TIDMAEP

RNS Number : 3178X

Anglo-Eastern Plantations PLC

27 August 2015

Anglo-Eastern Plantations Plc

("AEP", "Group" or "Company")

Announcement of interim results for six months ended 30 June

2015

Anglo-Eastern Plantations Plc, and its subsidiaries are a major

producer of palm oil and rubber with plantations across Indonesia

and Malaysia amounting to some 128,000 hectares, has today released

its results for the six months ended 30 June 2015.

Financial Highlights

2014 2014 2014

6 months 6 months 12 months

to 30 to 30 to 31

June June Dec

$ m $ m $ m

(unaudited) (unaudited (audited)

& restated)

Revenue 104.0 130.0 251.3

Profit before tax

- before biological

asset ("BA") adjustment 22.0 43.2 85.0

- after BA adjustment 5.0 66.3 51.2

EPS, after BA adjustment 5.91cts 103.66cts 77.61cts

Total Net Assets 481.8 552.0 518.0

Enquiries:

Anglo-Eastern Plantations

Plc

Dato' John Lim Ewe Chuan 020 7216 4621

Charles Stanley Securities

Russell Cook / Karri

Vuori 020 7149 6000

Chairman's Interim Statement

I am pleased to present the interim results for the Group for

the six months to 30 June 2015.

Following a significant decline in Crude Palm Oil ("CPO") prices

in the first half, revenue for the six months to 30 June was $104.0

million compared to $130.0 million for the first six months of

2014. At the same time the Group was subject to an increase in

operating expenses which has resulted in a gross profit of $25.0

million compared to $45.1 million in the six months to June 2014.

Overall profits before tax, excluding the adjustment arising from a

revaluation of the Group's Biological Asset ("BA adjustment"), fell

from $43.2 million to $22.0 million for the period.

Fresh Fruit Bunches ("FFB") production for the first half of

2015 was 1% lower at 388,600mt compared to the same period last

year. The slight decline in production was mainly attributed to the

replanting of old palms and time taken for crop harvest to return

to normal after the effects of the flood in North Sumatera in

December last year. The Group continued to buy external crops to

maximise the utilization of its mills. The Group has maintained a

competitive pricing policy for bought-in crops, which increased by

9% from 310,900mt for last year to 338,400mt.

Operational and financial performance

For the six months ended 30 June 2015, revenue was $104.0

million, a decrease of 20% (1H 2014: $130.0 million). Gross margins

for the period dropped from 35% to 24% reflecting higher operating

expenses and a 26% decrease in average CPO price in the first half

of 2015 compared to the same period in the previous year. In the

same period, Indonesian Rupiah weakened by 11% against the US

Dollar.

During the first six months of 2015 the CPO price averaged at

$663/mt, 26% lower compared to $895/mt for first half of 2014.

The CPO price for the first half remained weak. The current CPO

price stayed around $515/mt which was far lower than the 10-year

average CPO price at $750/mt. As a result the directors have

benchmarked the 10-year average CPO price assumptions against

market expectations and have adopted the CPO price of $650/mt of

biological assets to represent a more sustainable CPO price over

the long term. This is supported by the World Bank Commodities

Price Forecast for palm oil for 2015 at $670/mt. This has resulted

in a negative adjustment of $17.0 million from the BA adjustment

(1H 2014: positive $23.1 million). The operating profit after BA

adjustment for the period fell to $4.6 million (1H 2014: $63.9

million) while profit before tax was $5.0 million compared to the

$66.3 million achieved for the same period in 2014.

The resulting earnings per share for the period were reduced 94%

at 5.91cts (1H 2014: 103.66cts).

The Group's balance sheet remains strong and cash flow remains

healthy. Net assets at 30 June 2015 were $481.8 million compared to

$518.0 million at 31 December 2014. The decline was attributable

largely to the adjustment in value of the Biological Assets and a

weaker Rupiah.

As at 30 June 2015 the Group's total cash balance was $110.9

million (1H 2014: $115.8 million) with total borrowings of $34.8

million (1H 2014: $35.0 million), giving a net cash position of

$76.1 million, compared to $80.8 million as at 30 June 2014.

With the current low CPO prices, the five subsidiaries with over

11,100ha of newly matured oil palms, out of 17,300ha planted in

Bengkulu, Bangka and Kalimantan are expected to be profitable in

about three to four years when the FFB yield reach the optimum

level. The decline in cash reflects the need to sustain and finance

the loss making subsidiaries as the yield of newly matured

plantations catches up with operating expenses.

