TIDMAPF

RNS Number : 0224H

Anglo Pacific Group PLC

26 November 2015

News Release

November 26, 2015

Anglo Pacific Group PLC

Q3 2015 Trading Update

Anglo Pacific Group PLC ("Anglo Pacific", the "Company" or the

"Group") (LSE: APF, TSX: APY), the London and Toronto listed

royalty company, issues the following trading update for the period

July 1, 2015 to November 25, 2015. Unless otherwise stated, all

unaudited financial information is for the quarter ended September

30, 2015.

Highlights

-- Royalty related income of GBP1.9m in Q3 2015 (Q3 2014:

GBP0.5m) despite headwinds in the price of commodities

-- Royalty related income of GBP5.7m for the nine months ended

September 30, 2015 (nine months ended September 30, 2014: GBP3.0m;

and FY2014: GBP3.5m)

-- Successful completion of longwall changeouts at both Kestrel

and Narrabri in the period, leaving full year production targets

unchanged

-- Positive developments for the Group's Narrabri and Salamanca

royalties

-- Cash and cash equivalents of GBP3.6m as at September 30, 2015

(June 30, 2015: GBP4.0m)

-- Total quoted equity interests valued at GBP7.4m as at

September 30, 2015 (June 30, 2015: GBP6.5m)

-- Borrowings of GBP8.6m as at September 30, 2015 (June 30,

2015: GBP2.6m)

-- Net assets of GBP161.4m at September 30, 2015 (June 30, 2015:

GBP171.0m)

Julian Treger, Chief Executive Officer of the Company,

commented:

"We are pleased to build on the half year performance and report

a significant increase in royalty income compared to the third

quarter of last year. The increase in the Group's royalty income is

largely due to the royalty income received from the Narrabri

royalty, acquired in the first half of the year, and has been

achieved in a period where commodity prices have remained under

significant pressure.

With longwall changeouts successfully completed at both Kestrel

and Narrabri, we are expecting a strong finish to 2015. There have

also been additional positive developments at our Narrabri and

Salamanca royalties following the end of the quarter, which have

the potential to significantly enhance our near term royalty

flows.

Our move to the standard listing on the Main Market creates

greater flexibility as we continue to grow the business, whilst

still providing shareholders with a high level of protection. We

continue to work hard to identify and appraise new royalty

opportunities which will complement our existing portfolio and

further the considerable progress we have made this year."

Portfolio update

Planned longwall changeouts at both Kestrel and Narrabri

impacted production at the Group's two main royalties in the third

quarter. Both changeouts completed on time and will therefore not

impact total expected production and income for the year. Anglo

Pacific's guidance in relation to production at Kestrel within the

Group's royalty land remains unchanged.

Significant news followed the quarter ended September 30, 2015

with the positive updates from Berkeley Energy, which continues to

make exceptional progress at its Salamanca Project, suggesting

potential upside for both Anglo Pacific's royalty and equity

interests. In addition, Whitehaven Coal announced that they are to

apply for consent to mine up to 11Mtpa of coal at Narrabri, a large

increase to the current permitted levels of production (8Mtpa),

which has the potential to significantly enhance the Group's near

term royalty flows.

Kestrel

In line with Anglo Pacific's expectations, Rio Tinto announced

Kestrel Mine Q3 2015 production of 0.54 Mt of hard coking coal and

0.11 Mt of thermal coal run of mine ("ROM") compared to 0.94 Mt of

hard coking coal and 0.18 Mt of thermal coal during Q2 2015.

Production rates at Kestrel were lower during Q3 2015 due to the

planned longwall changeout which was announced by Rio Tinto in its

Half Year Results 2015. The longwall changeout has not affected

Anglo Pacific's H2 2015 guidance range of 70% to 75% of production

within Anglo Pacific's royalty area.

Anglo Pacific expects total production at the Kestrel Mine to

recover during Q4 2015 as production rates continue to improve

towards nameplate longwall capacity of around 6Mtpa.

On November 16, 2015 several Australian media publications

reported that Rio Tinto had applied for an extension of their

mining licence at Kestrel. As part of this application, Rio Tinto

was reported to have told the Australian federal government that it

would close the Kestrel Mine if the application was refused. The

Group has reviewed the Rio Tinto application in detail and believes

that it is part of the normal permitting process for an extension

of the existing mining licence to cover the full extent of the mine

plan.

The application for licence extension relates to the 500 series

longwall panels which are due to be mined at the back end of its

expected mine life and are largely outside of the Anglo Pacific

royalty area. Rio Tinto has not commented on the timing of any

closure, and the Company does not believe this would occur before

the completion of any permitted Reserves in the current mine

schedule. The Group believes this will have little or no impact on

its Kestrel royalty.

