American Shared Hospital Services Closes Sale of Its Gamma Knife Business in Turkey

June 10 2014 - 12:14PM

Business Wire

AMERICAN SHARED HOSPITAL SERVICES (NYSE MKT:AMS), a

leading provider of turnkey technology solutions for advanced

radiosurgical and radiation therapy services, announced today that

it has closed the sale of its Gamma Knife and Image Guided

Radiation Therapy (IGRT) services business in Turkey to Euromedic

Cancer Treatment Centers BV (Euromedic). Payment to AMS consisted

of cash, which will be used primarily to pay down debt associated

with the Turkey operations, and an earn-out based on future revenue

from the two Gamma Knife units and one IGRT unit AMS operated in

Istanbul and Adana, Turkey.

“We anticipate that the earn-out portion of the transaction may

generate considerable returns for AMS over the next few years,”

said AMS Chairman and Chief Executive Officer Ernest A. Bates,

M.D.

About AMS

American Shared Hospital Services provides turnkey technology

solutions for advanced radiosurgical and radiation therapy

services. AMS is the world leader in providing Gamma Knife

radiosurgery equipment, a non-invasive treatment for malignant and

benign brain tumors, vascular malformations and trigeminal

neuralgia (facial pain). The Company also offers the latest IGRT

and IMRT systems, as well as its proprietary Operating Room for the

21st CenturySM concept. AMS owns a common stock investment in

Mevion Medical Systems, Inc., developer of the compact MEVION S250

Proton Therapy System.

About Euromedic

Euromedic is one of the largest healthcare investors and

operators through Private Public Partnerships (PPP) in Europe. The

company performs best-in-class radiological diagnostic, clinical

laboratory and cancer care services in 145 wholly-owned medical

centers. The company is continually growing and driving treatment

delivery to areas where none yet exists.

Euromedic International is a Dutch holding company that employs

more than 3,000 medical professionals. The company operates

diagnostic, clinical laboratory and cancer care (radiotherapy)

centers in Poland, Hungary, Romania, Bosnia and Herzegovina,

Croatia, Greece, Italy, Turkey, the Czech Republic, Ireland,

Switzerland, Lithuania, Bulgaria and Portugal. Euromedic activities

are divided into three divisions - Euromedic Diagnostics, which

operates diagnostic centers, Euromedic Cancer Care Centres,

which provide state-of-the-art comprehensive cancer treatment

services, and Euromedic Labs, which provide high-quality laboratory

investigations. Euromedic is audited by E&Y and its centers

operate strictly according to the globally accepted standard – ISO

9001. Visit www.euromedic.com for more information.

The Company’s shareholders

Euromedic’s success is due to its commitment to using the best

technology available, employing the best local experts in their

field, and ultimately doing the best for the patient. However, it

is also due to exemplary corporate governance. The shareholders of

Euromedic are among the largest private equity groups in the world

and, together with Euromedic management, drive the success and

growth of the company.

Ares Life Sciences (Ares) is a Jersey-based

investment partnership established in 2008 with the backing of the

Bertarelli family. Ares focuses its investment activities

exclusively on revenue-generating life sciences companies,

primarily in Europe, with the presence or capacity to expand

internationally. In the life sciences sector, Ares' main interest

is in biotechnology, pharmaceuticals, medical technology and

healthcare services. Ares is advised by a team of experienced life

science and investment executives.

Visit www.areslifesciences.com for more information.

Montagu Private Equity is one of Europe’s leading

private equity firms. Founded in 1968, Montagu can look back on

more than 40 years’ experience, investing in more than 400

transactions. Montagu has a strong track record of supporting

portfolio companies, dedicating significant resource to management

teams, as well as providing additional capital expenditure to fund

further growth. Montagu also has considerable expertise in helping

businesses to accelerate their growth in their home markets, as

well as to internationalise and expand their customer base. This

approach has led to real growth across Montagu’s portfolio. The

firm has assets under management of €3.3 billion. Montagu invests

in businesses that operate in stable markets across Europe with

transaction values ranging from approximately €100 million to €1

billion. Visit www.montagu.com for more information.

Safe Harbor Statement

This press release may be deemed to contain certain

forward-looking statements with respect to the financial condition,

results of operations and future plans of American Shared Hospital

Services, which involve risks and uncertainties including, but not

limited to, the risks of the Gamma Knife and radiation therapy

businesses, the risks of developing The Operating Room for the 21st

Century program, and the risks of investing in a development-stage

company, Mevion Medical Systems, Inc. Further information on

potential factors that could affect the financial condition,

results of operations and future plans of American Shared Hospital

Services is included in the filings of the Company with the

Securities and Exchange Commission, including the Company's Annual

Report on Form 10-K for the year ended December 31, 2013, the

Quarterly Report on Form 10-Q for the quarter ended March 31, 2014

and the definitive Proxy Statement for the Annual Meeting of

Shareholders to be held on June 10, 2014.

American Shared Hospital ServicesErnest A. Bates, M.D.,

(415) 788-5300Chairman and Chief Executive

Officereabates@ashs.comorBerkman AssociatesNeil Berkman,

(310) 477-3118Presidentinfo@berkmanassociates.com

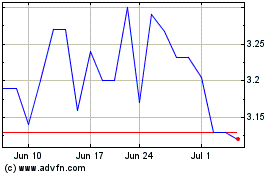

American Shared Hospital... (AMEX:AMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

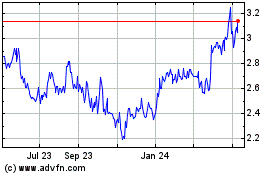

American Shared Hospital... (AMEX:AMS)

Historical Stock Chart

From Apr 2023 to Apr 2024