TIDMAEX

RNS Number : 2206G

Aminex PLC

19 November 2015

Aminex plc

("Aminex" or "the Company")

INTERIM MANAGEMENT STATEMENT - THIRD Quarter 2015

Aminex PLC ("Aminex" or "the Group" or the "Company"), an oil

and gas company listed on the London and Irish Stock Exchanges,

today releases its Interim Management Statement for the period 1

July 2015 to the date of this statement.

HIGHLIGHTS

-- Agreement signed with Bowleven plc for a total gross

consideration of $28 million in respect of:

o the sale of a 25% interest in Kiliwani North Development

Licence ("KNDL") and

o a multi-well farm-out for a 50% interest in the Ruvuma

Production Sharing Agreement

o inter-conditional agreement signed with Solo Oil plc to

participate pro rata in Ruvuma farm-out terms

-- Gas Sales Agreement terms agreed with Tanzanian Petroleum

Development Corporation pending final payment protection terms

which are largely agreed

-- Back-in rights for KNDL exercised by Tanzania Petroleum Development Corporation

-- Solo Oil retains option to acquire a further 6.5% in KNDL

following signing of Gas Sales Agreement

-- Tendering process for Ntorya-2 appraisal well underway with expected spud early 2016

-- Nyuni Area PSA work programme varied with deferral of

drilling obligations approved by Ministry of Energy and Mines

-- Sale of Egyptian interest into a royalty position

Chief Executive Jay Bhattacherjee said:

"It has been a transformational period for your Company; most

notably today's agreement with Bowleven for the sale of 25%

interest in KNDL and a potential multi-well farm-out of a 50%

interest in the Ruvuma Production Sharing Agreement which, after

Solo Oil's participation in the Ruvuma farm-out, provides a net

consideration of $24.375 million to Aminex. The Gas Sales Agreement

and subsequent first gas from Kiliwani North, news about which we

are aware is keenly awaited by shareholders, is expected by

end-2015. Our strategy of moving into a development and production

phase remains a key objective.

Following the completion of the combined transactions announced

today and with cash expected to be generated from KNDL soon, the

Board considers the Company to be well placed to identify other

production and development opportunities in line with the Company's

longer-term strategy."

Aminex is pleased to release its Interim Management Statement

for the period 1 July 2015 to the date of the statement.

PART DISPOSAL AND FARM-OUT

The Company today concurrently announces that it has reached an

agreement with Bowleven plc ("Bowleven"), the AIM listed oil and

gas company for part disposal and farm-out of its Tanzanian assets

(the "Bowleven Agreement"). Terms of the Bowleven Agreement include

the disposal by Aminex of 25% interest in the KNDL and farming into

the Ruvuma PSA, including the Ntorya appraisal programme, for a 50%

gross interest. Under an inter-conditional agreement with its

existing joint venture partner Solo Oil plc ("Solo"), the farm-out

terms for the Ruvuma PSA will be shared proportionately by Aminex

and Solo (the "Solo Agreement"):

-- Cash consideration of $8.5 million

-- Shares in Bowleven to the value of $5 million with a 9 month lock-up period

-- Net carry of $10 million on all Ruvuma PSA activity, enabling a multi well programme

-- A cash bonus of $0.5 million on the completion of drilling of the Ntorya-2 well

-- A bonus of $4 million, to be settled in cash or shares at

Bowleven's option, payable on achieving commercial production from

the Ruvuma PSA for a minimum of 30 days

The combined transaction is conditional upon, amongst other

things, the execution of formal agreements with Bowleven and Solo,

Aminex shareholder approval, and approval from the Tanzanian

authorities.

Under the Solo Agreement, Solo will receive a 25% share of the

net carry of $10 million and will be entitled to 25% of the

contingent bonuses. The net effective value to Aminex of the

transaction will be $24.375 million.

KILIWANI NORTH GAS FIELD (operator)

The Kiliwani North-1 gas well, which tested at 40 MMcfd, has

been completed and is ready to produce. An independent engineering

report ascribes the gas field with 28 BCF Contingent Resource and

it is anticipated that a sustained production rate of up to

approximately 30 MMcfd will optimise the economics and the life of

the reservoir. Initial gas production will enable the pipeline

operator to pressure-test the short spur line between the wellhead

and the new gas plant with revenue gas-flow expected in Q4 2015.

