TIDMAAZ

RNS Number : 3403R

Anglo Asian Mining PLC

21 September 2017

Anglo Asian Mining plc / Ticker: AAZ / Index: AIM / Sector:

Mining

21 September 2017

Anglo Asian Mining plc

Interim Results for the six-month period to 30 June 2017

Commencement of Gold and Silver production from the Ugur open

pit mine at Gedabek licence area, Azerbaijan

Anglo Asian Mining plc ("Anglo Asian" or the "Company"), the AIM

listed gold, copper and silver producer focused in Azerbaijan, is

pleased to announce its interim results for the six-month period

ended 30 June 2017 ("H1 2017"). Note that all references to "$" are

to United States dollars.

In addition, the Company has included a summary update on its

latest mine, the Ugur open pit mine ("Ugur"), located within the

Company's Gedabek licence area ("Gedabek"). Ugur, as announced

earlier this month, has commenced gold and silver production. It

will be an important contributor to the Company's production whilst

other optimisation and expansion initiatives continue until the end

of 2017 at the main Gedabek open pit and Gadir underground

mines.

An updated corporate presentation on the Company's H1 2017

financial results will be available later today, Thursday 21

September 2017 on the Anglo Asian web-site:

http://www.angloasianmining.com.

H1 2017 Production Overview

-- H1 2017 results confirmed anticipated increased copper and

decreased gold bullion production due to optimisation and expansion

initiatives undertaken during the period which will significantly

enhance the Company's long term outlook:

o Gold production for H1 2017 totalled 23,218 ounces - 18,389

ounces contained within gold doré, 9 ounces from SART processing

and 4,820 ounces from flotation (H1 2016: total 33,837 ounces)

o Copper production for H1 2017 increased to 1,322 tonnes - 397

tonnes from SART processing and 925 tonnes from flotation (H1 2016:

total 969 tonnes)

o Silver production for H1 2017 totalled 85,087 ounces - 5,713

ounces contained within gold doré, 10,240 ounces from SART

processing and 69,134 ounces from flotation (H1 2016: total 90,782

ounces)

o Total production for H1 2017 expressed as gold equivalent

ounces of 28,489 ounces (H1 2016: 36,729 gold equivalent

ounces)

-- Target production for the 12 months to 31 December 2017

expressed as gold equivalent ounces remains at between 64,000 and

72,000 ounces compared to FY 2016 actual total production of 72,304

gold equivalent ounces

Sales overview

-- Increased sales of copper concentrate offsetting reduced sales of gold bullion:

o H1 2017 gold bullion sales of 15,689 ounces at an average of

$1,238 per ounce (H1 2016: 27,804 ounces at an average of $1,230

per ounce)

o H1 2017 copper concentrate shipments to the customer totalled

5,396 dry metric tonnes ("dmt") with a sales value of $10.3 million

(excluding Government of Azerbaijan production share) (H1 2016:

2,901 dmt with a sales value of $5.1 million)

Financial overview

-- Revenue decreased to $29.8 million (H1 2016: $39.3 million)

due to lower gold bullion sales partially offset by higher sales of

copper concentrate

-- All in sustaining cost ("AISC") of production per ounce of

gold (including the Government of Azerbaijan's share) of $564 per

ounce, a decrease of 20 per cent. compared to H1 2016 of $703 per

ounce

-- Loss before taxation of $1.3 million (H1 2016: profit of $3.5

million) due to the planned lower production as a result of

optimisation and expansion initiatives carried out during the

period

-- Cash generated from operations of $10.8 million (H1 2016: $16.9 million)

-- Capital expenditure of $3.4 million (H1 2016: $6.6 million)

mainly on deferred stripping ($1.6 million), the water treatment

plant ($0.8 million) and Ugur development ($0.6 million)

-- Decreased net debt of $29.0 million as at 30 June 2017 (31 December 2016: $34.6 million)

-- Cash of $1.5 million as at 30 June 2017 (31 December 2016: $1.4 million)

Operational overview

-- Ugur JORC (2012) total resource of 199,000 ounces of gold and 1,049,000 ounces of silver

-- Mining of Ugur deposit commenced in September 2017 with first

production of gold doré from ore - average daily gold production as

doré from 1 to 10 September 2017 of 212 ounces more than doubled

compared to the previous eight months

-- Water treatment plant became operational in August 2017

-- Six metre raise of tailings dam wall currently underway

Chairman's statement

Review of 2017 to date

The period under review has been a busy one in developing your

Company into a sustainable and long term mining business. The

strategic review earlier in the year set down clear objectives for

2017. These included bringing the new Ugur gold deposit into

production by the final quarter of 2017 together with other

production and optimisation initiatives. These objectives have now

been broadly executed, and I am especially pleased to report the

completion of the JORC (2012) resource in August and the

commencement of gold doré production from Ugur's open pit mine

earlier this month.

The Company made a loss before taxation of $1.3 million in the

period due to the planned lower production arising from the

optimisation initiatives. However, cash generation continued to be

strong with $10.8 million generated from operations and net debt

decreased by a further $5.6 million in the period. Total production

of gold of 23,218 ounces was reduced from 33,837 ounces in the

corresponding period of 2016. This was due to the production

optimisation initiatives which inevitably, and as anticipated,

resulted in a temporary reduction in the level of gold production.

However, copper production increased to 1,322 tonnes from 969

tonnes in 2016 and continues to be an increasingly significant

proportion of our revenue. Production of gold as doré since the

beginning of September has also increased significantly with the

commencement of mining from Ugur.

The increase in precious metal prices which we saw last year has

continued into 2017 and we sold our gold bullion at an average

selling price of $1,238 per ounce compared to $1,230 per ounce in

the corresponding period in H1 2016. The Company has not carried

out any sales hedging in 2017. The increase in the price of gold

has accelerated since the end of June with the gold price now

around $1,300 per ounce. The increasing price of copper from its

low of $4,350 per tonne in January 2016 to its current price in the

region of $6,500 per tonne has also been very beneficial for the

Company given its increasing copper production.

The Group produced gold at an all in sustaining cost ("AISC") of

$564 per ounce and cash generated from operations was $10.8

million. We continued to service our debts on time and net debt

reduced from $34.6 million at 31 December 2016 to $29.0 million at

30 June 2017.

During the period under review, the Company initially produced

gold doré and copper concentrate by using crushed ore as feedstock

for its agitation leaching plant and then treating the tailings

produced by flotation. This configuration was reversed from early

February with crushed ore feedstock initially treated by flotation.

This was to treat the high copper content ore stockpiles whilst

production optimisation was carried out. The configuration was

changed yet again with the commencement of mining from Ugur. The

Ugur oxide-rich ores are treated by agitation leaching but the

tailings are not treated by flotation as Ugur ore does not contain

copper. The flotation plant is now independently processing 300 to

400 tonnes per day of mainly high sulphide stockpiled ore using its

own mills. The variety of methods available to us to utilise our

processing facilities, and the fact that changes to their

configuration were carried out without any significant lapses in

production, demonstrate their high versatility.

The completion of the JORC (2012) resource estimation for the

Ugur gold deposit in August 2017 and the commencement of production

from the deposit this month was a significant achievement for the

Company and all the employees involved. Ugur's total JORC (2012)

mineral resource of 199,000 ounces of gold is a valuable addition

to the Company's resources and will further advance the

sustainability of the Company.

The water purification plant at Gedabek is now operational and

produces potable (drinking quality) water which can be used either

in the Company's processing facilities or discharged into the

environment. The Company is also constructing a six metre raise of

the tailings dam wall, which is expected to be complete by the end

of 2017. The tailings dam will then have adequate capacity for the

next two to three years.

The Company continues to place special emphasis on Health,

Safety and Environment ("HSE") issues. The Company's HSE department

was increased in June 2017 from three to seven staff and the lost

time injury ("LTI") rate continued to decrease.

