Amlin PLC Preliminary Results -47-

March 02 2015 - 2:01AM

UK Regulatory

Government 167.6 - 167.6 31.3 97.8 - 97.8 20.9

Corporate 111.8 - 111.8 20.9 136.7 - 136.7 29.1

Property

United Kingdom 32.1 - 32.1 6.0 28.1 - 28.1 6.0

------------------------------------------------------ ------ -------- ----- ----- ------ -------- ----- -----

Total directly managed scheme assets - United Kingdom 444.3 13.7 458.0 85.6 388.2 15.8 404.0 86.3

------------------------------------------------------ ------ -------- ----- ----- ------ -------- ----- -----

The Netherlands 64.2 12.0 51.7 11.1

Belgium 3.6 0.7 3.4 0.7

Switzerland 9.3 1.7 9.0 1.9

------------------------------------------------------ ------ -------- ----- ----- ------ -------- ----- -----

Insured scheme assets 77.1 14.4 64.1 13.7

------------------------------------------------------ ------ -------- ----- ----- ------ -------- ----- -----

Total scheme assets 535.1 100.0 468.1 100.0

------------------------------------------------------ ------ -------- ----- ----- ------ -------- ----- -----

The analysis of the scheme assets by asset class are not

provided for the Amlin Re Europe and Amlin Europe defined benefit

schemes as the investment decisions are at the discretion of the

third parties to whom Amlin Re Europe and Amlin Europe have ceded

investment risk under the insurance policies taken out to meet

their obligations. These scheme assets are shown as insured scheme

assets in the table above.

Asset-liability matching strategies

In accordance with the governance arrangements set out above,

investment strategies are in place to maintain long-term

investments which are aligned to the obligations under the defined

benefit pension schemes. The Group actively monitors how the

duration and expected yield of the investments match the expected

cash outflows arising from the pension obligations.

In addition, for the scheme in the UK, a proportion of the

Fund's assets are invested in a liability driven investment

portfolio. The objective of this portfolio is to match these assets

to a proportion of the Fund's liabilities.

The Group has not changed the processes used to manage its risks

from prior period.

Maturity profile of the defined benefit obligations

The weighted average duration of the defined benefit obligation

(years) is as follows:

2014 2013

UK 17 17

The Netherlands 26 22

Belgium 13 12

Switzerland 18 19

------------------ ---- ----

The expected maturity analysis of the undiscounted pension

benefits is as follows:

UK The Netherlands Belgium Switzerland

GBPm GBPm GBPm GBPm

Less than a year 16.1 1.3 0.3 0.5

Between 1-2 years 16.5 1.4 0.3 0.6

Between 2-5 years 51.5 4.8 1.5 1.7

Over 5 years 905.9 213.9 14.3 34.0

----------------------------- ----- --------------- ------- -----------

Total as at 31 December 2014 990.0 221.4 16.4 36.8

----------------------------- ----- --------------- ------- -----------

UK The Netherlands Belgium Switzerland

GBPm GBPm GBPm GBPm

Less than a year 16.0 1.4 0.2 0.5

Between 1-2 years 16.4 1.5 0.3 0.5

Between 2-5 years 51.6 4.9 1.3 1.8

Over 5 years 1,016.0 313.2 15.7 35.8

----------------------------- ------- --------------- ------- -----------

Total as at 31 December 2013 1,100.0 321.0 17.5 38.6

----------------------------- ------- --------------- ------- -----------

Expected contributions

The effect of the defined benefit plans on the Group's future

cash flows as a result of the expected contributions for the year

ending 31 December 2015 is as follows:

UK The Netherlands Belgium Switzerland

GBPm GBPm GBPm GBPm

Contributions from the Group 2.5 1.2 0.4 0.7

Contributions from plan participants 0.1 0.6 - 0.3

------------------------------------- ----- --------------- ------- -----------

Total contributions to the schemes 2.6 1.8 0.4 1.0

------------------------------------- ----- --------------- ------- -----------

b) The stakeholder defined contribution schemes

The defined contribution schemes operated by the Group are

stakeholder arrangements. The total contributions to the schemes

for the year ended 31 December 2014 are GBP8.3 million (2013:

GBP7.8 million).

c) Other arrangements

In addition to the defined benefit schemes and defined

contribution schemes, the Group has an occupational money purchase

scheme which provides death in service protection for all

employees. Regular contributions, expressed as a percentage of

employees' earnings, are paid into this scheme and are allocated to

accounts in the names of the individual members, which are

independent of the Group's finances. There were no outstanding

contributions at 31 December 2014 (2013: GBPnil).

