TIDMAEP

RNS Number : 1363Q

Anglo-Eastern Plantations PLC

27 August 2014

27 August2014

Anglo-Eastern Plantations Plc

("AEP", "Group" or "Company")

Announcement of interim results for six months ended 30 June

2014

Anglo-Eastern Plantations Plc, and its subsidiaries are a major

producer of palm oil and rubber with plantations across Indonesia

and Malaysia amounting to some 127,794 hectares, has today released

its results for the six months ended 30 June 2014.

Financial Highlights

2014 2013 2013

6 months 6 months 12 months

to 30 to 30 to 31

June June Dec

$ m $ m $ m

(unaudited) (unaudited (audited)

& restated)

Revenue 130.0 83.5 201.9

Profit before tax

- before biological asset ("BA")

adjustment 43.2 15.8 59.7

- after BA adjustment 66.3 18.3 153.4

EPS, after BA adjustment 103.66cts 21.11cts 235.95cts

Total Net Assets 552.0 463.2 494.0

Enquiries:

Anglo-Eastern Plantations Plc

Dato' John Lim Ewe Chuan 020 7216 4621

Charles Stanley Securities

Russell Cook / Karri Vuori 020 7149 6000

Chairman's statement

I am pleased to present the interim results for the Company for

the six months to 30 June 2014. The Group performance improved

significantly compared to last year due to improved Crude Palm Oil

("CPO") prices, higher Fresh Fruit Bunches ("FFB") production and

increased purchase of external crops by the mills.

Despite the relatively good performance in the first half the

Board emphasises that challenging times are ahead for the Group and

the palm oil industry in general. Of late CPO price has weakened

mainly due to the prospect of a record soybean production in North

and South America on the back of favourable weather expectations

and increased planting acreage.

Demand remains soft as top buyers in India and China purchase a

greater proportion of soybean as the price differential between the

two edible oils continues to narrow. The spread was about $98 per

metric tonne on 4 July 2014 down from an average of $244/mt on the

same date in 2013. Pressure on the CPO price is exacerbated further

by a good supply of sunflower oil in the market at very competitive

prices. A slowly deflating energy market due to the poor

infrastructure for oil distribution and biodiesel blending in some

developing countries has also undermined earlier widely held

expectations for biodiesel to absorb surplus CPO.

Operational and financial performance

For the six months ended 30 June 2014, revenue was $130.0

million, an increase of 56% (1H 2013: $83.5 million). Gross margins

for the period increased from 25% to 35% reflecting a 6% increase

in average CPO price in the first half of 2014 compared to the same

period in the previous year. This was on top of 20% weakening of

Indonesian Rupiah against the US Dollar for the same period.

The Group benefited from a $23.1 million revaluation of its

biological assets ("BA valuation") (1H 2013: $2.5 million). With

this contribution operating profits for the period increased by

259% to $63.9 million (1H 2013: $17.8 million) while profit before

tax was $66.3 million, 262% higher than the $18.3 million achieved

for the same period in 2013.

The resulting earnings per share for the period were up 391% at

103.66cts (1H 2013: 21.11cts).

During the first six months of 2014 the CPO price averaged at

$895/mt compared to $847/mt for 1H 2013. FFB production for the

first six months of 2014 was 393,900mt, 17% higher compared to

335,900mt for 1H 2013. Bought-in crops for the same period was

310,900mt, 62% higher than last year of 191,900mt due to better

prices offered for external crops.

The Group's balance sheet remains strong and cash flow remains

healthy even after our capital expenditure necessary to maintain

immature trees and new planting.

The BA valuation is determined using discounted cash flow over

the expected 20-year economic life of the assets. Among the

assumption used in the valuation includes the 10-year average CPO

price. The BA valuation increased by $23.1 million for 30 June 2014

was due primarily to the increase in the 10-year average CPO price

from $700/mt to $725/mt.

As at 30 June 2014 the Group's total cash balance was $115.8

million (1H 2013: $98.7 million) with total borrowings of $35.0

million (1H 2013: $35.0 million), giving a net cash position of

$80.8 million, compared to $63.7million as at 30 June 2013.

Operating costs

The operating costs for the Indonesian operations were higher in

1H 2014 compared to the same period in 2013 mainly due to the

increase in wages, fertilisers, fuel and general upkeep of

plantations. Higher operating costs were also partly attributed to

13% increase in matured areas.

Production and Sales

2014 2013 2013

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

mt mt mt

Oil palm production

FFB

- all estates 393,900 335,900 787,500

- bought-in or processed for

third parties 310,900 191,900 496,600

Saleable CPO 141,700 109,900 262,600

Saleable palm kernels 33,100 25,400 61,500

Oil palm sales

CPO 145,000 108,700 253,200

Palm kernels 31,600 24,900 60,800

FFB sold outside 37,300 12,300 54,300

Rubber production 480 450 1,049

The Group's five mills processed a total of 667,500mt in FFB for

the 1H 2014, a 29% increase compared to 515,500mt for the same

period last year.

Internal crop production was higher by 17% in line with an

increase in matured plantations in the Bengkulu and Central

Kalimantan.

