TIDMASY

RNS Number : 1396L

Andrews Sykes Group PLC

29 September 2016

Andrews Sykes Group plc

Interim Financial Statements 2016

Summary of results

for the six months ended 30 June 2016

(Unaudited)

6 months 6 months

ended ended

30 June 30 June

2016 2015

GBP'000 GBP'000

Revenue from continuing operations 30,287 28,240

EBITDA* from continuing operations 8,799 7,293

Operating profit 6,395 4,973

Inter-company foreign exchange gains and losses 1,062 (355)

Profit for the financial period 6,195 3,732

Basic earnings per share (pence) 14.66p 8.83p

Interim dividends declared per equity share

(pence) 11.90p 11.90p

Net funds 15,392 13,505

======== ========

* Earnings Before Interest, Taxation, Depreciation, profit on

the sale of property, plant and equipment, Amortisation and

non-recurring items.

For further information please contact:

Andrews Sykes Group plc

Paul Wood, Group Managing Director

Andy Phillips, Group Chief Financial Officer +44 (0)1902 328700

----------------------------------------------- ---------------------

GCA Altium (NOMAD)

Paul Lines

Adam Sivner +44 (0)845 505 4300

----------------------------------------------- ---------------------

Arden Partners plc (Broker)

Steve Douglas +44 (0) 20 7614 5920

----------------------------------------------- ---------------------

Chairman's Statement

Overview

The group produced a successful result for the first half of

2016, once again the winter months created some good opportunities

for our heating and boiler hire products. Overall, the group's

revenue for the six months ended 30 June 2016 was GBP30.3 million,

an increase of GBP2.1 million compared with the same period last

year. As a consequence operating profit increased by GBP1.4 million

from GBP5.0 million in the first half of 2015 to GBP6.4 million for

the six months ended 30 June 2016.

The group continues to be profitable and cash generative. Cash

generated from operations was GBP7.1 million (2015: GBP5.0 million)

and net funds increased by GBP0.8 million from GBP14.6 million as

at 31 December 2015 to GBP15.4 million as at 30 June 2016 this was

after paying the 2015 final dividend of 11.9 pence per share, or

GBP5.0 million in total, during the period.

Management continue to safeguard the operational structure of

the business. Cash spent on new plant and equipment, primarily hire

fleet assets, amounted to GBP2.2 million and a further GBP0.7

million from stock was also added to the hire fleet. We have

continued our policy of pursuing organic growth within our market

sectors and start up costs of the new businesses discussed in

previous Strategic Reports continue to be expensed as incurred.

Continuing investment in both our existing core businesses and the

ongoing development of new operations and income streams will

ensure that we remain in a strong position and will safeguard

profitability into the future.

Operations review

Our main hire and sales business segment in the UK and Europe

continued to expand during first half of 2016. Our pumping activity

has increased when compared to 2015 and, despite a mild winter, our

heating products have maintained revenue levels. Demand for our air

conditioning products was in line with previous years.

Our operations across the Benelux region have continued a strong

recovery with growth on last year's performance being recorded. Our

recently established businesses in France, Switzerland and

Luxembourg continue to trade in line with our expectations.

Andrews Air Conditioning & Refrigeration, our UK air

conditioning installation business, produced an operating profit of

GBP0.1 million.

Khansaheb Sykes, our long established business based in the UAE,

had a strong start to the year, with improvements in our

traditional pump hire activities. The climate rental division also

continues to make a positive contribution. Overall, the operating

profit of Khansaheb Sykes was GBP0.3 million ahead of the same

period last year.

Profit for the financial period and Earnings per Share

Profit before tax was GBP7.5 million (2015: GBP4.7 million)

reflecting both the above GBP1.4 million increase in operating

profit and a significant improvement in net finance income and

costs, also of GBP1.4 million, compared with the same period in

2015. This improvement was primarily due to a net inter-company

foreign exchange gain of GBP1.1 million compared with a loss of

GBP0.3 million in 2015 which in turn was mainly due to the

weakening of Sterling.

