TIDMAPF

RNS Number : 9858F

Anglo Pacific Group PLC

26 February 2015

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN ARE NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN OR INTO THE UNITED STATES, AUSTRALIA, JAPAN, JERSEY, SOUTH

AFRICA, NEW ZEALAND OR ANY JURISDICTION IN WHICH THE SAME WOULD BE

UNLAWFUL. THIS ANNOUNCEMENT IS NOT AN OFFER OF SECURITIES IN THE

UNITED STATES, CANADA, SOUTH AFRICA, AUSTRALIA, JAPAN, JERSEY OR

ANY JURISDICTION IN WHICH THE SAME WOULD BE UNLAWFUL.

This Announcement is an advertisement and not a prospectus or a

prospectus equivalent document and does not constitute or form part

of, and should not be construed as, any offer for sale or

subscription of, or solicitation of any offer to buy or subscribe

for, any shares in Anglo Pacific Group PLC or securities in any

other entity, in any jurisdiction, including the United States, nor

shall it, or any part of it, or the fact of its distribution, form

the basis of, or be relied on in connection with, any contract or

investment decision whatsoever, in any jurisdiction. This

Announcement is for information only and does not constitute a

recommendation regarding any securities. Any investment decision

must be made exclusively on the basis of the final prospectus

published by the Company (incorporating a circular for the purposes

of the Listing Rules of the UK Listing Authority) (the

"Prospectus") and any supplement thereto in connection with the

admission of New Ordinary Shares of the Company to the premium

segment of the Official List of the UK Listing Authority and to

trading on the London Stock Exchange's main market for listed

securities. Copies of the Prospectus are available from the

Company's registered office.

News Release

February 26, 2015

Anglo Pacific Group PLC

Results of General Meeting

Anglo Pacific Group PLC ("Anglo Pacific", the "Company") (LSE:

APF, TSX: APY) is pleased to announce that at the General Meeting

held earlier today, the resolutions proposed in connection with the

Proposed Acquisition and Firm Placing and Placing and Open Offer

were duly passed on a show of hands. Resolution 3 was passed as a

special resolution.

In accordance with Listing Rule 9.6.2, a copy of the resolutions

will shortly be submitted to the National Storage Mechanism, and

will be available for inspection at

www.morningstar.co.uk/uk/NSM.

The full text of all the resolutions passed at the meeting can

be found in the Notice of General Meeting, which is available for

inspection in the Prospectus at www.morningstar.co.uk/uk/NSM and on

the Company's website by pasting the following URL into the address

bar of your browser: www.anglopacificgroup.com/investors.php.

Full details of the proxy voting will also be available on the

Company's website later today by pasting the following URL into the

address bar of your browser:

http://anglopacificgroup.com/pdf/150226-EGMVotingResults.pdf.

Application has been made for the 49,375,000 New Ordinary Shares

to be admitted to the premium segment of the Official List and to

trading on the London Stock Exchange's main market for listed

securities and to be listed on the Toronto Stock Exchange, such

admission being expected at 8:00 a.m. on February 27, 2015 on the

London Stock Exchange's main market for Listed Securities and at

market open on February 27, 2015 on the Toronto Stock Exchange. The

New Ordinary Shares, when issued and fully paid, will rank pari

passu in all respects with the Existing Ordinary Shares.

The following table sets out the shareholdings and percentage

interests in the issued share capital of the Company of the

Directors, persons discharging managerial responsibilities

("PDMRs") and their connected persons following admission of the

New Ordinary Shares and the Acquisition Shares, including shares

taken up in the Open Offer (but excluding outstanding awards under

the Company Share Option Plan, Joint Share Ownership Plan and Value

Creation Plan):

Name of Number of Percentage Number of Percentage

Director/PDMR Ordinary of Existing Ordinary of total

Shares prior Ordinary Shares immediately issued share

to admission Shares following capital(1)

admission(1)

Julian Treger 1,199,389 1.03% 5,391,454 3.17%

Bob Stan - - 73,540 0.04%

Mark Potter 100,000 0.09% 121,473 0.07%

Mike Blyth 20,600 0.02% 61,372 0.04%

Anthony

Yadgaroff 180,501 0.16% 180,501 0.11%

Rachel Rhodes - - - -

David Archer - - - -

Kevin Flynn 2,000 0.00% 2,388 0.00%

Peter Mason 1,192 0.00% 1,423 0.00%

(1)Post admission of New Ordinary Shares and Acquisition

Shares

The expected date of completion of the Acquisition is March 5,

2015. Application has been made for the 4,135,238 Acquisition

Shares to be admitted to the premium segment of the Official List

and to trading on the London Stock Exchange's main market for

listed securities and to be listed on the Toronto Stock Exchange,

such admission being expected at 8:00 a.m. on March 6, 2015 on the

London Stock Exchange's main market for Listed Securities and at

market open on March 6, 2015 on the Toronto Stock Exchange. The

Acquisition Shares, when issued and fully paid, will rank pari

passu in all respects with the Existing Ordinary Shares.