Bought-in crops were 62% higher than last year due to additional

sources of FFB supplies and improved pricing.

Capital outlay is required to improve road conditions in

Bengkulu, easing the FFB transportation especially during rainy

season. Significant capital expenditure is expected in the

replanting of 1,029ha of old palms in North Sumatra.

Commodity prices

CPO price was fairly strong for the 1H 2014 and hit a high of

$993/mt in March 2014. The average CPO price for 1H 2014 was

$895/mt (1H 2013: $847/mt). The higher CPO price in the first three

months of 2014 was due to initial concerns over dry weather that

hit Peninsular Malaysia and parts of Indonesia which delayed the

ripening of fruits.

Rubber price averaged $1,823/mt, 30% lower than 2013 (1H 2013:

$2,599/mt).

Development

The Group's planted areas at 30 June 2014 comprised:

Total Mature Immature

ha ha ha

North Sumatra 19,249 17,702 1,547

Bengkulu 18,819 17,717 1,102

Riau 4,873 4,873 -

South Sumatra 3,969 159 3,810

Kalimantan 10,391 4,651 5,740

Bangka 307 - 307

Plasma 734 510 224

-------- -------- ----------

Indonesia 58,342 45,612 12,730

Malaysia 3,695 3,379 316

-------- -------- ----------

Total : 30 June 2014 62,037 48,991 13,046

-------- -------- ----------

Total : 31 December 2013 61,099 43,236 17,863

-------- -------- ----------

Total : 30 June 2013 59,715 43,483 16,232

-------- -------- ----------

The Group's new planting for the first six months ended 30 June

2014 totalled 941ha. The slow rate of new planting is due to

protracted land compensation negotiations.

The Group is optimistic that planting will pick up in the second

half of 2014. The Group's total landholding comprises some

127,794ha, of which the planted area stands around 62,037ha (1H

2013: 59,715ha).

The biogas purification equipment and biomass plant for the mill

in North Sumatra are in final stages of testing and commissioning

in early Q3 2014. This mill will enhance the treatment of the

effluent and at the same time mitigate the emission of biogas.

Under this project, the empty fruit bunches will be processed into

dried long fibres for export.

The earthworks for the construction of the 45mt/hr palm oil mill

in Central Kalimantan are 85% completed while civil and mechanical

works is progressing as scheduled with the mill expected to be

completed and operational in Q2 2015.

Dividend

As in previous years no interim dividend has been declared. A

final dividend of 3.0 pence per share in respect of the year to 31

December 2013 was paid on 17 June 2014.

Outlook

It has been reported in the Public Ledger that many buyers of

refined palm oil in China struggled for funding as the country

crackdown on commodity financing in the face of slowing domestic

demand. This may lead to lower CPO imports as a result of tighter

access to credit. However, the industry believe CPO price is

expected to be resilient due to concerns on weaker FFB production

in Malaysia and parts of Indonesia in the fourth quarter of 2014

due to a prolonged dry spell in the first three months of the year.

Parts of some growing areas in Malaysia and Indonesia received less

than 50 millimetres of rain in January and February, the driest

period since 1997. El Nino weather phenomenon is also forecasted

this year and if materialises could induce droughts which would

curb production and yield.

The Board remains cautiously confident of reporting a

satisfactory level of profitability. Cash generation is expected to

remain strong and the Board looks forward to reporting further

progress in its next Interim Management Statement.

Principal risks and uncertainties

The directors do not consider that the principal risks and

uncertainties have changed since the publication of the annual

report for the year ended 31 December 2013.

A more detailed explanation of the risks relevant to the Group

is on pages 18 to 20 and from pages 78 to 83 of the 2013 annual

report which is available at www.angloeastern.co.uk.

Following the conclusion of the discussions with the Financial

Reporting Council ("FRC") regarding the use of current market data

to estimate notional rent for the use of land in its discounted

cash flow for the determination of biological assets, details of

which were set out in the 2013 Annual Report and Accounts, the

Group has adopted a notional rent equivalent to 9% of the value of

planted land in valuing its biological asset and resulted in the

accounts for the period ended 30 June 2013 being restated. The

details of the restatement are disclosed in Note 2 - Prior period

restatement on page 15.

Madam Lim Siew Kim

Chairman

27 August 2014

Responsibility Statements

We confirm that to the best of our knowledge:

a) The unaudited interim financial statements have been prepared

in accordance with IAS34: Interim Financial Reporting as adopted by

the European Union;

b) The Chairman's statement includes a fair review of the

information required by DTR 4.2.7R (an indication of important

events during the first six months and a description of the

principal risks and uncertainties for the remaining six months of

the year); and

c) The interim financial statements include a fair review of the

information required by DTR 4.2.8R (material related party

transactions in the six months ended 30 June 2014 and any material

changes in the related party transactions described in the last

Annual Report) of the Disclosure and Transparency Rules of the

United Kingdom Financial Services Authority.