TPDC has advised that the processing plant is close to completion

and a Gas Sales Agreement ("GSA") with appropriate payment

protection mechanisms will be concluded in order to begin

commissioning and testing. Gas from Kiliwani North will represent

Aminex's first commercial production in Africa. The pipeline

operator has constructed a sales pipeline from Kiliwani North to

the nearby processing plant at its own cost, with the Company

responsible for supplying and installing a gas metering unit. The

Company will therefore sell its production at the wellhead, greatly

simplifying commercial and management issues and allowing for low

operating and production costs.

In October 2015, the TPDC notified the Company of its intention

to exercise its right to acquire a 5% working interest in the KNDL

and will become a full working interest partner. The assignment of

this working interest will be subject to TPDC reimbursing the Joint

Venture Partners for TPDC's proportionate share of development

capital expenditure on the licence to date and becoming a party to

the KNDL Joint Operating Agreement.

Under the agreement with Bowleven, Aminex's interest will, on

completion, become 30.575% and Aminex will continue to act as

operator through its wholly-owned subsidiary, Ndovu Resources

Limited.

Under the terms of an Asset Sale Agreement signed in February

2015, Solo acquired 6.5% (before TPDC back-in) of KNDL for a

consideration of $3.5 million and was granted an option to acquire

a further 6.5% (before TPDC back-in) interest in the field for $3.5

million within 30 days of a GSA being signed. Approval from the

Tanzanian authorities for this second sale was obtained in

conjunction with the first sale. If Solo takes up its option,

Aminex's interest will become 24.4% after the TPDC back-in.

RUVUMA PSA (operator)

On completion of the proposed transactions with Bowleven and

Solo, Aminex will benefit from the $10 million net carry on all

production sharing agreement related costs. The net carry should

enable Aminex to participate in a multi-well drilling programme

which includes the recompletion of Ntorya 1. The contingent

consideration of $0.5 million on completion of drilling the

Ntorya-2 well and $4 million after 30 days production has been

achieved from the field would further support the Company's short

and medium-term cash requirements. As a result of the farm-out

agreement reached concurrently with Solo, Solo will receive 25% of

the above considerations directly from Aminex.

Aminex has contracted North Sea Well Engineering Ltd.

("Norwell") to manage the Ntorya-2 and Ntorya-3 well planning,

which is currently ongoing as well as the planning for a workover

of the Ntorya-1 well. In 2012 the Ntorya-1 discovery well in the

Ruvuma PSA tested 20 MMcfd together with 139 barrels of associated

condensate. Ntorya-1 is currently suspended awaiting workover to

recomplete the well. Early summer the management of Aminex took the

decision to allow for pressure build up to occur within the well to

see if it would be suitable candidate for re-entry and eventual

production. The results of the analysis indicate that the desired

results were achieved and the well is indeed a viable re-entry

candidate. Ntorya-2, located just west and up-dip of Ntorya-1, will

target tertiary reservoirs and the same Cretaceous sandstones as

found in the Ntorya-1 well. Ntorya-1 encountered 25-metres of gross

pay of which 3.5 metres was tested while a further 16.5-metres was

considered to be below the gas down to water contact. The primary

objective for Ntorya-2 will be to test the same net 20-metre sand

interval which is believed to be above the gas down to water

contact at the proposed location. The estimated prospective

resource for the appraisal well is 118 BCF Pmean gas in-place

(management estimate) with a 60% chance of success. Following the

Ntorya 1 recompletion and the Ntorya 2 well, the Ntorya-3 will be

drilled in the main Cretaceous channel fairway. The Company is

currently in the final phases of a tendering process to choose a

drilling contractor and will update shareholders once that has been

announced.

An updated resource report by LR Senergy, completed in May 2015,

has assigned 70 BCF best estimate contingent resources or 153 BCF

Pmean resources to the Ntorya-1 gas discovery. The up-dip part of

Ntorya, in addition to the gas discovery, has been ascribed a

further 945 Pmean BCF gas in-place for a total of 1.1 TCF Pmean gas

in-place for the greater Ntorya gas field.

While there are further exploration drilling commitments

required by December 2016 in addition to the current drilling

plans, Aminex is currently in discussions with the TPDC to

facilitate and accelerate the development of Ntorya and meet the

remaining obligations.

NYUNI AREA PSA (operator)

(MORE TO FOLLOW) Dow Jones Newswires

November 19, 2015 02:01 ET (07:01 GMT)

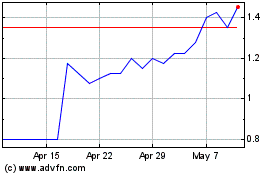

Aminex (LSE:AEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aminex (LSE:AEX)

Historical Stock Chart

From Apr 2023 to Apr 2024