The total tax charge increased by GBP0.4 million from GBP0.9

million for the six months ended 30 June 2015 to GBP1.3 million for

the current six month period. The effective tax rate decreased from

20.2% for the six months ended 30 June 2015 to 17.7% in the current

period. The rate for the current period is less than the standard

UK corporation tax rate of 20% which is mainly due to (i) the

utilisation of off balance sheet overseas tax losses due, in part,

to overseas foreign exchange gains and (ii) the effect of profits

being made in lower tax regions overseas. A reconciliation of the

theoretical corporation tax charge based on the accounts profit

multiplied by the UK annualised corporation tax rate of 20% and the

actual tax charge is given in note 4 of these interim accounts.

Profit after tax was GBP6.2 million (2015: GBP3.7 million) and

consequently the basic earnings per share increased by 5.83 pence,

or 66%, from 8.83 pence for the first half of 2015 to 14.66 pence

for the period under review. There were no share buy-backs in the

period.

Dividends

The final dividend of 11.90 pence per ordinary share for the

year ended 31 December 2015 was approved by members at the AGM held

on 21 June 2016. Accordingly on 24 June 2016 the company made a

total dividend payment of GBP5,029,000 which was paid to

shareholders on the register as at 27 May 2016.

The board continues to adopt the policy of returning value to

shareholders whenever possible. The group remains profitable, cash

generative and financially strong. Accordingly the board has

decided to declare an interim dividend for 2016 of 11.90 pence per

share which in total amounts to GBP5,029,000. This will be paid on

2 November 2016 to shareholders on the register as at 7 October

2016. The shares will go ex-dividend on 6 October 2016.

Bank loan agreement

During the period, and in accordance with the agreed repayment

profile, the group repaid the third annual instalment of GBP1

million that was due for payment on 30 April 2016. The remaining

loan balance of GBP5 million is due for repayment in full on 30

April 2017 and therefore this amount has been included within

current liabilities as at 30 June 2016. The group intends to

finance this loan repayment by a new loan of the same amount and

management have already commenced negotiations with the banks to

secure this position.

Outlook

Trading in the third quarter to date has continued to be

positive. After a slow start to the summer Europe has experienced

above average temperatures during September which continue to

stimulate high demand for air conditioning products. Once again

activity in the Middle East has remained consistent through the

summer period, with trading levels ahead of last year in both

Sharjah and Abu Dhabi.

The board remains cautiously optimistic that the group will

return an improved performance for the full year.

JG Murray 28 September 2016

Chairman

Consolidated income statement

for the 6 months ended 30 June 2016 (unaudited)

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 30,287 28,240 60,058

Cost of sales (12,692) (12,602) (25,284)

Gross profit 17,595 15,638 34,774

Distribution costs (5,772) (5,343) (10,828)

Administrative expenses (5,428) (5,322) (10,738)

Operating profit 6,395 4,973 13,208

EBITDA* 8,799 7,293 17,701

Depreciation and impairment losses (2,702) (2,531) (4,959)

Profit on the sale of plant and equipment 298 211 466

--------- --------- ---------------

Operating profit 6,395 4,973 13,208

--------- --------- ---------------

Finance income 145 145 280

Finance costs (73) (84) (164)

Intercompany foreign exchange gains

and losses 1,062 (355) 43

Profit before taxation 7,529 4,679 13,367

Taxation (1,334) (947) (2,567)

Profit for the financial period 6,195 3,732 10,800

--------- --------- ---------------

There were no discontinued operations in either

of the above periods

Earnings per share from continuing operations

Basic and diluted (pence) 14.66p 8.83p 25.55p

Dividends paid during the period

per equity share (pence) 11.90p 11.90p 23.80p

Proposed dividend per equity share

(pence) 11.90p 11.90p 11.90p

* Earnings Before Interest, Taxation, Depreciation, profit on

the sale of property, plant and equipment, Amortisation and

non-

recurring items.