By order of the Board

Dato' John Lim Ewe Chuan

27 August 2014

Condensed Consolidated Income Statement

2014 2013 2013

6 months to 30 June 6 months to 30 June Year to 31 December

(unaudited) (unaudited & restated) (audited)

--------------------------------------- -------------------------------------- ---------------------------------------

Notes Result Result Result

Continuing before before before

operations BA BA BA BA BA BA

adjustment adjustment Total adjustment adjustment Total adjustment adjustment Total

$000 $000 $000 $000 $000 $000 $000 $000 $000

------------------- ------- ------------ ------------ ------------ ------------ ---------- ------------ ------------ -----------

Revenue 130,006 - 130,006 83,528 - 83,528 201,917 - 201,917

Cost of sales (84,892) - (84,892) (62,408) - (62,408) (133,400) - (133,400)

------------------- ------- ------------ ------------ ----------- ------------ ------------ ---------- ------------ ------------ -----------

Gross profit 45,114 - 45,114 21,120 - 21,120 68,517 - 68,517

Biological asset

revaluation

movement (BA

adjustment) - 23,103 23,103 - 2,503 2,503 - 93,661 93,661

Administration

expenses (4,300) - (4,300) (5,795) - (5,795) (8,898) - (8,898)

------------------- ------- ------------ ------------ ----------- ------------ ------------ ---------- ------------ ------------ -----------

Operating profit 40,814 23,103 63,917 15,325 2,503 17,828 59,619 93,661 153,280

Exchange loss 413 - 413 (512) - (512) (2,781) - (2,781)

Finance income 2,942 - 2,942 1,763 - 1,763 4,676 - 4,676

Finance expense 4 (1,003) - (1,003) (784) - (784) (1,774) - (1,774)

------------------- ------- ------------ ------------ ----------- ------------ ------------ ---------- ------------ ------------ -----------

Profit before tax 5 43,166 23,103 66,269 15,792 2,503 18,295 59,740 93,661 153,401

Tax expense 6 (11,918) (5,776) (17,694) (5,926) (626) (6,552) (16,178) (23,415) (39,593)

------------------- ------- ------------ ------------ ----------- ------------ ------------ ---------- ------------ ------------ -----------

Profit for the

period 31,248 17,327 48,575 9,866 1,877 11,743 43,562 70,246 113,808

------------------- ------- ------------ ------------ ----------- ------------ ------------ ---------- ------------ ------------ -----------

Attributable to:

- Owners of the

parent 25,879 15,209 41,088 6,859 1,509 8,368 35,950 57,571 93,521

- Non-controlling

interests 5,369 2,118 7,487 3,007 368 3,375 7,612 12,675 20,287

------------------- ------- ------------ ------------ ----------- ------------ ------------ ---------- ------------ ------------ -----------

31,248 17,327 48,575 9,866 1,877 11,743 43,562 70,246 113,808

------------------- ------- ------------ ------------ ----------- ------------ ------------ ---------- ------------ ------------ -----------

Earnings per share

for profit

attributable

to the owners of

the

parent during the

period

- basic 8 103.66cts 21.11cts 235.95cts

- diluted 8 103.54cts 21.09cts 235.67cts

Condensed Consolidated Statement of Comprehensive Income

2014 2013 2013

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited & restated) (audited)

$000 $000 $000

---------------------------------------------------- ------------- ------------------------ ----------------

Profit for the period 48,575 11,743 113,808

---------------------------------------------------- ------------- ------------------------ ----------------

Other comprehensive income

Items may be reclassified to profit or loss

in subsequent periods:

Profit / (Loss) on exchange translation of

foreign operations 12,403 (13,845) (112,824)

---------------------------------------------------- ------------- ------------------------ ----------------

Net other comprehensive income may be reclassified

to profit or loss in subsequent periods 12,403 (13,845) (112,824)

---------------------------------------------------- ------------- ------------------------ ----------------

Items not to be reclassified to profit or

loss in subsequent periods:

Unrealised (loss) / gain on revaluation of

the estates (704) (3,057) 31,807

Deferred tax on revaluation 177 765 (7,951)

Remeasurements of retirement benefit plan - (1,414) 278

Deferred tax on retirement benefit - - (71)

---------------------------------------------------- ------------- ------------------------ ----------------

Net other comprehensive (expense) / income

not being reclassified to profit or loss in

subsequent periods (527) (3,706) 24,063

---------------------------------------------------- ------------- ------------------------ ----------------

Total other comprehensive income / (expenses)

for the period, net of tax 11,876 (17,551) (88,761)

Total comprehensive income / (expenses) for

the period 60,451 (5,808) 25,047

Attributable to:

- Owners of the parent 50,718 (6,396) 21,508

- Non-controlling interests 9,733 588 3,539

---------------------------------------------------- ------------- ------------------------ ----------------

60,451 (5,808) 25,047

---------------------------------------------------- ------------- ------------------------ ----------------

Condensed Consolidated Statement of Financial Position

2014 2013 2013

as at 30 June as at 30 June as at 31 December

Notes (unaudited) (unaudited & restated) (audited)

$000 $000 $000

------------------------------------------------- --------------- ------------------------ -------------------

Non-current assets

Biological assets 304,156 215,117 265,835

Property, plant and equipment 224,030 210,865 213,342

Receivables 5,857 5,216 5,649

-------------------------------------------------- --------------- ------------------------ -------------------

