ANGLE is now working to establish and complete a large scale

patient study to prove the efficacy of the Parsortix system for

this application. The patient study will be carefully controlled

and undertaken both in Europe and the United States. Timescales are

not yet fully determined but the aim is to complete the study in

Europe by the end of calendar 2016. This study has the potential to

unlock an ovarian cancer market estimated to be worth GBP300

million per annum.

Establishment of corporate collaborations to drive adoption of

Parsortix

ANGLE's strategy to drive market adoption is to leverage the

sales and marketing resource of existing downstream molecular

analysis companies through corporate collaborations.

The cancer cells obtained from patient blood using the Parsortix

system can be analysed using existing molecular analysis platforms

already installed worldwide in hospital pathology laboratories for

analysis of solid biopsy material. It is therefore in the interests

of the companies that own these systems to promote the use of the

Parsortix system as a front end for their own platforms as this

will generate additional sales for them from their existing

installed platform.

This process is underway with the first two corporate

collaborations initiated during the year.

Commercial strategy on track with research use sales commencing

this financial year

Our strategy to commercialise Parsortix falls into two phases.

Now that strong third party evaluations have been received for the

system and its operation robustly investigated internally, we will

initially target first sales for research use purposes.

Our main approach to achieving this is to:

-- Leverage Key Opinion Leaders to participate in cancer drug trials in which they are involved

-- Migrate existing Key Opinion Leaders to paying customers

We estimate that the research use sales market is worth

approximately GBP250 million per annum and aim to commence sales

into this market in the current financial year.

For the second phase, access to the clinical sales market

(treating patients) is dependent on successful patient studies and

regulatory authorisation. The first clinical application is

targeted to be the ovarian cancer triaging application described

above. Our aim is that the patient study to support sales in this

market will be completed in Europe by the end of calendar year

2016.

We estimate that the overall market size for clinical

applications of the Parsortix system across all cancer types is in

excess of GBP8 billion per annum.

Intellectual property further strengthened

Protecting the Company's intellectual property is crucial to

ensure a dominant position in using our Parsortix system is

established and maintained for as long as possible.

Strong progress was made with this during the year and a second

US patent and patents in China and Australia have been granted.

Progress is being made with multiple other patents worldwide and we

hope to have a granted European patent later this financial

year.

Continued momentum post year end

Prostate cancer 52-patient study published by Barts Cancer

Institute indicating capture of cancer cells from Parsortix liquid

biopsy in 100% of patients

Post the year-end, very positive results for the Parsortix

system were published by Barts Cancer Institute (BCI) in relation

to prostate cancer. These showed the capture of cancer cells from

the Parsortix liquid biopsy in 100% of patients, both those with

metastatic cancer and early stage cancer.

BCI demonstrated the ability of the Parsortix system to harvest

mesenchymal cells involved in cancer metastasis and then showed a

direct correlation between the number of these cells and the stage

of development of the patient's cancer. This was important because

traditional antibody-based systems fail to capture these cells and

the BCI study suggests that these cells may be crucially important

in the process of metastasis.

The results of this study are very encouraging and further

validate our belief that the Parsortix technology significantly

advances the field of liquid biopsy. BCI are now working towards

the development of a clinical application for a second indication

for the Parsortix platform in prostate cancer.

Scientific Advisory Board further strengthened in the United

States

The Company has established a Scientific Advisory Board of

leading researchers and oncologists to help direct the Company's

efforts towards clinical adoption of the Parsortix system.

The Scientific Advisory Board was strengthened with the

appointment of two prominent specialists from top cancer centres in

the United States; leading translational researcher Jim Reuben from

MD Anderson and leading medical oncologist Daniel Danila from

Memorial Sloan Kettering.

Regulatory authorisation

ANGLE is committed to driving acceptance and approval of its

technology worldwide.

Regulatory authorisation is a requirement before the Parsortix

system can be sold for use in the clinical market (treatment of

patients), although as discussed above, earlier sales will be made

into the research market.

ANGLE already has a CE Mark for clinical use of the Parsortix

system in the European Union. Dialogue has been in progress with

the FDA for over a year to obtain similar approval in the United

States.

ANGLE is seeking to become the first company authorised in the

United States to harvest cancer cells from patient blood. Securing

FDA approval requires extensive, detailed work to meet the

requirements of the FDA's necessarily thorough and comprehensive

review.

Dialogue continues to be positive and ANGLE is committing

substantial management resource to the process. To support this,

ANGLE has taken on additional external support from a number of

leading experts with a track record of successful FDA

authorisations for similar diagnostic systems.

Whilst some additional studies are still required, we remain

positive about the prospect of achieving FDA authorisation and

believe that once achieved, this will give the Company a further

major advantage in the market.

Outlook

We have made strong progress advancing our strategy this year

through the validation of the Parsortix cell separation system by

world class cancer centres. We have identified ovarian cancer for

the first clinical application for the Parsortix system following a

successful patient study with the Medical University of Vienna

which demonstrated Parsortix's potential to identify ovarian cancer

with high sensitivity and specificity where traditional techniques

fail. In the coming year, we are well-funded to focus on the

development of research use sales and advance a large scale study

in ovarian cancer to establish Parsortix as a diagnostic tool to

enable clinicians to choose the most appropriate treatment thereby

improving patient outcomes.

We are confident that we have the foundations in place to take a

significant share of the cancer diagnostic / liquid biopsy market

and look forward to reporting further progress in the year

ahead.

Garth Selvey

Chairman

22 July 2015

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 30 APRIL 2015

2014

(Restated(*)

2015 )

Note GBP'000 GBP'000

Operating costs (3,878) (2,211)

-------- --------------

Operating profit/(loss) from

continuing operations (3,878) (2,211)

Net finance income/(costs) 9 13

-------- --------------

Profit/(loss) before tax from

continuing operations (3,869) (2,198)

Tax - -

-------- --------------

Profit/(loss) for the year from

continuing operations (3,869) (2,198)

Profit/(loss) from discontinued

operations 5 (18) 960

-------- --------------

Profit/(loss) for the year (3,887) (1,238)

Other comprehensive income

Items that may be subsequently reclassified to profit

or loss

Exchange differences on translating

foreign operations 92 (96)

-------- --------------

Other comprehensive income/(loss) 92 (96)

Total comprehensive income/(loss)

for the year (3,795) (1,334)

======== ==============

Profit/(loss) for the year attributable

to:

Owners of the parent

From continuing operations (3,576) (2,024)

From discontinued operations (18) 960

Non-controlling interests

From continuing operations (293) (173)

From discontinued operations - (1)

Profit/(loss) for the year (3,887) (1,238)

======== ==============

Total comprehensive income/(loss)

for the year attributable to:

Owners of the parent

From continuing operations (3,421) (2,158)

From discontinued operations (18) 960

Non-controlling interests

From continuing operations (356) (135)

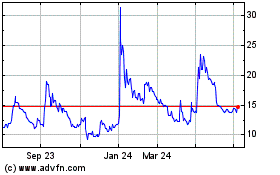

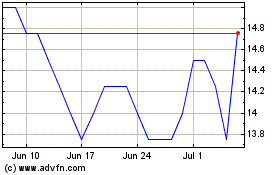

Angle (LSE:AGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Angle (LSE:AGL)

Historical Stock Chart

From Apr 2023 to Apr 2024