Released on exercise (16)

Impairment of IP (94)

___ ______ ___ _______ ___ ______ ___ ______ ___ ______

At 30 April 2015 5,897 25,299 432 2,553 33

========== ========== ========== ========== =========

Equity attributable to

owners of the parent

Total Non-

Retained ESOT Shareholders' controlling Total

earnings shares equity interests equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 May 2013 (18,673) (102) 7,098 (311) 6,787

For the year to 30 April

2014

-------------------------------------- ------------- ----------- -------------- ------------ ------------

Consolidated profit/(loss) (1,064) (1,064) (174) (1,238)

Other comprehensive income

Exchange differences on

translating foreign operations (134) 38 (96)

-------------------------------------- ------------- ----------- -------------- ------------ ------------

Total comprehensive income (1,064) (1,198) (136) (1,334)

Share based payments 62 62

Disposal of controlling

interest (40) (40) 40 -

___ ________ ___ ______ ___ _______ ___ _______ ___ _______

At 30 April 2014 (19,777) (102) 5,922 (407) 5,515

For the year to 30 April

2015

-------------------------------------- ------------- ----------- -------------- ------------ ------------

Consolidated profit/(loss) (3,594) (3,594) (293) (3,887)

Other comprehensive income

Exchange differences on

translating foreign operations 155 (63) 92

-------------------------------------- ------------- ----------- -------------- ------------ ------------

Total comprehensive income (3,594) (3,439) (356) (3,795)

Issue of shares 8,258 8,258

Share based payments 111 111

Released on forfeiture 1 - -

Released on exercise 16 - -

Impairment of IP 94 - -

___ ________ ___ ______ ___ _______ ___ _______ ___ _______

At 30 April 2015 (23,260) (102) 10,852 (763) 10,089

=========== ========== ========== ========== ==========

NOTES TO THE PRELIMINARY ANNOUNCEMENT

FOR THE YEAR ENDED 30 APRIL 2015

1 Preliminary announcement

The preliminary announcement set out above does not constitute

ANGLE plc's statutory Financial Statements for the years ended 30

April 2015 or 2014 within the meaning of section 434 of the

Companies Act 2006 but is derived from those audited Financial

Statements. The auditor's report on the consolidated Financial

Statements for the year ended 30 April 2015 and 2014 is unqualified

and does not contain statements under s498(2) or (3) of the

Companies Act 2006.

The accounting policies used for the year ended 30 April 2015

are unchanged from those used for the statutory Financial

Statements for the year ended 30 April 2014, except as referred to

in Note 2. The 2015 statutory accounts will be delivered to the

Registrar of Companies following the Company's Annual General

Meeting.

2 Compliance with accounting standards

While the financial information included in this preliminary

announcement has been computed in accordance with IFRS, this

announcement does not itself contain sufficient information to

comply with IFRS.

Accounting standards adopted in the year

No new accounting standards that have become effective and

adopted in the year have had a significant effect on the Group's

Financial Statements.

Accounting standards issued but not yet effective

At the date of authorisation of the Financial Statements, there

were a number of other Standards and Interpretations (International

Financial Reporting Interpretation Committee - IFRIC) which were in

issue but not yet effective, and therefore have not been applied in

these Financial Statements. The Directors have not yet assessed the

impact of the adoption of these standards and interpretations for

future periods.

The Revenue accounting policy has been rewritten and a number of

other accounting policies have been slightly amended and updated

for readability.

3 Going concern

The Financial Statements have been prepared on a going concern

basis which assumes that the Group will be able to continue its

operations for the foreseeable future.

The Group's business activities, together with the factors

likely to affect its future development, performance and financial

position are set out in the Chairman's Statement.

The Directors have prepared and reviewed the financial

projections for the 12 month period from the date of signing of

these Financial Statements. Based on the level of existing cash and

the projected income and expenditure (the timing of some of which

is at the Group's discretion), the Directors have a reasonable

expectation that the Company and Group have adequate resources to

continue in business for the foreseeable future. Accordingly the

going concern basis has been used in preparing the Financial

Statements.

4 Critical accounting estimates and judgements

The preparation of the Financial Statements requires the use of

estimates, assumptions and judgements that affect the reported

amounts of assets and liabilities at the date of the Financial

Statements and the reported amounts of revenues and expenses during

the reporting period. Although these estimates, assumptions and

judgements are based on management's best knowledge of the amounts,

events or actions, and are believed to be reasonable, actual

results ultimately may differ from those estimates.

The estimates, assumptions and judgements that have a

significant risk of causing a material adjustment to the carrying

amounts of assets and liabilities are described below.

Valuation of Other receivables - investments held at fair value

(Note 8)

Valuation of Other receivables - investments relates to the

value attributed to a retention payment due in December 2015 from

the disposal of Geomerics Limited. Judgements are required in a

number of areas when determining valuation.

Valuation, amortisation and impairment of intangible assets

(Note 7)

IAS 38 Intangible Assets contains specific criteria that if met

mean development expenditure must be capitalised as an internally

generated intangible asset. Judgements are required in both

assessing whether the criteria are met and then in applying the

rules. Intangible assets are amortised over their useful lives.

Useful lives are assessed by reference to observable data (e.g.

remaining patent life) and taking into consideration specific

product (e.g. product life cycle) and market characteristics (e.g.

estimates of the period that the assets will generate revenue).

Each of these factors is periodically reviewed for appropriateness.

Changes to estimates in useful lives may result in significant

variations in the amortisation charge.

The Group is required to review, at least annually, whether

intangible assets have suffered any impairment. The recoverable

amount is determined using, amongst others, value-in-use

calculations. The use of this method requires the estimation of

future cash flows and the selection of a suitable discount rate in

order to calculate the present value of these cash flows. When

reviewing intangible assets for impairment the Group has had to

make various assumptions and estimates of individual components and

their potential value and potential impairment impact. The Group

considers that for each of these variables there is a range of

reasonably possible alternative values, which results in a range of

fair value estimates. None of these estimates of fair value is

considered more appropriate or relevant than any other and

therefore determining a fair value requires considerable

judgement.

Share based payments

In calculating the fair value of equity-settled share-based

payments the Group uses an options pricing model. The Directors are

required to exercise their judgement in choosing an appropriate

options pricing model and determining input parameters that may

have a material effect on the fair value calculated. These input

parameters include, among others, expected volatility, expected

life of the options taking into account exercise restrictions and

behavioural considerations of employees, the number of options

expected to vest and liquidity discounts.

5 Discontinued operations

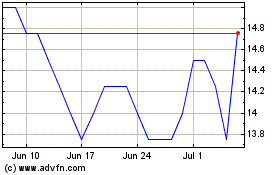

Angle (LSE:AGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

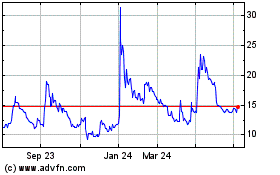

Angle (LSE:AGL)

Historical Stock Chart

From Apr 2023 to Apr 2024