Outlook

I continue to look forward with optimism. In the period under

review, a number of key initiatives were completed which will

enhance the sustainability and long term future of the Company's

mining operations. As anticipated, our production and hence

profitability was modestly impacted by these initiatives in the

period. However, the positive impact of these initiatives is

already evident and they will deliver significant value during the

remainder of the year and into 2018 and beyond.

With the above in mind, I am pleased to reconfirm our total

production target for 2017 at between 64,000 to 72,000 ounces

compared to 72,304 ounces in 2016. This target is stated in gold

equivalent ounces ("GEOs") given the increasing proportion of

copper in our production

Appreciation

I would like to take this opportunity to thank our Anglo Asian

employees, our partners, the Government of Azerbaijan, advisers and

fellow directors for their continued support as we continue to

build the Company into a leading and profitable gold, copper and

silver producer in Azerbaijan and Caucasia. I would also like to

especially thank our shareholders for their invaluable support as

we look forward to a successful completion of 2017 and beyond.

Khosrow Zamani

Non-executive Chairman

20 September 2017

Strategic review

Gebabek - mining and production

The Gedabek mining operation is located in a 300-square

kilometre contract area ("Gedabek Licence") in the Lower Caucasus

mountains in western Azerbaijan on the Tethyan Tectonic Belt, one

of the world's most significant copper and gold-bearing geological

structures. Within the Gedabek Licence are the majority of the

Group's open pit and underground mines and its processing

facilities.

The principal mining operation ("Main Open Pit") within the

Gedabek Licence is conventional open cast mining from several

contiguous open pits. Ore is also mined from the Gadir underground

mine, which is located approximately one kilometre away, from the

Main Open Pit. Gosha, which is approximately 50 kilometers away

from the Gedabek Licence, is the Company's second underground mine

and ore mined at Gosha is transported to Gedabek for processing.

The main ore body at Gedabek is a polymetallic deposit from which

Anglo Asian produces gold, copper and silver. In 2016, the Company

discovered the Ugur gold deposit which is located three kilometres

north-west from the Company's processing facilities at Gedabek. A

JORC (2012) total resource of 199,000 ounces of gold and 1,049,000

ounces of silver was published in August 2017 and mining of an

oxide-rich ore at Ugur, commenced in September 2017, by

conventional open cast mining.

Four different processing methods are used to produce gold,

silver and copper. Agitation leaching and heap leaching (both of

crushed and whole ore) are used to produce gold doré.

Sulphidisation, Acidification, Recycling and Thickening ("SART")

and flotation are used to produce a copper concentrate which also

includes gold and silver. The Company's processing facilities are

flexible. Crushed ore can either be initially treated by agitation

leaching and the tailings from this process treated by flotation to

fully recover the metals or vice versa. The agitation leaching and

flotation plants can also be run at the same time as separate

stand-alone plants using different feedstock. The methodology

employed will depend upon the chemical composition of the ores to

be treated.

In early 2017, a wide-ranging strategic review of Gedabek was

completed in response to the discovery of the Ugur gold deposit and

the decreasing gold grade and higher percentage of copper of ore

mined in the Main Open Pit. As a result of this strategic review,

several initiatives were undertaken to ensure sustainable long-term

production at Gedabek. Ore production from both the Main Open Pit

and the Gadir underground mine was temporarily reduced so that

exploration, ore zone definition and production optimisation could

be carried out. The Company also started to process its 1.1 million

tonnes of high copper content stockpiles during this period of

reduced ore mining to maintain production. Exploration and

development of the Ugur deposit was maintained throughout the

period so that mining could commence from an open pit by the final

quarter of 2017. This was achieved ahead of schedule at the

beginning of September 2017 as announced on 13 September.

The Company also changed its processing of ore during the period

in response to the strategic review. Until early February 2017, ore

was crushed and then initially processed by the Company's agitation

leaching plant and the tailings from the plant fed to the flotation

plant for processing to recover any remaining metal. In early

February 2017, due to the higher percentage of copper in the

stockpiled ores being processed, ore was crushed and initially

processed by flotation and the tailings from the flotation plant

treated by agitation leaching. This processing methodology was

maintained until late August 2017. The configuration was then

changed again with the commencement of mining from Ugur. The Ugur

oxide-rich ores do not contain copper and are treated by agitation

leaching but the tailings are not treated by flotation. The

flotation plant is now independently processing stockpiled ore

using its own mills.

During H1 2017, the Company mined 542,936 dry tonnes of ore from

its Gedabek open pit (H1 2016: 835,381 tonnes). Continued mining

was made possible during the quarter due to careful utilisation of

equipment and human resources. In H1 2017, 25,573 dry tonnes of

high grade ore with an average content of 3.85 grammes per tonne

was mined from its Gadir underground mine (H1 2016: 55,488 tonnes

with an average content of 5.84 grammes per tonne) in conjunction

with its exploration programme.

As previously reported, low grade ore (less than 1.5 grammes per

tonne of gold) is being treated by heap leaching, whilst higher

grade ore (more than 1.5 grammes per tonne of gold) is being

processed through the combined agitation leaching and flotation

plants.

During H1 2017, Anglo Asian stacked 272,495 tonnes of dry

crushed ore on to heap leach pads with an average gold content of

1.03 grammes per tonne (H1 2016: 201,652 tonnes with an average

gold content of 1.40 grammes per tonne). The Company also heap

leached uncrushed (Run of Mine - "ROM") ore. During H1 2017, Anglo

Asian stacked 219,181 tonnes of ROM ore on to heap leach pads with

an average gold content of 0.88 grammes per tonne (H1 2016: 377,940

tonnes with an average gold content of 0.80 grammes per tonne).

During H1 2017, the Company processed 360,872 tonnes of ore with

an average gold content of 1.64 grammes per tonne through the

combined agitation leaching and flotation plants (H1 2016: 184,074

tonnes of ore with an average gold content of 1.52 grammes per

tonne). Of the ore processed in H1 2017, 209,268 tonnes were mined

from the open pit and the Gadir and Gosha underground mines and

152,604 tonnes were from the Company's stockpiles.

During H1 2017, the Company produced gold doré containing 18,389

ounces of gold and 5,713 ounces of silver at Gedabek (H1 2016:

31,309 ounces of gold and 4,941 ounces of silver). The agitation

leaching plant produced 10,114 and 2,993 ounces of gold and silver,

respectively, and the heap leach operations produced 8,275 and

2,720 ounces of gold and silver, respectively. The decreased gold

doré production in H1 2017 compared to H1 2016 was due to lower

gold grade of processed ores and the production optimisation

initiatives undertaken during the period.

During H1 2017, the flotation plant processed 275,581 tonnes of

ore in the form of feed-stock of both milled ore and tailings from

the agitation leaching plant. The gross metal contained within this

feed-stock was 10,317 ounces of gold, 149,588 ounces of silver and

1,340 tonnes of copper. Copper concentrate of 5,585 dmt was

produced containing 925 tonnes of copper and 4,820 ounces of gold.

SART processing produced 846 dmt of copper concentrate containing

397 tonnes of copper and 9 ounces of gold.

