TIDMAGL

RNS Number : 4529F

Angle PLC

28 July 2016

For Immediate Release 28 July 2016

ANGLE plc

("ANGLE" or "the Company")

Preliminary Results for the year ended 30 April 2016

ESTABLISHED RESEARCH USE SALES AND PROGRESSED FIRST CLINICAL

APPLICATION IN OVARIAN CANCER

ANGLE plc (AIM: AGL OTCQX: ANPCY), the specialist medtech

company, today announces audited preliminary results for the year

ended 30 April 2016.

Operational Highlights

-- First sales of the Parsortix system reported in December

2015. Sales pipeline developing in the research use market

-- Analytical and clinical study programmes developed to progress FDA clearance for Parsortix

- planned initial FDA clearance in metastatic breast cancer

- three world-leading US cancer centres selected to perform

clinical validation work

-- Clinical study programmes developed and now recruiting

patients in the detection of ovarian cancer, the Company's first

clinical application:

- Europe: Medical University of Vienna, Charité Medical

University Berlin and Vivantes Network for Health GmbH

- United States: University of Rochester Medical Center Wilmot

Cancer Institute

- global market for this clinical application estimated to be

GBP300 million per annum

-- Growing body of published evidence from third party cancer centres - as at 30 April 2016

- 3 publications in peer-reviewed journals and 10 posters

presented at cancer conferences

-- Strengthened IP position provides protection until 2034.

Patents granted in Europe, Australia, Canada and China during the

period, building on United States IP coverage

Financial Highlights

-- Maiden revenues of GBP0.4 million (2015: GBPnil) from Parsortix

-- Loss from continuing operations of GBP5.1 million (2015:

GBP3.9 million) reflecting planned investment to advance and drive

adoption of Parsortix

-- Cash balance at 30 April 2016 of GBP3.8 million (30 April 2015: GBP8.4 million)

Post year end highlights

-- Cancer Research UK Manchester Institute selected Parsortix

for routine use in clinical trials:

- immediate incorporation of ANGLE's Parsortix system in 10

clinical trials

- 4 further clinical trials currently in planning

-- Clinical applications in metastatic breast and prostate cancer being assessed

- addressing estimated global markets of GBP1.0 billion and

GBP3.0 billion per annum

- follows successful pilot studies by University of Southern

California Norris Comprehensive Cancer Center and Barts Cancer

Institute

-- Financial position strengthened following successful

fundraising from major institutional investors raising GBP10.2

million (GBP9.6 million net of expenses)

Garth Selvey, Non-Executive Chairman of ANGLE plc,

commented:

"ANGLE is funded to execute our business plan with the immediate

priorities of building research use sales in leading institutions,

completing analytical and clinical studies to support FDA clearance

in the US, and completing clinical studies for our first clinical

application in ovarian cancer. The recent pilot study results in

breast cancer and prostate cancer represent breakthroughs that

offer major growth potential for the future. ANGLE is well

positioned to become a leading player in the emerging liquid biopsy

market, which is expected to revolutionise cancer care."

Details of webcast

Please see

http://www.angleplc.com/investor-information/investor-centre/ for

details.

For further information:

ANGLE plc 01483 685830

Andrew Newland, Chief Executive

Ian Griffiths, Finance Director

Cenkos Securities

Stephen Keys (Nominated adviser)

Russell Kerr, Oliver Baxendale

(Sales) 020 7397 8900

WG Partners

David Wilson

Claes Spång 020 3705 9330

FTI Consulting

Simon Conway, Mo Noonan,

Stephanie Cuthbert 020 3727 1000

Kimberly Ha (US) 001 212 850 5612

These Preliminary Results may contain forward-looking

statements. These statements reflect the Board's current view, are

subject to a number of material risks and uncertainties and could

change in the future. Factors that could cause or contribute to

such changes include, but are not limited to, the general economic

climate and market conditions, as well as specific factors

including the success of the Group's research and development and

commercialisation strategies, the uncertainties related to

regulatory clearance and the acceptance of the Group's products by

customers.

CHAIRMAN'S STATEMENT

Introduction

We have made significant progress across the business during the

year. Having completed the transition to specialist medtech

company, ANGLE moved into the early commercialisation phase,

securing first sales for research use and developing its clinical

application for ovarian cancer.

We have made good progress with the analytical and clinical

studies to support FDA clearance and plans have been put in place

for ovarian cancer clinical studies in Europe and the United States

for the Company's first clinical application.

During the period, key opinion leaders demonstrated significant

performance capabilities of the Parsortix system in pilot studies

with breast and prostate cancer patients.

Overview of Financial Results

Revenue of GBP0.4 million (2015: GBPnil) came from first

commercial sales of the Parsortix system for research use. Planned

investment in studies to develop and validate the clinical

application and commercial use of Parsortix increased, resulting in

operating costs of GBP5.7 million (2015: GBP3.9 million). Thus the

resulting loss for the year from continuing operations

correspondingly increased to GBP5.1 million (2015: GBP3.9

million).

