TIDMAGL

RNS Number : 4381D

Angle PLC

29 January 2015

For Immediate Release 29 January 2015

ANGLE plc

("ANGLE" or "the Company")

Interim Results for the six months ended 31 October 2014

MOVING CLOSER TO A CLINICAL APPLICATION

ANGLE plc (AIM: AGL and OTCQX: ANPCY), the specialist medtech

company, today announces unaudited interim results for the six

months ended 31 October 2014.

Highlights

-- Collaboration agreements signed with a further five leading

international cancer research centres bringing the total number of

key opinion leaders working with the Parsortix system to eight

covering the UK, Europe and the United States collectively covering

breast, colorectal, oesophageal, ovarian, prostate and pancreatic

cancers

-- Four of the key opinion leaders publicly reported during the

period bringing a total of five key opinion leaders reporting

positively on their evaluation of the Parsortix system. The

remaining three are in progress

-- Continued progress towards FDA authorisation

-- Second US patent granted relating to improvements in

technology and specific use for foetal and cancer applications

-- Management team strengthened with US specialist medtech commercialisation experience

-- Loss for the half year of GBP1.6 million (H1 2014: loss

GBP0.5 million) reflecting planned investment in Parsortix of

GBP1.6 million (H1 2014: GBP1.1 million)

-- Cash balance at 31 October 2014 of GBP2.3 million (30 April 2014: GBP3.9 million)

Progress post the half year end

-- Commercial collaboration established with the diagnostics

division of a large pharmaceutical company to investigate the

combination of ANGLE's Parsortix circulating tumour cell (CTC)

harvesting platform as a front end to the Collaborator's single

cell analysis system

-- Commercial collaboration established with EKF Diagnostics

Holdings plc to investigate the combination of ANGLE's Parsortix

circulating tumour cell (CTC) harvesting platform with EKF's

PointMan(TM) DNA enrichment technology as a liquid biopsy to

provide a combined solution

-- Patient study provides basis for clinical application in

ovarian cancer with the Medical University of Vienna reporting the

Parsortix system delivers "unprecedented sensitivity and

specificity". Following these excellent results in ovarian cancer,

ANGLE has commenced a process, in collaboration with the Medical

University of Vienna to develop a clinical application for ovarian

cancer.

Garth Selvey, Chairman, commented:

"Following patient study results from our key opinion leader the

Medical University of Vienna showing 'unprecedented sensitivity and

specificity' of the Parsortix system in ovarian cancer, ANGLE is

now progressing its first clinical application in ovarian cancer.

There is a very strong medical need for such an application in

ovarian cancer detection and monitoring of patients and we estimate

there is a sales potential in excess of GBP300 million per annum

for this application. Our other seven key opinion leaders will

continue to pursue clinical applications in other types of cancer

including breast cancer, colorectal cancer and prostate

cancer."

Analyst meeting and webcast details

A meeting for analysts will be held at 10:00am on 29 January

2015 at the offices of Buchanan, 107 Cheapside, London EC2V 6DN.

Please contact Buchanan on 020 7466 5000 for details.

To listen to the live webcast of the analyst meeting, please log

on to the following web address approximately 5 minutes prior to

10.00am:

http://vm.buchanan.uk.com/2015/angle290115/registration.htm

For further information:

ANGLE plc 01483 685830

Andrew Newland, Chief Executive

Ian Griffiths, Finance Director

Cenkos Securities

Stephen Keys, Christopher Golden (Nominated

adviser)

Andy Roberts (Sales) 020 7397 8900

Buchanan

Mark Court, Sophie Cowles 020 7466 5000

Notes for editors

About ANGLE plc

ANGLE is a specialist medtech company commercialising a platform

technology that can capture cells circulating in blood, such as

cancer cells, even when they are as rare in number as one cell in

one billion blood cells, and harvest the cells for analysis.

ANGLE's cell separation technology, known as the Parsortix

system, harvests the cells of interest through a liquid biopsy,

with the patient only subjected to a simple blood test. Parsortix

is the subject of two granted US patents and three extensive

families of patents being progressed worldwide. The system is based

on a microfluidic device that captures cells based on a combination

of their size and compressibility. The Parsortix system is

established with strong positive evaluations from leading cancer

research centres and is working with these cancer centres to

demonstrate key applications. Parsortix has a CE Mark for Europe

and FDA authorisation is in process for the US.

The analysis of the cells that can be harvested from patient

blood with ANGLE's Parsortix system has the potential to help

deliver personalised cancer care offering profound improvements in

clinical and health economic outcomes in the treatment and

diagnosis of various forms of cancer.

The Parsortix system is designed to be compatible with existing

major medtech analytical platforms and to act as a companion

diagnostic for major pharma in helping to identify patients that

will benefit from a particular drug and then monitoring the drug's

effectiveness.

ANGLE has established formal collaborations with world-class

cancer centres and is working with these cancer centres to

demonstrate key applications for its Parsortix non-invasive cancer

diagnostic system as a liquid biopsy. Details are available here

http://www.angleplc.com/the-company/collaborators/

In addition to cancer, the Parsortix technology has the

potential for deployment with several other important cell types in

the future.

For Frequently Used Terms, please see the Company's website on

http://www.angleplc.com/the-parsortix-system/glossary/

For more information visit www.angleplc.com.

Forward Looking Statements

These Interim Results may contain forward-looking statements.

These statements reflect the Board's current view, are subject to a

number of material risks and uncertainties and could change in the

future. Factors that could cause or contribute to such changes

include, but are not limited to, the general economic climate and

market conditions, as well as specific factors relating to the

financial or commercial prospects or performance of the Group's

products.

CHAIRMAN'S STATEMENT

Introduction

ANGLE was previously involved in the commercialisation of

intellectual property and has set up and developed several medtech

and technology-based companies. Having identified an outstanding

commercial opportunity in Parsortix, ANGLE has transitioned over

the past few years to become a specialist medtech operating company

whose focus is Parsortix.

