Anglo-Eastern Plantations PLC Interim Management Statement (6957Y)

May 19 2016 - 2:02AM

UK Regulatory

TIDMAEP

RNS Number : 6957Y

Anglo-Eastern Plantations PLC

19 May 2016

19 May 2016

Anglo-Eastern Plantations Plc

("AEP", "Group" or "Company")

Interim Management Statement

Anglo-Eastern Plantations Plc and its subsidiaries, which owns,

operates and develops plantations in Indonesia and Malaysia,

amounting to some 128,600 hectares producing mainly palm oil and

some rubber of which approximately 65,200 hectares (including

Plasma) are planted, today announces its Interim Management

Statement in respect of the period since 31 December 2015.

Operational and financial performance

For the first three months ended 31 March 2016, our own

production of fresh fruit bunches ("FFB") was 187,000mt, an

increase of 9% compared to the same period in 2015 (3M15:

172,200mt). Increased production was in line with higher matured

planting from the Kalimantan plantations. FFB bought-in was

110,800mt, which represents a decrease of 13% in comparison with

the same period in 2015 (3M15: 127,900mt). Total Crude Palm Oil

("CPO") produced was 63,200mt, 9% higher than the corresponding

period in 2015 (3M15: 58,200mt) due to better oil extraction

rate.

CPO CIF Rotterdam price averaged $630/mt for the first three

months to 31 March 2016. This represents a decrease of 6% from the

average price of $669/mt recorded in the first quarter of 2015 but

is above $560/mt being the price at the start of 2016.

The Group's balance sheet remains strong with the Company

continuing to generate positive cash flow. The Company's Long Term

Development Loans totalled $35.8m as at 31 March 2016 (31 March

2015: $34.9m). The increase is due to a loan drawdown in February

2016. The Group has net cash of $67.3m as at 31 March 2016.

Development

The Group's new planting for the three months ended 31 March

2016 totalled 186 hectares. As reported previously this was

primarily due to delays in settlement with the villagers for land

compensation payments. These negotiations are continuing and

management is confident that some of these negotiations will be

concluded successfully. The replanting of circa 1,500 hectares in

North Sumatera will start in the second quarter of 2016 and should

be completed by the year end.

The Biogas plant in Central Kalimantan is about 75% completed

and expected to be operational by the start of fourth quarter of

2016. Civil works for a third Biogas plant within the Group has

started in Bengkulu. This is in line with the Group's commitment to

reduce its carbon foot prints.

Outlook

The CPO CIF Rotterdam price started the year at $560/mt and has

been rising rapidly; it closed at $731/mt on 31 March 2016. The CPO

price is expected to remain strong until at least the end of June

2016 due to concerns over weaker CPO supply resulting from the

El-Nino effect and the heat wave experienced in Indonesia and

Malaysia.

The improving crude oil prices will also enhance the

competitiveness and development in biodiesel which will result in a

higher demand for CPO.

For further enquiry, contact:

Anglo-Eastern Plantations

Plc

Dato' John Lim Ewe Chuan +44 (0)20 7216 4621

Panmure Gordon

Andrew Godber +44 (0)20 7886 2500

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCKMGMKKLRGVZG

(END) Dow Jones Newswires

May 19, 2016 02:02 ET (06:02 GMT)

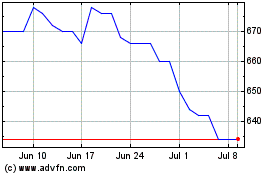

Anglo-eastern Plantations (LSE:AEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Anglo-eastern Plantations (LSE:AEP)

Historical Stock Chart

From Apr 2023 to Apr 2024