Angle PLC Proposed further subscription for £2.8 million (3760T)

October 12 2017 - 2:00AM

UK Regulatory

TIDMAGL

RNS Number : 3760T

Angle PLC

12 October 2017

For immediate release 12 October 2017

ANGLE plc ("the Company")

PROPOSED FURTHER SUBSCRIPTION FOR GBP2.8 MILLION

ANGLE plc (AIM:AGL OTCQX:ANPCY), a world-leading liquid biopsy

company, is pleased to announce that further to the announcement on

5 October 2017, the Company has conditionally raised approximately

GBP2.8 million by way of a subscription for 7,481,570 new Ordinary

Shares (the "Further Subscription Shares") at a price of 37.5 pence

each (the "Further Subscription"). The Further Subscription is in

addition to the Fundraising to raise approximately GBP12.2 million

(before expenses) through the issue of 34,789,178 new Ordinary

Shares at a price of 35 pence per new Ordinary Share, as announced

on 5 October 2017.

The Further Subscription has been entered into to allow an

investor to subscribe for new shares; the investor had wanted to

participate in the Fundraising, but due to the compact timelines of

the Fundraising, could not co-ordinate the necessary paperwork in

time. Whilst neither the Directors nor the Company gives any

warranty or undertaking that EIS relief will be available in

relation to any of the Further Subscription Shares it is expected

that the investor will seek EIS relief in respect of 2,666,666 of

the Further Subscription Shares ("EIS Further Subscription

Shares"); EIS relief will not be sought for the remaining 4,814,904

Further Subscription Shares ("Non-EIS Further Subscription

Shares"). The issue price for the Further Subscription Shares

represents a premium of approximately 7.14 per cent. to the issue

price of the Fundraising Shares.

Issue of the EIS Further Subscription Shares is not conditional

on either the passing of the Resolutions at the General Meeting or

the Placing Agreement becoming unconditional and is only

conditional upon admission to trading on AIM of the EIS Further

Subscription Shares becoming effective (the "EIS Further

Subscription Admission").

Issue of the Non-EIS Further Subscription Shares is not

conditional on the passing of the Resolutions at the General

Meeting, the Placing Agreement becoming unconditional or on EIS

Further Subscription Admission and is only conditional upon

admission to trading on AIM of the Non-EIS Further Subscription

Shares becoming effective. Application will be made by the Company

for the Further Subscription Shares to be admitted to trading on

AIM. It is expected that the Further Subscription Shares will be

admitted to trading on AIM and that dealings will commence at 8am

on 25 October 2017 for the EIS shares and on 26 October 2017 for

the remainder. Following the EIS Further Subscription Admission and

the Non-EIS Further Subscription Admission, it is expected that the

Company will have 82,297,344 Ordinary Shares in issue.

As a result of the Further Subscription, the total number of new

Ordinary Shares to be issued pursuant to the Fundraising and the

Further Subscription will be 42,270,748 and the total number of

Ordinary Shares in issue following admission of all of the

Fundraising Shares and the Further Subscription Shares will be

117,086,522. The new Ordinary Shares being issued pursuant to the

Fundraising and Further Subscription will represent approximately

36.1 per cent. of the Enlarged Issued Share Capital.

ANGLE Founder and Chief Executive, Andrew Newland,

commented:

"This further subscription will give the Company a stronger

balance sheet, which will provide flexibility to both target

relevant investment and assist the Company in pursuing commercial

partnerships for both Parsortix(TM) and the assets to be acquired

from Axela."

Capitalised terms not otherwise defined in this announcement

shall have the same meaning ascribed to such terms in the

announcement entitled "Acquisition and Fundraising" released on 5

October 2017 unless the context requires otherwise.

For further information ANGLE:

ANGLE plc +44 (0) 1483 343434

Andrew Newland, Chief Executive

Ian Griffiths, Finance Director

finnCap Ltd (NOMAD and Joint

Broker)

Corporate Finance - Adrian

Hargrave, Simon Hicks, Kate

Bannatyne

Corporate Broking - Alice Lane,

Nikita Jain +44 (0)20 7220 0500

WG Partners (Joint Broker)

Nigel Barnes, Nigel Birks,

Andrew Craig, Chris Lee +44 (0) 203 705 9330

FTI Consulting

Simon Conway, Mo Noonan, Stephanie

Cuthbert +44 (0) 203 727 1000

Kimberly Ha (US) +1 212 850 5612

For Frequently Used Terms, please see the Company's website on

http://www.angleplc.com/the-parsortix-system/glossary/

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IOEVFLFFDBFLFBZ

(END) Dow Jones Newswires

October 12, 2017 02:00 ET (06:00 GMT)

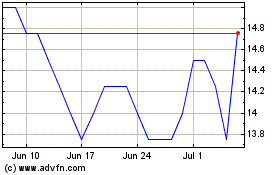

Angle (LSE:AGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

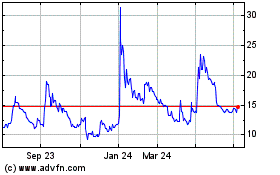

Angle (LSE:AGL)

Historical Stock Chart

From Apr 2023 to Apr 2024