to the product development team and processes are having

a positive effect on the progress of our new pharmaceutical product

pipeline. In order to maintain momentum and explore the extensive

range of business opportunities available to Animalcare, we are

starting to recruit additional resource.

We expect to launch three new pharmaceutical products in the

second half of the financial year, on distribution from one of our

European partners, which will keep up the momentum in the core part

of our business.

Introduction of compulsory microchipping for dogs in Wales has

been delayed from March 2015 and may now coincide with its

introduction in England in April 2016. Industry changes to the

Animalcare pet and owner database requested by DEFRA are almost

complete ahead of schedule. Engagement by dog owners in preparation

for the deadline in England in April 2016 has been slow but as this

gathers momentum Animalcare is well placed to benefit.

The Board is committed to its strategy to invest in enhanced

generic medicines that will deliver growth and protectable revenue

in the medium to long-term. As anticipated, the market remains

challenging which results in continued pressure on margins,

however, the business remains on target to perform in line with

management expectations in H2 and for the full year to 30(th) June

2015.

* Underlying measures are before the effect of exceptional costs

and other items as disclosed in note 3.

Iain Menneer Chris Brewster

Chief Executive Officer Chief Financial Officer

Condensed Consolidated Statement of Comprehensive Income -

Unaudited

Six months ended 31(st) December 2014

6 months ended 31(st) December 6 months ended 31(st) December

2014 2013

----------------------- ---- --------------------------------------- ----------------------------------------------

Exceptional

and other Exceptional and

Underlying items (i) Total Underlying results other items (i) Total

Note results GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

======================= ==== ---------------- ----------- -------- ================== ================ ========

Revenue 6,928 - 6,928 6,462 - 6,462

----------------------- ---- ---------------- ----------- -------- ------------------ ---------------- --------

Cost of sales (2,971) - (2,971) (2,867) - (2,867)

======================= ==== ---------------- ----------- -------- ================== ================ ========

Gross profit 3,957 - 3,957 3,595 - 3,595

----------------------- ---- ---------------- ----------- -------- ------------------ ---------------- --------

Distribution

costs (135) - (135) (144) - (144)

----------------------- ---- ---------------- ----------- -------- ------------------ ---------------- --------

Administrative

expenses (1,948) (49) (1,997) (1,883) (59) (1,942)

======================= ==== ---------------- ----------- -------- ================== ================ ========

Research &

development

expenses (84) - (84) (133) - (133)

======================= ==== ---------------- ----------- -------- ================== ================ ========

Operating profit/loss 1,790 (49) 1,741 1,435 (59) 1,376

----------------------- ---- ---------------- ----------- -------- ------------------ ---------------- --------

Finance

income/(expense) 13 1 14 14 (14) -

======================= ==== ---------------- ----------- -------- ================== ================ ========

Profit/(loss)

before tax 1,803 (48) 1,755 1,449 (73) 1,376

----------------------- ---- ---------------- ----------- -------- ------------------ ---------------- --------

Income tax

(expense)/credit (374) 10 (364) (305) 16 (289)

======================= ==== ---------------- ----------- -------- ================== ================ ========

Total comprehensive

income/(loss)

for the period 1,429 (38) 1,391 1,144 (57) 1,087

----------------------- ---- ---------------- ----------- -------- ------------------ ---------------- --------

Basic earnings

per share 6 6.8p 6.6p 5.5p 5.2p

----------------------- ---- ---------------- ----------- -------- ------------------ ---------------- --------

Fully diluted

earnings per

share 6 6.8p 6.6p 5.5p 5.2p

----------------------- ---- ---------------- ----------- -------- ------------------ ---------------- --------

Total comprehensive income/(loss) for the period is attributable

to the equity holders of the parent.

(i) In order to aid understanding of underlying business

performance, the Directors have presented underlying results before

the effect of exceptional and other items. These items are analysed

in note 3.

