American Tower Corporation Announces Tax Reporting Information for 2016 Distributions

January 20 2017 - 4:30PM

Business Wire

American Tower Corporation (NYSE: AMT) today announced year-end

tax reporting information for its 2016 distributions. Stockholders

are urged to consult with their personal tax advisors as to their

specific tax treatment of American Tower’s distributions.

American Tower Corporation Common StockCUSIP 03027X100Ticker

Symbol: AMT

RecordDate

PaymentDate

CashDistribution(per

share)

OrdinaryTaxableDividends(per share)

QualifiedTaxableDividends (1)(per

share)

Capital

GainDistribution(per share)

AMTIPreference(per

share)

04/12/2016 04/28/2016 $0.510000 $0.510000

$0.004216 $0.000000 -$0.015023 06/17/2016

07/15/2016 $0.530000 $0.530000

$0.006620 $0.000000 -$0.023589 09/30/2016

10/17/2016 $0.550000 $0.550000 $0.006869

$0.000000 -$0.024479 12/28/2016 01/13/2017

$0.580000 $0.580000 $0.007244 $0.000000

-$0.025814

(1) Included in Ordinary Taxable Dividends

American Tower Corporation 5.25% Mandatory Convertible Preferred

Stock, Series ACUSIP 03027X308Ticker Symbol: AMTPRA

RecordDate

PaymentDate

CashDistribution(per

share)

OrdinaryTaxableDividends(per share)

QualifiedTaxableDividends (1)(per

share)

Capital

GainsDistribution(per share)

AMTIPreference(per

share)

02/01/2016 02/16/2016 $1.312500 $1.312500

$0.000000 $0.000000 $0.000000 05/01/2016

05/16/2016 $1.312500 $1.312500

$0.016393 $0.000000 -$0.058416 06/17/2016

06/17/2016 $1.207820* $1.207820 $0.015086

$0.000000 -$0.053757 08/01/2016 08/15/2016

$1.312500 $1.312500 $0.016393 $0.000000

-$0.058416 11/01/2016 11/15/2016 $1.312500

$1.312500 $0.016393 $0.000000

-$0.058416

*This represents a deemed distribution as a result of a

conversion rate adjustment triggered on June 17, 2016.

(1) Included in Ordinary Taxable Dividends

American Tower Corporation Depositary Shares, each representing

a 1/10th ownership interest in a share of 5.50% Mandatory

Convertible Preferred Stock, Series BCUSIP 03027X407Ticker Symbol:

AMTPRB

RecordDate

PaymentDate

CashDistribution(per

share)

OrdinaryTaxableDividends(per share)

QualifiedTaxableDividends (1)(per

share)

Capital

GainsDistribution(per share)

AMTIPreference(per

share)

02/01/2016 02/16/2016 $1.375000 $1.375000

$0.000000 $0.000000 $0.000000 05/01/2016

05/16/2016 $1.375000 $1.375000

$0.017174 $0.000000 -$0.061198 08/01/2016

08/15/2016 $1.375000 $1.375000 $0.017174

$0.000000 -$0.061198 11/01/2016 11/15/2016

$1.375000 $1.375000 $0.017174 $0.000000

-$0.061198

(1) Included in Ordinary Taxable Dividends

Note: For the tax year ended December 31, 2016, there were no

unrecaptured section 1250 gains or non-dividend distributions.

This information represents final income allocations.

About American TowerAmerican Tower, one of the largest

global REITs, is a leading independent owner, operator and

developer of multitenant communications real estate with a

portfolio of over 144,000 communications sites. For more

information about American Tower, please visit

www.americantower.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170120005577/en/

American Tower CorporationLeah Stearns, 617-375-7500Senior Vice

President, Treasurer and Investor Relations

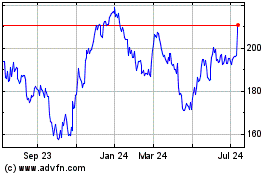

American Tower (NYSE:AMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

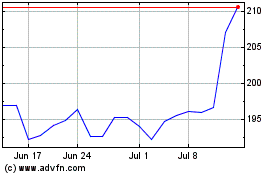

American Tower (NYSE:AMT)

Historical Stock Chart

From Apr 2023 to Apr 2024