American Realty Investors, Inc. (NYSE:ARL), a Dallas-based real

estate investment company, today reported results of operations for

the fourth quarter ended December 31, 2016. For the three months

ended December 31, 2016, the Company reported net income applicable

to common shares of $1.5 million or $0.09 per diluted earnings per

share, as compared to net loss applicable to common shares of $1.6

million or ($0.11) per diluted earnings per share for the same

period ended 2015.

For the twelve months ended December 31, 2016, we reported a net

loss applicable to common shares of $3.8 million or ($0.25) per

diluted earnings per share, as compared to a net loss applicable to

common shares of $3.2 million or ($0.21) per diluted earnings per

share for the same period ended 2015. The current year net loss

applicable to common shares of $3.8 million includes gain on sales

of income-producing properties of $16.2 million and gain on land

sales of $3.1 million, compared to the prior year net loss

applicable to common shares of $3.2 million, which includes gain on

land sales of $21.6 million, provision on the impairment of real

estate assets of $5.3 million and net income from discontinued

operations of $0.9 million.

Rental and other property revenues were $119.7 million for the

year ended December 31, 2016. This represents an increase of $15.5

million compared to the prior year revenues of $104.2 million. The

change by segment is an increase in the apartment portfolio of

$13.0 million and an increase in the commercial portfolio of $2.5

million. The increase in the apartment and commercial portfolios is

mainly due to the acquisition of new properties. Our apartment

portfolio continues to excel in the current economic conditions

with occupancies averaging over 92% and increasing rental rates. We

have been able to surpass expectations due to the high-quality

product offered, strength of our management team and our commitment

to our tenants. The increase in the commercial segment is also due

to an increase in rental rates and maintaining an average occupancy

rate of 85% in the commercial complexes in 2016. We anticipate that

our commercial portfolio will continue to improve as the Company

has been successful in attracting high-quality tenants and expects

to continue to see the benefits of those new leases in the

future.

Property operating expenses were $63.0 million for the year

ended December 31, 2016. This represents an increase of $9.0

million compared to the prior year operating expenses of $54.0

million. The change by segment is an increase in the apartment

portfolio of $5.8 million and an increase in the commercial

portfolio of $2.6 million. We added a net 2,145 apartment units

during 2015 and 723 during 2016 resulting in a $5.8 million

increase in the apartment portfolio. The increase in our commercial

portfolio was primarily due to the acquisition of an office

building in Houston, Texas late in the second quarter of 2015.

Depreciation and amortization expenses were $23.8 million for

the year ended December 31, 2016. This represents an increase of

$2.4 million compared to prior year depreciation of $21.4 million.

The increase is primarily due to the growth in our apartment

portfolio.

General and administrative expenses were $7.1 million dollars

for the year ended December 31, 2016. This represents an increase

of $0.2 million compared to the prior year general and

administrative expenses of $6.9 million.

There was no provision for impairment of notes receivable,

investment in real estate partnerships and real estate assets for

the year ended December 31, 2016 as compared to the prior year

provision of $5.3 million for our golf course and related assets

located in the U.S. Virgin Islands. This impairment was due to the

decision to sell the development parcels in the U.S. Virgin Islands

which resulted in a decrease in the estimated fair value of the

remaining assets.

Net income fee was $0.3 million for the year ended December 31,

2016, which represents a decrease of $0.2 million compared to the

prior year net income fee of $0.5 million. The net income fee paid

to Pillar is calculated at 7.5% of net income.

Advisory fees were $10.9 million for the year ended December 31,

2016, for an increase of $1.1 million compared to the prior year

advisory fees of $9.8 million. Advisory fees are computed based on

a gross asset fee of 0.0625% per month (0.75% per annum) of the

average of the gross asset value.

Interest income was $20.5 million for the year ending December

31, 2016. This represents an increase of $3.8 million compared to

the prior year interest income of $16.7 million dollars. This

increase was primarily due to an increase in amount receivable owed

from our Advisor.

Other income was $2.1 million for the year ending December 31,

2016. This represents a decrease of $2.0 million compared to prior

year other income of $4.1 million. The decrease is primarily due to

a property with a negotiated settlement of a debt with the lender

during 2015.