Consolidated balance sheet

as at 30 June 2016 (unaudited)

30 June 30 June 31 December

2016 2015 2015

---------- ----------- ------------

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 18,604 16,187 17,750

Lease prepayments 49 51 50

Trade investments 164 164 164

Deferred tax asset 482 495 282

Retirement benefit pension

surplus 1,512 1,695 2,443

---------- ----------- ------------

20,811 18,592 20,689

---------- ----------- ------------

Current assets

Stocks 5,709 5,002 4,199

Trade and other receivables 16,052 15,031 16,584

Overseas tax (denominated

in Euros) - 195 17

Cash and cash equivalents 20,590 19,697 20,715

---------- ----------- ------------

42,351 39,925 41,515

---------- ----------- ------------

Current liabilities

Trade and other payables (11,414) (10,716) (11,090)

Current tax liabilities (1,345) (1,149) (1,306)

Overseas tax (denominated

in euros) (44) - -

Bank loans (4,985) (980) (980)

Obligations under finance

leases (129) (101) (101)

Provisions - (2) -

---------- ----------- ------------

(17,917) (12,948) (13,477)

---------- ----------- ------------

Net current assets 24,434 26,977 28,038

Total assets less current

liabilities 45,245 45,569 48,727

Non-current liabilities

Bank loans - (4,985) (4,995)

Obligations under finance

leases (84) (126) (81)

(84) (5,111) (5,076)

---------- ----------- ------------

Net assets 45,161 40,458 43,651

---------- ----------- ------------

Equity

Called-up share capital 423 423 423

Share premium 13 13 13

Retained earnings 41,096 38,331 40,987

Translation reserve 3,374 1,436 1,973

Other reserves 245 245 245

Surplus attributable to equity

holders of the parent 45,151 40,448 43,641

Minority interest 10 10 10

Total equity 45,161 40,458 43,651

---------- ----------- ------------

Consolidated cash flow statement

for the six months ended 30 June 2016 (unaudited)

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Cash generated from operations 7,111 4,996 14,623

Interest paid (66) (86) (155)

Net UK corporation tax paid (941) (951) (1,881)

Overseas tax paid (263) (190) (463)

Net cash inflow from operating

activities 5,841 3,769 12,124

----------- -------------- ----------------

Investing activities

Sale of property, plant and

equipment 415 335 711

Purchase of property, plant

and equipment (2,237) (1,711) (5,234)

Interest received 124 100 197

----------- --------------

Net cash outflow from investing

activities (1,698) (1,276) (4,326)

----------- -------------- ----------------

Financing activities

Loan repayments (1,000) (1,000) (1,000)

Finance lease capital repayments (53) (49) (94)

Equity dividends paid (5,029) (5,029) (10,058)

----------- --------------

Net cash outflow from financing

activities (6,082) (6,078) (11,152)

----------- -------------- ----------------

Net decrease in cash and cash

equivalents (1,939) (3,585) (3,354)

Cash and cash equivalents at

the beginning of the period 20,715 24,077 24,077

Effect of foreign exchange rate

changes 1,814 (795) (8)

Cash and cash equivalents at

end of the period 20,590 19,697 20,715

----------- -------------- ----------------

Reconciliation of net cash flow to movement in net funds

in the period

Net decrease in cash and cash

equivalents (1,939) (3,585) (3,354)

Net cash outflow from the decrease

in debt 1,053 1,049 1,094

Non-cash movement re the new

financial leases (84) - -

Non-cash movements re costs

of raising loan finance (10) (10) (20)

------------ ------------- ----------------

Decrease in net funds during

the period (980) (2,546) (2,280)

Opening net funds at the beginning

of the period 14,558 16,846 16,846

Effect of foreign exchange rate

changes 1,814 (795) (8)

------------ ------------- ----------------

Closing net funds at the end

of the period 15,392 13,505 14,558

------------ ------------- ----------------

Consolidated statement of comprehensive total income

(CSOCTI)

for the six months ended 30 June 2016 (unaudited)

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

Profit for the financial period 6,195 3,732 10,800

Other comprehensive income/ (charges):

Items that may be reclassified to

profit and loss:

Currency translation differences

on foreign currency net investments 1,401 (712) (175)

Items that will never be reclassified

to profit and loss:

Remeasurement of defined benefit

liabilities and assets (1,305) 416 1,157

Related deferred tax 248 (83) (207)

Other comprehensive income/(charges)

for the period net of tax 344 (379) 775

Total comprehensive income for the

period 6,539 3,353 11,575

Notes to the consolidated interim financial statements

for the six months ended 30 June 2016

1 General information

Basis of preparation

These interim financial statements have been prepared in

accordance with International Accounting Standards (IAS) and

International Financial Reporting Standards (IFRS) as adopted by

the European Union and with the Companies Act 2006.

