TIDMAYM

Anglesey Mining plc

Half yearly report for the six months to 30 September 2016

Chairman's Statement and Management Report

In 2016, year to date, to a large extent we have seen an improvement in all the

metals which are key to Anglesey Mining and the immediate outlook for all these

metals is very positive.

Base metal prices move ahead

Zinc has continued to be one of the strongest performing metals in 2016, rising

from the US$0.70 per pound level at the end of 2015 to US$1.15 per pound in

recent days, an improvement in the year to date of more than 50%. For the past

five years the zinc market has been in deficit and the fundamentals for zinc

have been steadily improving. The closing in 2015 of Australia's Century mine

and the Lisheen mine in Ireland, combined with earlier closures of the

Glencore's Brunswick and Perseverance mines in Canada has removed more than one

million tonnes of mine supply which represents almost 9.9% of world mine

production.

Lead has also performed well in 2016 rising from US$0.75 per pound at the end

of 2015 to US$0.95 per pound during the third quarter, while uncertainty about

the global economy and investor anxiety continue to support the prices of gold

and silver.

More recently, following the election of Donald Trump in the United States,

there has been a dramatic increase in the prices of most metals, particularly

copper and iron ore. Copper is now selling at over $2.60 per pound, a level not

seen for several years. The likelihood of a major infrastructure programme in

the United Sates would be very significant for both copper and iron ore and

particularly for zinc, the demand for which is closely linked to steel

production and hence to iron ore demand.

Iron ore showing some strength

Iron ore is now selling at US$74 per tonne on a 62% iron basis FIS China. This

is a level not seen for almost two years, while at the same time the price of

metallurgical coal, the other major ingredient in steel making, has more than

doubled in the past six months. It is clear that Chinese consumption of iron

ore continues to increase. On a positive note particularly relevant to the

company the premiums for high grade fines and pellets, as would be produced by

Grangesberg in Sweden, are also increasing.

In the longer term, per capita steel consumption in China must catch up with

levels in the West and that would see at least a doubling in iron ore and zinc

demand.

Operations

At Anglesey Mining we have continued to keep our corporate and operating costs

at the lowest level possible and indeed have reduced general expenses by a

further 38% compared to the same period last year, which as noted at that time

were 50% of the prior year. The direct expenditure at all our projects has

again remained low throughout the period.

New studies on Parys Mountain

As announced in the Annual Report the company is updating the earlier scoping

and economic studies on its Parys Mountain zinc/lead/copper/silver/gold

property in Wales. This updated scoping study is being prepared by Micon

International Limited and by Fairport Engineering Limited, both of which are

acknowledged experts and leaders in the resources sector.

The Parys Mountain property is a significant zinc, copper and lead deposit with

small amounts of silver and gold, with a reported a resource of 2.1 million

tonnes at 6.9% combined base metals in the indicated category and 4.1 million

tonnes at 5.0% combined base metals in the inferred category. The site has a

head frame, a 300m deep production shaft and planning permission for operations

and there is also important exploration potential.

It is expected that the results of this updated study will form a solid base

from which to move the project towards production and will be used to assist

with future planning and potential financing of the development of the Parys

Mountain project. We expect that capital costs of developing Parys Mountain

will be lower in today's less competitive environment and, coupled with

positive changes in exchange rates, could make the project attractive at

expected metal prices. The Parys Mountain project will of course benefit from

the expected increase in zinc price which is the predominant metal to be

produced during in the early years of the mine life.

Labrador restructuring

In Canada, Labrador Iron Mines has made significant progress. A Plan of

Arrangement has been filed with Ontario Court and a meeting of creditors will

be held in early December. This filing marks a major milestone in the

court-supervised process to complete a restructuring of LIM's business. The

plan is intended to restructure LIM's business to preserve its mining assets

and to position LIM to refinance an orderly resumption of its iron ore mining

activities when economic conditions warrant. If the plan is implemented as

expected then Anglesey's holding in LIM will be diluted by an approximately

25%.

Grangesberg well positioned

In Sweden, a number of technical reviews have been continued to position the

Grangesberg iron ore project should the iron ore market continue to strengthen.

Anglesey holds a direct 6% interest in Grangesberg and a right of first

refusal over a further 51%. It has a shareholder and cooperation agreements for

operatorship of GIAB. The mining leases can be maintained for a number of years

with only minimum work levels. The high grade of concentrate to be produced

from Grangesberg, together with the extensive existing infrastructure on site

and nationally, and the potential for sales within Sweden's domestic markets,

negating the requirements for major port facilities and expensive handling and

shipping costs, will be key drivers in this expectation. In the meantime,

Grangesberg is also actively looking at alternative resource projects in Sweden

that could benefit from the local knowledge and corporate support available,

whilst awaiting a sustainable upturn in the iron ore and financing markets.

