AMERICAN SHARED HOSPITAL SERVICES (NYSE MKT:AMS),

a leading provider of turnkey technology solutions for advanced

radiosurgical and radiation therapy services, today announced

financial results for the fourth quarter and 2015.

Fourth Quarter Results

For the three months ended December 31, 2015, medical services

revenue increased 4.3% to $4,162,000 compared to medical services

revenue of $3,992,000 for the fourth quarter of 2014.

Net income for the fourth quarter of 2015 more than quadrupled

to $277,000, or $0.05 per share, compared to net income of $58,000,

or $0.01 per share, for the fourth quarter of 2014.

The total number of procedures performed in AMS' Gamma Knife

business decreased 1.7% for the fourth quarter of 2015

compared to the same period of 2014, primarily due to the

expiration of a site contract in March 2015. The increase in

revenue despite the decrease in procedure volume reflected a

favorable mix of treatments at the Company's retail sites, as well

as an increase in Medicare reimbursement for Gamma Knife services

that went into effect on January 1, 2015.

Medical services gross margin for the fourth quarter of 2015

increased to 44.7%, compared to medical services gross margin of

38.6% for the fourth quarter of 2014. The improvement in gross

margin was primarily the result of reduced maintenance costs.

Operating income increased 91.9% to $731,000 for the fourth

quarter of 2015 compared to operating income of $381,000 for the

same period a year earlier. Pre-tax income, net of income

attributable to non-controlling interest, increased to $383,000 for

the fourth quarter of 2015 compared to pre-tax income, net of

income attributable to non-controlling interest, of $154,000 for

the fourth quarter of 2014.

Selling and administrative expenses for the fourth quarter of

2015 decreased 5.5% to $792,000 compared to SG&A expenses of

$838,000 for the fourth quarter of 2014, primarily the result of

lower consulting expenses.

2015 Results

For the twelve months ended December 31, 2015, medical services

revenue increased 7.3% to $16,548,000 compared to medical services

revenue of $15,417,000 for 2014. Revenue for 2014 included the

Company's operations in Turkey, which were sold effective on May

31, 2014. Excluding prior year's revenue in Turkey, medical

services revenue increased 11.2% for 2015 compared to 2014.

The net loss for 2015 was $1,522,000, or $0.28 per share. The

loss was primarily attributable to a write-down of $2,140,000, or

$0.40 per share, related to AMS' strategic equity investment in

Mevion Medical Systems. Excluding this charge, the Company would

have reported net income of $618,000, or $0.12 per share, for 2015.

This compares to a net loss for 2014 of $952,000, or $0.19 per

share, which included a pre-tax loss on the sale of the Turkey

subsidiary of $572,000 and a pre-tax gain on foreign currency

transactions of $161,000 due to the strengthening of the Turkish

Lira against the U.S. Dollar.

The total number of procedures performed in AMS' Gamma Knife

business increased 6.9% for 2015 compared to 2014, excluding

procedures performed in Turkey. This increase reflected higher

procedure volume at certain of AMS' existing sites, as well as the

opening of the Company’s newest Gamma Knife site in Springfield,

Oregon in December 2014, offset by the expiration of one Gamma

Knife agreement in March 2015.

Operating income for 2015 increased to $1,980,000 compared to an

operating loss of $50,000 for 2014.

Interest expense decreased to $1,239,000 in 2015 compared to

$1,699,000 for 2014. Excluding interest expense in Turkey, this

decrease was due to the closure of the Company’s line of credit on

January 2, 2015, the pay-down of the Company’s existing debt

obligation for its IGRT device at the end of 2014 and an existing

lease obligation for a Gamma Knife site at the end of the first

quarter 2014, and a one-time benefit for a lease modification,

recorded in the third quarter of 2015.