The transition to medtech will be completed later this year and

it is expected that the Company will be reclassified by the London

Stock Exchange from the support services sector to the healthcare

equipment & services sector.

ANGLE's patented Parsortix system can harvest very rare

circulating tumour cells (CTCs) in cancer patient blood - even

where there is less than one CTC in a billion healthy cells. The

aim of the resulting liquid biopsy (simple blood test) is to enable

the investigation of mutations in the patient's cancer to enable

personalised cancer care.

In the first six months of the year, ANGLE successfully

completed evaluations with its key opinion leaders of the Parsortix

system's capability to harvest CTCs from patient blood for analysis

and moved into the commercialisation phase.

This has been followed by the initiation of patient studies by

key opinion leaders into potential clinical applications in breast,

ovarian and prostate cancers with further studies due to start in

colorectal, oesophageal and pancreatic cancers. The first of these

studies has reported "unprecedented sensitivity and specificity" in

ovarian cancer.

Results

The loss for the half year was GBP1.6 million (H1 2014: loss

GBP0.5 million), reflecting the planned investment in

Parsortix.

Investment, principally relating to Parsortix, increased to

GBP1.6 million (H1 2014: GBP1.1 million). This comprised operating

costs of GBP1.4 million (H1 2014: GBP0.8 million) and capitalised

expenditure of GBP0.2 million (H1 2014: GBP0.3 million).

The cash balance was GBP2.3 million at 31 October 2014 (30 April

2014: GBP3.9 million).

The Parsortix system

The Parsortix system comprises a desktop machine and consumable

cassette, protected by patents, approved to CE Mark standard,

available in volume under manufacturing agreements and already in

active use in a number of prestigious research environments. The

equipment can separate and harvest circulating tumour cells (CTCs)

from patient blood (a liquid biopsy) where the ratio is of the

order of one CTC to one billion healthy cells. In a research

environment, this can help gain further knowledge about the

progression of various cancers. In a clinical environment, the

equipment can help a clinician select the most efficacious

personalised care. Harvested CTCs may also be analysed further by a

variety of other types of commercially available analytical

equipment.

Strategy

The strategy is to collect clinical data and establish

commercially viable and effective clinical procedures for a limited

number of cancers. This is being done with key opinion leaders

(KOLs) in the UK, Europe and the USA. Much of the costs of such

studies is covered by the key opinion leader and the Company's

costs are contained. We are currently working with eight key

opinion leaders. Selective revenue opportunities from research

projects, where the use of Parsortix is already being specified in

plans, are modest in comparison to the clinical market but will

reinforce later entry into related clinical applications. Marketing

to clinical users will be indirect and collaborative such that

costs will be contained and available funds will be used to maximum

effect. The early definition of clinical applications is number one

on our critical path and we are delighted to have identified an

excellent potential clinical application in ovarian cancer.

Alongside this important accreditation work in the USA continues

with the FDA and constructive dialogue is ongoing.

Medtech focus

ANGLE has transitioned from a 'broad portfolio investment'

position to an operating medtech company with the potential to be a

market leader in an estimated GBP8 billion market. All systems

including remuneration have been simplified and adapted to the

norms of the healthcare sector in a continuing effort to keep

existing investors and attract new ones, both institutional and

private.

ANGLE has also established an American Depositary Receipt (ADR)

in the United States representing 10 ANGLE plc shares for 1 ADR,

which now trades on the OTCQX market with the ticker ANPCY. The ADR

is intended to enable US investors to invest in ANGLE shares to

increase the liquidity in ANGLE shares and increase the sources of

capital available to the Company.

The Company believes that the focus and progress of the

Parsortix product accompanied with a well-defined strategy offers a

new investment opportunity with a well defined route to

success.

Key opinion leaders

A core part of ANGLE's strategy is to work closely with world

class cancer research centres in order to access drug trials and

develop patient data in support of clinical applications. An

objective for the year was to extend the range and number of key

opinion leaders working with the Parsortix system.

At the start of the year, the Company had three established key

opinion leaders:

-- Cancer Research UK Manchester (formally known as Paterson

Institute for Cancer Research) working on colorectal, pancreatic

and lung cancer

-- University of Surrey Oncology Department working on colorectal cancer and melanoma

-- Medical Research Council Cancer Unit at the University of

Cambridge and Addenbrooke's Hospital working on oesophageal,

colorectal and pancreatic cancer

During the half year, strong progress was made with extending

the key opinion leader relationships into continental Europe and

the United States. Collaboration agreements have been signed with a

further five world class cancer research centres:

-- University Medical Center Hamburg-Eppendorf working on a

range of cancer types including non small cell lung cancer,

colorectal and breast cancers

-- Medical University of Vienna working on ovarian cancer

-- University of Southern California Norris Comprehensive Cancer

Center working on breast cancer

-- Sidney Kimmel Cancer Center at Thomas Jefferson University working on breast cancer

-- Barts Cancer Institute working on prostate cancer

There are now a total of eight world-class cancer centres

working with ANGLE's Parsortix system in the UK, continental Europe

and the United States to develop applications in the most prevalent

types of cancer.

Key opinion leader evaluations

During the half year, four of the Company's key opinion leaders

reported publicly on their use of the Parsortix system. All four

reported favourably and key aspects of the Parsortix system

identified included:

-- Cancer Research UK Manchester: The Parsortix system is

applicable to all types of CTCs including mesenchymal CTCs because

it does not rely on antibody-based capture. The Parsortix system

offers a very high level of purity of harvested CTCs enabling

molecular analysis

-- Medical University of Vienna: The Parsortix system can handle

large volumes of patient blood, up to 20ml, and continues to

capture CTCs efficiently. CTCs harvested from the Parsortix system

can be analysed using qPCR (an established form of molecular

analysis) and the Parsortix system efficiently reduces the level of

contaminating white blood cell background to below the limit of

detection of qPCR

-- University Medical Center Hamburg-Eppendorf: The Parsortix

system is an effective device for the enrichment of epithelial

and/or mesenchymal-like CTCs. The system overcomes hurdles of

label-dependent techniques since it is not based on antibody

affinity capture. Using the Parsortix system, tumour cells as well

as tumour cell clusters are easily accessible and ready for

molecular analysis

-- Barts Cancer Institute: the Parsortix system worked well with

prostate cancer patients. The Parsortix system captured a high

purity of CTCs and was 30 times purer than a leading antibody-based

system. The Parsortix CTC harvest was well suited for downstream

molecular analysis and was demonstrated with fluorescence in-situ

hybridisation analysis (an established form of molecular

analysis)

These evaluations confirm the system's capability to harvest

cancer cells from patient blood for analysis and brings to a total

of five key opinion leaders reporting uniformly positively on their

evaluation of the Parsortix system. The remaining three are in

progress.