Financial results

The group had no revenue for the period. The loss for the six months to 30

September 2016 was GBP124,576, a reduction of GBP11,373 in the loss from the

comparative period last year due to a reduction in administrative expenses. The

cash and net current liabilities positions also improved compared with the last

period as a result of cash advances of GBP125,000 from Juno under the working

capital agreement. Additional financing will be required for working capital to

maintain the group and carry out planned progress at Parys Mountain.

Outlook

Anglesey is exposed to zinc, lead, copper and precious metals at Parys Mountain

and to iron ore at LIM and Grangesberg. With recent political developments in

the UK and the United States, coupled with the likelihood of renewed stimulus

investment in China, we feel that there is sound reason to believe that the

future outlook for the commodity prices which are important to Anglesey Mining

is very positive.

We thank shareholders for their continued patience and support.

John F Kearney

Chairman

17 November 2016

Unaudited condensed consolidated income statement

Notes Unaudited six Unaudited six

months ended months ended

30 September 30 September

2016 2015

All operations are continuing

GBP GBP

Revenue - -

Expenses (42,418) (68,337)

Investment income 103 160

Finance costs (82,392) (66,959)

Foreign exchange gain/(loss) 131 (813)

Loss before tax (124,576) (135,949)

Taxation 8 - -

Loss for the period 7 (124,576) (135,949)

Loss per share

Basic - pence per share (0.1)p (0.1)p

Diluted - pence per share (0.1)p (0.1)p

Unaudited condensed consolidated statement of comprehensive income

Loss for the period (124,576) (135,949)

Other comprehensive income

Items that may subsequently be reclassified to profit or

loss:

Exchange difference (18,135) 33

on translation of foreign

holding

Total comprehensive loss (142,711) (135,916)

for the period

All attributable to equity holders of the company

Unaudited condensed consolidated statement of financial position

Notes Unaudited Audited 31

30 March 2016

September

2016

GBP GBP

Assets

Non-current assets

Mineral property exploration 9 14,945,175 14,926,626

and evaluation

Property, plant and equipment 204,687 204,687

Investments 10 86,660 86,660

Deposit 123,078 123,078

15,359,600 15,341,051

Current assets

Other receivables 30,411 32,759

Cash and cash equivalents 40,608 11,504

71,019 44,263

Total assets 15,430,619 15,385,314

Liabilities

Current liabilities

Trade and other payables (98,500) (136,259)

(98,500) (136,259)

Net current liabilities (27,481) (91,996)

Non-current liabilities

Loans

(3,323,437) (3,097,662)

Long term provision (50,000) (50,000)

(3,373,437) (3,147,662)

Total liabilities

(3,471,937) (3,283,921)

Net assets 11,958,682 12,101,393

Equity

Share capital 11 7,116,914 7,116,914

Share premium 9,848,949 9,848,949

Currency translation reserve (56,592) (38,457)

Retained losses

(4,950,589) (4,826,013)

Total shareholders' equity 11,958,682 12,101,393

All attributable to equity holders of the company

Unaudited condensed consolidated statement of cash flows

Notes Unaudited Unaudited

six months six months

ended 30 ended 30

September September

2016 2015

GBP GBP

Operating activities

Loss for the period (124,576) (135,949)

Adjustments for:

Investment income (103) (160)

Finance costs 82,392 66,959

Foreign exchange movement (131) 813

(42,418) (68,337)

Movements in working capital

Decrease in receivables 2,348 1,002

(Decrease)/increase in (25,672) 8,329

payables

Net cash used in operating (65,742) (59,006)

activities

Investing activities

Investment income 103 60

Mineral property exploration (30,388) (29,144)

and evaluation

Net cash used in investing activities (30,285) (29,084)

Financing activities

Loans 125,000 -

Net cash generated from 125,000 -

financing activities

Net increase/(decrease) in cash 28,973 (88,090)

and cash equivalents

Cash and cash equivalents at 11,504 96,873

start of period

Foreign exchange movement 131 (813)

Cash and cash equivalents at 40,608 7,970

end of period

All attributable to equity holders of the company

Unaudited condensed consolidated statement of changes in group equity

Share Share Currency Retained Total

capital premium translation losses GBP

GBP GBP reserve GBP

GBP

Equity at 1 April 7,116,914 9,848,949 (38,457) 12,101,393

2016 - audited (4,826,013)

Total

comprehensive income

for the period:

Exchange difference - - (18,135) - (18,135)

on translation of

foreign holding

Loss for the period - - - (124,576) (124,576)

Total - - (18,135) (124,576) (142,711)

comprehensive income

for the period:

Equity at 7,116,914 9,848,949 (56,592) 11,958,682

30 September 2016 - (4,950,589)

unaudited

Comparative period

Equity at 1 April 7,116,914 9,848,949 (31,163) 12,365,137

2015 - audited (4,569,563)

