Ameriprise Study: Majority of American Couples Feel Confident about Managing Their Finances but Still Disagree about Money

September 21 2016 - 6:00AM

Business Wire

Nearly seven in ten couples say they have

good communication around finance and money, but many disagree over

spending limits and major purchases

Money tops the list as the most important and frequent topic of

conversation between couples, according to new research released by

Ameriprise Financial (NYSE:AMP). Yet, while the majority of couples

claim to be on the same page about their finances, there are many

areas in which the duos don’t always see eye to eye. The Ameriprise

study on couples and money surveyed more than 1,500 couples between

the ages of 25-70, asking questions to both members in the

relationship to determine if their perspectives on money were

aligned. While three-quarters (77%) of couples say they agree on

most financial matters, more than a third also recognize there is

room for improvement.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20160921005021/en/

Do couples see eye to eye about money?

(Graphic: Ameriprise Financial)

Living in Financial HarmonyThe study found an

overwhelming 88% of couples are happy with how they’ve divvied up

financial responsibilities in their relationship and 68% say they

communicate well about their financial situation. Both individuals

in the pair weren’t shy about rating themselves as engaged,

responsible and confident when it comes to managing their

money.

Couples Reveal the

Top 5 Secrets to a Successful Financial Relationship

1. They make money a priority. 2. Most talk about and agree on

financial goals. 3. They set spending limits ($400 on average); any

purchases over this amount need to be discussed. 4. The majority

have joint banking accounts. 5. They share the responsibility for

retirement planning and investment decisions.

“Conversations about money are critical to successful

relationships. We know couples who talk openly and often about

their finances ultimately feel more confident about reaching their

future goals,” says Marcy Keckler, vice president of financial

advice strategy at Ameriprise. “Money doesn’t have to be a deal

breaker for couples. Instead, it provides them with the opportunity

to work as a team to create a strong financial foundation built on

communication, planning and shared responsibilities.”

The Evolution of Success; Opposites AttractCouples say

their unified front toward financial decisions didn’t happen

overnight. Instead, the majority (66%) evolved into their current

roles over time. And, when it comes to managing money—most couples

(73%) will agree…they approach financial decisions differently than

their significant other or spouse. For example, many who

characterize themselves as spenders have partners who self-identify

as savers. But, no matter their differences, more than half of

couples say they’ve become more financially responsible and their

relationship has improved over time.

Couples Say It’s ComplicatedEven though couples connect

on a variety of financial issues, there is no shortage of

disagreements. Many couples admit they could work to improve their

communication skills. Around three in ten confess they argue about

money at least once a month—most often about making a major

purchase, and spending habits. And, the majority of people (68%)

acknowledge they are prone to shop without telling their partner,

but say it’s mostly because they don’t think the purchase is big

enough to warrant their attention. Many couples are also out of

sync with each other when it comes to how much they’ve saved for

retirement (23%) and spending limits (54%)—and a small percentage

(5%) confess they are hiding an account from their partner.

Key Strategies to Help Couples Improve

Communication

- Discuss financial issues prior to

marriage or moving in together

- Come to a mutual understanding of

financial roles and responsibilities

- Make investment decisions and

retirement goals a priority in the relationship

- Work with a financial professional on a

tailored approach to manage your finances

“Talking about money can be tough for couples, but they don’t

have to figure out their finances on their own. Working with a

financial advisor can help them develop a comprehensive plan that

fits their needs both today and tomorrow,” says Marcy Keckler.

For more information about the study, please visit our research

page at ameriprise.com/couplesandmoneystudy

About the surveyThe Ameriprise study on couples and money

was created by Ameriprise Financial, Inc. and conducted online June

14 to July 14, 2016 by Artemis Strategy Group among 1,514 U.S.

opposite and same sex couples (married or living together for at

least six months with shared financial responsibility) between the

ages of 25-70 with at least $25,000 in investable assets.

About Artemis Strategy GroupArtemis Strategy Group

(www.Artemissg.com) is a

communications strategy research firm specializing in brand

positioning, thought leadership and policy issues.

About Ameriprise FinancialAt Ameriprise Financial, we

have been helping people feel confident about their financial

future for more than 120 years. With extensive asset management,

advisory and insurance capabilities and a nationwide network of

approximately 10,000 financial advisors, we have the strength and

expertise to serve the full range of individual and institutional

investors' financial needs. For more information, or to find an

Ameriprise financial advisor, visit ameriprise.com.

For further information and detail about the study including

verification of data that may not be published as part of this

report, please contact Ameriprise Financial.

Ameriprise Financial Services, Inc. Member FINRA and SIPC.

© 2016 Ameriprise Financial, Inc. All rights reserved.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160921005021/en/

Ameriprise Financial, Inc.Jennifer Johnson,

612-671-7188Media RelationsJennifer.3.johnson@ampf.comConnect with

us on Twitter: @Ameriprise

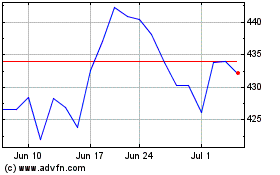

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Apr 2023 to Apr 2024