The following table summarises gold doré production and sales at

Gedabek for FY 2016 and H1 2017:

Gold produced* Silver Gold sales** Gold Sales

(ounces) Produced* (ounces) price

(ounces) ($/ounce)

Quarter ended

31 March 2016 13,383 1,958 12,143 1,184

30 June 2016 17,926 2,983 15,661 1,265

H1 2016 31,309 4,941 27,804 1,230

30 Sept 2016 15,407 2,502 12,567 1,332

31 Dec 2016 14,221 2,845 12,995 1,227

H2 2016 29,628 5,347 25,562 1,278

FY 2016 60,937 10,288 53,366 1,253

31 March 2017 9,258 2,447 8,283 1,220

30 June 2017 9,131 3,266 7,406 1,258

H1 2017 18,389 5,713 15,689 1,238

-------------- -------------- ----------- ------------- ----------

* including Government of Azerbaijan's share

** excludes Government of Azerbaijan's share

The following table summarises copper concentrate production

from both the Company's SART and flotation plants at Gedabek for FY

2016 and H1 2017:

Concentrate Copper Gold Silver

production* content* content* content*

2016 (dmt) (tonnes) (ounces) (ounces)

Quarter ended 31

March

SART processing 363 181 12 7,789

Flotation** 1,458 200 607 19,055

Total 1,821 381 619 26,844

Quarter ended 30

June

SART processing 373 195 4 10,047

Flotation** 1,988 302 1,445 39,184

Total 2,361 497 1,449 49,231

Quarter ended 30

Sept

SART processing 418 225 4 7,291

Flotation 1,426 260 1,123 24,106

Total 1,844 485 1,127 31,397

Quarter ended 31

December

SART processing 445 219 7 6,751

Flotation 2,059 359 1,255 40,620

Total 2,504 578 1,262 47,371

2017

Quarter ended 31

March

SART processing 428 210 5 5,523

Flotation 2,312 396 1,815 31,399

Total 2,740 606 1,820 36,922

Quarter ended 30

June

SART processing 418 187 4 4,717

Flotation 3,273 529 3,005 37,735

Total 3,691 716 3,009 42,452

------------------ ------------ --------- --------- ---------

* including Government of Azerbaijan's share.

** certain amounts for flotation production are different to

those previously disclosed due to final reconciliation of

production and sales.

The following table summarises copper concentrate production and

sales at Gedabek for FY 2016 and H1 2017. Note that sales of

concentrates are initially recorded at provisional amounts until

agreement of final assay:

Concentrate Copper Gold Silver Concentrate Concentrate

production* content* content* content* sales** sales**

(dmt) (tonnes) (ounces) (ounces) (dmt) ($000)

Quarter

ended

31 March

2016 1,821 381 619 26,844 1,319 2,137

30 June

2016 2,361 497 1,449 49,231 1,582 2,977

H1 2016 4,182 878 2,068 76,075 2,901 5,114

30 Sept

2016 1,844 485 1,127 31,397 1,782 3,612

31 Dec

2016 2,504 578 1,262 47,371 2,147 3,865

H2 2016 4,348 1,063 2,389 78,768 3,929 7,477

FY 2016 8,530 1,941 4,457 154,843 6,830 12,591

31 March

2017 2,740 606 1,820 36,922 2,230 4,220

30 June

2017 3,691 716 3,009 42,452 3,166 6,104

H1 2017 6,431 1,322 4,829 79,374 5,396 10,324

---------- ------------ --------- --------- --------- ------------- --------------

* including Government of Azerbaijan's share

** excludes Government of Azerbaijan's share

Gebabek - operational update

The Company's membrane water filtration plant, that produces

water of sufficient purity from water in the tailings dam that it

can be discharged into the environment, recently commenced

operation. A by-product concentrate will also be produced from

which metal and cyanide can be recovered. This will improve the

water balance of the site and save costs as it will reduce the

tailings dam capacity required. It will also enable the recovery of

metal currently in the tailings dam.

The Company has recently commenced a six metre raise of the wall

of its tailing dam. 700 cubic metres of material is being moved to

raise the wall and it is expected that the earthworks will be

completed by the end of November and the wall lined and completed

by the end of the year. This wall raise is expected to give the dam

an additional two to three years of storage capacity.

Gedabek - Ugur

Update on Ugur development

Anglo Asian's in-house exploration team defined a new mineral

occurrence in 2016 named "Ugur" (meaning "good luck" or "success"

in the Azeri language) from geological mapping and surface sampling

methods. Ugur is located three kilometres north-west from the

Company's processing facilities at its Gedabek Licence.

The deposit comprises an oxide gold-rich zone to a depth varying

between 50 to 60 metres. The area covered by drilling and the

proposed open pit outline is 350 metres (east-north-east) by 250

metres (north-north-west).

Throughout the period under review, the Company has extensively

explored the Ugur deposit to define its resource and reserves and

has also undertaken the development work necessary to bring the

deposit into production as an open cast mine.

The development work included the construction of a 4.6

kilometre road between the Ugur gold deposit and the Company's

processing facilities. Work is nearing completion on constructing

all necessary infra-structure. This includes the mine, geology and

medical and HSE offices, hygiene facilities, mechanical workshop,

lubricants and spares stores, a weighbridge and diesel store. The

weighbridge will be located at the intersection of the mine access

road and the haul road to the plant, while other building

infrastructure will be located about 500 metres from the open pit

boundary designated in accordance with blasting regulations.

Pre-stripping of the top soil has been carried out. Mining by

conventional shovel and truck haulage to an Ugur stockpile near the

processing facilities started mid-August 2017. Production of gold

dorè from Ugur ore started at the beginning of September 2017 as

announced on 13 September 2013.

JORC (2012) Mineral Resources and Ore Reserves Statements

The mineral resource and reserves are prepared in accordance

with JORC (2012) which is the current edition of the JORC Code

published in 2012. After a transition period, the 2012 edition came

into mandatory operation from 1 December 2013.

Mineral Resource

Mineral Resource

Gold Silver

Tonnage Grade Grade Gold Silver

(millions) (g/t)* (g/t)* (ounces) (ounces)**

Measured 4.12 1.2 6.3 164,000 841,000

Indicated 0.34 0.8 3.9 8,000 44,000

Measure and

Indicated 4.46 1.2 6.2 172,000 884,000

Inferred 2.50 0.3 2.1 27,000 165,000

Total 6.96 0.9 4.7 199,000 1,049,000

* grammes per tonne

** due to rounding, does not add.

Mineral Reserves

Gold Silver

Tonnage Grade Grade Gold Silver

Mineral Reserves (millions) (g/t)* (g/t)* (ounces) (ounces)

Proved 3.37 1.3 7.2 142,000 779,000

Probable 0.22 0.8 4.1 5,000 29,000

Proved and

probable 3.59 1.3 7.0 147,000 808,000

The Proved and Probable Ore Reserves estimate is based on that

portion of the Measured and Indicated Mineral Resource of the

deposit within the scheduled mine designs that may be economically

extracted, considering all "Modifying Factors" in accordance with

the JORC (2012) Code.

Mineral Resource and Reserve Estimation

Anglo Asian, together with the mining and geological consulting

group Datamine International, prepared the JORC (2012) resource and

reserves estimation of the Ugur deposit. This was following the

completion of 55 "phase one" reverse circulation ("RC") drill holes

totalling 1,842 metres, 50 core drill holes totalling 6,355 metres,

and 33 infill RC drill holes totalling 2,766 metres that

supplemented initial surface outcrop and channel sampling. The

detailed mineral resource and reserves estimates and a glossary of

terminology related to the mineral resource and reserves estimate

has been announced by the Company on 14 August 2017 and is

available on its web site at:

http://www.angloasianmining.com/scripts/php/rns_viewer.php?id=26308910.

A full JORC report will be available on the Company website by

the end of September 2017.

Corporate and social responsibility

Our health, safety, social and environmental ("HSE") performance

forms a central part of our philosophy of continuous commitment to

best in class practice. The Company continues to provide additional

resources to improve its safety and environmental record and during

the period four additional HSE officers were recruited. The number

of HSE officers at 30 June 2017 was seven compared to three at the

beginning of the period. The success of the Company's efforts at

improving safety is shown by the decreasing lost time injury

("LTI") rate. This was 1.21 per one million man hours in the period

compared to 3.06 in 2016 and 6.92 in 2015.

There was one lost time injury in the period. This was burns to

an employee due to a chemical spill in the SART plant. Action was

taken to prevent future chemical spills including additional staff

training and physical measures to further confine chemicals within

the SART plant.