Operating costs

The operating costs for the Indonesian operations were higher in

the first half of 2015 compared to the same period in 2014 mainly

due to an increase in wages, fertilisers, fuel and general upkeep

of plantations costs. Higher operating costs are also partly

attributed to a 9% increase in matured areas for the corresponding

period.

Production and Sales

2015 2014 2014

6 months 6 months Year

to 30 June to 30 June to 31 December

mt mt mt

Oil palm production

FFB

- all estates 388,600 393,900 857,400

- bought-in or processed

for third parties 338,400 310,900 626,200

Saleable CPO 141,300 141,700 294,100

Saleable palm kernels 33,500 33,100 68,300

Oil palm sales

CPO 144,900 145,000 299,400

Palm kernels 34,200 31,600 68,300

FFB sold outside 50,000 37,300 101,100

Rubber production 457 480 1,140

The palm oil mill in Kalimantan with an initial capacity of

45mt/hr has started commercial operations in June 2015. The Group's

six mills processed a total of 677,000mt in FFB for the first half

of 2015, a 1% increase compared to 667,500mt for the same period

last year.

Bought-in crops were 9% higher than last year due to competitive

pricing offered to FFB suppliers.

Significant capital expenditure is expected in the replanting of

over 1,400ha of old palms in North Sumatera which started in May

2015. Additional capital is required to replant 153ha of old rubber

trees with oil palm. The felling of old rubber trees in North

Sumatera began in June 2015.

Commodity prices

CPO price was fairly weak for the first half of 2015 and hit a

low of $610/mt in January 2015. The average CPO price for was

$663/mt, 26% lower than last year (1H 2014: $895/mt). The lower CPO

price was attributed to China's weak growth, abundance of vegetable

oil and the low crude oil prices which dampen the demand for

bio-diesel.

Rubber price averaged $1,388/mt, 24% lower than 2014 (1H 2014:

$1,823/mt).

Development

The Group's planted areas at 30 June 2015 comprised:

Total Mature Immature

ha ha ha

North Sumatera 19,228 17,333 1,895

Bengkulu 18,970 18,408 562

Riau 4,873 4,873 -

South Sumatera 3,983 1,086 2,897

Kalimantan 12,488 7,840 4,648

Bangka 514 - 514

Plasma 734 685 49

------- ------- ---------

Indonesia 60,790 50,225 10,565

Malaysia 3,696 3,380 316

------- ------- ---------

Total : 30 June 2015 64,486 53,605 10,881

------- ------- ---------

Total : 31 December

2014 63,470 48,127 15,343

------- ------- ---------

Total : 30 June 2014 62,037 48,991 13,046

------- ------- ---------

The Group's new planting for the first six months ended 30 June

2015 totalled 1,016ha compared to 941ha for same corresponding

period for 2014. The slower than anticipated rate of new planting

is due to protracted land compensation negotiations.

The Group remains optimistic that planting will pick up in the

second half of 2015. The Group's total landholding comprises some

128,000ha, of which the planted area stands around 64,486ha (1H

2014: 62,037ha).

Dividend

As in previous years no interim dividend has been declared. A

final dividend of 3.0 pence per share in respect of the year to 31

December 2014 was paid on 10 July 2015.

Outlook

(MORE TO FOLLOW) Dow Jones Newswires

August 27, 2015 08:00 ET (12:00 GMT)

The Australian Bureau of Meteorology has confirmed the

resurgence of a moderate to strong El Nino weather phenomenon for

2015. This was supported by other weather authorities in the United

States and Japan. The outcome of El Nino, which last occurred in

2009 to 2010, is expected to be droughts in parts of palm oil

producing countries like Indonesia and Malaysia. These two

countries are the world's biggest palm oil producers, accounting

for 86% of global palm oil supplies. According to reports, El Nino

is likely to hit and lower CPO output by at least 15% to 30% in the

next 12 to 24 months. But the seasonal high production in the

second half of 2015 is however likely to keep the upside of CPO

prices but analysts viewed the advent of El Nino to serve as a

catalyst to CPO prices.

The introduction of an export levy tax of $50/mt on CPO by the

Indonesian Government and a simpler export tax system expressed in

US dollar instead of a percentage of CPO price means that when the

CPO price is below $750/mt, the export tax levy will impact upon

the Group's profit. Nevertheless when CPO price recovers to above

$750/mt, the effective export tax rate will be lower providing some

relief to planters. The new export tax took effect from July

2015.

