TIDMAYM

Half yearly report for the six months to 30 September 2014

Chairman's Statement and Management Report

The half year to end of September 2014 has been a difficult period for the

resource industry and for the company. Labrador Iron Mines ("LIM") did not mine

any ore in the half year and reported a very large non-cash impairment in the

carrying value of its assets. LIM has indicated that it is seeking to complete

a financial restructuring under a plan of arrangement. The share price of LIM

continued to fall during the period and this is reflected in these accounts as

a non-cash diminution in value on the balance sheet and as a loss on the income

statement.

On a positive note the company entered into an arrangement in late May whereby

it took an effective working control in the Swedish company Grangesberg Iron AB

("GIAB") which is working towards the development of an underground iron ore

mine in central Sweden based around previous mining operations. Since taking

over management an Indicated and Inferred resource estimate compliant with the

Canadian requirements of NI 43-101 has been produced by GIAB. Further

development work continues.

At Parys Mountain in North Wales physical activities on site have been fairly

limited but progress is being made in planning for a potential mine development

programme supported by the expected strength of the zinc concentrate market.

The company reported an unaudited loss of GBP879,000 for the half year of which GBP

693,000 related to the reduction in value of LIM. Direct operating expenses at

GBP152,000 were almost 25% lower than for the same period in the previous year.

There is undoubtedly stress in the resources industry at present with prices

for precious metals and bulk minerals in particular suffering badly. This is

having a negative impact on investor sentiment towards the sector in general

which is reflected in the capital and equity markets with almost every share

price, Anglesey being no exception, being badly eroded. However the markets for

base metals, zinc in particular, have stood up fairly well during this

difficult time and we have reasonable expectations in the short to medium term

that this strength will continue. We look for a longer term recovery in the

price of iron ore.

Labrador Iron

Since January 2014 the spot price of iron ore has fallen over 45% to around

US$70 per tonne today, compared to an average price of US$135 per tonne in 2013

(62% Fe fines on a CFR China basis).

LIM did not recommence mining operations for the 2014 operating season due to

the prevailing low price of iron ore and an assessment of the current economics

of its iron ore projects. There was a strategic shift in corporate focus

towards establishing a lower cost operating framework while concurrently

re-negotiating the commercial terms of major contracts and seeking additional

capital investment and working capital. LIM continues to focus on the

development of the Houston Mine.

At period end LIM had a very significant working capital deficit and had not

met certain financial obligations. It urgently needs to secure additional

financing arrangements in order to fund or restructure its current working

capital deficit and to fund its continuing operations, planned development

programmes and corporate administration costs so as to continue as a going

concern. A financial restructuring and refinancing is required.

LIM is currently seeking to negotiate a potential support arrangement with RBRG

Gerald Metals, an existing creditor and off-take partner, that, if successfully

entered into, is expected to provide working capital financing to fund LIM's

ongoing activities, to provide potential future project development financing

and to enable LIM to continue as a going concern.

If LIM is unable to complete a potential financial restructuring and to obtain

adequate additional financing on a timely basis, which may require commercial

relief on certain major contracts, then it will be required to curtail all its

operations and development activities and may be required to liquidate its

assets under a formal process. Under such circumstances Anglesey's investment

in LIM would likely be further impaired.

Grangesberg Iron

In late May 2014 Anglesey entered into agreements giving it the right to

acquire a controlling interest in the Grangesberg iron ore mine situated in the

mineral-rich Bergslagen district of central Sweden about 200 kilometres

north-west of Stockholm. Until its closure in 1989 due to prevailing market

conditions Grangesberg had mined in excess of 150 million tonnes of iron ore.

In a series of agreements Anglesey purchased for US$145,000 a direct 6%

interest in GIAB, a private Swedish company founded in 2007 which, using our

investment and assistance, had recently completed a financial and capital

restructuring. GIAB holds a 25 year exploitation permit covering the previously

mined Grangesberg underground mining operations granted by the Swedish Mining

Inspectorate in May 2013.