Various actions to improve safety were taken in the period in

addition to increasing the staff within the HSE department.

Approximately 300 hours of safety training was given to employees,

contractors and visitors. Various items of emergency response

equipment such as fire-fighting and emergency breathing equipment,

vehicle extraction equipment and a portable defibrillator were also

purchased in the period.

Financial review

Revenue of $29.8 million was generated from the sales of Anglo

Asian's share of gold and silver bullion, refined from gold doré

bars, and copper and precious metal concentrate in the six months

ended 30 June 2017. Sales of gold and silver bullion were $19.5

million which comprised 15,689 ounces of gold and 5,020 ounces of

silver sold at an average price of $1,238 and $17 per ounce

respectively. Sales of copper and precious metal concentrate were

$10.3 million. No hedging of gold bullion sales was undertaken in

the six months to 30 June 2017.

Total cost of sales for the six months ended 30 June 2017

decreased by $4.0 million to $25.9 million compared to $29.9

million in 2016. Cash cost of sales decreased by $2.1 million to

$20.5 million compared to $22.6 million in 2016. For the six months

ended 30 June 2017, reagents costs were lower by $1.2 million and

mining costs were lower by $0.9 million compared to 2016. This was

due to reduced mining and production as a result of the

optimisation initiatives. Depreciation decreased by $2.9 million

from $9.9 million in 2016 to $7.0 million in 2017 due to lower gold

production.

Administrative expenses for the six months ended 30 June 2017

decreased to $2.3 million compared to $2.5 million in 2016.

Administrative expenses comprise the cost of the Company's office

in Baku, directors and other administrative staff salaries,

professional fees and the cost of maintaining the Company's listing

on the AIM market.

The finance costs for the six months ended 30 June 2017 of $1.9

million comprise interest on loans and letters of credit of $1.7

million and accretion expense on the rehabilitation provision of

$0.2 million. Finance costs were lower in the period due to lower

average borrowings in the period. There were no borrowing costs

capitalised in the six months ended 30 June 2017.

Income tax for the six months ended 30 June 2017 of $1.4 million

represents a deferred taxation charge in respect of the Azerbaijan

operations. The Company's Azerbaijan operations are expected to

produce taxable profits for the full year ending 31 December

2017.

The Group produced gold bullion at an all in sustaining cost

("AISC") for the six months ended 30 June 2017 of $564 per ounce

compared to $703 per ounce for the six months ended June 2016 and

$616 for the full year 2016. AISC for the period ended 30 June 2017

was lower than 2016 due to lower costs of sustaining capital and

higher by-product sales. There are no royalty costs included in the

Company's AISC calculation as the Production Sharing Agreement with

the Government of Azerbaijan is structured as a revenue sharing

arrangement. Therefore, the Company's AISC is calculated using a

cost of sales which is the cost of producing 100 per cent. of the

gold and such costs are allocated to total gold production

including the Government of Azerbaijan's share.

The Company had cash at 30 June 2017 of $1.5 million and total

debt at amortised cost of $30.5 million, giving net debt of $29.0

million. The joint Amsterdam Trade Bank ("ATB") and Gazprombank

(Switzerland) Ltd ("GPBS") loan has a debt service cover ratio

("DSCR") covenant of 1.25, and for the six months ended 30 June

2017, the DSCR was 1.00. The Company obtained waiver of the

covenant from ATB and GPBS prior to the end of period. The Company

had unutilised credit facilities of $0.95 million at 30 June

2017.

Capital expenditure of $3.4 million for the six months ended 30

June 2017 represented capitalised deferred stripping costs of $1.6

million; expenditure on the water treatment plant of $0.8 million,

Ugur development of $0.6 million and miscellaneous equipment and

other items of $0.4 million.

Capitalised exploration and evaluation expenditure of $0.1

million was incurred in the six months ended 30 June 2017 which was

mainly exploration in the Ordubad contract area.

The Group reports in US dollars and a substantial proportion of

its business is conducted in either US dollars or the Azerbaijan

Manat ("AZN") which has been stable at AZN 1 equalling

approximately $0.58 during the six months ended 30 June 2017. In

addition, the Company's revenues and the majority of its

interest-bearing debt are denominated in US dollars. The Company

currently does not have any significant exposure to foreign

exchange fluctuations and the situation is kept under review.

Anglo Asian Mining plc

Condensed group income statement

Six months ended 30 June 2017

6 months 6 months

to to

30 June 30 June

2017 2016

(unaudited) (unaudited)

Notes $000 $000

------------------------- ------ ---------------------------- ------------------

Revenue 29,838 39,323

Cost of sales (25,928) (29,960)

------------------------- ------ ---------------------------- ------------------

Gross profit 3,910 9,363

Other income 8 78

Administrative expenses (2,316) (2,524)

Other operating expense (996) (883)

Operating profit 606 6,034

Finance costs (1,930) (2,546)

------------------------- ------ ---------------------------- ------------------

(Loss) / profit before

tax (1,324) 3,488

Income tax 3 (1,418) (3,064)

------------------------- ------ ---------------------------- ------------------

(Loss) / profit after

tax (2,742) 424

------------------------- ------ ---------------------------- ------------------

(Loss) / profit per

share for the period

attributable to the

equity holders of

the parent (2,742) 424

------------------------- ------ ---------------------------- ------------------

Basic (US cents per

share) 4 (2.44) 0.38

------------------------- ------ ---------------------------- ------------------

Anglo Asian Mining plc

Condensed group statement of comprehensive income

Six months ended 30 June 2017

6 months 6 months

to to

30 June 30 June

2017 2016

(unaudited) (unaudited)

$000 $000

---------------------------- ------------ -------------

(Loss) / profit for the

period (2,742) 424

---------------------------- ------------ -------------

Total comprehensive (loss)

/ profit for the period (2,742) 424

---------------------------- ------------ -------------

Attributable to the equity

holders of the parent

company (2,742) 424

---------------------------- ------------ -------------

Anglo Asian Mining plc

Condensed group statement of financial position

30 June 2017

30 June 30 June 31 December

2017 2016 2016

(unaudited) (unaudited) (audited)

Notes $000 $000 $000

------------------------------ ------ -------------- -------------- -------------

Non-current assets

Intangible assets 5 16,283 17,553 16,848

Property, plant

and equipment 6 94,012 104,141 98,476

Inventory 7 - 2,595 -

Other receivables 8 1,272 1,113 1,084

------------------------------ ------ -------------- -------------- -------------

111,567 125,402 116,408

------------------------------ ------ -------------- -------------- -------------

Current assets

Inventory 7 34,229 27,087 34,018

Trade and other

receivables 8 18,421 10,209 16,250

Cash and cash equivalents 1,527 3,262 1,379

------------------------------ ------ -------------- -------------- -------------

54,177 40,558 51,647

------------------------------ ------ -------------- -------------- -------------

Total assets 165,744 165,960 168,055

------------------------------ ------ -------------- -------------- -------------

Current liabilities

Trade and other

payables 9 (26,534) (15,595) (21,833)

Interest-bearing

loans and borrowings 10 (26,047) (26,733) (26,165)

------------------------------ ------ -------------- -------------- -------------

(52,581) (42,328) (47,998)

------------------------------ ------ -------------- -------------- -------------

Net current assets

/ (liabilities) 1,596 (1,770) 3,649

------------------------------ ------ -------------- -------------- -------------

Non-current liabilities

Provision for rehabilitation (9,138) (8,800) (9,416)

Interest-bearing

loans and borrowings 10 (4,466) (17,257) (9,765)

Deferred tax liability (19,648) (18,498) (18,230)

------------------------------ ------ -------------- -------------- -------------

(33,252) (44,555) (37,411)

------------------------------ ------ -------------- -------------- -------------

Total liabilities (85,833) (86,883) (85,409)

------------------------------ ------ -------------- -------------- -------------