Balance Sheet Highlights

At December 31, 2015, cash and cash equivalents were $2,209,000

compared to $1,059,000 at December 31, 2014. As of December 31,

2014, AMS had a $9,000,000 renewable line of credit with a bank

secured by a certificate of deposit. This line was paid in full on

January 2, 2015 using the proceeds from the certificate of deposit.

As a result, current liabilities decreased to $8,698,000 at

December 31, 2015 compared to $16,251,000 at December 31, 2014.

Shareholders' equity at December 31, 2015 was $25,180,000, or $4.69

per outstanding share. This compares to shareholders' equity at

December 31, 2014 of $26,154,000, or $4.88 per outstanding

share.

CEO Comments

Chairman and Chief Executive Officer Ernest A. Bates, M.D.,

said, "Our Gamma Knife business performed well in the fourth

quarter and 2015 overall, with gains in treatments, revenue and

operating income compared to 2014. We attribute this top and bottom

line growth to our hard work this past year to refine our cost

structure to improve operating margins, and increased utilization

by our hospital partners. Our efforts in these areas will continue

in the new year.

"Based on the hospital outpatient prospective payment rates for

2016 announced by the Centers for Medicare and Medicaid Services

(CMS), we estimate that the average CMS reimbursement rate for

delivery of Gamma Knife or LINAC one session cranial radiosurgery

and separately reimbursable ancillary codes (exclusive of

co-insurance and other adjustments) will decrease by approximately

10% compared to 2015. To put this in perspective, we estimate that

CMS’s Gamma Knife rate reduction would have reduced AMS' annualized

2015 revenue by approximately 2%. So with our operations running

increasingly efficiently and the impact of Medicare rate reductions

on our revenue likely to be minimal, we expect our Gamma Knife

business to deliver another solid performance in 2016.

"We look forward with enthusiasm to the initiation of patient

treatments next month at AMS' first proton therapy center now

nearing completion at The Marjorie and Leonard Williams Center for

Proton Therapy at UF Health Cancer Center-Orlando Health in

Florida. In a major milestone, the MEVION S250 at this center has

completed its rigorous acceptance testing and has entered the

clinical commissioning phase. Clinical commissioning is the final

step before the first patient is treated. During the rigorous

acceptance testing phase, the MEVION S250 in Orlando met or

exceeded all specifications. Its operational control has been

officially transitioned to the physics and radiation oncology

proton teams at UF Health Cancer Center.

"We recently announced that AMS has entered into a definitive

agreement for the financing of our Orlando center. We expect our

success in guiding this complex project from inception through

delivery and installation of the MEVION S250 proton system and the

placing of permanent financing to facilitate our negotiations with

other hospitals around the country that have expressed interest in

partnering with AMS to develop proton centers of their own. We

believe that the clinical advantages of proton therapy in the

treatment of a wide range of cancers will support rapid growth in

the application of this advanced therapeutic technology, and we are

convinced that AMS will be a significant beneficiary."

Earnings Conference Call

American Shared has scheduled a conference call at 12:00 p.m.

PDT (3:00 p.m. EDT) today. To participate in the live call, dial

(800) 351-9852 at least 5 minutes prior to the scheduled start

time, and mention confirmation number 42198893. A simultaneous

WebCast of the call may be accessed through the Company's website,

www.ashs.com, or www.streetevents.com (institutional investors). A

replay will be available for 30 days at these same internet

addresses, or by dialing 888-843-7419 and entering 42198893 when

prompted.

About AMS

American Shared Hospital Services provides turnkey technology

solutions for advanced radiosurgical and radiation therapy

services. AMS is the world leader in providing Gamma Knife

radiosurgery equipment, a non-invasive treatment for malignant and

benign brain tumors, vascular malformations and trigeminal

neuralgia (facial pain). The Company also offers proton therapy,

the latest IGRT and IMRT systems, as well as its proprietary

Operating Room for the 21st CenturySM concept. AMS owns a common

stock investment in Mevion Medical Systems, Inc., developer of the

compact MEVION S250 Proton Therapy System.