534,043 431,198 484,826

------------------------------------------------- --------------- ------------------------ -------------------

Current assets

Inventories 9,817 6,987 8,448

Tax receivables 9,333 9,427 8,464

Trade and other receivables 10,261 12,181 7,271

Cash and cash equivalents 115,831 98,671 98,738

-------------------------------------------------- --------------- ------------------------ -------------------

145,242 127,266 122,921

------------------------------------------------- --------------- ------------------------ -------------------

Current liabilities

Loans and borrowings (196) (29) (84)

Trade and other payables (18,990) (14,710) (15,331)

Tax liabilities (7,845) (2,794) (4,988)

Dividend payables (20) (1,784) -

-------------------------------------------------- --------------- ------------------------ -------------------

(27,051) (19,317) (20,403)

------------------------------------------------- --------------- ------------------------ -------------------

Net current assets 118,191 107,949 102,518

-------------------------------------------------- --------------- ------------------------ -------------------

Non-current liabilities

Loans and borrowings (34,813) (35,010) (34,937)

Deferred tax liabilities (61,787) (35,894) (55,298)

Retirement benefits - net liabilities (3,593) (5,091) (3,099)

-------------------------------------------------- --------------- ------------------------ -------------------

(100,193) (75,995) (93,334)

------------------------------------------------- --------------- ------------------------ -------------------

Net assets 552,041 463,152 494,010

-------------------------------------------------- --------------- ------------------------ -------------------

2014 2013 2013

as at 30 June as at 30 June as at 31 December

Notes (unaudited) (unaudited & restated) (audited)

$000 $000 $000

Issued capital and reserves attributable

to

owners of the parent

Share capital 15,504 15,504 15,504

Treasury shares (1,171) (1,171) (1,171)

Share premium reserve 23,935 23,935 23,935

Share capital redemption reserve 1,087 1,087 1,087

Revaluation reserves 56,297 34,632 56,767

Exchange reserves (171,007) (100,194) (181,107)

Retained earnings 532,121 406,349 493,031

------------------------------------------------------ --------------- ------------------------ -------------------

456,766 380,142 408,046

Non-controlling interests 95,275 83,010 85,964

------------------------------------------------------ --------------- ------------------------ -------------------

Total equity 552,041 463,152 494,010

------------------------------------------------------ --------------- ------------------------ -------------------

Condensed Consolidated Statement of Changes in Equity

Attributable to owners of the parent

---------------------------------------------------------------------------------------------------------------------------------------

Share

capital Foreign

Share Treasury Share redemption Revaluation exchange Retained Non-controlling Total

capital shares premium reserve reserve reserve earnings Total interests equity

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

---------------------------------------------------------- --------- ---------- --------- ------------ ------------- ------------ ---------- ------------ ----------------- -------------

Balance at 31 December

2012 15,504 (1,171) 23,935 1,087 36,799 (88,838) 401,006 388,322 83,043 471,365

Items of other comprehensive

income

* Unrealised gain on revaluation of estates, net of

tax - - - - 20,062 - - 20,062 3,794 23,856

-Disposal of land (94) - 94 - - -

* Remeasurement of retirement benefit plan, net of t

ax - - - - - - 194 194 13 207

Loss on exchange translation

of foreign operations - - - - - (92,269) - (92,269) (20,555) (112,824)

---------------------------------------------------------- --------- ---------- --------- ------------ ------------- ------------ ---------- ------------ ----------------- -------------

Total other comprehensive

income / (expenses) - - - - 19,968 (92,269) 288 (72,013) (16,748) (88,761)

Profit for year - - - - - - 93,521 93,521 20,287 113,808

---------------------------------------------------------- --------- ---------- --------- ------------ ------------- ------------ ---------- ------------ ----------------- -------------

Total comprehensive income

and expenses for the year - - - - 19,968 (92,269) 93,809 21,508 3,539 25,047

Dividends paid - - - - - - (1,784) (1,784) (618) (2,402)

---------------------------------------------------------- --------- ---------- --------- ------------ ------------- ------------ ---------- ------------ ----------------- -------------

Balance at 31 December

2013 15,504 (1,171) 23,935 1,087 56,767 (181,107) 493,031 408,046 85,964 494,010

Items of other comprehensive

income

* Unrealised loss on revaluation of estates, net of

tax - - - - (470) - - (470) (57) (527)

* Gain on exchange translation of foreign operations - - - - - 10,100 - 10,100 2,303 12,403

---------------------------------------------------------- --------- ---------- --------- ------------ ------------- ------------ ---------- ------------ ----------------- -------------

Total other comprehensive

(expenses) / income - - - - (470) 10,100 - 9,630 2,246 11,876

Profit for period - - - - - - 41,088 41,088 7,487 48,575

---------------------------------------------------------- --------- ---------- --------- ------------ ------------- ------------ ---------- ------------ ----------------- -------------

Total comprehensive income

and expenses for the period - - - - (470) 10,100 41,088 50,718 9,733 60,451

Dividend paid - - - - - - (1,998) (1,998) (422) (2,420)