The information for the 12 months ended 31 December 2015 does

not constitute the group's statutory accounts for 2015 as defined

in Section 434 of the Companies Act 2006. Statutory accounts for

2015 have been delivered to the Registrar of Companies. The

auditor's report on those accounts was unqualified and did not

contain statements under Section 498(2) or (3) of the Companies Act

2006. These interim financial statements, which were approved by

the Board of Directors on 28 September 2016, have not been audited

or reviewed by the auditors.

The interim financial statement has been prepared using the

historical cost basis of accounting except for:

(i) properties held at the date of transition to IFRS which are stated at deemed cost;

(ii) assets held for sale which are stated at the lower of fair

value less anticipated disposal costs and carrying value; and

(iii) derivative financial instruments (including embedded

derivatives) which are valued at fair value.

Functional and presentational currency

The financial statements are presented in pounds Sterling

because that is the functional currency of the primary economic

environment in which the group operates.

2 Accounting policies

These interim financial statements have been prepared on a

consistent basis and in accordance with the accounting policies set

out in the group's Annual Report and Financial Statements 2015.

3 Revenue

An analysis of the group's revenue is as follows:

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

Continuing operations

Hire 25,450 22,996 49,910

Sales 2,806 3,186 5,993

Installations 2,031 2,058 4,155

Group consolidated revenue from the

sale of goods and provision

of services 30,287 28,240 60,058

-------- -------- ------------

The geographical analysis of the group's revenue by origination

is:

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

United Kingdom 20,172 19,239 39,830

Rest of Europe 4,787 3,989 9,925

Middle East and Africa 5,329 5,012 10,303

30,288 28,240 60,058

--------- -------- ------------

4 Taxation

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

Current tax

UK corporation tax at 20% (30 June

2015 and 31 December 2015: 20.25%) 980 779 2,043

Adjustments in respect of prior periods - - (177)

--------- -------- ------------

980 779 1,866

Overseas tax 299 120 536

Adjustments to overseas tax in respect

of prior periods 7 - 28

Total current tax charge 1,286 899 2,430

--------- -------- ------------

Deferred tax

Deferred tax on the origination and

reversal of temporary differences 48 48 12

Adjustments in respect of prior periods - - 125

Total deferred tax charge 48 48 137

--------- -------- ------------

Total tax charge for the financial

period attributable to

continuing operations 1,334 947 2,567

--------- -------- ------------

The tax charge for the financial period can be reconciled to the

profit before tax per the income statement multiplied by the

effective standard annualised corporation tax rate in the UK of 20%

(30 June 2015 and 31 December 2015: 20.25%) as follows:

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

Profit before taxation from continuing

and total operations 7,529 4,679 13,367

-------- -------- ------------

Tax at the UK effective annualised

corporation tax rate of 20%

(30 June 2015 and 31 December 2015:

20.25%) 1,506 947 2,707

Effects of:

Expenses not deductible for tax purposes 45 58 86

Movement in overseas trading losses (46) 122 88

Effect of different tax rates of subsidiaries

operating abroad (175) (180) (331)

Effect of change in rate of corporation

tax (3) - 41

Adjustments to tax charge in respect

of previous periods 7 - (24)

Total tax charge for the financial

period 1,334 947 2,567

-------- -------- ------------

The total effective tax charge for the financial period

represents the best estimate of the weighted average annual

effective tax rate expected for the full financial year applying

tax rates that have been substantively enacted by the balance sheet

date. Accordingly UK corporation tax has been provided at 20%; the

reduction to 20% for the tax years ending 31 March 2016 and 31

March 2017 having been substantially enacted on 2 July 2013. UK

deferred tax has been provided at 19% being the rate substantially

enacted at the balance sheet date at which the timing differences

are expected to reverse.

5 Earnings per share

Basic earnings per share

The basic figures have been calculated by reference to the

weighted average number of ordinary shares in issue and the

earnings as set out below. There are no discontinued operations in

any period.