Net assets 79,911 79,077 82,646

------------------------------ ------ -------------- -------------- -------------

Equity

Share capital 11 1,993 1,993 1,993

Share premium account 32,325 32,325 32,325

Share-based payment

reserve 161 292 154

Merger reserve 46,206 46,206 46,206

Retained (loss)

/ earnings (774) (1,739) 1,968

Total equity 79,911 79,077 82,646

------------------------------ ------ -------------- -------------- -------------

Anglo Asian Mining plc

Condensed group cash flow statement

Six months ended 30 June 2017

6 months 6 months

to to

30 June 30 June

2017 2016

(unaudited) (unaudited)

$000 $000

------------------------------------- --- ------------- -------------

(Loss) / profit before taxation (1,324) 3,488

Adjustments for:

Finance costs 1,930 2,546

Depreciation of property, plant

and equipment 7,290 9,844

Amortisation of mining rights

and other intangible assets 673 954

Share-based payment expense 7 9

Write down of unrecoverable

inventory 107 78

------------------------------------------ ------------- -------------

Operating cash flow before

movements in working capital 8,683 16,919

Decrease / (increase) in trade

and other receivables 1,391 (1,372)

Increase in inventories (318) (1,020)

Increase in trade and other

payables 1,029 2,388

------------------------------------------ ------------- -------------

Cash generated from operations 10,785 16,915

Income tax paid - -

------------------------------------- --- ------------- -------------

Net cash generated from operating

activities 10,785 16,915

------------------------------------------ ------------- -------------

Investing activities

Expenditure on property, plant

and equipment and mine development (3,404) (6,576)

Investment in exploration and

evaluation activities (109) (134)

Net cash used in investing

activities (3,513) (6,710)

------------------------------------------ ------------- -------------

Financing activities

Proceeds from borrowing 6,651 6,105

Repayment of borrowings (12,283) (11,468)

Interest paid (1,492) (1,829)

------------------------------------------ ------------- -------------

Net cash outflow from financing

activities (7,124) (7,192)

------------------------------------------ ------------- -------------

Net increase in cash and cash

equivalents 148 3,013

Cash and cash equivalents at

beginning of period 1,379 249

------------------------------------------ ------------- -------------

Cash and cash equivalents at

end of the period 1,527 3,262

------------------------------------------ ------------- -------------

Anglo Asian Mining plc

Condensed group statement of changes in equity

Six months ended 30 June 2017

(Unaudited)

Share-based

Share Share payment Merger Retained Total

earnings

capital premium reserve reserve / (loss) equity

$000 $000 $000 $000 $000 $000

---------------- ----------- -------- ------------ -------- ---------- --------

1 January 2017 1,993 32,325 154 46,206 1,968 82,646

Loss for the

period - - - - (2,742) (2,742)

Share based

payment - - 7 - - 7

---------------- ----------- -------- ------------ -------- ---------- --------

30 June 2017 1,993 32,325 161 46,206 (774) 79,911

---------------- ----------- -------- ------------ -------- ---------- --------

Six months ended 30 June 2016

(Unaudited)

Share-based

Share Share payment Merger Retained Total

capital premium reserve reserve earnings equity

$000 $000 $000 $000 $000 $000

---------------- ----------- -------- ------------ -------- --------- -------

1 January 2016 1,993 32,325 283 46,206 (2,163) 78,644

Profit for

the period - - - - 424 424

Share based

payment - - 9 - - 9

---------------- ----------- -------- ------------ -------- --------- -------

30 June 2016 1,993 32,325 292 46,206 (1,739) 79,077

---------------- ----------- -------- ------------ -------- --------- -------

Anglo Asian Mining plc

Notes to the condensed group financial statements

Six months ended 30 June 2017

1 General information

Anglo Asian Mining plc (the "Company") is a company incorporated

in England and Wales under the Companies Act 2006. The Company's

ordinary shares are traded on the AIM market of the London Stock

Exchange plc. The Company is a holding company. The principal

activity of the Company and its subsidiaries (the "Group") is

operating a portfolio of mining operations and metal production

facilities within Azerbaijan.

Basis of preparation

The condensed group financial statements for the six month

period ending 30 June 2017 have been prepared in accordance with

IAS 34 'Interim Financial Reporting' as issued by the International

Accounting Standards Board. The information for the half year ended

30 June 2017 does not constitute statutory accounts as defined in

section 435 of the Companies Act 2006. A copy of the statutory

accounts for the year ended 31 December 2016 has been delivered to

the Registrar of Companies. The auditor's report on those accounts

was not qualified, did not include a reference to any matters to

which the auditor drew attention by way of an emphasis of matter

and did not contain a statement under sections 498(2) or 498(3) of

the Companies Act 2006. The condensed group financial statements

have not been audited.

The condensed group financial statements have been prepared

under the historical cost convention except for the treatment of

share based payments. The condensed group financial statements are

presented in United States dollars ("$") and all values are rounded

to the nearest thousand except where otherwise stated. In the

condensed group financial statements "GBP" and "pence" are

references to the United Kingdom pound sterling and "AZN" is a

reference to the Azerbaijan Manat.

Accounting policies

The annual financial statements of Anglo Asian Mining plc are

prepared in accordance with IFRSs as issued by the International

Accounting Standards Board and as adopted by the European Union.

The condensed group financial statements included in this

half-yearly financial report have been prepared in accordance with

IAS 34 'Interim Financial Reporting' as issued by the International

Accounting Standards Board and adopted by the European Union.

The accounting policies adopted in the 2017 half-yearly

condensed group financial statements are the same as adopted in the

2016 annual report and accounts, other than those in respect of new

and revised standards that became effective from 1 January 2017 as

follows:

- IAS 7 - 'Statement of Cash Flows'

- IAS 12 - 'Recognition of Deferred Tax Assets for Unrealised

Losses - Amendments to IAS 12'

The adoption of these standards has had no material impact on

the 2017 half-yearly condensed group financial statements.

Going concern

The directors have prepared the condensed group financial

statements on a going concern basis after reviewing the Group's

forecast cash position for the period to 30 September 2018 and

satisfying themselves that the Group will have sufficient funds on

hand to realise its assets and meet its obligations as and when

they fall due.

In making this assessment, the directors have acknowledged the

market conditions in which the Group is operating. In the six

months to 30 June 2017, the price of gold averaged $1,238 per ounce

with a high of $1,293 per ounce and a low of $1,149 per ounce.

The Group commenced making payments on the principal of its debt

in 2015. At the date of these condensed group financial statements,

the Group has made all payments of interest and principal on time

other than by advance agreement with certain banks to defer

payment.

The Group's loan agreements with the Amsterdam Trade Bank

("ATB") and Gazprombank (Switzerland) Ltd ("GPBS") contain a debt

service cover ratio ("DSCR") covenant of 1.25. This ratio is

calculated twice a year from its published financial statements.

The Group has received a waiver of the DSCR covenant from ATB and

GPBS for the six months to 30 June 2017. Based on current

forecasts, the Directors recognise that the Group may not be

compliant with the DSCR covenant for the full year to 31 December

2017. Should the DSCR covenant not be met for this period, the

Directors would request a further waiver from ATB/GPBS which the

Directors believe would be obtained on the basis that all debts

continue to be serviced on time. Given the decreased indebtedness

of the Group, and that the ATB/GPBS loans are scheduled to be fully

repaid by August 2018, the Directors also believe that the Group

has options to refinance or otherwise settle the ATB/GPBS loans

before the end of their term.

Key to achieving the Group's forecast cash position, and

therefore its going concern assumption are the following:

- achieving the forecast production of gold doré from its heap

and agitation leaching facilities.

- achieving its forecast production of precious metal

concentrates from its SART and flotation processing.

- its metal (principally gold and copper) price assumptions being met or bettered.