The Board looks forward to reporting further progress in its

next Interim Management Statement.

Principal risks and uncertainties

With the downward trend of CPO prices and the continuing

weakening of the Indonesian Rupiah, the directors view the second

half of the year to be challenging. Other than these, the principal

risks and uncertainties have broadly remained the same since the

publication of the annual report for the year ended 31 December

2014.

A more detailed explanation of the risks relevant to the Group

is on pages 19 to 22 and from pages 80 to 84 of the 2014 annual

report which is available at www.angloeastern.co.uk.

Madam Lim Siew Kim

Chairman

27 August 2015

Responsibility Statements

We confirm that to the best of our knowledge:

a) The unaudited interim financial statements have been prepared

in accordance with IAS34: Interim Financial Reporting as adopted by

the European Union;

b) The Chairman's statement includes a fair review of the

information required by DTR 4.2.7R (an indication of important

events during the first six months and a description of the

principal risks and uncertainties for the remaining six months of

the year); and

c) The interim financial statements include a fair review of the

information required by DTR 4.2.8R (material related party

transactions in the six months ended 30 June 2015 and any material

changes in the related party transactions described in the last

Annual Report) of the Disclosure and Transparency Rules of the

United Kingdom Financial Services Authority.

By order of the Board

Dato' John Lim Ewe Chuan

27 August 2015

Condensed Consolidated Income Statement

2015 2014 2014

6 months to 30 June 6 months to 30 June Year to 31 December

(unaudited) (unaudited) (audited)

----------------------------------- ------------------------------------ ------------------------------------

Notes Result Result Result

Continuing before before before

operations BA BA BA BA BA BA

adjustment adjustment Total adjustment adjustment Total adjustment adjustment Total

$000 $000 $000 $000 $000 $000 $000 $000 $000

----------------- ------ ----------- ----------- --------- ----------- ----------- ---------- ----------- ----------- ----------

Revenue 103,952 - 103,952 130,006 - 130,006 251,258 - 251,258

Cost of sales (78,924) - (78,924) (84,892) - (84,892) (164,666) - (164,666)

----------------- ------ ----------- ----------- --------- ----------- ----------- ---------- ----------- ----------- ----------

Gross profit 25,028 - 25,028 45,114 - 45,114 86,592 - 86,592

Biological

asset

revaluation

movement (BA

adjustment) - (16,958) (16,958) - 23,103 23,103 - (33,718) (33,718)

Administration

expenses (3,478) - (3,478) (4,300) - (4,300) (7,747) - (7,747)

----------------- ------ ----------- ----------- --------- ----------- ----------- ---------- ----------- ----------- ----------

Operating profit 21,550 (16,958) 4,592 40,814 23,103 63,917 78,845 (33,718) 45,127

Exchange

(losses)

/ gains (1,800) - (1,800) 413 - 413 852 - 852

Finance income 3,238 - 3,238 2,942 - 2,942 7,276 - 7,276

Finance expense 3 (1,004) - (1,004) (1,003) - (1,003) (2,019) - (2,019)

----------------- ------ ----------- ----------- --------- ----------- ----------- ---------- ----------- ----------- ----------

Profit before

tax 4 21,984 (16,958) 5,026 43,166 23,103 66,269 84,954 (33,718) 51,236

Tax expense 5 (6,084) 4,240 (1,844) (11,918) (5,776) (17,694) (20,967) 8,429 (12,538)

----------------- ------ ----------- ----------- --------- ----------- ----------- ---------- ----------- ----------- ----------

Profit for the

period 15,900 (12,718) 3,182 31,248 17,327 48,575 63,987 (25,289) 38,698

----------------- ------ ----------- ----------- --------- ----------- ----------- ---------- ----------- ----------- ----------

Attributable

to:

- Owners of the

parent 12,805 (10,463) 2,342 25,879 15,209 41,088 52,422 (21,660) 30,762

-

Non-controlling

interests 3,095 (2,255) 840 5,369 2,118 7,487 11,565 (3,629) 7,936

----------------- ------ ----------- ----------- --------- ----------- ----------- ---------- ----------- ----------- ----------

15,900 (12,718) 3,182 31,248 17,327 48,575 63,987 (25,289) 38,698

----------------- ------ ----------- ----------- --------- ----------- ----------- ---------- ----------- ----------- ----------

Earnings per

share for

profit

attributable

to the owners

of the parent

during the

period

- basic 7 5.91cts 103.66cts 77.61cts

- diluted 7 5.90cts 103.54cts 77.53cts

Condensed Consolidated Statement of Comprehensive Income

2015 2014 2014

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

------------------------------------------------- ------------ ------------ ---------------