The cash balance was GBP3.8 million at 30 April 2016 (30 April

2015: GBP8.4 million). Post year end, the financial position was

strengthened following a successful placing of shares with major

institutional investors, which raised GBP10.2 million, gross

(GBP9.6 million net of expenses).

Far-reaching market potential

ANGLE's Parsortix system has widespread potential application

across all solid tumour types including, but not limited to,

bladder, brain, breast, colorectal, liver, lung, melanoma,

oesophageal, ovarian and other gynaecological, pancreatic and

prostate cancers. For each cancer type, there are multiple

potential clinical applications including the major categories

of:

-- population screening;

-- high risk diagnostic screening;

-- therapeutic decision-making including drug selection and companion diagnostics;

-- assessment of minimal residual disease to determine when treatment has been effective; and

-- post treatment monitoring (remission monitoring).

ANGLE's overall objective is for the Parsortix system to become

established as a platform of choice in the liquid biopsy space for

harvesting cancer cells from patient blood for analysis. The

Parsortix system could feed into existing analysis systems for

applications developed by numerous third parties in all cancers in

all categories, including next generation sequencing, PCR, FISH and

immunohistochemical staining.

In pursuit of this objective, ANGLE has established a tightly

focused strategy as follows:

1) Optimise the system and make it available for sale for

research use to identified leading research groups to (i) generate

establishment revenues and (ii) increase the number of leading

research groups utilising the system and demonstrating its

capabilities in different areas at their own cost.

2) Pursue FDA clearance of the system, the de facto global

standard, with the aim of being the first system ever cleared for

marketing by the FDA for harvesting cancer cells (CTCs) from

patient blood for subsequent analysis. This would provide major

competitive differentiation as well as demonstrate the system's

capabilities.

3) Secure Level 1 evidence of system performance through large,

rigorously controlled clinical studies - both sensitivity (avoiding

false negatives) and specificity (avoiding false positives) - in

specific clinical applications. Success in these clinical studies

not only has the potential to open up new, large markets for

clinical sales in that particular application but also to catalyse

third parties to develop further clinical applications themselves

using Parsortix.

The selection of the first clinical application in ovarian

cancer (differentiation of benign vs. malignant pelvic masses prior

to surgery) has been made based on a set of key criteria, which

include:

-- access to current key opinion leader in the disease area (for

expertise, relationships, patients) and successful pilot data;

-- "short" study end point;

-- differentiation from ctDNA , antibody-based CTC assays, and other tests;

-- existing standard of care poor with significant problems (high unmet medical need);

-- existing test or current standard of care available for benchmark comparison;

-- in the US, an existing CPT code (Current Procedural

Terminology used to report medical procedures and services) to

assist with reimbursement; and

-- other considerations including barriers to market entry such

as established clinical practice, cost and vested interests.

The ovarian cancer application addresses a clearly identified

market opportunity estimated to be worth over GBP300 million per

annum in potential Parsortix sales.

Following successful pilot studies undertaken by key opinion

leaders, University of Southern California Norris Comprehensive

Cancer Center and Barts Cancer Institute, in breast and prostate

cancers respectively, ANGLE is now evaluating whether, and if so,

how, clinical applications could be developed using Parsortix for

breast and prostate cancers.

Due to the prevalence of these cancer types and the need for

repeat testing, ANGLE estimates the market opportunities in breast

and prostate to be worth over GBP1.0 billion and GBP3.0 billion per

annum in potential Parsortix sales respectively for these clinical

applications.

Research use sales

Having successfully completed an intensive phase of system

optimisation and successful evaluations with multiple third party

cancer centres, ANGLE initiated sales of the Parsortix system for

research use with first sales announced in the second half of the

financial year (December 2015). The sales pipeline is developing

with selected leading institutions, addressing a research use

market estimated to be GBP250 million per annum.

Sales of both Parsortix instruments and cassettes (a one-time

use consumable part of the system) have been made to multiple

customers. A number of key achievements have already been made

including:

-- sales to

- existing key opinion leaders transitioning to paying

customers

- leading cancer research centres

- big pharma and immunotherapy companies

-- repeat customer and multiple instrument orders

-- first customer publishing results following their purchase of the system

We expect further revenue growth to come from key opinion leader

(KOL) referrals and from our product being specified in the cancer

drug trials in which the KOLs are involved.

The contract signed subsequent to the year-end with Cancer

Research UK Manchester Institute for routine use of Parsortix in

their clinical trials is important in establishing the credibility

of the system. This contract has led to immediate revenue

generation, as Parsortix has already been incorporated into 10

clinical trials to date and is to be adopted in an additional 4

trials currently in their planning stages. Cancer Research UK

Manchester Institute has already processed over 700 clinical

samples and there is significant potential to expand this over time

as the partner hospital, the Christie, is one of the largest

single-site cancer hospitals in Europe and currently has 620 active

clinical trials in process.