Total

comprehensive income

for the period:

Exchange difference - - 33 - 33

on translation of

foreign holding

Loss for the period - - - (135,949) (135,949)

Total - - 33 (135,949) (135,916)

comprehensive income

for the period:

Equity at 7,116,914 9,848,949 (31,130) 12,229,221

30 September 2015 - (4,705,512)

unaudited

All attributable to equity holders of the company

Notes to the accounts

1. Basis of preparation

This half-yearly financial report comprises the unaudited condensed

consolidated financial statements of the group for the six months ended 30

September 2016. It has been prepared in accordance with the Disclosure and

Transparency Rules of the UK Financial Services Authority, the requirements of

IAS 34 - Interim financial reporting (as adopted by the European Union) and

using the going concern basis and the directors are not aware of any events or

circumstances which would make this inappropriate. It was approved by the board

of directors on 17 November 2016. It does not constitute financial statements

within the meaning of section 434 of the Companies Act 2006 and does not

include all of the information and disclosures required for annual financial

statements. It should be read in conjunction with the annual report and

financial statements for the year ended 31 March 2016 which is available on

request from the company or may be viewed at www.angleseymining.co.uk.

The financial information contained in this report in respect of the year ended

31 March 2016 has been extracted from the report and financial statements for

that year which have been filed with the Registrar of Companies. The report of

the auditors on those accounts did not contain a statement under section 498(2)

or (3) of the Companies Act 2006 and was not qualified. The half-yearly results

for the current and comparative periods are unaudited.

2. Significant accounting policies

The accounting policies applied in these unaudited condensed consolidated

financial statements are consistent with those set out in the annual report and

financial statements for the year ended 31 March 2016. The following amendments

to interpretations were effective in the current period and have been adopted:

IAS 1 (amendment) 'Presentation of Financial Statements' - Disclosure

initiative - 1 January 2016

IAS 16 (amendment) 'Property, Plant and Equipment' and IAS 38 (amendment)

'Intangible Assets' - Clarification of acceptable methods of depreciation and

amortisation - 1 January 2016

IAS 27 (amendment) 'Separate Financial Statements' - Equity method in separate

financial statements - 1 January 2016

IFRS 11 (amendment) 'Joint Arrangements' - Accounting for acquisitions of

interests in joint operations - 1 January 2016

Annual Improvements to IFRS (2012 - 2014) - 1 January 2016

The adoption of the amendments and new interpretations has not resulted in a

change to the accounting policies nor had a material effect on the financial

performance and position of the group. In preparing these financial statements

any accounting assumptions and estimates made by management were consistent

with those applied to the aforesaid annual report and financial statements.

3. Risks and uncertainties

The principal risks and uncertainties set out in the group's annual report and

financial statements for the year ended 31 March 2016 remain the same for this

half-yearly financial report and can be summarised as: development risks in

respect of mineral properties, especially in respect of permitting and metal

prices; liquidity risks during development; and foreign exchange risks. More

information is to be found in the 2016 annual report - see note 1 above.

4. Statement of directors' responsibilities

The directors confirm to the best of their knowledge that: (a) the unaudited

condensed consolidated financial statements have been prepared in accordance

with the requirements of IAS 34 Interim financial reporting (as adopted by the

European Union); and (b) the interim management report includes a fair review

of the information required by the FSA's Disclosure and Transparency Rules

(4.2.7 R and 4.2.8 R). This report and financial statements were approved by

the board on 17 November 2016 and authorised for issue on behalf of the board

by Bill Hooley, chief executive officer and Danesh Varma, finance director.

5. Activities

The group is engaged in mineral property development and currently has no

turnover. There are no minority interests or exceptional items.

6. Earnings per share

The loss per share is computed by dividing the loss attributable to ordinary

shareholders of GBP0.1 million (loss to 30 September 2015 GBP0.1m), by 160,608,051

(2015 - unchanged) - the weighted average number of ordinary shares in issue

during the period. Where there are losses the effect of outstanding share

options is not dilutive.

7. Business and geographical segments

There are no revenues. The cost of all activities charged in the income

statement relates to exploration and development of mining properties. The

group's income statement and assets and liabilities are analysed as follows by

geographical segments, which is the basis on which information is reported to

the board.