Profit for the period 3,182 48,575 38,698

-------------------------------------------------- ------------ ------------ ---------------

Other comprehensive income

Items may be reclassified to profit

or loss in subsequent periods:

(Loss) / Profit on exchange translation

of foreign operations (36,914) 12,403 (12,019)

-------------------------------------------------- ------------ ------------ ---------------

Net other comprehensive (expense)

/ income may be reclassified to

profit or loss in subsequent periods (36,914) 12,403 (12,019)

-------------------------------------------------- ------------ ------------ ---------------

Items not to be reclassified to

profit or loss in subsequent periods:

Unrealised (loss) / gain on revaluation

of the estates (860) (704) 386

Deferred tax on revaluation 215 177 (96)

Remeasurements of retirement benefit

plan - - (680)

Deferred tax on retirement benefit - - 170

-------------------------------------------------- ------------ ------------ ---------------

Net other comprehensive expense

not being reclassified to profit

(MORE TO FOLLOW) Dow Jones Newswires

August 27, 2015 08:00 ET (12:00 GMT)

or loss in subsequent periods (645) (527) (220)

-------------------------------------------------- ------------ ------------ ---------------

Total other comprehensive (expense)

/ income for the period, net of

tax (37,559) 11,876 (12,239)

Total comprehensive (expense) /

income for the period (34,377) 60,451 26,459

Attributable to:

- Owners of the parent (28,328) 50,718 21,188

- Non-controlling interests (6,049) 9,733 5,271

-------------------------------------------------- ------------ ------------ ---------------

(34,377) 60,451 26,459

------------------------------------------------- ------------ ------------ ---------------

Condensed Consolidated Statement of Financial Position

2015 2014 2014

as at 30 June as at 30 June as at 31 December

Notes (unaudited) (unaudited) (audited)

$000 $000 $000

----------------------------------------------- -------------- -------------- ------------------

Non-current assets

Biological assets 225,728 304,156 251,374

Property, plant and equipment 217,241 224,030 227,380

Receivables 3,044 5,857 3,007

------------------------------------------------ -------------- -------------- ------------------

446,013 534,043 481,761

----------------------------------------------- -------------- -------------- ------------------

Current assets

Inventories 8,248 9,817 7,846

Tax receivables 11,158 9,333 9,231

Trade and other receivables 8,153 10,261 8,807

Cash and cash equivalents 110,860 115,831 125,937

------------------------------------------------ -------------- -------------- ------------------

138,419 145,242 151,821

----------------------------------------------- -------------- -------------- ------------------

Current liabilities

Loans and borrowings (438) (196) (313)

Trade and other payables (22,660) (18,990) (21,010)

Tax liabilities (3,764) (7,845) (10,752)

Dividend payables (1,869) (20) (20)

------------------------------------------------ -------------- -------------- ------------------

(28,731) (27,051) (32,095)

----------------------------------------------- -------------- -------------- ------------------

Net current assets 109,688 118,191 119,726

------------------------------------------------ -------------- -------------- ------------------

Non-current liabilities

Loans and borrowings (34,375) (34,813) (34,625)

Deferred tax liabilities (34,929) (61,787) (44,368)

Retirement benefits - net liabilities (4,623) (3,593) (4,445)

------------------------------------------------ -------------- -------------- ------------------

(73,927) (100,193) (83,438)

----------------------------------------------- -------------- -------------- ------------------

Net assets 481,774 552,041 518,049

------------------------------------------------ -------------- -------------- ------------------

Condensed Consolidated Statement of Financial Position

(continued)

2015 2014 2014

as at 30 June as at 30 June as at 31 December

Notes (unaudited) (unaudited) (audited)

$000 $000 $000

Issued capital and reserves

attributable to owners of the

parent

Share capital 15,504 15,504 15,504

Treasury shares (1,171) (1,171) (1,171)

Share premium reserve 23,935 23,935 23,935

Share capital redemption reserve 1,087 1,087 1,087

Revaluation reserves 56,468 56,297 57,029

Exchange reserves (220,612) (171,007) (190,503)

Retained earnings 521,828 532,121 521,355

------------------------------------------- -------------- -------------- ------------------

397,039 456,766 427,236

Non-controlling interests 84,735 95,275 90,813

------------------------------------------- -------------- -------------- ------------------