We are delighted to have Cancer Research UK Manchester Institute

as a customer and believe this contract helps validate our

credentials and provides a strong reference for adoption by other

potential customers running pharmaceutical drug trials.

The installed base, including those at ANGLE labs, key opinion

leaders, customers and prospective customers, is now over 90

Parsortix systems, with over 17,000 blood samples processed with

the system. Each new customer brings additional instrument revenue

and increases the installed base, driving ongoing increased

revenues from consumables and service contracts. Furthermore, each

new research use customer is undertaking investigations into new

uses of the system, which they aim to publish, thereby creating

increased awareness and consequent market demand for the Parsortix

system.

Regulatory authorisation

Regulatory authorisation is a requirement before the Parsortix

system can be sold for use in clinical markets (for treatment of

patients). ANGLE already has a CE Mark for the indicated clinical

use of the Parsortix system in Europe as a platform for harvesting

cancer cells for analysis and major efforts are being focused on

securing similar FDA clearance in the United States. FDA clearance

would not only allow sale of the product for clinical use in the

United States but would also be a de-facto gold standard

demonstrating performance of the system and influencing system

adoption worldwide.

It is widely accepted that clinical use of CTCs (cancer cells

circulating in patient blood) to detect cancer, select therapies,

and monitor patients in remission has the potential to make a

profound impact on delivering personalised cancer care thereby

benefitting patients and reducing overall healthcare costs.

Currently, there are no products that have been cleared by the FDA

for the harvest of cancer cells from patient blood for subsequent

analysis. ANGLE's aim is for the Parsortix system to be the first

such product.

ANGLE has been in dialogue with the FDA for over two years, and

a great deal of work has been completed on the development of

robust analytical and clinical (patient) studies with the aim of

securing FDA clearance for the Parsortix system for the harvest of

circulating tumour cells from patient blood for subsequent

analysis.

While FDA clearance of the Parsortix system is being pursued

first for metastatic breast cancer, the intention is to

subsequently expand that initial clearance to multiple other cancer

types including ovarian and prostate. Each new cancer application

will require additional patient studies (as planned with each

clinical application) but can build on the original approved

analytical validation of the system and does not need to repeat all

this work.

Three world-leading US cancer centres have been selected to

complete the necessary clinical validation work (patient studies)

for metastatic breast cancer. These centres will help to provide

the clinical evidence needed to secure the FDA clearance in

metastatic breast cancer and crucially, they may be major future

customers and opinion leaders in securing uptake of the Parsortix

system for clinical use once FDA clearance has been secured. The

additional clinical studies require 196 metastatic breast cancer

patients to be studied alongside 196 healthy volunteers of similar

age and demographics to be evaluated with the Parsortix system.

While the speed of patient accrual is outside of the Company's

control, the aim is to complete the necessary analytical and

clinical studies as quickly as possible so that the results can be

submitted to the FDA in calendar year 2017. The timing of eventual

FDA clearance is dependent on the Agency's assessment of the study

results, both analytical and clinical.

Most competitors are pursuing a laboratory service approach to

their business model. In contrast, as the Parsortix system is

patent-protected, ANGLE has a product-based strategy with the sale

of instruments and consumables to customers for use in their own

laboratory. This product-based strategy meets the needs of many

customers and commercially provides ANGLE with a rapidly scalable

business model not available to service-based businesses, which are

intrinsically limited by the size of their laboratories, staff and

overheads. The FDA clearance is a key element to drive this

product-based strategy, particularly in the United States, and the

Directors believe that, once obtained, FDA clearance will provide

ANGLE with a strong competitive advantage.

Ovarian cancer clinical application: triaging abnormal pelvic

mass

In September 2015, the Medical University of Vienna published

results from a pilot study demonstrating the ability to detect

ovarian cancer using cells harvested by the Parsortix system. ANGLE

is now working with the Medical University of Vienna and other

leading cancer centres to demonstrate, through prospective clinical

studies, the capability to use the system to triage patients having

surgery for abnormal pelvic mass into those with low and high risk

of ovarian cancer. The goal is to discriminate benign

(non-cancerous) from malignant (cancerous) pelvic masses, enabling

patients to receive appropriately targeted treatment. ANGLE

estimates that the addressable global market for ovarian cancer,

available for Parsortix sales, would be in excess of GBP300 million

per annum.

During the year, ANGLE completed the complex and intensive

process required to initiate the ovarian cancer clinical studies.

This process included:

-- optimising the system protocols for the application;

-- developing and approving the study plans and the data

collection and study documentation tools;

-- obtaining ethics approval and contracting with leading cancer centres; and

-- designing and delivering all the necessary forms, consumables

and training required for the clinical studies.