6 months ended 30 June

2016

------------------------

Continuing Number of

earnings Shares

GBP'000

Basic earnings/weighted average number

of shares 6,195 42,262,082

-----------

Basic earnings per ordinary share (pence) 14.66p

6 months ended 30 June

2015

------------------------

Continuing Number of

earnings shares

GBP'000

Basic earnings/weighted average number

of shares 3,732 42,262,082

-----------

Basic earnings per ordinary share (pence) 8.83p

12 months ended 31 December

2015

-------------------------------

Continuing Number of

earnings shares

GBP'000

Basic earnings/weighted average number

of shares 10,800 42,262,082

---------------

Basic earnings per ordinary share (pence) 25.55p

Diluted earnings per share

There were no dilutive instruments outstanding at 30 June 2016

or either of the comparative periods and, therefore, there is no

difference in the basic and diluted earnings per share for any of

these periods. There were no discontinued operations in any

period.

6 Dividend payments

Dividends declared and paid on ordinary one pence shares during

the 6 months ended 30 June 2016 were as follows:

Paid during the 6 months

ended 30 June 2016

-------------------------------

Pence per share Total dividend

paid

GBP'000

Final dividend for the year ended 31 December

2015 paid to members on the register on

27 May 2016 on 24 June 2016 11.90p 5,029

--------------- --------------

The above dividend was charged against reserves during the 6

months ended 30 June 2016.

On 28 September 2016 the directors declared an interim dividend

of 11.90 pence per ordinary share which in total amounts to

GBP5,029,000. This will be paid on 2 November 2016 to shareholders

on the register on 7 October 2016 and will be charged against

reserves in the second half of 2016.

Dividends declared and paid on ordinary one pence shares during

the 6 months ended 30 June 2015 were as follows:

Paid during the 6 months

ended 30 June 2015

-------------------------------

Pence per share Total dividend

declared

GBP'000

Final dividend for the year ended 31 December

2014 paid to members on the register on

29 May 2015 on 19 June 2015 11.90p 5,029

--------------- --------------

The above dividend was charged against reserves during the 6

months ended 30 June 2015.

Dividends declared and paid on ordinary one pence shares during

the 12 month period ended 31 December 2015 were as follows:

Paid during the 12 months

ended

31 December 2015

-------------------------------

Pence per share Total dividend

paid

GBP'000

Final dividend for the year ended 31 December

2014 paid to members on the register on

29 May 2015 on 19 June 2015 11.90p 5,029

Interim dividend declared on 29 September

2015 and paid to shareholders on the register

as at 9 October 2015 on 4 November 2015 11.90p 5,029

--------------- --------------

23.80p 10,058

--------------- --------------

The above dividends were charged against reserves during the 12

months ended 31 December 2015.

7 Retirement benefit obligations - Defined benefit pension scheme

The group closed the UK group defined benefit pension scheme to

future accrual as at 29 December 2002. The assets of the defined

benefit pension scheme continue to be held in a separate trustee

administered fund.

As at 30 June 2016 the group had a net defined benefit pension

scheme surplus, calculated in accordance with IAS 19 (revised)

using the assumptions as set out below, of GBP1,512,000 (30 June

2015: GBP1,695,000; 31 December 2015: GBP2,443,000). The asset has

been recognised in the financial statements as the directors are

satisfied that it is recoverable in accordance with IFRIC 14.

Following the triennial recalculation of the funding deficit as

at 31 December 2013 a revised schedule of contributions and

recovery plan was agreed with the pension scheme trustees in June

2014. In accordance with this schedule of contributions, which is

effective from 1 January 2014, the group made additional

contributions in 2014 to remove the funding deficit calculated as

at 31 December 2013 and this has now been eliminated. Throughout

2015 and 2016 to date the group has continued to make a

contribution towards expenses of GBP10,000 per month. In addition

the group made an additional voluntary contribution of GBP32,000

per month from January 2016 and this was increased to GBP80,000 per

month from April 2016. The group expects to continue to make the

current level of contributions until 31 March 2017 at which time

they will cease pending a review of the position in conjunction

with the December 2016 triennial funding valuation.

Assumptions used to calculate the scheme surplus

A qualified independent actuary has updated the results of the

December 2013 full actuarial valuation to calculate the surplus as

disclosed below.