Condensed Consolidated Statement of Comprehensive Income -

Audited

Year ended 30(th) June 2014

Exceptional

Underlying and other items

results (i) Total

Note GBP'000 GBP'000 GBP'000

----------------------------------- ---- ---------- ---------------- --------

Revenue 12,881 - 12,881

----------------------------------- ---- ---------- ---------------- --------

Cost of sales (5,739) - (5,739)

----------------------------------- ---- ---------- ---------------- --------

Gross profit 7,142 - 7,142

----------------------------------- ---- ---------- ---------------- --------

Distribution costs (257) - (257)

----------------------------------- ---- ---------- ---------------- --------

Administrative expenses (3,823) (119) (3,942)

----------------------------------- ---- ---------- ---------------- --------

Research & development expenditure (260) - (260)

----------------------------------- ---- ---------- ---------------- --------

Operating profit/(loss) 2,802 (119) 2,683

----------------------------------- ---- ---------- ---------------- --------

Finance income 27 27

----------------------------------- ---- ---------- ---------------- --------

Finance expense - (38) (38)

----------------------------------- ---- ---------- ---------------- --------

Profit/(loss) before tax 2,829 (157) 2,672

----------------------------------- ---- ---------- ---------------- --------

Income tax (expense)/credit (570) 35 (535)

----------------------------------- ---- ---------- ---------------- --------

Total comprehensive income/(loss)

for the year 2,259 (122) 2,137

----------------------------------- ---- ---------- ---------------- --------

Basic earnings per share 6 10.8p 10.3p

----------------------------------- ---- ---------- ---------------- --------

Fully diluted earnings per

share 6 10.8p 10.2p

----------------------------------- ---- ---------- ---------------- --------

Total comprehensive income/(loss) for the year is attributable

to the equity holders of the parent.

(i) In order to aid understanding of underlying business

performance, the directors have presented underlying results before

the effect of exceptional costs and other items. These items are

analysed in note 3.

Condensed Consolidated Statement of Changes in Shareholders'

Equity

Six months ended 31(st) December 2014

Year ended

6 months ended 6 months ended 30(th) June

31(st) December 31(st) December 2014

2014 Unaudited 2013 Unaudited Audited

Note GBP'000 GBP'000 GBP'000

---------------------------- ---- ---------------- ---------------- ------------

Balance at beginning

of period 19,453 17,962 17,962

---------------------------- ---- ---------------- ---------------- ------------

Total comprehensive

income for the period 1,391 1,087 2,137

---------------------------- ---- ---------------- ---------------- ------------

Transactions with owners

of the Company, recognised

in equity:

---------------------------- ---- ---------------- ---------------- ------------

Dividends paid 5 (838) (788) (1,103)

---------------------------- ---- ---------------- ---------------- ------------

Issue of share capital 11 15 242

---------------------------- ---- ---------------- ---------------- ------------

Share-based payments 73 65 215

---------------------------- ---- ---------------- ---------------- ------------

Balance at end of period 20,090 18,341 19,453

---------------------------- ---- ---------------- ---------------- ------------

Condensed Consolidated Balance Sheet

31(st) December 2014

31(st) December 31(st) December

2014 2013 30(th) June 2014

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------ --------------- --------------- ----------------

Non-current assets

------------------------------ --------------- --------------- ----------------

Goodwill 12,711 12,711 12,711

------------------------------ --------------- --------------- ----------------

Other intangible assets 1,395 1,379 1,327

------------------------------ --------------- --------------- ----------------

Property, plant and equipment 330 403 372

------------------------------ --------------- --------------- ----------------

14,436 14,493 14,410

------------------------------ --------------- --------------- ----------------

Current assets

------------------------------ --------------- --------------- ----------------

Inventories 1,938 1,800 2,420

------------------------------ --------------- --------------- ----------------

Trade and other receivables 2,165 1,528 1,883

------------------------------ --------------- --------------- ----------------

Cash and cash equivalents 5,037 3,640 3,812

------------------------------ --------------- --------------- ----------------

9,140 6,968 8,115

------------------------------ --------------- --------------- ----------------

Total assets 23,576 21,461 22,525

------------------------------ --------------- --------------- ----------------

Current liabilities

------------------------------ --------------- --------------- ----------------

Trade and other payables (1,976) (1,579) (1,606)

------------------------------ --------------- --------------- ----------------

Current tax liabilities (481) (475) (385)

------------------------------ --------------- --------------- ----------------

Deferred income (242) (231) (242)

------------------------------ --------------- --------------- ----------------

(2,699) (2,285) (2,233)

------------------------------ --------------- --------------- ----------------

Net current assets 6,441 4,683 5,882

------------------------------ --------------- --------------- ----------------

Non-current liabilities

------------------------------ --------------- --------------- ----------------

Deferred income (703) (764) (730)

------------------------------ --------------- --------------- ----------------

Deferred tax liabilities (84) (71) (109)