As announced this month, two clinical studies have been

initiated for recruitment of women scheduled for surgery for

evaluation of a pelvic mass. A blood sample is taken prior to

surgery and separated on the Parsortix system to harvest any

circulating tumour cells that may be present. Gene expression of

the cells is then determined and compared with the actual status of

the tissue removed by surgery which is analysed after the operation

by a pathologist as part of standard care. The comparison of the

combined Parsortix and RNA marker analysis results with the

histopathological diagnosis will enable an evaluation of the

sensitivity (ability to detect malignant conditions) and

specificity (ability to detect benign conditions) of the assay.

Existing blood tests for ovarian cancer have very poor

specificity, with nearly half of the benign patients being

incorrectly diagnosed as malignant. In contrast, Parsortix has so

far performed at 100% specificity for ovarian cancer. As it works

with live cancer cells rather than general markers of disease, it

offers the potential for high specificity avoiding the problem of

false positives that affects all existing techniques.

A European study of 200 patients is currently taking place at

the Medical University of Vienna, the Charité Medical University

Berlin and the two largest hospitals of the Vivantes Network for

Health GmbH in Berlin. This two part study includes a "training

study" to be done on the first half of the patients enrolled into

the study for determination of the optimal combination of RNA

markers for detection of cancer cells captured by Parsortix, and a

"verification study" to analyse the performance of the selected

combination of markers in the second half of the patients enrolled

into the study. Whilst the timing is dependent on a number of

factors including the speed of patient recruitment and enrolment at

the trial centres, we anticipate being able to report results by

calendar year end.

Once the European study is complete, European hospitals with

accredited laboratories will be able to design a laboratory

developed test based on the RNA markers identified, thus enabling

ANGLE to start generating revenue from clinical sales. ANGLE will

then seek to undertake a European "validation study" to validate

the clinical utility of the offering of Parsortix with the

downstream RNA analysis. The successful validation will allow ANGLE

to fulfil the In Vitro Diagnostic Directive (CE Marking)

requirements for the specific clinical application, thereby

allowing sale of the ovarian clinical application to all European

hospitals without the requirement for a laboratory developed

test.

A separate United States study of approximately 200 patients is

taking place at the University of Rochester Medical Center Wilmot

Cancer Institute. This study is similar in design to the European

ovarian study and is expected to be completed in the first half of

calendar 2017. It is intended to provide additional patient data in

the United States market, which will be important for subsequent

FDA clearance of the ovarian clinical application described. It is

expected that a further multi-site United States "validation study"

will be needed to secure FDA clearance for the ovarian

application.

Other potential clinical applications

Following successful pilot studies, ANGLE is assessing the

potential to develop additional clinical applications in metastatic

breast cancer and prostate cancer.

Breast cancer: blood test alternative to invasive metastatic

biopsy

During the year, the University of Southern California (USC)

Norris Comprehensive Cancer Center performed pilot study work

demonstrating the potential for the use of Parsortix as a liquid

biopsy for metastatic breast cancer. USC undertook the first head

to head comparison of the results of the molecular evaluation of

invasive metastatic biopsy tissue with a similar evaluation of a

Parsortix liquid biopsy.

Data was presented at this year's American Association for

Cancer Research (AACR) Annual Meeting (2016), showing a correlation

in metastatic breast cancer patients between the molecular

signatures of CTCs (circulating tumour cells) harvested from a

simple blood test using Parsortix and tissue obtained from invasive

biopsy of a secondary cancer site.

Prostate cancer: blood test alternative to prostate biopsy

During the year, Barts Cancer Institute's work with the

Parsortix system was presented at the 10th International Symposium

on Minimal Residual Cancer (ISMRC): Liquid Biopsy in Cancer

Diagnostics and Treatment, held in Hamburg.

The Barts patient data suggests that the Parsortix system has

the potential to be used both to detect cancer and to assess its

aggressiveness. This would mean that men with low level disease

could avoid unnecessary and potentially harmful solid biopsy and

surgical intervention, instead having "active surveillance",

whereas men with an aggressive form of disease could be

fast-tracked for further investigation and treatment.

A simple blood test to assess whether a solid prostate biopsy is

warranted would improve patient care as well as reduce healthcare

costs.

Growing body of published evidence

The Parsortix system is now being adopted widely amongst leading

researchers in the field, and as a result there is a growing body

of published evidence from third party cancer centres in support of

the Parsortix system.

As of 30 April 2016, there were 3 publications in peer-reviewed

journals (30 April 2015: nil) and 10 posters presented at

international cancer conferences (30 April 2015: 3). During the

year, there were several other posters presented, which have not

yet been made available publicly, as they are being developed for

peer-reviewed publications.

The rate of publication of third party evidence is accelerating

as research use customers publish their results. Peer reviewed

published scientific data and Level 1 clinical evidence are

fundamental to the Company's overall strategy aimed at Parsortix

being routinely adopted as the system of choice for the harvesting

of cancer cells from patient blood for analysis.

