------------------------------------------------------ ----------- -----------

Basic net assets per share 356.8p 336.7p

------------------------------------------------------ ----------- -----------

Basic tangible net assets per share 304.1p 288.7p

------------------------------------------------------ ----------- -----------

Note: The calculation of Tangible net assets was amended in 2014

to incorporate an adjustment for Non-controlling interests included

in the Equity attributable to owners of the Parent Company.

18. Subsidiaries and associates

a) Principal subsidiaries

The principal subsidiaries at 31 December 2014 which are

consolidated in these financial statements are detailed below.

Unless otherwise stated, the Group owns 100% of ordinary share

capital and voting rights in these entities:

Subsidiaries Principal activity Registered in

Allied Cedar Insurance

Group Limited Intermediate holding company England and Wales

Amlin AG Reinsurance company Switzerland

Amlin Bermuda Holdings

Limited Finance company Bermuda

Amlin Corporate Member

Limited Corporate member at Lloyd's England and Wales

Amlin Corporate Services Group service, employing and intermediate

Limited holding company England and Wales

Amlin Europe N.V.(1) Insurance company The Netherlands

Amlin Insurance (UK) Limited Insurance company England and Wales

Amlin (Overseas Holdings)

Limited Intermediate holding company England and Wales

Amlin Plus Limited(2) Lloyd's coverholder England and Wales

Amlin Singapore Pte Limited Lloyd's service company Singapore

Amlin Underwriting Limited Lloyd's managing agency England and Wales

Amlin Underwriting Services

Limited Lloyd's coverholder England and Wales

AUA Insolvency Risk Services

Limited Regulated broker England and Wales

JR Clare Underwriting

Agencies Limited Lloyd's coverholder England and Wales

Lead Yacht Underwriters

Limited Lloyd's coverholder England and Wales

Leadenhall Capital Partners

LLP(3) Investment adviser and fund manager England and Wales

RaetsMarine Insurance

B.V. Broker The Netherlands

---------------------------- ----------------------------------------- -----------------

Note:

1. Pursuant to a merger agreement dated 27 March 2014, all the

assets and liabilities of Amlin France Holdings SAS were

transferred to Amlin France SAS. Following this merger, Amlin

France SAS was wound up without liquidation effective 04 December

2014 and all its business operations and employees transferred into

Amlin Europe NV

where it now operates as the French branch of Amlin Europe

N.V.

2. The non-controlling interest in Amlin Plus Limited (40%) was

acquired by the Group on 20 May 2014.

3. Amlin Group has a 75% share in Leadenhall Capital Partners

LLP, effective from 23 October 2014, see note 3(a) for more

details.

Some subsidiaries have been omitted from this statement to avoid

providing particulars of excessive length but none materially

affects the results or net assets of the Group.

b) Investments in associates

The Group owns interests in two associates: Miles Smith Holdings

Limited and Manchester Underwriting Management Limited. The

aggregate amount of the Group's share of profit after tax from

investments in associates during the year is as follows:

2014 2013

GBPm GBPm

Share of profit after tax of associates(1) 3.7 3.9

------------------------------------------- ----- -----

Total comprehensive income 3.7 3.9

------------------------------------------- ----- -----

Investment in associates(2) 7.0 12.5

------------------------------------------- ----- -----

Total assets 7.0 12.5

------------------------------------------- ----- -----

Notes:

1. Includes the Group's share of profit from its investment in

Leadenhall Capital Partners LLP of GBP3.4 million (2013: GBP3.6

million) prior to the Group acquiring a controlling

interest.

2. Includes the Group's equity accounted investment in

Leadenhall Capital Partners LLP of GBPnil (2013: GBP5.7 million)

prior to the Group acquiring a controlling interest.

At 31 December 2014, the Group had an aggregate balance

receivable from associates, excluding loans as detailed below, of

GBP4.2 million (2013: GBP6.4 million). No amounts were provided for

doubtful recovery of outstanding balances and no expense was

recognised during the year in respect of bad or doubtful debts due

from associates.

The Group's loan to Miles Smith Holdings Limited of GBP0.2

million was settled during the year (2013: GBP0.2 million).