Continued progress towards FDA authorisation

The Parsortix system is CE Mark authorised for clinical sales in

the European Union.

A submission was made to the FDA at the end of March 2014

seeking clearance for the use of the system as a platform for the

capture and harvesting of large cells from blood for the purposes

of analysis.

The FDA has engaged constructively with ANGLE and its advisors

in an ongoing dialogue in relation to this novel clinical

approach.

Research use sales to support drug trials and other research

So far, despite customer interest, ANGLE has deliberately held

back on sales in order to concentrate on key opinion leaders and

refine the system based on their feedback. Following uniformly

positive evaluations of the system by five different key opinion

leaders, ANGLE now intends to progress sales for research use

addressing this estimated GBP250 million per annum market.

The Parsortix system has already been specified in the plans for

several research projects, which are expected to lead to first

sales during 2015.

ANGLE is seeking the adoption of the Parsortix system in

pharmaceutical company drug trials using the CTC as a marker to

indicate therapy effectiveness. There are estimated to be 750 Phase

II cancer drug trials initiated each year. These typically cover

100 patients over two years with the need for three blood tests per

patient. We estimate that each such trial has the potential to

generate in excess of GBP100,000 revenue for ANGLE if the Parsortix

system is used.

There are estimated to be 120 Phase III cancer drug trials

initiated each year. These typically cover 1,000 patients over

three years with the need for five blood tests per patient. We

estimate that each such trial has the potential to generate in

excess of GBP750,000 revenue for ANGLE if the Parsortix system is

used.

Securing 5% of the Phase II and Phase III cancer drug trials as

customers would generate an estimated GBP8 million of sales per

annum.

As well as generating sales revenue, use of the Parsortix system

in successful cancer drug trials may lead to the adoption of

Parsortix as a companion diagnostic to the new drug when launched

in the market. This would result in the Parsortix system being

routinely used with that drug to assess the suitability of the drug

for each patient and then to assess its efficacy once used.

Sales for clinical use

Sales of the Parsortix system for clinical use is the primary

objective for commercialisation of the business. We estimate that

the clinical market available to ANGLE is worth in excess of GBP8

billion per annum.

Accessing this market requires both regulatory authorisation and

strong patient data proving the benefit of the clinical application

to the patient. Both of these requirements are understandably

highly challenging.

As well as the work on regulatory authorisation described above,

ANGLE has a comprehensive strategy in place to deliver the

necessary patient data. This involves working with key opinion

leaders on patient studies to identify clinical applications and

then undertaking prospective clinical studies to demonstrate the

medical benefit to the patient.

To this end, ANGLE has established multiple patient studies with

the key opinion leaders to investigate new clinical applications

for the treatment of patients using the Parsortix system. The

studies are being coordinated on a highly cost efficient basis

leveraging the resources and capabilities of the key opinion

leaders.

Patient studies are being conducted in ovarian cancer (already

reported), breast cancer and prostate cancer and studies are due to

start soon in colorectal, oesophageal and pancreatic cancers.

Ovarian cancer - Medical University of Vienna

The first such patient study has just been completed by the

Medical University of Vienna, who reported "unprecedented

sensitivity and specificity" using the Parsortix system in

combination with their own RNA markers. Vienna consider the patient

study to have been highly successful and a strong basis for a

clinical application in ovarian cancer.

Other patient studies are expected to report during 2015. These

include potential clinical applications in relation to breast

cancer, prostate cancer and colorectal cancer.

Where patient studies are successful, as in the case of ovarian

cancer, they will then be followed by clinical studies to

substantiate the medical benefit to patients from taking

therapeutic decisions based on analysis of the CTCs harvested using

the Parsortix system. The results of these studies together with

FDA authorisation will be the trigger for widespread use of the

Parsortix system in patient care.

Ovarian Cancer

Annually 239,000 women are diagnosed with ovarian cancer

worldwide. There is a high mortality rate and 152,000 die from it

each year. Ovarian cancer is commonly known as the silent killer

due to its lack of symptoms in its earlier stages. It is frequently

diagnosed late in which case the UK five year survival rate is only

3.5% for Stage IV and 18.6% for Stage III at diagnosis (Source:

Cancer Research UK Ovarian Cancer survival statistics). In contrast

where it is diagnosed at Stage I, the UK five year survival rates

are much higher at 90%. As a result there is an acute medical need

for improved ovarian cancer detection.

The Parsortix system used in combination with Vienna's RNA

markers was able to detect cancer in primary epithelial ovarian

cancer patients with a sensitivity of 90% and a specificity of

100%. Epithelial ovarian cancer (also known as ovarian carcinoma)

is the most common ovarian cancer and accounts for some 90% of

cases. If these results are repeated in the clinical study, this

offers the potential for a blood test to enable early diagnosis of

ovarian cancer.

For each ovarian cancer patient, there is the potential for the

Parsortix system to be deployed, on average, 3 times in screening,

5 times in monitoring therapy and twice in remission monitoring. We

estimate that the market size for Parsortix sales of a clinical

application in ovarian cancer, for Europe and the United States

markets only, is in excess of GBP300 million per annum.