Income statement analysis

Unaudited six months ended 30 September

2016

UK Sweden - Canada -

investment investment Total

GBP GBP GBP GBP

Expenses (42,409) (9) - (42,418)

Investment income 103 - - 103

Finance costs (82,392) - - (82,392)

Exchange rate 105 26 - 131

movements

Loss for the period (124,593) 17 - (124,576)

Unaudited six months ended 30 September

2015

UK Sweden - Canada -

investment investment Total

GBP GBP GBP GBP

Expenses (68,337) - - (68,337)

Investment income 160 - - 160

Finance costs (66,959) - - (66,959)

Exchange rate - (57) (756) (813)

movements

Loss for the period (135,136) (57) (756) (135,949)

Assets and liabilities

` Unaudited 30 September 2016

UK Sweden Canada

investment investment Total

GBP GBP GBP GBP

Non current assets 15,272,940 86,659 1 15,359,600

Current assets 69,755 1,264 - 71,019

Liabilities (280,189) -

(3,191,748) (3,471,937)

Net assets/ 12,150,947 (192,266) 1 11,958,682

(liabilities)

Audited 31 March 2016

UK Sweden Canada Total

investment investment

GBP GBP GBP GBP

Non current assets 15,254,391 86,659 1 15,341,051

Current assets 43,069 1,194 - 44,263

Liabilities (245,461) -

(3,038,460) (3,283,921)

Net assets/ 12,259,000 (157,608) 1 12,101,393

(liabilities)

8. Deferred tax

There is an unrecognised deferred tax asset of GBP1.3 million (31 March 2016 - GBP

1.2m) which, in view of the group's results, is not considered to be

recoverable in the short term. There are also capital allowances, including

mineral extraction allowances, exceeding GBP12.5 million (unchanged from 31 March

2016) unclaimed and available. No deferred tax asset is recognised in the

condensed financial statements.

9. Mineral property exploration and evaluation costs

Mineral property exploration and evaluation costs incurred by the group are

carried in the unaudited condensed consolidated financial statements at cost,

less an impairment provision if appropriate. The recovery of these costs is

dependent upon the successful development and operation of the Parys Mountain

project which is itself conditional on finance being available to fund such

development. During the period expenditure of GBP18,549 was incurred (six months

to 30 September 2015 - GBP24,127). There have been no indicators of impairment

during the period.

10. Investments

Labrador Grangesberg Total

GBP GBP GBP

At 1 April 2015 1 86,659.00 86,660

Addition during period - -

At 31 March 2016 1 86,659 86,660

Addition during period - - -

At Unaudited 30 September 1 86,659 86,660

2016

Labrador: The group's investment is classified as 'unquoted' and is held at a

nominal value of GBP1.

Grangesberg: The group has a 6% holding in Grangesberg Iron AB (an unquoted

Swedish company) and a right of first refusal over shares amounting to a

further 51% of that company. This investment has been initially recognised and

subsequently measured at cost, on the basis that the shares are not quoted and

a reliable fair value is not able to be estimated.

11. Share capital

Ordinary shares Deferred shares Total

of 1p of 4p

Issued and Nominal Number Nominal Number Nominal

fully paid value GBP value GBP value GBP

-

At 31 March 1,606,081 160,608,051 5,510,833 137,770,835 7,116,914

2015,

2016 and 30

September 2016

12. Financial instruments

Group Available for sale Loans &

assets receivables

Unaudited 31 March Unaudited 31

30 2016 30 March

September September 2016

2016 2016

GBP GBP GBP GBP

Financial assets

Investments 1 1 - -

Deposit - - 123,078 123,078

Other debtors - - 30,411 32,759

Cash and cash - - 40,608 11,504

equivalents

- -

1 1 194,097 167,341

Unaudited 31 March

30 2016

September

2016

GBP GBP

Financial

liabilities

Trade payables (44,206) (77,465)

Other payables (54,294) (58,794)

Loans

(3,323,437) (3,097,662)

(3,421,937) (3,233,921)

13. Events after the reporting period

None.

14. Related party transactions

None.

Corporate information

Directors:

John Kearney Chairman

Bill Hooley Chief executive

Danesh Varma Finance director

David Lean Non executive

Howard Miller Non executive

Parys Mountain site: Parys Mountain, Amlwch, Anglesey, LL68 9RE

Phone 01407 831275

London office: Painter's Hall, 9 Little Trinity Lane, London, EC4V 2AD

Phone 020 7653 9881

Registered office: Tower Bridge House, St. Katharine's Way, London, E1W 1DD

Share registrars: Capita Registrars www.capitaregistrars.com

Phone: 0871 664 0300 - for all change of address and shareholder

administration matters (calls cost 10p per minute plus network extras,

lines open 0830 to 1730 Mon-Fri)

Web site: www.angleseymining.co.uk

E-mail: mail@angleseymining.co.uk

Shares listed on the London Stock Exchange - LSE:AYM

Company registration number 1849957

END

(END) Dow Jones Newswires

November 18, 2016 06:08 ET (11:08 GMT)

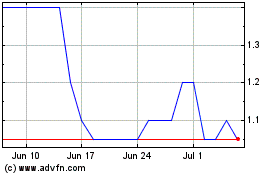

Anglesey Mining (LSE:AYM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Anglesey Mining (LSE:AYM)

Historical Stock Chart

From Apr 2023 to Apr 2024