Mortgage and loan interest expense was $59.4 million for the

year ended December 31, 2016. This represents an increase of $6.9

million compared to the prior year expense of $52.5 million. The

change by segment is an increase in the other portfolio of $7.4

million, an increase in the apartment portfolio of $1.7 million and

an increase in the commercial portfolio of $0.3 million, partially

offset by a decrease in the land portfolio of $2.5 million. Within

the other portfolio, the majority of the increase is due to

incurring two new mezzanine debt obligations during 2015. Within

the apartment and commercial portfolios, the majority of the

increase is due to the acquisition of new properties, partially

offset by loan refinancing at lower rates.

Gain on sale of income-producing properties was $16.2 million

for the year ended December 31, 2016. During 2016, we sold two

apartment communities for a total sales price of $20.4 million and

recorded an aggregate gain of $16.4 million from the sale of these

two properties. We also sold an industrial warehouse that resulted

in a loss of $0.2 million.

Gain on land sales was $3.1 million and $21.6 million for the

years ended December 31, 2016 and 2015, respectively. During 2016,

we sold a combined 129.7 acres of land for a total sales price of

$29.1 million and recorded an aggregate gain of $3.1 million.

During 2015, we sold approximately 595 acres of land for a total

sales price of $107.3 million and recorded a gain of $18.9 million.

In addition, we recognized $2.7 million in deferred gain from prior

years land sales during the year ended December 31, 2015.

About American Realty Investors, Inc.

American Realty Investors, Inc., a Dallas-based real estate

investment company, holds a diverse portfolio of equity real estate

located across the U.S., including office buildings, apartments,

shopping centers, and developed and undeveloped land. The Company

invests in real estate through direct ownership, leases and

partnerships and invests in mortgage loans on real estate. The

Company also holds mortgage receivables. For more information,

visit the Company’s website at www.americanrealtyinvest.com.

AMERICAN REALTY INVESTORS, INC.

CONSOLIDATED BALANCE SHEETS December

31, December 31, 2016

2015 (dollars in thousands, except share and par

value amounts) Assets Real estate, at cost $ 1,017,684 $

954,390 Real estate subject to sales contracts at cost, net of

depreciation ($0 in 2016 and $0 in 2015) 48,919 49,155 Less

accumulated depreciation (165,597 ) (150,038 ) Total

real estate 901,006 853,507 Notes and interest receivable

Performing (including $125,799 in 2016 and $125,915 in 2015 from

related parties) 143,601 137,280 Less allowance for estimated

losses (including $15,537 in 2016 and $15,537 in 2015 from related

parties) (17,037 ) (17,037 ) Total notes and interest

receivable 126,564 120,243 Cash and cash equivalents 17,522 15,232

Restricted cash 38,399 45,711 Investments in unconsolidated

subsidiaries and investees 6,087 8,365 Receivable from related

party 24,672 28,147 Other assets 60,659 46,163

Total assets $ 1,174,909 $ 1,117,368

Liabilities and Shareholders’ Equity Liabilities: Notes and

interest payable $ 845,107 $ 797,962 Notes related to assets held

for sale 376 376 Notes related to assets subject to sales contracts

5,612 6,422 Deferred revenue (including $70,935 in 2016 and $70,892

in 2015 from sales to related parties) 91,380 91,336 Accounts

payable and other liabilities (including $10,854 in 2016 and $7,236

in 2015 to related parties) 56,303 44,383

998,778 940,479 Shareholders’ equity: Preferred

stock, Series A: $2.00 par value, authorized 15,000,000 shares,

issued and outstanding 2,000,614 shares in 2016 and 2015

(liquidation preference $10 per share), including 900,000 shares in

2016 and 2015 held by ARL 2,205 2,205 Common stock, $0.01 par

value, authorized 100,000,000 shares; issued 15,930,145 shares and

outstanding 15,514,360 shares in 2016 and 2015, including 140,000

shares held by TCI (consolidated) in 2016 and 2015 159 156 Treasury

stock at cost; 415,785 shares in 2016 and 2015, and 140,000 shares

held by TCI (consolidated) as of 2016 and 2015 (6,395 ) (6,395 )

Paid-in capital 111,510 109,861 Retained earnings 14,398

17,130 Total American Realty Investors, Inc.