Intellectual property further strengthened

Intellectual property protecting the Parsortix system was

further strengthened during the year with patents being granted in

Europe, Australia, Canada and China, increasing the patent

protection already in place in the United States. These extended

the breadth and duration of patent coverage for the Parsortix

system out to 2034.

The protected intellectual property position enables the Company

to sell the Parsortix system as a product, with an instrument and

consumable. This will allow for revenue generation by the end users

once high level clinical evidence is in place and reimbursement has

been established. This is an option not available to most other

participants in the liquid biopsy market, which are limited to

service-based laboratory offerings necessitating the hospital to

send blood outside of their facility for analysis.

This patented product based approach to the business with third

party manufacturers gives ANGLE a scalable business model which

meets the needs of customers wishing to provide in-house patient

testing.

Outlook

ANGLE is funded to execute our business plan with the immediate

priorities of building research use sales in leading institutions,

completing analytical and clinical studies to support FDA clearance

in the US, and completing clinical studies for our first clinical

application in ovarian cancer. The recent pilot study results in

breast cancer and prostate cancer represent breakthroughs that

offer major growth potential for the future. ANGLE is well

positioned to become a leading player in the emerging liquid biopsy

market, which is expected to revolutionise cancer care.

Garth Selvey

Chairman

27 July 2016

ANGLE PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 30 APRIL 2016

2016 2015

Note GBP'000 GBP'000

Revenue 361 -

Cost of sales (107) -

-------- --------

Gross profit 254 -

Operating costs (5,703) (3,878)

-------- --------

Operating profit/(loss) from continuing operations (5,449) (3,878)

Net finance income/(costs) 22 9

-------- --------

Profit/(loss) before tax from continuing operations (5,427) (3,869)

Tax (charge)/credit 5 309 -

-------- --------

Profit/(loss) for the year from continuing operations (5,118) (3,869)

Profit/(loss) from discontinued operations 32 (18)

-------- --------

Profit/(loss) for the year (5,086) (3,887)

Other comprehensive income/(loss)

Items that may be subsequently reclassified to profit or loss

Exchange differences on translating foreign operations (7) 92

-------- --------

Other comprehensive income/(loss) (7) 92

Total comprehensive income/(loss) for the year (5,093) (3,795)

======== ========

Profit/(loss) for the year attributable to:

Owners of the parent

From continuing operations (4,924) (3,576)

From discontinued operations 31 (18)

Non-controlling interests

From continuing operations (194) (293)

From discontinued operations 1 -

Profit/(loss) for the year (5,086) (3,887)

======== ========

Total comprehensive income/(loss) for the year attributable to:

Owners of the parent

From continuing operations (4,978) (3,421)

From discontinued operations 31 (18)

Non-controlling interests

From continuing operations (147) (356)

From discontinued operations 1 -

Total comprehensive income/(loss) for the year (5,093) (3,795)

======== ========

Earnings/(loss) per share

Basic and Diluted (pence per share)

From continuing operations (8.69) (8.12)

From discontinued operations 0.05 (0.04)

From continuing and discontinued operations 6 (8.64) (8.16)

ANGLE PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 APRIL 2016

Note 2016 2015

GBP'000 GBP'000

ASSETS

Non-current assets

Property, plant and equipment 455 423

Intangible assets 7 1,346 1,149

----------- -----------

Total non-current assets 1,801 1,572

----------- -----------

Current assets

Inventories 376 197

Trade and other receivables 8 489 1,008

Taxation 309 -

Cash and cash equivalents 3,764 8,443

----------- -----------

Total current assets 4,938 9,648

----------- -----------

Total assets 6,739 11,220

=========== ===========

EQUITY AND LIABILITIES

Equity

Share capital 9 5,898 5,897

Share premium 25,299 25,299

Share-based payments reserve 629 432

Other reserve 2,553 2,553

Translation reserve (21) 33

Retained earnings (28,141) (23,260)

ESOT shares (102) (102)

----------- -----------

Equity attributable to owners of the parent 6,115 10,852

----------- -----------

Non-controlling interests (880) (763)

Total equity 5,235 10,089

----------- -----------

Liabilities

Current liabilities

Trade and other payables 1,504 1,131

----------- -----------

Total current liabilities 1,504 1,131

----------- -----------

Total liabilities 1,504 1,131

----------- -----------

Total equity and liabilities 6,739 11,220

=========== ===========

ANGLE PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEARED 30 APRIL 2016

2016 2015

GBP'000 GBP'000

Operating activities

Profit/(loss) before tax from continuing

operations (5,427) (3,869)

Adjustments for:

Depreciation of property, plant and

equipment 198 111

(Profit)/loss on disposal of property,

plant and equipment - 1

Amortisation and impairment of intangible

assets 187 204

Exchange differences (65) (41)

Net finance (income)/costs (22) (9)

Share-based payments 238 111

---------- ----------

Operating cash flows before movements

in working capital: (4,891) (3,492)

