TIDMAPF

RNS Number : 9102F

Anglo Pacific Group PLC

26 February 2015

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN ARE NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN OR INTO THE UNITED STATES, AUSTRALIA, JAPAN, JERSEY, SOUTH

AFRICA, NEW ZEALAND OR ANY JURISDICTION IN WHICH THE SAME WOULD BE

UNLAWFUL. THIS ANNOUNCEMENT IS NOT AN OFFER OF SECURITIES IN THE

UNITED STATES, CANADA, SOUTH AFRICA, AUSTRALIA, JAPAN, JERSEY OR

ANY JURISDICTION IN WHICH THE SAME WOULD BE UNLAWFUL.

This Announcement is an advertisement and not a prospectus or a

prospectus equivalent document and does not constitute or form part

of, and should not be construed as, any offer for sale or

subscription of, or solicitation of any offer to buy or subscribe

for, any shares in Anglo Pacific Group PLC or securities in any

other entity, in any jurisdiction, including the United States, nor

shall it, or any part of it, or the fact of its distribution, form

the basis of, or be relied on in connection with, any contract or

investment decision whatsoever, in any jurisdiction. This

Announcement is for information only and does not constitute a

recommendation regarding any securities. Any investment decision

must be made exclusively on the basis of the final prospectus

published by the Company (incorporating a circular for the purposes

of the Listing Rules of the UK Listing Authority) (the " Prospectus

") and any supplement thereto in connection with the admission of

New Ordinary Shares of the Company to the premium segment of the

Official List of the UK Listing Authority and to trading on the

London Stock Exchange's main market for listed securities. Copies

of the Prospectus are available from the Company's registered

office.

News Release

February 26, 2015

Anglo Pacific Group PLC

Results of Open Offer

Further to the announcement by Anglo Pacific Group PLC ("Anglo

Pacific", the "Company") (LSE: APF, TSX: APY) on February 6, 2015,

Anglo Pacific is pleased to announce that it has received valid

acceptances in respect of 15,460,557 New Ordinary Shares from

existing Qualifying Shareholders raising gross proceeds of

approximately GBP12.4 million. This represents approximately 68 per

cent of the maximum New Ordinary Shares available under the Open

Offer. Qualifying Shareholders who have validly applied for New

Ordinary Shares will receive their full Open Offer entitlement.

The 7,164,443 Open Offer Shares not applied for by Qualifying

Shareholders under the Open Offer will be taken up by Placees under

the terms of the Placing.

The Placing and Open Offer, together with the Firm Placing and

Acquisition, remain conditional upon the passing of the Resolutions

at the General Meeting of the Company to be held at 10:30 a.m. on

February 26, 2015.

Application has been made for the 49,375,000 New Ordinary Shares

to be admitted to the premium segment of the Official List and to

trading on the London Stock Exchange's main market for listed

securities and to be listed on the Toronto Stock Exchange. It is

expected that Admission will become effective at 8:00 a.m. on

February 27, 2015 on the London Stock Exchange's main market for

Listed Securities and at market open on February 27, 2015 on the

Toronto Stock Exchange.

The New Ordinary Shares to be issued pursuant to the Firm

Placing and Placing and Open Offer will, following Admission, rank

pari passu in all respects with the Existing Ordinary Shares and

will carry the right to receive all dividends and distributions

declared, made or paid on or in respect of the Ordinary Shares

after Admission.

The expected date of completion of the Acquisition is March 5,

2015. Application will made for the 4,135,238 Acquisition Shares to

be admitted to the premium segment of the Official List and to

trading on the London Stock Exchange's main market for listed

securities and to be listed on the Toronto Stock Exchange, such

admission being expected at 8:00 a.m. on March 6, 2015 on the

London Stock Exchange's main market for Listed Securities and at

market open on March 6, 2015 on the Toronto Stock Exchange. The

Acquisition Shares, when issued and fully paid, will rank pari

passu in all respects with the Existing Ordinary Shares.

Upon admission of the New Ordinary Shares and following

admission of the Acquisition Shares and assuming no further

exercise of options under the Share Schemes, the total issued share

capital is expected to be 169,942,034 Ordinary Shares and this

figure may be used by Shareholders as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change to, their interest in the

Company under the Disclosure and Transparency Rules of the

Financial Conduct Authority.

Capitalised terms used, but not defined, in this announcement,

have the same meanings as set out in the announcement released by

the Company on February 4, 2015 in relation to the Firm Placing,

Placing and Open Offer.

BMO Capital Markets Limited and Macquarie Capital (Europe)

Limited are acting as joint bookrunners in connection with the Firm

Placing, Placing and Open Offer and Shard Capital Partners LLP is

acting as Co-Manager.