Narrabri

During the third quarter, Whitehaven Coal announced that a

planned longwall changeout was successfully completed at Narrabri.

ROM coal production for the quarter was 1.0 Mt, down 52% compared

to 2.1 Mt in the quarter ended September 30, 2014. Narrabri

production was impacted by the scheduled longwall changeout,

therefore quarterly production is not fully comparable with the

same quarter of the previous year, during which no longwall

changeout occurred. Saleable coal production for the quarter was

1.6 Mt, with coal sales of 1.6 Mt. The sale of coal inventories

resulted in coal sales exceeding ROM coal production.

On October 30, 2015, Whitehaven Coal announced that it was

seeking approval for an 11Mtpa production limit at the Narrabri

Mine. If granted, this has the potential to lead to significantly

increased production at the mine, ahead of the levels of annual

production included in the Group's calculations at the time it

acquired the royalty. The acceleration of production is one source

of additional value which the Group seeks as part of any royalty

acquisition and it is encouraging that Narrabri is outperforming

the Group's expectations at current and planned future production

levels.

EVBC

EVBC continues to produce at a steady rate for the Group. On

November 13, 2015 Orvana Minerals announced that they had met their

updated 2015 production guidance with 53,733 ounces of gold, a

decrease in production of 14.5% compared to FY 2014. Orvana noted

that the weaker Euro had impacted positively on their costs.

Maracás

The Group's royalty income has been impacted by the decline in

the vanadium pentoxide price throughout 2015, which has now dropped

to $2.40 per pound. In spite of this, production at the mine

continues to ramp up, and Largo Resources announced that they

achieved a production record of 110% of nameplate capacity for a

short period in August. Although operating costs continue to fall,

and should fall further as production increases, these remain above

the current vanadium price.

Salamanca

Anglo Pacific is encouraged by Berkeley Energy's decision, as

published on November 4, 2015, to accelerate the development of the

Salamanca Project, with site works now expected to commence in

mid-2016. This, combined with the longer mine life, increased grade

and a higher uranium production profile, should considerably

increase the potential value of the Group's Salamanca royalty, well

in excess of the current carrying value of AUD$4m.

Berkeley Energy noted that the inclusion of the Zona 7 deposit

into the wider Salamanca Project (which previously only included

the Retortillo and Alameda deposits) transformed the project

economics, with a stated net present value of US$871.3m and an IRR

of 93.3% over a mine life of 18 years.

In addition to holding a 1% Net Smelter Royalty covering all

production from Berkeley Energy's Spanish and Portuguese assets,

the Group also has a 16.75% disclosed equity interest in Berkeley

Energy, which has increased in value throughout 2015. At September

30, 2015 this was carried on the Balance Sheet at GBP6.1m, and the

share price has further increased in value by 12% since.

Royalty income

A key part of the Group's strategy is to diversify its sources

of royalty income. The Group has gone someway to achieving this

strategy through its acquisition of the Narrabri royalty, which

generated royalty related income of GBP2.5m, representing 44% of

the Group's total royalty related income of GBP5.7m for the nine

months ended September 30, 2015 (September 30, 2014: GBP3.0m).

Anglo Pacific is encouraged that royalty income for 2015 will be

considerably higher than that received in 2014 which, the Company

believes, represented a low point for its royalty income.

Standard listing

In October the Company completed its planned transition from the

premium to the standard segment of the Main Market of the London

Stock Exchange. The transfer was a result of ongoing discussions

with the UK Listing Authority in relation to the appropriate

categorisation of the Company under the Listing Rules with respect

to technical considerations related to the Company's royalty

business model. After careful consideration of the alternative

listing regimes available to the Company, the Board concluded that

remaining on the Official List with a standard listing would be the

most appropriate listing category.

The move creates greater flexibility as the Group continues to

grow the business, whilst still providing shareholders with a high

standard of protection as a London listed company. The Company

retains its TSX listing.

Financial position

(MORE TO FOLLOW) Dow Jones Newswires

November 26, 2015 02:02 ET (07:02 GMT)

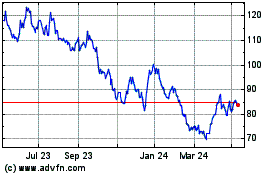

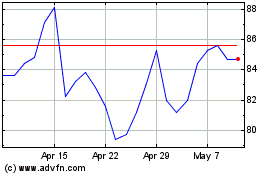

Ecora Resources (LSE:ECOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ecora Resources (LSE:ECOR)

Historical Stock Chart

From Apr 2023 to Apr 2024