Balance at 30 June 2014 15,504 (1,171) 23,935 1,087 56,297 (171,007) 532,121 456,766 95,275 552,041

---------------------------------------------------------- --------- ---------- --------- ------------ ------------- ------------ ---------- ------------ ----------------- -------------

Balance at 31 December

2012 15,504 (1,171) 23,935 1,087 36,799 (88,838) 401,006 388,322 83,043 471,365

Items of other comprehensive

income

* Unrealised loss on revaluation of estates, net of

tax - - - - (2,167) - - (2,167) (125) (2,292)

* Remeasurement of retirement benefit plan, net of t

ax - - - - - - (1,241) (1,241) (173) (1,414)

* Loss on exchange translation of foreign operations - - - - - (11,356) - (11,356) (2,489) (13,845)

---------------------------------------------------------- -------- --------- -------- ------- --------- ----------- --------- ---------- --------- -----------

Total other comprehensive

expenses - - - - (2,167) (11,356) (1,241) (14,764) (2,787) (17,551)

Profit for period as restated - - - - - - 8,368 8,368 3,375 11,743

---------------------------------------------------------- -------- --------- -------- ------- --------- ----------- --------- ---------- --------- -----------

Total comprehensive income

and expenses for the period - - - - (2,167) (11,356) 7,127 (6,396) 588 (5,808)

Dividends payable - - - - - - (1,784) (1,784) (621) (2,405)

Balance at 30 June 2013

as restated 15,504 (1,171) 23,935 1,087 34,632 (100,194) 406,349 380,142 83,010 463,152

---------------------------------------------------------- -------- --------- -------- ------- --------- ----------- --------- ---------- --------- -----------

Condensed Consolidated Statement Cash Flows

2014 2013 2013

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited

(unaudited) & restated) (audited)

$000 $000 $000

----------------------------------- ------------- -------------- ----------------

Cash flows from operating

activities

Profit before tax 66,269 18,295 153,401

Adjustments for:

BA adjustment (23,103) (2,503) (93,661)

Loss / (Profit) on disposal

of tangible fixed assets 2 91 (319)

Depreciation 3,107 4,143 6,406

Retirement benefit provisions 418 550 1,325

Net finance income (1,939) (979) (2,902)

Unrealised (gain) / loss

in foreign exchange (413) 512 2,781

Tangible fixed assets written

off 6 31 97

Operating cash flow before

changes in working capital 44,347 20,140 67,128

Increase in inventories (1,145) (1,089) (3,591)

(Increase) / Decrease in

trade and other receivables (3,628) (4,430) 2,456

Increase / (Decrease) in

trade and other payables 3,312 (529) 2,400

----------------------------------- ------------- -------------- ----------------

Cash inflow from operations 42,886 14,092 68,393

Interest paid (1,003) (784) (1,774)

Retirement benefit paid (6) (52) (244)

Overseas tax paid (10,309) (15,113) (23,981)

----------------------------------- ------------- -------------- ----------------

Net cash flow from / (used

in) operations 31,568 (1,857) 42,394

----------------------------------- ------------- -------------- ----------------

Investing activities

Property, plant and equipment

- purchase (17,589) (23,583) (49,938)

- sale 34 87 641

Interest received 2,942 1,763 4,676

Net cash used in investing

activities (14,613) (21,733) (44,621)

----------------------------------- ------------- -------------- ----------------

Financing activities

Dividends paid by Company (1,998) - (1,784)

Drawdown of long term loans - 10,000 10,000

Finance lease repayment (12) (36) (30)

Dividends paid to non-controlling

interests (398) (621) (618)

Net cash (used in) / from

financing activities (2,408) 9,343 7,568

----------------------------------- ------------- -------------- ----------------

Increase / (Decrease) in

cash and cash equivalents 14,547 (14,247) 5,341

Cash and cash equivalents

At beginning of period 98,738 116,250 116,250

Foreign exchange 2,546 (3,332) (22,853)

----------------------------------- ------------- -------------- ----------------

At end of period 115,831 98,671 98,738

----------------------------------- ------------- -------------- ----------------

Comprising:

Cash at end of period 115,831 98,671 98,738

----------------------------------- ------------- -------------- ----------------

Notes to the interim statements

1. Basis of preparation of interim financial statements

These interim consolidated financial statements have been

prepared in accordance with IAS 34,"Interim Financial Reporting",

as adopted by the European Union. They do not include all

disclosures that would otherwise be required in a complete set of

financial statements and should be read in conjunction with the

2013 Annual Report. The financial information for the half years

ended 30 June 2014 and 30 June 2013 does not constitute statutory

accounts within the meaning of Section 434(3) of the Companies Act

2006 and has been neither audited nor reviewed pursuant to guidance

issued by the Auditing Practices Board.

Basis of preparation

The annual financial statements of Anglo-Eastern Plantations Plc

are prepared in accordance with IFRSs as adopted by the European

Union. The comparative financial information for the year ended 31

December 2013 included within this report does not constitute the

full statutory accounts for that period. The statutory Annual

Report and Financial Statements for 2013 have been filed with the

Registrar of Companies. The Independent Auditors' Report on the

Annual Report and Financial Statements for 2013 was unqualified,

did not draw attention to any matters by way of emphasis, and did

not contain a statement under 498(2) or 498(3) of the Companies Act

2006.

