American Realty Investors, Inc. (NYSE:ARL), a Dallas-based real

estate investment company, today reported results of operations for

the fourth quarter ended December 31, 2015. For the three months

ended December 31, 2015, the Company reported net loss applicable

to common shares of $1.6 million or $0.11 per diluted earnings per

share, as compared to net income applicable to common shares of

$26.7 million or $1.91 per diluted earnings per share for the same

period ended 2014.

For the twelve months ended December 31, 2015, we reported a net

loss applicable to common shares of ($3.2) million or ($0.21) per

diluted earnings per share, as compared to a net income applicable

to common shares of $28.8 million or $2.28 per diluted earnings per

share for the same year ended 2014. The current year net loss

applicable to common shares of ($3.2) million includes gain on land

sales of $21.6 million, provision on the impairment of real estate

assets of $5.3 million and net income from discontinued operations

of $0.9 million, as compared to the prior year net income

applicable to common shares of $28.8 million, which includes a gain

on land sales of $0.6 million, and net income from discontinued

operations of $37.9 million.

Rental and other property revenues were $104.2 million for the

twelve months ended December 31, 2015. This represents an increase

of $24.8 million, as compared to the prior year revenues of $79.4

million. This change, by segment, is an increase in the apartment

portfolio of $14.7 million and an increase in the commercial

portfolio of $10.1 million. The increase in the apartment and

commercial portfolios is mainly due to the acquisition of new

properties. Our apartment portfolio continues to excel in the

current economic conditions with occupancies averaging over 94% and

increasing rental rates. We have been able to surpass expectations

due to the high-quality product offered, strength of our management

team and our commitment to our tenants. The increase in the

commercial segment is also due to a high rise in the occupancy rate

of the commercial complexes, in 2015 the average occupancy rate was

over 86%. Our commercial portfolio is performing significantly

better than in previous periods and we anticipate that it will

continue to improve as the Company has been successful in

attracting high-quality tenants and expects to continue to see the

benefits of those new leases in the future. We continue to work

aggressively to attract new tenants and strive for continuous

improvement of our properties in order to maintain our existing

tenants.

Property operating expenses were $54.0 million for the twelve

months ended December 31, 2015. This represents an increase of

$11.9 million, as compared to the prior year operating expenses of

$42.1 million. This change, by segment, is an increase in the

apartment portfolio of $7.4 million and an increase in the

commercial portfolio of $4.7 million. Within the apartment

portfolio, there was an increase of $5.9 million in the acquired

properties portfolio, and an increase $1.5 million in the same

property portfolio. Within the commercial portfolio, there was an

increase of $3.6 million in the acquired properties portfolio and

an increase of $1.1 million in the same store properties. The

increase in the apartment portfolio was due to the acquisition of

new properties throughout the year. The increase in the commercial

portfolio was due to an acquisition of a property within the year

and an increase in real estate taxes.

Depreciation and amortization expenses were $21.4 million for

the twelve months ended December 31, 2015. This represents an

increase of $3.8 million as compared to prior year depreciation of

$17.6 million. Within the apartment and commercial portfolios, the

majority of this change is due to the acquisition of new properties

and an increase in tenant improvements and repairs projects.

General and administrative expenses were $6.9 million for the

twelve months ended December 31, 2015. This represents a decrease

of $3.4 million, as compared to the prior year general and

administrative expenses of $10.3 million. The majority of this

change is due to decreases in legal expenses and franchise taxes in

the current year.

The provision for impairment of notes receivable, investment in

real estate partnerships, and real estate assets was $5.3 million

for the year ended December 31, 2015. There was no provision for

impairment expense in the prior year. For the year ended, the

Company provided an impairment of $5.3 million for the golf course

and related assets located in the U.S. Virgin Islands. This

impairment relates to the decision to sell the development parcels

in the U.S. Virgin Islands and the resultant decrease in the

estimated fair value of the remaining assets.

Net income fee was $0.5 million for the twelve months ended

December 31, 2015. This represents a decrease of $3.2 million, as

compared to the prior year net income fee of $3.7 million. The net

income fee paid to Pillar is calculated at 7.5% of net income.

Advisory fees were $9.8 million for the twelve months ended

December 31, 2015. This represents an increase of $0.9 million, as

compared to the prior year advisory fees of $8.9 million. Advisory

fees are computed based on a gross asset fee of 0.0625% per month

(0.75% per annum) of the average of the gross asset value.

Interest income was $16.7 million for the twelve months ended

December 31, 2015. This represents a decrease of $3.4 million, as

compared to the prior year interest income of $20.1 million. The

majority of this decrease is due to the recognition of

uncollectable interest in the prior year on notes receivable.