Convertible loan stock of GBP0.7 million (2013: GBP0.7 million) has

been issued by the associate to the Group. The conversion date is

31 December 2015. Interest on the convertible loan stock is accrued

at 5.0% over five-year gilts.

The Group has a loan to Manchester Underwriting Management

Limited of GBP2.2 million (2013: GBP2.7 million). The loan is

repayable in full on dates between 1 January 2015 and 21 November

2018. Interest is charged at rates between 5.0% and 5.5% above the

Bank of England base rate.

c) Interests in unconsolidated structured entities

As per note 12(b), the Group holds financial investments in

certain pooled vehicles which are typically sub-funds of umbrella

structures. These sub-funds meet the definition of structured

entities under IFRS 10 as voting and similar rights are not the

dominant factor in determining who controls the entity. Decision

making at the sub-fund level is typically restricted to

administrative tasks only, and instead it is the voting rights at

the umbrella level which determines the control of the

sub-funds.

The investments which meet the definition of structured entities

are the Group's investments in pooled vehicles - liquidity funds

and pooled vehicles - bonds and LIBOR plus funds, as listed in note

12(g). The funds under management with each of the fund managers in

these pooled vehicles are also included within the same note. These

amounts are recorded within financial assets on the Group's

consolidated statement of financial position.

The maximum exposure to loss from the Group's interests in

unconsolidated structured entities is 100% of the funds invested in

those entities, should the fair value of the assets held

deteriorate to nil.

The Group has provided no financial or other support to any

unconsolidated structured entities in the period outside of

transactions in the ordinary course of investment management, and

has no current intentions to do so.

d) Subsidiaries exempt from statutory audit

The subsidiaries at 31 December 2014 which are consolidated in

these financial statements but are exempt from statutory audit are

detailed below. The Group owns 100% of ordinary share capital and

voting rights in these entities:

Subsidiaries Principal activity Status Registered in

========================== ======================= ======= ========================

Amlin Netherlands Holdings Intermediate holding Active The Netherlands

BV company

Amlin Reinsurance Managers Reinsurance company Active United States of America

Inc.

Haven Knox-Johnston Lloyd's service company Dormant England and Wales

Limited

Just Law Limited Service company Dormant England and Wales

St Margaret's Insurance Intermediate holding Dormant England and Wales

Services Limited company

Summit Insurance Group Insurance company Dormant England and Wales

========================== ======================= ======= ========================

19. Contingent liabilities

Aside from the escrow account entered into with the Trustee of

the Lloyd's Superannuation Fund defined benefit pension scheme, as

described in note 16(a), and the contingent consideration relating

to the acquisition of Leadenhall Capital Partners LLP, as described

in note 3(a), the Group has no material contingent liabilities at

31 December 2014 (2013: GBPnil).

20. Commitments

a) Capital commitments

The Group has agreed to redeem the US$50.0 million subordinated

debt in March 2015 as described in note 12(e). In addition to the

commitments made to RaetsMarine Insurance B.V. below and to

Leadenhall Capital Partners LLP as described in note 3(a), the

Group has made a contractual commitment for the construction of a

new office building (Victoria Road, Chelmsford) at 31 December 2014

of GBP3.6 million (2013: GBP13.5 million).

The Group has also made commitments to subscribe to property

funds at 31 December 2014 of GBP68.6 million (2013: GBP41.5

million) in the normal course of investment activities.

b) Operating lease commitments

The Group leases various offices under operating lease

agreements. The Group is required to give notice for the

termination of these agreements. The lease expenditure charged to

the consolidated statement of profit or loss during the year is

GBP9.9 million (2013: GBP9.6 million), as disclosed in note

7(g).

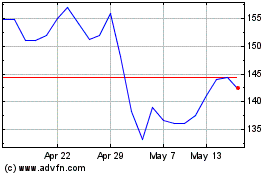

Aston Martin Lagonda Glo... (LSE:AML)

Historical Stock Chart

From Mar 2024 to Apr 2024

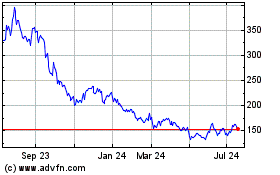

Aston Martin Lagonda Glo... (LSE:AML)

Historical Stock Chart

From Apr 2023 to Apr 2024