------------------------------ --------------- --------------- ----------------

(787) (835) (839)

------------------------------ --------------- --------------- ----------------

Total liabilities (3,486) (3,120) (3,072)

------------------------------ --------------- --------------- ----------------

Net assets 20,090 18,341 19,453

------------------------------ --------------- --------------- ----------------

Capital and reserves

------------------------------ --------------- --------------- ----------------

Called up share capital 4,194 4,152 4,192

------------------------------ --------------- --------------- ----------------

Share premium account 6,400 6,204 6,391

------------------------------ --------------- --------------- ----------------

Retained earnings 9,496 7,985 8,870

------------------------------ --------------- --------------- ----------------

Equity attributable to

equity holders of the parent 20,090 18,341 19,453

------------------------------ --------------- --------------- ----------------

Cash Flow Statement

Six months ended 31(st) December 2014

6 months ended 6 months ended Year ended

31(st) December 31(st) December 30(th) June

2014 Unaudited 2013 Unaudited 2014 Audited

GBP'000 GBP'000 GBP'000

----------------------------------- ---------------- ---------------- -------------

Comprehensive income for

the period before tax 1,755 1,376 2,672

----------------------------------- ---------------- ---------------- -------------

Adjustments for:

----------------------------------- ---------------- ---------------- -------------

Depreciation of property,

plant and equipment 55 49 69

----------------------------------- ---------------- ---------------- -------------

Amortisation of intangible

assets 141 151 410

----------------------------------- ---------------- ---------------- -------------

Finance income (13) (14) (27)

----------------------------------- ---------------- ---------------- -------------

Share-based payment award 73 65 152

----------------------------------- ---------------- ---------------- -------------

Release of deferred income (26) (26) (49)

----------------------------------- ---------------- ---------------- -------------

Operating cash flows before

movements in working capital 1,985 1,627 3,227

----------------------------------- ---------------- ---------------- -------------

(Increase)/decrease in inventories 482 (382) (1,002)

----------------------------------- ---------------- ---------------- -------------

Decrease/(increase) in receivables (282) 134 (221)

----------------------------------- ---------------- ---------------- -------------

Increase/(decrease) in payables 368 (402) (376)

----------------------------------- ---------------- ---------------- -------------

Cash generated by operations 2,553 949 1,628

----------------------------------- ---------------- ---------------- -------------

Income taxes paid (293) (264) (561)

----------------------------------- ---------------- ---------------- -------------

Net cash flow from operating

activities 2,260 685 1,067

----------------------------------- ---------------- ---------------- -------------

Investing activities:

----------------------------------- ---------------- ---------------- -------------

Payments to acquire intangible

assets (195) (6) (199)

----------------------------------- ---------------- ---------------- -------------

Payments to acquire property,

plant and equipment (26) (25) (32)

----------------------------------- ---------------- ---------------- -------------

Receipts from sale of property,

plant and equipment - - 2

----------------------------------- ---------------- ---------------- -------------

Interest received 13 14 27

----------------------------------- ---------------- ---------------- -------------

Net cash used in investing

activities (208) (17) (202)

----------------------------------- ---------------- ---------------- -------------

Financing:

----------------------------------- ---------------- ---------------- -------------

Receipts from issue of share

capital 11 15 305

----------------------------------- ---------------- ---------------- -------------

Equity dividends paid (838) (788) (1,103)

----------------------------------- ---------------- ---------------- -------------

Net cash used in financing

activities (827) (773) (798)

----------------------------------- ---------------- ---------------- -------------

Net (decrease)/increase

in cash and cash equivalents 1,225 (105) 67

----------------------------------- ---------------- ---------------- -------------

Cash and cash equivalents

at start of period 3,812 3,745 3,745

----------------------------------- ---------------- ---------------- -------------

Cash and cash equivalents

at end of period 5,037 3,640 3,812

----------------------------------- ---------------- ---------------- -------------

Comprising:

----------------------------------- ---------------- ---------------- -------------

Cash and cash equivalents 5,037 3,640 3,812

----------------------------------- ---------------- ---------------- -------------

Condensed Notes to the Financial Statements

31(st) December 2014

1. GENERAL INFORMATION

Animalcare Group plc ("the Company") is a company incorporated

in England and Wales under the Companies Act 2006 and is domiciled

in the United Kingdom. The condensed set of financial statements as

at, and for, the six months ended 31(st) December 2014 comprises

the Company and its subsidiaries (together referred to as the

"Group"). The nature of the Group's operations and its principal

activities are set out in the latest Annual Report.

