Ampco-Pittsburgh Corporation (NYSE:AP) announces sales for the

fourth quarter of 2014 of $74,587,000 versus $77,055,000 for the

fourth quarter of 2013, a 3.2% decrease. Sales for 2014

approximated $272,858,000 against $281,050,000 for 2013, a 2.9%

decrease.

Income (loss) from operations for the three and twelve months

ended December 31, 2014 approximated $(2,757,000) and $80,000,

respectively, and includes a pre-tax charge of $4,487,000 for the

estimated increase in the cost of asbestos-related litigation net

of estimated insurance recoveries. Income (loss) from operations

for the three and twelve months ended December 31, 2013

approximated $4,088,000 and $28,967,000, respectively, and for the

twelve months ended December 31, 2013 includes a pre-tax credit of

$16,340,000 for estimated additional insurance recoveries for

asbestos liabilities resulting from insurance coverage settlement

agreements entered into during the third quarter of 2013.

The Corporation incurred a net loss for the three months and

year ended December 31, 2014 of $2,043,000 or $0.20 per common

share and $1,187,000 or $0.11 per common share, respectively, which

includes an after-tax charge of $2,916,000 or $0.28 per common

share for the estimated increase in the cost of asbestos-related

litigation net of estimated insurance recoveries. For the three

months December 31, 2013, the Corporation incurred a net loss of

$1,500,000 or $0.14 per common share which includes an after-tax

effect of $4,165,000 or $0.40 per common share associated with the

charge the Corporation recorded to recognize an impairment of its

investment in a forged-roll joint venture company located in China.

For the year ended December 31, 2013, the Corporation earned net

income of $12,437,000 or $1.20 per common share which includes an

after-tax credit of $10,621,000 or $1.03 per common share for the

estimated additional insurance recoveries offset by the after-tax

charge of $4,165,000 or $0.40 per common share for the impairment

of the Corporation’s investment in a forged-roll joint venture

company for a net increase to net income of $6,456,000 or $0.63 per

common share.

Sales and operating income for the Forged and Cast Engineered

Products segment (formerly referred to as the Forged and Cast Rolls

segment) for the quarter and year were less than the comparable

prior year periods principally due to a lower volume of shipments

attributable to a worldwide reduction in demand for rolls.

Additionally, pricing and profit margins suffered due to the supply

demand imbalance in the industry.

With respect to the Air and Liquid Processing segment, although

sales for the quarter were comparable to the same period of the

prior year, operating income, excluding asbestos-related activity

discussed above, was less primarily due to product mix. For the

year, sales and operating income, excluding asbestos-related

activity discussed above, approximated those in 2013.

John Stanik, Ampco-Pittsburgh’s Chief Executive Officer

commented, “The current state of the global roll market is

concerning. The market demand for rolls in 2014 was disappointing

mainly due to lower operating levels for the steel and non-ferrous

industries. When this is combined with the current overcapacity for

roll production and the customer demand for significantly lower

prices, the overall effect on our business was a severe decline in

financial performance. Ampco-Pittsburgh is taking steps to adjust

its capacity, reduce costs and institute price increases in the

immediate future.

“Regarding the Air and Liquid Processing segment, our failure to

grow in 2014 is less concerning. I believe these equipment

businesses are strong and improving. As discussed in the release,

mix was our primary issue in 2014.

“Strategic planning is in full force. This effort will result in

strategic and tactical action items to address growth and

profitability in 2016 and beyond.”

The matters discussed herein may contain forward-looking

statements that are subject to risks and uncertainties that could

cause actual results to differ materially from expectations. Some

of these risks are set forth in the Corporation's Annual Report on

Form 10-K as well as the Corporation's other reports filed with the

Securities and Exchange Commission.

AMPCO-PITTSBURGH

CORPORATIONFINANCIAL

SUMMARY(Dollars in thousands

except per share amounts)

Three

Months

Ended December

31,

Year

Ended

December

31,

2014

2013

2014

2013

Sales

$ 74,587

$ 77,055 $

272,858 $ 281,050

Costs of products sold (excl. depreciation) 59,882

58,765 218,597 217,342 Selling and administrative 9,955 11,547

37,380 39,682 Depreciation 2,811 2,617 11,818 11,342 Charge

(credit) for asbestos litigation (1) 4,487 - 4,487 (16,340 ) Loss

on disposition of assets

209

38 496

57 Total operating expense

77,344 72,967

272,778 252,083

(Loss) income from operations (2,757 ) 4,088 80 28,967 Other

expense – net

(584 )

(118 ) (972 )

(1,787 ) (Loss) income before income taxes

(3,341 ) 3,970 (892 ) 27,180 Income tax benefit (provision) 1,539

2,145 766 (5,813 ) Equity losses in Chinese joint venture (2)

(241 ) (7,615

) (1,061 )

(8,930 ) Net (loss) income (3)

$ (2,043 ) $

(1,500 ) $

(1,187 ) $

12,437 Earnings per common share: Basic

(3)

$ (0.20 ) $

(0.14 ) $ (0.11

) $ 1.20 Diluted (3)

$ (0.20 ) $

(0.14 ) $ (0.11

) $ 1.20

Weighted-average number of common shares outstanding: Basic

10,426 10,364

10,405 10,358

Diluted

10,426

10,364 10,405

10,406 (1) For 2014, charge

represents estimated increase in the cost of asbestos-related

litigation net of estimated insurance recoveries. For 2013, credit

represents estimated additional insurance recoveries for asbestos

liabilities resulting from insurance coverage settlement agreements

entered into during the third quarter. (2) Equity losses in

Chinese joint venture for the three and twelve months ended

December 31, 2013 includes a charge of $6,407 to recognize an

impairment of the Corporation’s investment in a forged-roll joint

venture company located in China. (3) Net loss for the three

months and year ended December 31, 2014 includes an after-tax

charge of $2,916 or $0.28 per common share for the estimated

increase in the cost of asbestos-related litigation net of

estimated insurance recoveries. Net loss for the three months ended

December 31, 2013 includes an after-tax charge of $4,165 or $0.40

per common share to recognize an impairment of the Corporation’s

investment in a forged-roll joint venture company located in China.

Net income for 2013 includes an after-tax credit of $10,621 or

$1.03 per common share for estimated additional insurance

recoveries for asbestos liabilities resulting from insurance

coverage settlement agreements entered into during the third

quarter, offset by an after-tax charge of $4,165 or $0.40 per

common share to recognize an impairment of the Corporation’s

investment in a forged-roll joint venture for a net increase to net

income of $6,456 or $0.63 per common share.

Ampco-Pittsburgh CorporationDee Ann Johnson, 412-456-4410Chief

Financial Officer and Treasurerdajohnson@ampcopgh.com

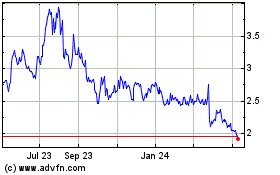

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ampco Pittsburgh (NYSE:AP)

Historical Stock Chart

From Apr 2023 to Apr 2024