shareholders' equity 121,877 122,957 Non-controlling interest

54,254 53,932 Total equity

176,131 176,889 Total liabilities and equity $

1,174,909 $ 1,117,368

AMERICAN REALTY INVESTORS, INC. CONSOLIDATED STATEMENTS

OF OPERATIONS For the Years Ended December 31,

2016 2015

2014 (dollars in thousands, except per share

amounts) Revenues: Rental and other property revenues

(including $708, $726 and $701 for the year ended 2016, 2015 and

2014, respectively, from related parties) $ 119,663 $ 104,188 $

79,412

Expenses: Property operating expenses

(including $900, $770 and $645 for the year ended 2016, 2015 and

2014, respectively, from related parties) 62,950 54,002 42,124

Depreciation 23,785 21,418 17,593 General and administrative

(including $4,053, $3,855 and $3,628 for the year ended 2016, 2015

and 2014, respectively, from related parties) 7,119 6,893 10,282

Provision on impairment of real estate assets - 5,300 - Net income

fee to related party 257 492 3,669 Advisory fee to related party

10,918 9,775 8,943 Total

operating expenses 105,029 97,880

82,611 Operating income (loss) 14,634 6,308 (3,199 )

Other income (expense): Interest income (including

$18,864, $15,859 and $19,029 for the year ended 2016, 2015 and

2014, respectively, from related parties) 20,453 16,674 20,054

Other income 2,091 4,106 1,415 Mortgage and loan interest

(including $5,300, $3,774 and $3,660 for the year ended 2016, 2015

and 2014, respectively, from related parties) (59,362 ) (52,477 )

(40,826 ) Loss on the sale of investments - (1 ) (92 ) Earnings

from unconsolidated subsidiaries and investees 493 428 347

Litigation settlement - (352 ) 3,591

Total other expenses (36,325 ) (31,622 )

(15,511 ) Loss before gain on sales, non-controlling

interest and taxes (21,691 ) (25,314 ) (18,710 ) Gain on sale of

income-producing properties 16,207 - - Gain on land sales

3,121 21,648 561 Loss from

continuing operations before tax (2,363 ) (3,666 ) (18,149 ) Income

tax benefit (expense) (46 ) (517 ) 20,413

Net income (loss) from continuing operations (2,409 )

(4,183 ) 2,264 Discontinued operations: Income

(loss) from discontinued operations (2 ) 644 (3,557 ) Gain on sale

of real estate from discontinued operations - 735 61,879 Income tax

expense from discontinued operations 1 (483 )

(20,413 ) Net income from discontinued operations (1 ) 896

37,909 Net income (loss) (2,410 ) (3,287 ) 40,173 Net (income) loss

attributable to non-controlling interests (322 )

1,327 (9,288 ) Net income (loss) attributable

to American Realty Investors, Inc. (2,732 ) (1,960 ) 30,885

Preferred dividend requirement (1,101 ) (1,216 )

(2,043 ) Net income (loss) applicable to common shares $

(3,833 ) $ (3,176 ) $ 28,842

Earnings per share -

basic Loss from continuing operations $ (0.25 ) $ (0.27 ) $

(0.71 ) Income from discontinued operations -

0.06 2.99 Net income (loss) applicable to

common shares $ (0.25 ) $ (0.21 ) $ 2.28

Earnings

per share - diluted Loss from continuing operations $ (0.25 ) $

(0.27 ) $ (0.71 ) Income from discontinued operations -

0.06 2.99 Net income (loss)

applicable to common shares $ (0.25 ) $ (0.21 ) $ 2.28

Weighted average common shares used in computing earnings

per share 15,514,360 15,111,107 12,683,956 Weighted average common

shares used in computing diluted earnings per share 15,514,360

15,111,107 12,683,956

Amounts attributable to

American Realty Investors, Inc. Loss from continuing operations

$ (2,731 ) $ (2,856 ) $ (7,024 ) Income from discontinued

operations (1 ) 896 37,909 Net

income (loss) $ (2,732 ) $ (1,960 ) $ 30,885

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170403006540/en/

American Realty Investors, Inc.Investor

RelationsGene Bertcher,

800-400-6407investor.relations@americanrealtyinvest.com

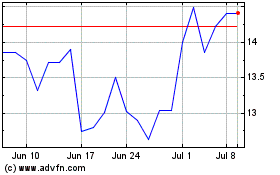

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Mar 2024 to Apr 2024

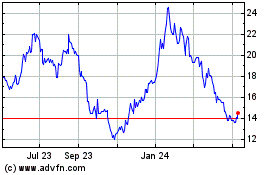

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Apr 2023 to Apr 2024