Should there be a moderate and sustained decrease in either the

production or metal price assumptions, the Group would look to

defer non-essential capital expenditure and administrative costs in

order to preserve cash. The Group also has access to additional

local sources of short term finance if required.

The Group's assumptions are neither overly aggressive or overly

conservative and appropriate rigour and diligence has been

performed by the directors in approving the assumptions. The

directors believe all assumptions are prepared on a realistic basis

using the best available information.

After making due enquiry, the directors have a reasonable

expectation that the Company and the Group have adequate resources

to continue in operational existence for the foreseeable future.

Accordingly, the Group continues to adopt the going concern basis

in preparing the condensed group financial statements.

2 Operating segments

The Group determines operating segments based on the information

that is internally provided to the Group's chief operating decision

maker. The chief operating decision maker has been identified as

the board of directors. The board of directors currently considers

consolidated financial information for the entire Group and reviews

the business based on the Group income statement and Group

statement of financial position in their entireties. Accordingly,

the Group has only one operating segment, mining operations. The

mining operations comprise the Group's major producing asset, the

open cast and underground mines located at the Gedabek and Gosha

licence areas, which account for all the Group's revenues and the

majority of its cost of sales, depreciation and amortisation. The

Group's mining operations are all located within Azerbaijan and

therefore all within one geographic segment.

All sales of gold and silver bullion are made to one customer,

the Group's gold refinery, MKS Finance SA, based in Switzerland.

Copper concentrate is sold to Industrial Minerals SA.

3 Income tax

The income taxation charge or credit during the period

represents the change in deferred tax liability during the period

incurred by the representative office registered in Azerbaijan of

RV Investment Group Services LLC (a wholly owned subsidiary of the

Company).

The deferred taxation asset or liability is calculated at the

taxation rates that are expected to apply in the period when the

liability is settled or the asset is realised. Deferred taxation is

charged or credited in the income statement, except when it relates

to items charged or credited directly to equity, in which case the

deferred taxation is also dealt with in equity.

Deferred taxation assets and liabilities are offset when there

is a legally enforceable right to offset current taxation assets

against current taxation liabilities and when they relate to income

taxes levied by the same taxation authority and the Group intends

to settle its current taxation assets and liabilities on a net

basis.

The deferred taxation liability increased in the 6 months to 30

June 2017 due to a decrease of unused taxation losses during the

period as the representative office of RV Investment Group Services

LLC (a wholly owned subsidiary of the Company) in Azerbaijan

incurred taxable profits in the period.

.

At the statement of financial position date, the Group has

unused taxation losses within the Company and a subsidiary (Anglo

Asian Operations Limited) available for offset against future

profits. No deferred taxation asset has been recognised in respect

of such losses due to the unpredictability of future profit

streams. Unused taxation losses may be carried forward

indefinitely.

4 (Loss) / profit per ordinary share

6 months 6 months

to to

30 June 30 June

2017 2016

(unaudited) (unaudited)

(Loss) / profit per $000 $000

ordinary share

(Loss) / profit after

tax for the period (2,742) 424

Basic (loss) / profit

per share (US cents) (2.44) 0.38

Diluted (loss) /

profit per share

(US cents) (2.43) 0.38

------------- -------------

Weighted average Number Number

number of shares

----------------------- --- ------------- -------------

For basic earnings

per share 112,661,024 112,661,024

5 Intangible assets

Exploration Exploration Other

& evaluation & evaluation Mining intangible

Gedabek Ordubad rights assets Total

(unaudited) (unaudited) (unaudited) (unaudited) (unaudited)

$000 $000 $000 $000 $000

------------------- ------------- -------------- ------------- ------------- ---------------

Cost

1 January 2016 - 3,860 41,925 498 46,283

Additions 191 168 - - 359

31 December 2016 191 4,028 41,925 498 46,642

Additions 9 99 - - 108

------------------- ------------- -------------- ------------- ------------- ---------------

30 June 2017 200 4,127 41,925 498 46,750

------------------- ------------- -------------- ------------- ------------- ---------------

Amortisation

and impairment

1 January 2016 - - 27,626 284 27,910

Charge for year - - 1,843 41 1,884

31 December 2016 - - 29,469 325 29,794

Charge for period - - 654 19 673

------------------- ------------- -------------- ------------- ------------- ---------------

30 June 2017 - - 30,123 344 30,467

------------------- ------------- -------------- ------------- ------------- ---------------

Net book value

31 December 2016 191 4,028 12,456 173 16,848

------------------- ------------- -------------- ------------- ------------- -------------

30 June 2017 200 4,127 11,802 154 16,283

------------------- ------------- -------------- ------------- ------------- -------------

6 Property, plant and equipment

Plant

and

equipment

and Assets

motor Producing under

vehicles mines construction Total

(unaudited) (unaudited) (unaudited) (unaudited)

$000 $000 $000 $000

----------------------- ------------- ------------- -------------- -------------

Cost

1 January 2016 19,666 175,062 477 195,205

Additions 1,799 4,404 3,556 9,759

Transfer to producing

mines - 3,598 (3,598) -

Increase in provision

for

rehabilitation - 369 - 369

31 December 2016 21,465 183,433 435 205,333

Additions 74 1,856 1,405 3,335

Transfer to producing

mines - 208 (208) -

(Decrease) in

provision for

rehabilitation - (509) - (509)

30 June 2017 21,539 184,988 1,632 208,159

----------------------- ------------- ------------- -------------- -------------

Depreciation

and impairment

1 January 2016 12,642 74,135 - 86,777

Charge for year 2,014 18,066 - 20,080

31 December 2016 14,656 92,201 - 106,857

Charge for period 875 6,415 - 7,290

----------------------- ------------- ------------- -------------- -------------

30 June 2017 15,531 98,616 - 114,147

----------------------- ------------- ------------- -------------- -------------

Net book value

31 December 2016 6,809 91,232 435 98,476

----------------------- ------------- ------------- -------------- -------------

30 June 2017 6,008 86,372 1,632 94,012

----------------------- ------------- ------------- -------------- -------------

7 Inventory

30 June 30 June 31 December

2017 (unaudited) 2016 2016

Non-current assets $000 (unaudited) (audited)

$000 $000

--------------------------- ------------------ -------------- -------------

Cost

Ore stockpiles - 2,595 -

--------------------------- ------------------ -------------- -------------

Current assets

--------------------------- ------------------ -------------- -------------

Cost

Finished goods

- bullion 1,264 680 903

Finished goods

- metal in concentrate 755 507 240

Metal in circuit 13,763 12,618 12,119

Ore stockpiles 7,921 5,040 9,784

Spare parts and

consumables 10,526 8,242 10,972

--------------------------- ------------------ -------------- -------------

Total current inventories 34,229 27,087 34,018

--------------------------- ------------------ -------------- -------------

Total inventories 34,229 29,682 34,018

--------------------------- ------------------ -------------- -------------

Current ore stockpiles consist of high-grade and low-grade oxide

ores that are expected to be processed during the 12 months

subsequent to the balance sheet date.

Non-current ore stockpiles consist of high-grade sulphide ore

that is expected to be processed more than 12 months after the

balance sheet date.

Inventory is recognised at lower of cost or net realisable

value.

8 Trade and other receivables

31 December

2016

30 June 30 June (audited)

2017 (unaudited) 2016

Non-current assets $000 (unaudited)

$000 $000

--------------------------- ------------------ ---------------- ---------------- ---

Advances for fixed asset

purchases 1,228 1,018 989

Loans 44 95 95

--------------------------- ------------------ ---------------- ---------------- ---

1,272 1,113 1,084

--------------------------- ------------------ ---------------- ---------------- ---

Current assets

--------------------------- ------------------ ---------- ---- ------- -------

Gold held due to the

Government of Azerbaijan 13,640 5,093 10,078

VAT refund due 217 319 339

Other tax receivable 908 789 926

Trade receivables 1,159 1,820 639

Prepayments and advances 2,409 2,138 4,218

Loans 88 50 50

18,421 10,209 16,250

--------------------------- ------------------ ---------- ---- ------- -------

The directors consider that the carrying amount of trade and

other receivables approximates to their fair value.