This Interim Report does not constitute statutory accounts as

defined in Section 435 of the Companies Act 2006. The information

contained herein has not been reviewed by the Group's auditor.

The prior year comparatives are derived from the audited

financial information as set out in the Group's Annual Report for

the year ended 30(th) June 2014 and the unaudited financial

information in the Group's Interim Report for the six months ended

31(st) December 2013. The comparative figures for the financial

year ended 30(th) June 2014 are not the Group's statutory accounts.

Those accounts have been reported on by the Group's auditor and

delivered to the Registrar of Companies. The report of the auditor

was (i) unqualified, (ii) did not include any reference to matters

to which the auditors drew attention without qualifying their

report and (iii) did not contain a statement under section 498(2)

or (3) of the Companies Act 2006.

The Interim Report for the six months ended 31(st) December 2014

was approved by the Board of Directors and authorised for issue on

24(th) February 2015.

2. SIGNIFICANT ACCOUNTING POLICIES

Basis of preparation and accounting policies

Except as described below, the condensed consolidated interim

financial information for the six months ended 31(st) December 2014

has been prepared using accounting policies consistent with those

of the Company's annual accounts for the year ended 30(th) June

2014, which were prepared in accordance with IFRSs as adopted by

the European Union.

Taxes on income in the interim periods are accrued using the

estimated tax rate that would be applicable for the full financial

year.

The following new standards and amendments are mandatory for the

first time for the financial period beginning 1(st) July 2014:

IFRS 10: Consolidated Financial Statements

IFRS 12: Disclosure of Interest in Other Entities

Amendments to IFRS 13: Fair value measurement

IAS 27(Amended): Separate Financial Statements

Amendments to IAS32: Financial Instruments: Disclosures -

Offsetting Financial Assets and Liabilities

Amendments to IAS 36: Recoverable Amount Disclosures for

non-Financial Assets

Amendments to IAS 39: Novation of Derivatives and Continuation

of Hedge Accounting

Adoption where applicable has not had a material effect on the

Group's financial information.

Going concern

The principal risks and uncertainties facing the Group remain

those set out in the latest Annual Report.

For the purposes of their assessment of the appropriateness of

the preparation of the interim financial information on a going

concern basis, the Directors have considered the current cash

position and forecasts of future trading including working capital

and investment requirements.

During the period the Group met its day-to-day general corporate

and working capital requirements through existing cash resources.

At 31(st) December 2014 the Group had cash on hand of GBP5.0

million (30(th) June 2014: GBP3.8 million).

The Group's forecasts and projections, taking account of

reasonable possible changes in trading performance, show that the

Group should have sufficient cash resources to meet its

requirements for at least the next 12 months. Accordingly, the

adoption of the going concern basis in preparing the interim

financial information remains appropriate.

3. EXCEPTIONAL AND OTHER ITEMS

Six months ended 31(st) December 2014

6 months ended 6 months ended Year ended

31(st) December 31(st) December 30(th) June 2014

2014 Unaudited 2013 Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------- ---------------- ---------------- -----------------

Amortisation of acquired

intangible assets 59 59 119

----------------------------- ---------------- ---------------- -----------------

Supplier legal dispute (10) - -

----------------------------- ---------------- ---------------- -----------------

Interest rate swap refund (18)

----------------------------- ---------------- ---------------- -----------------

Fair value movements

on foreign currency hedging 17 14 38

----------------------------- ---------------- ---------------- -----------------

Total exceptional and

other items 48 73 157

----------------------------- ---------------- ---------------- -----------------

4. REVENUE AND OPERATING SEGMENTS

During the period, the principal activity of the Group was the

supply and distribution of veterinary medicines, identification and

other products for companion animals.

The Chief Operating Decision Maker ("CODM") is considered to be

the Chief Executive Officer of Animalcare Group plc. Performance

assessment is principally based on underlying operating profit. The

Group solely comprises one reportable segment, being Companion

Animal.

An analysis of revenue by product group is disclosed within the

Business Review.

