American Realty Investors, Inc. (NYSE: ARL), a Dallas-based real

estate investment company, today reported results of operations for

the second quarter ended June 30, 2017. The reported results are

directly related to the strategic initiative we embraced at the

onset of the year to grow our multi-family apartment base through

Abode Properties, our wholly owned subsidiary.

The growth in revenue and corresponding improvement in Net

Operating Income for the six months ended June 30, 2017

demonstrates the viability of our business strategy. Management

will continue its plan for growth from its operating properties and

expects to reinvest in areas that will complement this growth;

further management will maintain strong attention to all details of

its operations including appropriate expense controls.

During the six months ended June 30, 2017, a subsidiary of the

Company sold bonds on the Tel Aviv, Israel stock exchange. The

bonds will over time be repaid in Israeli shekels; however, upon

sale, the cash received was converted into approximately $102

million US dollars. The cash has been and will be used to pay off

more expensive debt, purchase existing assets, and develop new

multifamily housing projects. The company believes that this new

source of cash will have a substantial positive impact on the

ability of the company to grow as well as pay off relative

expensive shorter-term debt that will more than offset the

additional net interest expense.

The bonds will be repaid in Israeli Shekels as the bonds mature

at a rate of 20% each year from 2019 through 2023. Until such

actual payments are made, there will not be any significant need to

convert US dollars to Israeli shekels. The Company records

unrealized gains or losses each quarter based upon the relative

exchange values of the US dollar and the Israeli shekel; however,

no gain or loss will be realized until a conversion from US dollars

to Israeli shekels actually occurs in the future. The recorded

unrealized gain or loss is reflected as a separate line item to

highlight the fact that it is a non-cash transaction until actual

payment of principal and interest on the bonds is made.

For the three months ended June 30, 2017, we reported a net loss

applicable to common shares of $11.2 million or ($0.72) per diluted

loss per share compared to a net income applicable to common shares

of $2.4 million or $0.16 per diluted income per share for the same

period ended 2016. This is directly related to the increased

borrowing and we remain highly certain that dramatic additions to

the number of apartments within the portfolio during this strategic

growth period will ultimately enhance shareholder values, even

beyond the recent improvements we have experienced since we

announced this approach in Q4 2016.

The reported financial results are as follows.

“The Company’s strategic posture of maintaining a strong focus

on our multi-family portfolio has created valuable results. We are

committed to solidifying the portfolio and paying very close

attention to all operational details, while at the same time

maintaining our commitment to creating value. We believe our second

quarter 2016 operating results, combined with our recent

acquisitions, demonstrates yet another quarter of stabilized

performance for the Company. We believe the portfolio is well

positioned to deliver solid financial returns for the remainder of

2016”, said Danny Moos, the Company’s Chief Executive Officer and

President. “We are pleased that we are seeing continued

improvements in our operations from these endeavors and will

continue to adapt to market challenges with an eye on both near

term economic challenges and long-term prospects as the real estate

market improves.”

Revenues

Rental and other property revenues were $31.6 million for the

three months ended June 30, 2017. This represents an increase of

$0.8 million compared to the prior period revenues of $30.8

million. The change by segment is an increase in the apartment

portfolio of approximately $1.2 million, partially offset by a

decrease in the commercial portfolio of $0.4 million. We purchased

four and sold two multifamily properties over the prior year, which

resulted in a net increase of 203 units and was the primary reason

for the increase in our apartment portfolio revenues.

Expense

Property operating expenses were $15.4 million for the three

months ended June 30, 2017. This represents an increase of $0.2

million compared to the prior period operating expenses of $15.2

million. The change by segment was an increase in the other

portfolio of $0.1 million and increases of less than $0.1 million

in the commercial and apartment portfolios.

Depreciation and amortization expense was approximately $6.4

million for the three months ended June 30, 2017 for an increase of

$0.5 million compared to the prior period expense of $5.9 million.

The increase is primarily due to the growth in our apartment

portfolio over the past year.

Other income (expense)

Mortgage and loan interest expense was $17.3 million for the

three months ended June 30, 2017. This represents an increase of

$3.3 million compared to the prior period expense of $14 million.

The change by segment was increases of $4.5 million and $0.4

million in our corporate debt and commercial portfolios,

respectively, partially offset by decreases of $1.1 million and

$0.5 million in our apartment and land portfolios, respectively.

