Anglo-Eastern Plantations PLC Interim Management Statement (2071O)

May 26 2015 - 4:48AM

UK Regulatory

TIDMAEP

RNS Number : 2071O

Anglo-Eastern Plantations PLC

26 May 2015

26 May 2015

Anglo-Eastern Plantations Plc

("AEP", "Group" or "Company")

Interim Management Statement

Anglo-Eastern Plantations Plc and its subsidiaries, which owns,

operates and develops plantations in Indonesia and Malaysia,

amounting to some 127,800 hectares producing mainly palm oil and

some rubber of which approximately 63,830 hectares are planted,

today announces its Interim Management Statement in respect of the

period since 31 December 2014.

Operational and financial performance

For the first three months ended 31 March 2015, our own

production of fresh fruit bunches ("FFB") was 172,200mt, a decrease

of 5% compared to the same period in 2014 (3M14: 180,630mt). FFB

bought-in was 127,900mt, which represents a decrease of 5% in

comparison with the same period in 2014 (3M14: 135,300mt). Total

Crude Palm Oil ("CPO") produced was 58,200mt, 9% lower than the

corresponding period in 2014 (3M14: 64,000mt).

CPO CIF Rotterdam price averaged $669/mt for the first three

months to 31 March 2015. This represents a decrease of 26% from the

average of $904/mt recorded in the first quarter of 2014 and is

within our expected price range of $600/mt to $800/mt for the first

half of 2015.

The Group's balance sheet remains strong with the Company

continuing to achieve positive cash flow generation. The Company's

Long Term Development Loans totalled $34.9m as at 31 March 2015

(3M14: $35.0m). The decrease was due to repayment of loans.

Development

New planting by the Group for the first three months ended 31

March 2015 was 356 hectares (3M14: 427 hectares). As indicated in

the preliminary announcement on 30 April 2015, new plantings remain

behind schedule due to delays in finalising settlement of land

compensation with villagers in Bengkulu, Bangka and Kalimantan. The

villagers seek compensation beyond what the Group considered fair

and reasonable resulting in protracted negotiations.

The mill construction in Central Kalimantan is progressing on

schedule. This mill with an initial capacity of 45mt/hr is expected

to be operational by the end of second quarter of 2015.

Outlook

The CPO price closed at $655/mt in mid-May 2015, representing a

7% decrease from the start of the year. The Australian Bureau of

Meteorology has recently predicted a moderate-to-strong El Nino

with increased intensify from September 2015. It reported that it

is likely to create drier conditions in Indonesia and parts of

South East Asia. Historically El Nino will result in lower rainfall

in palm oil producing regions which would result in lower CPO

inventory and lead to higher CPO prices. Nevertheless its effect,

if any, is likely to be felt post 2015.

In the near term, the upside on CPO price may be limited in view

of seasonally higher production and high stockpiles. The Board

remains cautious but expects profitability and cash flow to remain

in line with management forecasts for 2015.

For further enquiry, contact:

Anglo-Eastern Plantations Plc

Dato' John Lim Ewe Chuan +44 (0)20 7216 4621

Charles Stanley Securities

Russell Cook

Karri Vuori +44 (0)20 7149 6000

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSDMGZKRVNGKZG

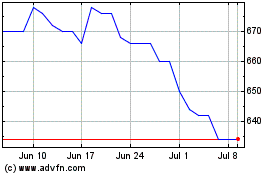

Anglo-eastern Plantations (LSE:AEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Anglo-eastern Plantations (LSE:AEP)

Historical Stock Chart

From Apr 2023 to Apr 2024