The Vienna team has worked for many years with a wide range of

CTC systems, both those commercially available from ANGLE's

competitors and new technologies under development including

commercial and academic systems. Due to lack of suitable cell

surface markers, antibody-based systems are ineffective for ovarian

cancer. The best result that has been obtained to date with other

non-antibody based systems is a CTC detection sensitivity level of

24.5% (i.e. fails to capture CTCs from three quarters of ovarian

cancer patients).

A key priority now is for ANGLE to work with the Medical

University of Vienna, and other leading ovarian cancer centres with

whom they partner, to deliver a robust clinical study supporting

clinical application. This will be progressed as quickly as

possible and is expected to take 18 months to complete. This would

allow for initial sales for this clinical application in ANGLE

financial year ending 30 April 2017.

Other Clinical Applications

Metastatic breast cancer screening

ANGLE is working with the University of Southern California

Norris Comprehensive Cancer Center on a patient study using

Parsortix as a liquid biopsy for metastatic breast cancer

patients.

If successful, such a liquid biopsy could replace the need for

surgical biopsy of the secondary cancer site such as liver

resection. This would reduce the need for surgical intervention (no

patient wants unnecessary operations) and reduce healthcare costs

as a blood test is much cheaper than an operation and an over-night

hospital stay. Furthermore, it could easily be repeated as often as

required, which is not possible with a traditional solid

biopsy.

The patient study is using the Parsortix liquid biopsy to

harvest CTCs for RNA analysis of the cancer cells to determine the

disease status of the metastatic sites so that therapeutic

decisions can be made for the patient's ongoing treatment. The

results of the RNA analysis allow the oncologists to make key

decisions over which therapies may be most effective for the

patient at that stage of their disease. Possible therapeutic

decisions include:

-- Clinical grade therapies: The RNA analysis will allow the

determination of (i) HER2 status (ii) oestrogen receptor (ER) and

(iii) progesterone receptor (PR). Women who have breast cancer with

hormone receptors are prescribed hormonal treatments, such as

tamoxifen or anastrozole. Women with breast cancers that have high

levels of HER2 receptors are given a drug called trastuzumab

(Herceptin(R) )

-- Research grade therapies: In addition there are numerous

(dozens) breast cancer drug trials in progress, which can be

prescribed to late stage patients once the RNA analysis is

completed, that may enable an improved outcome. Examples include

trials of new drugs in relation to the P1K3CA gene and triple

negative breast cancer

The incidence of new breast cancer cases in 2012 is estimated at

1,700,000 worldwide. Of these a total of approximately 33% either

present at Stage IV (metastatic cancer) or progress to Stage IV.

The targeted clinical application has the potential to address some

300,000 metastatic patients per annum in the accessible market

geographies. If a liquid biopsy is undertaken on a six monthly

basis for these patients over a five year follow-up period and

ANGLE secures a 10% share of the resulting market, the sales

potential accessible to ANGLE is worth around GBP100 million per

annum for this clinical application.

The aim is to complete the patient study in the middle of 2015

and then follow it with a clinical study targeting the end of 2016

for completion. This would allow for initial sales for this

clinical application in ANGLE year ending 30 April 2017.

Other cancer types

Similar to the metastatic breast cancer clinical application,

ANGLE is working with Barts Cancer Institute on a patient study in

relation to a potential metastatic prostate cancer clinical

application.

Work is also being undertaken with Cancer Research UK Manchester

with patient studies due to start soon in relation to colorectal

cancer and pancreatic cancer and with the Medical Research

Council's Cancer Unit at the University of Cambridge in relation to

oesophageal cancer.

Commercialisation partnerships with diagnostic companies

The Parsortix system is "open-source" and has been designed to

work with all existing analytical systems in the same way that the

existing solid biopsy provides cancer cells for a wide variety of

analytical systems. Such systems cannot otherwise be used with

CTCs. Combination with the Parsortix system gives the analytical

system the potential for an additional source of revenue analysing

a different form of patient tissue.

ANGLE's commercialisation strategy is to establish a series of

partnerships with multiple leading diagnostic companies to offer a

complete solution to the oncologist. ANGLE believes this is the

optimal approach for unlocking the multi-billion dollar worldwide

market available to the Company and its potential strategic

partners.

Partners will be selected for their specialist technical

capabilities enabling new high medical utility applications and/or

their market strength and existing installed base of diagnostic

systems enabling accelerated market adoption of the Parsortix

system.

Commercial returns from these partnerships may include upfront

payments, milestone payments as the combined product is brought to

market and royalty income and/or sales revenues as the product is

sold in the market.

Through partnerships with established analytical platforms,

ANGLE intends to leverage their distribution channels whilst at the

same time limiting the need for its own investment in direct sales

and marketing. It is expected that the Parsortix system may be

integrated as a front end into multiple analytical platforms as

"Parsortix inside".

Earlier this month, ANGLE announced the first two such

commercial collaborations.

Diagnostics division of a large pharmaceutical company

The first was with the diagnostics division of a large

pharmaceutical company (the "Collaborator") to investigate the

combination of ANGLE's Parsortix CTC harvesting platform with the

Collaborator's single cell analysis system. The Collaborator is

evaluating the use of the Parsortix system as a standard

pre-enrichment system for their single cell analysis system.

If the collaboration is successful, the Parsortix system may be

sold by the Collaborator along side its own system as a source of

patient sample for analysis using the Collaborator's analytical

platform.

EKF Diagnostics Holdings plc

The second commercial collaboration was with EKF Diagnostics

Holdings plc, the AIM listed point-of-care, central laboratory and

molecular diagnostics business to investigate the combination of

ANGLE's Parsortix CTC harvesting platform with EKF's PointMan(TM)

DNA enrichment technology as a liquid biopsy. The collaboration

will initially work on colorectal cancer and then expand to cover

other cancer types. CTCs will be harvested from cancer patients'

blood using ANGLE's Parsortix system and then analysed using EKF's

PointMan(TM) DNA enrichment technology to identify genetic

variation in the cancer, which may aid therapeutic decision

making.

