Only 21% of parents have told their children

how much inheritance they will receive

According to new research released by Ameriprise Financial

(NYSE: AMP), more than half (52%) of Americans say they feel

extremely or very confident about their family’s financial future.

Their secret: regular family conversations about money. Families

with the most financial confidence say they cover a variety of

topics including long-term financial goals, retirement and estate

planning. The Family Wealth Checkup study surveyed 2,700 Americans

between the ages of 25-70, revealing how families navigate

financial communication and the challenges they encounter along the

way.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20170315005007/en/

Family Dynamics: Financial DiscussionsThe study found

family members tend to discuss different topics with different

relatives. Adult children are most likely to initiate conversations

with their parents about managing current finances (74%), the cost

of healthcare (73%) and long-term financial goals (70%). When

parents take the lead in financial discussions with their adult

children, they also bring up managing debt (73%). In general,

survey respondents report they are less likely to talk to their

family members about estate planning and inheritance but it’s still

a popular topic (67% talked to their parents, 69% talked to their

adult children about this topic).

“Estate planning and inheritance are inherently emotional and

often uncomfortable topics of conversation, but addressing them

head on as a family can prevent a lot of uncertainty and tension

down the road,” says Marcy Keckler, vice president of Financial

Advice Strategy at Ameriprise Financial. “Our message to anyone who

hasn’t done so already is to seize the opportunity now to foster an

honest and healthy dialogue with your loved ones.”

The Family Legacy: Planning TogetherMost survey

participants (83%) want to leave money or assets to a loved one;

however, only 64% feel they are on track or prepared to leave an

inheritance and even less (50%) have a formal plan in place. Only

21 percent of parents who are planning to leave something to their

children have told them how much inheritance they will receive. As

a result, expectations don’t always match reality. The majority of

respondents (53%) expected to receive more than $100,000. In fact,

the majority (52%) of those who have received an inheritance got

less than $100,000; an amount that only matched the expectations of

28 percent of those surveyed.

Money transferred within families can often cause conflict.

Nearly a quarter (24%) of respondents think an inheritance will

cause tension or disagreements with family members—a sentiment that

rings true for a quarter of individuals who have received money

following the loss of a loved one.

Don’t Wait, Communicate!Both parents and their adult

children say the top trigger for conversations around estate

planning is aging. But, age can also create a barrier between

family members when it comes to who should initiate the

conversation. The number one reason why adult children haven’t

talked with their parents about the topic is that they “don’t

believe it’s their place to raise the issue.” Parents, meanwhile,

don’t bring up the subject because “they haven’t thought about it”

(25%), or “don’t feel it’s appropriate” (19%).

Though estate planning can be a tough topic to initiate,

families who have talked about it say the discussion went much

smoother than anticipated. The overwhelming majority said the

conversations were straightforward, easy and relaxed as opposed to

awkward or difficult.

“The hardest part is starting the conversation, which is where a

financial advisor can make a difference,” says Keckler. “Working

with a financial professional can help family members get on the

same page and could mean the difference between leaving behind a

loving legacy or leaving behind a headache and hurt feelings.

Family Wealth

Checkup Tips

1. Start discussions early and don’t shy away from serious subjects

-- 9 in 10 adult children who have

discussed estate planning say a life altering incident triggered

the talk with their parents. Don’t wait until a family tragedy to

bring up finances.

2. Have an estate plan in place

-- It’s important to have written

instructions of your wishes, such as a will or trust, and be sure

your beneficiary designations are up to date across all

accounts.

3. Tell loved ones where to find important documents

-- Family members should know where

important documents are located, including how to access online

accounts.

4. Work with a financial professional

-- A financial advisor can help families

understand their full financial picture with a customized approach

to fit their unique needs.

For more information about the study, please visit our research

page at Ameriprise.com/familywealth

About the survey

The Family Wealth Checkup study was created by Ameriprise

Financial, Inc. and conducted online by Artemis Strategy Group

November 23 – December 15, 2016 among 2,700 U.S. adults between the

ages of 25-70 with at least $25,000 in investable assets. For

further information and details about the study, including

verification of data that may not be published as part of this

report, please contact Ameriprise Financial or go to

Ameriprise.com/familywealth.

About Artemis Strategy Group

Artemis Strategy Group (www.Artemissg.com) is a communications strategy

research firm specializing in brand positioning, thought leadership

and policy issues.

About Ameriprise Financial

At Ameriprise Financial, we have been helping people feel

confident about their financial future for more than 120 years.

With extensive asset management, advisory and insurance

capabilities and a nationwide network of approximately 10,000

financial advisors, we have the strength and expertise to serve the

full range of individual and institutional investors' financial

needs. For more information, or to find an Ameriprise financial

advisor, visit ameriprise.com.

For further information and detail about the study including

verification of data that may not be published as part of this

report, please contact Ameriprise Financial.

Ameriprise Financial Services, Inc. Member FINRA and SIPC.

© 2017 Ameriprise Financial, Inc. All rights reserved.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170315005007/en/

Ameriprise Financial, Inc.Jennifer Johnson,

612-671-7188Media RelationsJennifer.3.johnson@ampf.comConnect with

us on Twitter: @Ameriprise

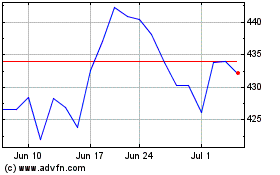

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Apr 2023 to Apr 2024