American Realty Investors, Inc. (NYSE:ARL), a Dallas-based real

estate investment company, today reported results of operations for

the fourth quarter ended December 31, 2014. For the three months

ended December 31, 2014, the Company reported net income applicable

to common shares of $26.7 million or $1.91 per diluted earnings per

share, as compared to net income applicable to common shares of

$38.4 million or $3.33 per diluted earnings per share for the same

period ended 2013.

For the twelve months ended December 31, 2014, we reported net

income applicable to common shares of $28.8 million or $2.28 per

diluted earnings per share, as compared to net income applicable to

common shares of $38.8 million or $3.36 per diluted earnings per

share for the same period ended 2013.

The current year net, income applicable to common shares of

$28.8 million includes $17.6 million of depreciation expense, a

credit of $3.6 million of litigation settlement expense and gains

from the sales of real estate holdings of $62.4 million.

Management’s efforts to enhance the value of our overall

portfolio has resulted in the continuing improvement in the

Company’s results of operations. We continue to see growth in the

multifamily market with increasing rents, stable operating

expenses, and an occupancy rate over 94%. We are diligent in our

mission to provide high-quality living opportunities to our

tenants.

In our commercial portfolio, we are seeing the benefit of our

efforts with new leases executed and increasing rents as first year

concessions expire. We believe that we will continue to see growth

in our commercial portfolio as the economic conditions improve and

we capitalize on the influx of attractive prospects in the

pipeline.

Our ability to take advantage of lower-interest rate mortgages

available has reduced our monthly obligations and increased cash

flow within our multifamily portfolio.

The positive results of operations has allowed the Company to

invest in mortgage receivables in various multifamily projects not

under the Company’s ownership. We will continue to invest in the

multifamily market, as conditions are optimal for achieving a high

return on our investment.

In the current period, rental and other property revenues

increased within the apartment portfolio by $2.5 million mainly due

to increased rental rates and high occupancy. The commercial

portfolio decreased by $3.8 million primarily due to a lease

termination fee that was received in the prior year.

Property operating expenses were $42.1 million for the twelve

months ended December 31, 2014, representing an increase of $2.8

million as compared to the same period in the previous year.

Operating expenses have remained consistent with prior periods due

to labor efficiencies and improvements in preventative maintenance

across the portfolio, with only an increase in real estate taxes as

a result of the increase in the value of our portfolio and some

non-recurring repair projects completed in the current year.

Litigation settlement expense was a credit of $3.6 million for

the twelve months ended December 31, 2014, representing a decrease

of $23.9 million as compared to the same period in the previous

year. The majority of the credit to the current year litigation

expense was due to a settlement with the lender relating to one of

the commercial properties in which the balance in the amount of

$3.5 million was forgiven. Matters were settled in the prior year

in order to avoid future litigation and legal expenses.

About American Realty Investors, Inc.

American Realty Investors, Inc., a Dallas-based real estate

investment company, holds a diverse portfolio of equity real estate

located across the U.S., including office buildings, apartments,

shopping centers, and developed and undeveloped land. The Company

invests in real estate through direct ownership, leases and

partnerships and invests in mortgage loans on real estate. The

Company also holds mortgage receivables. For more information,

visit the Company’s website at www.americanrealtyinvest.com.

AMERICAN REALTY INVESTORS, INC. CONSOLIDATED

STATEMENTS OF OPERATIONS

For the Years Ended December 31, 2014

2013 2012 (dollars in thousands, except per share

amounts) Revenues: Rental and other property revenues

(including $701, $670 and $587 for the year ended 2014, 2013 and

2012, respectively, from related parties) $ 79,412 $ 80,750 $

81,849

Expenses: Property operating expenses

(including $645, $699 and $879 for the year ended 2014, 2013 and

2012, respectively, from related parties) 42,124 39,318 40,000

Depreciation 17,593 15,954 14,873 General and administrative

(including $3,628, $3,646 and $3,539 for the year ended 2014, 2013

and 2012, respectively, from related parties) 10,282 7,919 6,037

Provision on impairment of notes receivable and real estate assets

- 18,980 2,330 Net income fee to related party 3,669 4,089 180

Advisory fee to related party 8,943 10,166

10,182 Total operating expenses 82,611

96,426 73,602 Operating income

(loss) (3,199 ) (15,676 ) 8,247

Other income

(expense): Interest income (including $19,029, $19,110 and

$14,182 for the year ended 2014, 2013 and 2012, respectively, from

related parties) 20,054 19,445 14,612 Other income (including $0,

$0 and $6,000 for the year ended 2014, 2013 and 2012, respectively,

from related parties) 1,415 10,163 7,770 Mortgage and loan interest

(including $3,660, $3,927 and $3,692 for the year ended 2014, 2013

and 2012, respectively, from related parties) (35,416 ) (36,158 )

(38,224 ) Deferred borrowing costs amortization (2,556 ) (2,952 )

(684 ) Loan charges and prepayment penalties (2,854 ) (5,557 )

(3,574 ) Loss on the sale of investments (92 ) (283 ) (118 )

Earnings from unconsolidated subsidiaries and investees 347 391 372

Litigation settlement 3,591 (20,313 )

(175 ) Total other expenses (15,511 ) (35,264 )

(20,021 ) Loss before gain (loss) on land sales,

non-controlling interest, and taxes (18,710 ) (50,940 ) (11,774 )

Gain (loss) on land sales 561 (455 )

5,475 Loss from continuing operations before tax (18,149 )

(51,395 ) (6,299 ) Income tax benefit (expense) 20,413

40,513 (144 ) Net income (loss) from

continuing operations 2,264 (10,882 )

(6,443 ) Discontinued operations: Loss from discontinued operations

(3,557 ) (2,634 ) (9,297 ) Gain on sale of real estate from

discontinued operations 61,879 98,951 8,885 Income tax benefit

(expense) from discontinued operations (20,413 )

(33,711 ) 144 Net income (loss) from discontinued

operations 37,909 62,606 (268 ) Net income (loss) 40,173 51,724

(6,711 ) Net (income) loss attributable to non-controlling

interests (9,288 ) (10,448 ) 1,126 Net

income (loss) attributable to American Realty Investors, Inc.