Changes in accounting standards

The same accounting policies, presentation and methods of

computation are followed in these condensed consolidated financial

statements as were applied in the Group's latest annual audited

financial statements except for the following new standards that

have come into effect from the previous reporting date:

-- IFRS 10 Consolidated Financial Statements

-- IFRS 11 Joint Arrangements

-- IFRS 12 Disclosures of Interest in Other Entities

-- IAS 27 Separate Financial Statements

-- IAS 28 Investments in Associates and Joint Ventures

-- IAS 32 Amendments - Offsetting Financial Assets and Financial Liabilities

-- IAS 36 Amendments - Recoverable Amounts Disclosures for Non-financial Assets

-- IFRIC 21 Levies

None of the new standards, interpretations and amendments above

have had a material effect on the Group's reporting.

After making enquiries, the directors have a reasonable

expectation that the Company and the Group have adequate resources

to continue operations for the foreseeable future. For this reason,

they continue to adopt the going concern basis in preparing the

financial statements.

2. Prior period restatement

Following the conclusion of the discussions with the Financial

Reporting Council ("FRC") regarding the use of current market data

to estimate notional rent for the use of land in its discounted

cash flow for the determination of biological assets, details of

which were set out in the 2013 Annual Report and Accounts, the

Group has adopted a notional rent equivalent to 9% of the value of

planted land in valuing its biological asset and resulted in the

accounts for the period ended 30 June 2013 being restated. The

effect of the restatements is summarised in the following page.

2013

6 months

The impact of these prior period adjustments: to 30 June

(unaudited

& restated)

After Biological Assets $000 $000

--------------------------------------------------- ---------- --------------

Profit for the period before restatement 22,317

Effect of change in restatement:

Biological asset revaluation movement (14,098)

Tax expense 3,524

----------

(10,574)

Profit for the period after restatement 11,743

--------------

Other comprehensive expenses for the

period before restatement (18,573)

Effect of change in restatement:

Profit on exchange translation of

foreign operations 1,022

--------------

Other comprehensive expenses for the

period after restatement (17,551)

--------------

The effect of these prior period adjustments had a negative

impact on the earnings per share of 25.03cts for the period to 30

June 2013.

The following table summarises the impact of these prior period

adjustments on the Consolidated Statement of Financial

Position:

Deferred

Biological tax Exchange Retained Non-controlling

assets liabilities reserve earnings interest

$000 $000 $000 $000 $000

Balance as reported 30

June 2013 265,487 (48,486) (102,827) 442,449 87,321

Effect of restatement during

the year (50,370) 12,592 2,633 (36,100) (4,311)

Restated balance as at

30 June 2013 215,117 (35,894) (100,194) 406,349 83,010

------------ -------------- ----------- ----------- -----------------

3. Foreign exchange

2014 2013 2013

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

Average exchange rates

Rp : $ 11,725 9,732 10,445

$ : GBP 1.67 1.54 1.56

RM : $ 3.27 3.07 3.15

Closing exchange rates

Rp : $ 11,855 9,925 12,170

$ : GBP 1.71 1.52 1.66

RM : $ 3.21 3.16 3.28

4. Finance costs

2014 2013 2013

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$000 $000 $000

Payable 1,003 784 1,774

------------- ------------- ----------------

5. Segment information

North South Total

Sumatra Bengkulu Sumatra Riau Bangka Kalimantan Indonesia Malaysia UK Total

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

6 months to 30 June 2014

(unaudited)

Total sales

revenue

(all external) 48,753 53,335 38 21,787 - 3,002 126,915 2,215 - 129,130

Other income 283 373 - 220 - - 876 - - 876

---------- ---------- --------- --------- -------- ------------ ----------- ----------

Total revenue 49,036 53,708 38 22,007 - 3,002 127,791 2,215 - 130,006

---------- ---------- --------- --------- -------- ------------ ----------- ---------- --------- ----------

Profit / (loss)

before

tax 17,056 18,182 (167) 8,848 (21) (728) 43,170 531 (535) 43,166

BA Movement 23,103

Profit for the

period

before tax per

consolidated

income statement 66,269

----------

Depreciation (1,092) (1,045) (203) (272) (16) (354) (2,982) (125) - (3,107)

Inter-segment

transactions 2,806 (1,704) (197) (490) - (921) (506) 476 30 -

Income tax (7,289) (3,722) (1,581) (2,095) (7) (2,653) (17,347) (66) (281) (17,694)

Total Assets 214,804 155,588 70,765 80,644 13,283 109,770 644,854 29,996 4,435 679,285

Non-Current

Assets 165,229 126,071 68,839 39,477 13,193 97,695 510,504 22,346 1,193 534,043

Non-Current

Assets -

Additions 3,298 1,615 2,466 605 420 9,138 17,542 47 - 17,589

6 months to 30 June 2013 (unaudited &

restated)