At the same time we negotiated a 12 month option to acquire 51% of the enlarged

share capital of GIAB for the issue of new ordinary shares of Anglesey to the

value of US$1.75 million priced at a minimum of 3.375 pence per share. We also

entered into shareholder and cooperation agreements such that during the term

of the option Anglesey holds management control and operatorship of GIAB and

has appointed three out of five directors to the board of GIAB.

In late September an NI 43-101Technical Report was prepared by Roscoe Postle

Associates Inc ("RPA") showing a compliant resource estimate for the

Grangesberg Mine of 115.2 million tonnes at 40.2% Fe in the indicated category

and 33.1 million tonnes at 45.2% Fe in the inferred category. RPA concluded

that the Grängesberg iron ore deposit hosts a significant iron resource that

has excellent potential for expansion at depth.

A programme is currently being progressed to look closely at geo-mechanical and

hydro-geological aspects of the site which will be critical components of the

permitting regime required for the dewatering and reopening of the mine.

In the coming months, under Anglesey's direction GIAB will complete a review

and update of its previous pre-feasibility study on the project incorporating

inputs from the compliant resource estimate and from the geo-technical

investigations and this will be a key determinant in our decision to exercise

the option on the GIAB majority share block.

Parys Mountain

We are continuing to review development options at the 100% owned Parys

Mountain zinc-copper-lead deposit in North Wales, UK where a JORC

Code-compliant resource of 2.1mt at 6.9% combined base metals in the indicated

category and 4.1mt at 5.0% combined in the inferred category was published in

November 2012. A detailed review of the resource base for the entire mine

property has been prepared by Micon International and these results are being

evaluated.

The company is of the view that the market for zinc and zinc concentrates will

further strengthen particularly in Europe in the next two years and on that

basis believes that it is now an appropriate time to seriously consider the

commencement of production at Parys Mountain. We are actively looking at

suitable second hand processing facilities that can be readily and simply

incorporated into an on-site plant at Parys Mountain.

The directors acknowledge that financing Parys Mountain at this time of

depressed investor interest in the resources sector will not be simple. We

believe that the strength of the resource base coupled with the project's UK

location with its inherent political and financial stability and with the

widely held expectation of a resurgence in interest in zinc could enable a

financing package to be put together.

Financial Results

There was a net loss for the period of GBP0.88 million (2013 loss GBP3.21 million);

approximately GBP0.69 million of this 2014 loss was in respect of the diminution

in the value of the investment in LIM resulting from a fall in the share price

of that company. Administration expenses at GBP0.15 million were significantly

lower than the comparative period in 2013. The group had no revenue for the

period. At the period end cash resources had been reduced due to activities

related to the GIAB acquisition and stood at GBP31,000. Additional funds will

need to be raised in the immediate future. However GIAB is well funded to carry

out its planned programmes.

Outlook

The prospects for the iron ore price in the short term are not encouraging with

a continuing surplus of supply over demand resulting from the recent completion

of large expansion projects by the major producers in Australia and Brazil.

This is likely to keep prices pegged at low levels at least until the spring of

2015. The future of LIM and the maintenance of the value of our investment in

that company will be dependent upon some resurgence in the iron ore price.

In the longer term we believe that the iron ore price will recover once the

current expansion in production is absorbed by continuing growth in China,

India and other developing countries and by production cutbacks from current

producers, which should bring the supply-demand situation back to a balance

position by around 2017. It can be expected that the iron ore price should

have recovered significantly by that time, and would then benefit GIAB which

could be in a position to recommence initial production by around 2018.

We feel that the outlook for base metals and particularly for zinc, the major

source of initial revenue from Parys Mountain, will improve. There are a number

of major zinc mines scheduled for closure and this should lead to a shortage of

zinc concentrate for smelters outside China which will move the zinc price

upward. In this scenario smelters and metal traders will be more aggressive in

the search for new concentrate supply and will be prepared to assist with

finance for new production such as from Parys Mountain.