Total equity 481,774 552,041 518,049

------------------------------------------- -------------- -------------- ------------------

Condensed Consolidated Statement of Changes in Equity

Attributable to owners of the parent

--------------------------------------------------------------------------------------------------------------------------------

Share

capital Foreign Non-controlling

Share Treasury Share redemption Revaluation exchange Retained interests Total

capital shares premium reserve reserve reserve earnings Total equity

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- ---------- ----------------- -----------

Balance at 31 December

2013 15,504 (1,171) 23,935 1,087 56,767 (181,107) 493,031 408,046 85,964 494,010

Items of other comprehensive

income

* Unrealised gain on revaluation of estates, net of

tax - - - - 262 - - 262 28 290

* Remeasurement of retirement benefit plan, net of t

ax - - - - - - (440) (440) (70) (510)

* Loss on exchange translation of foreign operations - - - - - (9,396) - (9,396) (2,623) (12,019)

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- ---------- ----------------- -------------

Total other comprehensive

income / (expenses) - - - - 262 (9,396) (440) (9,574) (2,665) (12,239)

Profit for year - - - - - - 30,762 30,762 7,936 38,698

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- ---------- ----------------- -------------

Total comprehensive

income and expenses

for the year - - - - 262 (9,396) 30,322 21,188 5,271 26,459

Dividends paid - - - - - - (1,998) (1,998) (422) (2,420)

(MORE TO FOLLOW) Dow Jones Newswires

August 27, 2015 08:00 ET (12:00 GMT)

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- ---------- ----------------- -------------

Balance at 31 December

2014 15,504 (1,171) 23,935 1,087 57,029 (190,503) 521,355 427,236 90,813 518,049

Items of other comprehensive

income

* Unrealised loss on revaluation of estates, net of

tax - - - - (561) - - (561) (84) (645)

* Loss on exchange translation of foreign operations - - - - - (30,109) - (30,109) (6,805) (36,914)

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- ---------- ----------------- -------------

Total other comprehensive

expenses - - - - (561) (30,109) - (30,670) (6,889) (37,559)

Profit for period - - - - - - 2,342 2,342 840 3,182

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- ---------- ----------------- -------------

Total comprehensive

income and expenses

for the period - - - - (561) (30,109) 2,342 (28,328) (6,049) (34,377)

Dividend payable - - - - - - (1,869) (1,869) (29) (1,898)

Balance at 30 June

2015 15,504 (1,171) 23,935 1,087 56,468 (220,612) 521,828 397,039 84,735 481,774

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- ---------- ----------------- -------------

Condensed Consolidated Statement of Changes in Equity

(continued)

Attributable to owners of the parent

----------------------------------------------------------------------------------------------------------------------------

Share

capital Foreign Non-controlling

Share Treasury Share redemption Revaluation exchange Retained interests Total

capital shares premium reserve reserve reserve earnings Total Equity

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- -------- ----------------- ---------

Balance at 31 December

2013 15,504 (1,171) 23,935 1,087 56,767 (181,107) 493,031 408,046 85,964 494,010

Items of other comprehensive

income

* Unrealised loss on revaluation of estates, net of

tax - - - - (470) - - (470) (57) (527)

* Gain on exchange translation of foreign operations - - - - - 10,100 - 10,100 2,303 12,403

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- -------- ----------------- ---------

Total other comprehensive

(expenses) / income - - - - (470) 10,100 - 9,630 2,246 11,876

Profit for period - - - - - - 41,088 41,088 7,487 48,575

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- -------- ----------------- ---------

Total comprehensive

income and expenses

for the period - - - - (470) 10,100 41,088 50,718 9,733 60,451

Dividends paid - - - - - - (1,998) (1,998) (422) (2,420)

Balance at 30 June

2014 15,504 (1,171) 23,935 1,087 56,297 (171,007) 532,121 456,766 95,275 552,041

---------------------------------------------------------- --------- ---------- --------- ----------- ------------- ---------- ---------- -------- ----------------- ---------

Condensed Consolidated Statement of Cash Flows

2015 2014 2014

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

----------------------------- ------------ ------------ ---------------

Cash flows from operating

activities

Profit before tax 5,026 66,269 51,236

Adjustments for:

BA adjustment 16,958 (23,103) 33,718

Loss on disposal of

tangible fixed assets 41 2 36

Depreciation 3,407 3,107 6,833

Retirement benefit

provisions 494 418 951

Net finance income (2,234) (1,939) (5,257)

Unrealised loss /

(gain) in foreign

exchange 1,800 (413) (852)

