TIDMAMC

RNS Number : 4395R

Amur Minerals Corporation

29 June 2015

29 June 2015

AMUR MINERALS CORPORATION

(AIM: AMC)

Operational Blueprint Defined For Kun-Manie

Amur Minerals Corporation ("Amur" or the "Company") is pleased

to present the forward looking Operational Blueprint ("Blueprint")

for the development of the Kun-Manie nickel copper sulphide project

located in the Russian Far East. The optimised design has been

derived from the combination of an extensive Company generated

update to the 2007 SRK Consulting Ltd ("SRK") Pre Feasibility Study

("PFS") and the consideration of the terms and conditions as

contained within the newly acquired "Detailed Exploration and

Production Licence" (the "Licence").

Highlights of the Operational Blueprint include the

following:

-- Existing resources can sustain a 15 year production period

where 6.0 million tonnes per annum are produced. Infill drilling

will be required.

-- Mine production will be derived from four open pits and two underground operations.

-- A simple flotation concentrate will be generated which can be

smelted by the Company owned smelter as verified by Outotec.

-- The project has an estimated operating cost per ore tonne of $US 34.86 per ore tonne.

-- The total initial capital expenditure is projected to be $US

1.38 billion to be expended in a two year construction period.

Sustaining capital is estimated to be $US 474 million over 15

years.

-- The Net Present Value ("NPV") using a 10% discount rate is

projected to be $US 0.71 billion and $US1.44 billion using the long

term nickel prices of $US 7.50 per pound and $US 9.50. per pound

These economic projects cover an owner operated smelter and

refinery.

The Blueprint establishes an operational plan for the

comprehensive beneficiation of the sulphide ores from mining

through the sale of final metal products generated by a Company

owned smelter / refinery on the international market. Definition of

the Blueprint included various trade off sensitivity studies that

identified the most profitable configuration for Kun-Manie. From

the plan, the operational configuration, technical operating

parameters, operating and capital cost expenditures as well as pro

forma cash flow projects have been established by the Company. The

results will be independently audited by one of three shortlisted

western mining consultancies possessing Russian experience.

Robin Young, CEO of Amur Minerals Corporation, commented:

"This Operation Blueprint contained within our PEA, represents

ten years of successful exploration at Kun Manie, along with a

total redesign of the project. As we worked on the study, we

challenged all past and previous assumptions. As a result, mining

will best be performed using a combination of underground and open

pit productions, power will be generated on site, a substantial

access road upgrade can be supported and the construction of own

smelter and refinery.

"These choices make a tremendous difference to the bottom line,

which we measure in global project NPV. Moving forward through

infill drilling, metallurgy and more detailed engineering studies,

we will continue to search for ways to optimise the project so that

it delivers the highest possible value to the shareholders. We are

comfortable with the final values we have generated as a Company,

however, we are compiling a Request for Proposal from three

independent companies."

Enquiries:

Company Nomad and Broker Public Relations

Amur Minerals S.P. Angel Yellow Jersey

Corp. Corporate Finance

LLP

Robin Young Dominic Barretto

CEO Ewan Leggat Kelsey Traynor

Katy Birkin

+44 (0) 7981 +44 (0) 20 +44 (0) 77

126 818 3470 0470 99 003 220

Notes to Editors

The information contained in this announcement has been reviewed

and approved by the CEO of Amur, Robin Young. Mr. Young is a

Geological Engineer (cum laude) and is a Qualified Professional

Geologist, as defined by the Toronto and Vancouver Stock

Exchanges.

For further information, see the Company website at

www.amurminerals.com.

Long Term Operational Blueprint

In 2014, the Company initiated an internal evaluation and update

of the 2007 SRK Consulting Ltd ("SRK") Pre Feasibility Study

("PFS"). A substantial amount of technical data had been acquired

since the 2007 PFS was issued, including the increase in the

resource base through step out drilling and the discovery of two

new deposits. The first conclusion derived from the update was that

the additional resource could support a 20 year mine life producing

at a nominal production rate of 4.0 million tonnes per year. This

work confirmed that infill drilling should take priority over

resource expansion, which also remains highly prospective.