John F Kearney

Chairman

25 November 2014

Unaudited condensed consolidated income statement

Unaudited six Unaudited six

Notes months ended months ended

30 September 30 September

2014 2013

All operations are continuing GBP GBP

Revenue - -

Expenses (152,230) (196,480)

Impairment of investment 10 (692,702) (2,440,187)

Exchange difference on

investment impairment 10 20,850 (527,771)

Investment income 1,044 14,267

Finance costs (56,200) (57,149)

Foreign exchange gain/(loss) 330 (1,566)

Loss before tax (878,908) (3,208,886)

Tax 8 - -

Loss for the period (878,908) (3,208,886)

Loss per share

Basic - pence per share (0.5)p (2.0)p

Diluted - pence per share (0.5)p (2.0)p

Unaudited condensed consolidated statement of comprehensive income

Loss for the period (878,908) (3,208,886)

Other comprehensive income:

None

Total comprehensive loss (878,908) (3,208,886)

for the year

All attributable to equity holders of the company

Unaudited condensed consolidated statement of financial position

Unaudited 30

Notes September Audited 31

2014 March 2014

GBP GBP

Assets

Non-current assets

Mineral property exploration and evaluation 9 14,854,707 14,802,048

Property, plant and equipment 204,687 204,687

Investments 10 803,092 1,257,985

Deposit 122,806 122,596

15,985,292 16,387,316

Current assets

Other receivables 20,530 17,017

Cash and cash equivalents 31,556 289,097

52,086 306,114

Total assets 16,037,378 16,693,430

Liabilities

Current liabilities

Trade and other payables (266,303) (99,647)

(266,303) (99,647)

Net current (liabilities)/assets (214,217) 206,467

Non-current liabilities

Loan (2,475,073) (2,418,873)

Long term provision (42,000) (42,000)

(2,517,073) (2,460,873)

Total liabilities (2,783,376) (2,560,520)

Net assets 13,254,002 14,132,910

Equity

Share capital 11 7,116,914 7,116,914

Share premium 9,848,949 9,848,949

Retained losses (3,711,861) (2,832,953)

Total shareholders' equity 13,254,002 14,132,910

All attributable to equity holders of the company

Unaudited condensed consolidated statement of cash flows

Unaudited six Unaudited six

Notes months ended months ended

30 September 30 September

2014 2013

GBP GBP

Operating activities

Loss for the period (878,908) (3,208,886)

Adjustments for:

Investment income (1,044) (14,267)

Finance costs 56,200 57,149

Impairment of investment 10 692,702 2,440,187

Exchange difference on

investment impairment 10 (20,850) 527,771

Foreign exchange movement (330) 1,566

(152,230) (196,480)

Movements in working capital

(Increase)/decrease in receivables (3,513) 2,168

Increase/(decrease) in payables 13,877 (10,123)

Net cash used in operating activities (141,866) (204,435)

Investing activities

Investment income 834 14,017

Mineral property exploration and evaluation (41,899) (46,568)

Investment in Grangesberg (74,940) -

Net cash used in investing activities (116,005) (32,551)

Loan received

Net decrease in cash (257,871) (236,986)

and cash equivalents

Cash and cash equivalents at start of year 289,097 670,345

Foreign exchange movement 330 (1,566)

Cash and cash equivalents at end of year 31,556 431,793

All attributable to equity holders of the company

Unaudited condensed consolidated statement of changes in group equity

Share Share Retained

capital premium earnings Total

GBP GBP GBP GBP

Equity at 1

April 2014 - 7,116,914 9,848,949 (2,832,953) 14,132,910

audited

Total

comprehensive

income for the

period:

Loss for the - - (878,908) (878,908)

period

Total

comprehensive

income - - (878,908) (878,908)

for the

period:

Equity at 30

September 7,116,914 9,848,949 (3,711,861) 13,254,002

2014 -

unaudited

Comparative

period

Equity at 1

April 2013 - 7,116,914 9,848,949 4,340,750 21,306,613

audited

Total

comprehensive

income

for the

period:

Loss for the - - (3,208,886) (3,208,886)

period

Total

comprehensive

income - - (3,208,886) (3,208,886)

for the

period:

Equity at 30

September 7,116,914 9,848,949 1,131,864 18,097,727

2013 -

unaudited

All attributable to equity holders of the company

Notes to the accounts

1. Basis of preparation

This half-yearly financial report comprises the unaudited condensed

consolidated financial statements of the group for the six months ended 30

September 2014. It has been prepared in accordance with the Disclosure and

Transparency Rules of the UK Financial Services Authority, the requirements of

IAS 34 - Interim financial reporting (as adopted by the European Union) and

using the going concern basis and the directors are not aware of any events or

circumstances which would make this inappropriate. It was approved by the board

of directors on 25 November 2014. It does not constitute financial statements

within the meaning of section 434 of the Companies Act 2006 and does not

include all of the information and disclosures required for annual financial

statements. It should be read in conjunction with the annual report and

financial statements for the year ended 31 March 2014 which is available on

request from the company or may be viewed at www.angleseymining.co.uk.

The financial information contained in this report in respect of the year ended

31 March 2014 has been extracted from the report and financial statements for

that year which have been filed with the Registrar of Companies. The report of

the auditors on those accounts did not contain a statement under section 498(2)

or (3) of the Companies Act 2006 and was not qualified. The half-yearly results

for the current and comparative periods are unaudited.

2. Significant accounting policies

The accounting policies applied in these unaudited condensed consolidated

financial statements are consistent with those set out in the annual report and

financial statements for the year ended 31 March 2014. The following amendments

to interpretations were effective in the current period and have been adopted:

IFRS 10 Consolidated Financial Statements: Original issue; Issued October 2012;

Effective - Annual periods beginning on or after 1 January 2014

IFRS 11 Joint Arrangements: Original issue; Issued - May 2011; Effective -

Annual periods beginning on or after 1 January 2014

IFRS 12 Disclosure of Interests in Other Entities: Original issue; Issued -

May 2011; Effective - Annual periods beginning on or after 1 January 2014

IAS 27 Separate Financial Statements (as amended in 2011): Original issue;

Issued - May 2011; Effective - Annual periods beginning on or after 1 January

2014

IAS 28 Investments in Associated and Joint Ventures: Original issue; Issued -

May 2011; Effective - Annual periods beginning on or after 1 January 2014

The adoption of the following amendments and new interpretations has not

resulted in a change to the accounting policies nor had a material effect on

the financial performance and position of the group. In preparing these

financial statements any accounting assumptions and estimates made by

management were consistent with those applied to the aforesaid annual report

and financial statements.

IAS 32 Financial Instruments: Presentation: Amendments relating to the

offsetting of assets and liabilities; Issued - December 2011; Effective -

Annual periods beginning on or after 1 January 2014

IAS 36 Impairment of Assets: Amendments arising from Recoverable Amounts

Disclosure for Non-financial Assets; Issued - 2004, Amended - May 2013;

Effective Annual periods beginning on or after 1 January 2014

IAS 39 Financial Instruments: Amendments for novation of derivatives; Amended

June 2013; Effective for Annual periods beginning on or after 1 January 2014

IAS 39 Financial Instruments: Recognition and Measurement; Original issue;

Issued - June 2013; Effective for Annual periods beginning on or after 1

January 2014

IFRIC 21 Levies; Effective - Annual periods beginning on or after 1 January

2014

3. Risks and uncertainties

The principal risks and uncertainties set out in the group's annual report and

financial statements for the year ended 31 March 2014 remain the same for this

half-yearly financial report and can be summarised as: development risks in

respect of mineral properties, especially in respect of permitting and metal

prices; liquidity risks during development; and foreign exchange risks. More

information is to be found in the 2014 annual report - see note 1 above.