30,885 41,276 (5,585 ) Preferred dividend requirement (2,043

) (2,452 ) (2,452 ) Net income (loss) applicable to

common shares $ 28,842 $ 38,824 $ (8,037 )

Earnings per share - basic Loss from continuing operations $

(0.71 ) $ (2.07 ) $ (0.67 ) Income (loss) from discontinued

operations 2.99 5.43 (0.02 ) Net

income (loss) applicable to common shares $ 2.28 $ 3.36

$ (0.69 )

Earnings per share - diluted Loss

from continuing operations $ (0.71 ) $ (2.07 ) $ (0.67 ) Income

(loss) from discontinued operations 2.99 5.43

(0.02 ) Net income (loss) applicable to common shares

$ 2.28 $ 3.36 $ (0.69 ) Weighted average

common shares used in computing earnings per share 12,683,956

11,525,389 11,525,389 Weighted average common shares used in

computing diluted earnings per share 12,683,956 11,525,389

11,525,389

Amounts attributable to American Realty

Investors, Inc. Loss from continuing operations $ (7,024 ) $

(21,330 ) $ (5,317 ) Income (loss) from discontinued operations

37,909 62,606 (268 ) Net income

(loss) $ 30,885 $ 41,276 $ (5,585 )

AMERICAN REALTY INVESTORS, INC.

CONSOLIDATED BALANCE SHEETS December 31,

December 31, 2014 2013 (dollars in

thousands, except share and par value amounts) Assets

Real estate, at cost $ 810,214 $ 799,698

Real estate held for sale at cost, net of

depreciation ($0 in 2014 and $2,390 in 2013)

- 16,427 Real estate subject to sales contracts at cost, net of

depreciation ($2,300 in 2014 and $1,949 in 2013) 19,026 27,598 Less

accumulated depreciation (129,477 ) (143,429 ) Total

real estate 699,763 700,294 Notes and interest receivable

Performing (including $139,466 in 2014 and $145,754 in 2013 from

related parties) 149,484 153,275 Non-performing 3,161 3,140 Less

allowance for estimated losses (including $15,537 in 2014 and

$15,809 in 2013 from related parties) (18,279 )

(19,600 ) Total notes and interest receivable 134,366 136,815 Cash

and cash equivalents 12,299 16,437 Restricted cash 49,266 32,929

Investments in unconsolidated subsidiaries and investees 4,279

3,789 Receivable from related party 21,414 14,086 Other assets

44,111 38,972 Total assets $ 965,498

$ 943,322

Liabilities and Shareholders’

Equity Liabilities: Notes and interest payable $ 638,891 $

618,930 Notes related to assets held for sale 1,552 17,100 Notes

related to assets subject to sales contracts 18,616 23,012 Deferred

revenue (including $72,564 in 2014 and $74,303 in 2013 from sales

to related parties) 74,409 76,148 Accounts payable and other

liabilities (including $11,024 in 2014 and $15,394 in 2013 to

related parties) 52,442 73,271 785,910

808,461 Shareholders’ equity: Preferred stock, Series A:

$2.00 par value, authorized 15,000,000 shares, issued and

outstanding 2,461,252 and 3,353,954 shares in 2014 and 2013,

respectively (liquidation preference $10 per share), including

900,000 shares in 2014 and 2013 held by ARL. Series K: $2.00 par

value, authorized, issued and outstanding zero and 135,000 shares

in 2014 and 2013, respectively (liquidation preference $22 per

share) 3,126 4,908 Common stock, $0.01 par value, authorized

100,000,000 shares; issued 14,443,404 and 11,941,174 shares and

outstanding 14,027,619 and 11,525,389 shares in 2014 and 2013,

respectively; including 140,000 shares held by TCI (consolidated)

in 2014 and 229,214 shares held by TCI (consolidated) in 2013. 141

115 Treasury stock at cost; 415,785 shares in 2014 and 2013 and

140,000 shares held by TCI (consolidated) as of 2014 and 229,214

shares held by TCI (consolidated) as of 2013 (6,395 ) (6,395 )

Paid-in capital 108,378 102,974 Retained earnings 19,090

(11,795 ) Total American Realty Investors, Inc.

shareholders' equity 124,340 89,807 Non-controlling interest

55,248 45,054 Total equity 179,588

134,861 Total liabilities and equity $ 965,498

$ 943,322

American Realty Investors, Inc.Investor

RelationsGene Bertcher,

800-400-6407investor.relations@americanrealtyinvest.com

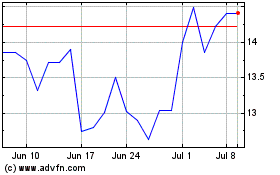

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Mar 2024 to Apr 2024

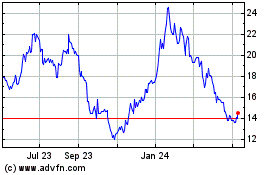

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Apr 2023 to Apr 2024