ANGLE believes that the combination of ANGLE's Parsortix system

with EKF's PointMan(TM) technology may be advantageous for two

reasons. Firstly the PointMan(TM) system preferentially amplifies

variant sequences of interest whilst suppressing amplification of

the wild type i.e. normal DNA. As a result it has the potential to

identify all mutations in gene sequences associated with clinical

utility of targeted cancer therapies. In contrast competing genetic

analysis systems generally amplify only those areas which may be

predicted to be mutant and therefore can miss unexpected mutations.

Secondly the system is highly sensitive with the ability to work

with very low levels of target material, potentially as low as one

CTC.

If the collaboration is successful, ANGLE and EKF will explore

ways to offer their respective systems as a combined solution.

Second US patent granted

The Company continues to strengthen its intellectual property.

During the half year, a second US patent was granted protecting the

Parsortix system. Patents are being prosecuted worldwide.

Management team strengthened

During the half year, ANGLE appointed a senior US business

development executive, Peggy Robinson as US Vice President. From

2007 to 2011, Peggy was director of marketing for Johnson &

Johnson company Veridex, and its predecessor Immunicon, responsible

for the launch and market expansion of CellSearch. Following this,

in 2011 and 2012, Peggy was Director of Strategic Alliances /

Services for Veridex. During this time she developed and

implemented strategies to form collaborations for CellSearch with

pharmaceutical and biotech companies. More recently, Peggy has been

consulting on business strategies, marketing, strategic alliances,

key opinion leaders and product development of new technologies,

with an emphasis on cancer, chronic disease and companion

diagnostics.

Outlook

Following patient study results from our key opinion leader the

Medical University of Vienna showing 'unprecedented sensitivity and

specificity' of the Parsortix system in ovarian cancer, ANGLE is

now progressing its first clinical application in ovarian cancer.

There is a very strong medical need for such an application in

ovarian cancer detection and monitoring of patients and we estimate

there is a sales potential in excess of GBP300 million per annum

for this application. Our other seven key opinion leaders will

continue to pursue clinical applications in other types of cancer

including breast cancer, colorectal cancer and prostate cancer.

Garth Selvey

Chairman

28 January 2015

ANGLE plc

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHS ENDED 31 OCTOBER 2014

Six months

Note ended Year ended

31 October 31 October 30 April

2014 2013 2014

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Revenue 2 288 414 801

Change in fair value 17 404 1,334

Operating costs (1,918) (1,374) (3,485)

________ ________ ________

Operating profit/(loss) (1,613) (556) (1,350)

Net finance income/(costs) _______7 _______80 112

Profit/(loss) before tax (1,606) (476) (1,238)

Tax 3 - - -

Profit/(loss) for the

period (1,606) (476) (1,238)

Other comprehensive income

Items that may be subsequently

reclassified to profit

or loss

Exchange differences on

translating foreign operations 49 (44) (96)

Other comprehensive income __ 49 __ (44) _ (96)

Total comprehensive income

for the period (1,557) (520) (1,334)

========= ========= ==========

Profit/(loss) for the period

attributable to:

Owners of the parent (1,476) (396) (1,064)

Non-controlling interests (130) (80) (174)

_________ _________ _________

Profit/(loss) for the

period (1,606) (476) (1,238)

========= ========= =========

Total comprehensive income for the period

attributable to:

Owners of the parent (1,394) (455) (1,198)

Non-controlling interests (163) (65) (136)

_________ __________ _________

Total comprehensive income

for the period (1,557) (520) (1,334)

========= ========= =========

Earnings/(loss) per share 4

Basic and Diluted (pence per

share) (3.56) (1.05) (2.74)

All activity arose from continuing operations

ANGLE plc

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 OCTOBER 2014

Note 31 October 31 October 30 April

2014 2013 2014

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Other receivables 618 - 601

Property, plant and equipment 338 198 139

Intangible assets 5 1,186 1,099 1,142

_SHY____________ _SHY_________ __________

Total non-current assets 2,142 1,297 1,882

_SHY____________ _SHY_________ _SHY________

Current assets

Non-controlled investments - 4,839 -

Inventories 106 15 52

Trade and other receivables 305 530 328

Cash and cash equivalents 2,268 358 3,898

__________ __________ __________

Total current assets 2,679 5,742 4,278

___________ __________ __________

Total assets 4,821 7,039 6,160

========= ========= =========

EQUITY AND LIABILITIES

Equity

Issued capital 6 4,524 4,524 4,524

Share premium 18,414 18,414 18,414

Share based payments reserve 473 397 432

Other reserve 2,553 2,553 2,553

Translation reserve (40) (47) (122)

Retained earnings (21,253) (19,069) (19,777)

ESOT shares (102) (102) (102)

__________ __________ __________

Equity attributable to owners

of the parent 4,569 6,670 5,922

__________ __________ __________

Non-controlling interests (570) (376) (407)

Total equity 3,999 6,294 5,515

============== ============== ==============

Liabilities

Non-current liabilities

Controlled investments -

loans - 132 -

_________ _________ _________

Total non-current liabilities - 132 -

Current liabilities

Trade and other payables 822 613 645

_________ _________ _________

Total current liabilities 822 613 645

_________ _________ _________

Total liabilities 822 745 645

_________ _________ _________

Total equity and liabilities 4,821 7,039 6,160

============= ============= =============

ANGLE plc

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHS ENDED 31 OCTOBER 2014

Six months ended Year ended

31 October 31 October 30 April

2014 2013 2014

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Operating activities

Profit/(loss) before tax from

continuing operations (1,606) (476) (1,238)

Adjustments for:

Depreciation of property, plant

and equipment 43 29 57

Disposal of property, plant

and equipment - - 13

Amortisation and impairment

of intangible assets 46 150 99

Exchange differences (19) (2) 9

Net finance (income)/costs (7) (80) (112)