Interest expense for our corporate loans increased $4.5 million,

primarily due to interest expense related to the Israeli Series A

Bonds of $2.3 million and interest of $1.4 million on two other

corporate loans closed in 2016 and an increase of $0.7 million in

loan fee expense due to prepayment of a corporate loan. The

decrease of $1.1 million in interest expense on our apartment

portfolio was due to loan prepayment penalties paid during the

first three months of 2016 that exceeded the increase in interest

expense that resulted from the growth in our apartment

portfolio.

A subsidiary of the Company issued $104.5 million in bonds

during 2017 that will be repaid in Israeli Shekels. During the

three months ended June 30, 2017, the Company recorded an

unrealized foreign currency transaction loss of $3.4 million based

upon the relative exchange values of the US dollar and the Israeli

shekel as applied to the bond principal and accrued interest at

quarter-end. We did not have any unrealized foreign currency

transaction gain or loss during the three months ended June 30,

2016.

Gain on sale of income-producing properties was $5.2 million for

the three months ended June 30, 2016. The Company sold one

apartment community located in Irving, Texas to an independent

third party for a total sales price of $8.1 million, which resulted

in a gain of $5.2 million. There were no sales of income-producing

properties during the three months ended June 30, 2017.

During the second quarter of 2017, we recorded a loss on land

sales of $0.5 million from the sale of two parcels totaling 8.3

acres for an aggregate sales price of $0.5 million. During the same

period of 2016, we recorded a gain on land sales of $1.7 million

for the sale of 12.2 acres of land for a total sales price of $3.1

million.

About American Realty Investors, Inc.

American Realty Investors (www.americanrealtyinvest.com)

maintains a strong emphasis on creating greater shareholder value

through acquisition, financing, operation, developing and the

selective sale of real estate across selective geographic regions

in the United States. A New York Stock Exchange company, American

Realty Investors is traded under the symbol “ARL”. American Realty

Investors produces revenue through the professional management of

apartments, office buildings and select parcels of land that can be

readily developed in the near term. Value is added under American

Realty Investors ownership, and the properties are repositioned

into higher classifications through physical improvements and

improved management. Transcontinental also develops new properties,

such as luxury apartment homes principally on land it owns or

acquires.

AMERICAN REALTY INVESTORS, INC. CONSOLIDATED

STATEMENTS OF OPERATIONS (unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2017 2016 2017

2016 (dollars in thousands, except per share amounts)

Revenues: Rental and other property revenues (including $199

and $174 for the three months and $389 and $347 for the six months

ended 2017 and 2016, respectively, from related parties) $ 31,587 $

30,834 $ 63,409 $ 60,039

Expenses: Property operating

expenses (including $239 and $231 for the three months and $476 and

$441 for the six months ended 2017 and 2016, respectively, from

related parties) 15,429 15,191 31,693 30,407 Depreciation and

amortization 6,409 5,868 12,739 11,698 General and administrative

(including $1,185 and $942 for the three months and $2,367 and

$1,860 for the six months ended 2017 and 2016, respectively, from

related parties) 1,995 2,412 4,026 4,437 Net income fee to related

party 77 54 137 126 Advisory fee to related party 2,849

2,687 5,508 5,425

Total operating expenses 26,759 26,212

54,103 52,093 Net operating income

4,828 4,622 9,306 7,946

Other income (expenses):

Interest income (including $4,972 and $4,504 for the three months

and $9,092 and $10,029 for the six months ended 2017 and 2016,

respectively, from related parties) 5,059 4,788 9,852 10,079 Other

income (116 ) 902 1,327 1,200 Mortgage and loan interest (including

$1,683 and $1,355 for the three months and $3,195 and $2,447 for

the six months ended 2017 and 2016, respectively, from related

parties) (17,347 ) (13,975 ) (34,143 ) (28,189 ) Earnings from

unconsolidated subsidiaries and investees 153 129 208 284 Foreign

currency transaction loss (3,425 ) -

(3,747 ) - Total other expenses (15,676 )

(8,156 ) (26,503 ) (16,626 ) Loss before gains

on sale of income producing properties and land, non-controlling

interest, and taxes (10,848 ) (3,534 ) (17,197 ) (8,680 ) Gain on

sale of income-producing properties - 5,168 - 4,925 Gain (loss) on

land sales (476 ) 1,719 (31 )

3,370 Net income (loss) from continuing operations

before taxes (11,324 ) 3,353 (17,228 ) (385 ) Income tax benefit

- - - 1 Net

income (loss) from continuing operations (11,324 ) 3,353 (17,228 )

