American Realty Investors, Inc. (NYSE:ARL), a Dallas-based real

estate investment company, today reported results of operations for

the first quarter ended March 31, 2017. For the three months ended

March 31, 2017, we reported a net loss applicable to common shares

of $6.0 million or ($0.39) per diluted loss per share compared to a

net loss applicable to common shares of $3.7 million or ($0.24) per

diluted loss per share for the same period ended 2016. Included in

the net loss from operations is non-cash expenses of depreciation

and amortization of $6.3 million and $5.8 million for the three

months ended March 31, 2017 and 2016 respectively.

The growth in revenue and corresponding improvement in Net

Operating Income for the three months ended March 31, 2017

demonstrates the viability of our business strategy. Management

will continue its plan for growth from its operating properties and

expects to reinvest in areas that will complement this growth;

further management will maintain strong attention to all details of

its operations including appropriate expense controls.

Our ability to take advantage of lower-interest rate mortgages

available has reduced our monthly obligations and increased cash

flow within our multifamily portfolio.

Revenues

Rental and other property revenues were $31.8 million for the

three months ended March 31, 2017. This represents an increase of

$2.6 million compared to the prior period revenues of $29.2

million. This change, by segment, is an increase in the apartment

portfolio of $1.3 million, and an increase in the commercial

portfolio of $1.3 million. The increase in our apartment portfolio

was mainly due to the acquisition of new properties. Our apartment

portfolio continues to thrive in the current economic conditions

with occupancies averaging over 95%. We have been able to surpass

expectations due to the high-quality product offered, strength of

our management team and our commitment to our tenants. We are

continuing to market our properties aggressively to attract new

tenants and strive for continuous improvement of our properties in

order to maintain our existing tenants.

Expense

Property operating expenses were $16.3 million for the three

months ended March 31, 2017. This represents an increase of $1.1

million compared to the prior period operating expenses of $15.2

million. This change, by segment, is an increase in the apartment

portfolio of $1.4 million, which was consistent with the

acquisition of new properties. In addition, there was a decrease of

$0.2 million in property operating expenses for the commercial

portfolio.

Depreciation and amortization expense was $6.3 million for the

three months ended March 31, 2017. This represents an increase of

$0.5 million compared to the prior period expense of $5.8 million.

This change by segment is an increase of $0.5 million in the

apartment portfolio.

Advisory fees decreased less than $0.1 million for the three

months ended March 31, 2017 compared to the prior period. Advisory

fees are computed based on a gross asset fee of 0.0625% per month

(0.75% per annum) of the weighted average of the gross asset

value.

Other income (expense)

Mortgage and loan interest expense was $16.8 million for the

three months ended March 31, 2017. This represents an increase of

$2.6 million compared to the prior period expense of $14.2 million.

The change by segment is an increase in the other portfolio of $1.7

million and an increase in the apartment portfolio of $0.6 million.

Within the other portfolio, the increase was primarily due to $1.3

million of interest expense related to the Israeli bond sale, which

closed in the first quarter of 2017. In addition, we secured a new

mezzanine debt obligation in the third quarter of 2016. The

increase within the apartment portfolio is primarily due to loan

charges and prepayment penalties for the refinancing of two

mortgage loans at lower interest rates.

Gain on land sales decreased for the three months ended March

31, 2017 compared to the prior period. During the first quarter of

2017, we sold 2.49 acres of land for a sales price of $1.1 million

and recorded a gain of $0.4 million. During the first quarter of

2016, we sold 40.88 acres of land for a sales price of $4.2 million

and recorded a gain of $1.7 million.

About American Realty Investors, Inc.

American Realty Investors, Inc., a Dallas-based real estate

investment company, holds a diverse portfolio of equity real estate

located across the U.S., including office buildings, apartments,

shopping centers, and developed and undeveloped land. The Company

invests in real estate through direct ownership, leases and

partnerships and invests in mortgage loans on real estate. The

Company also holds mortgage receivables. For more information,

visit the Company’s website at www.americanrealtyinvest.com.