Change in fair value (17) (404) (1,334)

Share based payments __ 41 _____27 _ 62

Operating cash flows before

movements in working capital: (1,519) (756) (2,444)

(Increase)/decrease in inventories (148) 47 22

(Increase)/decrease in trade

and other receivables 22 (99) 131

Increase/(decrease) in trade

and other payables ___200 ___61 ___56

Net cash from/(used in) operating

activities (1,445) (747) (2,235)

Investing activities

Purchase of property, plant

and equipment (153) (84) (83)

Purchase of intangible assets (42) (235) (270)

Provision of short term loans - (407) (511)

Proceeds on disposal of investment - - 5,160

Interest received ______8 _____4 _____11

Net cash from/(used in) investing

activities (187) (722) 4,307

Financing activities

Net proceeds from issue of share

capital - - -

Interest paid - - _______-

Net cash from/(used in) financing

activities - -

Net increase/(decrease) in cash

and cash equivalents (1,632) (1,469) 2,072

Cash and cash equivalents at

start of period 3,898 1,828 1,828

______

Effect of exchange rate fluctuations ________2 (1) _________(2)

Cash and cash equivalents at

end of period 2,268 358 3,898

=========== =========== ===========

ANGLE plc

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHS ENDED 31 OCTOBER 2014

------------------------------------------------------------

Attributable to equity holders of the parent ------------------------------------------------------------

Share Non-

based Total

Issued Share payments Other Translation Retained ESOT Shareholders' controlling Total

capital premium reserve reserve reserve earnings shares equity interests equity

(Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 May 2013 4,524 18,414 370 2,553 12 (18,673) (102) 7,098 (311) 6,787

For the period

to 31 October

2013

------------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ --------------- ------------ ------------

Consolidated

profit/(loss) (396) (396) (80) (476)

Other

comprehensive

income

Exchange

differences

in

translating

foreign

operations (59) (59) 15 (44)

------------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ --------------- ------------ ------------

Total

comprehensive

income (59) (396) (455) (65) (520)

Share based

payments 27 27 27

___

___ ______ ___ _______ ___ ______ ___ ______ ___ ______ ________ ___ ______ ___ _______ ___ _______ ___ _______

At 31 October

2013 4,524 18,414 397 2,553 (47) (19,069) (102) 6,670 (376) 6,294

For the period

to 30 April

2014

------------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ --------------- ------------ ------------

Consolidated

profit/(loss) (668) (668) (94) (762)

Other

comprehensive

income

Exchange

differences

in

translating

foreign

operations (75) (75) 23 (52)

------------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ --------------- ------------ ------------

Total

comprehensive

income (75) (668) (743) (71) (814)

Share based

payments 35 35 35

Disposal of

controlling

interest (40) (40) 40 -

At 30 April

2014 4,524 18,414 432 2,553 (122) (19,777) (102) 5,922 (407) 5,515

For the period

to 31 October

2014

Consolidated

profit/(loss) (1,476) (1,476) (130) (1,606)

Other

comprehensive

income

Exchange

differences

in

translating

foreign

operations 82 82 (33) 49

------------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ --------------- ------------ ------------

Total

comprehensive

income 82 (1,476) (1,394) (163) (1,557)

Share based

payments 41 41 41

___

___ ______ ___ _______ ___ ______ ___ ______ ___ ______ ________ ___ ______ ___ _______ ___ _______ ___ _______

At 31 October

2014 4,524 18,414 473 2,553 (40) (21,253) (102) 4,569 (570) 3,999

========== ========== ========== ========== ========= =========== ========== ========== ========== ==========

ANGLE plc

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (continued)

FOR THE SIX MONTHS ENDED 31 OCTOBER 2014

Share premium

Represents amounts subscribed for share capital in excess of the

nominal value, net of directly attributable share issue costs.

Other reserve

The other reserve is a "merger" reserve arising from the

acquisition of the former holding company.

Translation reserve

The translation reserve account comprises cumulative exchange

differences arising on consolidation from the translation of the

financial statements of international operations. Under IFRS this

is separated from retained earnings.

ESOT shares

This reserve relates to shares held by the ANGLE Employee Share

Ownership Trust (ESOT) and may be used to assist in meeting the

obligations under employee remuneration schemes.

Non-controlling interests

Represents amounts attributed to non-controlling (minority)

interests for profits or losses in the Statement of Comprehensive

Income and assets or liabilities in the Statement of Financial

Position.

Share based payments reserve

The share based payments reserve account is used for the

corresponding entry to the share based payments charged through a)

the Statement of Comprehensive Income for staff incentive

arrangements relating to ANGLE plc equity b) the Statement of

Comprehensive Income for staff incentive arrangements relating to

the controlled investments equity, and c) the Statement of

Financial Position for acquired intangible assets in the controlled

investments comprising intellectual property (IP). These components

are separately identified in the table below.

Transfers are made from this reserve to retained earnings as the

related share options are exercised, cancelled, lapse or expire or

as a controlled investment becomes non-controlled (a deemed

disposal).

Controlled Controlled

ANGLE investments investments

employees employees IP Total

(Unaudited) (Unaudited) (Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000 GBP'000

At 1 May 2013 212 41 117 370

Charge for the period 27 - - 27

_________ _________ _________ _________

At 31 October 2013 239 41 117 397

Charge for the period 35 - - 35

_________ _________ _________ _________

At 30 April 2014 274 41 117 432

Charge for the period 41 - - 41

_________ _________ _________ _________

At 31 October 2014 315 41 117 473

========== ========== ========= =========

ANGLE plc

NOTES TO THE INTERIM FINANCIAL INFORMATION

FOR THE SIX MONTHS ENDED 31 OCTOBER 2014

1 Basis of preparation and accounting policies

This Condensed Interim Financial Information is the unaudited

interim consolidated financial information (the "Condensed Interim

Financial Information") of ANGLE plc, a company incorporated in

Great Britain and registered in England and Wales, and its

subsidiaries (together referred to as the "Group") for the six

month period ended 31 October 2014 (the "interim period").