Other income was $4.1 million for the twelve months ended

December 31, 2015. This represents an increase of $2.7 million as

compared to the prior year other income of $1.4 million. The

increase is primarily due to a property with a negotiated

settlement of a debt with the lender.

Mortgage and loan interest expense was $47.5 million for the

twelve months ended December 31, 2015. This represents an increase

of $9.5 million, as compared to the prior year expense of $38.0

million. This change by segment is an increase in the apartment

portfolio of $2.0 million, an increase in the commercial portfolio

of $0.9 million, and an increase in the other portfolio of $6.6

million. Within the apartment and commercial portfolios, the

majority of the increase is due to the acquisition of new

properties, offset by loan refinancing at lower rates. Within the

other portfolio, the majority of the increase is due to incurring

new mezzanine debt obligations.

Loan charges and prepayment penalties were $5.0 million for the

twelve months ended December 31, 2015. This represents an increase

of $2.1 million, as compared to the prior year expense of $2.9

million. This change is mainly due to refinancing and prepayment

penalties made on some of our existing loans.

Litigation settlement expenses were $0.4 million for the twelve

months ended December 31, 2015. This represents an increase of $3.9

million, as compared to the prior year credit of $3.6 million. This

variance is due to the settlement of a debt resulting in a gain of

$3.5 million in the prior year.

Gain on land sales was $21.6 million for the twelve months ended

December 31, 2015. In the current year, we sold approximately 595

acres of land in eleven transactions for a sales price of $107.3

million and recorded a gain of $18.9 million. In addition, we

recognized $2.7 million in deferred gain from prior years’ land

sales.

About American Realty Investors, Inc.

American Realty Investors, Inc., a Dallas-based real estate

investment company, holds a diverse portfolio of equity real estate

located across the U.S., including office buildings, apartments,

shopping centers, and developed and undeveloped land. The Company

invests in real estate through direct ownership, leases and

partnerships and invests in mortgage loans on real estate. The

Company also holds mortgage receivables. For more information,

visit the Company’s website at www.americanrealtyinvest.com.

AMERICAN REALTY INVESTORS, INC. CONSOLIDATED

STATEMENTS OF OPERATIONS

For the Years Ended December 31, 2015

2014 2013 (dollars in thousands, except per share

amounts) Revenues: Rental and other property revenues

(including $726, $701 and $670 for the year ended 2015, 2014 and

2013, respectively, from related parties) $ 104,188 $ 79,412 $

80,750

Expenses: Property operating expenses

(including $770, $645 and $699 for the year ended 2015, 2014 and

2013, respectively, from related parties) 54,002 42,124 39,318

Depreciation 21,418 17,593 15,954 General and administrative

(including $3,855, $3,628 and $3,646 for the year ended 2015, 2014

and 2013, respectively, from related parties) 6,893 10,282 7,919

Provision on impairment of notes receivable and real estate assets

5,300 - 18,980 Net income fee to related party 492 3,669 4,089

Advisory fee to related party 9,775 8,943

10,166 Total operating expenses 97,880

82,611 96,426 Operating income

(loss) 6,308 (3,199 ) (15,676 )

Other income

(expense): Interest income (including $15,859, $19,029 and

$19,110 for the year ended 2015, 2014 and 2013, respectively, from

related parties) 16,674 20,054 19,445 Other income 4,106 1,415

10,163 Mortgage and loan interest (including $3,774, $3,660 and

$3,927 for the year ended 2015, 2014 and 2013, respectively, from

related parties) (47,512 ) (37,972 ) (39,110 ) Loan charges and

prepayment penalties (4,965 ) (2,854 ) (5,557 ) Loss on the sale of

investments (1 ) (92 ) (283 ) Earnings from unconsolidated

subsidiaries and investees 428 347 391 Litigation settlement

(352 ) 3,591 (20,313 ) Total other expenses

(31,622 ) (15,511 ) (35,264 ) Loss before gain

(loss) on land sales, non-controlling interest, and taxes (25,314 )

(18,710 ) (50,940 ) Gain (loss) on land sales 21,648

561 (455 ) Loss from continuing operations

before tax (3,666 ) (18,149 ) (51,395 ) Income tax benefit

(expense) (517 ) 20,413 40,513

Net income (loss) from continuing operations (4,183 )

2,264 (10,882 ) Discontinued operations: Income

(loss) from discontinued operations 644 (3,557 ) (2,634 ) Gain on

sale of real estate from discontinued operations 735 61,879 98,951

Income tax benefit (expense) from discontinued operations

(483 ) (20,413 ) (33,711 ) Net income (loss) from

discontinued operations 896 37,909 62,606 Net income (loss) (3,287

) 40,173 51,724 Net income (loss) attributable to non-controlling

interests 1,327 (9,288 ) (10,448 ) Net

income (loss) attributable to American Realty Investors, Inc.