The VAT refunds due relate to VAT paid on purchases.

Gold bullion held and transferable to the Government of

Azerbaijan is bullion held by the Group due to the Government of

Azerbaijan. The Group holds the Government's share of the product

from its mining activities and from time to time transfers that

product to the Government of Azerbaijan. A corresponding liability

to the Government of Azerbaijan is included in trade and other

payables as disclosed in note 9.

The Group does not consider any trade and other receivables as

past due or impaired.

9 Trade and other payables

30 June 31 December

2017 (unaudited) 2016

$000 30 June

2016 (unaudited) (audited)

$000 $000

--------------------------------- ----------------- ------------------ ------------

Accruals and other payables 3,626 4,349 3,111

Derivative liability - 262 -

Trade creditors 6,931 4,711 7,815

Gold held due to the Government

of Azerbaijan 13,640 5,093 10,078

Payable to the Government

of Azerbaijan from copper

concentrate joint sale 2,337 1,180 829

--------------------------------- ----------------- ------------------ ------------

26,534 15,595 21,833

--------------------------------- ----------------- ------------------ ------------

Trade creditors primarily comprise amounts outstanding for trade

purchases and ongoing costs. Trade creditors are non-interest

bearing. Accruals and other payables mainly consist of accruals

made for accrued but not paid salaries, bonuses, related payroll

taxes and social contributions, accrued interest on borrowings, and

services provided but not billed to the Group by the end of the

reporting period. The directors consider that the carrying amount

of trade and other payables approximates to their fair value.

The amount payable to the Government of Azerbaijan from copper

concentrate joint sale represents the portion of cash received from

the customer for the government's portion from the joint sale of

copper concentrate.

10 Interest-bearing loans and borrowings

Amortised cost

30 June 30 June 31 December

2017 (unaudited) 2016 (unaudited) 2016 (audited)

$000 $000 $000

---------------------------------- ----------------- ------------------ ----------------

International Bank of Azerbaijan

- agitation leaching plant

loan 3,875 8,700 5,385

International Bank of Azerbaijan

- loan facilities 510 3,320 970

Gazprombank (Switzerland) 6,180 -

Ltd -

Amsterdam Trade Bank 6,180 22,186 17,307

Atlas Copco - vendor financing 550 1,390 801

Yapi Kredit Bank 2,623 1,373 672

Pasha Bank 6,190 3,161 5,935

Kapital Bank 545 - 1,000

Director 3,860 3,860 3,860

---------------------------------- ----------------- ------------------ ----------------

Total interest bearing

loans and borrowings 30,513 43,990 35,930

---------------------------------- ----------------- ------------------ ----------------

Loans repayable in less

than one year 26,047 26,733 26,165

Loans repayable in more

than one year 4,466 17,257 9,765

---------------------------------- ----------------- ------------------ ----------------

Total interest bearing

loans and borrowings 30,513 43,990 35,930

----------------

International Bank of Azerbaijan ("IBA")

Agitation leaching plant loan

In 2012 and 2013, the Group borrowed $49.5 million under a

series of loan agreements to finance the construction of its

agitation leaching plant. The annual interest rate for each

agreement is 12 per cent. The repayment of principal began two

years from the withdrawal date for each agreement. The loans were

partially repaid by the proceeds of a refinancing loan from

Amsterdam Trade Bank. The loans are repayable commencing in 31

March 2015 and finishing in 30 June 2018.

Loan facilities

During 2014, the Group entered into a credit facility for $1.5

million for a period of one year at an annual interest rate of 12

per cent. The repayment date of the credit facility was extended in

2015 and the loan was repaid in July 2016.

In 2016, the Group entered into two further credit facilities

with IBA:

-- AZN1 million at an annual interest rate of 18 per cent. The

interest and principal were repayable on a reducing balance basis

in 12 equal monthly installments of AZN92,000. The final

installment was repaid in January 2017.

-- $1.5 million at an annual interest rate of 12 per cent. The

interest and principal are repayable on a reducing balance basis in

24 equal monthly installments of $71,000 and the final installment

is payable in February 2018.

Amsterdam Trade Bank ("ATB") and Gazprombank (Switzerland) Ltd

("GPBS")

During 2013, the Group entered into a loan agreement for $37.0

million to refinance its agitation leaching plant loan from IBA.

The annual interest rate is 8.25 per cent. plus LIBOR. Principal is

repayable in 15 equal quarterly installments of $2,467,000. The

first payment of principal commenced in February 2015 with the

final installment payable in August 2018. The Group has pledged to

ATB its present and future claims against MKS Finance SA, the

Group's sole buyer of gold doré until termination of the loan

agreement.

On 15 February 2017, a transaction was finalised to transfer 50

per cent. of the balance of the loan being $8.6 million to GPBS.

The terms of the loan and security remained unchanged and ATB will

act as agent to administer the loan on behalf of ATB and GPBS.

The total gross amount outstanding to ATB and GPBS at 30 June

2017 was $12.3 million (30 June 2016: $22.2 million; 31 December

2016: $17.3 million).

Atlas Copco

The amounts outstanding are in respect of vendor equipment

financing. The amount outstanding at 31 December 2015 was repaid in

July 2016. In 2016, the Group entered into further vendor equipment

financing for Euro 1.1 million at an annual interest rate of 8.14

per cent. The principal is repayable quarterly in 8 equal

installments which commenced on 31 August 2016 with the final

repayment on 31 May 2018. Interest is payable quarterly with the

principal.

Yapi Credit Bank, Azerbaijan ("YCBA")

The Group has entered into several credit facilities with YCBA.

The annual interest rate for each facility is 10 to 11 per cent.

and each facility is repayable in 12 equal monthly installments on

a reducing balance basis starting one month after drawdown. In

2016, new credit facilities were entered into totaling $1,488,000

(2015: $1,929,000).

In the 6 months to 30 June 2017, the Group entered into further

credit facilities with YCBA. These totaled $2.7 million and the

interest rate for each loan was 9.5 per cent. One loan for $0.5

million, which commenced in January 2017, is repayable in 12 equal

monthly installments. The remaining loans totaling $2.2 million are

all for a duration of 12 months with repayment of principal at the

end of the loan with interest payable monthly.

Pasha Bank

Letters of credit for flotation plant construction

In 2014, the Group entered into a facility for $2.5 million to

finance a letter of credit for the construction of its flotation

plant. The facility carried an annual interest rate of 6 per cent.

for the unused portion of, and 6.8 per cent. plus one month LIBOR

for the used portion of the credit facility. In 2016, an additional

facility was entered into for $1.2 million which carried an annual

interest rate of 6.2 per cent. for the unused portion and 7.05 per

cent. plus one month LIBOR for the used portion of the credit

facility. The facilities were repaid in two equal installments of

$1.8 million in May and November 2016.

Loans

The Group entered into loans with Pasha Bank in 2016 at annual

interest rates and maturities as in the following table.

Loan value Term Interest Principal repayment

$000 (months) rate

(per cent.)

----------- ---------- ------------- ------------------------------

2 equal installments in March

1,000 18 7 and September 2017

----------- ---------- ------------- ------------------------------

1,500 12 9 November 2017

----------- ---------- ------------- ------------------------------

7 equal installments, 2017

916 24 7 - $525,000 2018 - $391,000

----------- ---------- ------------- ------------------------------

2 equal installments January

2,100 2 14 and February 2017

----------- ---------- ------------- ------------------------------

2 equal installments January

416 2 18 and February 2017

----------- ---------- ------------- ------------------------------

In the 6 months to 30 June 2017, the Group entered into an

additional loan of $3.0 million with Pasha Bank. The interest rate

is 8.5 per cent. and the tenor is 12 months. The principal is

repayable at the end of the loan and interest is payable monthly.

