TIDMAAZ

RNS Number : 0823K

Anglo Asian Mining PLC

14 April 2015

Anglo Asian Mining plc / Ticker: AAZ / Index: AIM / Sector:

Mining

14 April 2015

Anglo Asian Mining plc

Q1 2015 Operations Update

Gedabek gold, copper and silver mine, Azerbaijan

Anglo Asian Mining plc ("Anglo Asian" or "the Company"), the AIM

listed gold, copper and silver producer focused in Azerbaijan, is

pleased to provide a production and operations update from its

Gedabek gold, copper and silver mine ("Gedabek") in western

Azerbaijan for the three months to 31 March 2015 ("Q1 2015").

Production overview

-- Gold production for Q1 2015 increased to 17,193 ounces with

11,222 ounces from the agitation leaching plant, 5,963 ounces from

heap leach operations and 8 ounces from SART processing (Q4 2014:

total 17,053 ounces)

-- Gold production was 52 per cent. higher than the same period of the previous year (Q1 2014)

-- Copper production for Q1 2015 totalled 182 tonnes from SART processing (Q4 2014: 205 tonnes)

-- Silver production for Q1 2015 totalled 1,950 ounces with 388

ounces from the agitation leaching plant, 208 ounces from heap

leaching operations and 1,354 ounces from SART processing (Q4 2014:

total 3,749 ounces)

-- Gold production target for the year to 31 December 2015 ("FY

2015") is between 70,000 ounces and 75,000 ounces (including

approximately 5,000 ounces of production from the small scale

flotation plant targeted to be commissioned in Q3 2015)

Sales

-- Q1 2015 gold sales of 17,206 ounces at an average of US$1,214 per ounce

-- Q1 2015 copper concentrate shipments to the customer totalled

272 dry metric tonnes ("dmt"), containing 162 tonnes of copper

Company financials

-- Net debt, being interest-bearing loans and borrowings less

cash and cash equivalents, totals US$50.7 million at 31 March 2015

(US$52.4 million at 31 December 2014)

Anglo Asian CEO Reza Vaziri said, "We are delighted to report

exceptional gold and copper production for Q1 2015, especially as

the first three months of the year have historically seen

production capabilities and ore throughput constrained at Gedabek

due to the seasonal harsh winter conditions. This is a highly

credible performance for the quarter and shows that the various

initiatives taken during 2014 to improve production performance are

now starting to show positive results.

"In line with this, we are making good progress on the building

of our small scale flotation plant and the necessary modifications

to enable it to process the tailings of the agitated leach plant.

We expect the plant to be commissioned in Q3 2015.

"With this in mind, our production target for 2015 of between

70,000 and 75,000 ounces of gold represents a significant increase

of around 16 to 24 per cent. compared to the FY 2014 production of

60,285 ounces. I look forward to providing further updates in due

course as we continue to improve our production performance in

order to deliver the utmost value for shareholders."

Full details

Gedabek is a polymetallic deposit from which Anglo Asian

produces gold, copper and silver from its open pit mining

operation. The Company also processes ore from its Gosha deposit,

approximately 50 kilometres away from Gedabek. Three different

processing methods, agitation leaching, heap leaching and

Sulphidisation, Acidification, Recycling, and Thickening ('SART')

are used to produce precious metal and copper.

During Q1 2015, the Company produced 17,193 ounces of gold at

Gedabek; 11,222 ounces from the agitation leaching plant, 5,963

ounces from heap leach operations and 8 ounces from SART

processing. Anglo Asian completed gold sales of 17,206 ounces of

gold at an average of US$1,214 per ounce for Q1 2015.

The Company's SART plant has been performing well producing

copper concentrate and for Q1 2015 copper production totalled 182

dmt. Anglo Asian has a strategic three year sales partnership in

place with Industrial Minerals (SA) which commenced in May 2014 for

the sale of Anglo Asian copper concentrates. Sales of copper

concentrate for Q1 2015 totalled 272 dmt.

Silver production for Q1 2015 totalled 1,950 ounces; with 388

ounces from the agitation leaching plant, 208 ounces from heap

leaching operations and 1,354 ounces from SART.

The following summary table of gold production and prices

outlines quarter-on-quarter gold production at Gedabek for Q1 2015

and the four quarters of the previous year.

Quarter ended Gold Produced* Gold Gold Sales Copper Copper Concentrate Silver

(oz) Sales** Price Produced Sales (dmt) Produced

(oz) (US$) (dmt) (oz)

31 Mar 2014 11,318 10,403 1,302 141 152 13,139

30 Jun 2014 15,736 13,142 1,291 228 523 8,785

30 Sept 2014 16,178 13,798 1,281 210 250 5,504

31 Dec 2014 17,053 13,272 1,201 205 391 3,749

Total FY

2014 60,285 50,615 1,267 784 1,316 31,177

31 Mar 2015 17,193 17,206 1,214 182 272 1,950

* including Government of Azerbaijan's share

** excludes Government of Azerbaijan's share

As previously reported, low grade ore (less than 1.5 grammes per

tonne of gold) is being treated by heap leaching, whilst higher

grade ore (more than 1.5 grammes per tonne of gold) is being

processed through the agitation leaching plant.