(384 ) Discontinued operations: Net income from discontinued

operations - - - 3 Income tax expense from discontinued operations

- - - (1 ) Net

income from discontinued operations - -

- 2 Net income (loss) (11,324 ) 3,353

(17,228 ) (382 ) Net (income) loss attributable to non-controlling

interest 435 (864 ) 628

(334 ) Net income (loss) attributable to American Realty Investors,

Inc. (10,889 ) 2,489 (16,600 ) (716 ) Preferred dividend

requirement (275 ) (53 ) (550 ) (550 )

Net income (loss) applicable to common shares $ (11,164 ) $ 2,436

$ (17,150 ) $ (1,266 )

Earnings per share -

basic Net income (loss) from continuing operations $ (0.72 ) $

0.16 $ (1.11 ) $ (0.08 )

Earnings per share -

diluted Net income (loss) from continuing operations $ (0.72 )

$ 0.16 $ (1.11 ) $ (0.08 ) Weighted average common

shares used in computing earnings per share 15,514,360 15,514,360

15,514,360 15,514,360 Weighted average common shares used in

computing diluted earnings per share 15,514,360 15,514,360

15,514,360 15,514,360

Amounts attributable to

American Realty Investors, Inc. Net income (loss) from

continuing operations $ (10,889 ) $ 2,489 $ (16,600 ) $ (718 ) Net

income from discontinued operations - -

- 2 Net income (loss) applicable to

American Realty Investors, Inc. $ (10,889 ) $ 2,489 $

(16,600 ) $ (716 )

AMERICAN REALTY INVESTORS, INC. CONSOLIDATED BALANCE

SHEETS June 30, December 31,

2017 2016 (unaudited) (dollars in

thousands, except share and par value amounts) Assets

Real estate, at cost $ 1,102,963 $ 1,017,684 Real estate subject to

sales contracts at cost, net of depreciation 5,384 48,919 Less

accumulated depreciation (177,700 ) (165,597 ) Total

real estate 930,647 901,006 Notes and interest receivable

Performing (including $99,793 in 2017 and $128,548 in 2016 from

related parties) 123,911 143,601 Less allowance for doubtful

accounts (including $17,037 in 2017 and 2016 from related parties)

(17,037 ) (17,037 ) Total notes and interest

receivable 106,874 126,564 Cash and cash equivalents 58,260 17,522

Restricted cash 37,585 38,399 Investments in unconsolidated

subsidiaries and investees 6,294 6,087 Receivable from related

party 30,913 24,672 Other assets 62,163 60,659

Total assets $ 1,232,736 $ 1,174,909

Liabilities and Shareholders’ Equity Liabilities: Notes and

interest payable $ 826,309 $ 845,107

Notes related to real estate held for

sale

376 376

Notes related to real estate subject to

sales contracts

4,012 5,612 Bond and bond interest payable 104,505 - Deferred

revenue (including $70,915 in 2017 and $70,935 in 2016 from sales

to related parties) 91,087 91,380 Accounts payable and other

liabilities (including $10,769 in 2017 and $10,854 in 2016 to

related parties) 48,303 56,303

1,074,592 998,778 Shareholders’ equity: Preferred stock,

Series A: $2.00 par value, authorized 15,000,000 shares, issued and

outstanding 2,000,614 shares in 2017 and 2016 (liquidation

preference $10 per share), including 900,000 shares in 2017 and

2016 held by ARL or subsidiaries. 2,205 2,205 Common stock, $0.01

par value, authorized 100,000,000 shares; issued 15,930,145 and

14,443,404 shares; outstanding 15,514,360 and 14,027,619 shares in

2017 and 2016, respectively; including 140,000 shares held by TCI

(consolidated) in 2017 and 2016. 159 159 Treasury stock at cost;

415,785 shares in 2016 and 2015, and 140,000 shares held by TCI

(consolidated) as of 2017 and 2016 (6,395 ) (6,395 ) Paid-in

capital 110,751 111,510 Retained earnings (2,202 )

14,398 Total American Realty Investors, Inc. shareholders'

equity 104,518 121,877 Non-controlling interest 53,626

54,254 Total shareholders' equity

158,144 176,131 Total liabilities and

shareholders' equity $ 1,232,736 $ 1,174,909

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170814006017/en/

American Realty Investors, Inc.Investor

RelationsGene Bertcher,

800-400-6407investor.relations@americanrealtyinvest.com

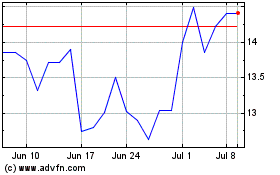

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Mar 2024 to Apr 2024

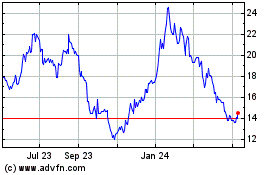

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Apr 2023 to Apr 2024