The Condensed Interim Financial Information has been prepared in

accordance with International Accounting Standard 34 Interim

Financial Reporting ("IAS 34"), as adopted by the EU, and on the

basis of the accounting policies which are expected to be adopted

in the Report and Accounts for the year ending 30 April 2015. New

and revised International Financial Reporting Standards (IFRS) and

interpretations recently adopted by the EU and that became

effective in the period did not have or are not expected to have a

significant impact on the Group. Where necessary, comparative

information has been reclassified or expanded from the previously

reported Condensed Interim Financial Information to take into

account any presentational changes which may be made in the Report

and Accounts 2015.

This Condensed Interim Financial Information does not constitute

statutory financial statements as defined in section 434 of the

Companies Act 2006 and is unaudited. The comparative information

for the six months ended 31 October 2013 is also unaudited. The

comparative figures for the year ended 30 April 2014 have been

extracted from the Group financial statements as filed with the

Registrar of Companies. The report of the auditors on those

accounts was unqualified and did not contain statements under

sections 498(2) or (3) of the Companies Act 2006.

The Condensed Interim Financial Information was approved by the

Board and authorised for issue on 28 January 2015.

Going concern

The Financial Information has been prepared on a going concern

basis which assumes that the Group will be able to continue its

operations for the foreseeable future.

The Directors have prepared and reviewed the financial

projections for the 12 month period from the date of signing of

this Condensed Interim Financial Information. Based on the level of

existing cash, expected availability of funding from investors and

projected income and expenditure (the timing of some of which is at

the Group's discretion), the Directors have a reasonable

expectation that the Company and Group have adequate resources to

continue in business for the foreseeable future. Accordingly the

going concern basis has been used in preparing the Condensed

Interim Financial Information.

Critical accounting estimates and judgements

The preparation of the Condensed Interim Financial Information

requires the use of estimates and assumptions and judgements that

affect the reported amounts of assets and liabilities at the date

of the Financial Information and the reported amounts of revenues

and expenses during the reporting period. Although these estimates

and assumptions and judgements are based on management's best

knowledge of the amounts, events or actions, and are believed to be

reasonable, actual results ultimately may differ from those

estimates.

The estimates and assumptions that have a significant risk of

causing a material adjustment to the carrying amounts of assets and

liabilities relate to 1) the valuation and impairment of unlisted

investments held at fair value and 2) the valuation, amortisation

and impairment of intangible assets.

2 Operating segment and revenue analysis

The Group's principal trading activity is undertaken in relation

to Parsortix, a specialist medical diagnostics company with

pioneering products in cancer diagnostics and foetal health.

For management reporting purposes, the Group is divided into the

following operating segments:

-- Medical diagnostics

-- Legacy businesses comprising:

- non-controlled investments

- management services

The nature of these operations is significantly different.

ANGLE has redesigned its business as a specialist medtech

company. The management services business is a legacy business. The

remaining contracts complete on 31 March 2015 and no new contracts

are being sought. Once this is completed, ANGLE intends to seek

reclassification with the London Stock Exchange into the healthcare

sector.

In assessing performance and making resource allocation

decisions, the Board of Directors reviews each segment. The tables

below show the operating results by segment together with assets

and liabilities.

Medical Non-controlled Management

diagnostics investments services Total

(Unaudited) (Unaudited) (Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000 GBP'000

Period ended 31 October

2014

Statement of Comprehensive Income

Revenue 288 288

Change in fair value 17 17

Amortisation and impairment

of intangible assets (46) (46)

Other operating costs (1,533) (339) (1,872)

----------------------------- ------------- --------------- ------------- ------------

Operating costs ___(1,579) __________ ___ (399) _ (1,918)

Operating profit/(loss) (1,579) 17 (51) (1,613)

Finance income/(costs) _______7 __________ ____________ _______7

Profit/(loss) before

tax (1,572) 17 (51) (1,606)

======= ======= ======= =======

Statement of Financial Position

Assets

Other receivables

(non-current) 618

Property, plant and

equipment 338

Intangible assets 1,186

Inventories 106

Trade and other receivables 305

Cash and cash equivalents 2,268

________

Total assets 4,821

======

Liabilities

Trade and other payables 822

________

Total liabilities 822

======

Medical Non-controlled Management

diagnostics investments services Total

(Unaudited) (Unaudited) (Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000 GBP'000

Period ended 31 October

2013

Statement of Comprehensive Income

Revenue 102 312 414

Change in fair

value 404 404

--------------------------- --------------- ----------------- -------------- ----------------

Amortisation and

impairment of intangible

assets (150) (150)

Other operating

costs (903) (321) (1,224)

--------------------------- --------------- ----------------- -------------- ----------------

Operating costs ___(1,053) ________ ____(321) __(1,374)

Operating profit/(loss) (951) 404 (9) (556)

Finance income/(costs) _80 ________ ________ ______80

Profit/(loss) before

tax (871) 404 (9) (476)

====== ====== ====== ======

Statement of Financial Position

Assets

Property, plant

and equipment 198

Intangible assets - product

development 974

Intangible assets

- other 125

Investments (current) 4,839

Inventories 15

Trade and other

receivables 530

Cash and cash equivalents 358

____________

Total assets 7,039

========

Liabilities

Trade and other

payables 613

Loans and borrowings 132

____________

Total liabilities 745

========

Medical Non-controlled Management

diagnostics investments services Total

(Audited) (Audited) (Audited) (Audited)

GBP'000 GBP'000 GBP'000 GBP'000

Year ended 30 April

2014

Statement of Comprehensive Income

Revenue 156 645 801

Change in fair value 132 1,202 1,334

----------------------------- ------------- --------------- ------------- --------------

Amortisation and

impairment of intangible

assets (99) (99)

Other operating costs (2,731) (655) (3,386)

----------------------------- ------------- --------------- ------------- --------------

Operating costs (2,830) _________ (655) (3,485)

Operating profit/(loss) (2,542) 1,202 (10) (1,350)

Finance income/(costs) 12 100 ____________ 112

Profit/(loss) before

tax (2,530) 1,302 (10) (1,238)

======== ======== ======== ========

Statement of Financial Position

Assets

Other receivables

(non-current) 601

Property, plant and

equipment 139

Intangible assets 1,142

Inventories 52

Trade and other receivables 328

Cash and cash equivalents 3,898

____________

Total assets 6,160

========

Liabilities

Trade and other payables 645

____________

Total liabilities 645

========

3 Tax

The Group is eligible for the UK corporation tax substantial

shareholdings exemption. This results in the capital gain from any

disposals of UK investments where the Group has an equity stake

greater than 10%, and subject to certain other tests, being free of

corporation tax.