4. Statement of directors' responsibilities

The directors confirm to the best of their knowledge that: (a) the unaudited

condensed consolidated financial statements have been prepared in accordance

with the requirements of IAS 34 Interim financial reporting (as adopted by the

European Union); and (b) the interim management report includes a fair review

of the information required by the FSA's Disclosure and Transparency Rules

(4.2.7 R and 4.2.8 R). This report and financial statements were approved by

the board on 25 November 2014 and authorised for issue on behalf of the board

by Bill Hooley, Chief Executive Officer and Danesh Varma, Finance Director.

5. Activities

The group is engaged in mineral property development and currently has no

turnover. There are no minority interests or exceptional items.

6. Earnings per share

The loss per share is computed by dividing the loss attributable to ordinary

shareholders of GBP0.9 million (loss to 30 September 2013 GBP3.2m), by 160,608,051

(2013 - unchanged) - the weighted average number of ordinary shares in issue

during the period. Where there are losses the effect of outstanding share

options is not dilutive.

7. Business and geographical segments

There are no revenues. The cost of all activities charged in the income

statement relates to exploration and development of mining properties. The

group's income statement and assets and liabilities are analysed as follows by

geographical segments, which is the basis on which information is reported to

the board.

Income statement analysis

Unaudited six months ended 30 Unaudited six months

September 2014 ended 30 September 2013

UK Canada - UK Canada -

investment Total investment Total

GBP GBP GBP GBP GBP GBP

Expenses (152,230) - (152,230) (196,480) - (196,480)

Loss on

fair value - (692,702) (692,702) - (2,440,187) (2,440,187)

of

investment

Exchange

difference - 20,850 20,850 - (527,771) (527,771)

on loss

above

Investment

income 1,044 - 1,044 14,267 - 14,267

Finance

costs (56,200) - (56,200) (57,149) - (57,149)

Exchange

rate 330 - 330 (1,566) - (1,566)

movements

Loss for (207,056) (671,852) (878,908) (240,928) (2,967,958) (3,208,886)

the period

There are no income statement items to report in respect of Grangesberg.

Assets and liabilities

` Unaudited 30 September 2014

UK Sweden Canada Total

investment investment

GBP GBP GBP GBP

Non current

assets 15,182,200 216,959 586,133 15,985,292

Current assets 52,086 - - 52,086

Liabilities (2,783,376) - - (2,783,376)

Net assets 12,450,910 216,959 586,133 13,254,002

Audited 31 March 2014

UK Sweden Canada Total

investment investment

GBP GBP GBP GBP

Non current

assets 15,129,331 - 1,257,985 16,387,316

Current assets 306,114 - - 306,114

Liabilities (2,560,520) - - (2,560,520)

Net assets 12,874,925 - 1,257,985 14,132,910

8. Deferred tax

There is an unrecognised deferred tax asset of GBP1.2 million (31 March 2014 - GBP

1.2m) which, in view of the group's results, is not considered to be

recoverable in the short term. There are also capital allowances, including

mineral extraction allowances, exceeding GBP11 million (unchanged from 31 March

2014) unclaimed and available. No deferred tax asset is recognised in the

condensed financial statements.

9. Mineral property exploration and evaluation costs

Mineral property exploration and evaluation costs incurred by the group are

carried in the unaudited condensed consolidated financial statements at cost,

less an impairment provision if appropriate. The recovery of these costs is

dependent upon the successful development and operation of the Parys Mountain

project which is itself conditional on finance being available to fund such

development. During the period expenditure of GBP53,159 was incurred (six months

to 30 September 2013 - GBP34,377). There have been no indicators of impairment

during the period.