(1,960 ) 30,885 41,276 Preferred dividend requirement (1,216

) (2,043 ) (2,452 ) Net income (loss) applicable to

common shares $ (3,176 ) $ 28,842 $ 38,824

Earnings per share - basic Loss from continuing operations $

(0.27 ) $ (0.71 ) $ (2.07 ) Income (loss) from discontinued

operations 0.06 2.99 5.43

Net income (loss) applicable to common shares $ (0.21 ) $ 2.28

$ 3.36

Earnings per share - diluted

Loss from continuing operations $ (0.27 ) $ (0.71 ) $ (2.07 )

Income (loss) from discontinued operations 0.06

2.99 5.43 Net income (loss) applicable

to common shares $ (0.21 ) $ 2.28 $ 3.36

Weighted average common shares used in computing earnings per share

15,111,107 12,683,956 11,525,389 Weighted average common shares

used in computing diluted earnings per share 15,111,107 12,683,956

11,525,389

Amounts attributable to American Realty

Investors, Inc. Loss from continuing operations $ (2,856 ) $

(7,024 ) $ (21,330 ) Income (loss) from discontinued operations

896 37,909 62,606 Net

income (loss) $ (1,960 ) $ 30,885 $ 41,276

AMERICAN REALTY INVESTORS, INC. CONSOLIDATED

BALANCE SHEETS

December 31, December 31, 2015 2014

(dollars in thousands, except share and par value amounts)

Assets Real estate, at cost $ 954,390 $ 810,214 Real estate

subject to sales contracts at cost, net of depreciation ($0 in 2015

and $2,300 in 2014) 49,155 19,026 Less accumulated depreciation

(150,038 ) (129,477 ) Total real estate 853,507

699,763 Notes and interest receivable Performing (including

$125,915 in 2015 and $139,466 in 2014 from related parties) 137,280

149,484 Non-performing - 3,161 Less allowance for estimated losses

(including $15,537 in 2015 and $15,537 in 2014 from related

parties) (17,037 ) (18,279 ) Total notes and interest

receivable 120,243 134,366 Cash and cash equivalents 15,232 12,299

Restricted cash 45,711 49,266 Investments in unconsolidated

subsidiaries and investees 8,365 4,279 Receivable from related

party 28,147 21,414 Other assets 46,163 44,111

Total assets $ 1,117,368 $ 965,498

Liabilities and Shareholders’ Equity Liabilities: Notes and

interest payable $ 797,962 $ 638,891 Notes related to assets held

for sale 376 1,552 Notes related to assets subject to sales

contracts 6,422 18,616 Deferred revenue (including $70,892 in 2015

and $72,564 in 2014 from sales to related parties) 91,336 74,409

Accounts payable and other liabilities (including $7,236 in 2015

and $11,024 in 2014 to related parties) 44,383

52,442 940,479 785,910 Shareholders’ equity:

Preferred stock, Series A: $2.00 par value, authorized 15,000,000

shares, issued and outstanding 2,000,614 and 2,461,252 shares in

2015 and 2014, respectively (liquidation preference $10 per share),

including 900,000 shares in 2015 and 2014 held by ARL. 2,205 3,126

Common stock, $0.01 par value, authorized 100,000,000 shares;

issued 15,930,145 and 14,443,404 shares and outstanding 15,514,360

and 14,027,619 shares in 2015 and 2014, respectively; including

140,000 shares held by TCI (consolidated) in 2015 and 2014. 156 141

Treasury stock at cost; 415,785 shares in 2015 and 2014, and

140,000 shares held by TCI (consolidated) as of 2015 and 2014.

(6,395 ) (6,395 ) Paid-in capital 109,861 108,378 Retained earnings

17,130 19,090 Total American Realty

Investors, Inc. shareholders' equity 122,957 124,340

Non-controlling interest 53,932 55,248

Total equity 176,889 179,588 Total

liabilities and equity $ 1,117,368 $ 965,498

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160330006283/en/

American Realty Investors, Inc.Investor

RelationsGene Bertcher,

800-400-6407investor.relations@americanrealtyinvest.com

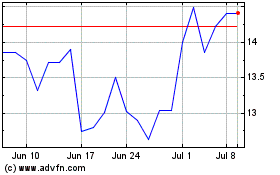

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Mar 2024 to Apr 2024

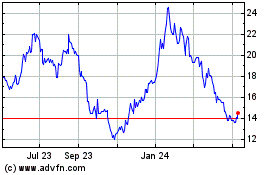

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Apr 2023 to Apr 2024