(Increase)/decrease in inventories (238) (191)

(Increase)/decrease in trade and other

receivables (107) (191)

Increase/(decrease) in trade and other

payables 474 452

---------- ----------

Net cash from/(used in) operating activities (4,762) (3,422)

Investing activities

Purchase of property, plant and equipment (186) (325)

Purchase of intangible assets (332) (105)

Interest received 21 11

---------- ----------

Net cash from/(used in) investing activities (497) (419)

Financing activities

Net proceeds from issue of share capital 1 8,257

---------- ----------

Net cash from/(used in) financing activities 1 8,257

Net increase/(decrease) in cash and

cash equivalents from continuing operations (5,258) 4,416

Discontinued operations

Net cash from/(used in) operating activities (34) 118

Net cash from/(used in) investing activities 611 8

---------- ----------

Net increase/(decrease) in cash and

cash equivalents from discontinued operations 577 126

Net increase/(decrease) in cash and

cash equivalents (4,681) 4,542

Cash and cash equivalents at start of

year 8,443 3,898

Effect of exchange rate fluctuations 2 3

---------- ----------

Cash and cash equivalents at end of

year 3,764 8,443

========== ==========

ANGLE PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 30 APRIL 2016

----------------------------------------------- Equity attributable to owners of the parent

-----------------------------------------------

Share-based Total Non-

Share Share payments Other Translation Retained ESOT Shareholders' controlling Total

capital premium reserve reserve reserve earnings shares equity interests equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 May 2014 4,524 18,414 432 2,553 (122) (19,777) (102) 5,922 (407) 5,515

For the year to

30 April 2015

------------------ ----------- ----------- ------------ ----------- ------------ ------------ ----------- -------------- ------------ -----------

Consolidated

profit/(loss) (3,594) (3,594) (293) (3,887)

Other

comprehensive

income/(loss)

Exchange

differences

on

translating

foreign

operations 155 155 (63) 92

------------------ ----------- ----------- ------------ ----------- ------------ ------------ ----------- -------------- ------------ -----------

Total

comprehensive

income/(loss) 155 (3,594) (3,439) (356) (3,795)

Issue of shares 1,373 6,885 8,258 8,258

Share-based

payments 111 111 111

Released on

forfeiture (1) 1 - -

Released on

exercise (16) 16 - -

Impairment of

IP in

investment (94) 94 - -

___ ___ ___

___ ______ _______ ___ ______ ___ ______ ___ ______ ________ ___ ______ ___ _______ __ _______ _______

At 30 April 2015 5,897 25,299 432 2,553 33 (23,260) (102) 10,852 (763) 10,089

For the year to

30 April 2016

------------------ ----------- ----------- ------------ ----------- ------------ ------------ ----------- -------------- ------------ -----------

Consolidated

profit/(loss) (4,893) (4,893) (193) (5,086)

Other

comprehensive

income/(loss)

Exchange

differences

on

translating

foreign

operations (54) (54) 47 (7)

------------------ ----------- ----------- ------------ ----------- ------------ ------------ ----------- -------------- ------------ -----------

Total

comprehensive

income/(loss) (54) (4,893) (4,947) (146) (5,093)

Issue of shares 1 - 1 1

Share-based

payments 238 238 238

Released on

deemed

disposal (41) 41 - -

Deemed disposal

of controlling

interest in

investment (29) (29) 29 -

___ ___ ___

___ ______ _______ ___ ______ ___ ______ ___ ______ ________ ___ ______ ___ _______ ___ ______ _______

At 30 April 2016 5,898 25,299 629 2,553 (21) (28,141) (102) 6,115 (880) 5,235

========== ========== ========== ========== ========= =========== ========== ========== ========== ==========

ANGLE PLC

NOTES TO THE PRELIMINARY ANNOUNCEMENT

FOR THE YEARED 30 APRIL 2016

1 Preliminary announcement

The preliminary announcement set out above does not constitute

ANGLE plc's statutory Financial Statements for the years ended 30

April 2016 or 2015 within the meaning of section 434 of the

Companies Act 2006 but is derived from those audited Financial

Statements. The auditor's report on the consolidated Financial

Statements for the year ended 30 April 2016 and 2015 is unqualified

and does not contain statements under s498(2) or (3) of the

Companies Act 2006.

The accounting policies used for the year ended 30 April 2016

are unchanged from those used for the statutory Financial

Statements for the year ended 30 April 2015, except as referred to

in Note 2. The 2016 statutory accounts will be delivered to the

Registrar of Companies following the Company's Annual General

Meeting.

2 Compliance with accounting standards

While the financial information included in this preliminary

announcement has been computed in accordance with IFRS, this

announcement does not itself contain sufficient information to

comply with IFRS.

Accounting standards adopted in the year

No new accounting standards that have become effective and

adopted in the year have had a significant effect on the Group's

Financial Statements.