AMERICAN REALTY INVESTORS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

For the Three Months Ended March 31,

2017 2016 (dollars in

thousands, except per share amounts) Revenues: Rental

and other property revenues (including $190 and $173 for the three

months ended 2017 and 2016, respectively, from related parties) $

31,822 $ 29,205

Expenses: Property operating expenses

(including $237 and $210 for the three months ended 2017 and 2016,

respectively, from related parties) 16,265 15,216 Depreciation and

amortization 6,330 5,830 General and administrative (including $962

and $918 for the three months ended 2017 and 2016, respectively,

from related parties) 2,031 2,025 Net income fee to related party

60 72 Advisory fee to related party 2,659

2,738

Total operating expenses

27,345 25,881 Net operating income

4,477 3,324

Other income (expenses): Interest income

(including $4,476 and $4,528 for the three months ended 2017 and

2016, respectively, from related parties) 4,792 5,291 Other income

1,443 298 Mortgage and loan interest (including $1,511 and $1,092

for the three months ended 2017 and 2016, respectively, from

related parties) (16,796 ) (14,214 ) Foreign currency transaction

loss (323 ) - Earnings from unconsolidated subsidiaries and

investees 55 155 Total other expenses

(10,829 ) (8,470 ) Loss before gain on land sales,

non-controlling interest, and taxes (6,352 ) (5,146 ) Loss on sale

of income producing properties - (244 ) Gain on land sales

445 1,652 Net loss from continuing operations

before taxes (5,907 ) (3,738 ) Income tax benefit -

1 Net loss from continuing operations (5,907 ) (3,737

) Discontinued operations: Net income from discontinued operations

- 3 Income tax expense from discontinued operations -

(1 ) Net income from discontinued operations -

2 Net loss (5,907 ) (3,735 ) Net income attributable

to non-controlling interest 193 530 Net

loss attributable to American Realty Investors, Inc. (5,714 )

(3,205 ) Preferred dividend requirement (275 ) (497 )

Net loss applicable to common shares $ (5,989 ) $ (3,702 )

Earnings per share - basic Net loss from continuing

operations $ (0.39 ) $ (0.24 )

Earnings per share -

diluted Net loss from continuing operations $ (0.39 ) $ (0.24 )

Weighted average common shares used in computing earnings

per share 15,514,360 15,514,360 Weighted average common shares used

in computing diluted earnings per share 15,514,360 15,514,360

Amounts attributable to American Realty Investors,

Inc. Net loss from continuing operations $ (5,714 ) $ (3,207 )

Net income from discontinued operations - 2

Net loss applicable to American Realty Investors, Inc. $

(5,714 ) $ (3,205 )

AMERICAN REALTY INVESTORS,

INC. CONSOLIDATED BALANCE SHEETS March

31, December 31, 2017

2016 (dollars in thousands, except share and par

value amounts) Assets Real estate, at cost $ 1,035,008 $

1,017,684 Real estate subject to sales contracts at cost 48,323

48,919 Less accumulated depreciation (171,607 )

(165,597 ) Total real estate 911,724 901,006 Notes and interest

receivable: Performing (including $121,173 in 2017 and $125,799 in

2016 from related parties) 138,733 143,601 Less allowance for

estimated losses (including $15,537 in 2017 and 2016 from related

parties) (17,037 ) (17,037 ) Total notes and interest

receivable 121,696 126,564 Cash and cash equivalents 55,284 17,522

Restricted cash 31,259 38,399 Investments in unconsolidated joint

ventures and investees 6,141 6,087 Receivable from related party

22,064 24,672 Other assets 65,557 60,659

Total assets $ 1,213,725 $ 1,174,909

Liabilities and Shareholders’ Equity Liabilities: Notes and

interest payable $ 830,742 $ 845,107 Notes related to real estate

held for sale 376 376 Notes related to real estate subject to sales

contracts 4,177 5,612 Bond and interest payable 71,975 - Deferred

revenue (including $70,945 in 2017 and $70,935 in 2016 to related

parties) 91,390 91,380 Accounts payable and other liabilities

(including $10,793 in 2017 and $10,854 in 2016 to related parties)

45,183 56,303 Total liabilities

1,043,843 998,778 Shareholders’ equity: Preferred stock,

Series A: $2.00 par value, authorized 15,000,000 shares, issued and

outstanding 2,000,614 shares in 2017 and 2016 (liquidation

preference $10 per share), including 900,000 shares in 2017 and

2016 held by ARL. 2,205 2,205 Common stock, $0.01 par value,

authorized 100,000,000 shares; issued 15,930,145 shares and

outstanding 15,514,360 in 2017 and 2016, including 140,000 shares

held by TCI (consolidated) in 2017 and 2016. 159 159 Treasury stock

at cost; 415,785 shares in 2017 and 2016, and 140,000 shares held

by TCI (consolidated) as of 2017 and 2016 (6,395 ) (6,395 ) Paid-in

capital 111,168 111,510 Retained earnings 8,684

14,398 Total American Realty Investors, Inc.

shareholders' equity 115,821 121,877 Non-controlling interest

54,061 54,254 Total shareholders'

equity 169,882 176,131 Total

liabilities and shareholders' equity $ 1,213,725 $ 1,174,909

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170517006311/en/

American Realty Investors, Inc.Investor

RelationsGene Bertcher,

800-400-6407investor.relations@americanrealtyinvest.com

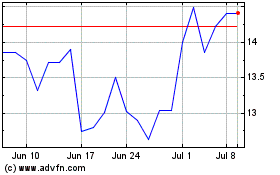

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Mar 2024 to Apr 2024

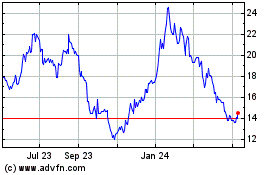

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Apr 2023 to Apr 2024