The major assumptions used to determine the present value of the

scheme's defined benefit obligation were:

30 June 30 June 31 December

2016 2015 2015

Rate of increase in pensionable N/A N/A N/A

salaries

Rate of increase in pensions 2.90% 3.10% 3.00%

in payment

Discount rate applied to scheme 2.80% 3.60% 3.70%

liabilities

Inflation assumption - RPI 2.90% 3.20% 3.00%

Inflation assumption - CPI 1.90% 2.20% 2.00%

Percentage of members taking

maximum tax free lump sum on

retirement

90% 90% 90%

From 1 January 2011, the government amended the basis for

statutory increases to deferred pensions and pensions in payment.

Such increases are now based on inflation measured by the Consumer

Price Index (CPI) rather than the Retail Price Index (RPI). Having

reviewed the scheme rules and considered the impact of the change

on this pension scheme, the directors consider that future

increases to (i) all deferred pensions and (ii) Guaranteed Minimum

Pensions accrued between 6 April 1988 and 5 April 1997 and

currently in payment will be based on CPI rather than RPI.

Accordingly, this assumption was adopted as at 31 December 2010 and

subsequently.

Assumptions regarding future mortality experience are set based

on advice in accordance with published statistics. The mortality

table used at 30 June 2016 is 110% S2NA CMI2015 (30 June 2015: 110%

S1NA CMI2014; 31 December 2015: 110% S2NA CMI2015) with a 1% per

annum long term improvement for both males and females (30 June

2015: 1% males and females; 31 December 2015: 1% males and

females).

The assumed average life expectancy in years of a pensioner

retiring at the age of 65 given by the above tables is as

follows:

30 June 30 June 31 December

2016 2015 2015

Male, current age 45 22.6 years 22.5 years 22.6 years

Female, current age 45 24.9 years 25.2 years 24.9 years

Valuations

The fair value of the scheme's assets, which are not intended to

be realised in the short term and may be subject to significant

change before they are realised, and the present value of the

scheme's liabilities, which are derived from cash flow projections

over long periods and are inherently uncertain, were as

follows:

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

Total fair value of plan assets 40,768 38,385 37,734

Present value of defined benefit

funded obligation calculated in

accordance with stated assumptions (39,256) (36,690) (35,291)

----------- ----------- ------------

Surplus in the scheme calculated

in accordance with stated

assumptions recognised in the balance

sheet 1,512 1,695 2,443

----------- ----------- ------------

The movement in the fair value of the scheme's assets during the

period was as follows:

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

Fair value of plan assets at the start

of the period 37,734 38,864 38,864

Expected return on pension scheme assets 688 649 1,298

Actual return less expected return

on pension scheme assets 2,737 (359) (895)

Employer contributions - normal 396 60 120

Benefits paid (717) (774) (1,521)

Administration expenses charged in

the income statement (70) (55) (132)

Fair value of plan assets at the end

of the period 40,768 38,385 37,734

--------- -------- -----------

The movement in the present value of the defined benefit

obligation during the period was as follows:

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

Present value of defined benefit funded

at the beginning of the period (35,291) (37,611) (37,611)

Interest on defined benefit obligation (640) (628) (1,253)

Actuarial (loss) / gain recognised

in the CSOCTI calculated in

accordance with stated assumptions (4,042) 775 2,052

Benefits paid 717 774 1,521

Closing present value of defined benefit

funded obligation calculated

in accordance with stated assumptions (39,256) (36,690) (35,291)

---------- ---------- -----------

Amounts recognised in the income statement

The amounts (charged) / credited in the income statement

were:

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

Expected return on pension scheme

assets 688 649 1,298

Interest on pension scheme liabilities (640) (628) (1,253)

---------- -------- ------------

Net pension interest credit included

within finance income 48 21 45

Scheme administration expenses (70) (55) (132)

Net pension charge in the income statement (22) (34) (87)

---------- -------- ------------

Actuarial gains and losses recognised in the consolidated

statement of comprehensive total income (CSOCTI)

The amounts (charged) / credited in the CSOCTI were:

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

Actual return less expected return

on pension scheme assets 2,737 (359) (895)

Experience gains and losses arising

on plan obligation 281 123 371

Changes in demographic and financial

assumptions underlying the

present value of plan obligations (4,323) 652 1,681

---------- ---------- -----------

Actuarial (loss) / gain calculated

in accordance with stated assumptions

recognised in the CSOCTI (1,305) 416 1,157

---------- ---------- -----------

8 Called up share capital

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

Issued and fully paid:

42,262,082 ordinary shares of one

pence each (30 June 2015 and 31 December

2015: 42,262,082 ordinary shares of

one pence each) 423 423 423

--------- -------- -----------

The company did not buy back any shares for cancellation during

the 6 months ended 30 June 2016 or either of the comparative

periods. The company did not issue any shares in the period or

either of the comparative periods. No share options were granted,

forfeited or expired during any of the periods and there were no

share options outstanding at any period end.