10. Investments

Labrador Grangesberg

(quoted) (unquoted) Total

GBP GBP GBP

At 31 March 2013 7,964,532 7,964,532

Impairment resulting from

adjustment to fair value (5,451,267) (5,451,267)

Exchange difference arising

on adjustment above (1,255,280) (1,255,280)

At 31 March 2014 1,257,985 1,257,985

Addition during period - 216,959 216,959

Impairment resulting from

adjustment to fair value (692,702) - (692,702)

Exchange difference arising

on adjustment above 20,850 - 20,850

At 30 September 2014 586,133 216,959 803,092

Labrador: Labrador Iron Mines Holdings Limited (LIM) (TSX quoted) is the 100%

owner and operator of a series of iron ore properties in Labrador and Quebec,

many of which were formerly held and initially explored by the group. The group

treats its 15% holding in LIM as an investment. The published fair value of

this investment based on the quoted market price at 30 September 2014 is GBP0.6

million (31 March 2014 - GBP1.3 million). The group holds this investment as a

strategic non-controlling interest, not held for trading and classified as

'available for sale'.

Grangesberg: In May 2014 the group entered into a series of agreements in

connection with the potential acquisition of iron ore properties at Grangesberg

in Sweden. Certain expenditures which have resulted in the group having a 6%

holding in Grangesberg Iron AB (an unquoted Swedish company) and an option to

purchase shares amounting to 51% of that company have been treated in these

statements as an investment held at fair value through the income statement.

11. Share capital

Ordinary shares Deferred shares Total

of 1p of 4p

Issued

and Nominal Number Nominal Number Nominal

fully value GBP value GBP value GBP

paid

At 31

March

2013,

2014 and 1,606,081 160,608,051 5,510,833 137,770,835 7,116,914

30

September

2014

12. Financial instruments

Available for sale Assets at fair Loans &

Group assets value through receivables

income statement

Unaudited Unaudited 31 Unaudited 31

30 September 31 March 30 March 30 March

2014 2014 September 2014 September 2014

2014 2014

GBP GBP GBP GBP

Financial assets

Investments 586,133 1,257,985 216,959 - - -

Deposit - - - - 122,806 122,596

Other debtors - - - - 20,530 17,017

Cash and cash

equivalents - - - - 31,556 289,097

- -

586,133 1,257,985 216,959 - 174,892 428,710

Unaudited 31

30 September March

2014 2014

GBP GBP

Financial liabilities

Trade creditors (40,231) (34,863)

Other creditors (142,019) -

Loans due to Juno (2,475,073) (2,418,873)

(2,657,323) (2,453,736)

13. Events after the reporting period

None.

14. Related party transactions

None.

Anglesey Mining plc

Directors:

John Kearney Chairman

Bill Hooley Chief executive

Danesh Varma Finance director

David Lean Non executive

Howard Miller Non executive

Roger Turner Non executive

Parys Mountain site: Parys Mountain, Amlwch, Anglesey, LL68 9RE

Phone 01407 831275

London office: Painter's Hall, 9 Little Trinity Lane, London, EC4V 2AD

Phone 020 7653 9881

Registered office: Tower Bridge House, St. Katharine's Way, London, E1W 1DD

Share registrars: Capita Registrars www.capitaregistrars.com

Phone 0871 664 0300 - for all change of address and shareholder

administration matters (calls cost 10p per minute plus network extras,

lines open 0830 to 1730 Mon-Fri)

Web site: www.angleseymining.co.uk

E-mail: mail@angleseymining.co.uk

Shares listed on the London Stock Exchange - LSE:AYM

Company registration number 1849957

END

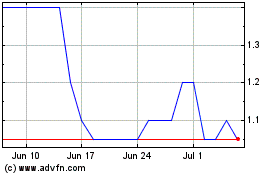

Anglesey Mining (LSE:AYM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Anglesey Mining (LSE:AYM)

Historical Stock Chart

From Apr 2023 to Apr 2024