Total sales

revenue

(all external) 40,378 25,727 2 14,481 - 680 81,268 1,842 - 83,110

Other income 413 (31) - 34 - 2 418 - - 418

Total revenue 40,791 25,696 2 14,515 - 682 81,686 1,842 - 83,528

---------- ---------- --------- --------- -------- ------------ ----------- ---------- --------- ----------

Profit / (loss)

before

tax 12,110 1,879 (292) 4,374 (10) (1,271) 16,790 (284) (714) 15,792

BA Movement 2,503

Profit for the

period

before tax per

consolidated

income statement 18,295

----------

Depreciation (1,378) (1,653) (236) (502) (15) (230) (4,014) (129) - (4,143)

Inter-segment

transactions 664 (858) (84) (252) - (457) (987) 957 30 -

Income tax (6,771) (2,202) 2,071 (1,216) 107 787 (7,224) 892 (220) (6,552)

Total Assets 176,750 144,251 50,404 65,872 11,260 84,184 532,721 19,196 6,547 558,464

Non-Current

Assets 129,532 124,531 48,113 37,974 10,662 67,136 417,948 11,887 1,363 431,198

Non-Current

Assets -

Additions 4,738 3,120 6,180 625 488 8,262 23,413 170 - 23,583

North South Total

Sumatra Bengkulu Sumatra Riau Bangka Kalimantan Indonesia Malaysia UK Total

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

Year to 31 December 2013 (audited)

Total sales

revenue (all

external) 93,261 63,019 18 38,166 - 2,516 196,980 4,318 2 201,300

Other income 827 112 6 91 - (419) 617 - - 617

---------- ---------- --------- --------- -------- ------------ ----------- ----------

Total revenue 94,088 63,131 24 38,257 - 2,097 197,597 4,318 2 201,917

---------- ---------- --------- --------- -------- ------------ ----------- ---------- --------- ----------

Profit / (loss)

before

tax 33,879 15,700 (443) 19,017 1 (6,633) 61,521 206 (1,987) 59,740

BA Movement 93,661

Profit for the

period

before tax per

----------

consolidated

income

statement 153,401

----------

Depreciation (2,248) (2,268) (475) (585) (32) (540) (6,148) (258) - (6,406)

Inter-Segment

Transactions 2,821 (2,236) (242) (656) - (1,512) (1,825) 845 980 -

Income tax (24,567) (8,086) (554) (6,542) 79 (288) (39,958) 585 (220) (39,593)

Total Assets 195,447 148,268 59,285 67,739 12,744 89,882 573,365 29,720 4,662 607,747

Non-Current Assets 153,524 122,485 57,673 38,726 12,462 76,259 461,129 22,334 1,363 484,826

Non-Current Assets

-

Additions 13,164 5,952 10,172 1,513 1,069 17,828 49,698 240 - 49,938

In the 6 months to 30 June 2014, revenues from 4 customers of

the Indonesian segment represent approximately $87.7m of the

Group's total revenues. In year 2013, revenues from 4 customers of

the Indonesian segment represent approximately $110.1m of the

Group's total revenues. An analysis of these revenues is provided

below:

2014 2013 2013

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited) (unaudited) (audited)

$m % $m % $m %

Major Customers

Customer 1 28.9 22.2 14.6 17.4 31.4 15.6

Customer 2 21.3 16.4 13.7 16.3 30.5 15.1

Customer 3 19.6 15.2 9.4 11.3 25.6 12.7

Customer 4 17.9 13.7 8.1 9.6 22.6 11.1

--------------------- --------- --------- ----------- -------- -------- --------

Total 87.7 67.5 45.8 54.6 110.1 54.5

--------------------- --------- --------- ----------- -------- -------- --------

6. Tax

2014 2013 2013

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited

(unaudited) & restated) (audited)

$000 $000 $000

Foreign corporation tax

- current year 12,415 6,090 17,804

Foreign corporation tax

- prior year - - (61)

Deferred tax adjustment

- current year 5,279 462 22,143

Deferred tax adjustment

- prior year - - (293)

------------- -------------- ----------------

17,694 6,552 39,593

------------- -------------- ----------------

7. Dividend

The final and only dividend in respect of 2013, amounting to

3.0p per share, or $1,997,614 was paid on 17 June 2014 (2012:

4.5cts per share, or $1,783,637, paid on 5 July 2013). As in

previous years no interim dividend has been declared.

8. Earnings per ordinary share (EPS)

2014 2013 2013

6 months 6 months Year

to 30 June to 30 June to 31 December

(unaudited

(unaudited) & restated) (audited)

Profit for the period attributable

to owners of the Company before

BA adjustment 25,879 6,859 35,950

Net BA adjustment 15,209 1,509 57,571

------------- -------------- ----------------

Earnings used in basic and

diluted EPS 41,088 8,368 93,521

------------- -------------- ----------------

Number Number Number

'000 '000 '000

Weighted average number of

shares in issue in period

- used in basic EPS 39,636 39,636 39,636

- dilutive effect of outstanding

share options 48 48 48

------------- -------------- ----------------

- used in diluted EPS 39,684 39,684 39,684

------------- -------------- ----------------

Shares in issue at period end 39,976 39,976 39,976

Less: Treasury shares (340) (340) (340)