Tangible fixed assets

written off 86 6 135

Operating cash flow

before changes in

working capital 25,578 44,347 86,800

(Increase) / Decrease

in inventories (959) (1,145) 451

Decrease / (Increase)

in trade and other

receivables 971 (3,628) 664

Increase in trade

and other payables 2,999 3,312 5,929

----------------------------- ------------ ------------ -----------------

Cash inflow from operations 28,589 42,886 93,844

Interest paid (1,004) (1,003) (2,019)

Retirement benefit

paid (1) (6) (61)

Overseas tax paid (17,259) (10,309) (17,756)

----------------------------- ------------ ------------ -----------------

Net cash flow from

operations 10,325 31,568 74,008

----------------------------- ------------ ------------ -----------------

Investing activities

Property, plant and

equipment

- purchase (19,602) (17,589) (49,754)

- sale 19 34 156

Interest received 3,238 2,942 7,276

Net cash used in investing

activities (16,345) (14,613) (42,322)

----------------------------- ------------ ------------ -----------------

Condensed Consolidated Statement of Cash Flows (continued)

2015 2014 2014

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

------------------------------- ------------ ------------ ---------------

Financing activities

Dividends paid by

Company - (1,998) (1,998)

Finance lease repayment - (12) (20)

Dividends paid to

non-controlling interests (46) (398) (402)

Repayment of existing

long term loans (125) - (63)

Net cash used in financing

activities (171) (2,408) (2,483)

(MORE TO FOLLOW) Dow Jones Newswires

August 27, 2015 08:00 ET (12:00 GMT)

------------------------------- ------------ ------------ ---------------

(Decrease) / Increase

in cash and cash equivalents (6,191) 14,547 29,203

Cash and cash equivalents

At beginning of period 125,937 98,738 98,738

Foreign exchange (8,886) 2,546 (2,004)

------------------------------- ------------ ------------ ---------------

At end of period 110,860 115,831 125,937

------------------------------- ------------ ------------ ---------------

Comprising:

Cash at end of period 110,860 115,831 125,937

------------------------------- ------------ ------------ ---------------

Notes to the interim statements

1. Basis of preparation of interim financial statements

These interim consolidated financial statements have been

prepared in accordance with IAS 34, "Interim Financial Reporting",

as adopted by the European Union. They do not include all

disclosures that would otherwise be required in a complete set of

financial statements and should be read in conjunction with the

2014 Annual Report. The financial information for the half years

ended 30 June 2015 and 30 June 2014 does not constitute statutory

accounts within the meaning of Section 434(3) of the Companies Act

2006 and has been neither audited nor reviewed pursuant to guidance

issued by the Auditing Practices Board.

Basis of preparation

The annual financial statements of Anglo-Eastern Plantations Plc

are prepared in accordance with IFRSs as adopted by the European

Union. The comparative financial information for the year ended 31

December 2014 included within this report does not constitute the

full statutory accounts for that period. The statutory Annual

Report and Financial Statements for 2014 have been filed with the

Registrar of Companies. The Independent Auditors' Report on the

Annual Report and Financial Statements for 2014 was unqualified,

did not draw attention to any matters by way of emphasis, and did

not contain a statement under 498(2) or 498(3) of the Companies Act

2006.

Changes in accounting standards

The same accounting policies, presentation and methods of

computation are followed in these condensed consolidated financial

statements as were applied in the Group's latest annual audited

financial statements.

After making enquiries, the directors have a reasonable

expectation that the Company and the Group have adequate resources

to continue operations for the foreseeable future. For this reason,

they continue to adopt the going concern basis in preparing the

financial statements.

2. Foreign exchange

2015 2014 2014

6 months 6 months Year

to 30 to 30

June June to 31 December

(unaudited) (unaudited) (audited)

Average exchange rates

Rp : $ 12,968 11,725 11,861

$ : GBP 1.52 1.67 1.65

RM : $ 3.64 3.27 3.27

Closing exchange rates

Rp : $ 13,332 11,855 12,385

$ : GBP 1.57 1.71 1.56

RM : $ 3.78 3.21 3.50

3. Finance costs

2015 2014 2014

6 months 6 months Year

to 30 to 30

June June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

Payable 1,004 1,003 2,019

------------ ------------ ---------------

4. Segment information

North South Total

Sumatera Bengkulu Sumatera Riau Bangka Kalimantan Indonesia Malaysia UK Total

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

6 months to 30 June 2015

(unaudited)