In mid-2014, the PFS update was under executive review and

prepared for release when two events impacted the quality of the

study, placing its release on hold.

-- Economic sanctions placed against the Russian Federation

required a reassessment of the equipment selection by identifying

alternatives from within Russia and from sources outside the

sanctions bloc.

-- A rapid devaluation of the Russian Rouble impacted the

quality of all operating costs and selected capital equipment

estimates. This especially disrupted the projections related to

labour costs. The devaluation was so significant that it

invalidated significant portions of the study.

During Q3 and Q4 2014, the Company continued to update the study

information where possible whilst monitoring the Rouble exchange

rate. By February 2015, the Rouble had stabilised and the Company

resumed its update of the study, which included a key change in

scope. In Q4 2014, the terms and conditions for the Production

Licence were negotiated (though final approval was still pending)

with a 20 year Production Licence life being established. As a

result, the Company increased the annual nominal throughput from

4.0 million to 6.0 million tonnes. It was determined that the

existing resource inventory could support the increase as well as

sustain a total production of 90 million tonnes for a 15 year mine

life.

Another key decision was undertaken by management wherein a

longer term vision of the operation was implemented. This called

for the development of an 'Operational Blueprint' of an optimised

conceptual design, providing for a fully integrated operation that

will produce a substantially improved financial assessment for

Kun-Manie. By doing so, a series of trade off studies were

identified wherein each step of the proposed operation could be

optimised. In June 2015, the Operational Blueprint and the

associated economic evaluation were completed.

It is important to note the reasons that the Company is

restricted from specifically identifying its work as a PFS by JORC

standards and therefore considers the results to be at a PEA level.

There are three primary reasons for this use of the study as a PEA.

Firstly, the project analysis included Inferred resource as

reserves, portions of the work and results were derived internally

by the Company, although much of the work is based on external

results compiled by qualified specialist companies and our CEO, Mr.

Robin Young is a licenced professional geologist provided

substantial input to the document which could be considered to be a

conflict of interest. Until the PEA has undergone independent

audit, the Company cautions the shareholder that there are forward

looking statements which could vary substantially from results

obtained in the future. Presently, the Company has shortlisted

three internationally recognised mining consultancies to complete

the audit of the PEA which contains new information and

identifiable changes from 2007 allowing the Company to update its

strategy in a way that can significantly enhance the long-term

economics of mining at Kun Manie. Pressing ahead without

consideration of important new data could sacrifice profitability

for short savings of time, a trade-off the Company could not have

justified to its shareholders.

The Proposed Operational Blueprint

The PEA has established the Operational Blueprint for the

Kun-Manie nickel - copper sulphide project. The indicated scale of

the project supports the conclusions that it will be a substantial

producer, placing the Company among some of the world's larger

nickel miners. The integrated Operational Blueprint for Kun-Manie

includes the following:

-- Power for the site will be generated using diesel fuelled

generators, typical of remote Russian operations. The capital cost

for site-generated power is substantially less than that required

to construct a 360 kilometre long power line, estimated by the

utility company to range from US$800,000 to US$1,000,000 per

kilometre. Conversely, operating costs will be higher than with

power delivered through a grid. This is a substantial change from

2007, when the local utility stated that the power line would be

constructed at its expense. This is no longer the case. Power

generation alternatives such as wind, hydroelectric, etc. could

augment the power needs on site and shall be further

investigated.

-- To support the additional needs to provide power at the site, the access road design will be substantially upgraded by widening it to handle two-way traffic on a year round basis. This requires additional road maintenance equipment and is substantially higher than previous capital cost estimates related to construction of the 320 kilometre long access road.

Amur Minerals (LSE:AMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

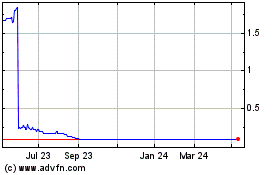

Amur Minerals (LSE:AMC)

Historical Stock Chart

From Apr 2023 to Apr 2024