Anglo American Platinum Swings to Loss - Update

July 24 2017 - 3:42AM

Dow Jones News

(Adds background)

By Alexandra Wexler

JOHANNESBURG--Anglo American Platinum Ltd. (AMS.JO), the world's

top producer of the precious metal, swung to a loss during the

first half of 2017, reflecting a stronger rand, impairments and

lower sales, the company said Monday.

The Johannesburg-listed miner reported a loss of 1.19 billion

South African rand ($91.95 million) for the six months ended June

30, from a profit of ZAR1.54 billion during the same period in

2016, in line with the company's previously announced guidance.

That loss includes post-tax impairments of ZAR2.21 billion,

including about ZAR900 million related to Union mine and equity

interests in Bafokeng Rasimone Platinum Mine of about ZAR950

million and Bokoni Platinum Holdings of about ZAR45 million.

Amplats, a majority-owned unit of globally diversified miner

Anglo American PLC (AAL.LN), reported headline earnings, which

strip out certain exceptional and one-off items, of ZAR747 million

for the first half of 2017, down 55% from the same period a year

earlier, also in line with the company's previously announced

guidance.

Amplats, like other South African platinum producers, has been

hammered by labor issues and years of low prices, which have driven

away investment. Earnings in 2015 were hurt by impairments and

write-offs of ZAR14 billion after tax and restructuring costs. In

2016, though, the company returned to profit as a weaker rand and

cost-improvement initiatives helped to offset the pressure of lower

U.S. dollar metal prices as years of restructuring and assets sales

began to pay off.

"We will continue to manage the business for a low price

environment," Chief Executive Chris Griffith said on a media

call.

At June 30, the company's net debt was ZAR5.91 billion, down 40%

over the last year. The company's average U.S. dollar net sales

revenue per ounce of platinum group of metals--which includes

rhodium, platinum, palladium and other metals--sold rose 5% in the

first half of 2017 to $865 an ounce from the same period a year

earlier.

Amplats shares on the Johannesburg Stock Exchange are up 18%

this year, though down 20% over the last 12 months, while futures

for the white metal are up 3.4% year-to-date on the New York

Mercantile Exchange's Comex division, but down 14% over the last 12

months.

Total refined platinum production at the company rose 9.6% to

1.1 million ounces in the six months to June 30, while refined

platinum production from the company's own mining operations fell

20% to 615.6 million ounces from the first half of 2016.

Amplats reported net revenue of ZAR27.3 billion for the year,

down 11% from the six months ended June 30, 2016.

-Write to Alexandra Wexler at alexandra.wexler@wsj.com

(END) Dow Jones Newswires

July 24, 2017 03:27 ET (07:27 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

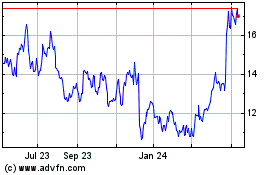

Anglo American (QX) (USOTC:NGLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

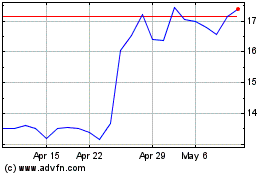

Anglo American (QX) (USOTC:NGLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024