Total sales

revenue

(all external) 37,526 38,458 38 21,377 - 3,615 101,014 1,691 - 102,705

Other income 553 302 2 362 - - 1,219 28 - 1,247

--------- --------- --------- -------- ------- ----------- ---------- ---------

Total revenue 38,079 38,760 40 21,739 - 3,615 102,233 1,719 - 103,952

--------- --------- --------- -------- ------- ----------- ---------- --------- ------ ---------

Profit / (loss)

before tax 9,691 8,607 (517) 8,290 (11) (3,700) 22,360 (66) (310) 21,984

BA Movement (16,958)

Profit for the

period

before tax per

---------

consolidated

income

statement 5,026

---------

Depreciation (1,165) (1,087) (182) (270) (12) (585) (3,301) (106) - (3,407)

Inter-segment

transactions 1,835 (1,078) (380) (310) - (619) (552) 522 30 -

Income tax (2,751) (299) 553 (1,563) (24) 2,581 (1,503) (316) (25) (1,844)

Total Assets 187,402 141,718 55,931 71,733 12,774 87,273 556,831 23,186 4,415 584,432

Non-Current

Assets 136,701 107,573 54,404 34,508 12,614 81,321 427,121 17,699 1,193 446,013

Non-Current

Assets

- Additions 3,522 1,348 1,812 584 646 11,589 19,501 101 - 19,602

6 months to 30 June 2014 (unaudited)

Total sales

revenue

(all external) 48,753 53,335 38 21,787 - 3,002 126,915 2,215 - 129,130

Other income 283 373 - 220 - - 876 - - 876

Total revenue 49,036 53,708 38 22,007 - 3,002 127,791 2,215 - 130,006

--------- --------- --------- -------- ------- ----------- ---------- --------- ------ ---------

Profit / (loss)

before tax 17,056 18,182 (167) 8,848 (21) (728) 43,170 531 (535) 43,166

BA Movement 23,103

Profit for the

period

before tax per

---------

consolidated

income

statement 66,269

---------

Depreciation (1,092) (1,045) (203) (272) (16) (354) (2,982) (125) - (3,107)

Inter-segment

transactions 2,806 (1,704) (197) (490) - (921) (506) 476 30 -

Income tax (7,289) (3,722) (1,581) (2,095) (7) (2,653) (17,347) (66) (281) (17,694)

Total Assets 214,804 155,588 70,765 80,644 13,283 109,770 644,854 29,996 4,435 679,285

Non-Current

Assets 165,229 126,071 68,839 39,477 13,193 97,695 510,504 22,346 1,193 534,043

Non-Current

Assets

- Additions 3,298 1,615 2,466 605 420 9,138 17,542 47 - 17,589

North South Total

Sumatera Bengkulu Sumatera Riau Bangka Kalimantan Indonesia Malaysia UK Total

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

Year to 31 December 2014 (audited)

Total sales

revenue

(all external) 97,135 95,886 102 44,912 - 7,416 245,451 4,253 - 249,704

Other income 813 697 3 37 - 2 1,552 2 - 1,554

--------- --------- --------- -------- ------- ----------- ---------- ---------

Total revenue 97,948 96,583 105 44,949 - 7,418 247,003 4,255 - 251,258

(MORE TO FOLLOW) Dow Jones Newswires

August 27, 2015 08:00 ET (12:00 GMT)

--------- --------- --------- -------- ------- ----------- ---------- --------- ------ ---------

Profit / (loss)

before tax 36,631 30,795 (552) 19,477 (57) (1,226) 85,068 255 (369) 84,954

BA Movement (33,718)

Profit for the

period

before tax per

---------

consolidated

income

statement 51,236

---------

Depreciation (2,385) (2,228) (411) (572) (33) (958) (6,587) (246) - (6,833)

Inter-segment

transactions 3,446 (2,331) (257) (671) - (1,443) (1,256) 962 294 -

Income tax (8,731) (5,775) 1,968 (4,589) 171 4,268 (12,688) 437 (287) (12,538)

Total Assets 202,284 153,418 58,008 84,263 13,078 92,854 603,905 25,398 4,279 633,582

Non-Current

Assets 149,187 121,171 56,539 39,756 12,845 82,236 461,734 18,834 1,193 481,761

Non-Current

Assets

- Additions 10,214 4,845 5,492 1,224 930 26,932 49,637 117 - 49,754

In the 6 months to 30 June 2015, revenues from 4 customers of

the Indonesian segment represent approximately $61.4m of the

Group's total revenues. In year 2014, revenues from 4 customers of

the Indonesian segment represent approximately $152.1m of the

Group's total revenues. An analysis of these revenues is provided

below:

2015 2014 2014

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$m % $m % $m %

Major Customers

Customer 1 19.7 18.9 28.9 22.2 47.9 19.1

Customer 2 16.9 16.2 21.3 16.4 45.5 18.1

Customer 3 14.7 14.2 19.6 15.2 33.5 13.3

Customer 4 10.1 9.7 17.9 13.7 25.2 10.1

----------------- --------- --------- ----------- -------- -------- --------

Total 61.4 59.0 87.7 67.5 152.1 60.6

----------------- --------- --------- ----------- -------- -------- --------

5. Tax

2015 2014 2014

6 months 6 months Year

to 30 to 30

June June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

Foreign corporation

tax - current year 8,155 12,415 22,855

Foreign corporation

tax - prior year - - 32

Deferred tax adjustment

- current year (6,311) 5,279 (10,402)

Deferred tax adjustment

- prior year - - 53

------------ ------------ ---------------

1,844 17,694 12,538

------------ ------------ ---------------

6. Dividend

The final and only dividend in respect of 2014, amounting to

3.0p per share, or $1,869,091 was paid on 10 July 2015 (2013: 3.0p

per share, or $1,997,614, paid on 17 June 2014). As in previous

years no interim dividend has been declared.

7. Earnings per ordinary share (EPS)

2015 2014 2014

6 months 6 months Year

to 30 to 30

June June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

Profit for the period

attributable to owners

of the Company before

BA adjustment 12,805 25,879 52,422

Net BA adjustment (10,463) 15,209 (21,660)

------------ ------------ ---------------

Earnings used in basic

and diluted EPS 2,342 41,088 30,762

------------ ------------ ---------------

Number Number Number

'000 '000 '000

Weighted average number

of shares in issue in

period

- used in basic EPS 39,636 39,636 39,636

- dilutive effect of

outstanding share options 43 48 43

------------ ------------ ---------------

- used in diluted EPS 39,679 39,684 39,679

------------ ------------ ---------------

Shares in issue at period

end 39,976 39,976 39,976

Less: Treasury shares (340) (340) (340)

------------ ------------ ---------------

Shares in issue at period

end excluding treasury

shares 39,636 39,636 39,636

------------ ------------ ---------------

Basic EPS before BA

adjustment 32.31cts 65.29cts 132.26cts

Basic EPS after BA

adjustment 5.91cts 103.66cts 77.61cts

Dilutive EPS before

BA adjustment 32.27cts 65.21cts 132.12cts

Dilutive EPS after

BA adjustment 5.90cts 103.54cts 77.53cts

8. Fair value measurement of financial instruments

The carrying amounts and fair values of the financial

instruments which are not recognised at fair value in the Statement

of Financial Position are exhibited below:

2015 2014 2014

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

Carrying Fair Carrying Fair Carrying Fair

amount value amount value amount value

$000 $000 $000 $000 $000 $000

Non-current

receivables

Due from non-controlling

interests 1,193 924 1,193 872 1,193 872

Due from cooperatives

under Plasma

scheme 1,612 1,527 4,396 3,945 1,557 1,397

Due from village

smallholder

schemes 239 220 268 247 257 237

--------- ------- --------- ------- --------- -------

3,044 2,671 5,857 5,064 3,007 2,506

--------- ------- --------- ------- --------- -------

Borrowings

due after

one year

Long term

loan 34,375 34,500 34,813 35,095 34,625 34,028

--------- ------- --------- ------- --------- -------

Financial instruments not measured at fair value includes cash

and cash equivalents, trade and other receivables, trade and other

payables, and borrowings due within one year.

Due to their short-term nature, the carrying value of cash and

cash equivalents, trade and other receivables, trade and other

payables and borrowings due within one year approximates their fair

value.

All non-current receivables and long term loan are classified as

Level 3 in the fair value hierarchy.

(MORE TO FOLLOW) Dow Jones Newswires

August 27, 2015 08:00 ET (12:00 GMT)

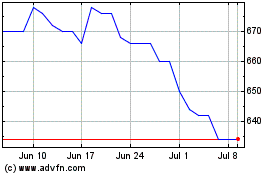

Anglo-eastern Plantations (LSE:AEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Anglo-eastern Plantations (LSE:AEP)

Historical Stock Chart

From Apr 2023 to Apr 2024