Accounting standards issued but not yet effective

At the date of authorisation of the Financial Statements, there

were a number of other Standards and Interpretations (International

Financial Reporting Interpretation Committee - IFRIC) which were in

issue but not yet effective, and therefore have not been applied in

these Financial Statements. The Directors have not yet assessed the

impact of the adoption of these standards and interpretations for

future periods.

A Cost of sales accounting policy has been added and a number of

other accounting policies have been slightly amended and updated

for readability.

3 Going concern

The Financial Statements have been prepared on a going concern

basis which assumes that the Group will be able to continue its

operations for the foreseeable future.

The Group's business activities, together with the factors

likely to affect its future development, performance and financial

position are set out in the Chairman's Statement. Note 10 includes

information on the fundraise of GBP9.6m net of expenses completed

after the reporting date.

The Directors have prepared and reviewed the financial

projections for the 12 month period from the date of signing of

these Financial Statements. Based on the level of existing cash and

the projected income and expenditure (the timing of some of which

is at the Group's discretion), the Directors have a reasonable

expectation that the Company and Group have adequate resources to

continue in business for the foreseeable future. Accordingly the

going concern basis has been used in preparing the Financial

Statements.

4 Critical accounting estimates and judgements

The preparation of the Financial Statements requires the use of

estimates, assumptions and judgements that affect the reported

amounts of assets and liabilities at the date of the Financial

Statements and the reported amounts of revenues and expenses during

the reporting period. Although these estimates, assumptions and

judgements are based on management's best knowledge of the amounts,

events or actions, and are believed to be reasonable, actual

results ultimately may differ from those estimates.

The estimates, assumptions and judgements that have a

significant risk of causing a material adjustment to the carrying

amounts of assets and liabilities are described below.

Valuation, amortisation and impairment of intangible assets

(Note 7)

IAS 38 Intangible Assets contains specific criteria that if met

mean development expenditure must be capitalised as an internally

generated intangible asset. Judgements are required in both

assessing whether the criteria are met and then in applying the

rules. Intangible assets are amortised over their useful lives.

Useful lives are assessed by reference to observable data (e.g.

remaining patent life) and taking into consideration specific

product (e.g. product life cycle) and market characteristics (e.g.

estimates of the period that the assets will generate revenue).

Each of these factors is periodically reviewed for appropriateness.

Changes to estimates in useful lives may result in significant

variations in the amortisation charge.

The Group is required to review, at least annually, whether

there are indications (events or changes in circumstances) that

intangible assets have suffered impairment and that the carrying

amount may exceed the recoverable amount. If there are indications

of impairment then an impairment review is undertaken. The

recoverable amount is the higher of the asset's fair value less

costs to sell and its value-in-use. The value-in-use method

requires the estimation of future cash flows and the selection of a

suitable discount rate in order to calculate the present value of

these cash flows. When reviewing intangible assets for impairment

the Group has had to make various assumptions and estimates of

individual components and their potential value and potential

impairment impact. The Group considers that for each of these

variables there is a range of reasonably possible alternative

values, which results in a range of fair value estimates. None of

these estimates of fair value is considered more appropriate or

relevant than any other and therefore determining a fair value

requires considerable judgement.

Share-based payments

In calculating the fair value of equity-settled share-based

payments the Group uses an options pricing model. The Directors are

required to exercise their judgement in choosing an appropriate

options pricing model and determining input parameters that may

have a material effect on the fair value calculated. These input

parameters include, among others, expected volatility, expected

life of the options taking into account exercise restrictions and

behavioural considerations of employees, the number of options

expected to vest and liquidity discounts.

Research and development tax credit (Note 5)

Management makes its best estimate of qualifying R&D

expenditure to calculate the R&D tax credit. The interpretation

of qualifying expenditure requires judgement.

Deferred tax assets

The Group has unused tax losses. Management judgement is

required to determine the amount of deferred tax assets that can be

recognised, based upon the likely timing and level of future

taxable profits together with an assessment of the effect of future

tax planning strategies. Changes in these judgements and

assumptions could have a material impact on the Group's reported

tax charge.

5 Tax

The Group undertakes research and development activities. In the

UK these activities qualify for tax relief resulting in tax

credits.

6 Earnings/(loss) per share

The basic and diluted earnings/(loss) per share is calculated on

the loss for the year from continuing and discontinued operations

of GBP5.1 million (2015: GBP3.9 million).

In accordance with IAS 33 Earnings per share 1) the "basic"

weighted average number of ordinary shares calculation excludes

shares held by the Employee Share Ownership Trust (ESOT) as these

are treated as treasury shares and 2) the "diluted" weighted

average number of ordinary shares calculation excludes potentially

dilutive ordinary shares from instruments that could be converted.

Share options are potentially dilutive where the exercise price is

less than the average market price during the period. Due to the

losses in 2016 and 2015, share options are non-dilutive for those

years and therefore the diluted loss per share is equal to the

basic loss per share.