Upon admission of the New Ordinary Shares, assuming no further

exercise of options under the Share Schemes, the total issued share

capital is expected to be 165,806,796 Ordinary Shares. Following

admission of the Acquisition Shares, assuming no further exercise

of options under the Share Schemes, the total issued share capital

is expected to be 169,942,034. These figures may be used by

Shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to, their interest in the Company under the Disclosure and

Transparency Rules of the Financial Conduct Authority.

Capitalised terms used, but not defined, in this announcement,

have the same meanings as set out in the announcement released by

the Company on February 4, 2015 in relation to the Firm Placing,

Placing and Open Offer.

BMO Capital Markets Limited and Macquarie Capital (Europe)

Limited are acting as joint bookrunners in connection with the Firm

Placing, Placing and Open Offer and Shard Capital Partners LLP is

acting as Co-Manager.

For further information:

Anglo Pacific Group PLC +44 (0) 20 3435 7400

Julian Treger - Chief Executive

Officer

Mark Potter - Chief Investment

Officer

Website: www.anglopacificgroup.com

BMO Capital Markets Limited -

Sponsor and Joint Bookrunner +44 (0) 20 7664 8020

Jeffrey Couch / Neil Haycock /

Tom Rider / Jenny Wyllie

Macquarie Capital (Europe) Limited

- Joint Bookrunner +44 (0) 20 3037 2000

Raj Khatri / Ken Fleming / Fergus Marcroft

/ Nicholas Harland / Ariel Tepperman

Shard Capital Partners LLP - Co-Manager +44 (0) 20 3463 4970

Katrina Damouni / Damon Heath

/ Gareth Burchell

Bell Pottinger +44 (0) 20 3772 2500

Nick Lambert / Lorna Cobbett

About the Company

Anglo Pacific is a global natural resources royalty company. The

Company's strategy is to develop a leading international

diversified royalty company with a portfolio centred on base metals

and bulk materials, focusing on accelerating income growth through

acquiring royalties on projects that are currently cash flow

generating or are expected to be within the next 24 months. It is a

continuing policy of the Company to pay a substantial portion of

these royalties to shareholders as dividends.

Disclaimer

This Announcement is for information only and is not for

release, publication or distribution, directly or indirectly, in or

into the United States, Australia, Japan, Jersey, South Africa, New

Zealand or any jurisdiction in or into which the same would be

unlawful. This Announcement is not an offer of securities in any

jurisdiction, including the United States, Canada, Australia,

Japan, Jersey or South Africa or any jurisdiction in which the same

would be unlawful. Any failure to comply with this restriction may

constitute a violation of the securities laws of such jurisdiction.

Persons needing advice should consult an independent financial

adviser.

This Announcement has been issued by and is the sole

responsibility of the Company. Save for the responsibilities and

liabilities, if any, of any of the Banks under FSMA or the

regulatory regime established thereunder, none of the Banks assumes

any responsibility whatsoever and the Banks make no representations

or warranties, express or implied, in relation to the contents of

this Announcement, including its accuracy, completeness or

verification or for any other statement made or purported to be

made by the Company, or on the Company's behalf, or by any of the

Banks, or on their behalf, and nothing contained in this

Announcement is, or shall be, relied on as a promise or

representation in this respect, whether as to the past or the

future, in connection with the Company, the Firm Placing, Placing,

Open Offer or the Acquisition. The Banks disclaim to the fullest

extent permitted by law all and any responsibility and liability

whether arising in tort, contract or otherwise which they might

otherwise be found to have in respect of this Announcement or any

such statement.

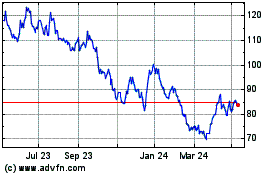

Ecora Resources (LSE:ECOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

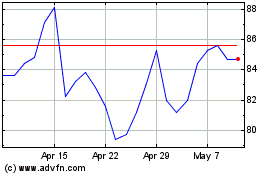

Ecora Resources (LSE:ECOR)

Historical Stock Chart

From Apr 2023 to Apr 2024