AngloGold Ashanti Pushed to Loss by Low Gold Prices

November 09 2015 - 3:10AM

Dow Jones News

AngloGold Ashanti Ltd. reported a loss of $72 million in the

three months ending Sept. 30, compared with a profit of $41 million

a year ago, missing expectations as low gold prices continued to

challenge the world's No. 3 producer of the precious metal.

The Johannesburg-based mining company reported a 22% drop in

revenue to $987 million, beating expectations of a 29% slide in the

quarter.

As miners have had to dig ever deeper to reach South Africa's

gold deposits, massive cost increases including labor and

electricity have hit profitability as gold prices have tumbled in

the global market. AngloGold has cut overhead expenditure by more

than two-thirds since the end of 2012 to combat gold prices, which

are down more than 40% from 2011 highs above $1,900 an ounce. The

company received an average price of $1,123 an ounce, down 12% from

$1,281 a year earlier.

The company's huge net debt fell by 25% from the previous

quarter to $2.32 billion, mainly due to proceeds from the sale of

the company's Colorado gold mine, Cripple Creek & Victor.

A joint venture to develop and operate the company's Obuasi mine

in Ghana with Randgold Resources Ltd. could help reduce that debt

further. "We're working hard to consummate the JV early next year,"

Srinivasan Venkatakrishnan, the company's chief executive, said

Monday.

AngloGold produced 955,000 ounces of gold from continuing

operations during the three months ended Sept. 30, down 11% from

the same period a year earlier, but up 0.5% from the second quarter

of 2015. All-in sustaining costs dropped 9.4% from a year earlier

to $937 an ounce. The company also lowered its guidance for its

2015 all-in sustaining costs from $1,000 to $1,050 an ounce to

between $950 and $980 an ounce.

"These results show relentless cost discipline and continued

delivery on our strategic commitments," Mr. Venkatakrishnan

said.

AngloGold also managed to reach a three-year wage deal in

October with the majority of its workers' unions, concluding

contentious four-month negotiations and effectively eliminating the

chance of a strike.

After plunging as much as 27% year-to-date in August,

AngloGold's shares are currently trading down 3.8% year-to-date on

the Johannesburg Stock Exchange.

Write to Alexandra Wexler at alexandra.wexler@wsj.com

Access Investor Kit for "Randgold Resources Ltd."

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=GB00B01C3S32

Access Investor Kit for "Randgold Resources Ltd."

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US7523443098

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 09, 2015 02:55 ET (07:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

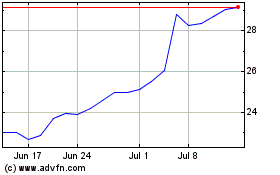

AngloGold Ashanti (NYSE:AU)

Historical Stock Chart

From Mar 2024 to Apr 2024

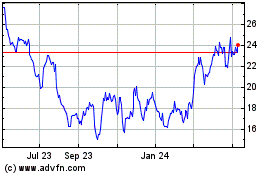

AngloGold Ashanti (NYSE:AU)

Historical Stock Chart

From Apr 2023 to Apr 2024