For further information:

Anglo Pacific Group PLC +44 (0) 20 3435 7400

Julian Treger - Chief Executive

Officer

Mark Potter - Chief Investment

Officer

Website: www.anglopacificgroup.com

BMO Capital Markets Limited -

Sponsor and Joint Bookrunner +44 (0) 20 7664 8020

Jeffrey Couch / Neil Haycock /

Tom Rider / Jenny Wyllie

Macquarie Capital (Europe) Limited

- Joint Bookrunner +44 (0) 20 3037 2000

Raj Khatri / Ken Fleming / Fergus Marcroft

/ Nicholas Harland / Ariel Tepperman

Shard Capital Partners LLP - Co-Manager +44 (0) 20 3463 4970

Katrina Damouni / Damon Heath

/ Gareth Burchell

Bell Pottinger +44 (0) 20 3772 2500

Nick Lambert / Lorna Cobbett

About the Company

Anglo Pacific is a global natural resources royalty company. The

Company's strategy is to develop a leading international

diversified royalty company with a portfolio centred on base metals

and bulk materials, focusing on accelerating income growth through

acquiring royalties on projects that are currently cash flow

generating or are expected to be within the next 24 months. It is a

continuing policy of the Company to pay a substantial portion of

these royalties to shareholders as dividends.

Disclaimer

This Announcement is for information only and is not for

release, publication or distribution, directly or indirectly, in or

into the United States, Australia, Japan, Jersey, South Africa, New

Zealand or any jurisdiction in or into which the same would be

unlawful. This Announcement is not an offer of securities in any

jurisdiction, including the United States, Canada, Australia,

Japan, Jersey or South Africa or any jurisdiction in which the same

would be unlawful. Any failure to comply with this restriction may

constitute a violation of the securities laws of such jurisdiction.

Persons needing advice should consult an independent financial

adviser.

This Announcement has been issued by and is the sole

responsibility of the Company. Save for the responsibilities and

liabilities, if any, of any of the Banks under FSMA or the

regulatory regime established thereunder, none of the Banks assumes

any responsibility whatsoever and the Banks make no representations

or warranties, express or implied, in relation to the contents of

this Announcement, including its accuracy, completeness or

verification or for any other statement made or purported to be

made by the Company, or on the Company's behalf, or by any of the

Banks, or on their behalf, and nothing contained in this

Announcement is, or shall be, relied on as a promise or

representation in this respect, whether as to the past or the

future, in connection with the Company, the Firm Placing, Placing,

Open Offer or the Acquisition. The Banks disclaim to the fullest

extent permitted by law all and any responsibility and liability

whether arising in tort, contract or otherwise which they might

otherwise be found to have in respect of this Announcement or any

such statement.

BMO, Macquarie Capital and Shard Capital, each of which is

authorised and regulated in the United Kingdom by the Financial

Conduct Authority, are acting exclusively for the Company and

no-one else in connection with the Firm Placing, Placing and Open

Offer and they will not be responsible to anyone other than the

Company for providing the protections afforded to their respective

clients or in relation to the contents of this Announcement or any

transaction or any other matters referred to herein nor for

providing advice in relation to the Firm Placing, Placing and Open

Offer.

The distribution of this Announcement and the proposed issue and

placing of the New Ordinary Shares pursuant to the Firm Placing,

Placing and Open Offer as set out in this Announcement in certain

jurisdictions may be restricted by law. No action has been taken by

the Company or the Banks that would permit an offering of such

shares or possession or distribution of this Announcement or any

other offering or publicity material relating to such shares in any

jurisdiction where action for that purpose is required. Any failure

to comply with these restrictions may constitute a violation of the

securities laws of such jurisdiction. Persons into whose possession

this Announcement comes are required by the Company and the Banks

to inform themselves about, and to observe, such restrictions.

This Announcement is not being distributed by, nor has it been

approved for the purposes of section 21 FSMA by, a person

authorised under FSMA. This Announcement is being distributed and

communicated to persons in the UK only in circumstances in which

section 21(1) of FSMA does not apply.

The New Ordinary Shares have not been and will not be registered

under the U.S. Securities Act of 1933 (the "Securities Act") or

under any securities laws of any state or other jurisdiction of the

United States. The New Ordinary Shares may not be offered or sold

in the United States except pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act and in compliance with any applicable state

securities laws. There will be no public offer of securities in the

United States.

This Announcement may not be and must not be acted on or relied

on by a Canadian purchaser and this Announcement does not itself

constitute an offer to sell any New Ordinary Shares in, or to any

person subject to, the laws of Canada. This Announcement is being

sent into Canada only for information and does not constitute an

offer to sell, or a solicitation of an offer to buy, New Ordinary

Shares to or from a person in Canada.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this Announcement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ROITAMJTMBITTJA

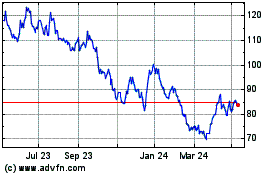

Ecora Resources (LSE:ECOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

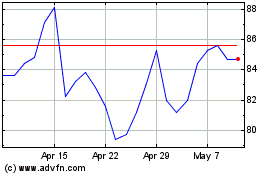

Ecora Resources (LSE:ECOR)

Historical Stock Chart

From Apr 2023 to Apr 2024