17. Capital & reserves

a) Share capital

2014 2014 2013 2013

Number GBPm Number GBPm

Allotted, called up and fully paid ordinary shares

At 1 January issued ordinary shares of 28.125p each 504,799,359 142.0 502,076,006 141.2

Ordinary shares of 28.125 pence each issued in the year 66,541 - 2,723,353 0.8

-------------------------------------------------------- ----------- ----- ----------- -----

At 31 December issued ordinary shares of 28.125p each 504,865,900 142.0 504,799,359 142.0

-------------------------------------------------------- ----------- ----- ----------- -----

The Company transferred 756,372 shares out of treasury during

the year at a cost of GBP1.9 million (2013: 716,586 shares at a

cost of GBP1.8 million). The shares have been transferred to meet

exercises of employee share options, leaving 3,495,713 shares in

treasury at 31 December 2014 (2013: 4,252,085 shares). This number

does not include shares held by the trustee of the Group's Employee

Share Ownership Trust as disclosed in note 7(d).

The Group issued 66,541 ordinary shares on 7 November 2014 in

conjunction with the acquisition of Leadenhall Capital Partners

LLP, as per note 3(a). The shares issued have the same rights as

all other shares in issue. The fair value of the shares issued is

GBP0.3 million (434.115 pence per share).

b) Other reserves

All items of other comprehensive income in 2014 and 2013 are

charged to 'Other reserves'. Other reserves are as follows:

2014 2013

Note GBPm GBPm

Capital redemption reserve 123.1 123.1

Defined benefit pension reserve (49.9) (40.1)

Foreign operations translation reserve (8.1) (9.6)

Employee share option reserve 11.3 9.3

Hedge accounting reserve (41.1) (43.0)

Merger reserve 87.7 87.7

Pre-1999 goodwill write-off (45.7) (45.7)

Other 1.0 1.2

Tax relating to components of other reserves 8 30.8 29.5

--------------------------------------------- ---- ------ ------

109.1 112.4

--------------------------------------------- ---- ------ ------

c) Net assets per share

Net assets and tangible net assets per share are as follows:

Note 2014 2013

Net assets GBP1,785.9m GBP1,678.6m

Non-controlling interests (GBP3.1m) (GBP0.5m)

Equity attributable to owners of the Parent

Company GBP1,782.8m GBP1,678.1m

Adjustments for goodwill and intangible assets

(excluding non-controlling interest's share) 15 (GBP263.6m) (GBP239.1m)

----------------------------------------------- ----- ----------- -----------

Tangible net assets (excluding non-controlling

interest's share in 2014) GBP1,519.2m GBP1,439.5m

----------------------------------------------- ----- ----------- -----------

Number of shares in issue at end of the year 504.9m 504.8m

Adjustment for ESOT and treasury shares (5.3m) (6.2m)

------------------------------------------------------ ----------- -----------

Basic number of shares after ESOT and treasury

shares adjustment 499.6m 498.6m

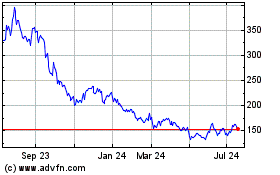

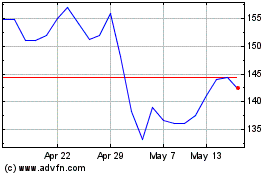

Aston Martin Lagonda Glo... (LSE:AML)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aston Martin Lagonda Glo... (LSE:AML)

Historical Stock Chart

From Apr 2023 to Apr 2024