Tax is therefore based on the profits in the Management services

business as relieved by losses incurred in the Group's other UK

trading activities. Loss relief may not absorb the tax in relation

to all of the profits and where this occurs tax is provided on the

basis of the estimated effective tax rate for the full year.

Controlled investments undertake research and development

activities. In the UK these activities qualify for tax relief and

result in tax credits.

4 Earnings/(loss) per share

The basic and diluted earnings/(loss) per share is calculated on

an after tax loss of GBP1.6 million (six months to 31 October 2013:

loss GBP0.5 million, year to 30 April 2014: loss GBP1.2 million).

In accordance with IAS 33 Earnings per share 1) the "basic"

weighted average number of ordinary shares calculation excludes

shares held by the Employee Share Ownership Trust (ESOT) as these

are treated as treasury shares and 2) the "diluted" weighted

average number of ordinary shares calculation excludes potentially

dilutive ordinary shares from instruments that could be converted.

Share options are potentially dilutive where the exercise price is

less than the average market price during the period. Due to the

losses in the periods, share options are non-dilutive for the

respective periods and therefore the diluted loss per share is

equal to the basic loss per share.

The basic and diluted earnings/(loss) per share are based on

45,129,800 weighted average ordinary 10p shares (six months to 31

October 2013: 45,129,800; year to 30 April 2014: 45,129,800).

5 Intangible assets

Intellectual Computer Product

Property software Goodwill development Total

(Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost or deemed

cost

At 1 May 2013 524 12 98 973 1,607

Additions - - - 201 201

Exchange movements (1) - - (36) (37)

_________ _________ _________ _________ _________

At 31 October

2013 523 12 98 1,138 1,771

Additions 30 1 - 16 47

Reclassification 62 - (62) -

Disposals (400) (2) (98) - (500)

Exchange movements (9) - - (47) (56)

_________ _________ _________ _________ _________

At 30 April 2014 206 11 - 1,045 1,262

Additions 22 1 - 10 33

Exchange movements 7 1 - 57 65

_________ _________ _________ _________ _________

At 31 October

2014 235 13 - 1,112 1,360

======= ======= ======= ======= =======

Amortisation and impairment

At 1 May 2013 400 10 98 19 527

Charge for the

period - - - 150 150

Exchange movements - - - (5) (5)

_________ _________ _________ _________ _________

At 31 October

2013 400 10 98 164 672

Charge for the

period - 1 - (52) (51)

Disposals (400) (2) (98) - (500)

Exchange movements - - - (1) (1)

_________ _________ _________ _________ _________

At 30 April 2014 - 9 - 111 120

Charge for the

period - 1 - 45 46

Exchange movements - - - 8 8

________ _________ _________ _________ _________

At 31 October

2014 - 10 - 164 174

======= ======= ======= ======= =======

Net book value

At 31 October

2014 235 3 - 948 1,186

At 30 April 2014 206 2 - 934 1,142

At 31 October

2013 123 2 - 974 1,099

The carrying value of intangible assets is reviewed for

impairment annually or whenever events or changes in circumstances

indicate that the carrying value may not be recoverable. The

recoverable amount is assessed on the basis of "value in use". The

key assumptions to assess value in use are the estimated useful

economic life, future revenues, cash flows and the discount rate to

determine the net present value of these cash flows. Where value in

use exceeds the carrying value then no impairment is made. Where

value in use is less than the carrying value then an impairment

charge is made.

Amortisation and impairment charges are included in operating

costs in the Consolidated Statement of Comprehensive Income.

"Product development" relates to internally generated assets

that were capitalised in accordance with IAS 38 Intangible Assets.

Capitalised product development costs are directly attributable

costs comprising cost of materials, specialist contractor costs,

labour and overheads. Product development costs are amortised over

their estimated useful lives commencing when a new product is in

commercial production. Development costs not meeting the IAS 38

criteria for capitalisation continue to be expensed through the

Statement of Comprehensive Income as incurred.

6 Share capital

The Company has one class of ordinary shares which carry no

right to fixed income and at 31 October 2014 had 45,243,059

Ordinary shares of GBP0.10 each allotted, called up and fully paid.

During the period the Company issued 60,000 and subsequent to the

period end a further 2,500,000 new share options with performance

and/or vesting conditions.

7 Post reporting date events

As explained in the Chairman's Statement, the Company has made

strong progress with Parsortix.

Shareholder communications

The announcement is being sent to all shareholders on the

register at 28 January 2014. Copies of this announcement are posted

on the Company's website www.ANGLEplc.com and are available from

the Company's registered office: 3 Frederick Sanger Road, Surrey

Research Park, Guildford, Surrey, GU2 7YD.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LFFVILDITFIE

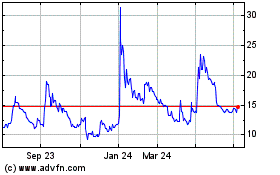

Angle (LSE:AGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

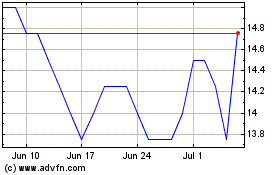

Angle (LSE:AGL)

Historical Stock Chart

From Apr 2023 to Apr 2024