5. DIVIDENDS

6 months ended 6 months ended Year ended

31(st) December 31(st) December 30(th) June 2014

2014 Unaudited 2013 Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------- ---------------- ---------------- -----------------

Ordinary final dividend

paid for the year ended

30(th) June 2013 of

3.8p per share - 788 788

-------------------------- ---------------- ---------------- -----------------

Ordinary interim dividend

paid for the year ended

30(th) June 2014 of 1.5p

per share - - 315

-------------------------- ---------------- ---------------- -----------------

Ordinary final dividend

paid for the year ended

30(th) June 2014 of

4.0p per share 834 - -

-------------------------- ---------------- ---------------- -----------------

834 788 1,103

-------------------------- ---------------- ---------------- -----------------

The interim dividend was approved by the Board of Directors on

24(th) February 2015 and has not been included as a liability as at

31(st) December 2014.

6. EARNINGS PER SHARE

Basic earnings per share amounts are calculated by dividing the

total comprehensive income for the period attributable to ordinary

equity holders of the Company by the weighted average number of

fully paid ordinary shares outstanding during the period.

The dilutive effect of share options is calculated by adjusting

the weighted average number of ordinary shares outstanding to

assume conversion of all dilutive potential ordinary shares from

the start of the period. The only dilutive potential ordinary

shares of the Company are share options.

The following income and share data was used in the earnings per

share computations:

6 months 6 months

ended 31(st) 6 months Year ended ended 31(st) 6 months Year ended

December ended 31(st) 30th June December ended 31(st) 30(th) June

2014 December 2014 2014 December 2014

Unaudited 2013 Unaudited Audited Unaudited 2013 Unaudited Audited

--------------------- ------------- --------------- ---------- -------------- --------------- --------------

Underlying Underlying Underlying

earnings earnings earnings Total earnings Total earnings Total earnings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ------------- --------------- ---------- -------------- --------------- --------------

Total comprehensive

income attributable

to equity holders

of the Company 1,429 1,144 2,259 1,391 1,087 2,137

--------------------- ------------- --------------- ---------- -------------- --------------- --------------

No. No. No. No. No. No.

--------------------- ------------- --------------- ---------- -------------- --------------- --------------

Basic weighted

average number

of shares 20,962,390 20,746,630 20,824,931 20,962,390 20,746,630 20,824,931

--------------------- ------------- --------------- ---------- -------------- --------------- --------------

Dilutive potential

ordinary shares 16,222 226,725 126,980 16,222 226,725 126,590

--------------------- ------------- --------------- ---------- -------------- --------------- --------------

Fully diluted

weighted average

number of shares 20,978,612 20,973,361 20,951,911 20,978,612 20,973,361 20,951,911

--------------------- ------------- --------------- ---------- -------------- --------------- --------------

Total earnings

per share:

--------------------- ------------- --------------- ---------- -------------- --------------- --------------

Basic 6.8p 5.5p 10.8p 6.6p 5.2p 10.3p

--------------------- ------------- --------------- ---------- -------------- --------------- --------------

Fully diluted 6.8p 5.5p 10.48 6.6p 5.2p 10.2p

--------------------- ------------- --------------- ---------- -------------- --------------- --------------

7. CAUTIONARY STATEMENT

This Interim Management Report ("IMR") consists of the

Chairman's Statement and the Operational and Financial Review,

which have been prepared solely to provide additional information

to shareholders to assess the Group's strategies and the potential

for those strategies to succeed. The IMR should not be relied upon

by any other party or for any other purpose.

The IMR contains a number of forward looking statements. These

statements are made by the Directors in good faith based upon the

information available to them up to the time of their approval of

this report and such statements should be treated with caution due

to the inherent uncertainties, including both economic and business

risk factors, underlying any such forward looking information.

This IMR has been prepared for the Group as a whole and

therefore emphasises those matters which are significant to

Animalcare Group plc and its subsidiaries when viewed as a

whole.

8. INTERIM REPORT

The Group's Interim Report for the six months ended 31st

December 2014 was approved and authorised for issue on 24th

February 2015 and is expected to be posted to shareholders during

the week commencing 23rd February 2015. Further copies will be

available to download on the Company's website at:

www.animalcaregroup.co.uk and will also be available from the

Company's head office at 10 Great North Way, York Business Park,

Nether Poppleton, York, YO26 6RB.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PGUBCPUPAGMW

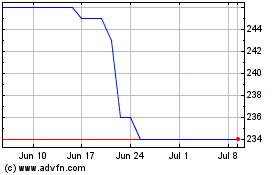

Animalcare (LSE:ANCR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Animalcare (LSE:ANCR)

Historical Stock Chart

From Apr 2023 to Apr 2024