Andersons Upgraded to Strong Buy - Analyst Blog

April 14 2014 - 4:00PM

Zacks

On Apr 12, Zacks Investment

Research upgraded The Andersons Inc. (ANDE), a

diversified company operating in six different business segments

ranging from buying, selling and storing grain to leasing railcars

and running retail stores catering to the latest home hardware

needs, to a Zacks Rank #1 (Strong Buy).

Why the Upgrade?

The share price and earnings estimates of Andersons have been

trending upward, following its record fourth-quarter 2013 results

on Feb 12. Adjusted earnings moved up an impressive 104% to $1.08

from 53 cents (adjusted to reflect the company's Feb 2014

three-for-two stock split) earned in the year-ago quarter. Results

beat the Zacks Consensus Estimate of $1.05, delivering a positive

earnings surprise of 2.86%, the third straight quarter of a

positive earnings surprise.

For full-year 2013, Andersons reported earnings per share of $3.18,

up 12.7% from $2.82 (adjusted to reflect the company's Feb 2014

three-for-two stock split) in 2012. Segment wise, the Ethanol Group

had record operating income in 2013 and a best ever fourth quarter,

reversing the loss incurred in the prior-year comparable period,

attributed to strong ethanol margins. The Rail Group was close to

the record 2012 results. The Turf and Specialty Group had a record

year, with more than double the prior-year results. Despite

unfavorable impacts of the 2012 drought, the Grain Group performed

well, helped by strong earnings of the Lansing Trade Group.

Andersons will benefit from its activities on the acquisition front

in 2013. The acquisition of Blenheim, Ontario-based Thompsons Ltd.,

a grain and food-grade bean handler and Mile Rail, LLC, a provider

of agronomy input as well as railcar repair and cleaning equipment

will be accretive to earnings for full-year 2014. In December,

Andersons finalized the acquisition of the granulation

manufacturer, Cycle Group, Inc. The company purchased the assets of

Cycle Group to geographically expand the Turf & Specialty

Group's granulation business. In addition, the acquisition will

increase the company’s production and distribution capabilities in

the high-value markets of the granular business and help to serve

customers better.

The Agricultural Group is expected to benefit from the record corn

crop seen in 2013 and the anticipated sizable corn crop in 2014.

The Rail, Grain and Plant and Nutrients Groups are also expected to

perform well. Though margins have improved in the ethanol business,

the company remains cautious as the ethanol market will continue to

be volatile. In addition, Andersons’ stock split and dividend

distribution program will drive growth in the future.

Over the last 60 days, the Zacks Consensus Estimate for 2014 has

gone up 5% to $4.00 per share as all of the 4 estimates have moved

upward. Over the same time frame, the Zacks Consensus Estimate for

2015 has gone up 2.3% to $4.01 per share as 2 out of 3 estimates

have been revised upward.

Other Stocks to Consider

Some other stocks worth considering in the sector include

Gruma S.A.B. de CV (GMK), Archer Daniels

Midland Company (ADM) and CVR Partners,

LP (UAN), all of which carry a Zacks Rank #2 (Buy).

ARCHER DANIELS (ADM): Free Stock Analysis Report

ANDERSONS INC (ANDE): Free Stock Analysis Report

GRUMA SA-ADR B (GMK): Free Stock Analysis Report

CVR PARTNERS LP (UAN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

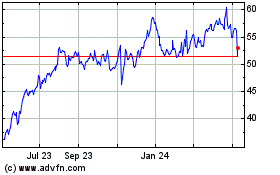

Andersons (NASDAQ:ANDE)

Historical Stock Chart

From Mar 2024 to Apr 2024

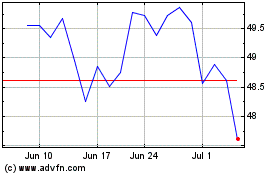

Andersons (NASDAQ:ANDE)

Historical Stock Chart

From Apr 2023 to Apr 2024