------------- -------------- ----------------

Shares in issue at period end

excluding treasury shares 39,636 39,636 39,636

------------- -------------- ----------------

Basic EPS before BA adjustment 65.29cts 17.30cts 90.70cts

Basic EPS after BA adjustment 103.66cts 21.11cts 235.95cts

Dilutive EPS before BA adjustment 65.21cts 17.28cts 90.59cts

Dilutive EPS after BA adjustment 103.54cts 21.09cts 235.67cts

9. Fair value measurement of financial instruments

IAS 34 requires that interim financial statements include

certain of the disclosures about fair value of financial

instruments set out in IFRS 13 and IFRS 7. These disclosures

include the classification of fair values within a three-level

hierarchy. The three levels are defined based on the observability

of significant inputs to the measurement, as follows:

-- Level 1 - quoted prices (unadjusted) in active markets for

identical assets or liabilities;

-- Level 2 - inputs other than quoted prices included within

Level 1 that are observable for the asset or liability, either

directly or indirectly;

-- Level 3 - unobservable inputs for the asset or liability.

The following tables show the Levels within the hierarchy of

Group's assets measured at fair value on a recurring basis at 30

June 2014, 30 June 2013 and 30 December 2013:

Level 1 Level Level 3 Total

2

30 June 2014 $000 $000 $000 $000

---------------------- ------------ ------- --------- ---------

Biological assets - - 304,156 304,156

Land - - 153,756 153,756

Level 1 Level Level 3 Total

2

30 June 2013 $000 $000 $000 $000

---------------------- ------------ ------- --------- ---------

Biological assets - - 215,117 215,117

Land - - 143,792 143,792

Level 1 Level Level 3 Total

2

31 December 2013 $000 $000 $000 $000

---------------------- ------------ ------- --------- ---------

Biological assets - - 265,835 265,835

Land - - 149,871 149,871

There were no items classified under Level 1 and Level 2 and

thus no transfers between Level 1 and Level 2 during the

periods.

The methodology used for biological asset valuations is using

discounted cash flow ("DCF") over the expected 20-year economic

life of the asset. The assumption applied in the valuation were,

inter alia, an assumed CPO selling price of $725/mt (30 June 2013

and 31 December 2013: $700/mt), discount rate of 15.8% (30 June

2013: 17.5%, 31 December 2013: 15.8%) and notional rent equivalent

to 9% (30 June 2013 and 31 December 2013: 9%) of the value of

planted land. The discount rates were determined by the Directors

based on their assessment of various risks including financial,

business and country risk of where the plantations are located as

well as taking into account the Company's weighted average cost of

capital. The CPO price is taken to be the 10-year average (30 June

2013 and 31 December 2013: 10-year average) rounded to the nearest

$25 based on historical widely-quoted commodity price for CPO and

represents the Directors' best estimate of the price sustainable

over the longer term. An inflation rate of 5% (30 June 2013 and 31

December 2013: 5%) was applied to the second to sixth years of the

DCF. The notional rent charge is based on key capital market and

property indicators in the countries and regions of operations.

There were no changes in valuation techniques during the

periods.

The significant unobservable inputs used in the fair value

measurement of biological assets and its relationship to fair value

are exhibited below:

Significant

unobservable inputs Relationship of unobservable inputs

to fair value

CPO selling price The higher the CPO selling price, the

higher the fair value

Discount rate The higher the discount rate, the lower

the fair value

Notional rent The higher the notional rent, the lower

the fair value

For the six months ended 30 June 2014, the directors are of the

opinion the fair value movements of the land are insignificant as

compared to the land value at 31 December 2013 and therefore the

land value at 31 December 2013 is adopted as fair value of land at

30 June 2014 except for the adjustment of exchange differences. The

fair values of the land at 31 December 2013 for five major

companies in Indonesia and a Malaysia company are derived using the

sale comparison approach. Although there is observable market data,

there is a significant degree of judgement in determining the

adjustments required in deriving at the final land valuation. Sale

prices of comparable land in similar location are adjusted for

differences in key attributes such as location, legal title, land

area, land type and topography. The valuation model is based on

price per hectare. The growth rates per hectare obtained by

comparing the current valuation against the valuation undertaken in

year 2011 were then applied to the 2011 land value of the remaining

companies in the same geographical location to derive year 2013

fair value of land. Unplantable land was excluded in this exercise

since it has zero value.

The fair value of the following financial assets and liabilities

approximate their carrying amount:

-- Non-current receivables

-- Trade and other receivables

-- Cash and cash equivalents

-- Borrowings

-- Trade and other payables

10. Report and financial information

Copies of the interim report for the Group for the period ended

30 June 2014 are available on the AEP website at

www.angloeastern.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR MMGZRZNVGDZM

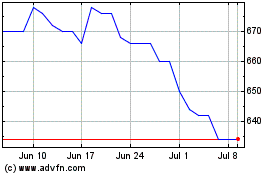

Anglo-eastern Plantations (LSE:AEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Anglo-eastern Plantations (LSE:AEP)

Historical Stock Chart

From Apr 2023 to Apr 2024