The basic and diluted earnings/(loss) per share are based on a

weighted average of 58,863,713 ordinary 10p shares (2015:

47,625,033).

7 Intangible assets

Intellectual Computer Product Total

property software development

GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 May 2014 206 11 1,045 1,262

Additions 66 1 37 104

Exchange movements 14 - 109 123

At 30 April 2015 286 12 1,191 1,489

Additions 241 1 90 332

Disposals (94) (7) - (101)

Exchange movements 9 - 58 67

At 30 April 2016 442 6 1,339 1,787

============= ========= ============ ========

Amortisation and impairment

At 1 May 2014 - 9 111 120

Charge for the year - 1 109 110

Impairment 94 - - 94

Exchange movements - - 16 16

At 30 April 2015 94 10 236 340

Charge for the year 2 1 124 127

Disposals (94) (7) - (101)

Impairment 60 - - 60

Exchange movements - - 15 15

At 30 April 2016 62 4 375 441

============= ========= ============ ========

Net book value

At 30 April 2016 380 2 964 1,346

============= ========= ============ ========

At 30 April 2015 192 2 955 1,149

============= ========= ============ ========

The carrying value of intangible assets is reviewed for

indications of impairment whenever events or changes in

circumstances indicate that the carrying value may exceed the

recoverable amount. The recoverable amount is the higher of the

asset's fair value less costs to sell and its "value-in-use". The

key assumptions to assess value-in-use are the estimated useful

economic life, future revenues, cash flows and the discount rate to

determine the net present value of these cash flows. Where

value-in-use exceeds the carrying value then no impairment is made.

Where value-in-use is less than the carrying value then an

impairment charge is made.

During the period the Group decided to abandon a particular

patent application which resulted in an impairment charge.

Amortisation and impairment charges are charged to operating

costs in the Consolidated Statement of Comprehensive Income.

"Product development" relates to internally generated assets

that were capitalised in accordance with IAS 38 Intangible Assets.

Capitalised product development costs are directly attributable

costs comprising cost of materials, specialist contractor costs,

labour and overheads. Product development costs are amortised over

their estimated useful lives commencing when the related new

product is in commercial production. Development costs not meeting

the IAS 38 criteria for capitalisation continue to be expensed

through the Statement of Comprehensive Income as incurred.

8 Trade and other receivables

2016 2015

GBP'000 GBP'000

Current assets:

Trade receivables 104 4

Other receivables - investments - 636

Other receivables 132 124

Prepayments and accrued income 253 244

-------- --------

489 1,008

======== ========

"Other receivables - investments" related to the Group's

investment in Geomerics (computer games middleware and computer

graphics) which was sold in December 2013. The deal included a

deferred retention payment of GBP0.7 million which was received in

full in December 2015. This Other receivable was designated at fair

value and had been discounted for the time value of money.

9 Share capital

The Company has one class of ordinary shares which carry no

right to fixed income and at 30 April 2016 had 58,978,338 ordinary

shares of 10p each allotted, called up and fully paid (2015:

58,974,338).

The Company issued 4,000 new ordinary shares with a nominal

value of GBP0.10 at an exercise price of GBP0.2575 per share as a

result of the exercise of share options by a former employee.

Shares were admitted to trading on AIM in September 2015.

10 Post reporting date events

The Company successfully completed a fundraise of GBP10.2

million (GBP9.6 million net of expenses). The Company issued

15,815,436 new ordinary shares with a nominal value of GBP0.10 at

an issue price of GBP0.645 per share in a placing. Shares were

admitted to trading on aim in May 2016.

11 Shareholder communications

Copies of this announcement are posted on the Company's website

www.ANGLEplc.com.

The Annual General Meeting of the Company will be held at 2:00pm

on Tuesday 4 October 2015 at the Surrey Technology Centre, 40 Occam

Road, the Surrey Research Park, Guildford, GU2 7YG. Notice of the

meeting will be enclosed with the audited Statutory Financial

Statements.

The audited Statutory Financial Statements for the year ended 30

April 2016 are expected to be distributed to shareholders by 9

September 2016 and will subsequently be available on the Company's

website or from the registered office, 3 Frederick Sanger Road,

Surrey Research Park, Guildford, GU2 7YD.

This preliminary announcement was approved by the Board on 27

July 2016.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR PGURWMUPQGRM

(END) Dow Jones Newswires

July 28, 2016 02:01 ET (06:01 GMT)

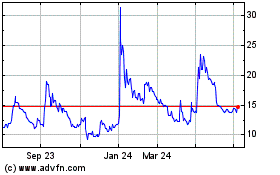

Angle (LSE:AGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

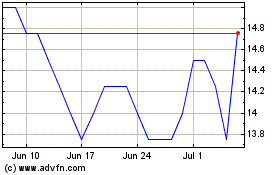

Angle (LSE:AGL)

Historical Stock Chart

From Apr 2023 to Apr 2024