The loan for $916,000 was also increased by $534,000 with the

remaining terms remaining unchanged.

No principal repayment was made in respect of any of these loans

in 2016. In the six months to 30 June 2017, principal repayments

were made totaling $0.3 million.

Kapital Bank

In December 2016, the Group entered into a working capital

credit facility for $1 million with Kapital Bank. The facility is

for one year with an annual interest rate of 7 per cent. Interest

is payable monthly and the principal is repayable by 4 equal

quarterly monthly installments commencing March 2017.

Director

On 20 May 2015, the chief executive of Anglo Asian Mining PLC

provided a $4 million loan facility to the Group. Any loan from the

facility was initially repayable on 8 January 2016 at an interest

rate of 10 per cent. The loan has been subsequently extended on the

same terms till 8 January 2018.

As Reza Vaziri, the chief executive of Anglo Asian Mining PLC is

a director of the Company, the loan constitutes a related party

transaction pursuant to AIM rule 13. The independent directors

(being Khosrow Zamani, Richard Round, John H. Sununu and John

Monhemius) consider, that having consulted with the Company's

nominated adviser, SP Angel Corporate Finance LLP, that the terms

of the loan are fair and reasonable insofar as its shareholders are

concerned.

11 Share capital

shares US$000

---------------------------------- ------------ -------

Ordinary shares issued and fully

paid:

1 January 2016, 31 December

2016 and 30 June 2017 112,661,024 1,993

---------------------------------- ------------ -------

12 Contingencies and commitments

The Group undertakes its mining operations in the Republic of

Azerbaijan pursuant to the provisions of the agreement on the

exploration, development and production sharing for the prospective

gold mining areas: Gedabek, Gosha, Ordubad Group (Piazbashi,

Agyurt, Shakardara, Kiliyaki), Soutely, Kyzilbulag and Vejnali

deposits dated 20 August 1997 (the "PSA"). The PSA contains various

provisions relating to the obligations of the R.V. Investment Group

Services LLC ("RVIG"), a wholly owned subsidiary of the Company.

The principal provisions are regarding the exploration and

development programme, preparation and timely submission of reports

to the Government and compliance with environmental and ecological

requirements. The directors believe that RVIG is in compliance with

the requirements of the PSA. The Group has announced a discovery on

the Gosha Mining Property in February 2011, and submitted the

development programme to the Government according to the PSA

requirements, which was approved in 2012. In April 2012, the Group

announced a discovery on the Ordubad Group of Mining Properties and

submitted the development programme to the Government for review

and approval according to the PSA requirements.

The mining licence of Gedabek expires in March 2022, with

options to extend the licence by ten years conditional upon

satisfaction by RVIG of certain requirements stipulated in the

PSA.

RVIG is also required to comply with the clauses contained in

the PSA relating to environmental damage. The directors believe

RVIG is substantially in compliance with the environmental clauses

contained in the PSA.

In accordance with a pledge agreement signed on 24 July 2013,

the Group is a guarantor for one of its suppliers,

Azerinterpartlayish-X MMC for a loan from the International Bank of

Azerbaijan in the amount of AZN500,000 for an initial 36 months.

The pledge agreement was extended in 2016 till 1 July 2018. The

amount of the loan at outstanding at 30 June 2017 was AZN271,000

(30 June 2016: AZN483,000 and 31 December 2016: AZN364,026).

There were no significant operating lease and no capital lease

commitments at 30 June 2017 (30 June 2016 and 31 December 2016:

none).

13 Related party transactions

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation and are not

disclosed in this note. Transactions between the Group and other

related parties are disclosed below.

Trading transactions

During the period, there were no trading transactions between

group companies and related parties who are not members of the

Group.

Other related party transactions

a) Total payments in the 6 months to 30 June 2017 of $442,000 (6

months to 30 June 2016: $778,000) were made for equipment and spare

parts purchased from Proses Muhendislik Danismanlik Inshaat ve

Tasarim Anonim Shirket ("PMDI"), an entity in which the chief

technical officer of Azerbaijan International Mining Company has a

direct ownership interest. There is an outstanding advance payment

to PMDI of $35,000 at 30 June 2017 (30 June 2016: $138,000 and 31

December 2016: $34,000).

b) On 20 May 2015, the chief executive made a $4 million loan

facility available to the Group. The interest accrued and unpaid at

30 June 2017 was $672,000 (30 June 2016: $394,000 and 31 December

2016: $385,000). Details of the loan are disclosed in note 10 -

"Interest -bearing loans and borrowings".

14 Approval of condensed group financial statements

The condensed group financial statements of Anglo Asian Mining

plc and its subsidiaries for the six month period ended 30 June

2017 were authorised for issue in accordance with a resolution of

the directors on 20 September 2017.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

**ENDS**

For further information please visit www.angloasianmining.com or

contact:

Anglo Asian Mining Tel: +994 12 596

Reza Vaziri plc 3350

-------------- ------------------- ------------------

Anglo Asian Mining Tel: +994 502 910

Bill Morgan plc 400

-------------- ------------------- ------------------

Ewan Leggat SP Angel Corporate Tel: +44 (0) 20

Finance LLP 3470 0470

Nominated Adviser

and Broker

-------------- ------------------- ------------------

Soltan Tagiev SP Angel Corporate Tel + 44 (0) 20

Finance LLP 3470 0470

-------------- ------------------- ------------------

Susie Geliher St Brides Partners Tel: +44 (0) 20

Ltd 7236 1177

-------------- ------------------- ------------------

Notes:

Anglo Asian Mining plc (AIM:AAZ) is a gold, copper and silver

producer in Central Asia with a broad portfolio of production and

exploration assets in Azerbaijan. The Company has a 1,962 square

kilometre portfolio, assembled from analysis of historic Soviet

geological data and held under a Production Sharing Agreement

modelled on the Azeri oil industry.

The Company developed Azerbaijan's first operating

gold/copper/silver mine, Gedabek, which commenced gold production

in May 2009. Gedabek is an open cast mine with a series of

interconnected pits. The Company also operates the high grade Gadir

underground mine which is co-located at the Gedabek site. The

Company has a second underground mine, Gosha, which is 50

kilometres from Gedabek. Ore mined at Gosha is processed at Anglo

Asian's Gedabek plant. The Company has also started production in

September 2017 from its Ugur open pit mine, a recently discovered

gold ore deposit at Gedabek.

Gold production for the year ended 31 December 2016 from Gedabek

totalled 65,394 ounces with 1,941 tonnes of copper also produced.

Gedabek is a polymetallic deposit and its ore has a high copper

content, and as a result the Company produces copper concentrate

from its Sulphidisation, Acidification, Recycling, and Thickening

(SART) plant. Anglo Asian also produces a copper and precious metal

concentrate from its flotation plant, which is processing tailings

from the agitation leach plant.

Anglo Asian is also actively seeking to exploit its first mover

advantage in Azerbaijan to identify additional projects, as well as

looking for other properties in order to fulfil its expansion

ambitions and become a mid-tier gold and copper metal production

company.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SESFISFWSEEU

(END) Dow Jones Newswires

September 21, 2017 02:00 ET (06:00 GMT)

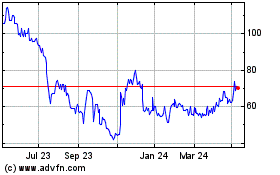

Anglo Asian Mining (LSE:AAZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

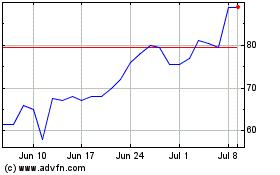

Anglo Asian Mining (LSE:AAZ)

Historical Stock Chart

From Apr 2023 to Apr 2024