Safe Harbor Statement

This press release may be deemed to contain certain

forward-looking statements with respect to the financial condition,

results of operations and future plans of American Shared Hospital

Services, which involve risks and uncertainties including, but not

limited to, the risks of the Gamma Knife and radiation therapy

businesses, the risks of developing The Operating Room for the 21st

Century program, the risks of investing in Mevion Medical Systems,

Inc., and the risks of the timing, financing, and operations of the

Company’s proton therapy business. Further information on potential

factors that could affect the financial condition, results of

operations and future plans of American Shared Hospital Services is

included in the filings of the Company with the Securities and

Exchange Commission, including the Company's Annual Report on Form

10-K for the year ended December 31, 2014, its quarterly reports on

Form 10-Q for the three months ended March 31, 2015, June 30, 2015,

and September 30, 2015, and the definitive Proxy Statement for the

Annual Meeting of Shareholders held on June 16, 2015.

Selected Financial Data

(unaudited)

Summary of Operations Data Three

months ended

Twelve months ended December 31, December 31, 2015 2014 2015 2014

Medical services revenue $ 4,162,000 $ 3,992,000 $

16,548,000 $ 15,417,000 Costs of revenue 2,300,000

2,450,000 9,833,000 10,138,000

Gross margin 1,862,000 1,542,000 6,715,000 5,279,000 Selling

& administrative expense 792,000 838,000 3,496,000 3,630,000

Interest expense 339,000 323,000

1,239,000 1,699,000 Operating income(loss)

731,000 381,000 1,980,000 (50,000 )

(Loss) on write down of investment in

equity securities

(26,000 ) -- (2,140,000 ) -- (Loss) on sale of subsidiary -- -- --

(572,000 ) Gain on foreign currency transactions -- -- -- 161,000

Other income 4,000 6,000 18,000

28,000 Income(loss) before income taxes

709,000 387,000 (142,000 ) (433,000 ) Income tax expense

106,000 96,000 434,000

129,000 Net income(loss) $ 603,000 $ 291,000 $ (576,000 ) $

(562,000 )

Less: Net (income) loss attributable to

non-controlling interest

(326,000 ) (233,000 ) (946,000 )

(390,000 )

Net income(loss) attributable to American

Shared Hospital Services

$ 277,000 $ 58,000 $ (1,522,000 ) $ (952,000 )

Earnings(loss) per common share: Basic $ 0.05 $ 0.01

$ (0.28 ) $ (0.19 ) Assuming dilution $ 0.05 $ 0.01 $

(0.28 ) $ (0.19 )

Balance Sheet Data

December 31, 2015 2014 Cash and cash

equivalents $ 2,209,000 $ 1,059,000 Current assets $ 6,007,000 $

14,247,000 Certificate of deposit $ -- $ 9,000,000 Investment in

equity securities $ 579,000 $ 2,709,000 Total assets $ 54,114,000 $

67,528,000 Current liabilities $ 8,698,000 $ 16,251,000

Shareholders' equity $ 25,180,000 $ 26,154,000

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160329005316/en/

American Shared Hospital ServicesErnest A. Bates, M.D., (415)

788-5300Chairman and Chief Executive

Officereabates@ashs.comorBerkman AssociatesNeil Berkman, (310)

477-3118Presidentinfo@berkmanassociates.com

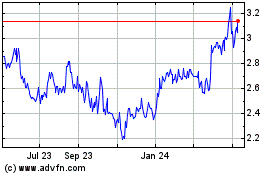

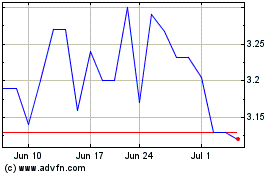

American Shared Hospital... (AMEX:AMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Shared Hospital... (AMEX:AMS)

Historical Stock Chart

From Apr 2023 to Apr 2024