During Q1 2015, Anglo Asian stacked 92,586 tonnes of dry crushed

ore on to heap leach pads with an average gold content of 1.47

grammes per tonne. The Company also heap leached uncrushed (Run of

Mine - "ROM") ore. During Q1 2015, Anglo Asian stacked 135,887

tonnes of ROM ore on to heap leach pads with an average gold

content of 1.00 grammes per tonne.

During Q1 2015, the Company processed 136,717 tonnes of ore with

an average gold content of 3.61 grammes per tonne through the

agitation leaching plant.

There was a 71 per cent. gold recovery in agitation leaching for

Q1 2015, the same as the previous two quarters. Gold doré is

produced from both heap and agitated leach intermediate solutions,

which are combined for final processing and also recirculated

around the plant, heap leach pads and tailings dam. Heap leaching

is also a long term process and recoveries are therefore only

estimates calculated from available metallurgical statistics.

As recently announced on 9 March 2015, the construction of a

small scale flotation plant is proceeding to plan. As also

announced, the Company is proceeding with the necessary design

modifications to enable the plant to treat the tailings from the

agitation leach plant.

The Company had net debt at 31 March 2015 of US$50.7 million, a

reduction of US$1.7 million since 31 December 2014. The net debt at

31 March 2015 was as follows:

US$m

Amsterdam Trade Bank - Agitation plant loan 34.5

International Bank of Azerbaijan - loan 13.4

Atlas Copco equipment finance loan 0.8

YapiKredit 0.7

Pasha Bank 1.8

Total Loans 51.2

Cash on hand and at bank (0.5)

Net debt 50.7

**ENDS**

For further information please visit www.angloasianmining.com or

contact:

Reza Vaziri Anglo Asian Mining plc Tel: +994 12 596 3350

-------------------- ------------------------------ ----------------------

Bill Morgan Anglo Asian Mining plc Tel: +994 502 910 400

-------------------- ------------------------------ ----------------------

Ewan Leggat SP Angel Corporate Finance Tel: +44 (0) 20 3470

LLP 0470

Nominated Adviser and Broker

-------------------- ------------------------------ ----------------------

Stuart Gledhill SP Angel Corporate Finance Tel + 44 (0) 20 3470

LLP 0470

-------------------- ------------------------------ ----------------------

Felicity Winkles St Brides Partners Ltd Tel: +44 (0) 20 7236

1177

-------------------- ------------------------------ ----------------------

Lottie Brocklehurst St Brides Partners Ltd Tel: +44 (0) 20 7236

1177

-------------------- ------------------------------ ----------------------

Notes:

Anglo Asian Mining plc (AIM:AAZ) is a gold, copper and silver

producer in Central Asia with a broad portfolio of production and

exploration assets in Azerbaijan. The Company has a 1,962 square

kilometre prospective exploration portfolio, assembled from

analysis of historic Soviet geological data and held under a

Production Sharing Agreement modelled on the Azeri oil

industry.

The Company developed Azerbaijan's first operating

gold/copper/silver mine, Gedabek, which commenced gold production

in May 2009. Gold production for the year ended 31 December 2014

from Gedabek totalled 60,285 ounces and 784 tonnes of copper. The

Company is also developing a second resource area, Gosha, which is

50 kilometres from Gedabek, and the ore produced at Gosha is

processed at Anglo Asian's Gedabek plant. The Company's production

target for full year 2015 is between 70,000 ounces and 75,000

ounces of gold. Gedabek is a polymetallic deposit and its ore has a

high copper content, and as a result the Company produces copper

concentrate from its Sulphidisation, Acidification, Recycling, and

Thickening (SART) plant. Anglo Asian is also constructing a small

scale, low capital expenditure flotation plant to produce a copper

and precious metal concentrate. This will initially process ore

from its existing stockpiles of sulphide ore with a high copper

content.

Anglo Asian is also actively looking to exploit its first mover

advantage in Azerbaijan to identify additional projects, as well as

looking for other properties in order to fulfil its expansion

ambitions and become a mid-tier gold and copper metal production

company.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCIJMRTMBMBBTA

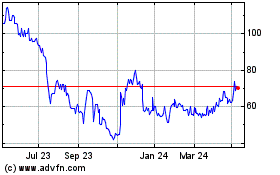

Anglo Asian Mining (LSE:AAZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

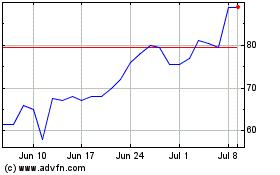

Anglo Asian Mining (LSE:AAZ)

Historical Stock Chart

From Apr 2023 to Apr 2024