Anglo-American Posts Steep First-Half Loss --Update

July 28 2016 - 5:15AM

Dow Jones News

By Scott Patterson

LONDON-- Anglo American on Thursday reported a steep first-half

loss as the mining giant continues to suffer from weak commodity

prices, though it showed some success in paring down its heavy debt

load.

The U.K.-listed miner posted a net loss of $813 million for the

first half of 2016, compared with an adjusted $3 billion loss for

the same period last year.

The loss included a $1.2 billion impairment for some of Anglo's

Australian coal assets, the company said.

Excluding some one-time items, Anglo posted a net profit of $698

million in the first half, down 23% from last year but better than

forecasts for a gain of $340 million, according to a survey of six

analysts by The Wall Street Journal. Anglo's shares rose 7% in

early trading Thursday.

"The balance sheet is stronger and we're in a much better

position than we were six months ago," Anglo American Chief

Executive Mark Cutifani said on a media conference call

Thursday.

Using a rugby metaphor, he said Anglo is "at half time, and

we're in the lead, [but] we're facing off against the All Blacks,"

a reference to New Zealand's world-beating rugby team. Despite such

a formidable obstacle, "I wouldn't bet against us," he said.

Soft commodity prices weighed on sales, however. Anglo's revenue

fell 20% to $10.6 billion during the period from last year. Net

debt fell to $11.7 billion as of June 30, down from $12.9 billion

at the end of 2015, the result of cost cuts and volume increases,

among other things.

The company earlier this year said it expects to sell $3 billion

to $4 billion in assets this year it launches a sweeping

restructuring plan. Anglo expects its net debt to fall to less than

$10 billion by year-end, reflecting the $1.5 billion sale of its

Brazilian niobium and phosphate assets earlier this year and other

asset disposals.

Diamonds were a big driver of first-half earnings, accounting

for 42% of earnings before interest and taxes. A 29% increase in

volumes sold over the same period last year provided a boost to

results at Anglo's De Beers unit. Mr. Cutifani cautioned that

second-half results aren't likely to be as robust.

Cost cuts and favorable currency moves in countries such as

South Africa, where De Beers has big mining operations, provided a

boost to earnings, the company said. Bruce Cleaver, the newly

appointed CEO of De Beers, said in an interview the company expects

to be able to continue to trim costs while maintaining ambitious

production, exploration and other investment goals.

"We've caused no structural damage to the business by cutting

costs," he said. "We'll continue to work hard on that."

Still, Anglo continues to struggle with low prices for the other

commodities it mines and sells amid ongoing soft demand from China.

While earnings at De Beers were slightly higher than last year's

first half, they fell in every other asset category, including

platinum, copper, nickel, iron ore and coal. Overall earnings

before interest and taxes slid 27% in the first half from last

year.

In February, Anglo said it plans to exit coal entirely and to

pare back its exposure to iron ore, even floating the potential

sale of its massive Brazilian iron-ore mine Minas Rio. Mr. Cutifani

said the company plans to reduce its mining businesses to 16 from

45, sales that will help cut its staff by more than half.

Anglo in 2015 reported a loss of $5.6 billion, the result of a

steep dive in commodity prices in the second half of the year as

well as $3.8 billion in impairment charges.

Write to Scott Patterson at scott.patterson@wsj.com

(END) Dow Jones Newswires

July 28, 2016 05:00 ET (09:00 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

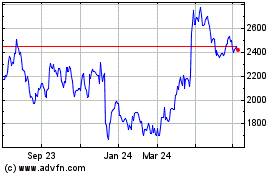

Anglo American (LSE:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

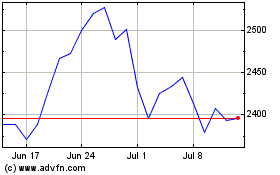

Anglo American (LSE:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024