The company has one class of ordinary shares which carry no

right to fixed income.

9 Cash generated from operations

6 months 6 months 12 months

ended ended ended

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

Profit for the period attributable

to equity shareholders 6,195 3,732 10,800

Adjustments for:

Taxation charge 1,334 947 2,567

Finance costs 1,135 84 164

Finance income (1,207) (145) (280)

Inter-company foreign exchange gains

and losses (1,062) 355 (43)

Profit on the sale of property, plant

and equipment (298) (211) (466)

Depreciation 2,702 2,531 4,959

EBITDA* 8,799 7,293 17,701

Excess of normal pension contributions

compared with service and

administration expenses (326) (5) 12

Workings capital movements:

Stocks (2,195) (1,389) (1,024)

Trade and other receivables 508 (660) (2,196)

Trade and other payables 325 (236) 139

Provisions - (7) (9)

Cash generated from operations 7,111 4,996 14,623

-------- -------- ------------

* Earnings Before Interest, Taxation, Depreciation, profit on

the sale of property, plant and equipment, Amortisation and

non-recurring items.

10 Analysis of net funds

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

Cash and cash equivalents per cash

flow statement 20,590 19,697 20,715

-------- ---------- -----------

Bank loans (4,985) (5,965) (5,975)

Obligations under finance leases (213) (227) (182)

-------- ---------- -----------

Gross debt (5,198) (6,192) (6,157)

-------- ---------- -----------

Net funds 15,392 13,505 14,558

-------- ---------- -----------

11 Adoption of Financial Reporting Standards (FRS) 101 and 102 -

Reduced disclosure framework for parent and UK subsidiary company

accounts

The group's consolidated financial statements for the year ended

31 December 2016 will continue to be prepared in accordance with

European Union endorsed International Financial Reporting Standards

(IFRSs) on a consistent basis with the previous financial year.

Last year, the parent company accounts of Andrews Sykes Group

plc were prepared in accordance with FRS 102 and the company

elected to take advantage of the reduced disclosure framework

permitted by paragraph 1.12 of that standard. The company intends

to continue to take advantage of the reduced disclosure framework

again this year. Paragraph 1.11 requires the company to give

shareholders the opportunity to object to the adoption of the

reduced disclosure framework within a reasonable specified

timeframe. Accordingly any shareholder wishing to object to the

adoption of the reduced disclosure framework set out in paragraph

1.12 of FRS 102 for the parent company accounts of Andrews Sykes

Group plc should write to the Company Secretary at the company's

registered office no later than 30 November 2016 setting out the

reasons for any objection. Any letter received after that date will

not be valid.

The group's UK subsidiary companies' accounts for the year ended

31 December 2016 will continue to be prepared in accordance with

the reduced disclosure framework of either FRS 101 or FRS 102

depending upon the circumstances relevant to each subsidiary.

12 Distribution of interim financial statements

Following a change in regulations in 2008, the company is no

longer required to circulate this half year report to shareholders.

This enables us to reduce costs associated with printing and

mailing and to minimise the impact of these activities on the

environment. A copy of the interim financial statements is

available on the company's website, www.andrews-sykes.com.

The company news service from the London Stock Exchange

END

IR DVLFLQKFFBBF

(END) Dow Jones Newswires

September 29, 2016 02:00 ET (06:00 GMT)

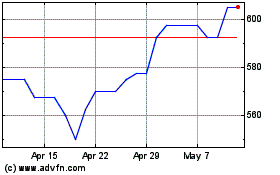

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Mar 2024 to Apr 2024

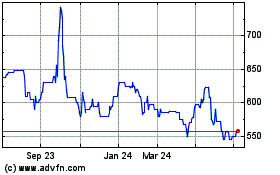

Andrews Sykes (LSE:ASY)

Historical Stock Chart

From Apr 2023 to Apr 2024